Security Screening Systems Market Report By Product Type (X-ray Screening Systems, Explosive Detection Systems (EDS), Metal Detectors, Biometric Systems, Liquid Scanner, Others), By Application (Airport Security, Border Security, Correctional Facilities, Public Safety & Security, Critical Infrastructure Protection, Others), By End-Use, By Technology, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50263

-

August 2024

-

322

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

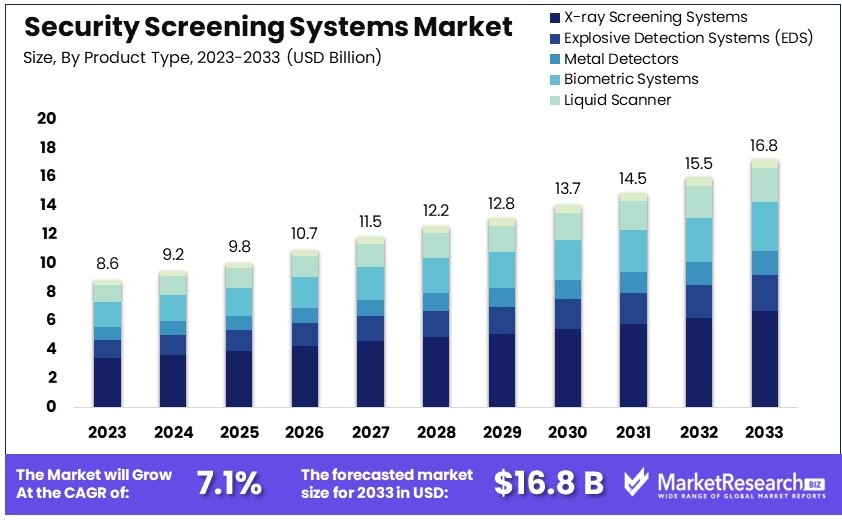

The Global Security Screening Systems Market size is expected to be worth around USD 16.8 Billion by 2033, from USD 8.6 Billion in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Security Screening Systems Market involves the production and deployment of technologies used to detect and prevent security threats. This market includes equipment like X-ray machines, metal detectors, and biometric systems. Increasing global security concerns, regulatory requirements, and the need for safe public spaces drive demand.

Innovations in AI and machine learning enhance threat detection capabilities, making systems more efficient and accurate. The market serves various sectors including airports, public venues, government buildings, and commercial facilities. Leading companies focus on integrating advanced technologies and providing comprehensive solutions to ensure safety and compliance with international security standards.

The security screening systems market is poised for robust growth, driven by the increasing need for effective security measures in high-traffic areas, particularly airports. The Transportation Security Administration (TSA) screens over 2 million passengers daily, amounting to more than 750 million annually. This immense volume highlights the critical role of security screening systems in ensuring safety. Additionally, the TSA screens 1.4 million checked items and 5.5 million carry-on items daily for explosives and prohibited items, underscoring the high demand for advanced screening technologies.

Technological advancements are at the forefront of this market's growth. Airports across the nation are equipped with nearly 950 advanced imaging technology machines. These machines enhance security measures while maintaining passenger privacy, reflecting the balance between security and convenience that modern systems must achieve.

Compliance and effectiveness are also key drivers in this market. The TSA conducts over 29,000 assessments annually to ensure the efficacy and adherence to regulations of their screening procedures. This rigorous compliance framework ensures that the screening systems are not only effective but also meet stringent security standards.

The convergence of high passenger volumes, technological advancements, and strict compliance measures presents a significant opportunity for growth in the security screening systems market. Companies operating in this space must focus on innovation and efficiency to meet the increasing demands. By leveraging advanced technologies and maintaining high compliance standards, stakeholders can enhance their market position and drive future growth. The security screening systems market, therefore, offers substantial potential, driven by the essential need for safety in transportation hubs and other high-traffic areas.

Key Takeaways

- Market Value: The Security Screening Systems Market was valued at $8.6 billion in 2023 and is expected to reach $16.8 billion by 2033, with a CAGR of 7.1%.

- Product Type Analysis: X-ray Screening Systems dominated with 40%; they are crucial for comprehensive and efficient security screening in various sectors.

- Application Analysis: Airport Security dominated with 50%; airports are critical points requiring stringent security measures, driving high demand.

