Self Compacting Concrete Market By Raw Materials (Cement, Admixtures, Fibers, Aggregates, Water, Additions), By Type (Powder Type, Viscosity Agent Type, Combination Type), By Application (Columns, Concrete Frame), By End User (Infrastructure, Building and Construction, Oil and Gas Construction), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48024

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

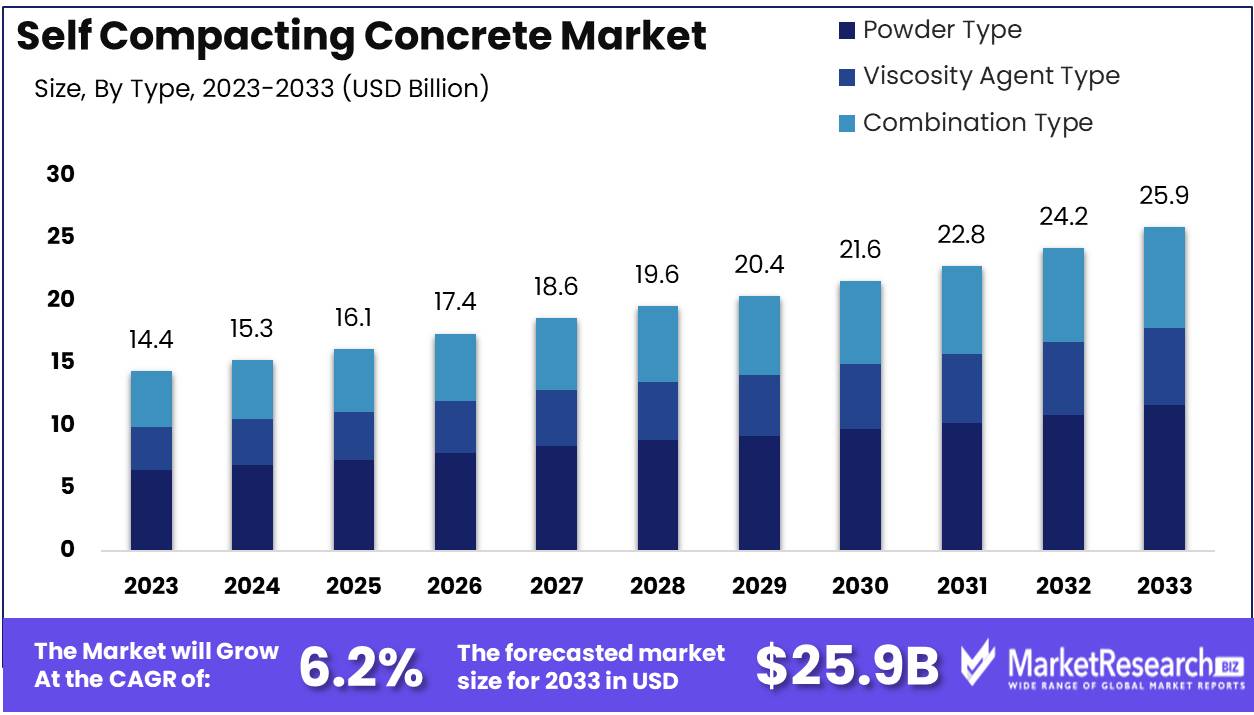

The Self Compacting Concrete Market was valued at USD 14.4 billion in 2023. It is expected to reach USD 25.9 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The Self-Compacting Concrete (SCC) market encompasses the production and utilization of advanced concrete that flows under its own weight to fill formwork without the need for mechanical vibration. This innovative material enhances construction efficiency, quality, and durability, addressing challenges such as complex formworks and congested reinforcement. Driven by increasing infrastructure projects, urbanization, and stringent building regulations, the SCC market is poised for significant growth.

The Self-Compacting Concrete (SCC) market is poised for significant growth, driven by rapid urbanization and the expansion of global infrastructure projects. As urban centers expand and modernize, the demand for materials that streamline construction processes and enhance structural integrity is escalating. SCC's ability to flow and settle without mechanical vibration makes it an attractive choice for complex forms and densely reinforced structures, reducing labor costs and improving project timelines. However, the market's expansion is tempered by the high initial costs associated with SCC, which can deter adoption in cost-sensitive projects. This cost barrier is particularly pronounced in developing regions where budget constraints are a critical concern.

