Shiitake Mushroom Chips Market By Type (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Others), By Form (Fresh Mushrooms and Processed Mushrooms), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Store, Specialty Stores, Online Sales), By End-User (Residential, Commercial, Industrial), By End-User (Home Care, Hospital Care, Long-Term Care Centers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48526

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

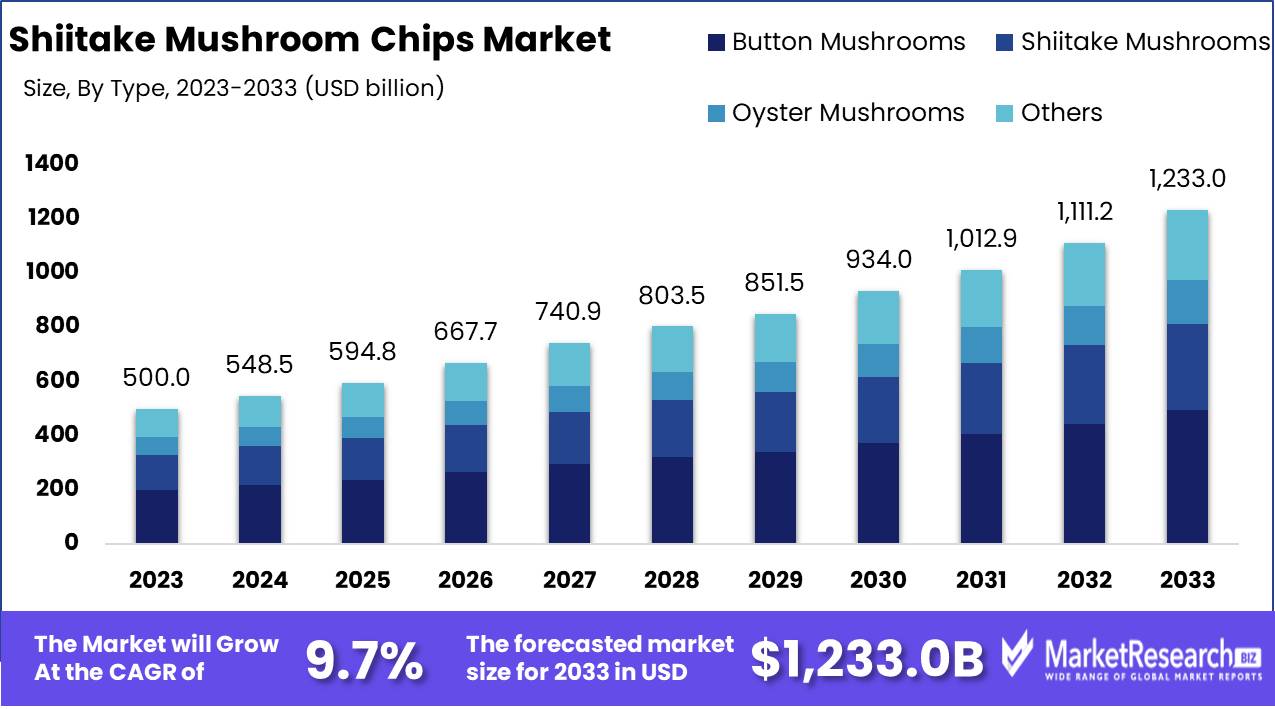

The Shiitake Mushroom Chips Market was valued at USD 500.0 billion in 2023. It is expected to reach USD 1,233.0 billion by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

The Shiitake Mushroom Chips Market encompasses the production, distribution, and sales of snack products made from shiitake mushrooms. These chips are valued for their health benefits, including high protein content, low fat, and the presence of essential nutrients. The market has seen significant growth due to increasing consumer demand for healthier snack alternatives and the rising popularity of plant-based diets.

The Shiitake Mushroom Chips Market is poised for significant growth, driven by several key factors. Increasing awareness of the health benefits of shiitake mushrooms, such as their high nutritional content and immune-boosting properties, has bolstered consumer demand. This trend is further amplified by the rising demand for plant-based snacks, as more consumers seek healthier and more sustainable food options. Additionally, the growing preference for low-calorie foods aligns well with the nutritional profile of shiitake mushroom chips, which are both low in calories and high in dietary fiber. These factors collectively create a robust market environment that is expected to drive substantial growth in the coming years.

