River Current Energy Market By Type(Pondage, Without Pondage), By Application(Power Generation, Energy Storage, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42557

-

Jan 2022

-

161

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Driving Factors

- Restraining Factors

- River Current Energy Market Segmentation Analysis

- River Current Energy Industry Segments

- River Current Energy Market Regional Analysis

- River Current Energy Industry By Region

- River Current Energy Industry Key Players

- River Current Energy Market Recent Development

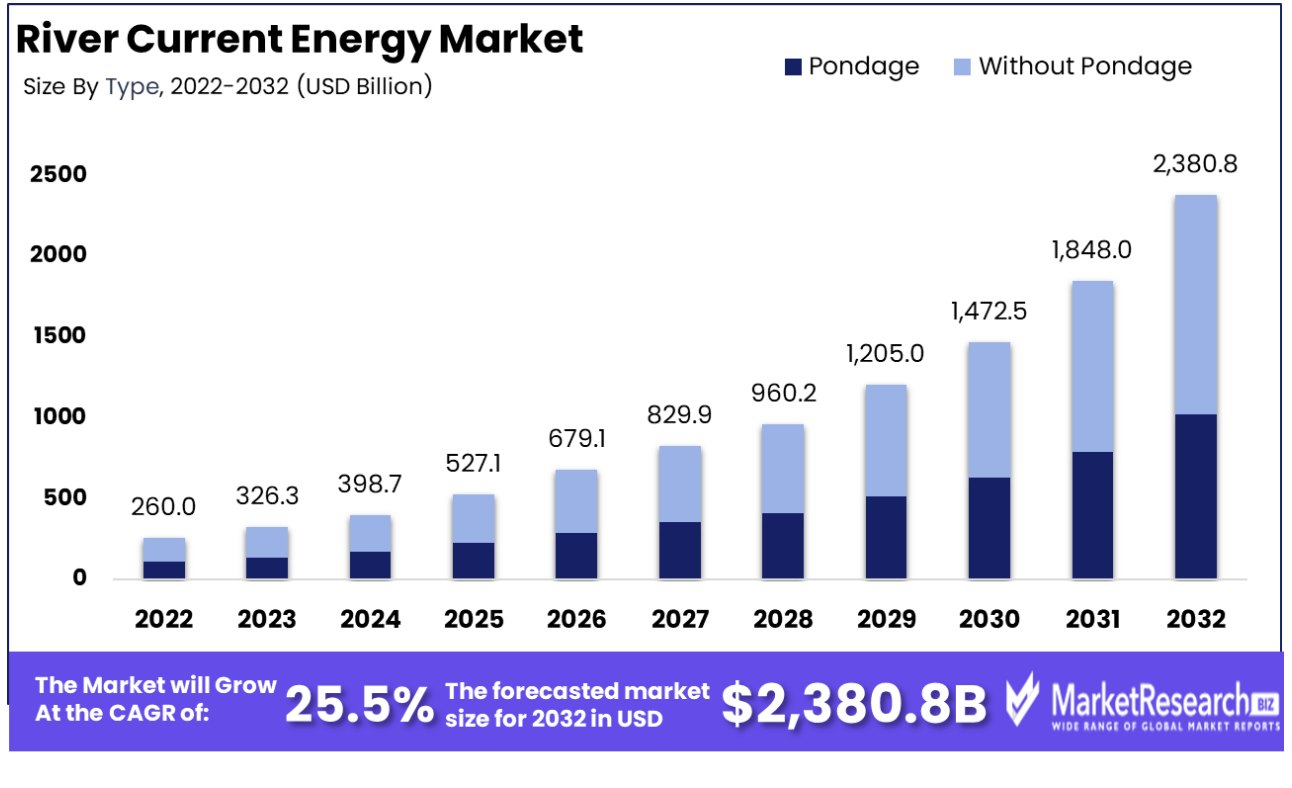

- Report Scope

River Current Energy Market size is estimated to reach USD 260 Mn by 2032, an increase from its USD 2380.8 Mn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 25.5% during 2023-2032.

