Small Molecule Innovator CDMO Market Size, Share, Growth, And Industry Analysis – By Service Type (Formulation Development, Process Optimization, Analytical Testing), By Therapeutic Area (Oncology, Cardiovascular Diseases, Central Nervous System Disorders), By Stage of Development, By End-User, By Scale of Operation, and By Region Forecast – 2023-2032

-

40874

-

Aug 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

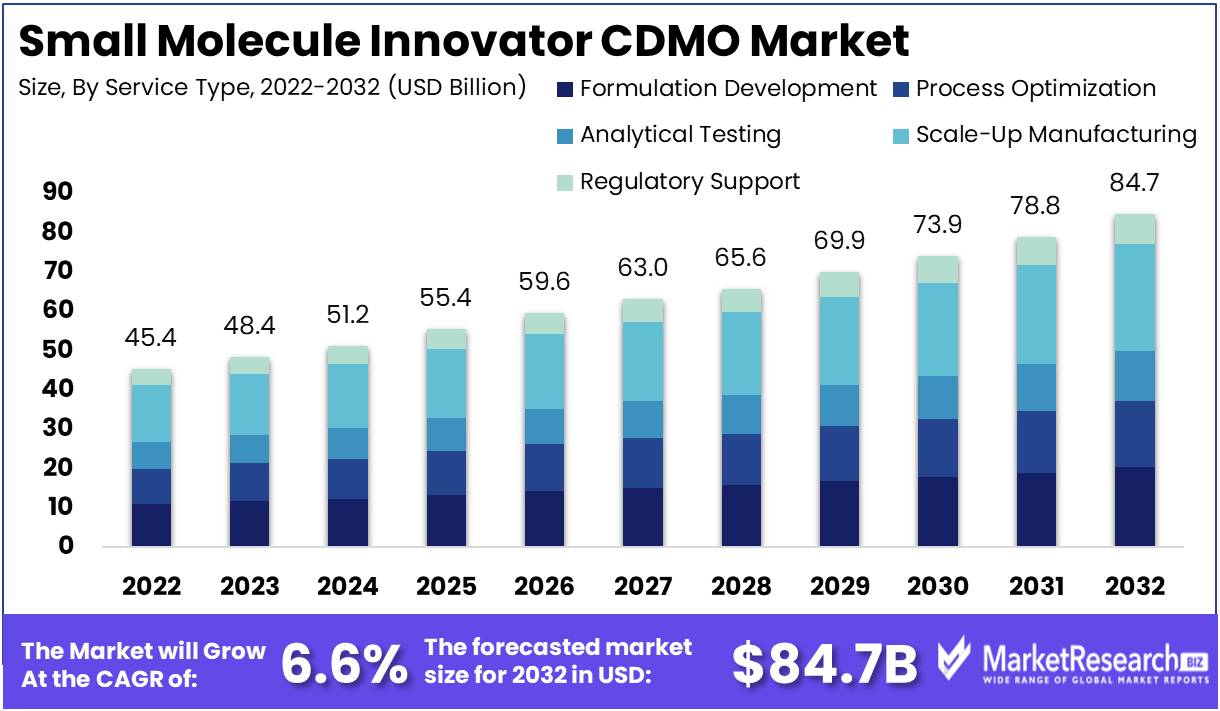

The global small molecule innovator CDMO market revenue is expected to increase to USD 84.7 Bn in 2032 from USD 45.4 Bn in 2022, and register a revenue CAGR of 6.6% during the forecast period (2023 to 2032).

A small molecule innovator CDMO is a specialized partner in the pharmaceutical industry, and provides comprehensive services to bring new drugs from concept to commercialization. Responsibilities encompass drug development, process optimization, and manufacturing. CDMOs offer flexible solutions tailored to various stages of drug development, including pre-clinical, clinical, and commercial production.

Services range from formulation development, analytical testing, and regulatory support to manufacturing at various scales. With expertise in synthetic chemistry and state-of-the-art facilities, CDMOs facilitate the creation of novel small molecule therapies while ensuring compliance, quality, and efficiency, ultimately accelerating drug candidates' journey to market.

The global small molecule innovator CDMO market continues to present major revenue potential, driven by increasing innovation in pharmaceuticals, outsourcing trends, and demand for specialized expertise. Key drivers include cost-effective drug development, regulatory compliance support, and the need for flexible production capacities.