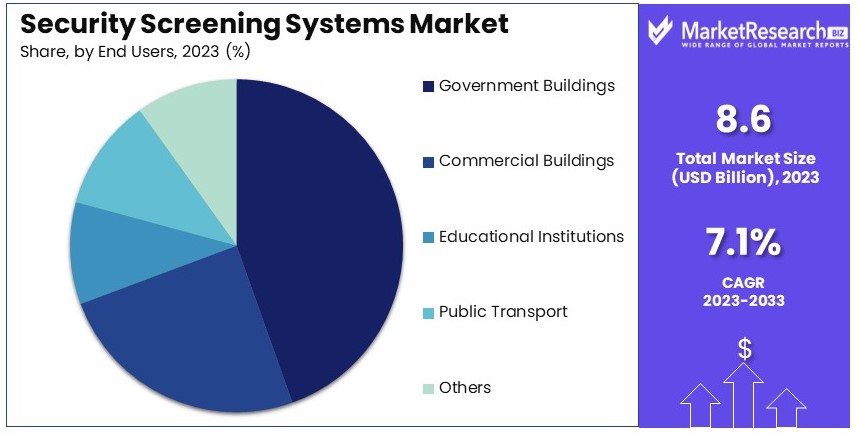

- End-Use Analysis: Government Buildings dominated with 45%; security is paramount in government facilities, making them key users of these systems.

- Technology Analysis: 3D X-ray Technology dominated with 55%; this technology offers superior imaging and detection capabilities, enhancing security effectiveness.

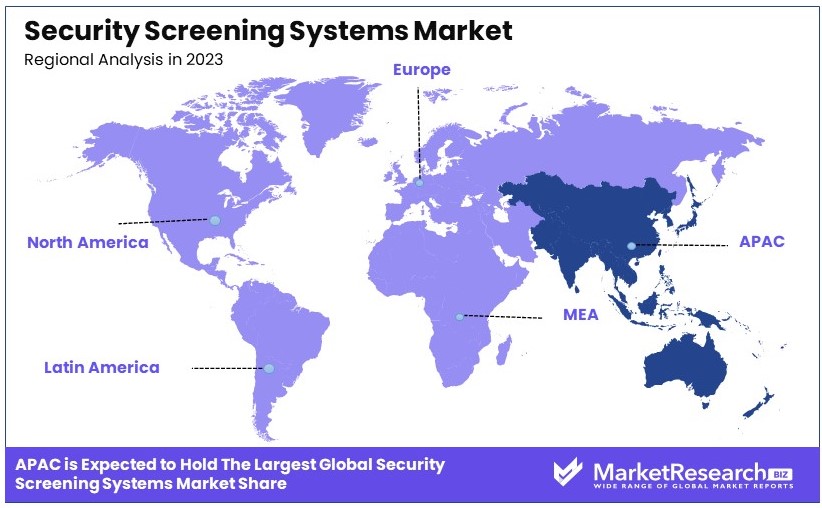

- Dominant Region: APAC held 42.6%; rapid infrastructure development and increased security threats are driving the market in this region.

- Analyst Viewpoint: The market is moderately saturated, with significant competition among key players. Future growth is driven by technological advancements and rising global security concerns.

Driving Factors

Increased Security Threats Drive Market Growth

The rise in global security threats has necessitated advanced security screening systems, boosting market growth. Smart airports, government buildings, and public venues are increasingly adopting sophisticated screening technologies to ensure safety. For example, the use of full-body scanners and advanced imaging technology (AIT) in airports has become more prevalent to detect potential threats, ensuring the safety of passengers and personnel.

These technologies are designed to identify weapons, explosives, and other prohibited items quickly and accurately, enhancing overall security measures. The continuous threat of terrorism and other criminal activities has led to a heightened focus on security, prompting significant investments in state-of-the-art screening solutions. This increased demand for security measures is a direct response to the evolving nature of threats, making advanced screening systems an essential component in modern security protocols.

Technological Advancements Drive Market Growth

Continuous advancements in screening technology have significantly contributed to the market's expansion. Innovations such as artificial intelligence, machine learning, and automated threat detection have enhanced the efficiency and accuracy of security systems. An example of this is the deployment of AI-powered X-ray machines that can quickly identify prohibited items in luggage, improving throughput and reducing the burden on security personnel.