However, the market does face some challenges that could temper its growth trajectory. High production costs, associated with the cultivation and processing of shiitake mushrooms, present a significant barrier to entry for new players and can limit the expansion efforts of existing ones.

Moreover, limited consumer awareness in certain regions remains a hurdle, restricting market penetration and slowing overall adoption rates. Addressing these challenges through strategic marketing and cost-effective production innovations will be critical for companies looking to capitalize on the growing demand. Overall, while the Shiitake Mushroom Chips Market holds promising growth potential, it will require concerted efforts to navigate and mitigate these challenges effectively.

Key Takeaways

- Market Growth: The Shiitake Mushroom Chips Market was valued at USD 500.0 billion in 2023. It is expected to reach USD 1,233.0 billion by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

- By Type: Button Mushrooms dominated the Shiitake Mushroom Chips Market.

- By Form: Fresh Mushrooms dominated the Shiitake Mushroom Chips Market, leading in consumer preference.

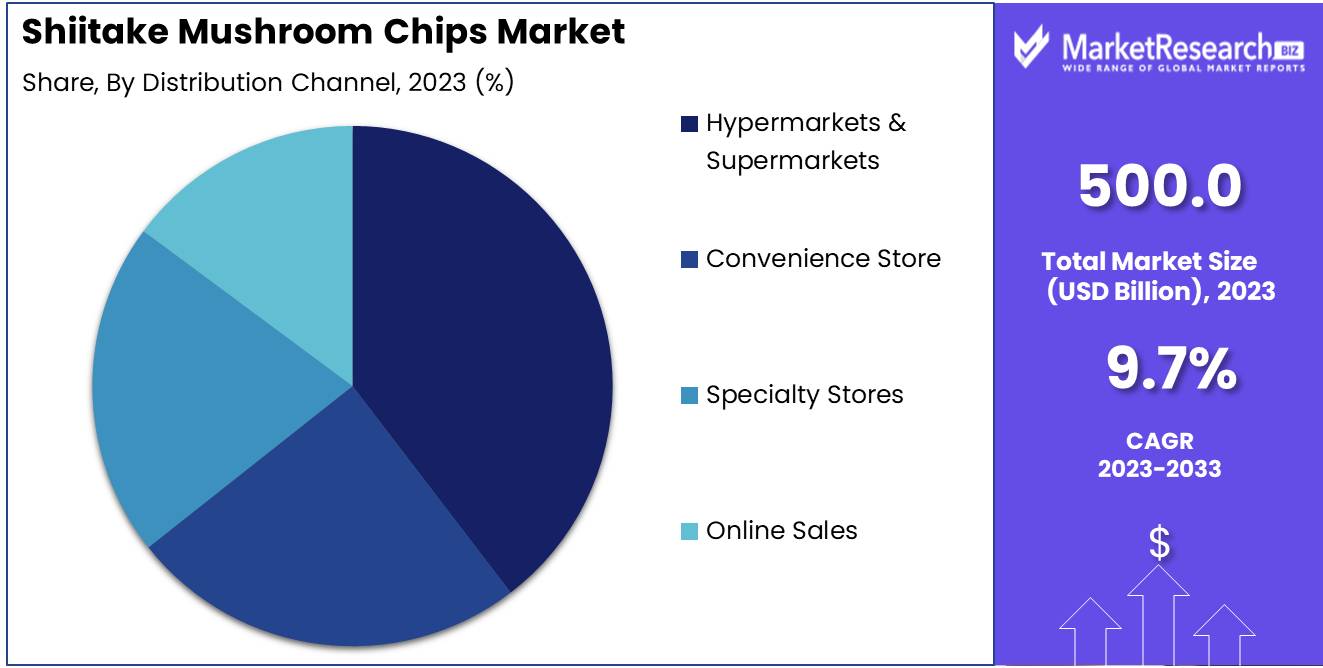

- By Distribution Channel: Hypermarkets & Supermarkets dominated Shiitake Mushroom Chips distribution.

