RNA Therapeutics Market Report By Product (Vaccines, Drugs), By Type (mRNA Therapeutics, RNA Interference, Antisense Oligonucleotides), By Indication (Infectious Diseases, Rare Genetic Diseases/Hereditary Diseases, Other Indications), By End User (Hospitals and Clinics, Research Settings), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46932

-

May 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

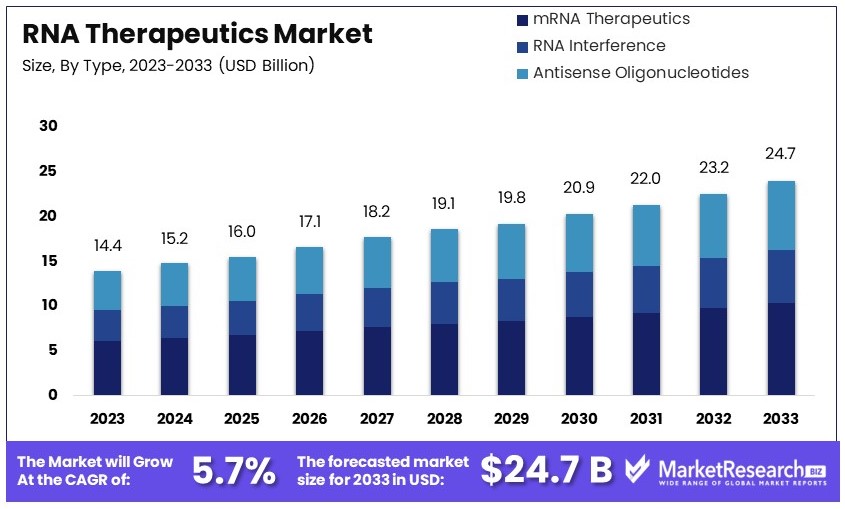

The Global RNA Therapeutics Market size is expected to be worth around USD 24.7 Billion by 2033, from USD 14.4 Billion in 2023, growing at a CAGR of 5.7% during the forecast period from 2024 to 2033.

The RNA Therapeutics Market focuses on drugs that use ribonucleic acid (RNA) to treat diseases. RNA therapeutics include mRNA vaccines, RNA interference (RNAi), and antisense oligonucleotides. They target genetic disorders, cancer, and infectious diseases. The market is growing rapidly due to recent technological advancements.

The success of mRNA COVID-19 vaccines has increased interest. Key players are investing heavily in research and development. The market is segmented by technology, application, and end-user. North America holds the largest market share, followed by Europe and Asia-Pacific. The outlook is positive with ongoing innovations and increasing demand for personalized medicine.

The RNA therapeutics market is positioned for substantial growth, driven by the rising prevalence of chronic diseases and the significant economic burden they impose. Chronic diseases are responsible for 41 million deaths annually, accounting for 63% of worldwide deaths. Major preventable diseases such as cardiovascular disease, cancer, chronic respiratory diseases, and diabetes are leading contributors.

In the United States, an estimated 129 million people suffer from at least one major chronic disease. Additionally, 42% of the population has two or more chronic conditions, and 12% have at least five. This high prevalence of chronic diseases underscores the urgent need for innovative treatments.

RNA therapeutics offer promising solutions by targeting the genetic and molecular bases of these diseases. These therapies can modulate gene expression and offer precision medicine approaches that are not possible with traditional treatments. The market is witnessing increased investment in research and development, aimed at expanding the applications of RNA-based therapies.

The economic impact of chronic diseases is immense. Globally, the cost of chronic diseases is projected to reach $47 trillion by 2030. In the United States alone, chronic diseases account for more than $1 trillion in healthcare costs annually. These figures highlight the potential savings and health benefits that effective RNA therapeutics could provide.

In summary, the RNA therapeutics market is on a growth trajectory, driven by the need to address the global burden of chronic diseases and the associated economic costs. Continued advancements in RNA technology and increased investment will likely enhance the market's growth prospects, offering new hope for patients with chronic conditions.

