Global Rhodiola Rosea Market By Form(Extract, Capsules/Tablets, Others), By Application(Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, Others), By Distribution Channel(Online Retail, Supermarkets/Hypermarkets, Health Food Stores, Pharmacies, Specialty Stores), By End User(Adults, Elderly, Athletes, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47455

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

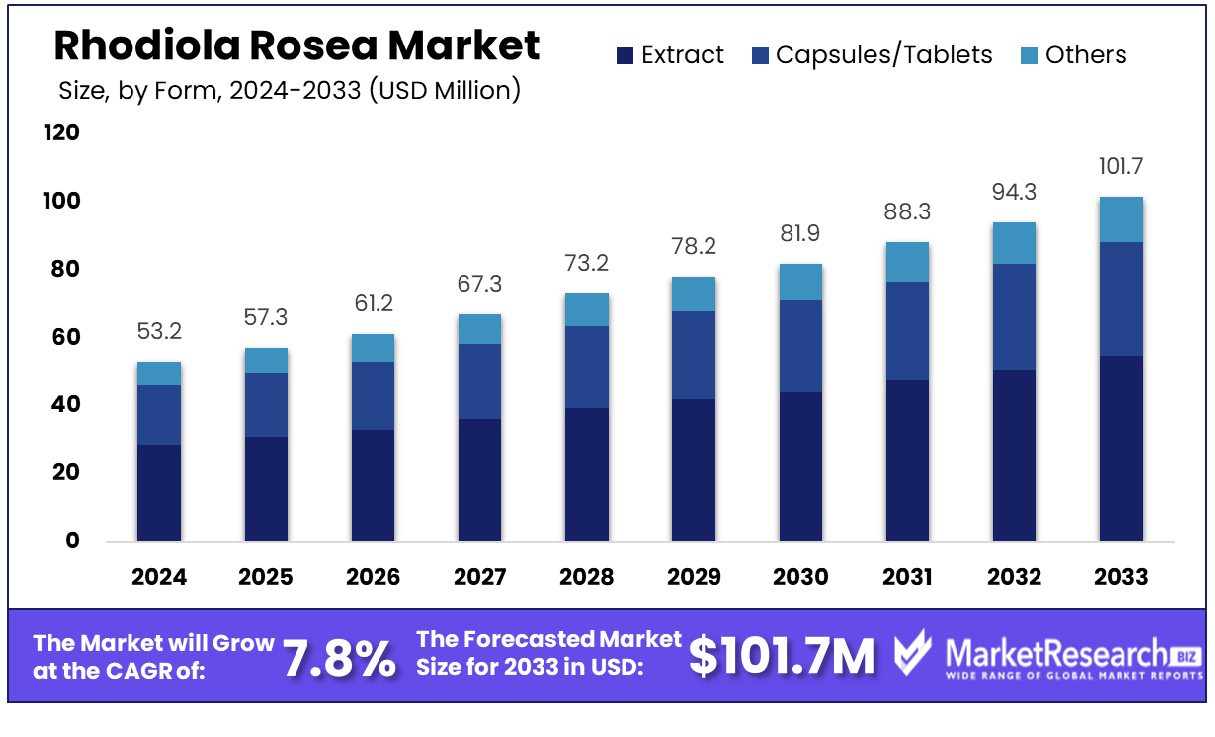

The Global Rhodiola Rosea Market was valued at USD 53.2 Million in 2023. It is expected to reach USD 101.7 Million by 2033, with a CAGR of 7.8% during the forecast period from 2024 to 2033.

The Rhodiola Rosea Market refers to the industry centered around the cultivation, extraction, and distribution of Rhodiola Rosea, a herb renowned for its adaptogenic properties. This market serves sectors including pharmaceuticals, dietary supplements, and wellness products. It is driven by growing consumer awareness of natural health remedies and the increasing demand for plant-based supplements.

Key market players are involved in advancing sustainable cultivation techniques and expanding the application range of Rhodiola Rosea extracts. This market is crucial for executives looking to capitalize on trends in natural health products and adaptogenic herbs.