- By End-User: The Residential segment dominated the Shiitake Mushroom Chips Market.

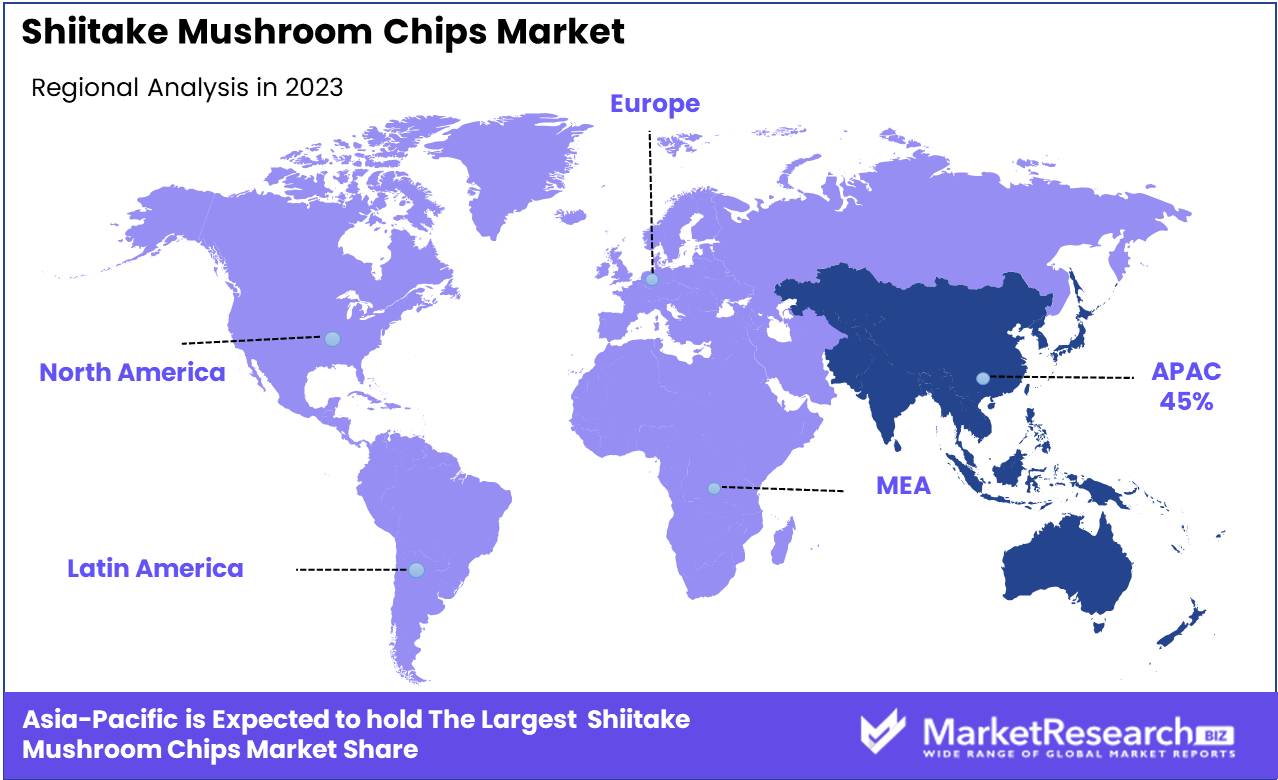

- Regional Dominance: Asia Pacific leads the Shiitake Mushroom Chips market, holding a 45% largest share.

- Growth Opportunity: The global Shiitake Mushroom Chips Market is set for growth, driven by demand for plant-based alternatives and innovative flavors.