Moreover, the application of SCC demands specialized technical knowledge and skilled labor. The precision required in mix design and placement necessitates a workforce proficient in advanced concrete technologies, which is not uniformly available across all regions. This expertise gap can limit the widespread adoption of SCC, especially in areas with a shortage of skilled labor. Despite these challenges, the long-term benefits of SCC, including enhanced durability, reduced maintenance costs, and superior finish quality, present compelling advantages that are expected to drive market growth.

As construction technologies evolve and training programs improve, the technical and cost barriers may diminish, fostering broader utilization of SCC in infrastructure development projects worldwide. The integration of SCC into mainstream construction practices holds the potential to revolutionize the sector, aligning with global trends towards more efficient and sustainable building methods.

Key Takeaways

- Market Growth: The Self Compacting Concrete Market was valued at USD 14.4 billion in 2023. It is expected to reach USD 25.9 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Raw Materials: Cement dominated the raw materials segment in the SCC market.

- By Type: Powder Type dominated the Self Compacting Concrete market segment.

- By Application: Columns dominated SCC market applications, enhancing structural integrity.

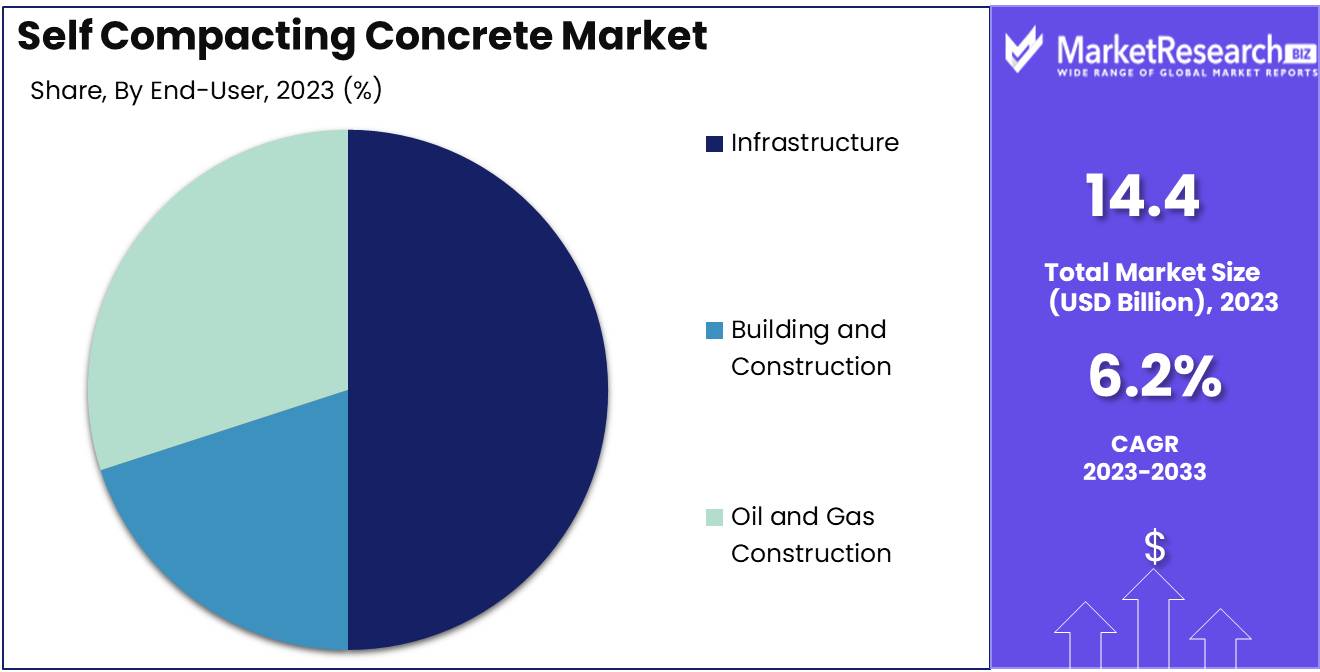

- By End User: Infrastructure dominated the SCC market due to rising global demand.