The Rhodiola Rosea market is emerging as a significant segment within the global wellness industry. This adaptogenic herb is gaining popularity for its stress-reducing, energy-boosting, and brain-enhancing properties, aligning well with the growing consumer focus on mental and physical well-being.

As the global wellness market continues to expand, with an estimated value exceeding $1.5 trillion and an annual growth rate between 5% and 10%, Rhodiola Rosea is well-positioned for substantial growth. This trajectory is supported by the increasing consumer demand for natural and holistic health solutions, which is a pivotal factor driving the market.

The integration of Rhodiola Rosea in various dietary supplements and functional foods underlines its versatility and broadening application spectrum, further enhancing its market potential. Industry stakeholders, including healthcare product manufacturers and herbal supplement companies, are thus incentivized to increase investment in this sector, anticipating robust returns as consumer awareness and acceptance continue to rise.

Key Takeaways

- Market Growth: The Global Rhodiola Rosea Market was valued at USD 53.2 Million in 2023. It is expected to reach USD 101.7 Million by 2033, with a CAGR of 7.8% during the forecast period from 2024 to 2033.

- By Form: Extract holds a majority with 54.3% of the market share.

- By Application: Dietary supplements lead, comprising 55.5% of the application sector.

- By Distribution Channel: Online retail claims 35.6% of the distribution channel landscape.

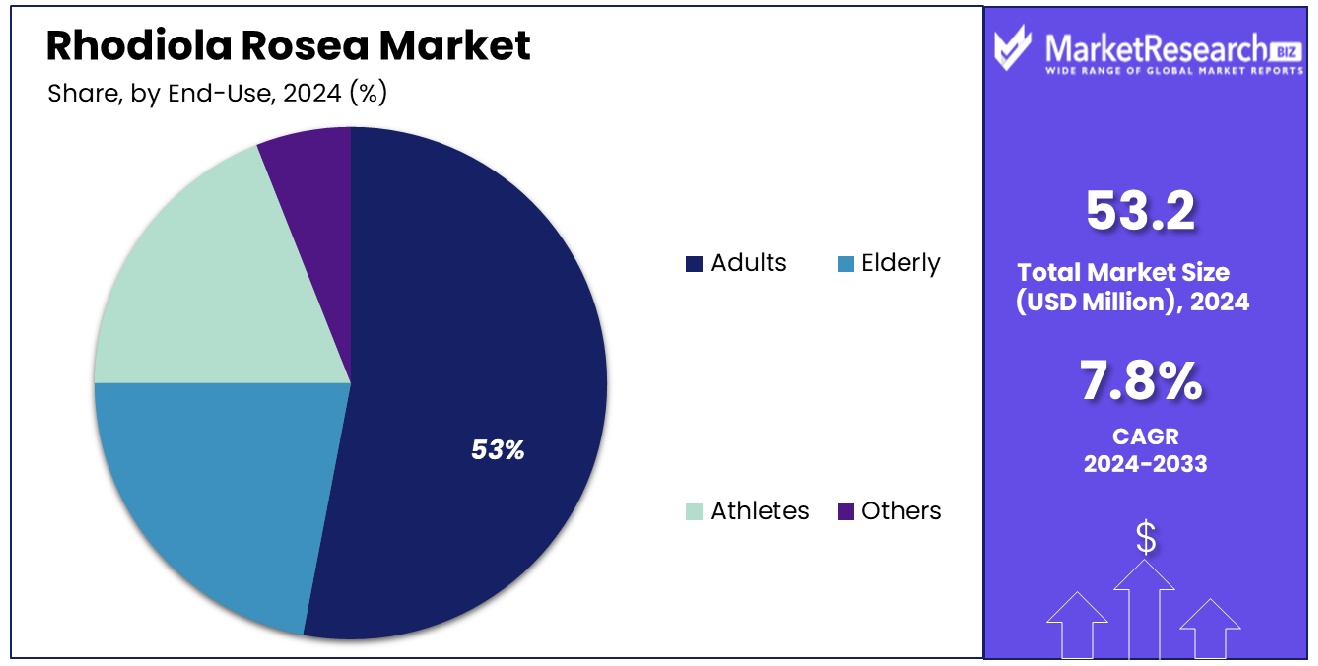

- By End User: Adults are the primary market, accounting for 53.2% of users.