Consumption trends show a steady surge in outsourcing complex processes. Services provided encompass formulation, process optimization, analytical testing, and scale-up manufacturing. Advancements in synthetic chemistry and biotechnology bolster market expansion. Collaborative industry initiatives and partnerships are enhancing capabilities of CDMOs. Advantages include accelerated drug timelines and reduced infrastructure costs. Comprehensive analysis underscores the pivotal role CDMOs play in shaping the pharmaceutical landscape.

Driving factors

Increasing Drug Development Complexity & Importance of CDMO Capabilities

The growing complexity of small molecule drug development prompts pharmaceutical companies to seek specialized expertise from CDMOs, leading to higher demand for their services. The COVID-19 pandemic served to highlight the significance of flexible manufacturing capacities, as CDMOs emerged as pivotal partners equipped to swiftly adjust production according to demand fluctuations. These CDMOs enable pharmaceutical companies to navigate the challenge of over- or under-production risks.

Moreover, outsourcing to CDMOs aligns with companies' objectives to streamline their focus on core research and development initiatives, entrusting manufacturing intricacies to specialists. Leveraging established processes and cutting-edge facilities, CDMOs expedite drug development and enhance speed-to-market capabilities, a critical advantage in an evolving landscape. Access to advanced technologies, often invested in by CDMOs, enables pharmaceutical companies to harness innovations without substantial internal investments. By sharing the responsibility of drug development and manufacturing, CDMOs offer risk mitigation and reduce financial and operational vulnerabilities.

Also, their economies of scale drive cost optimization, especially when compared to maintaining in-house manufacturing. Navigating intricate regulatory landscapes is another forte of CDMOs, particularly relevant in a post-pandemic scenario where regulations emphasize supply chain resilience and safety. Many CDMOs' global presence aligns with pharmaceutical companies' market diversification strategies, offering access to diverse markets. Collaborating with CDMOs also serves as a component of resilience planning, ensuring a secure supply of essential medications amid supply chain vulnerabilities highlighted by the pandemic.

Regulatory Compliance Expertise & Flexible Production Capacities

CDMOs possess in-depth knowledge of regulatory guidelines, ensuring that drug development processes adhere to strict industry standards. This expertise attracts clients seeking efficient regulatory approval pathways, thereby boosting revenue for CDMOs.

CDMOs offer versatile manufacturing solutions that cater to varying project scales. As pharmaceutical companies require adaptable production capacities, CDMOs' ability to accommodate these needs directly contributes to revenue growth.

Technological Advancements & Global Market Expansion

Continuous innovations in synthetic chemistry, process optimization, and analytical techniques enhance capabilities of CDMOs, enabling them to provide cutting-edge services. Also, clients are willing to pay a premium for access to advanced technologies, and this ensures steady revenue inflow.

The global pharmaceutical market's growth and geographical expansion open up new opportunities for CDMOs. As pharmaceutical companies seek to tap into diverse markets, CDMOs' international presence and expertise become essential, driving revenue growth through expanded clientele.

Restraining Factors

Regulatory Hurdles & Intellectual Property Concerns

Evolving and stringent regulations in the pharmaceutical industry can lead to delays in drug development timelines. Compliance challenges can hinder ability of CDMOs to deliver on time, thereby impacting their revenue growth.

Collaborating with CDMOs requires sharing sensitive proprietary information, raising intellectual property protection concerns. This may discourage some pharmaceutical companies from outsourcing, limiting revenue potential for CDMOs.

Economic Uncertainty & Capacity Constraints

Economic downturns and fluctuations can lead pharmaceutical companies to reduce outsourcing expenditures, and this can affect CDMO order volumes and revenue streams.

Limited manufacturing capacities within CDMOs can hinder their ability to accommodate high-demand projects, potentially leading to missed opportunities and revenue loss.

Technological Lag & Supply Chain Disruptions

Inadequate adoption of cutting-edge technologies can make CDMOs less competitive. Clients seeking advanced solutions may opt for alternatives, impacting revenue growth for less technologically advanced CDMOs.

Disruptions in the global supply chain, as seen during the COVID-19 pandemic, can lead to delays in raw material procurement, production slowdowns, and project cancellations, negatively affecting CDMOs revenue prospects.

Opportunity

Comprehensive Services & Technological Advancements

CDMOs can capitalize on offering end-to-end services, encompassing drug development, formulation, process optimization, analytical testing, and manufacturing. This integrated approach attracts clients seeking a single partner to streamline their drug development journey.

