Global Scandium Metal Market By Product Type(Oxide, Fluoride, Chloride, Nitrate, Iodide, Alloy, Carbonate, Others), By End-User Industry(Aerospace and Defense, Solid Oxide Fuel Cells (SOFCs), Ceramics, Lighting, Electronics, 3D Printing, Sporting Goods, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

14729

-

April 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

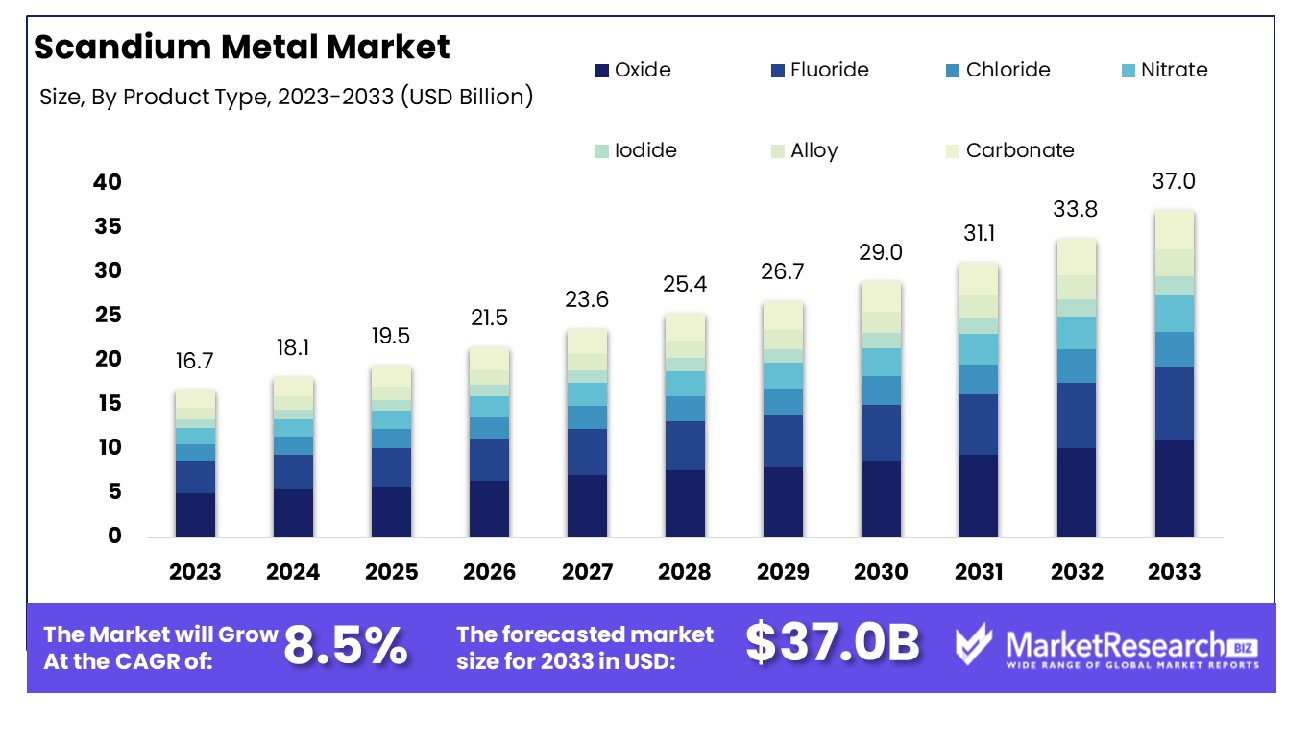

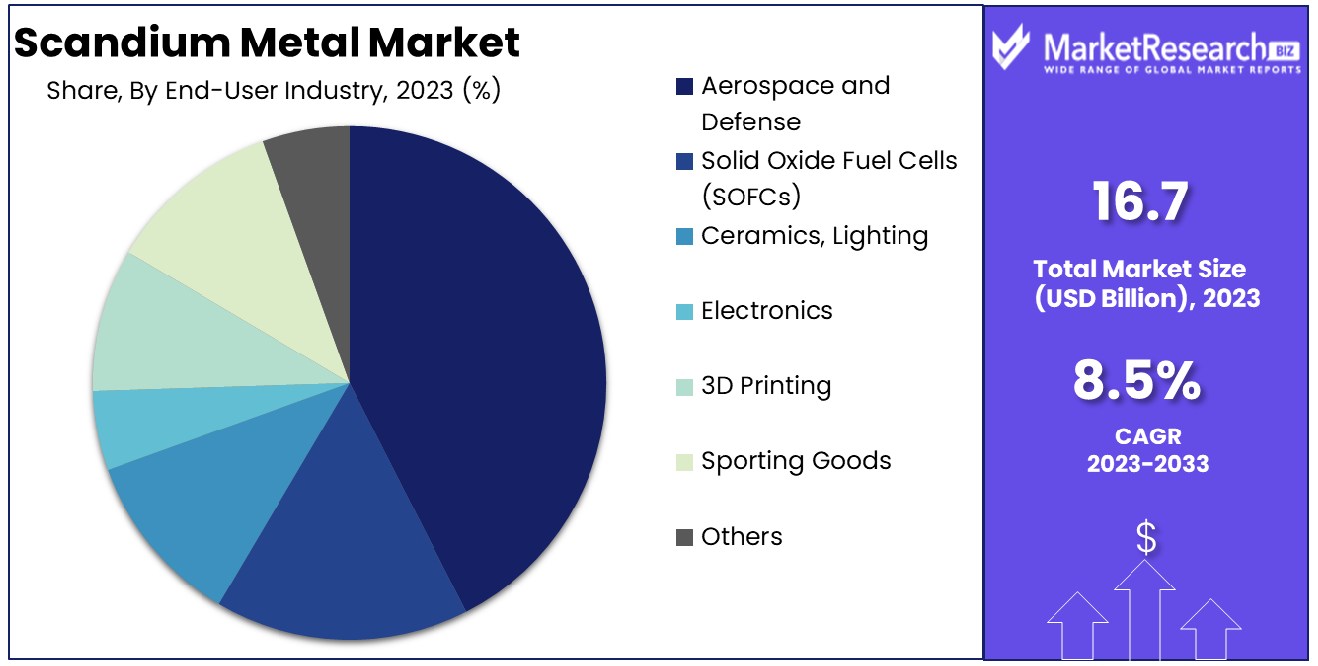

The Global Scandium Metal Market was valued at USD 16.7 billion in 2023. It is expected to reach USD 37.0 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033. The surge in demand for new advanced technologies and the rise in aerospace and defense industries are some of the main key driving factors for scandium metal.

Scandium is defined as a rare earth metal with the atomic number 21 and the symbol Sc. It is a silvery-white, lightweight metal that is comparatively soft and has a higher melting point than aluminum. Scandium is mainly obtained from rare earth minerals and is an end product of uranium extraction. It has several industrial applications which is primarily in the aerospace industry due to its high melting point, lightness, and strength making it appropriate for lightweight alloys used in aircraft elements.