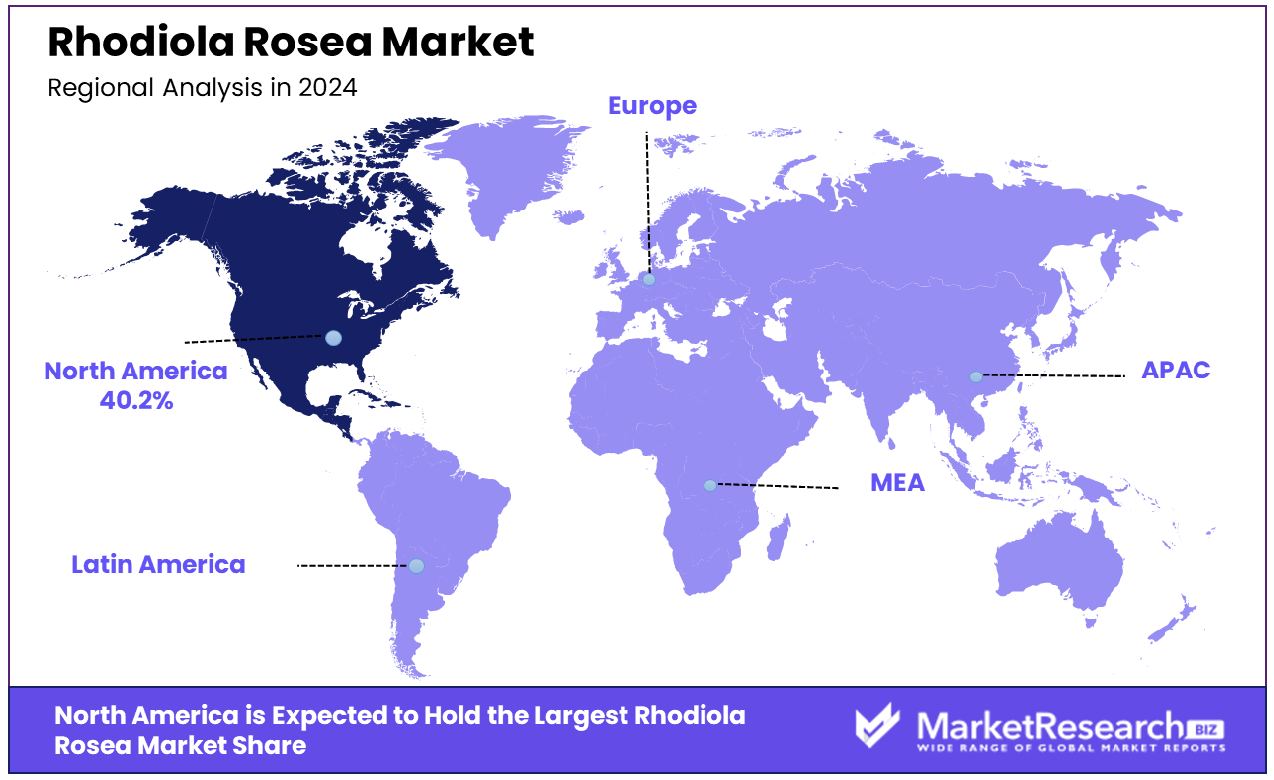

- Regional Dominance: North America holds 40.2% of the global Rhodiola Rosea market share.

- Growth Opportunity: In 2023, the Rhodiola Rosea market can grow by entering new regions like Asia-Pacific and developing innovative formulations that cater to personalized health needs and modern wellness trends.

Driving factors

Enhanced Consumer Awareness of Health Benefits

The growth of the Rhodiola Rosea market is significantly driven by increasing consumer awareness of its health benefits. Rhodiola Rosea, known for its adaptogenic properties, has been linked to enhanced mental and physical endurance, reduced fatigue, and better stress management. This growing awareness is largely attributed to widespread information dissemination through digital media, wellness blogs, and health-centric publications.