Investing in cutting-edge technologies, such as continuous manufacturing and advanced analytics, positions CDMOs as leaders in innovation. Providing access to novel solutions enhances their value proposition and opens new revenue streams.

Specialized Expertise & Regulatory Support

Developing niche expertise in certain therapeutic areas or complex processes like high-potency compounds can attract pharmaceutical companies with specific needs. Specialization enables CDMOs to command premium pricing and secure long-term partnerships.

Offering specialized regulatory expertise, especially in navigating complex global regulations, can be a revenue driver. Companies seeking a seamless regulatory approval process are likely to engage CDMOs with proven track records.

Strategic Partnerships, Flexible Capacity Models, and Value Addition

Establishing strategic collaborations with pharmaceutical companies can lead to revenue-sharing models, where CDMOs earn a portion of the commercial success of the developed drugs, aligning their interests with that of clients.

Introducing flexible capacity models, such as shared manufacturing facilities or rapid scale-up capabilities, enables CDMOs to cater to varying client needs. This adaptability enhances client satisfaction and attracts a broader clientele.

Offering value-added services beyond traditional services, such as supply chain optimization, risk management, and sustainability consulting can create additional revenue streams while positioning CDMOs as holistic partners.

By Service Type

The scale-up manufacturing segment accounts for majority revenue share among the service type segments in the global small molecule innovator CDMO market. As drug candidates progress through clinical trials and enter commercialization, the need for large-scale manufacturing intensifies. CDMOs offering expertise in efficiently scaling up production to meet market demand become indispensable partners for pharmaceutical companies. This segment's revenue dominance is due to the importance of scale-up manufacturing in ensuring seamless transition from clinical success to full-scale production.

By Therapeutic Area

The oncology segment among the therapeutic area segments accounts for a substantially larger revenue share due to the complexity of oncology and high demand for innovative treatments. Oncology drugs often require intricate formulations and specialized manufacturing processes. CDMOs with expertise in developing and producing these therapies secure a significant revenue share. The global prevalence of cancer and the continuous push for novel, personalized treatments further bolster revenue in this segment.