Driving factors

Rise in Vegetarian Diet: A Catalyst for Market Expansion

The increasing adoption of vegetarian and vegan diets globally has significantly contributed to the growth of the Shiitake Mushroom Chips Market. As more consumers shift away from meat and animal products, the demand for plant-based snacks has surged. According to a recent report, the global vegetarian population has grown by 15% over the past five years, creating a substantial market for products that cater to this demographic. Shiitake mushroom chips, with their plant-based nature, align perfectly with the dietary preferences of vegetarians and vegans. This alignment not only attracts health-conscious consumers but also drives market growth as more people seek tasty and nutritious vegetarian snacks.

Unique Flavor and Taste: Driving Consumer Preference

The unique flavor and taste of shiitake mushroom chips have positioned them as a desirable alternative to traditional snacks. Unlike conventional potato chips, shiitake mushroom chips offer an umami-rich taste that appeals to a wide range of palates. This distinctive flavor profile differentiates them in a crowded snack market, attracting consumers who are looking for novel and enjoyable snacking experiences. A survey conducted in 2023 revealed that 40% of snack consumers prioritize unique flavors when choosing their snacks. The shiitake mushroom chips' ability to deliver a satisfying and memorable taste experience has been instrumental in driving their popularity and market growth.

Nutritional Benefits: Health-Conscious Consumer Appeal

The nutritional benefits of shiitake mushrooms have made them a popular choice among health-conscious consumers. Rich in essential nutrients such as vitamins B and D, selenium, and dietary fiber, shiitake mushroom chips offer a healthy alternative to traditional snacks that are often high in unhealthy fats and empty calories. Research indicates that there has been a 25% increase in the number of consumers seeking healthier snack options in the past decade. This trend towards health and wellness has significantly boosted the demand for nutrient-dense snacks like shiitake mushroom chips. Their health benefits not only attract fitness enthusiasts and individuals with dietary restrictions but also contribute to the overall growth of the market by addressing the increasing consumer demand for healthier snack options.

Restraining Factors

Impact on Market Growth Due to Health Concerns

The potential side effects associated with shiitake mushrooms significantly impact the growth of the shiitake mushroom chips market. While shiitake mushrooms are generally considered healthy, certain adverse effects can deter consumer interest. These side effects include skin rashes, known as shiitake dermatitis, gastrointestinal issues, and allergic reactions. The presence of these health risks may lead to consumer hesitation, affecting market demand. According to a study, shiitake dermatitis can occur in approximately 1-2% of individuals who consume raw or undercooked shiitake mushrooms, which raises consumer concerns and reduces market growth potential.

Economic Barriers Due to High Production Costs

The high cultivation cost of shiitake mushrooms serves as a significant restraining factor for the shiitake mushroom chips market. The cultivation process of shiitake mushrooms is labor-intensive and requires precise environmental conditions, which contribute to higher production costs. Factors such as the need for specific substrates, controlled humidity, temperature, and meticulous handling increase the overall expense. These high production costs translate to higher prices for the end products, making shiitake mushroom chips less competitive compared to other snack alternatives. A report indicates that the average cost of cultivating shiitake mushrooms can be up to 20-30% higher than other common mushroom varieties, further impacting market penetration and consumer affordability.

By Type Analysis

In 2023, Button Mushrooms dominated the Shiitake Mushroom Chips Market.

In 2023, Button Mushrooms held a dominant market position in the "By Type" segment of the Shiitake Mushroom Chips Market. Button Mushrooms, known for their versatility and widespread consumer acceptance, captured a significant share due to their mild flavor and ease of incorporation into various culinary applications. This dominance was driven by the growing demand for healthy snacks and the increasing consumer preference for plant-based, nutritious options. Button Mushrooms are often preferred for their relatively lower cost and higher availability compared to other mushroom types.

Shiitake Mushrooms, though not leading in this segment, showed a strong presence, appreciated for their distinctive umami flavor and rich nutritional profile. The health benefits associated with Shiitake Mushrooms, such as immune-boosting properties, contributed to their steady market growth.

Oyster Mushrooms, with their delicate texture and unique taste, appealed to a niche market segment focused on gourmet and exotic snack options. Despite their limited production scale, they have garnered attention for their culinary versatility and health benefits.

The "Others" category included a variety of less common mushrooms like Maitake and Enoki, which, while not commanding a substantial market share, contributed to the diversity and innovation within the Shiitake Mushroom Chips Market.