Scandium is also used in the production of high-intensity lamps, electronics, and sports equipment. It has distinct properties that make it precious in enhancing the performance of materials. However, the scarcity and the high expense of extraction limit its extensive use. Ongoing research focuses on discovering its potential in fields such as fuel cells, solid oxide fuel cells, and other advanced technologies by propelling interest in its features and applications.

In October 2023, highlighted that approximately 0.1% of the annual global aluminum production was alloyed with 0.5% scandium, which would outcome in a yearly global scandium requirement of 345 tonnes which is 11x the current requirement. The present demand in the aerospace, automotive, defense, SOFC, and wind turbine sectors could reach almost 500 tonnes by 2030. The recent NI 43-101 compliant resource update secured the total resource at 27.7 million tonnes at an average grade of 271 ppm scandium oxide.

Work continuously on a feasibility study, permitting, design and engineering studies, and offtake agreement. Moreover, recent optimization efforts have grown Sc recovery to 96% and rare earth recovery to 94% at the leaching stage with a mine-to-precipitate recovery of 76% for Sc and 60% for rare earth. According to Air Recognition in September 2022, highlights that P00215 to the contract for KC-46A Air Force production Lot 8 aircraft, subscriptions, and licenses were given to the Boeing organization. This also consists of 15 extra KC-46A planes. 100% of the contract’s foreign military sales to Israel are valued at USD 886,242,124.