These advancements not only improve the speed and reliability of security checks but also help in minimizing human error. The integration of cutting-edge technologies into security systems has made them more effective and user-friendly, leading to widespread adoption across various sectors. The ongoing development of more sophisticated screening technologies continues to drive the market forward, ensuring that security measures keep pace with emerging threats.

Regulatory Compliance and Government Initiatives Drive Market Growth

Stringent regulations and increased government investments in security infrastructure are driving the market forward. Governments worldwide are mandating the use of advanced screening systems in various sectors to enhance public safety. For instance, the Transportation Security Administration (TSA) in the United States has implemented more rigorous screening protocols, which include the adoption of advanced CT scanners for carry-on luggage screening, thereby pushing market growth.

These regulatory requirements ensure that the latest and most effective technologies are in place to protect the public. Government initiatives and funding for security enhancements not only stimulate the market but also set a standard for security practices globally. This regulatory support, combined with technological innovation and increased security awareness, creates a robust framework for the sustained growth of the security screening systems market.

Restraining Factors

High Costs of Implementation and Maintenance Restrain Market Growth

The high costs associated with the implementation and maintenance of advanced security screening systems can be a significant restraining factor. These systems require substantial initial investment as well as ongoing maintenance and upgrades, which can be prohibitive for many institutions.

For example, the installation of full-body scanners at airports involves not only the purchase of expensive equipment but also the cost of training personnel and maintaining the systems, which can strain budgets. Smaller airports and institutions with limited funding may find it challenging to adopt these advanced technologies, limiting market growth. The high costs also mean that upgrades and replacements are delayed, affecting the efficiency and effectiveness of security measures.

Privacy Concerns and Public Opposition Restrain Market Growth

Privacy concerns and public opposition to intrusive security measures can limit the adoption of advanced screening technologies. Systems like full-body scanners and facial recognition software often face backlash due to perceived violations of personal privacy and civil liberties.

An example is the controversy over the use of facial recognition technology in public spaces, which has led to legal challenges and bans in certain jurisdictions, such as the ban imposed by the city of San Francisco. This opposition can slow down the deployment of these technologies and lead to stricter regulations, impacting market growth. The need to balance security with privacy rights creates additional challenges for companies in gaining public and regulatory acceptance for their products.

Product Type Analysis

X-ray Screening Systems dominate with 40% due to their effectiveness in detecting concealed objects.

The security screening systems market is extensively categorized by product types including X-ray screening systems, explosive detection systems (EDS), metal detectors, biometric systems, liquid scanners, and others. X-ray screening systems emerge as the dominant sub-segment, capturing about 40% of the market share. This dominance is primarily attributed to their widespread use in various security check points due to their effectiveness in identifying concealed objects and threats within baggage and cargo without manual inspection.

Explosive detection systems are critical in high-threat areas such as airports and border security, focusing on detecting potential threats and preventing hazardous incidents. Metal detectors are ubiquitous in nearly all security-sensitive environments, providing a first line of defense against metallic threats.

Biometric systems are increasingly being adopted for their ability to provide secure access through unique biological traits such as fingerprints, facial recognition, and iris scans, thereby enhancing personal security and reducing fraud. Liquid scanners have also become essential in airports to quickly and efficiently screen liquids, aerosols, and gels in compliance with aviation security regulations. The "others" category includes emerging technologies that are continuously being developed to address specific security needs and are expected to gain traction as the market evolves.

The strength of X-ray screening systems in the market is driven by continuous advancements in imaging technology and machine learning algorithms that improve the accuracy and speed of threat detection. This segment is also benefiting from increasing global investments in security infrastructure prompted by rising security threats worldwide. As these systems become more sophisticated and integrated with other technologies like artificial intelligence, their market dominance is likely to be sustained, providing a comprehensive security solution across multiple industries.

Application Analysis

Airport Security dominates with 50% due to stringent security requirements and high passenger volumes.

In the segmentation by application, the security screening market serves airport security, border security, correctional facilities, public safety and security, critical infrastructure protection, and others. Airport security holds the predominant position, accounting for about 50% of the application segment's market share. The critical need for robust security measures in airports, driven by high passenger volumes and the imperative to thwart terrorist activities, supports the extensive deployment of advanced screening systems.