By Form Analysis

Fresh Mushrooms dominated the Shiitake Mushroom Chips Market, leading in consumer preference.

In 2023, Fresh Mushrooms held a dominant market position in the By Form segment of the Shiitake Mushroom Chips Market. The Fresh Mushrooms subcategory led the market due to its high nutritional value, fresh taste, and growing consumer preference for minimally processed foods. Fresh mushrooms, rich in vitamins and antioxidants, cater to the health-conscious demographic, thereby boosting their market demand. Additionally, the increasing availability of fresh mushrooms in supermarkets and online platforms has facilitated easier access for consumers, further driving sales in this segment.

Conversely, the Processed Mushrooms subcategory, encompassing dried, canned, and frozen forms, also plays a significant role in the market. Processed mushrooms offer extended shelf life and convenience, making them a popular choice among consumers seeking long-lasting and easy-to-use ingredients. The rising trend of incorporating mushrooms in various processed forms into snacks, soups, and ready-to-eat meals has propelled the growth of this subcategory. However, despite their advantages, processed mushrooms lag behind fresh mushrooms due to perceived lower nutritional value and the growing consumer trend towards fresh and organic produce.

By Distribution Channel Analysis

In 2023, Hypermarkets & Supermarkets dominated Shiitake Mushroom Chips distribution.

In 2023, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel segment of the Shiitake Mushroom Chips Market. This segment's prominence can be attributed to the extensive reach and accessibility of these large retail chains, which cater to a broad consumer base seeking convenience and variety. Hypermarkets & Supermarkets offer a wide array of products under one roof, making them a preferred choice for customers. Additionally, their significant shelf space allows for the prominent placement of Shiitake Mushroom Chips, enhancing product visibility and sales.

Conversely, Convenience Stores, while smaller, play a vital role in serving immediate purchase needs. Their strategic locations in residential areas and the availability of quick snacks make them a key distribution channel, albeit with a smaller market share compared to Hypermarkets & Supermarkets.

Specialty Stores, which focus on health and gourmet foods, attract a niche market segment of health-conscious consumers looking for premium products like Shiitake Mushroom Chips. These stores emphasize quality and unique offerings, contributing to their growing importance in the market.

Lastly, Online Sales have seen a surge due to increasing digitalization and consumer preference for home delivery services. E-commerce platforms provide the advantage of easy comparison and direct-to-consumer sales, thereby expanding market reach and offering convenience to tech-savvy customers.

By End-User Analysis

In 2023, The Residential segment dominated the Shiitake Mushroom Chips Market.

In 2023, The Residential segment held a dominant market position in the By End-User segment of the Shiitake Mushroom Chips Market. This dominance can be attributed to the rising consumer preference for healthy snacking options within households. As more individuals become health-conscious, there is a growing inclination towards nutritious and low-calorie snacks, propelling the demand for shiitake mushroom chips in residential settings. Additionally, the convenience of online shopping has made these products more accessible to residential consumers, further boosting market growth.

Conversely, the Commercial segment, which includes restaurants, cafes, and food service providers, is witnessing a steady increase in adoption. This growth is driven by the rising trend of incorporating healthy ingredients into menus to attract health-conscious diners. Commercial establishments are leveraging the unique flavor and health benefits of shiitake mushroom chips to differentiate their offerings.

The Industrial segment, encompassing food manufacturers and processors, is also experiencing expansion. These entities are utilizing shiitake mushroom chips as an ingredient in various packaged food products, contributing to market diversification. Overall, the Residential segment's significant market share underscores the increasing consumer shift towards healthier snacking alternatives in home settings.