Hydropower has quickly emerged as an indispensable contributor to low-carbon electricity generation worldwide, accounting for almost 50 percent of low-carbon power production globally in 2022. Hydropower outpaced nuclear energy's contribution by 55% while surpassing renewable sources like wind, solar PV, bioenergy, and geothermal. Hydropower was responsible for 6.2% of total utility-scale generation as well as 28.7% of renewable power produced at utility-scale levels in the US alone according to estimates by the Energy Information Administration in 2022. Hydrokinetic technologies continue to drive market expansion thanks to R&D innovations and economies of scale that lower costs significantly. As levelized costs are projected to become competitive with wind and solar energy, reaching $0.12-0.20/kWh within the next five years, hydrokinetic energy becomes increasingly financially viable.

The Marine and Hydrokinetic Toolkit (MHKiT), developed by NREL, is a crucial resource for marine energy developers, offering tools to analyze and optimize technology performance. This open-source toolkit accelerates the marine energy industry's progress toward commercial viability. River Current Energy Market benefits from Generative AI's energy data-driven insights, enhancing efficiency and sustainability in hydropower generation.

Policy measures such as carbon pricing, capital subsidies, renewable energy mandates, and tax incentives play a critical role in encouraging marine renewable energy adoption. One such investment in this sector was the U.S. Department of Energy's announcement to invest $35 million towards developing tidal and river current energy systems scheduled to launch by 2023. The advancements in tidal power projects worldwide, notably in Orkney, Scotland, and the broader UK, underscore the sector's progress and growth potential, propelled by technological advancements and heightened investment.

Further, The manufacturing of low-cost, durable hydrokinetic turbines represents a significant growth opportunity in the renewable energy sector. Companies that can efficiently harness kinetic energy from rivers and ocean currents in an environmentally friendly manner have the potential to revolutionize energy generation.

Moreover, the initiative by ORPC and Shell Technology to use the Mississippi River's currents for zero-carbon electricity generation through Modular RivGen Power System units is a pioneering approach in sustainable energy. If successful, this strategy could set a precedent for utilizing river currents for large-scale electricity generation, providing a blueprint for similar projects in other rivers and potentially transforming the renewable energy landscape.

Driving Factors

Environmental Concerns Boost River Current Energy Adoption

The growing awareness of the environmental impacts of fossil fuels and the urgent need for clean and green energy sources is significantly promoting the adoption of renewable energy, including river current energy. The United Nations emphasizes the vitality of renewable and green energy sources by stressing emissions must be cut by nearly half by 2030 and reach net zero by 2050 to mitigate climate change's most dire repercussions. River Current Energy has quickly established itself as an eco-friendly renewable resource and alternative energy source to traditional fossil fuel sources, helping reduce carbon emissions and environmental degradation. This shift towards environmentally sustainable practices should continue, driving sustained market expansion for river current energy as part of a global movement towards more eco-friendly practices.

Government Initiatives Propel River Current Energy Market

Governments worldwide are implementing policies to promote clean energy and reduce reliance on fossil fuels. These initiatives often include financial incentives, such as subsidies or tax breaks, and regulatory support, making investments in renewable energy more attractive.

The diverse methods and technologies employed in these funded projects demonstrate the potential for innovation in harnessing water-based energy. The ongoing commitment of governments to clean energy initiatives indicates a market that will continue to expand, supported by policy frameworks conducive to the growth of renewable energy sources.

Technological Advancements Enhance River Current Energy Market

Technological advancements in renewable energy technologies, including river current energy, are reducing costs and increasing demand across various sectors. As technology in this field evolves, it becomes more efficient, cost-effective, and applicable to a broader range of uses. Improvements in turbine design, materials, and energy conversion efficiency have made river current energy a more viable option for power generation.

These technological advancements are attracting interest from various sectors, including industrial, residential, and municipal, for their potential to provide sustainable energy solutions. Additionally, emerging technologies such as advanced photovoltaics, big data, AI, distributed energy storage systems, and hydrogen energy are driving the transition towards a cleaner and more sustainable energy landscape.

Restraining Factors

Installation Complexity and Permitting Processes Hinder River Current Energy Market Growth

The complexity of installing river current energy devices, coupled with the challenges of navigating permitting processes, significantly restrains the growth of the river current energy market. Establishing infrastructure in riverine environments requires overcoming numerous technical and environmental challenges, including ensuring the safety and stability of the installations in dynamic river conditions.

