Rough Terrain Crane Market by Type(26 Ton - 74 Ton ,75 to 100 tons ,Above 100 Ton), by Application(Construction: Dominated Segment ,Industries ,Utilities ,Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Rough Terrain Crane Market Size, Share, Trends Analysis

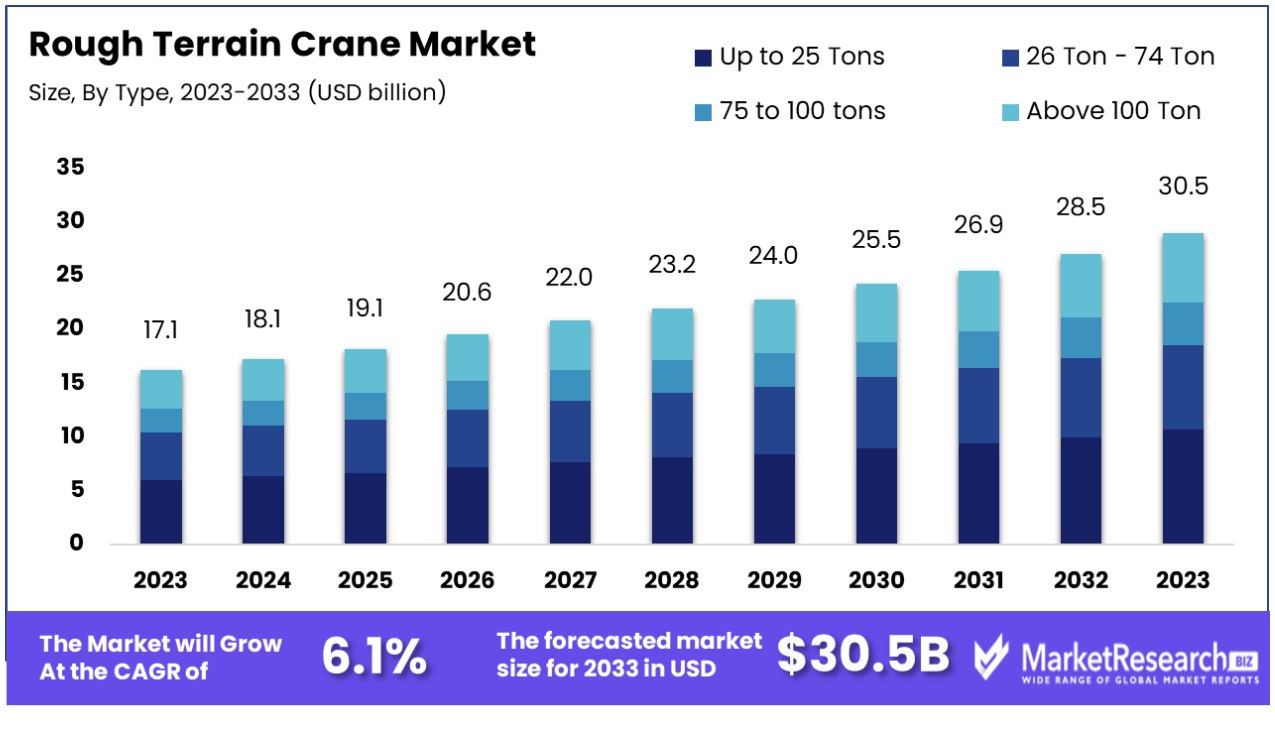

The rough terrain crane market was valued at USD 17.10 billion in 2023. It is expected to reach USD 30.5 billion by 2032, with a CAGR of 6.11% during the forecast period from 2024 to 2033.

The surge in demand in construction sectors as well as in many other industries and innovative infrastructure developments are some of the main driving factors for the rough terrain crane market expansion. Rough Terrain Crane is required in every industry such as in construction, agriculture, or the energy sector, choosing the right equipment is important for the completion of the production. Rough terrain crane is widely used in the construction industry as it helps to ease difficult tasks such as accumulating mud, loose gravel, and other construction stuff.

Rough terrain cranes are mostly called mobile cranes and are developed to maneuver over several different types of surfaces. To get such a level of maneuverability, these rough terrain cranes are created on a body with large bulky rubber tires that can scramble or climb over rough surfaces while maintaining grip on difficult terrain. It is more compact than most other types of off-road cranes which signifies that they can adjust into less space without any worry. Many rough terrain cranes have 4-wheel drive while other units have 4-wheel steering permitting reliable maneuverability and management on even the tough surfaces.

