Rfid Tags Market By Product Type (Active RFID Tags, Passive RFID Tags), By Frequency (Low Frequency (LF) RFID Tags, Ultra-high Frequency (UHF) RFID Tags), By End-Use (Agriculture, Transportation, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

40391

-

July 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

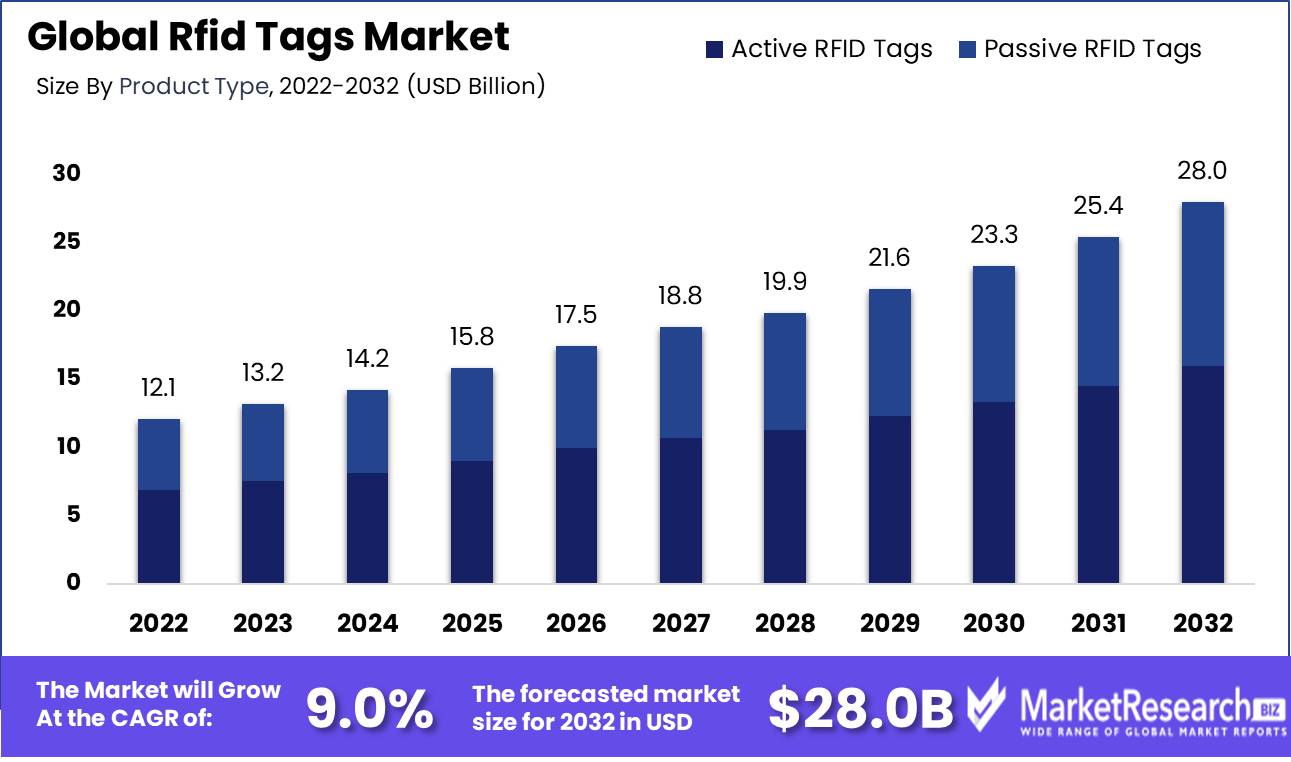

The Rfid Tags Market size is expected to be worth around USD 28.0 Bn by 2032 from USD 12.1 Bn in 2022, growing at a CAGR of 9.0% during the forecast period from 2023 to 2032.

In the contemporary era of heightened global interconnectedness, the imperative for businesses, regardless of their scale, to implement effective inventory management and optimize their supply chain has assumed paramount importance. RFID (Radio Frequency Identification) tags are utilized in this context. The implementation of RFID technology has significantly transformed asset tracking and management practices within businesses, offering instantaneous visibility and a multitude of advantages. This report aims to comprehensively explore various aspects of the RFID tags market, including its definition, goals, significance, benefits, noteworthy advancements, significant investments, growth patterns, diverse applications, industries involved in its adoption, key drivers, ethical considerations, responsible practices, and business implications.

The market for RFID tags plays a crucial role in enhancing the efficiency of diverse business operations. One of the primary benefits associated with RFID tags lies in their capacity to facilitate real-time, precise, and automated data acquisition. The implementation of this technology obviates the necessity of manual data input, thereby mitigating the occurrence of human fallibility and conserving significant amounts of time. Moreover, the utilization of RFID tags facilitates the optimization of inventory management procedures within businesses, enhancing the visibility of supply chains.