Key Takeaways

- Market Value: RNA Therapeutics Market was valued at USD 14.4 Billion in 2023, and is expected to reach USD 24.7 Billion in 2033, at a CAGR of 5.7%

- Product Analysis: Vaccines dominate with 56%; success of mRNA vaccines.

- Type Analysis: mRNA therapeutics dominate with 39%; versatility in vaccine development.

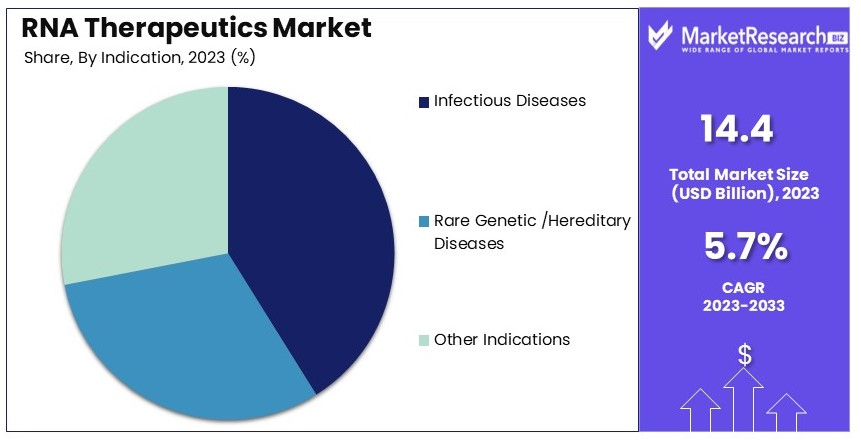

- Indication Analysis: Infectious diseases dominate with 41%; RNA-based vaccines focus.

- End User Analysis: Hospitals and clinics dominate with 57%; central role in administration.

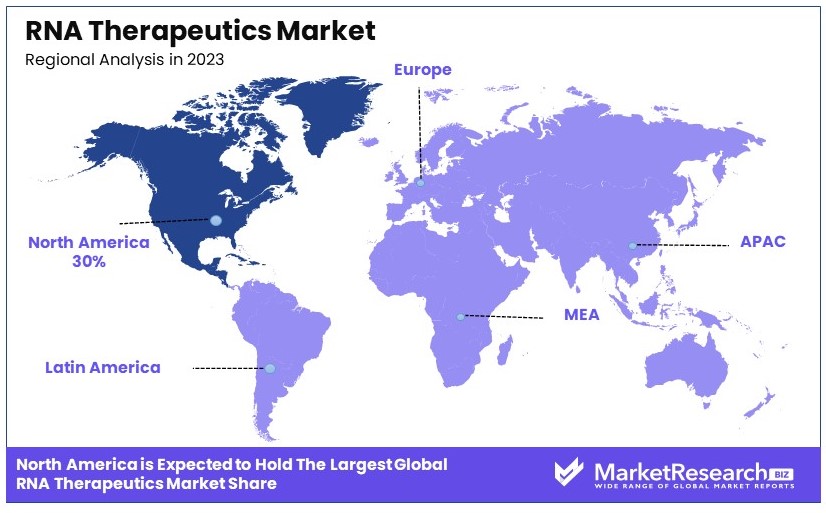

- Dominant Region: North America with 30%; strong biotech industry and research investments.

- High Growth Region: Europe with 25%; supportive government policies and pharmaceutical industry.

- Analyst Viewpoint: Market driven by mRNA vaccine success; increasing investment in RNA-based therapies.

- Growth Opportunities: Development of RNA-based drugs for genetic disorders; expanding applications in infectious diseases.