Border security also relies heavily on screening systems to prevent illegal immigration and contraband trafficking. Correctional facilities use these systems to avoid the smuggling of prohibited items into facilities. Public safety and security applications are widespread, ranging from event security to municipal buildings, requiring versatile and reliable screening solutions. Critical infrastructure protection is another significant application, ensuring the safety of utilities and national monuments against potential threats.

The dominance of airport security in the screening systems market is underpinned by stringent regulatory standards and the need for high throughput systems capable of maintaining security without disrupting passenger flow. With the anticipated recovery of global travel post-pandemic, the demand for efficient, state-of-the-art screening technologies in airports is expected to rise further, reinforcing the segment's growth and its critical role in the overall security screening systems market.

End-Use Analysis

Government Buildings dominate with 45% due to high security needs against potential threats.

Security screening systems are extensively used across various end-use sectors such as government buildings, commercial buildings, educational institutions, public transport, and others. Among these, government buildings are the leading consumers, holding a 45% share of this market segment. The high priority for security in governmental operations to protect against espionage, terrorism, and other security threats justifies the widespread installation of advanced screening technologies.

Commercial buildings integrate screening systems as part of their standard security procedures to ensure the safety of employees and visitors. Educational institutions are increasingly adopting these measures to safeguard students and staff from potential harm. Public transport systems utilize extensive screening systems to prevent attacks and ensure the safety of the traveling public. The "others" category includes private and sensitive locations requiring tailored security measures to address specific risks.

The predominant use of screening systems in government buildings is propelled by increasing government expenditure on security infrastructure, the introduction of new and stringent regulations, and the adoption of cutting-edge technologies to enhance security measures. This segment's growth is further supported by the integration of biometric and intelligent video surveillance systems, which offer enhanced security capabilities and better threat detection capabilities, ensuring comprehensive protection for government facilities and assets.

Technology Analysis

3D X-ray Technology dominates with 55% due to superior imaging capabilities and enhanced threat detection.

Technology within the security screening systems market includes 2D X-ray technology, 3D X-ray technology, computed tomography (CT), and biometrics technology. 3D X-ray technology dominates this sector, accounting for approximately 55% of the technology segment's market share. This dominance is due to its superior imaging capabilities, which provide detailed views of an object from various angles, significantly enhancing threat detection accuracy.

2D X-ray technology remains widely used due to its cost-effectiveness and high-speed processing, suitable for environments with less stringent security requirements. Computed tomography is gaining prominence in airport security, offering detailed and clear images that aid in better detection of prohibited items within complex baggage contents. Biometrics technology is extensively used in access control systems, leveraging unique human identifiers such as fingerprints, facial recognition, and iris scans to provide secure and controlled access.

The lead held by 3D X-ray technology is bolstered by its comprehensive ability to detect non-metallic threats and its utility in a wide range of security screening scenarios. This technology is set to expand further with ongoing advancements that reduce scan times and improve detection algorithms, ensuring its continued dominance in the market and contribution to the overall enhancement of global security screening capabilities.

Key Market Segments

By Product Type

- X-ray Screening Systems

- Explosive Detection Systems (EDS)

- Metal Detectors

- Biometric Systems

- Liquid Scanner

- Others

By Application

- Airport Security

- Border Security

- Correctional Facilities

- Public Safety & Security

- Critical Infrastructure Protection

- Others

By End-Use

- Government Buildings

- Commercial Buildings

- Educational Institutions

- Public Transport

- Others

By Technology

- 2D X-ray Technology

- 3D X-ray Technology

- Computed Tomography (CT)

- Biometrics Technology

Growth Opportunities

Advancements in AI and Machine Learning Offer Growth Opportunity

The integration of AI and machine learning into security screening systems offers significant growth opportunities. These technologies enhance threat detection systems and operational efficiency. For example, Evolv Technology uses AI-powered systems to provide faster and more accurate security screenings. This reduces wait times and improves overall security.

AI and machine learning allow for real-time analysis and automated threat detection, minimizing human error. These advancements lead to more reliable and efficient screening processes. The continuous improvement in AI algorithms ensures that security systems stay ahead of evolving threats. The growing adoption of AI in security applications highlights the potential for substantial market growth, driven by the need for advanced and efficient security solutions.

