Small Molecule Api Market By Type (Synthetic, Biotech), By Therapeutic Area (Autoimmune Diseases, Oncology, Metabolic Diseases, Ophthalmology, Cardiovascular Diseases, Infectious Diseases, Neurology, Respiratory Disorders, Dermatology, Urology, Other Therapeutic Areas), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39888

-

July 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

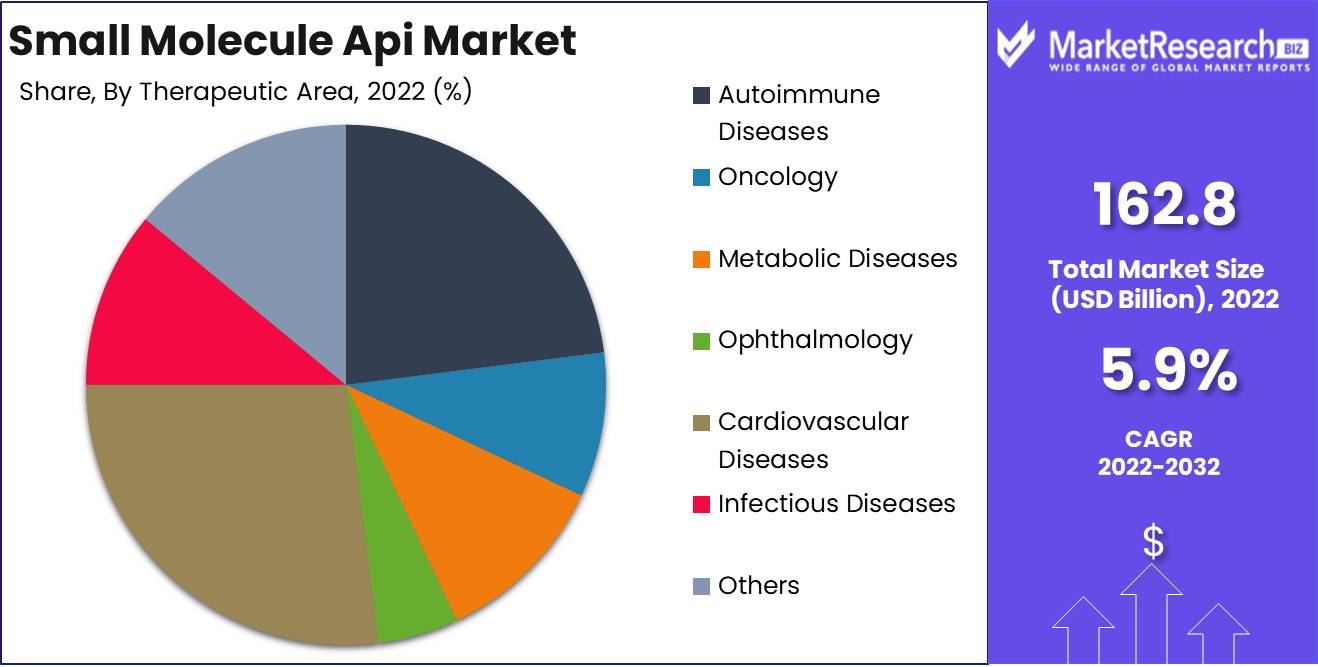

Small Molecule Api Market size is expected to be worth around USD 284.7 Bn by 2032 from USD 162.8 Bn in 2022, growing at a CAGR of 5.9% during the forecast period from 2023 to 2032.

The small molecule Api market pertains to the sector involved in the manufacturing and dissemination of small molecule active pharmaceutical ingredients (APIs). Application programming interfaces (APIs) are diminutive chemical compounds that play a crucial role in delivering therapeutic advantages in the development of pharmaceutical drugs. These APIs are extensively employed by the pharmaceutical industry for the treatment of diverse diseases and medical conditions.

The primary objective of the small molecule active pharmaceutical ingredient (Api) market is to provide APIs of superior quality and efficacy, thereby facilitating the development of groundbreaking pharmaceutical products. The application programming interfaces (APIs) possess the capability to engage with precise target molecules within the human body, thereby generating the intended therapeutic impact. Consequently, these APIs play a crucial role in the development of pharmaceuticals that are both safe and efficacious, ultimately leading to enhanced patient outcomes.