Driving Factors

Rising Prevalence of Chronic and Genetic Disorders Drives Market Growth

The increasing incidence of chronic diseases, such as cancer, cardiovascular diseases, and genetic disorders, significantly fuels the demand for RNA therapeutics. RNA therapeutics have the potential for chronic disease management at the molecular level by modulating gene expression, making them a promising area of research and development. For example, Onpattro (patisiran), an RNA interference (RNAi) therapy developed by Alnylam Pharmaceuticals, was approved by the FDA in 2018 for treating hereditary transthyretin-mediated amyloidosis (hATTR), a rare genetic disorder. This approval underscores the therapeutic potential and market growth of RNA-based treatments.

Statistics show a rising prevalence of chronic and genetic disorders globally, which correlates with the growing interest in RNA therapeutics. According to the World Health Organization, cancer alone accounted for approximately 10 million deaths in 2020, highlighting the urgent need for effective treatments. As RNA therapeutics offer targeted and personalized treatment options, their market adoption is likely to accelerate, supported by continued advancements and regulatory approvals.

The interaction of this factor with other elements, such as technological advancements and expanding applications, creates a synergistic effect, further driving market growth. As the prevalence of chronic and genetic disorders rises, the demand for innovative RNA-based therapies will continue to increase, contributing to the overall expansion of the RNA therapeutics market.

Advancements in RNA Delivery Technologies Drive Market Growth

One of the major challenges in RNA therapeutics has been the efficient delivery of RNA molecules to target tissues and cells. Recent advancements in delivery technologies, such as lipid nanoparticles, conjugates, and viral vectors, have facilitated better stability, targeting, and cellular uptake of RNA therapeutics, enhancing their therapeutic potential. For instance, Moderna Therapeutics has developed proprietary lipid nanoparticle delivery systems for its mRNA-based vaccines and therapeutics, which have shown promising results in clinical trials for various applications, including COVID-19 vaccines.

These technological innovations are pivotal in overcoming delivery barriers, a critical factor in the effective use of RNA therapeutics. The enhanced delivery systems not only improve the efficacy and safety of RNA therapeutics but also broaden their application range, thereby boosting market growth.

The advancements in delivery technologies complement other factors, such as the rising prevalence of diseases and expanding therapeutic applications, by ensuring that RNA therapeutics reach their intended targets more effectively. This integrated approach enhances the overall therapeutic outcomes, driving further growth in the RNA therapeutics market.

Expanding Applications in Oncology and Rare Diseases Drive Market Growth

RNA therapeutics have demonstrated significant potential in treating various cancers and rare diseases, where traditional therapies have been ineffective or associated with severe side effects. RNAi-based therapies, in particular, have shown promising results in targeting cancer-specific gene expression and reducing tumor growth. Onpattro (patisiran) and Givlaari (givosiran), both RNAi therapies developed by Alnylam Pharmaceuticals, have been approved for treating rare genetic disorders, hATTR and acute hepatic porphyria, respectively.

The expanding applications of RNA therapeutics in oncology drugs and rare diseases are supported by robust clinical evidence and regulatory approvals. This growth is driven by the increasing number of RNA-based therapies entering clinical trials and receiving regulatory approvals, particularly in oncology and rare diseases.

The synergy between the expanding applications and other market-driving factors, such as technological advancements and disease prevalence, enhances the overall growth trajectory. As more RNA-based therapies prove their efficacy and safety, their adoption in treating various cancers and rare diseases will likely continue to rise, further propelling the RNA therapeutics market forward.

Restraining Factors

Challenges in Stability and Delivery Restrain Market Growth

The inherent instability of RNA molecules and their susceptibility to degradation by nucleases significantly limit the growth of the RNA therapeutics market. Despite advancements in delivery technologies, ensuring efficient delivery to target tissues and cells while maintaining RNA integrity remains a challenge. The degradation of siRNA molecules by endogenous nucleases in the bloodstream can reduce their efficacy, necessitating higher doses or more frequent administration. This can increase the risk of side effects and treatment costs.

For example, siRNA molecules are often degraded before reaching their target, compromising their effectiveness. This instability restricts the broader application of RNA therapeutics, as it demands continuous improvement in delivery systems and formulations. According to a 2021 report, the global RNA therapeutics market faces significant hurdles due to these stability and delivery challenges, impacting its growth potential.