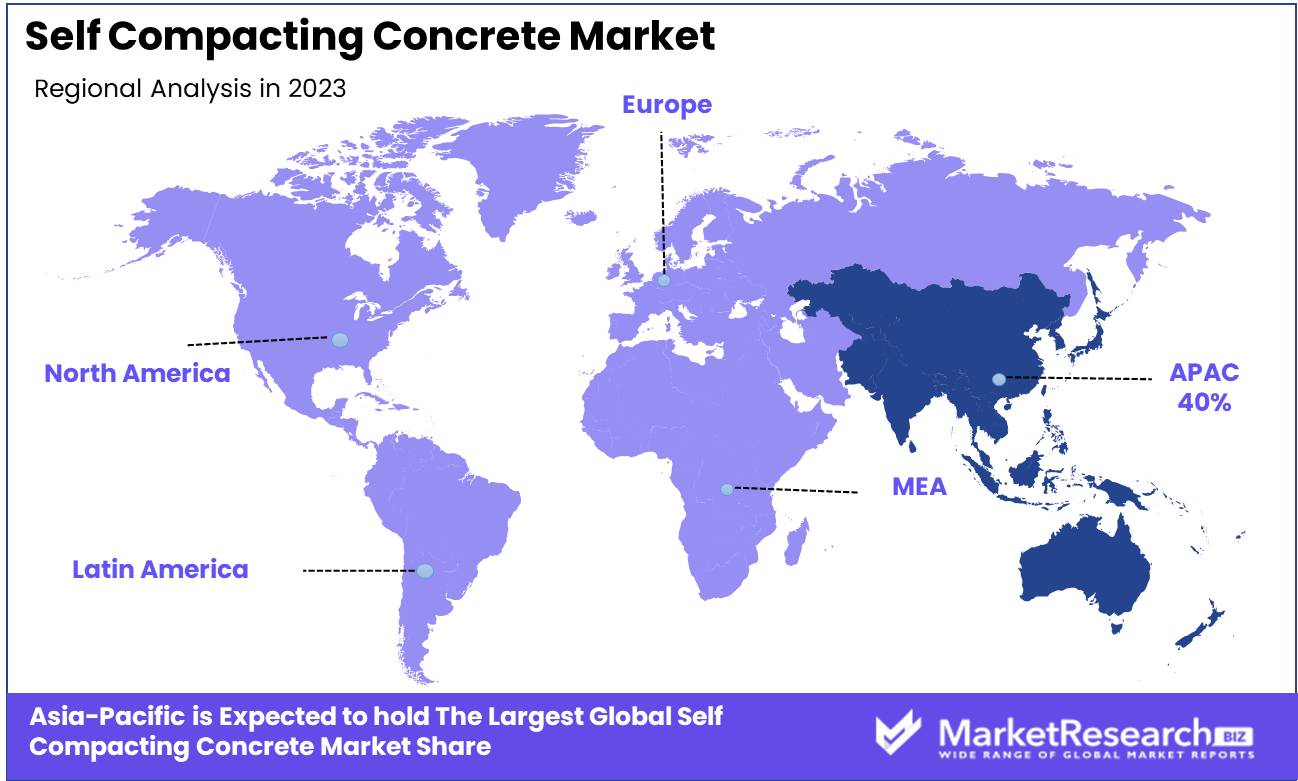

- Regional Dominance: Asia Pacific dominates the SCC market, leading with a 40% share.

- Growth Opportunity: The SCC market will thrive due to efficient construction techniques and an expanding construction industry, driving significant growth.

Driving factors

Significant Reduction in Overall Costs: Catalyzing Market Expansion

Self Compacting Concrete (SCC) significantly reduces overall construction costs by minimizing labor and equipment expenses. Unlike traditional concrete, SCC requires less manual intervention due to its high flowability, which allows it to settle into complex molds and tight spaces without the need for vibration. This property reduces the need for skilled labor, which is both scarce and costly in many regions.

Furthermore, the reduced need for vibratory equipment translates into lower equipment and maintenance costs. These cost savings are compelling for contractors and developers, driving widespread adoption and propelling the market's growth. The economic efficiency of SCC not only reduces direct costs but also accelerates project timelines, offering additional financial benefits through quicker project completions.