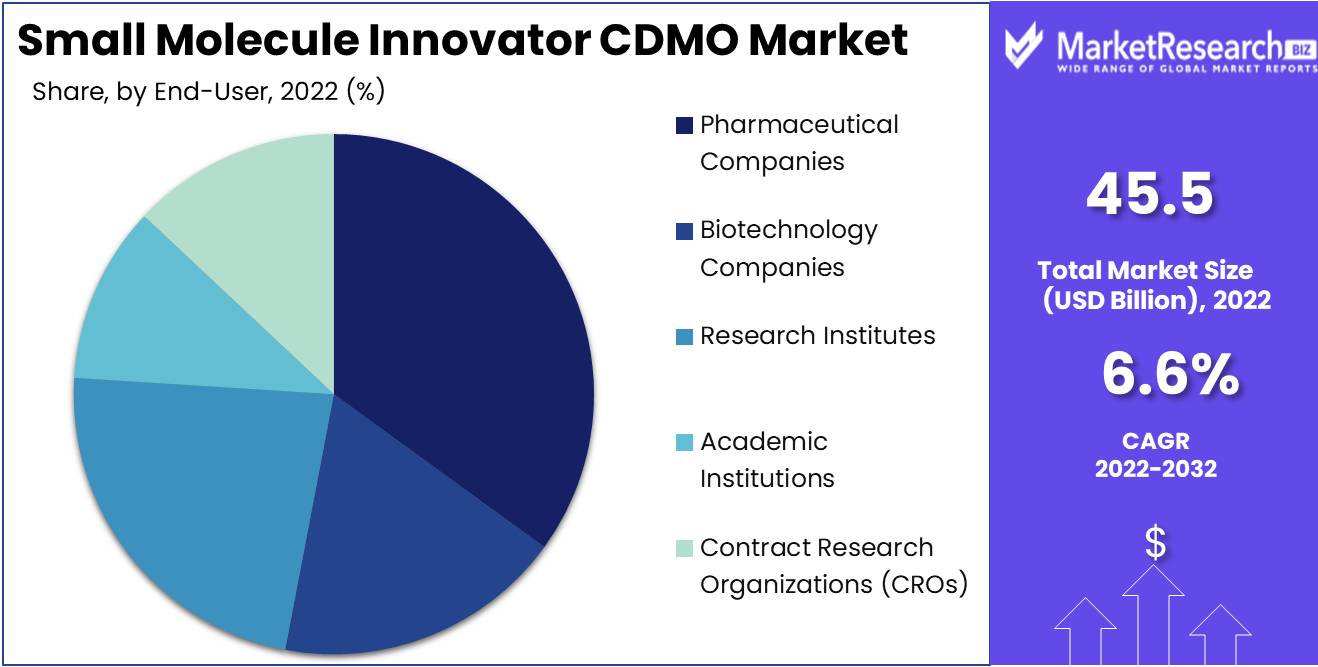

By End-User

The pharmaceutical companies segment among the various end-user segments accounts for major revenue in the global small molecule innovator CDMO market. These companies, ranging from large pharmaceutical giants to emerging biotechnology, consistently seek CDMO partnerships to streamline their drug development and manufacturing processes. Outsourcing allows them to allocate resources efficiently, reduce costs, and access specialized expertise. The revenue dominance of this segment is a direct result of the pharmaceutical industry's reliance on CDMOs to navigate the complex landscape of drug development and production.

Key Market Segments

By Service Type

- Formulation Development

- Process Optimization

- Analytical Testing

- Scale-Up Manufacturing

- Regulatory Support

By Therapeutic Area

- Oncology

- Cardiovascular Diseases

- Central Nervous System Disorders

- Infectious Diseases

- Autoimmune Diseases

By Stage of Development

- Pre-Clinical

- Phase I Clinical Trials

- Phase II Clinical Trials

- Phase III Clinical Trials

- Commercial Manufacturing

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- Research Institutes

- Academic Institutions

- Contract Research Organizations (CROs)