Regulatory Hurdles and Clinical Trial Complexity Restrain Market Growth

Regulatory hurdles and the complexity of clinical trials for RNA therapeutics pose significant challenges to market growth. As a relatively new class of drugs, RNA therapeutics face stringent regulatory requirements for demonstrating safety and efficacy. Conducting clinical trials is complex due to the need for specialized delivery systems, potential off-target effects, and the development of appropriate bioanalytical methods.

For example, the FDA initially placed a clinical hold on Alnylam's patisiran program due to concerns over potential safety issues related to the delivery system, delaying the drug's development and approval process. Such regulatory delays can hinder the timely introduction of RNA-based therapies to the market. According to industry reports, the regulatory landscape for RNA therapeutics remains a significant barrier, contributing to slower market growth and increased development costs.

Product Analysis

Vaccines dominate with 56% due to the success of mRNA vaccines in addressing infectious diseases and their rapid development capabilities.

The RNA therapeutics market is segmented into two main product categories: vaccines and drugs. The vaccines segment dominates the market, accounting for 56% of the market share. This dominance is primarily due to the significant success and widespread adoption of mRNA-based vaccines, particularly during the COVID-19 pandemic. mRNA vaccines, such as those developed by Pfizer-BioNTech and Moderna, have demonstrated high efficacy and rapid development timelines, making them crucial in combating infectious diseases. These vaccines have not only addressed urgent public health needs but also showcased the potential of RNA technologies, leading to increased investments and advancements in this field.

The success of mRNA vaccines has paved the way for further research and development in RNA-based vaccines for other infectious diseases, including influenza, Zika virus, and more. The ability to quickly design and produce mRNA vaccines in response to emerging pathogens positions this segment for sustained growth. Additionally, the expanding pipeline of RNA-based vaccines targeting various diseases highlights the segment's potential to address global health challenges effectively.

While vaccines hold a significant share, the drugs segment also plays a crucial role in the RNA therapeutics market. RNA-based drugs, including RNA interference (RNAi) therapies and antisense oligonucleotides, offer targeted treatments for genetic and chronic diseases. These drugs modulate gene expression and protein production at the molecular level, providing innovative solutions for conditions that are challenging to treat with traditional therapies. The approval of drugs like Onpattro (patisiran) and Spinraza (nusinersen) underscores the therapeutic potential of RNA-based drugs, driving market growth.

Type Analysis

mRNA therapeutics dominate with 39% due to their versatility in vaccine development and potential to treat various diseases.

The RNA therapeutics market is further segmented by type, with mRNA therapeutics holding the dominant position, accounting for 39% of the market share. mRNA therapeutics have gained significant attention due to their role in vaccine development and their potential to treat a wide range of diseases. The flexibility of mRNA technology allows for the rapid design and production of therapeutics, making it an attractive option for addressing emerging health threats and unmet medical needs.

mRNA therapeutics have shown promising results in various clinical trials, not only for vaccines but also for treating genetic disorders, cancer, and other diseases. The ability to encode proteins and modulate gene expression through mRNA opens new avenues for precision medicine. The success of mRNA vaccines during the COVID-19 pandemic has accelerated research and investment in this segment, leading to a robust pipeline of mRNA-based therapies in development.

Other types of RNA therapeutics, such as RNA interference (RNAi) and antisense oligonucleotides, also contribute to market growth. RNAi therapies, like Alnylam Pharmaceuticals' Onpattro, have demonstrated efficacy in treating rare genetic diseases by silencing specific genes. Antisense oligonucleotides, such as Biogen's Spinraza, provide targeted treatments for genetic disorders by binding to RNA molecules and altering protein production. These therapies offer innovative solutions for diseases that are difficult to treat with traditional methods, supporting the overall growth of the RNA therapeutics market.