Due to the rise in population, the construction sector is booming. According to the official educational journal of the Foundation of the American Subcontractor’s Association in 2022, there has been a surge in the construction sector.

As per the American Institute of Architects’ consensus construction forecast, non-residential construction will have a hike of 4.6% in 2022, while there will be 9% growth in residential sectors, as per the Oxford Economics and Construct Connect forecast.

Similarly, in the European Union construction is from 1.55% in Spain to 3% in the Netherlands and France. The average rise across the EU is anticipated at 2.7% while the UK is at 6.3%. In Canada, the construction sector will witness a 16.4% hike with no-residential at 23.6% and residential is 5.5% in 2022.

Rough terrain cranes have become indispensable tools in the construction industry, helping lift heavy loads with ease and providing unparalleled efficiency and effectiveness. These cranes are used in the construction of high-end buildings with less space and the requirement to hold materials to great heights. Their expertise in regulating, controlling, and high lifting capacity is important for such projects.

Due to their growing use in construction projects, demand for rough terrain cranes will continue to surge over the forecast period and expand their market presence.

Driving Factors

Industrialization Catalyzes Rough Terrain Crane Market

Industries such as construction, mining, and oil & gas are expanding into increasingly remote and undeveloped areas, where rough terrain cranes are essential for their all-terrain capabilities and robust construction.

As these sectors grow, so does the need for equipment that can operate effectively in challenging environments. This demand is not just a temporary surge but a long-term trend closely aligned with global industrial expansion, suggesting sustained growth for the rough terrain crane market as industrial activities continue to push into new frontiers.

Government Initiatives Propel Market Expansion

Government initiatives worldwide to bolster infrastructure are significantly propelling the rough terrain crane market. Investment in construction projects, from roads and bridges to large-scale public works, necessitates heavy lifting equipment capable of maneuvering in less developed areas.

Rough terrain cranes, known for their mobility and strength, are frequently the equipment of choice in difficult terrain environments. Government support is not merely a boost but a fundamental driver, ensuring a steady demand aligned with public infrastructure strategies. In the long term, as governments continue to invest in infrastructure to stimulate economic growth and improve public services, the market for rough terrain cranes is expected to expand correspondingly.

Oil and Gas Exploration Drives Demand

The intensive exploration of oil and gas in remote areas lacking established infrastructure is a key driver for the rough terrain crane market. These cranes' ability to navigate and operate in isolated and rough landscapes makes them indispensable for the energy sector.

As the quest for energy pushes companies into ever more challenging terrains, the demand for rough-terrain cranes naturally escalates. This trend is closely tied to the global energy demand and the continuous search for new energy sources, suggesting a long-term, sustained increase in market demand as energy exploration continues to reach new and more challenging environments.

Restraining Factors

Low Speed and Transportation Needs Limit Rough Terrain Crane Use

Rough terrain cranes move at low speeds and require transportation to the site, which can be a limiting factor for their use in certain applications. The logistical challenge and additional cost of transporting these cranes to various sites make them less desirable for projects with tight deadlines or those spread over large areas.

Their slow on-site movement can also reduce efficiency, particularly in fast-paced or time-sensitive construction environments. These operational limitations can discourage potential users who need more mobility and flexibility, thereby restraining market growth.

Safety Measures and Permits for Electric Line Contact Restrain Market

The potential for accidental contact with electric lines requires permits and safety measures, which can be a restraining factor for the rough terrain crane market. Operating near power lines is inherently risky, necessitating strict adherence to safety regulations and often requiring additional permits and planning.

This regulatory complexity can delay projects and increase costs, making these cranes less attractive for jobs in congested or urban areas with numerous overhead hazards. The need for extensive safety precautions and potential legal liabilities can limit the market's growth, as end users might opt for alternatives that pose fewer regulatory hurdles.

Rough Terrain Crane Market Segmentation Analysis

By Type:

In the rough terrain crane market, the segment of cranes with a capacity of Up to 25 Ton dominates. This dominance is primarily due to the versatility and mobility of these smaller-capacity cranes, making them suitable for a wide range of tasks in various settings, especially where space is limited or the terrain is challenging. They are commonly used in urban construction sites, minor lifting tasks, and projects where a compact and maneuverable crane is essential.