Moreover, obtaining the necessary permits can be a lengthy and complicated process, involving environmental impact assessments and approvals from multiple regulatory bodies. These factors contribute to delays and increased costs, making it difficult for new projects to get off the ground and impeding the market's overall expansion.

High Initial Investment Required Limits River Current Energy Market Expansion

The high initial investment required for river current energy projects is another significant barrier to market growth. Developing the technology and infrastructure for harnessing river current energy involves substantial upfront costs, including research and development, manufacturing of specialized equipment, and construction.

These costs can be prohibitively high, especially for startups and smaller companies, making it challenging to secure funding and investment. The financial risk associated with these large initial investments can deter potential investors, particularly in a market that is still emerging and lacks established profitability models.

River Current Energy Market Segmentation Analysis

By Type

Pondage systems in the River Current Energy Market dominate with a 54.6% share. This system involves creating a small reservoir or pondage to store river water, which can then be released through turbines to generate electricity. The advantage of bondage systems lies in their ability to regulate the flow of water, thereby providing a more consistent and controllable energy output compared to systems without pondage. Additionally, pondage systems can be designed to have a minimal environmental impact, making them a sustainable choice. The growth of this segment is driven by technological advancements that increase efficiency and reduce the environmental footprint of such installations.

Systems without bondage directly harness the river's natural flow to generate energy. While these systems are less disruptive to river ecosystems and easier to install, their energy output is more variable, depending on the river's flow rate. This variability limits their applicability in certain contexts but makes them suitable for remote or off-grid applications where a consistent energy supply is not critical.