Scandium metal provides advantages like improving the strength, corrosion resistance, and heat tolerance of alloys used in aerospace components by leading to lighter and more fuel-efficient aircraft. Moreover, it enhances the performance of high-intensity lamps and supports the development of advanced materials for electronic and sports equipment. Scandium metal's use in aerospace and defense applications will see demand surge over the coming years, creating market expansion.

Key Takeaways

- Market Growth: Global Scandium Metal Market was valued at USD 16.7 billion in 2023. It is expected to reach USD 37.0 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033.

- By Product Type: Scandium oxide is pivotal in aerospace, offering lightweight strength and corrosion resistance.

- By End-User Industry: Aerospace and defense sectors rely on scandium oxide for high-performance applications.

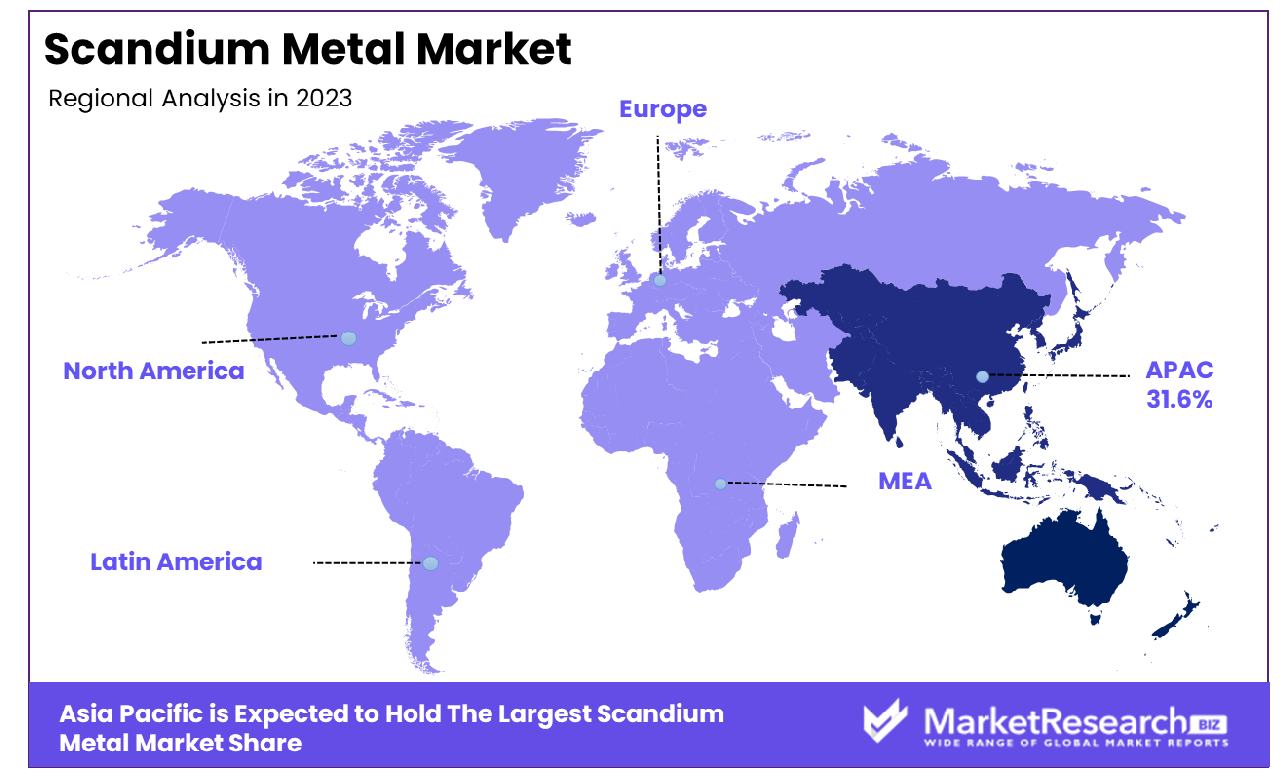

- Regional Dominance: The Asia-Pacific region holds a commanding 31.6% share in the Scandium Metal Market.

- Growth Opportunity: In 2023, the global scandium metal market will offer promising opportunities driven by increased demand in aerospace, automotive, electronics, and energy storage sectors, alongside sustainable extraction method development.