While the Up to 25 Ton segment leads due to its broad applicability and ease of use, the 26 Ton–74 Ton, 75 Ton–100 Ton, and Above 100 Ton segments also play significant roles. Cranes with higher capacities are crucial for projects requiring heavy lifting and are typically used in large-scale construction, industrial applications, and infrastructure projects where their larger lift capacities and reach are necessary.

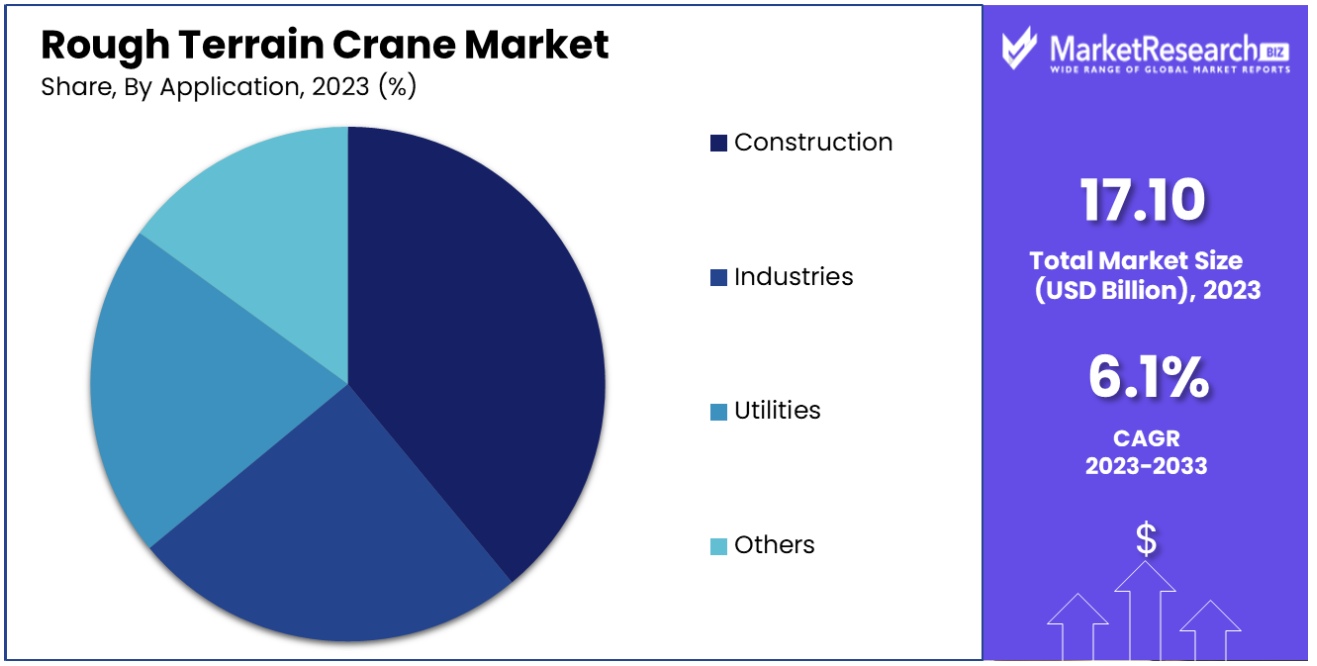

By Application:

The construction sector emerges as the dominant application in the rough terrain crane market. The expanding global construction industry, driven by urbanization, infrastructural development, and industrial expansion, fuels the demand for rough-terrain cranes. These cranes are favored in construction due to their ability to operate on uneven and rugged terrain, making them ideal for sites that are otherwise challenging for standard cranes.

While the Construction segment leads, Industries, Utilities, and Other sectors also significantly utilize rough terrain cranes. In industrial settings, these cranes are used for assembling heavy equipment and moving materials. Utilities often require them for maintenance and repair of infrastructure, and other sectors find various niche applications where the unique capabilities of rough terrain cranes are beneficial.