Expansion in Public and Private Sectors Offers Growth Opportunity

There is a growing demand for advanced security screening systems in both public and private sectors. This includes airports, government buildings, and corporate offices. Increased investment in infrastructure security provides opportunities for market expansion. For instance, the installation of advanced CT scanners at airports for carry-on baggage screening has been a major focus for companies like Smiths Detection.

The rise in security concerns globally has led to higher spending on advanced security measures. Public sector investments in infrastructure and private sector adoption of security systems contribute to this demand. The push for enhanced security measures in various sectors drives the need for innovative screening solutions, creating significant growth potential for the market.

Growing Adoption in Emerging Markets Offers Growth Opportunity

Emerging markets present significant growth potential due to increasing investments in security infrastructure. Countries in Asia-Pacific and the Middle East are upgrading their security systems, creating opportunities for market expansion. For example, the expansion of airport infrastructure in China has led to increased demand for advanced security screening systems.

The rising need for improved security in emerging economies drives the adoption of advanced screening technologies. Governments and private entities are investing in state-of-the-art security systems to protect critical infrastructure. This trend highlights the lucrative opportunities for companies to expand their presence in these regions, tapping into the growing demand for enhanced security solutions.

Trending Factors

Contactless and Remote Screening Technologies Are Trending Factors

The COVID-19 pandemic has accelerated the adoption of contactless and remote screening technologies, driven by the need to reduce physical contact and enhance safety. Innovations in this area include thermal imaging cameras and remote security checks. For example, FLIR Systems has developed thermal imaging solutions to detect elevated body temperatures in public spaces.

This trend is gaining momentum as organizations prioritize health and safety measures. The use of contactless technologies not only mitigates the risk of virus transmission but also improves efficiency and convenience in security screening processes. These technologies are particularly useful in high-traffic areas such as airports, stadiums, and public transportation hubs. The continued development and adoption of contactless and remote screening technologies are expected to drive significant growth in the security screening systems market, as they align with the ongoing emphasis on public health and safety.

Integration with Biometric Systems Are Trending Factors

The integration of biometric systems, such as facial recognition and fingerprint scanning, with security screening systems is a growing trend. This integration enhances security by providing more accurate identification and reducing the risk of false positives. For instance, CLEAR uses biometric technology to streamline security checks at airports and stadiums.

Biometric systems offer a higher level of security and efficiency compared to traditional methods. They provide quick and reliable identification, which is crucial for maintaining safety in high-security environments. The use of biometrics also reduces the need for physical contact, which is an added benefit in the context of the COVID-19 pandemic. As biometric technologies continue to advance, their integration with security screening systems is likely to become more widespread, driving market growth and innovation in this sector.

Enhanced Data Analytics and Reporting Are Trending Factors

The use of advanced data analytics and reporting tools is becoming increasingly important in security screening systems. These tools provide valuable insights into security operations, helping organizations improve their security measures and response times. For example, Rapiscan Systems offers data analytics solutions that provide real-time insights into screening operations.

Enhanced data analytics allow for better monitoring and management of security processes. They help identify potential threats more quickly and accurately, enabling faster response times. Additionally, these tools can optimize resource allocation and improve overall operational efficiency. The growing importance of data-driven decision-making in security is expected to drive the adoption of advanced analytics and reporting tools. This trend is likely to contribute to the expansion of the security screening systems market, as organizations seek to enhance their security capabilities through better data utilization.

Regional Analysis

APAC Dominates with 42.6% Market Share in the Security Screening Systems Market

APAC’s lead with a 42.6% market share in the security screening systems sector is influenced by several pivotal factors. High population density and escalating security concerns, especially in transportation and public venues, drive demand for advanced screening technologies. Significant investments in infrastructure development across major APAC countries enhance the deployment of these systems. Moreover, the region’s rapid technological adoption and innovation in security solutions contribute to its leading position.

The market dynamics in APAC are shaped by a combination of regional characteristics including burgeoning urbanization, increased government spending on security infrastructure, and heightened awareness of security needs in both public and private sectors. Additionally, international events, such as global sports and expo events hosted in the region, necessitate advanced security arrangements, thus boosting the market.

The future trajectory for APAC in the security screening market appears robust. Continued economic growth, coupled with rising security demands from emerging economies like India and China, is likely to propel further market expansion. The region's ongoing focus on adopting cutting-edge technology and enhancing public safety standards is expected to not only sustain but increase its market share, potentially influencing global security trends and technologies.