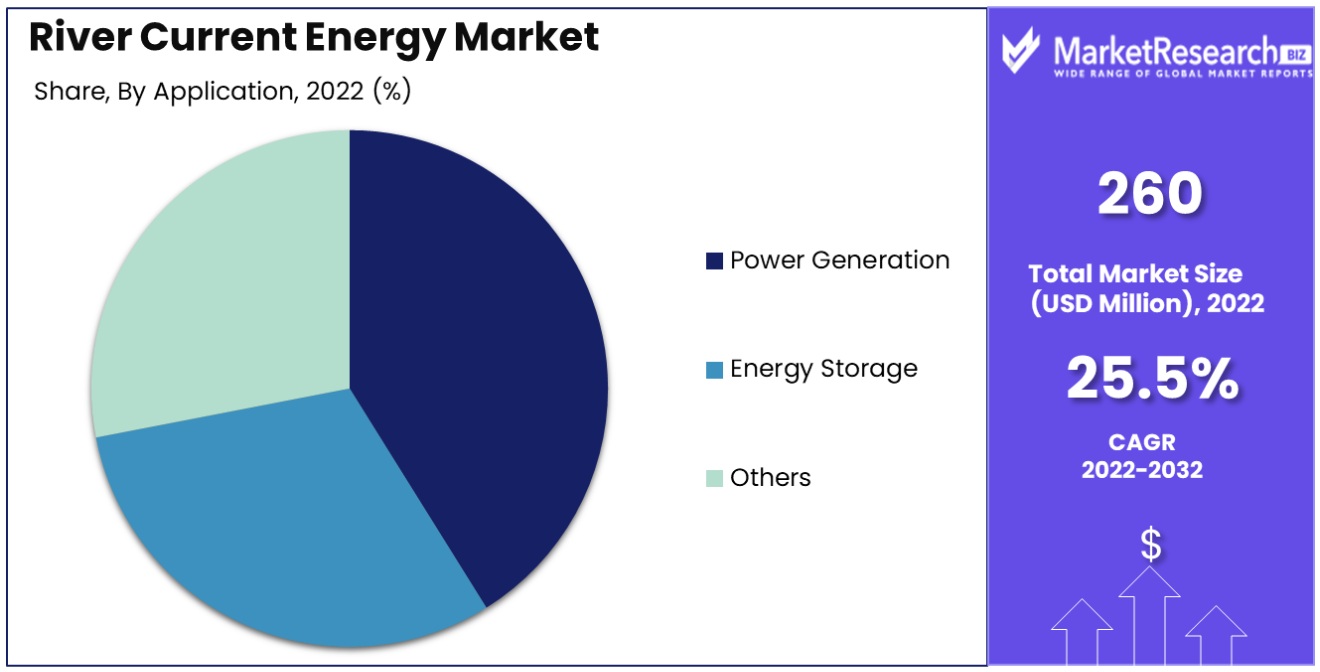

By Application

Power generation is the primary application of river current energy, accounting for 69.8% of the market. The focus on power generation is driven by the global push for renewable energy sources to reduce carbon emissions and dependence on fossil fuels. The integration of river current energy into the power grid is supported by advancements in turbine technology, which improve efficiency and reduce costs, making it a more viable option for large-scale power generation.

Energy storage is a growing application, where river current energy can be used to charge batteries or as part of pumped hydro storage systems. Other applications include localized energy solutions for remote communities, irrigation systems, and other innovative uses that harness the power of river currents.