Superior Finish Quality: Enhancing Aesthetic and Structural Appeal

SCC offers superior finish quality, characterized by smooth surfaces and uniform texture, which is highly desirable in both architectural and structural applications. The high fluidity of SCC ensures the complete filling of molds and minimal surface imperfections, reducing the need for post-placement repairs and finishing work. This quality is particularly advantageous for projects requiring high aesthetic standards, such as commercial buildings, bridges, and architectural facades. The ability to achieve high-quality finishes with less effort and fewer materials enhances the value proposition of SCC, making it a preferred choice among builders and designers. This demand for higher quality outcomes contributes significantly to the market growth as more projects specify SCC for its superior finish capabilities.

Growing Popularity of Low-Fines SCC: Innovation Driving Adoption

The increasing preference for low-fine SCC is another critical factor driving market growth. Low-fines SCC utilizes fewer fine aggregates, which not only reduces material costs but also improves the sustainability profile of the concrete. This type of SCC retains the desirable properties of standard SCC, such as self-compaction and high fluidity, while addressing environmental concerns by reducing the need for extensive raw material extraction. The adoption of low-fine SCC aligns with the construction industry's growing emphasis on sustainable practices and green building standards. As environmental regulations become stricter and the demand for eco-friendly construction materials rises, the market for low-fines SCC is poised for significant growth. The dual benefit of cost efficiency and sustainability offered by low-fines SCC positions it as a forward-thinking solution in modern construction.

Restraining Factors

High Raw Material Costs: A Significant Barrier to Market Expansion

The cost of raw materials is a critical factor impacting the growth of the Self Compacting Concrete (SCC) market. Self-compacting concrete requires high-quality materials, including specific types of aggregates, cement, and admixtures, which are typically more expensive than those used in conventional concrete. The reliance on these premium materials drives up the overall production costs of SCC.

For instance, the cost of superplasticizers, essential for achieving the desired flow properties without compromising the concrete's strength, can be significantly higher. According to industry data, the price of superplasticizers can range from $0.80 to $1.50 per kilogram, a substantial increase over standard plasticizers used in traditional concrete. This cost premium is directly transferred to the final product, making SCC more expensive and less attractive, particularly in cost-sensitive markets.

High raw material costs can also affect the competitive landscape. Smaller construction firms and projects with tight budgets may opt for traditional concrete to manage expenses, thereby limiting the broader adoption of SCC. Consequently, while the benefits of SCC in terms of labor savings and construction efficiency are well-documented, the initial financial outlay required for high-quality materials remains a deterrent to widespread market growth.

Availability of Skilled Labor: A Constraint on Market Development

The availability of skilled labor is another significant restraining factor for the SCC market. Unlike traditional concrete, which relies heavily on vibration and compaction techniques that are widely understood and practiced, SCC requires a different set of skills and knowledge. Proper mixing, placement, and curing of SCC necessitate specialized training and experience to avoid common issues such as segregation and bleeding.

There is a notable skills gap in the construction industry regarding the effective use of SCC. According to industry reports, only a fraction of the current workforce possesses the expertise required to handle SCC effectively. This skills gap poses a challenge in ensuring the quality and consistency of SCC applications. Inadequate training can lead to suboptimal performance and increased risk of project failures, which further deters contractors from adopting SCC.

Furthermore, the scarcity of skilled labor can lead to higher labor costs. To attract and retain skilled workers capable of handling SCC, companies may need to offer higher wages and invest in extensive training programs. This additional financial burden can be a deterrent, particularly for smaller firms or those operating in regions where labor costs are already high.

By Raw Materials Analysis

In 2023, Cement dominated the raw materials segment in the SCC market.

In 2023, Cement held a dominant market position in the "By Raw Materials" segment of the Self-Compacting Concrete (SCC) market. Cement is the primary binder in SCC, crucial for achieving the desired strength and durability. Its consistent quality and availability make it indispensable, ensuring the structural integrity of SCC applications. Admixtures, the second key component, play a vital role in enhancing workability and performance. These chemical additives adjust the properties of SCC to meet specific requirements, such as flowability and setting time, making them essential for diverse construction scenarios.

Fibers, though a smaller segment, contribute significantly to the reinforcement of SCC. They improve tensile strength and crack resistance, enhancing the overall durability of the concrete. Aggregates, comprising coarse and fine materials, form the bulk of SCC and are essential for its volumetric stability. High-quality aggregates ensure the mix's homogeneity and contribute to its self-compacting properties.