Regional Market Share and Growth Projections:

- North America: Holding approximately 30% of the global market, North America is driven by stringent regulatory standards and high adoption of biometric technology. The region’s share is expected to remain stable with a slight growth due to ongoing technological upgrades.

- Europe: Europe accounts for about 20% of the market. Growth is fueled by the increasing adoption of security systems at border crossings and by the transportation sector, responding to the region’s focus on combating terrorism and managing the influx of migrants.

- Middle East & Africa: MEA currently makes up 4% of the market but is expected to witness rapid growth. Increasing political instability and economic development projects are leading to heightened security needs, potentially doubling this region's market share by the end of the decade.

- Latin America: Latin America holds a smaller share at around 4% but is experiencing growth due to rising urbanization and public security investments. Expected economic improvements and major sporting events in the future may increase the demand for advanced security screening systems.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Security Screening Systems market is dominated by Smiths Detection and OSI Systems, known for their advanced screening technologies and global reach. Their strong market influence is driven by innovation and reliability.

L3Harris Technologies and Leidos contribute significantly with their comprehensive security solutions, enhancing their strategic positions in the market.

Rapiscan Systems and Unisys offer specialized screening systems, focusing on efficiency and accuracy. Their targeted approach strengthens their market presence.

Garrett Electronics and Analogic Corporation are recognized for their innovative detection systems, driving market growth with advanced technologies.

CEIA and Nuctech Company Limited provide high-quality security equipment, leveraging their expertise to enhance market influence.

Autoclear and VOTI Detection focus on user-friendly and effective screening solutions, catering to diverse security needs.

Adani Systems and Astrophysics Inc. offer reliable and advanced screening systems, contributing significantly to market advancements.

Security Electronic Equipment Co. Ltd. (SEE) provides cost-effective and efficient security solutions, broadening market opportunities. Collectively, these companies drive the Security Screening Systems market through innovation, strategic positioning, and a focus on enhancing security.

Market Key Players

- Smiths Detection

- OSI Systems

- L3Harris Technologies

- Leidos

- Rapiscan Systems

- Unisys

- Garrett Electronics

- Analogic Corporation

- CEIA

- Nuctech Company Limited

- Autoclear

- VOTI Detection

- Adani Systems

- Astrophysics Inc.

- Security Electronic Equipment Co. Ltd. (SEE)

Recent Developments

- August 2024: Honeywell completed the acquisition of a leading security integration firm, SecureNet Solutions, for $450 million. This acquisition aims to expand Honeywell's capabilities in providing comprehensive security solutions for airports, government buildings, and public transportation hubs, leveraging SecureNet's expertise in advanced surveillance and access control systems.

- Q2 2024: Rapiscan Systems reported a 20% increase in revenue, driven by increased demand for their security screening solutions in corporate offices and industrial facilities. The company's latest product, the ORION 920DX, has been particularly successful due to its advanced imaging capabilities and ease of integration into existing security infrastructures.

Report Scope

Report Features Description Market Value (2023) USD 8.6 Billion Forecast Revenue (2033) USD 16.8 Billion CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (X-ray Screening Systems, Explosive Detection Systems (EDS), Metal Detectors, Biometric Systems, Liquid Scanner, Others), By Application (Airport Security, Border Security, Correctional Facilities, Public Safety & Security, Critical Infrastructure Protection, Others), By End-Use (Government Buildings, Commercial Buildings, Educational Institutions, Public Transport, Others), By Technology (2D X-ray Technology, 3D X-ray Technology, Computed Tomography (CT), Biometrics Technology) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Smiths Detection, OSI Systems, L3Harris Technologies, Leidos, Rapiscan Systems, Unisys, Garrett Electronics, Analogic Corporation, CEIA, Nuctech Company Limited, Autoclear, VOTI Detection, Adani Systems, Astrophysics Inc., Security Electronic Equipment Co. Ltd. (SEE) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Smiths Detection

- OSI Systems

- L3Harris Technologies

- Leidos

- Rapiscan Systems

- Unisys

- Garrett Electronics

- Analogic Corporation

- CEIA

- Nuctech Company Limited

- Autoclear

- VOTI Detection

- Adani Systems

- Astrophysics Inc.

- Security Electronic Equipment Co. Ltd. (SEE)