Indication Analysis

Infectious diseases dominate with 41% due to the success of RNA-based vaccines and the focus on pandemic preparedness.

The RNA therapeutics market is segmented by indication, with infectious diseases being the dominant sub-segment, accounting for 41% of the market share. The success of RNA-based vaccines, particularly during the COVID-19 pandemic, has highlighted the potential of RNA therapeutics in addressing infectious diseases. mRNA vaccines, such as those developed by Pfizer-BioNTech and Moderna, have demonstrated high efficacy and rapid development timelines, making them essential tools in controlling infectious disease outbreaks.

The focus on infectious diseases extends beyond COVID-19, with ongoing research and development of RNA-based vaccines and therapies for other viral and bacterial infections. The ability to quickly design and produce RNA-based treatments in response to emerging pathogens positions this segment for continued growth. The global health community's emphasis on pandemic preparedness and the need for effective vaccines and treatments drive investments in RNA therapeutics targeting infectious diseases.

Other indications, such as rare genetic diseases and hereditary disorders, also contribute to the market's growth. RNA-based therapies, including RNA interference (RNAi) and antisense oligonucleotides, offer targeted treatments for these conditions by modulating gene expression and protein production. For instance, Alnylam Pharmaceuticals' Onpattro and Biogen's Spinraza have shown efficacy in treating rare genetic disorders, providing new treatment options for patients with limited alternatives. The expanding pipeline of RNA-based therapies for various indications supports the overall growth of the RNA therapeutics market.

End User Analysis

Hospitals and clinics dominate with 57% due to their central role in administering and distributing RNA-based therapies.

The RNA therapeutics market is segmented by end user, with hospitals and clinics being the dominant sub-segment, accounting for 57% of the market share. Hospitals and clinics play a crucial role in the administration and distribution of RNA-based therapies, including vaccines and drugs. The widespread adoption of mRNA vaccines during the COVID-19 pandemic has highlighted the importance of healthcare institutions in delivering these innovative treatments to the public.

Hospitals and clinics serve as primary points of care for patients receiving RNA-based therapies for various conditions, including infectious diseases, genetic disorders, and chronic illnesses. The integration of RNA therapeutics into standard medical practice requires healthcare professionals to be knowledgeable about these treatments and their administration. As RNA-based therapies become more prevalent, the role of hospitals and clinics in their delivery and management will continue to expand.

Research settings, including academic institutions and pharmaceutical companies, also play a significant role in the RNA therapeutics market. These settings are involved in the discovery, development, and clinical testing of RNA-based therapies. Collaborative efforts between research institutions and healthcare providers drive innovation and the translation of scientific discoveries into clinical applications. The synergy between research and clinical practice supports the growth of the RNA therapeutics market by advancing the development and implementation of new treatments.

Key Market Segments

By Product

- Vaccines

- Drugs

By Type

- mRNA Therapeutics

- RNA Interference

- Antisense Oligonucleotides

By Indication

- Infectious Diseases

- Rare Genetic Diseases/Hereditary Diseases

- Other Indications

By End User

- Hospitals and Clinics

- Research Settings

Growth Opportunities

Expanding Applications in Rare Diseases and Personalized Medicine Offers Growth Opportunity

RNA therapeutics present significant growth opportunities by addressing rare and genetic diseases that lack effective treatments. These therapies can target specific genetic mutations or modulate gene expression, enabling personalized medicine tailored to individual patients or specific disease subtypes. For instance, Ionis Pharmaceuticals and Roche are developing tominersen, an antisense oligonucleotide therapy, for Huntington's disease, a rare neurodegenerative disorder. This highlights the potential of RNA-based treatments to offer solutions for conditions with limited options.

The demand for personalized medicine is expected to grow rapidly, driven by advances in genetic research and the increasing prevalence of rare diseases. RNA therapeutics' ability to provide targeted treatments aligns well with these trends, creating a substantial opportunity for market expansion.