Water, the simplest yet critical component, affects the mix's fluidity and hydration process. Precise water content is vital for achieving the right balance between workability and strength. Lastly, additions, such as supplementary cementitious materials (SCMs), enhance specific properties of SCC, including sustainability and performance under various environmental conditions. These materials include fly ash, slag, and silica fume, which also help in reducing the overall carbon footprint of concrete production. Collectively, these raw materials form the foundation of SCC, with cement leading due to its essential role in the mixture.

By Type Analysis

In 2023, Powder Type dominated the Self Compacting Concrete market segment.

In 2023, Powder Type held a dominant market position in the By Type segment of the Self Compacting Concrete Market. This preeminent status can be attributed to its superior performance characteristics, including enhanced workability and stability in diverse construction applications. Powder Type SCC incorporates fine materials like fly ash, silica fume, and ground granulated blast-furnace slag, which improve the mixture’s viscosity and cohesion, reducing segregation and bleeding. This makes it highly sought after for complex architectural and structural projects that demand precision and durability.

Viscosity Agent Type, although not leading, demonstrated significant growth. This segment leverages admixtures to adjust the viscosity of concrete, providing flexibility and control over flow properties. It is particularly advantageous in scenarios requiring minimal bleeding and segregation, such as thin-walled structures or heavily reinforced sections, where traditional methods might fail.

Combination Type, which integrates both powder and viscosity agents, is gaining traction due to its balanced attributes. It offers the synergistic benefits of enhanced stability and workability, making it suitable for high-performance applications. This hybrid approach is anticipated to bridge the gap between the other two types, potentially reshaping market dynamics in the coming years.

By Application Analysis

In 2023, Columns dominated SCC market applications, enhancing structural integrity.

In 2023, Columns held a dominant market position in the "by application" segment of the Self Compacting Concrete (SCC) market. This leadership is primarily attributed to the superior properties of SCC, which ensure uniform compaction and high surface quality without the need for mechanical vibration. The use of SCC in columns enhances structural integrity and aesthetic appeal, meeting the stringent requirements of modern architectural designs and construction standards.

Concrete frames also showcased significant growth within the same segment. The adoption of SCC in concrete frames is driven by its ability to flow easily through complex formworks and around dense rebar configurations, ensuring optimal load distribution and minimizing voids. This application is particularly advantageous in high-rise buildings and infrastructure projects where the durability and reliability of the concrete framework are critical.

Both applications underscore the increasing preference for SCC due to its efficiency, quality, and performance benefits, positioning it as a key material in the advancement of contemporary construction practices. This trend is expected to continue as the industry moves towards more sustainable and labor-efficient building solutions.

By End User Analysis

In 2023, Infrastructure dominated the SCC market due to rising global demand.

In 2023, Infrastructure held a dominant market position in the end-user segment of the Self-Compacting Concrete (SCC) Market. This prominence is attributed to the rising global demand for durable, high-quality concrete in large-scale public works. Infrastructure projects, encompassing roads, bridges, tunnels, and dams, benefit significantly from SCC's enhanced flowability and minimal need for vibration, resulting in expedited construction timelines and reduced labor costs.

Concurrently, the Building and Construction segment has witnessed substantial growth, driven by the booming urbanization and the need for resilient, low-maintenance structures in both residential and commercial sectors. Here, SCC's superior finish and structural integrity offer compelling advantages.

Additionally, the Oil and Gas Construction segment remains crucial, albeit more niche, due to the stringent safety and performance standards in offshore and onshore facilities where SCC's uniformity and resistance to harsh environmental conditions are highly valued. Collectively, these segments underscore SCC's versatility and growing adoption across diverse applications, reinforcing its pivotal role in modern construction methodologies.