Rough Terrain Crane Market Industry Segments

By Type

- Up to 25 Tons

- 26 Ton - 74 Ton

- 75 to 100 tons

- Above 100 Ton

By Application

- Construction

- Industries

- Utilities

- Others

Growth Opportunities

Wind Farm Expansion Boosts Demand for Rough Terrain Cranes

Wind farms and their installation and maintenance requirements have created a surge in demand for rough terrain cranes, particularly their installation and maintenance tasks. With renewable energy initiatives expanding worldwide and more wind farms springing up worldwide, there is now more demand than ever for mobile and durable rough-terrain cranes that can operate in the challenging terrain of wind farm sites. Rough terrain cranes' mobility makes them the ideal solution for lifting heavy turbine components as well as performing maintenance tasks - giving this market tremendous growth potential.

Infrastructure Development in Emerging Economies Spurs Rough Terrain Crane Demand

The focus on infrastructure development, particularly in emerging economies, is driving the demand for rough terrain cranes. As countries invest in building roads, bridges, and urban structures, the need for heavy lifting and construction equipment rises. Rough terrain cranes are essential in these projects for their ability to navigate uneven and challenging job sites while providing powerful lifting capabilities. The ongoing urbanization and infrastructure expansion in these rapidly developing regions indicate a significant growth potential for the rough terrain crane market, as they are integral to the construction and development efforts.

Rough Terrain Crane Market Regional Analysis

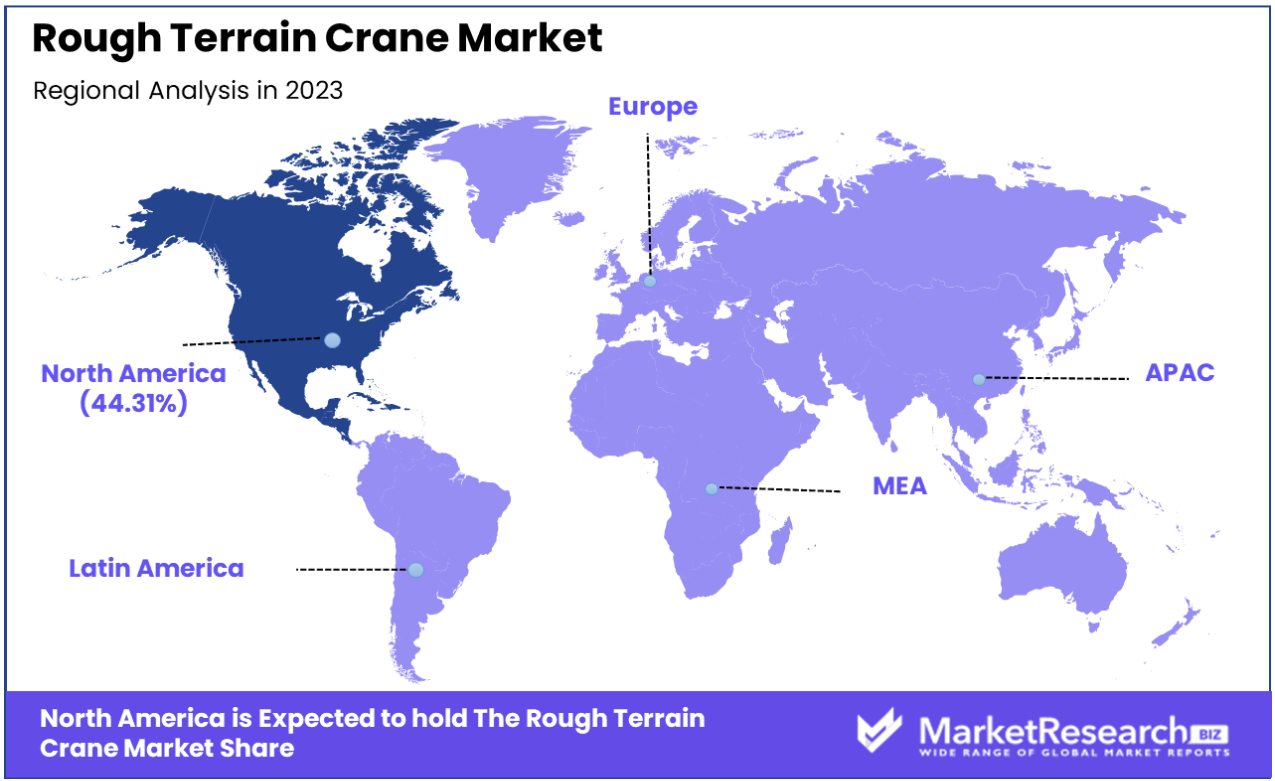

North America Dominates with 44.31% Market Share in Rough Terrain Crane Market

North America's significant 44.31% share of the rough terrain crane market is primarily driven by the region's extensive construction activities, particularly in infrastructure and energy sectors. The United States and Canada witnessed substantial investments in commercial and residential construction, leading to an increased demand for rough terrain cranes known for their mobility and durability. Additionally, the region's focus on upgrading its infrastructure and the adoption of advanced construction techniques contribute to the high market share. The presence of major construction firms and equipment manufacturers in North America further bolsters the market.