The market for small molecule Api market holds significant importance within the pharmaceutical industry. Application programming interfaces (APIs) serve as fundamental components in the formulation of drugs and play a crucial role in the process of drug research and development. Moreover, they are indispensable in the production of generic versions, which provide cost-effective alternatives to brand-name drugs. The availability of Api markets enables pharmaceutical companies to effectively address the increasing need for cost-effective healthcare solutions, while simultaneously satisfying the escalating consumer demands for these solutions.

A significant advancement observed in the market for small molecule active pharmaceutical ingredients (APIs) pertains to the emergence of high-potency APIs (HPAPIs), which are characterized by their potent nature and are primarily employed in the treatment of severe diseases like cancer. Highly potent active pharmaceutical ingredients (HPAPIs) necessitate specialized manufacturing and handling facilities to ensure the assurance of safety and quality. This enables the exploration of novel therapeutic approaches for intricate diseases.

Pharmaceutical companies and various stakeholders have made significant financial commitments to the small molecule active pharmaceutical ingredient (Api) market. These investments primarily focus on expanding manufacturing capabilities, enhancing product quality, ensuring compliance with regulatory standards, and broadening the range of products and services that utilize small molecule APIs for therapeutic purposes.

The small molecule Api market is influenced by several significant factors. The primary factors contributing to this phenomenon include heightened research and development endeavors within the pharmaceutical sector, a growing incidence of chronic illnesses, and an escalating need for generic medications. Moreover, the expansion of the industry can be attributed to significant factors such as advancements in manufacturing technology, increased regulatory scrutiny, and the availability of cost-effective treatment options.

Driving factors

Chronic Diseases Increase Drug Demand

The shift in consumer demographics and rise in chronic and age-related diseases are driving demand for pharmaceutical drugs. Chronic diseases including diabetes, cardiovascular disease, and cancer have increased as the global population ages and life expectancy rises. These illnesses need long-term therapy and care, thus drugs are in high demand.

Innovative Drugs Increase Demand

Medical research and technology advancements have led to a greater knowledge of diseases and the development of novel drug solutions. Targeted treatments with lower side effects are possible thanks to drug research and development advances. This has increased demand for pharmaceutical drugs, particularly in the small molecule Api market, which is used to make numerous drug formulations.

Generics Gain Popularity

The generic drug market is growing, driving demand for pharmaceutical drugs. Due to their cheap and availability, generic drugs have become popular. As patents for branded drugs expire, the generic drug market opens up, increasing demand.

Small Molecule API Market Driven by Outsourcing

Another driving factor driving small molecule Api market growth is the rise in contract production and outsourcing. Pharmaceutical companies are outsourcing Api production to contract manufacturers to focus on drug formulation and marketing. This tendency led to a large expansion of the small molecule Api driving growth.

Streamlined Approvals Increase API Demand

The small molecule Api market has had significant advancements in recent years, strengthening its position in the pharmaceutical industry. Global regulatory organizations have streamlined the approval process for generic drugs, making them more accessible to patients. The demand for small molecule APIs has increased as a result of increased competition among generic drug makers.

Drug Access Improves

The market has also seen advancements in manufacturing techniques and technologies, allowing for the large-scale production of high-quality APIs. These advancements have increased manufacturing efficiency and lowered costs, making pharmaceutical drugs more inexpensive and accessible to more patients.

Restraining Factors

Regulatory Obstacles Small Molecule API

Small molecule Api manufacturers encounter various regulatory and compliance challenges in the highly regulated pharmaceutical sector. The FDA and EMA's strict rules protect medicine safety and efficacy. The development, approval, and commercialization of small molecule APIs may be significantly hampered by these constraints. From research and development to clinical trials and approval, medication manufacturers must follow complex and rigorous guidelines.

Costly Approvals Small Molecule API Struggles

Significant challenges in the small molecule Api market include high costs and lengthy approval processes. Creating a new Api and getting regulatory approval can be difficult and expensive. Api manufacturing research and development need significant scientific skills, infrastructure, and equipment. Costs of preclinical and clinical trials, as well as patents and license agreements, can be significant. Quality standards also increase production costs.