By Scale of Operation

- Small-Scale Manufacturing

- Mid-Scale Manufacturing

- Large-Scale Manufacturing

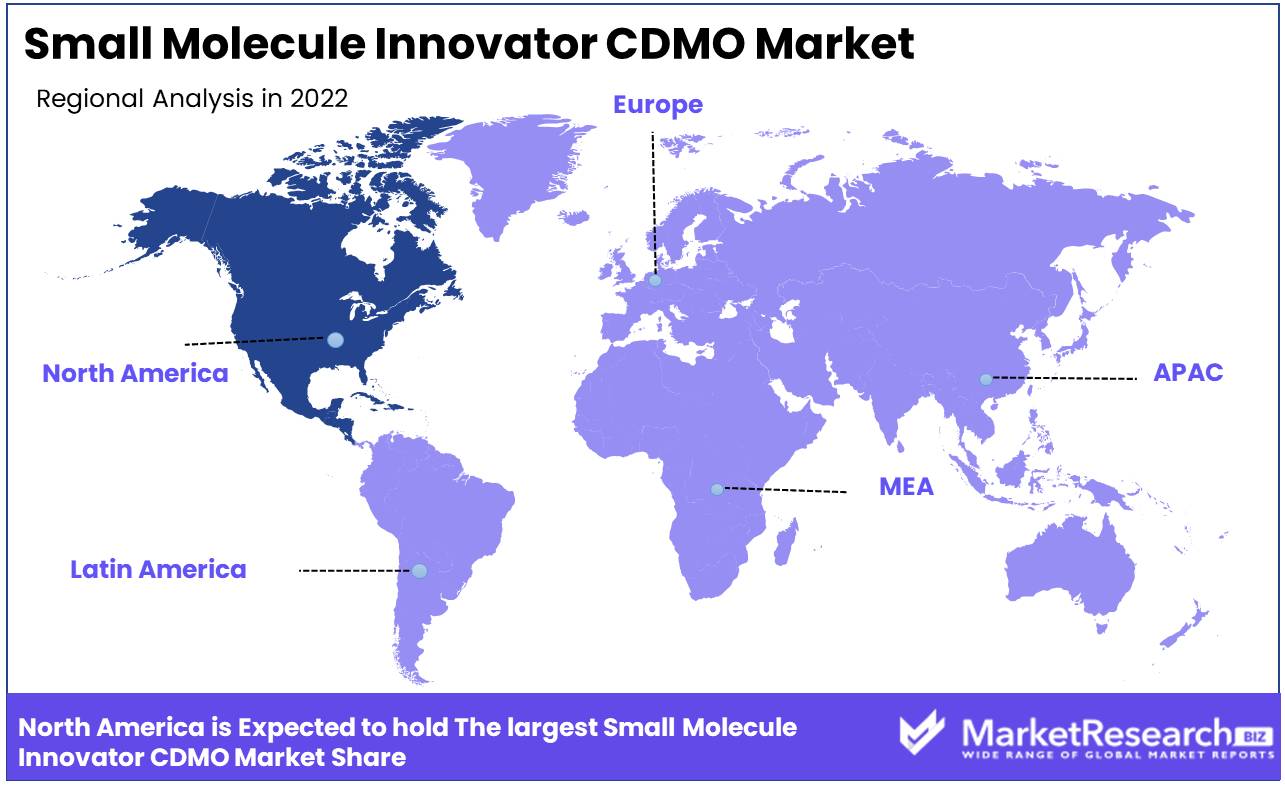

Regional Analysis

North America

North America accounts for a significantly large revenue share in the global small small molecule innovator CDMO market compared to that of markets in other regions. This revenue growth is driven by a robust pharmaceutical industry and technological advancements, especially in the US, which is base to a number of pharmaceutical giants outsourcing to CDMOs. Potential revenue growth remains high due to increased demand for specialized services and rising R&D costs. Industry growth is further supported by collaborations between CDMOs and academia. Technological developments like continuous manufacturing is expected to continue to boost efficiency. Initiatives promoting revenue growth include regulatory reforms and partnerships to expedite drug development.

Europe

Europe's mature pharmaceutical landscape sustains a substantial share in the global small molecule innovator CDMO market. The region's market share is distributed across countries such as Germany, Switzerland, and the UK. Potential revenue growth is driven by outsourcing trends and the emphasis on sustainable drug development. Industry growth is supported by the European Medicines Agency's regulatory framework. Technological developments focus on greener manufacturing processes. Government initiatives and research grants stimulate revenue growth, while strategic collaborations enhance expertise exchange among CDMOs and academic institutions.

Asia-Pacific

Asia-Pacific has been registering rapid revenue growth in the small molecule innovator CDMO market, with countries such as China and India emerging as key players. Market revenue share expansion is attributed to cost-effective manufacturing capabilities and a skilled workforce. Potential revenue growth is considerable due to increasing pharmaceutical investments and the region's role as a manufacturing hub. Industry growth is bolstered by regulatory reforms to streamline drug approvals. Technological developments include adoption of automation and digitalization. Initiatives such as government incentives and research collaborations attract foreign investments, boosting regional CDMO revenue.

Latin America

Latin America CDMO market revenue share is gradually increasing as the region gains recognition for cost-efficient manufacturing. Brazil and Mexico account for a relatively robust share in the market share. Potential revenue growth is notable due to rising outsourcing trends and the region's untapped market potential. Industry growth is fostered by regulatory reforms to attract foreign investments. Technological developments focus on quality enhancement. Initiatives supporting revenue growth include partnerships between CDMOs and local pharmaceutical companies, stimulating job creation and expertise sharing.

Middle East & Africa

Middle East & Africa accounts for a moderate revenue share in the global small molecule innovator CDMO market, with majority coming in from the UAE and South Africa. Potential revenue growth is promising due to increasing investments in healthcare infrastructure and pharmaceutical development. Industry growth is supported by regulatory reforms and efforts to strengthen the pharmaceutical sector. Technological developments aim to meet international quality standards. Initiatives such as research collaborations with global partners drive expertise enhancement, contributing to revenue growth within the region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Competitive Landscape

The global small molecule innovator CDMO market is highly competitive, driven by rapidly inclining demand across the pharmaceutical industry for specialized services and expertise to bring novel drugs to market efficiently. Leading players in this dynamic landscape include Lonza Group, Catalent, Patheon (a part of Thermo Fisher Scientific), Recipharm, and Evonik Industries. These industry giants have established themselves as trusted partners for pharmaceutical companies, offering a wide range of services encompassing drug formulation, process development, analytical testing, and commercial manufacturing.

These key players have a significant presence in various regions and possess state-of-the-art facilities, regulatory expertise, and a proven track record of successful collaborations with pharmaceutical clients. Their competitive advantage lies in their ability to offer comprehensive solutions across the entire drug development lifecycle, reducing time-to-market and enhancing cost-efficiency for their clients.

The competitive landscape is marked by ongoing innovation and technological advancements aimed at improving manufacturing processes, enhancing quality control, and ensuring regulatory compliance. These CDMOs also focus on developing flexible capacity models to accommodate varying project scales, addressing the diverse needs of their clientele.