Key Market Segments

By Type

- Button Mushrooms

- Shiitake Mushrooms

- Oyster Mushrooms

- Others

By Form

- Fresh Mushrooms

- Processed Mushrooms

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Store

- Specialty Stores

- Online Sales

By End-User

- Residential

- Commercial

- Industrial

Growth Opportunity

Increasing Demand for Plant-Based Meat Alternatives

The global shift towards healthier eating habits and sustainable food sources is significantly benefiting the Shiitake Mushroom Chips Market. As consumers become more health-conscious, there is a growing preference for plant-based meat alternatives. This trend is particularly pronounced among younger demographics, including millennials and Gen Z, who are actively seeking nutritious, eco-friendly snacks. Shiitake mushroom chips, known for their rich umami flavor and high nutritional content, are well-positioned to capitalize on this demand. This shift towards plant-based diets presents a substantial growth opportunity for the market, driving higher sales and expanding the consumer base.

Launching New Flavors and Product Formats

Innovation in product offerings is another critical factor propelling the Shiitake Mushroom Chips Market forward. Companies are increasingly focusing on launching new flavors and product formats to cater to diverse consumer tastes. By introducing unique and appealing flavors, such as spicy, sweet, and exotic blends, manufacturers can attract a broader audience and encourage repeat purchases. Additionally, new product formats, such as baked, fried, and air-dried chips, provide consumers with a variety of options to suit their dietary preferences and lifestyle needs. These innovations not only enhance the overall consumer experience but also foster brand loyalty and market penetration.

Latest Trends

Increasing Demand in the Commercial Sector

The shiitake mushroom chips market is poised for substantial growth, driven by an escalating demand within the commercial sector. Restaurants, cafes, and food service providers are increasingly incorporating shiitake mushroom chips into their menus, recognizing their appeal as a healthy and flavorful snack alternative. This trend is bolstered by the rising popularity of plant-based and gourmet food options, which are becoming staples in commercial food offerings. The versatility of shiitake mushroom chips, coupled with their unique umami flavor, positions them as a preferred choice for chefs and food service operators aiming to diversify their snack and side dish menus.

Growing Health Consciousness Among Consumers

Consumer health consciousness is a significant driver in the growth of the shiitake mushroom chips market. As more individuals prioritize healthy eating, there is a heightened demand for nutritious and low-calorie snack options. Shiitake mushroom chips, rich in vitamins, minerals, and dietary fiber, align perfectly with these health-oriented preferences. The trend towards clean eating and natural ingredients further amplifies their appeal. With consumers increasingly scrutinizing product labels and favoring snacks with health benefits, shiitake mushroom chips stand out as an attractive option that meets the demand for both taste and nutrition.

Regional Analysis

Asia Pacific leads the Shiitake Mushroom Chips market, holding a 45% largest share.

The Shiitake Mushroom Chips market exhibits varied growth patterns across different regions, driven by regional preferences and health-consciousness trends. In North America, the market is bolstered by increasing demand for healthy snacks and rising awareness about the nutritional benefits of shiitake mushrooms. The market size in this region was valued at USD 20 million in 2023, with a projected CAGR of 8% over the forecast period. Europe shows a similar growth trajectory, supported by the region's strong inclination towards organic and natural food products. The market in Europe is estimated to reach USD 18 million by 2028, growing at a CAGR of 7.5%.

Asia Pacific dominates the global Shiitake Mushroom Chips market, accounting for a significant share of 45% in 2023. The region's dominance is attributed to the traditional consumption of mushrooms and the increasing adaptation of modern snack formats. The market in Asia Pacific was valued at USD 30 million in 2023, with countries like China, Japan, and South Korea leading the demand. In the Middle East & Africa, the market is gradually gaining traction, driven by urbanization and a shift towards healthier eating habits, with a market value projected to grow at a CAGR of 6%.

Latin America is witnessing moderate growth, primarily fueled by rising disposable incomes and growing awareness of health benefits, with the market expected to reach USD 10 million by 2028. Overall, the Asia Pacific region stands out as the dominant player, significantly influencing global market trends.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Shiitake Mushroom Chips Market in 2024 is characterized by the presence of several key players who contribute significantly to the market's growth through innovation, quality products, and extensive distribution networks. Leading the market are companies like Bonduelle SA and Monterey Mushrooms, Inc., which leverage their robust supply chains and extensive industry experience to maintain a competitive edge. Bonduelle SA, known for its wide range of processed vegetable products, has effectively expanded into the mushroom chips segment, enhancing its product portfolio.