River Current Energy Industry Segments

By Type

- Pondage

- Without Pondage

By Application

- Power Generation

- Energy Storage

- Others

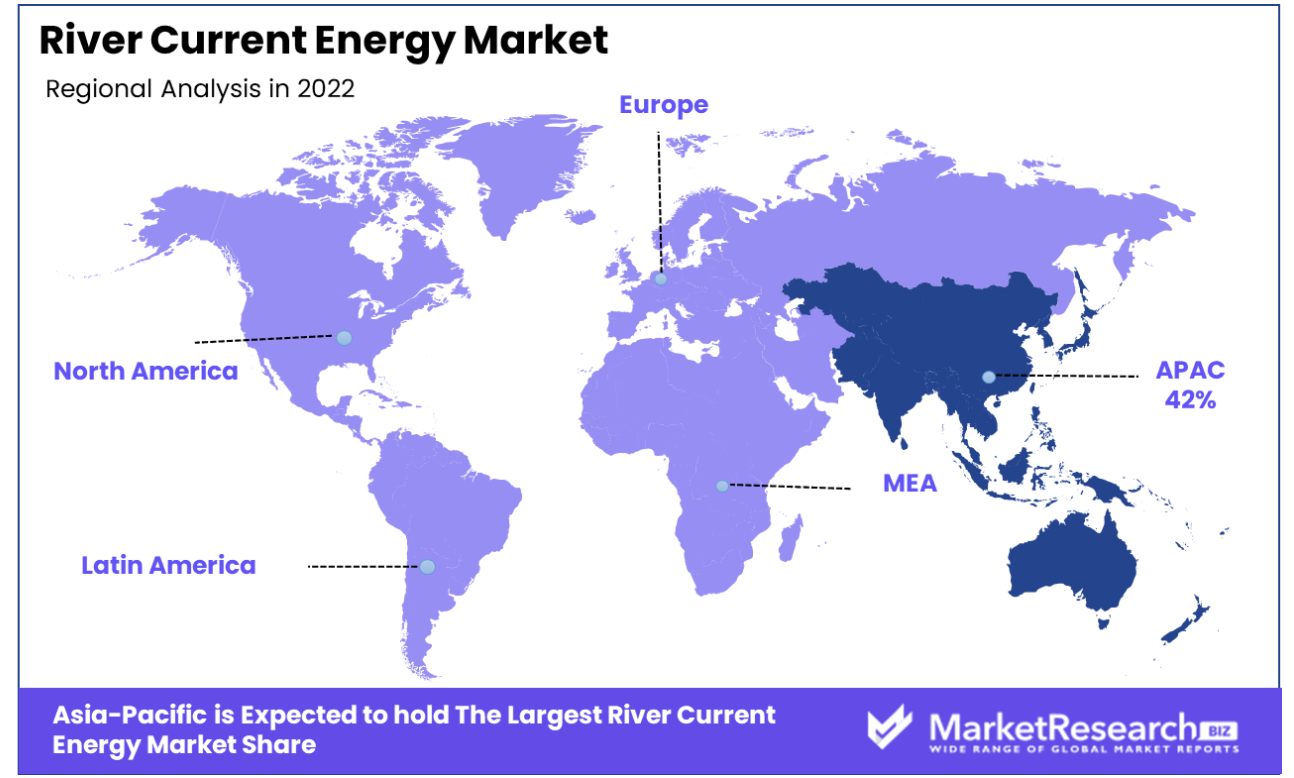

River Current Energy Market Regional Analysis

Asia Pacific Dominates with 42% Market Share in River Current Energy Market

Asia Pacific's commanding 42% share in the River Current Energy Market is driven by the region's rich river systems and a growing focus on renewable energy sources. The abundance of rivers with strong currents in countries like China, India, and Vietnam provides ample opportunities for harnessing river current energy. Additionally, increasing energy demand due to rapid industrialization and urbanization in these countries necessitates the exploration of sustainable energy sources, further contributing to the market's growth.

Asia Pacific market dynamics are heavily impacted by supportive government policies and investments in renewable energy projects such as river current energy systems. Technological advances in turbine design and energy conversion efficiency further enhance river current energy as a reliable power source. Furthermore, the region's commitment to reducing carbon emissions and combating climate change bolsters investments in sustainable energy technologies, including river current energy.

Europe is Pioneering in Sustainable Energy Development

Early estimates from the European Environment Agency (EEA) reveal that 22.5% of energy consumption across the EU in 2022 came from renewable sources - representing an increase compared to 2021. European nations have taken numerous initiatives to identify and utilize renewable energy sources, including river current energy. Their technological innovation and stringent environmental policies help foster this market growth.

North America's Emerging Market with Potential for Growth

North America, particularly the United States and Canada, is witnessing the rapid emergence of a river current energy market with significant potential. Their vast river systems present untapped opportunities for developing river current energy projects; furthermore, North America's growing focus on renewable energy sources and technological advancements related to harnessing methods are all contributing to its development as an energy market.

River Current Energy Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

River Current Energy Market Key Player Analysis

River Current Energy Market, a niche but growing area in renewable energy, features companies that are leaders in terms of innovation and uptake of this environmentally friendly source of power. General Electric and Alstom, with their extensive experience in power generation and technology, lead the market in developing efficient river current energy systems, reflecting the industry's focus on leveraging existing hydroelectric technologies while innovating for river current applications.

Jaworski Energy Services and ABB, known for their engineering and technological expertise, play crucial roles in optimizing energy extraction from river currents, demonstrating the market's shift towards maximizing efficiency and minimizing environmental impact. Schneider Electric's involvement, with its focus on energy management and automation solutions, underscores the importance of integrating river current energy into smarter, more sustainable power grids.

Overall, the River Current Energy Market is characterized by a blend of established companies leveraging their vast experience in power generation and newer, innovative firms introducing specialized technologies, together driving the advancement and commercial viability of River Current Energy as a promising source of renewable energy.

River Current Energy Industry Key Players

- General Electric

- Alstom

- Jaworski Energy Services

- ABB

- Schneider Electric

- GKinetic

- Cortus

- Hygen

River Current Energy Market Recent Development

- April 2022: According to Eco Wave Power AB, a pioneer in the generation of sustainable electricity from the ocean and sea waves, wave energy power stations with a capacity of up to 2MW could be constructed in Port Adriano, Spain. Under the terms of the agreement, Eco Wave Power will help Spain reach its challenging goals for the generation of renewable energy by taking advantage of the nation's enormous coastline.

- October 2021: Carnegie Wave Energy Ltd. has been able to start work on the MoorPower a Scaled Demonstrator project as a consequence of funding from the Blue Economy Cooperative Research Centre. MoorPower, a novel wave energy product created by CETO for moored vessels, makes it simpler to generate clean and dependable power for offshore activities.

Report Scope

Report Features Description Market Value (2022) USD 260 Million Forecast Revenue (2032) USD 2380.8 Million CAGR (2023-2032) 25.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Pondage, Without Pondage), By Application(Power Generation, Energy Storage, Others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape General Electric, Alstom, Jaworski Energy Services, ABB, Schneider Electric, GKinetic, Cortus, Hygen Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

General Electric Alstom Jaworski Energy Services ABB Schneider Electric GKinetic Cortus Hygen