Driving factors

Growing Airport Construction and Rising Aircraft Demand Boosting the Scandium Market

The Scandium Metal Market is experiencing a significant upsurge due to the burgeoning construction of airports worldwide and the escalating demand for aircraft. As airports expand and new ones emerge to accommodate increasing air travel, there's a parallel surge in the demand for lightweight, high-strength materials like scandium.

The metal's unique properties make it an indispensable component in aerospace applications, particularly in the production of aluminum-scandium alloys. These alloys are favored for their ability to enhance the performance and durability of aircraft components while reducing overall weight, thus contributing to fuel efficiency and lower emissions.

Demand for Aluminum-Scandium Alloys in Aerospace and High-Performance Applications

The Scandium Metal Market is propelled by the escalating demand for aluminum-scandium alloys across various aerospace and high-performance applications. These alloys, renowned for their exceptional strength, corrosion resistance, and weldability, are increasingly favored in critical aerospace components such as aircraft fuselages, wings, and landing gear.

Additionally, they find extensive use in high-performance sports equipment, military hardware, and automotive parts. The utilization of aluminum-scandium alloys enables manufacturers to produce lighter, more durable, and fuel-efficient products, thereby enhancing performance and reducing operational costs.

Limited Availability of Scandium Leading to High Prices and Market Growth Challenges

The Scandium Metal Market faces formidable challenges stemming from its limited availability and the resultant high prices. Despite its remarkable properties and versatile applications, scandium remains a relatively rare element, primarily extracted as a byproduct of rare earth metal mining or from certain mineral deposits. This scarcity, coupled with increasing demand, exerts significant upward pressure on scandium prices, posing challenges to market growth and widespread adoption.

However, efforts to explore alternative extraction methods, improve recovery efficiency, and expand production capacity offer glimmers of hope for mitigating supply constraints and stabilizing prices in the long term. Additionally, strategic collaborations, investments in research and development, and advancements in recycling technologies hold promise for enhancing scandium availability and fostering sustainable market growth.

Restraining Factors

Limited Commercial Production Hinders Scandium Metal Market Growth

The Scandium Metal Market faces a significant hurdle in the form of limited commercial production, which impedes its growth trajectory. Despite increasing demand for scandium across various industries, commercial-scale production remains constrained due to several factors. One primary reason is the scarcity of viable scandium deposits and the technical challenges associated with its extraction and processing. The limited number of mines dedicated to scandium production further exacerbates this issue, creating a bottleneck in the supply chain. As a result, the market struggles to meet escalating demand, leading to supply shortages and price volatility.

Moreover, the lack of established infrastructure and expertise in scandium extraction and refining further complicates efforts to ramp up production to satisfy market requirements. Addressing these barriers necessitates substantial investments in research, technology, and infrastructure to enhance the efficiency and scalability of scandium production processes. Collaborative efforts between industry stakeholders, government entities, and research institutions are crucial to overcoming these challenges and unlocking the full potential of the scandium market.

High Costs Associated with Extraction and Processing Dampen Market Growth

The Scandium Metal Market faces significant challenges stemming from the high costs associated with its extraction and processing. Despite its numerous industrial applications and unique properties, scandium remains an expensive metal to produce, primarily due to its limited availability and the complex extraction methods required. The scarcity of viable scandium deposits, coupled with the technical complexities involved in its recovery from ore or byproduct sources, drives up production costs significantly. Additionally, the processing of raw scandium materials into usable forms adds to the overall expense, further impacting market competitiveness.

High production costs not only hinder the expansion of scandium's market reach but also limit its adoption across various industries where cost-effectiveness is a critical consideration. To address this challenge, concerted efforts are needed to develop more efficient extraction technologies, optimize processing methods, and explore alternative sources of scandium. By reducing production costs and improving supply chain efficiencies, stakeholders can unlock new growth opportunities and foster greater market penetration for scandium-based products and applications.

By Product Type Analysis

Scandium oxide is pivotal in ceramics and electronics due to its high melting point and conductivity.

Oxide products dominated the Scandium Metal Market's By Product Type segment in 2023. Their wide variety of applications and superior properties contributed significantly to this dominance; specifically their strength-to-weight ratio, corrosion resistance and heat tolerance were especially popular within aerospace, automotive, electronics and sporting goods industries.