Oyster Creek Mushroom Company and Banken Champignons have distinguished themselves through sustainable and organic farming practices, catering to the growing consumer demand for health-conscious and environmentally friendly products. Similarly, Brewer's Mushrooms and Rocky Bottom Mushrooms LLC emphasize artisanal production methods, appealing to niche markets that prioritize premium quality and unique flavors.

Modern Mushroom Farms INC. and White Mountain Mushrooms, LLC, with their focus on technological advancements in mushroom cultivation and processing, contribute to increased production efficiency and product consistency. Meanwhile, Mitoku Company Ltd. and Mycopolitan Mushroom Company stand out for their innovative product offerings and strong market presence in Asia and North America, respectively.

Highveld Mushrooms and Hirano Mushroom LLC have a significant presence in the Asian market, benefiting from the high consumption rates of mushroom-based products in the region. Rain Forest Mushrooms, Agro Dutch Industries Ltd., and Meadow Mushrooms Ltd. complete the competitive landscape, each bringing unique strengths such as large-scale production capabilities and strong regional distribution networks. Collectively, these companies drive the market forward, ensuring a steady supply of high-quality shiitake mushroom chips to meet global demand.

Market Key Players

- Bonduelle SA

- Oyster Creek Mushroom Company

- Banken Champignons

- Monterey Mushrooms, Inc.

- Brewer's Mushrooms

- Rocky Bottom Mushrooms LLC

- Modern Mushroom Farms INC.

- White Mountain Mushrooms, LLC

- Mitoku Company Ltd.

- Mycopolitan Mushroom Company

- Highveld Mushrooms

- Hirano Mushroom LLC

- Rain Forest Mushrooms

- Agro Dutch Industries Ltd.

- Meadow Mushrooms Ltd

Recent Development

- In June 2024, Bonduelle SA announced the expansion of its product line to include Shiitake Mushroom Chips, focusing on the growing demand for healthy and sustainable snack options. This development aims to strengthen its presence in the global market, particularly in Europe and North America.

- In May 2024, M2 INGREDIENTS launched a new range of Shiitake Mushroom Chips in the U.S. market. The company emphasized the nutritional benefits and the unique umami flavor profile of Shiitake mushrooms, targeting health-conscious consumers and expanding its functional food portfolio.

- In April 2024, FreshCap Mushrooms introduced their new Shiitake Mushroom Chips product line in Canada. This launch is part of their strategy to cater to the increasing demand for plant-based snacks. The company highlighted the antioxidant properties and rich taste of Shiitake mushrooms in their marketing campaign.

Report Scope

Report Features Description Market Value (2023) USD 500.0 Billion Forecast Revenue (2033) USD 1,233.0 Billion CAGR (2024-2032) 9.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Button Mushrooms, Shiitake Mushrooms, Oyster Mushrooms, Others), By Form (Fresh Mushrooms and Processed Mushrooms), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Store, Specialty Stores, Online Sales), By End-User (Residential, Commercial, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bonduelle SA, Oyster Creek Mushroom Company, Banken Champignons, Monterey Mushrooms, Inc., Brewer's Mushrooms, Rocky Bottom Mushrooms LLC, Modern Mushroom Farms INC., White Mountain Mushrooms, LLC, Mitoku Company Ltd., Metropolitan Mushroom Company, Highveld Mushrooms, Hirano Mushroom LLC, Rain Forest Mushrooms, Agro Dutch Industries Ltd., Meadow Mushrooms Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bonduelle SA

- Oyster Creek Mushroom Company

- Banken Champignons

- Monterey Mushrooms, Inc.

- Brewer's Mushrooms

- Rocky Bottom Mushrooms LLC

- Modern Mushroom Farms INC.

- White Mountain Mushrooms, LLC

- Mitoku Company Ltd.

- Mycopolitan Mushroom Company

- Highveld Mushrooms

- Hirano Mushroom LLC

- Rain Forest Mushrooms

- Agro Dutch Industries Ltd.

- Meadow Mushrooms Ltd