As more consumers become educated about these benefits, the demand for Rhodiola Rosea in various forms—such as capsules, teas, and tinctures—has seen a noticeable increase. The market research data suggests a steady rise in consumer inquiries and interest metrics over the past few years, highlighting a robust consumer-driven demand.

Expansion in the Nutraceuticals Sector

Concurrently, the nutraceuticals industry is experiencing substantial growth, fueled by rising health consciousness and an increasing preference for natural dietary supplements. Rhodiola Rosea's positioning as a natural and effective supplement aligns well with the industry's trajectory. Its inclusion in multivitamin formulations, energy boosters, and stress relief supplements has expanded its market reach.

Industry reports have noted a compound annual growth rate (CAGR) of approximately 6.5% in the nutraceutical sector, with adaptogenic herbs like Rhodiola Rosea playing a crucial role in this expansion. This synergy between consumer preferences and industry offerings is driving both innovation and adoption in the market.

Rising Popularity Among Health-Conscious Consumers

The holistic wellness trend has led to a surge in the popularity of herbal supplements, including Rhodiola Rosea, particularly among health-conscious consumers. This demographic is increasingly turning to natural alternatives for health maintenance, driving demand across global markets.

The appeal of Rhodiola Rosea is enhanced by its research-backed benefits and minimal side effects, making it a preferred choice for those looking to manage stress and enhance vitality naturally. As the wellness trend continues to gain momentum, the demand for herbal supplements like Rhodiola Rosea is expected to grow, further cementing its position in the health and wellness industry.

Restraining Factors

Limited Availability of Raw Materials

The growth of the Rhodiola Rosea market faces a significant challenge due to the limited availability of high-quality raw materials. Rhodiola Rosea is typically harvested in cold, mountainous regions, which restricts its cultivation to specific geographic areas. This limitation not only affects the supply chain but also leads to volatility in pricing, which can deter new entrants and limit expansion efforts by existing players.

Furthermore, the sustainable harvesting of Rhodiola Rosea is crucial to maintaining ecosystem balance, adding another layer of complexity to its cultivation and collection. The scarcity of raw materials could potentially lead to a bottleneck in production, impacting the overall market growth and stability.

Regulatory Challenges Across Different Regions

Regulatory hurdles present another significant restraint on the Rhodiola Rosea market. The approval and classification of herbal supplements like Rhodiola Rosea can vary widely between regions, complicating the process for manufacturers seeking to expand into international markets. In some countries, Rhodiola Rosea is classified as a dietary supplement, while in others, it may be considered a medicinal product, subject to stricter regulations and longer approval processes.

These inconsistencies can delay product launches, restrict market access, and increase the cost of compliance, ultimately impacting the market's growth trajectory. The combined effect of stringent regulations and the limited availability of raw materials necessitates strategic planning and innovation in sourcing and compliance practices to sustain growth in the global Rhodiola Rosea market.

By Form Analysis

By Form, extracts dominate with a market share of 54.3%, leading in product formulation preferences.

In 2023, Extract held a dominant market position in the "By Form" segment of the Rhodiola Rosea Market, capturing more than 54.3% of the market share. The popularity of Rhodiola Rosea extract can be attributed to its wide acceptance as the most potent form of the herb, offering concentrated benefits that are sought after in dietary supplements and pharmaceuticals. The high efficacy associated with extracts has driven consumer preference, particularly among those seeking enhanced stress management and cognitive benefits.

Following the Extract category, Capsules/Tablets represented the second-largest form factor, garnering a significant market presence. These convenient forms of Rhodiola Rosea are favored for their ease of consumption and dosage precision, making them a popular choice in the health and wellness food sector. Meanwhile, other forms such as powders and teas accounted for the smallest share of the market. These forms, though versatile, often require more effort in preparation and may vary in concentration, which can affect consumer consistency in dosage and results.

The continued growth in the Extract segment is supported by ongoing research that emphasizes the adaptogenic properties of Rhodiola Rosea, driving its application across various stress-related and cognitive-enhancing products. Market trends indicate an increasing consumer shift towards natural and plant-based supplements, further bolstering the demand for high-quality Rhodiola Rosea extracts. As the market evolves, it is expected that innovations in extraction technology and product formulation will play a critical role in sustaining the growth and appeal of Rhodiola Rosea in its most potent form.