Small-molecule API IP Protection

Intellectual property challenges are a significant barrier to entry for the small molecule Api market. It is essential for manufacturers to secure their intellectual property rights because developing a new Api requires significant investment in research and development. Pharmaceuticals are competitive, and intellectual property issues are prevalent. Competitors may create similar APIs or identify patent gaps. These challenges can severely impair a manufacturer's capacity to make income from their unique Api formulation and procedure.

Effectiveness of Small-molecule API Trials

The pharmaceutical business prioritizes small molecule Api safety and efficacy. Manufacturers are hampered by safety and efficacy worries. In clinical trials, Api safety and efficacy must be shown in different patient populations. Adverse events, toxicities, and systemic adverse effects can greatly impact the approval process, necessitating extra investigations and perhaps delaying an Api's market introduction.

Small Molecule API Battle

Small molecule Api manufacturers compete fiercely with biologics and specialized medicines in addition to the aforementioned constraints. Monoclonal antibodies are a rising pharmaceutical market sector. Complex compounds offer focused and effective medicines, typically outperforming small molecule APIs.In order to acquire market share and financing, the small molecule Api market must compete with biologics.

Type Analysis

The small molecule Api market is constantly developing, with different segments fighting for dominance. Synthetic Segment dominates the market. Lab-made APIs are in this segment. The Synthetic Segment's adaptability, cost-effectiveness, and ease of customization are reasons for its dominance.

The Synthetic Segment offers APIs to cater to various therapeutic categories. Its capacity to replicate natural molecules and manufacture effective drugs has made it appealing. Pharmaceutical firms like this segment due to its low production costs.

Synthetic Segment adoption is not confined to wealthy economies. Rapid economic growth in many countries increases healthcare spending and demand for affordable and accessible medications. As a result, the Synthetic Segment in these regions has experienced tremendous growth, with pharmaceutical companies investing in infrastructure and technology to fulfill demand.

Therapeutic Area Analysis

The cardiovascular diseases segment occupies a dominant position in the small molecule Api market. Cardiovascular diseases including hypertension, coronary artery disease, and heart failure are widespread, causing a large disease burden. Pharmaceutical companies have heavily invested in the production of small molecule APIs for cardiovascular diseases to address this global health issue.

Economic development in emerging economies is driving cardiovascular disease segment adoption. The burden of cardiovascular diseases rises when these countries experience economic growth and healthcare infrastructure improvements. As disease prevalence rises, demand for small molecule APIs targeting cardiovascular diseases rises, driving segment growth.

Consumer trends also affect the cardiovascular diseases segment. Consumers are increasingly concerned about cardiovascular health and seeking medications to control and prevent related illnesses. The Cardiovascular Diseases Segment offers a comprehensive range of Small Molecule Effective APIs that address these healthcare demands. Consumer awareness campaigns and education have raised awareness of cardiovascular diseases, increasing demand for targeted medications.

Key Market Segments

By Type

- Synthetic

- Biotech

By Therapeutic Area

- Autoimmune Diseases

- Oncology

- Metabolic Diseases

- Ophthalmology

- Cardiovascular Diseases

- Infectious Diseases

- Neurology

- Respiratory Disorders

- Dermatology

- Urology

- Other Therapeutic Areas

Growth Opportunity

Entering Emerging Markets

The small molecule Api market's expansion into emerging markets is one of its main growth possibilities. Pharmaceutical companies are increasingly pursuing these unexplored markets due to rising demand for affordable and accessible drugs in regions like Asia-Pacific, Latin America, and Africa. Manufacturers can tap into a large consumer base by establishing a solid footing in emerging economies and adapting to local regulatory frameworks, leading to higher production and revenue for the small molecule Api.

Niche APIs

The development of niche and specialized APIs is another key growth opportunity for the small molecule Api market. Personalized healthcare increases the demand for specialized pharmaceuticals. Pharmaceutical companies can find APIs that cater to uncommon diseases or niche therapeutic areas by investing in research and innovation. This strategy offers new markets and gives small molecule Api companies an edge.