Fluoride-based scandium products also witnessed substantial demand, particularly in the production of high-performance alloys used in aircraft components and sporting equipment. Their ability to enhance the mechanical properties of alloys while maintaining lightweight characteristics contributed to their popularity among manufacturers.

Chloride-based scandium compounds emerged as another notable segment, driven by their application in solid oxide fuel cells (SOFCs) and as catalysts in chemical processes. The versatility of chloride compounds in facilitating energy-efficient reactions and enabling sustainable manufacturing practices propelled their adoption across various industries.

Additionally, nitrate-based scandium compounds gained traction in the pharmaceutical and healthcare sectors, owing to their role in the development of novel drugs and medical imaging agents. Their compatibility with biological systems and ability to modulate cellular functions spurred research and development activities in the healthcare industry.

Iodide-based scandium compounds found niche applications in electronics and optics, where their optical transparency and electrical conductivity were leveraged for advanced electronic devices and high-performance coatings. The unique combination of properties offered by iodide compounds contributed to their utilization in cutting-edge technologies.

Furthermore, alloy-based scandium products remained vital for enhancing the performance of aluminum alloys in aerospace and automotive applications. The addition of scandium improved the strength, ductility, and corrosion resistance of aluminum-based alloys, thereby expanding their utility in critical structural components.

Carbonate-based and other scandium compounds also played essential roles in niche applications, including ceramics, catalysts, and energy storage systems.

By End-User Industry Analysis

In aerospace and defense, scandium enhances aluminum alloys for lighter and stronger aircraft components.

Aerospace and Defense was the market leader for end-user industries within the Scandium Metal Market in 2023, due to their extensive utilization of scandium-based alloys used for aircraft and defense equipment manufacturing. Scandium alloys, known for their extraordinary strength, lightweight properties, and corrosion resistance properties are an integral component of producing vital aerospace components such as aircraft frames, engine parts, and missile casings - driving market growth within this segment.

Following closely, the Solid Oxide Fuel Cells (SOFCs) segment emerged as a significant consumer of scandium metal. SOFCs utilize scandium-stabilized zirconia electrolytes, which enhance the efficiency and longevity of fuel cell systems. The growing emphasis on clean energy solutions and the quest for sustainable power generation technologies propelled the adoption of scandium in SOFCs, particularly in stationary power generation applications.

In addition, the Ceramics and Lighting industries showcased notable demand for scandium-based materials. Scandium oxide, prized for its high refractive index and thermal stability, found widespread use in specialty ceramics and high-intensity discharge lamps. The superior optical properties of scandium-based ceramics and lighting components contributed to their popularity in architectural, automotive, and industrial lighting applications.

Moreover, the Electronics sector witnessed increased uptake of scandium compounds for advanced semiconductor manufacturing. Scandium's ability to enhance the performance and reliability of electronic devices, coupled with its compatibility with semiconductor fabrication processes, positioned it as a valuable material in the electronics industry.

The 3D Printing, Sporting Goods, and Other industries also exhibited a growing interest in scandium-based products, driven by their unique properties and versatility in various applications. This diverse array of end-user industries underscored the broad market potential of scandium metal, driving innovation and investment in scandium-related technologies and products.

Key Market Segments

By Product Type

- Oxide

- Fluoride

- Chloride

- Nitrate

- Iodide

- Alloy

- Carbonate

- Others

By End-User Industry

- Aerospace and Defense

- Solid Oxide Fuel Cells (SOFCs)

- Ceramics, Lighting

- Electronics

- 3D Printing

- Sporting Goods

- Others

Growth Opportunity

Growing Demand in Aerospace and Automotive Industries

The global scandium metal market is poised for significant expansion in 2023, primarily driven by the escalating demand for lightweight materials in key sectors such as the aerospace and automotive industries. Scandium's unique properties, including its high strength-to-weight ratio and corrosion resistance, make it an ideal choice for manufacturing lightweight alloys.

As the aerospace and automotive industries continue to prioritize fuel efficiency and emissions reduction, the demand for scandium-based alloys is expected to surge. This presents a lucrative opportunity for market players to capitalize on the growing need for innovative materials that enhance performance while reducing overall weight and environmental impact.