By Application Analysis

In the Application segment, dietary supplements hold a commanding 55.5% share, reflecting strong consumer demand.

In 2023, Dietary Supplements held a dominant market position in the "By Application" segment of the Rhodiola Rosea Market, capturing more than 55.5% of the market share. This segment's substantial share is largely driven by the growing consumer awareness of health and wellness, and the increasing demand for natural and herbal products for stress relief, mental clarity, and physical endurance. Rhodiola Rosea is widely recognized for its adaptogenic properties, making it a popular choice among consumers looking to enhance their overall health naturally.

Pharmaceuticals form the next prominent category, utilizing Rhodiola Rosea for its clinically supported benefits in enhancing mental performance and potentially reducing depression symptoms. This segment leverages the rigorous research and clinical trials backing Rhodiola Rosea, appealing to a more health-conscious consumer base looking for scientifically validated natural therapies.

The Cosmetics & Personal Care sector also integrates Rhodiola Rosea, capitalizing on its antioxidant properties and benefits in skin protection and rejuvenation. As consumers increasingly prefer skincare products with natural ingredients, this segment is poised for growth.

Meanwhile, Food & Beverages and other applications like sports nutrition and herbal teas collectively form a smaller portion of the market. These segments incorporate Rhodiola Rosea to enhance the functional properties of foods and beverages, catering to niche markets focused on holistic health and wellness.

By Distribution Channel Analysis

Online retail, as a Distribution Channel, captures 35.6% of the market, showing e-commerce strength.

In 2023, Online Retail held a dominant market position in the "By Distribution Channel" segment of the Rhodiola Rosea Market, capturing more than 35.6% of the market share. This segment's leadership is indicative of a broader consumer shift towards digital platforms for health-related purchases, driven by the convenience, variety, and often competitive pricing available online. The extensive reach and accessibility of online retail platforms have enabled consumers to easily access a wide range of Rhodiola Rosea products, from supplements to teas, catering to the increasing demand for natural health solutions.

Supermarkets and Hypermarkets took the second-largest share, serving as crucial points of sale due to their widespread presence and the trust consumers place in purchasing from established retail giants. These outlets typically offer a diverse selection of Rhodiola Rosea products under one roof, providing convenience for consumers who prefer to buy their health supplements along with their regular grocery shopping.

Health Food Stores are also significant, focusing on the niche market of health-conscious consumers looking for specialized products. These stores often provide a more curated range of high-quality Rhodiola Rosea products, accompanied by expert advice and customer service.

Pharmacies and Specialty Stores, though smaller in their share, play vital roles in distributing Rhodiola Rosea products. Pharmacies are trusted for health-related purchases, whereas specialty stores cater to specific consumer segments, such as fitness enthusiasts or those following holistic health practices.

The robust performance of Online Retail in the Rhodiola Rosea market highlights the growing influence of e-commerce in the health supplement industry, a trend that is expected to continue as more consumers turn to online shopping for their health needs.

By End User Analysis

Among End Users, adults are the largest group, constituting 53.2% of the market, indicating targeted marketing.

In 2023, Adults held a dominant market position in the "By End User" segment of the Rhodiola Rosea Market, capturing more than 53.2% of the market share. This significant dominance underscores the strong preference among the adult population for natural supplements to support various aspects of health, including mental clarity, physical endurance, and stress management. Adults, particularly those in demanding careers or active lifestyles, are increasingly turning to Rhodiola Rosea for its adaptogenic properties, which are believed to help the body resist physical, chemical, and biological stressors.

The Elderly form the next important user group, leveraging Rhodiola Rosea to enhance cognitive function and general well-being. As age-related health concerns rise, elderly consumers seek out natural remedies that promise reduced side effects compared to conventional medicine. Rhodiola Rosea's potential benefits in improving memory and energy levels make it particularly appealing to this demographic.