Service providers within the small molecule innovator CDMO market are constantly evolving to cater to the evolving demands of the pharmaceutical industry. Companies differentiate themselves by offering specialized services such as high-potency compound handling, niche therapeutic expertise, and advanced analytics capabilities.

As the pharmaceutical landscape evolves with increasing R&D complexities and regulatory demands, these leading players continue to adapt and expand their capabilities to maintain their competitive edge. The ability to offer integrated and efficient solutions that align with industry trends while ensuring high-quality outcomes for clients solidifies their standing within the competitive landscape.

Top Key Players in small molecule innovator CDMO market

- Lonza Group

- Catalent

- Patheon (a part of Thermo Fisher Scientific)

- Recipharm

- Evonik Industries

- Cambrex Corporation

- Alcami Corporation

- Jubilant Life Sciences

- Piramal Pharma Solutions

- WuXi AppTec

- Fareva Group

- Aenova Group

- Siegfried Holding AG

- AMRI (Albany Molecular Research Inc.)

- Symbiosis Pharmaceutical Services

Recent Development

- In January 2023, Lonza completed the expansion of its small molecules production facility in Bend, Oregon. The expansion will increase the facility's capacity by 50% and enable Lonza to produce more complex and potent APIs.

- In March 2023, Sterling signed a multi-year agreement with a global pharmaceutical company to develop and manufacture a new small molecule drug. The agreement includes a $100 million upfront payment and potential milestone payments of up to $1 billion.

- In April 2023, Jubilant Biosys announced the opening of a new API manufacturing facility in Hyderabad, India. The facility will have a capacity of 100 metric tons per year and will focus on the manufacture of APIs for small molecule drugs.

- In May 2023, Aeterna Zentaris announced the acquisition of Akari Therapeutics. The acquisition will give Aeterna Zentaris access to Akari's proprietary technology for the development and manufacturing of small molecule drugs.

Report Scope

Report Features Description Market Value (2022) USD 45.4 Bn Forecast Revenue (2032) USD 86.0 Bn CAGR (2023-2032) 6.6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Competitive Analysis, Segment and Sub-segment Breakdown and Analysis, Trend Analysis, Opportunity & Strategy Reporting Segments Covered Service Type (Formulation Development, Process Optimization, Analytical Testing, Scale-Up Manufacturing, Regulatory Support), Therapeutic Area (Oncology, Cardiovascular Diseases, Central Nervous System Disorders, Infectious Diseases, Autoimmune Diseases), Stage of Development (Pre-Clinical, Phase I Clinical Trials, Phase II Clinical Trials, Phase III Clinical Trials, Commercial Manufacturing), End-User (Pharmaceutical Companies, Biotechnology Companies, Research Institutes, Academic Institutions, Contract Research Organizations), Scale of Operation (Small-Scale Manufacturing, Mid-Scale Manufacturing, Large-Scale Manufacturing) Regional Analysis North America (United States, Canada); Asia Pacific (China, India, Japan, Australia & New Zealand, Association of Southeast Asian Nations (ASEAN), Rest of Asia Pacific); Europe (Germany, U.K., France, Spain, Italy, Russia, Poland, BENELUX [Belgium, the Netherlands, Luxembourg], NORDIC [Norway, Sweden, Finland, Denmark], Rest of Europe); Latin America (Brazil, Mexico, Argentina, Rest of Latin America); Middle East & Africa (Saudi Arabia, United Arab Emirates, South Africa, Egypt, Israel, Rest of Middle East & Africa) Competitive Landscape Lonza Group, Catalent, Patheon (a part of Thermo Fisher Scientific), Recipharm, Evonik Industries, Cambrex Corporation, Alcami Corporation, Jubilant Life Sciences, Piramal Pharma Solutions, WuXi AppTec, Fareva Group, Aenova Group, Siegfried Holding AG, AMRI (Albany Molecular Research Inc.), Symbiosis Pharmaceutical Services Customization Scope Further customization of segments, regions/country-breakdown can be provided upon request. Purchase Options Licenses Available are Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Lonza Group

- Catalent

- Patheon (a part of Thermo Fisher Scientific)

- Recipharm

- Evonik Industries

- Cambrex Corporation

- Alcami Corporation

- Jubilant Life Sciences

- Piramal Pharma Solutions

- WuXi AppTec

- Fareva Group

- Aenova Group

- Siegfried Holding AG

- AMRI (Albany Molecular Research Inc.)

- Symbiosis Pharmaceutical Services