Rough-terrain cranes, with their ability to navigate through diverse and challenging environments, are highly preferred. The growing trend of urbanization and the subsequent rise in high-rise construction drive the demand for cranes that offer high lifting capacities and maneuverability. Moreover, the region's stringent safety regulations and the emphasis on efficient and timely project completion propel the adoption of technologically advanced cranes.

Europe: Advanced Engineering and Environmental Regulations

Europe’s rough terrain crane market is driven by advanced engineering capabilities and strict environmental regulations. The region's emphasis on safety and efficiency, along with the adoption of eco-friendly construction practices, supports the demand for modern rough terrain cranes. The well-established construction industry and the increasing investment in infrastructure renovation contribute to market growth.

Asia-Pacific: Rapid Urbanization and Infrastructure Development

In Asia-Pacific, the rough terrain crane market is experiencing rapid growth due to the region's extensive urbanization and infrastructure development. Countries like China, India, and Japan are investing heavily in constructing new buildings, roads, and bridges, driving the need for robust and reliable construction equipment. The increasing focus on industrialization and the rising standards of construction safety and quality present significant opportunities for market expansion. As economic development continues, Asia-Pacific is expected to witness substantial growth in the rough terrain crane market.

Rough Terrain Crane Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Rough Terrain Crane Market Key Player Analysis

In the Rough Terrain Crane Market, crucial for operations in challenging environments, the companies listed are pivotal in driving innovation and meeting diverse operational needs. Liebherr Group and The Manitowoc Company, Inc. are industry leaders, known for their advanced engineering and robust cranes that offer superior performance and reliability. Their strategic positioning emphasizes technological innovation and global service networks, significantly influencing market standards and customer preferences.

Terex Corporation and Tadano Ltd. are key players with a broad range of rough terrain cranes, reflecting the industry's focus on versatility and adaptability to various lifting needs. Their commitment to safety and efficiency underlines the market's shift towards more advanced and user-friendly machinery.

Manitex International Inc. and Broderson Manufacturing Corporation, with their specialized product offerings, cater to specific market segments, showcasing the industry's ability to provide tailored solutions. SANY GROUP and Xuzhou Construction Machinery Group Co., Ltd. represent significant manufacturing capabilities in Asia, playing crucial roles in meeting the global demand for rough terrain cranes with their competitive offerings.

Rough Terrain Crane Market Key Players

- Manitex International, Inc.

- TIL Limited

- ENTREC Corporation

- Xuzhou Construction Machinery Group Co., Ltd.

- Broderson Manufacturing Corporation

- SANY GROUP

- Maxim Crane Works, L.P.

- Liebherr Group

- The Manitowoc Company, Inc.

- Terex Corporation

- Tadano Ltd.

- Kato Works Co., Ltd.

Rough Terrain Crane Market Recent Development

September 2022: With a new location in the United Arab Emirates, Thunder Cranes, a famous supplier of offshore, modular, and portable rental cranes, announced the resumption of its Middle Eastern activities.

December 2020: Eight new versions of wire rope hoists, with capacities ranging from 3.2 tonnes to 40 tonnes, were introduced by Dubai Cranes & Technical Services LLC. These are mostly made for Middle Eastern businesses.

Report Scope

Report Features Description Market Value (2023) USD 17.10 billion Forecast Revenue (2033) USD 30.5 billion CAGR (2024-2032) 6.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Up to 25 Tons, 26 Ton - 74 Ton, 75 to 100 tons, Above 100 Ton), By Application(Construction: Dominated Segment, Industries, Utilities, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Manitex International, Inc., TIL Limited, ENTREC Corporation, Xuzhou Construction Machinery Group Co., Ltd., Broderson Manufacturing Corporation, SANY GROUP, Maxim Crane Works, L.P., Liebherr Group, The Manitowoc Company, Inc., Terex Corporation, Tadano Ltd., Kato Works Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-