Pharma/CMO partnerships

Collaborations with existing pharmaceutical companies and CMOs offer small molecule Api market growth. Small Api manufacturers gain distribution, regulatory experience, and financial resources by cooperating with pharmaceutical giants. Partnerships speed drug development, share expertise, and decrease market time. In the small molecule Api , CMO collaborations allow manufacturers to use specialized manufacturing skills for cost-effective scaling and efficient production.

High-potency APIs

The focus on high-potential APIs is another intriguing growth prospect. HPAPI use has increased due to complicated disorders and targeted therapy demand. High-potency APIs require strict manufacturing controls. Pharmaceutical companies may cater to the growing demand for novel and effective drugs by investing in advanced technology and infrastructure to develop HPAPIs. HPAPI production frequently has better margins, making the small molecule Api market viable.

CMP adoption

Continuous manufacturing adoption promises a dramatic growth opportunity in the small molecule Api market. Continuous flow manufacturing cuts production time improves quality, and reduces waste. By integrating automation, real-time monitoring, and advanced analytics, manufacturers may boost production and cut costs, leading to increased market competitiveness.

Market Growth

The small molecule Api market also has growth potential in other sectors. These include green chemistry for sustainable manufacturing, artificial intelligence, and machine learning for efficient medication development, and new drug delivery technologies to improve patient experience and compliance. These innovations strengthen the small molecule Api growth potential and let companies compete.

Latest Trends

Oncology & Cardiovascular APIs Advancing Care

Oncology and cardiovascular illnesses are global healthcare issues. As science advances, small molecule APIs addressing various therapeutic areas have increased in development and demand. The production of oncology and cardiovascular APIs has grown significantly as a result of the ongoing research of novel therapy options and the intense focus on precision medicine. By staying ahead of the curve and understanding emerging technologies, manufacturers may improve patient care and grow their market share.

Peptide and Oligonucleotide APIs Therapeutic Revolution

Beyond small molecule APIs, therapeutic strategies have evolved. Peptide and oligonucleotide APIs have changed precision medicine. The therapeutic potential of these complex molecular entities is growing. The demand for peptide and oligonucleotide APIs is rising because they treat cancer, metabolic problems, and hereditary issues. Leading manufacturers' research and development to leverage these APIs' potential will change the market landscape.

Cheap Healthcare APIs

The demand for generic healthcare APIs has skyrocketed as a result of the pursuit of cheap healthcare solutions. Patients can afford high-quality generic APIs without sacrificing efficacy. Generic APIs are in high demand as a result of rising chronic disease rates and the need to cut healthcare costs. Collaborations between generic pharmaceutical companies and Api manufacturers are increasing in the market, boosting competition and market growth.

Environment-Friendly API Manufacturing

The Api industry is working to reduce its environmental impact. Regulatory bodies and pharmaceutical corporations now prioritize eco-friendly Api manufacturing. Manufacturers reduce pollution while assuring the production of high-quality APIs by minimizing energy use, eliminating waste, and applying greener technologies. The integration of eco-friendly activities coincides with global sustainability goals and attracts environmentally concerned partners and stakeholders.

APIs Transforming Innovation

Integration of digital technologies in Api development can boost innovation and efficiency in the digital age. These technologies—from automation and artificial intelligence to data analytics and machine learning—speed drug development and help manufacturers meet market expectations. Predictive modeling, virtual screening, and in silico testing have transformed small molecule Api market discovery and formulation, saving time and money. Manufacturers may grow, collaborate, and deliver optimum healthcare solutions by adopting digital solutions.

Regional Analysis

The North American region dominates the small molecule Api market. Pharma relies on the small molecule active pharmaceutical ingredient (Api) market. Many medications use these small compounds, and demand is rising. North America dominates this market's regions.

Several factors explain North America's small molecule Api market dominance. First, the region has a thriving pharmaceutical industry with many US and Canadian pharmaceutical companies. These firms are competitive in designing and manufacturing small molecule APIs because to their resources, research capabilities, and innovation.

North America has strong pharmaceutical regulations and quality standards. The FDA's strict rules ensure pharmaceutical product safety, efficacy, and quality. These laws build domestic and international trust in North American-made APIs.

North America's small molecule Api market dominance is also due to its strong infrastructure and manufacturing facilities. The region's cutting-edge technologies and efficient production techniques make API production affordable and high-quality. This encourages pharmaceutical companies to build manufacturing operations in North America and helps them meet worldwide demand for small molecule APIs.