Expansion of Applications in Electronics and Energy Storage

Furthermore, the expansion of applications for scandium in electronics and energy storage sectors is set to fuel market growth in 2023. Scandium is increasingly being utilized in electronic devices and energy storage systems due to its ability to enhance conductivity and improve battery performance.

With the rapid evolution of consumer electronics and the growing emphasis on renewable energy sources, the demand for scandium in these sectors is projected to escalate. Companies operating in the scandium market can leverage this opportunity by investing in research and development to explore new applications and optimize existing technologies, thus positioning themselves for long-term success.

Development of Sustainable Extraction Methods

Moreover, the development of sustainable extraction methods presents a promising avenue for the global scandium metal market in 2023. As the demand for scandium continues to rise, there is a growing imperative to explore environmentally friendly extraction processes that minimize resource depletion and reduce environmental impact.

Market players can differentiate themselves by investing in the development of efficient and sustainable extraction technologies, thereby addressing both economic and environmental concerns. By prioritizing sustainability, companies can not only meet the increasing demand for scandium but also contribute to the overall growth and resilience of the market in the years ahead.

Latest Trends

Surge in Demand Across Key Industries

In 2023, the global scandium metal market is witnessing a notable surge in demand across key industries such as aerospace, electronics, and automotive. This uptick can be attributed to scandium's exceptionally lightweight and high-strength properties, which make it an attractive choice for manufacturers seeking to enhance product performance while reducing weight and improving fuel efficiency.

In the aerospace sector, scandium-based alloys are increasingly being utilized to develop aircraft components that are both durable and lightweight, thereby contributing to enhanced fuel economy and operational efficiency. Similarly, in the electronics and automotive industries, scandium is gaining traction as a preferred material for manufacturing components that require high conductivity and mechanical strength. As these industries continue to prioritize innovation and sustainability, the demand for scandium is expected to remain robust, driving market growth and presenting lucrative opportunities for market players.

Focus on Research and Development

Another significant trend shaping the global scandium metal market in 2023 is the increasing emphasis on research and development activities aimed at expanding the applications of scandium alloys. With growing recognition of scandium's unique properties and potential benefits across various industries, manufacturers, and researchers are actively exploring new avenues for utilizing scandium in innovative ways.

This includes the development of advanced scandium-based alloys with enhanced properties, as well as the exploration of novel applications in emerging sectors such as renewable energy and additive manufacturing. By investing in research and development initiatives, market players can not only stay ahead of evolving industry trends but also unlock new growth opportunities and consolidate their position in the competitive market landscape.

Regional Analysis

In the Asia-Pacific region, the Scandium Metal Market commands a significant share of 31.6%.

North America: This region showcases a robust demand for scandium metal, driven primarily by its widespread usage in aerospace and defense applications. With a growing emphasis on lightweight materials and advanced manufacturing techniques, North America accounts for a significant portion of the global market share. The region's adoption of scandium-based alloys in critical industries such as aviation and automotive further bolsters its position as a key player in the market.

Europe: Europe emerges as a prominent market for scandium metal, leveraging its advanced industrial infrastructure and stringent quality standards. The region's focus on sustainable development and technological innovation drives the demand for scandium in various sectors, including transportation, electronics, and renewable energy. Additionally, Europe's robust research and development initiatives contribute to the exploration of new applications and the expansion of the scandium market landscape.

Asia-Pacific: Dominating the market with a commanding share of 31.6%, the Asia-Pacific region emerges as a powerhouse in the scandium metal market. Rapid industrialization, coupled with burgeoning aerospace and automotive industries, fuels the demand for lightweight materials, positioning Asia-Pacific as a key consumer of scandium-based alloys. Furthermore, the region's strong manufacturing base and increasing investments in infrastructure projects contribute to its significant market presence.

Middle East & Africa: While still emerging, the Middle East & Africa region shows promising potential in the scandium metal market. The region's growing focus on diversifying its economy and expanding industrial capabilities presents opportunities for scandium utilization, particularly in the aerospace and construction sectors. However, challenges such as limited infrastructure and technological development may impede market growth to some extent.