Key Market Segments

By Raw Materials

- Cement

- Admixtures

- Fibers

- Aggregates

- Water

- Additions

By Type

- Powder Type

- Viscosity Agent Type

- Combination Type

By Application

- Columns

- Concrete Frame

By End User

- Infrastructure

- Building and Construction

- Oil and Gas Construction

Growth Opportunity

Increasing Demand for Efficient Construction Techniques

The global self-compacting concrete (SCC) market is poised for significant growth, driven by the increasing demand for efficient construction techniques. SCC's ability to flow and settle under its own weight without the need for mechanical consolidation not only accelerates construction processes but also ensures superior finish quality and structural integrity. This efficiency translates into substantial time and labor cost savings, a critical factor in today's fast-paced construction environment. The enhanced performance of SCC in terms of durability and reduced maintenance further underscores its value proposition, positioning it as a preferred material in both residential and commercial projects.

Expansion of the Construction Industry

The ongoing expansion of the construction industry globally is another key driver for the SCC market. Rapid urbanization, coupled with large-scale infrastructure projects, particularly in emerging economies, is creating a robust demand for advanced building materials. According to recent industry reports, the global construction market is expected to grow at a compound annual growth rate (CAGR) of approximately 7.4% over the next decade. This growth trajectory is underpinned by increased investments in infrastructure, residential, and commercial construction, thereby providing a fertile ground for the adoption of SCC.

Latest Trends

Growing Demand from the Residential Sector

The self-compacting concrete (SCC) market is poised for significant growth driven by increased demand from the residential sector. Urbanization and the global trend towards sustainable construction are key factors accelerating the adoption of SCC in residential projects. The inherent properties of SCC, such as its ability to flow easily into complex formwork and around reinforcements without the need for mechanical vibration, make it highly suitable for the construction of residential buildings.

Moreover, the ongoing emphasis on reducing construction time and labor costs further enhances its appeal. As developers and contractors seek more efficient and durable building materials, the utilization of SCC in residential construction is expected to rise, contributing substantially to market growth.

Advancements in Self-Compacting Concrete Formulations

Technological advancements in SCC formulations are set to transform the market landscape. Innovations aimed at enhancing the material's performance characteristics such as improved flowability, reduced shrinkage, and increased durability are at the forefront. These advancements are driven by extensive R&D activities focusing on optimizing the mix design of SCC to achieve superior workability and strength. The development of eco-friendly and cost-effective admixtures is also playing a critical role in refining SCC formulations. By leveraging these technological improvements, manufacturers can offer more tailored solutions that meet the specific requirements of diverse construction projects. This trend not only elevates the quality and performance of SCC but also positions it as a preferred material in the construction industry.

Regional Analysis

Asia Pacific dominates the SCC market, leading with a 40% share.

The self-compacting concrete (SCC) market exhibits significant regional variations in demand and growth potential. In North America, the market is driven by extensive infrastructure renovation projects and the adoption of advanced construction technologies. The region's market is bolstered by substantial investments in commercial and residential buildings, with the U.S. leading this surge.

Europe demonstrates robust growth, particularly in countries like Germany, France, and the UK, where stringent building regulations and sustainability standards promote the use of SCC. The European SCC market benefits from the region's emphasis on reducing construction time and labor costs while enhancing structural durability.

The Asia Pacific region, however, dominates the global SCC market, accounting for approximately 40% of the total share. Rapid urbanization, significant infrastructural projects, and expanding construction activities in countries such as China, India, and Japan fuel this dominance. China's ambitious infrastructure development plans, including smart city initiatives and high-speed rail projects, significantly drive SCC demand.

In the Middle East & Africa, the market growth is spurred by substantial investments in infrastructure development and urbanization in Gulf Cooperation Council (GCC) countries. Mega projects like Saudi Arabia’s NEOM and the UAE's Expo 2020 infrastructure developments exemplify this trend, boosting SCC usage for its efficiency and performance benefits.

Latin America experiences moderate growth, primarily led by Brazil and Mexico, where urban development and public infrastructure projects stimulate demand. Economic fluctuations and political instability pose challenges, but ongoing development initiatives in major cities provide steady market support.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global self-compacting concrete (SCC) market is poised for significant growth in 2024, driven by advancements in construction techniques and increased infrastructure development. Key players in this market are strategically positioned to capitalize on these trends, leveraging their technological expertise and expansive operational footprints.

CEMEX S.A.B. de C.V. and LafargeHolcim Ltd are industry leaders, consistently innovating to enhance the properties of SCC. Their global presence and extensive R&D capabilities ensure they remain at the forefront of product development, focusing on sustainability and performance. HeidelbergCement AG and Buzzi Unicem SpA are also prominent, benefiting from their robust distribution networks and strong market positions in Europe. Their focus on high-quality, eco-friendly products aligns with the growing demand for sustainable construction materials.