North America also has good IP rights. Effective patent protection stimulates innovation and incentivizes pharmaceutical companies to spend on small molecule Api research. This has increased North America's market share by introducing new APIs.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The leading player in the small molecule Api market is Albemarle Corporation. The US-based company has excelled in active pharmaceutical ingredient development and production. Albemarle's quality and reliability have earned them long-term agreements with many global pharmaceutical corporations.

Allergan, headquartered in Ireland, is a major player in the small molecule Api market due to its diversified product line and high manufacturing standards. Allergan prioritizes research & development to introduce new APIs to the market. The industry respects their quality and excellence.

In the small molecule Api market, Aurobindo Pharma is a force to be reckoned with. The India-based company is known for supplying high-quality APIs that meet strict regulatory criteria. Aurobindo Pharma's vast product portfolio and commitment to excellence have helped them dominate the market.

Cambrex Corporation, headquartered in the US, is an industry leader in the production of small molecule APIs. Cambrex delivers high-quality APIs that satisfy client objectives with state-of-the-art manufacturing facilities and qualified workers. Innovative and customer-focused, the company leads the small molecule Api market.

In the small molecule Api market, Dr. Reddy's Laboratories Ltd is a major player. A strong research and development group develops new APIs for the company. Dr. Reddy's Laboratories Ltd. is known for efficiently manufacturing complicated APIs to fulfill pharmaceutical industry demands.

Top Key Players in Small Molecule Api Market

- Albemarle Corporation (U.S.)

- Allergan (Ireland)

- Aurobindo Pharma (India)

- Cambrex Corporation (U.S.)

- Dr. Reddy’s Laboratories Ltd (India)

- GSk plc (U.K.)

- Lonza (Switzerland)

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Siegfried Holding AG (Switzerland)

- Sun Pharmaceutical Industries Ltd (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Johnson Matthey (U.K.)

- Gilead Sciences, Inc. (U.S.)

- BASF SE (Germany)

Recent Development

- In 2023, Pharmaceutical giant Pfizer launched its latest small molecule Api.

- In 2022, Novartis, a major player in the healthcare industry, made waves with its innovative small molecule Api.

- In 2021, Merck, a respected pharmaceutical company, launched its groundbreaking small molecule Api for asthma therapy.

- In 2020, the Reputed pharmaceutical company AbbVie unveiled its groundbreaking small molecule Api for rheumatoid arthritis.

- In 2019, Johnson & Johnson, a global healthcare giant, launched their HIV/AIDS-fighting small molecule Api.

Report Scope

Report Features Description Market Value (2022) USD 162.8 Bn Forecast Revenue (2032) USD 284.7 Bn CAGR (2023-2032) 5.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic, Biotech), By Therapeutic Area (Autoimmune Diseases, Oncology, Metabolic Diseases, Ophthalmology, Cardiovascular Diseases, Infectious Diseases, Neurology, Respiratory Disorders, Dermatology, Urology, Other Therapeutic Areas) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Albemarle Corporation (U.S.), Allergan (Ireland), Aurobindo Pharma (India), Cambrex Corporation (U.S.), Dr. Reddy’s Laboratories Ltd (India), GSk plc (U.K.), Lonza (Switzerland), Merck KGaA (Germany), Novartis AG (Switzerland), Pfizer Inc. (U.S.), Siegfried Holding AG (Switzerland), Sun Pharmaceutical Industries Ltd (India), Teva Pharmaceutical Industries Ltd. (Israel), Johnson Matthey (U.K.), Gilead Sciences, Inc. (U.S.), BASF SE (Germany) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Albemarle Corporation (U.S.)

- Allergan (Ireland)

- Aurobindo Pharma (India)

- Cambrex Corporation (U.S.)

- Dr. Reddy’s Laboratories Ltd (India)

- GSk plc (U.K.)

- Lonza (Switzerland)

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Siegfried Holding AG (Switzerland)

- Sun Pharmaceutical Industries Ltd (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Johnson Matthey (U.K.)

- Gilead Sciences, Inc. (U.S.)

- BASF SE (Germany)