Latin America: Latin America's scandium metal market exhibits steady growth, driven by the region's thriving mining and metallurgy industries. With increasing investments in infrastructure development and renewable energy projects, Latin America presents opportunities for scandium usage in sectors such as transportation and energy storage. However, market expansion may be hindered by factors such as economic volatility and regulatory uncertainties.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global Scandium Metal Market witnessed a significant influence from key players who played pivotal roles in shaping the industry landscape. Among these key players, several noteworthy companies emerged as frontrunners, exerting substantial influence on market dynamics and trends.

Rusal, a renowned name in the metal industry, continued to assert its dominance in the global Scandium Metal Market. With its extensive experience and robust infrastructure, Rusal maintained a strong market position, leveraging its expertise to drive innovation and meet evolving consumer demands.

Platina Resources Ltd. and Metallica Minerals Limited also stood out as key players, contributing to market growth through strategic initiatives and efficient resource management. Their commitment to sustainability and responsible mining practices underscored their importance in the industry, resonating well with environmentally conscious consumers and stakeholders.

Furthermore, DNI Metals Inc. and Scandium International Mining Corp. demonstrated commendable performance, capitalizing on emerging opportunities and expanding their market presence. Their proactive approach to market trends and technological advancements positioned them as formidable contenders in the global Scandium Metal Market.

Additionally, companies such as Stanford Materials Corporation, Huizhou Top Metal Materials Co. Ltd. (TOPM), Hunan Oriental Scandium Co. Ltd., and Ganzhou Kemingrui Non-ferrous Materials Co. Ltd. played integral roles in driving market competitiveness and fostering innovation. Their contributions towards product development, distribution channels, and market expansion initiatives were instrumental in shaping the industry landscape.

Moreover, the presence of Bloom Energy Corporation added a dynamic dimension to the market, with its focus on sustainable energy solutions and utilization of scandium in fuel cell technologies. As the market continues to evolve, these major players are poised to navigate challenges and seize opportunities, driving growth and innovation in the global Scandium Metal Market.

Market Key Players

- Rusal

- Platina Resources Ltd.

- Metallica Minerals Limited

- DNI Metals Inc.

- Scandium International Mining Corp.

- Stanford Materials Corporation

- Huizhou Top Metal Materials Co. Ltd. (TOPM)

- Hunan Oriental Scandium Co. Ltd.

- Ganzhou Kemingrui Non-ferrous Materials Co. Ltd.

- Bloom Energy Corporation

Recent Development

- In February 2024, Rio Tinto expanded scandium oxide production at the Sorel-Tracy facility in Québec, signaling potential growth in the scandium sector; Scandium International Mining advances the Nyngan project for future production.

- In January 2024, Agnitron introduces an innovative gas injection showerhead for MOCVD, advancing epitaxial growth capabilities to include AlScN, and addressing hardware challenges in ultra-wide bandgap materials deposition.

- In October 2023, DeepGreen Metals Inc., a pioneer in deep-sea mining, announced advancements in sustainable mineral extraction methods, addressing environmental concerns while meeting global demand for critical metals.

Report Scope

Report Features Description Market Value (2023) USD 16.7 Billion Forecast Revenue (2033) USD 37.0 Billion CAGR (2024-2032) 8.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Oxide, Fluoride, Chloride, Nitrate, Iodide, Alloy, Carbonate, Others), By End-User Industry(Aerospace and Defense, Solid Oxide Fuel Cells (SOFCs), Ceramics, Lighting, Electronics, 3D Printing, Sporting Goods, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Rusal, Platina Resources Ltd., Metallica Minerals Limited, DNI Metals Inc., Scandium International Mining Corp., Stanford Materials Corporation, Huizhou Top Metal Materials Co. Ltd. (TOPM), Hunan Oriental Scandium Co. Ltd., Ganzhou Kemingrui Non-ferrous Materials Co. Ltd., Bloom Energy Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Rusal

- Platina Resources Ltd.

- Metallica Minerals Limited

- DNI Metals Inc.

- Scandium International Mining Corp.

- Stanford Materials Corporation

- Huizhou Top Metal Materials Co. Ltd. (TOPM)

- Hunan Oriental Scandium Co. Ltd.

- Ganzhou Kemingrui Non-ferrous Materials Co. Ltd.

- Bloom Energy Corporation