Combination Therapies and Synergistic Approaches Offer Growth Opportunity

Combining RNA therapeutics with other treatment modalities presents a promising growth opportunity. By leveraging RNAi therapies, small molecule drugs, antibodies, or cell therapies, synergistic effects can be achieved, enhancing treatment outcomes. Researchers are exploring combinations such as RNAi therapies with checkpoint inhibitors in cancer immunotherapy to boost the anti-tumor immune response and improve patient outcomes.

This approach can overcome resistance mechanisms and provide more comprehensive treatment strategies. The combination therapy market is projected to grow significantly, with oncology being a major focus area. The ability to integrate RNA therapeutics into combination treatments expands their application range and enhances their effectiveness, driving market growth.

Trending Factors

mRNA-based Vaccines and Therapeutics Are Trending Factors

The success of mRNA-based COVID-19 vaccines has underscored the potential of mRNA technology in both vaccine development and therapeutic applications. mRNA-based therapies offer advantages like rapid development, versatility, and the ability to encode various proteins or antigens.

This opens new avenues for infectious disease prevention and treatment, protein replacement therapy, and regenerative medicine. Companies like Moderna Therapeutics and BioNTech are expanding their mRNA platforms for various infectious diseases, rare genetic disorders, and cancer.

Strategic Collaborations and Partnerships Are Trending Factors

Collaborations and partnerships in the pharmaceutical and biotechnology sectors are accelerating the development of RNA therapeutics. These strategic alliances leverage the expertise and resources of different organizations, fostering innovation and enabling the rapid advancement of RNA-based therapies from research to commercialization. For example, Sanofi and Alnylam Pharmaceuticals have a strategic alliance to develop RNAi therapeutics for rare genetic diseases, combining Sanofi's global resources with Alnylam's RNAi technology expertise.

Such collaborations enhance the development pipeline and speed up regulatory approvals, facilitating market growth. The trend towards strategic partnerships is expected to continue, supporting the robust expansion of the RNA therapeutics market.

Regional Analysis

North America Dominates with 30% Market Share

North America's dominance in the RNA therapeutics market, with a 30% market share, is driven by several key factors. The region's advanced healthcare infrastructure and substantial investment in biotechnology and pharmaceutical research contribute significantly. Additionally, North America houses leading companies like Moderna and Alnylam Pharmaceuticals, which spearhead RNA therapeutics development. The robust regulatory framework, including the FDA's supportive policies for innovative therapies, further bolsters market growth.

Regional characteristics such as high healthcare expenditure and strong research and development capabilities positively impact the RNA therapeutics market in North America. The presence of top-tier research institutions and a collaborative environment between academia and industry enhance innovation and commercialization of RNA-based treatments. The region's focus on personalized medicine and rare disease treatment also drives market demand.

Europe Market Share and Growth

Europe holds a significant share of the RNA therapeutics market, accounting for 25%. The region benefits from a well-established pharmaceutical industry and strong government support for biotechnology research. The European Medicines Agency (EMA) plays a crucial role in facilitating market access for new therapies. Europe's market is expected to grow at a CAGR of 12% from 2021 to 2028, driven by ongoing clinical trials and increasing investment in RNA technologies.

Asia Pacific Market Share and Growth

Asia Pacific represents 20% of the RNA therapeutics market. The region is experiencing rapid growth due to increasing healthcare expenditure, a growing biotech industry, and rising awareness of RNA-based treatments. Countries like China and Japan are making significant strides in RNA research and development. The market in Asia Pacific is forecasted to grow at a CAGR of 15% from 2021 to 2028, reflecting its expanding role in the global market.

Middle East & Africa Market Share and Growth

The Middle East & Africa hold a smaller share of the RNA therapeutics market, at 10%. However, the region is witnessing gradual growth due to improving healthcare infrastructure and increased government initiatives to promote biotechnology. The market is expected to grow at a CAGR of 8% from 2021 to 2028, driven by rising investments and partnerships with global biotech firms.