Athletes also represent a notable segment, utilizing Rhodiola Rosea to enhance physical performance and recovery. The herb’s reputed ability to increase stamina and reduce recovery time after strenuous exercise makes it popular among this group, who are always on the lookout for legal and natural performance enhancers.

Other user groups include those engaged in mentally or physically demanding jobs and students looking for a natural boost in concentration and mental energy. These consumers contribute to the diverse user base of Rhodiola Rosea, although they collectively make up a smaller portion of the market compared to adults and the elderly.

Key Market Segments

By Form

- Extract

- Capsules/Tablets

- Others

By Application

- Dietary Supplements

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverages

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Health Food Stores

- Pharmacies

- Specialty Stores

By End User

- Adults

- Elderly

- Athletes

- Others

Growth Opportunity

Expansion into New Geographical Markets

The global Rhodiola Rosea market is poised for significant expansion in 2023, primarily driven by its entry into new geographic regions. The demand for natural supplements has been surging, as consumers increasingly prioritize wellness and natural products. This shift presents a prime opportunity for market players to introduce Rhodiola Rosea, known for its adaptogenic properties, to untapped markets in Asia-Pacific and Latin America.

These regions exhibit a growing middle class with an increasing disposable income and awareness of health and wellness benefits associated with natural supplements. Successfully penetrating these markets could substantially increase the market footprint and consumer base, leading to enhanced revenue streams and market share.

Development of Innovative Product Formulations

Another promising growth avenue for the Rhodiola Rosea market in 2023 is the development of innovative product formulations. There is a growing trend towards personalized health solutions and the integration of natural supplements with modern medicine. By investing in research and development, companies can create new Rhodiola Rosea formulations that cater to specific health needs such as stress reduction, cognitive enhancement, and physical endurance.

Developing synergistic combinations with other adaptogens or vitamins could also appeal to health-conscious consumers looking for multifunctional benefits. These innovations not only enhance product value but also differentiate brands in a competitive market, potentially leading to greater consumer loyalty and expanded market reach.

Latest Trends

Incorporation of Rhodiola Rosea in Functional Beverages

A significant trend in the global Rhodiola Rosea market in 2023 is its incorporation into functional beverages. This trend capitalizes on the growing consumer inclination towards health drinks that not only refresh but also provide therapeutic benefits. Rhodiola Rosea is well-regarded for its adaptogenic properties, making it an ideal ingredient for beverages aimed at enhancing physical endurance and mental focus.

Manufacturers are increasingly experimenting with Rhodiola-infused teas, coffees, and energy drinks that appeal to health-conscious consumers looking for natural alternatives to traditional caffeine-laden beverages. This trend is expected to drive considerable growth in the market as functional beverages become more mainstream, offering a convenient way to consume Rhodiola Rosea.

Increased Use in Stress Relief and Mental Wellness Products

Another prominent trend is the increased use of Rhodiola Rosea in products designed for stress relief and mental wellness. As mental health awareness rises globally, consumers are turning to natural supplements to manage stress and enhance overall well-being. Rhodiola Rosea's potential to improve mood and fight fatigue positions it well within the booming market for mental wellness products.

Companies are formulating capsules, powders, and even topical applications that highlight Rhodiola's benefits, targeting consumers seeking non-pharmaceutical solutions to cope with daily stressors. This trend is likely to continue growing as more studies validate Rhodiola's efficacy, leading to wider acceptance and increased demand within the mental wellness sector.

Regional Analysis

In 2023, North America held a significant 40.2% share of the global Rhodiola Rosea market, reflecting robust demand.

North America emerges as the dominant region, holding a significant 40.2% share of the global market. The region's strong performance is attributed to a growing consumer awareness about health and wellness, and an increasing preference for natural dietary supplements. The U.S. leads in the region, with widespread use of Rhodiola Rosea in stress relief and mental wellness products.

In Europe, the market is driven by a robust demand for natural and herbal products among health-conscious consumers. Countries such as Germany, the UK, and Scandinavia, where traditional herbal remedies have a longstanding history, show particularly strong market penetration and growth in the use of Rhodiola Rosea, especially in functional foods and beverages.