Sika AG and BASF SE are critical players due to their expertise in chemical admixtures, which are essential for improving the workability and durability of SCC. Their continuous innovation in admixture technologies supports the enhanced performance characteristics required in modern construction projects. Kilsaran International and Unibeton Ready Mix emphasize localized solutions, leveraging their regional expertise to meet specific market needs. This approach allows them to provide tailored SCC solutions that cater to local construction practices and regulatory requirements.

RMC Group plc, Firth Industries, and GCP Applied Technologies Inc. are notable for their advanced production techniques and quality control measures, ensuring consistency and reliability in their SCC offerings. Tarmac Trading Limited, CRH plc, and Vicat are leveraging their extensive operational bases and established customer relationships to expand their SCC product lines, focusing on both domestic and international markets.

Ultratech Cement Ltd and Italcementi continue to drive innovation in the SCC market in Asia and Europe, respectively. Their strategic investments in modern manufacturing facilities and sustainable practices position them well to meet the rising demand for SCC. Colas Group and Aggregate Industries are investing heavily in R&D to develop next-generation SCC products that meet stringent environmental standards and enhance construction efficiency. Hanson UK and CEMEX UK Operations Limited are pivotal in the UK market, with a strong focus on sustainability and compliance with local building standards.

Market Key Players

- CEMEX S.A.B. de C.V.

- LafargeHolcim Ltd

- HeidelbergCement AG

- Sika AG

- BASF SE

- Buzzi Unicem SpA

- Kilsaran International

- RMC Group plc

- Firth Industries

- GCP Applied Technologies Inc.

- CEMEX UK Operations Limited

- Tarmac Trading Limited

- CRH plc

- Vicat

- Aggregate Industries

- Hanson UK

- Unibet on Ready Mix

- Italcementi

- Ultratech Cement Ltd

- Colas Group

Recent Development

- In May 2024, Cemex unveiled its Smart SCC solutions, integrating digital technology to optimize the performance and quality control of self-compacting concrete. These solutions include sensors and software to monitor the concrete's properties in real time, ensuring consistency and reliability in various construction projects.

- In April 2024, BASF introduced new high-performance additives specifically designed for self-compacting concrete. These additives enhance the flowability and stability of SCC, making it more efficient for complex structural applications. This advancement is part of BASF's ongoing efforts to innovate in the construction chemicals sector.

- In March 2024, LafargeHolcim launched a new range of sustainable self-compacting concrete products, incorporating recycled materials and offering reduced carbon footprints. This innovation aligns with the company's commitment to sustainability and aims to meet the increasing demand for eco-friendly construction materials.

Report Scope

Report Features Description Market Value (2023) USD 14.4 Billion Forecast Revenue (2033) USD 25.9 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Raw Materials (Cement, Admixtures, Fibers, Aggregates, Water, Additions), By Type (Powder Type, Viscosity Agent Type, Combination Type), By Application (Columns, Concrete Frame), By End User (Infrastructure, Building and Construction, Oil and Gas Construction) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape CEMEX S.A.B. de C.V., LafargeHolcim Ltd, HeidelbergCement AG, Sika AG, BASF SE, Buzzi Unicem SpA, Kilsaran International, RMC Group plc, Firth Industries, GCP Applied Technologies Inc., CEMEX UK Operations Limited, Tarmac Trading Limited, CRH plc, Vicat, Aggregate Industries, Hanson UK, Unibeton Ready Mix, Italcementi, Ultratech Cement Ltd, Colas Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- CEMEX S.A.B. de C.V.

- LafargeHolcim Ltd

- HeidelbergCement AG

- Sika AG

- BASF SE

- Buzzi Unicem SpA

- Kilsaran International

- RMC Group plc

- Firth Industries

- GCP Applied Technologies Inc.

- CEMEX UK Operations Limited

- Tarmac Trading Limited

- CRH plc

- Vicat

- Aggregate Industries

- Hanson UK

- Unibet on Ready Mix

- Italcementi

- Ultratech Cement Ltd

- Colas Group