Latin America Market Share and Growth

Latin America accounts for 15% of the RNA therapeutics market. The region's market growth is supported by increasing healthcare investments and the presence of emerging biotech companies. Brazil and Mexico are key players in this region, with significant advancements in RNA research. The market in Latin America is projected to grow at a CAGR of 10% from 2021 to 2028, indicating steady progress in the adoption of RNA-based therapies.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the RNA therapeutics market, several key players drive innovation and market growth through strategic positioning and substantial influence. Moderna, Inc. and BioNTech SE lead the market with their mRNA-based vaccines, notably for COVID-19, demonstrating rapid development capabilities and high efficacy. Their success has spurred further investment in RNA technologies and expanded applications beyond infectious diseases.

Alnylam Pharmaceuticals, Inc. and Ionis Pharmaceuticals, Inc. are pioneers in RNA interference (RNAi) and antisense oligonucleotide therapies, respectively. These companies have established themselves by developing treatments for rare genetic disorders, enhancing the therapeutic landscape.

Pfizer Inc. and Novartis AG leverage their extensive resources and global reach to advance RNA-based therapies, focusing on both vaccines and therapeutics. Their strategic collaborations and robust R&D investments position them as significant players in the market.

Sarepta Therapeutics, Inc. and CRISPR Therapeutics are at the forefront of gene-editing technologies, offering innovative solutions for genetic diseases. Their cutting-edge research and clinical advancements underscore their market influence.

Sanofi and Astellas Pharma Inc. engage in strategic alliances to develop RNA therapeutics, combining their expertise with innovative biotech firms to enhance their market presence. Orna Therapeutics, though newer, is making strides with its unique circular RNA technology, contributing to the dynamic landscape of RNA therapeutics.

Together, these companies shape the RNA therapeutics market, driving advancements and expanding the potential of RNA-based treatments across various medical fields.

Market Key Players

- Moderna, Inc.

- Alnylam Pharmaceuticals, Inc.

- Pfizer Inc.

- Novartis AG

- Ionis Pharmaceuticals, Inc.

- Sarepta Therapeutics, Inc.

- Sanofi

- BioNTech SE

- Orna Therapeutics

- CRISPR Therapeutics

- Astellas Pharma Inc.

Recent Developments

- May 2024: Orna Therapeutics, a pioneering biotechnology company specializing in the design and delivery of a novel class of circular RNA (oRNA) therapeutics, announced the acquisition of ReNAgade Therapeutics. ReNAgade is a trailblazer in the field of RNA therapeutics that has demonstrated industry-leading delivery to multiple extra-hepatic cells in non-human primate (NHP) models over the past 18 months.

- May 2024: Radar Therapeutics, a biotech company, emerged from stealth with an announcement that it had raised $13.4 million in an oversubscribed seed financing round led by NfX Bio. Eli Lilly & Co, Biovision, and KdT Ventures also joined the round, with participation from PearVC, BEVC, and other investors.

Report Scope

Report Features Description Market Value (2023) USD 14.4 Billion Forecast Revenue (2033) USD 24.7 Billion CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vaccines, Drugs), By Type (mRNA Therapeutics, RNA Interference, Antisense Oligonucleotides), By Indication (Infectious Diseases, Rare Genetic Diseases/Hereditary Diseases, Other Indications), By End User (Hospitals and Clinics, Research Settings) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Moderna, Inc., Alnylam Pharmaceuticals, Inc., Pfizer Inc., Novartis AG, Ionis Pharmaceuticals, Inc., Sarepta Therapeutics, Inc., Sanofi, BioNTech SE, Orna Therapeutics, CRISPR Therapeutics, Astellas Pharma Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Moderna, Inc.

- Alnylam Pharmaceuticals, Inc.

- Pfizer Inc.

- Novartis AG

- Ionis Pharmaceuticals, Inc.

- Sarepta Therapeutics, Inc.

- Sanofi

- BioNTech SE

- Orna Therapeutics

- CRISPR Therapeutics

- Astellas Pharma Inc.