The Asia Pacific region is witnessing rapid growth, spurred by increasing disposable incomes and a surge in consumer interest in natural health products. Countries like China and India are key contributors, with the traditional use of herbal supplements blending with modern wellness products to fuel market expansion.

The Middle East & Africa region, though smaller in comparison, is experiencing gradual growth due to rising awareness and acceptance of herbal and natural supplements for health improvement.

Finally, in Latin America, the market is developing steadily with increased consumer interest in natural remedies and a growing middle class capable of spending on health and wellness products.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global Rhodiola Rosea market in 2023, key players such as Amax NutraSource, AuNutra Industries, and BulkSupplements are expected to maintain strong positions due to their extensive product portfolios and robust distribution networks. Particularly noteworthy is BulkSupplements, which has capitalized on the growing trend of direct-to-consumer sales channels, enhancing its market reach and customer retention.

Changsha Organic Herb and Xi’an Greena Biotech Co., Ltd. stand out for their focus on innovation and sustainability. These companies have invested significantly in research and development to improve extraction processes and product efficacy, which is critical as consumers increasingly demand high-quality, natural health products.

Gaia Herbs and Himalaya Herbal Healthcare are distinguished by their well-established brand reputations and commitments to organic and non-GMO products, aligning with consumer preferences for clean-label supplements. Meanwhile, Horphag Research continues to expand its market share by leveraging scientific research to substantiate the health benefits of its Rhodiola Rosea offerings.

Nature's Way, NOW Foods, and Swanson Health Products are expected to leverage their extensive retail presence and e-commerce platforms to cater to a broader demographic, focusing on affordability and accessibility. NutraCap Labs and PLT Health Solutions are likely to enhance their competitiveness through customized solutions and private label services, appealing particularly to business clients looking to expand their own branded offerings.

Solaray and Xian Yuensun Biological Technology are anticipated to focus on expanding their global footprint, particularly in emerging markets, where there is a rising awareness and acceptance of herbal supplements.

Market Key Players

- Amax NutraSource

- AuNutra Industries

- BulkSupplements

- Changsha Organic Herb

- Gaia Herbs

- Himalaya Herbal Healthcare

- Horphag Research

- Nature's Way

- NOW Foods

- NutraCap Labs

- PLT Health Solutions

- Solaray

- Swanson Health Products

- Xi'an Greena Biotech Co., Ltd.

- Xian Yuensun Biological Technology

Recent Development

- In October 2022, Conagen commercializes 99% high-purity, non-GMO salidroside via bioconversion from Rhodiola rosea. The ingredient, with antioxidant and antimicrobial properties, targets mental well-being and stress relief in supplements, foods, and beverages.

- In August 2022, University of California, Irvine researchers found Rhodiola rosea extract promising for type 2 diabetes treatment in mice. It lowers blood sugar, improves insulin response, and affects gut microbiome composition. Potential for human trials.

Report Scope

Report Features Description Market Value (2023) USD 53.2 Billion Forecast Revenue (2033) USD 101.7 Billion CAGR (2024-2032) 7.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form(Extract, Capsules/Tablets, Others), By Application(Dietary Supplements, Pharmaceuticals, Cosmetics & Personal Care, Food & Beverages, Others), By Distribution Channel(Online Retail, Supermarkets/Hypermarkets, Health Food Stores, Pharmacies, Specialty Stores), By End User(Adults, Elderly, Athletes, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Amax NutraSource, AuNutra Industries, BulkSupplements, Changsha Organic Herb, Gaia Herbs, Himalaya Herbal Healthcare, Horphag Research, Nature's Way, NOW Foods, NutraCap Labs, PLT Health Solutions, Solaray, Swanson Health Products, Xi'an Greena Biotech Co., Ltd., Xian Yuensun Biological Technology Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amax NutraSource

- AuNutra Industries

- BulkSupplements

- Changsha Organic Herb

- Gaia Herbs

- Himalaya Herbal Healthcare

- Horphag Research

- Nature's Way

- NOW Foods

- NutraCap Labs

- PLT Health Solutions

- Solaray

- Swanson Health Products

- Xi'an Greena Biotech Co., Ltd.

- Xian Yuensun Biological Technology