The RFID tags market is undergoing continuous development, characterized by significant innovations that are bringing about a revolution in the industry. A significant development in the field is the implementation of passive ultra-high frequency (UHF) RFID tags, which provide enhanced capabilities such as extended read ranges, accelerated data transfers, and improved read rates. These attributes make them particularly well-suited for the efficient management of large-scale inventories.

The utilization of RFID technology has garnered significant financial investments from a multitude of industries. Prominent retail corporations such as Walmart and Amazon have made substantial investments in radio frequency identification (RFID) tags with the aim of augmenting inventory management capabilities and enhancing the overall customer experience. Similarly, healthcare institutions have adopted this technology to establish precise patient tracking systems, thereby mitigating the occurrence of medical errors.

The market for RFID tags market has witnessed significant growth over the years and is projected to continue its upward trajectory in the foreseeable future. The increasing utilization of RFID technology by retail industries is a significant factor contributing to various benefits, such as enhanced inventory visibility, prevention of stockouts, and overall improvement in shopping experiences. The healthcare sector is expected to witness significant growth as a result of the rising demand for patient-tracking systems that effectively manage medications.

A multitude of industries are allocating resources toward the adoption of the RFID tags market in order to optimize their operational processes. Manufacturing companies employ technology to optimize production processes, monitor assets, and adhere to regulatory requirements. Similarly, automotive industry companies harness RFID technology to facilitate vehicle tracking, deter theft, and manage maintenance operations. In the aviation sector, RFID technology is adopted for efficient baggage handling, passenger tracking, and maintenance procedures.

Driving factors

IoT Adoption Growing

The Internet of Things (IoT) has transformed several industries, including the RFID tags market. The IoT and connected devices have led to a surge in RFID tag demand. These little but powerful electronic gadgets serve a critical role in tracking and collecting data from linked devices and sending it to a centralized system for real-time analysis. The demand for RFID tags is predicted to expand as IoT is integrated into transportation, healthcare, retail, and manufacturing.

Real-Time Inventory and Asset Tracking Demand

Efficient asset tracking and inventory management are crucial for businesses to improve efficiency. RFID tags allow real-time asset tracking at a low cost. RFID technology helps businesses make educated decisions, decrease losses, optimize inventory levels, and increase supply chain efficiency by providing precise and up-to-date asset location, status, and movement data. Due to this, RFID tags for asset tracking and inventory management are in high demand.

Supply Chain and E-commerce Growth

E-commerce's rapid growth has led to a surge in demand for efficient supply chain management solutions. RFID tags enable seamless tracking and tracing of products across the supply chain, including warehouses, distribution centers, and last-mile delivery. These tags can contain and send product details, expiration dates, and handling instructions, helping businesses confirm product authenticity, combat counterfeiting, and comply with regulations. The demand for RFID tags in supply chain tag applications will increase as the e-commerce industry grows.

RFID Tag Miniaturization

RFID technology has enabled tag shrinking, making tags smaller, more versatile, and cheaper. These tiny RFID tags can be installed in products, assets, and even people. These tags' lower size and improved functionality enable inventory management, access control, contactless payments, and medical device tracking. The advancements in RFID technology and tag shrinking have led to the growth of the RFID tags market, presenting enormous potential for businesses in various sectors.

RFID Tag Market Anti-Counterfeiting and Authentication Needs

Consumers and businesses face a growing threat from counterfeit products. Thus, product integrity and brand reputation require reliable anti-counterfeiting and authentication solutions. RFID tags market with encrypted codes, tamper-evident seals, and unique identifiers can help businesses track and authenticate their products along the supply chain. These solutions provide safe traceability and help authorities catch counterfeiters. The RFID tags market is seeing a surge in the usage of anti-counterfeiting solutions due to the growing demand for such measures.

Restraining Factors

Large Deployments Cost

As the RFID tags market increases, organizations look at large-scale deployments of this technology. RFID systems have pros and cons. Organizations must evaluate the costs of adopting and maintaining RFID systems on a large scale. Large-scale deployments of RFID tags incur costs. RFID tags, readers, antennae, and infrastructure are initial costs. These costs depend on the quantity of tags, technology, and implementation.

Security and Privacy

As RFID technology gains popularity, privacy, and security issues have hampered large-scale deployments. Healthcare, finance, and government handle sensitive data and valuable assets. RFID tags broadcast and store unique IDs and position data, raising privacy concerns. Unsecured data can be accessed by unauthorized persons, compromising privacy.

Low Standardization/Interoperability

Market discrepancies impede large-scale RFID tag deployments. Despite industry standards, RFID tags and readers can vary in design, function, and communication. This lack of uniformity may make it difficult to combine RFID components from several vendors, raising deployment costs and compatibility issues. Organizations should carefully choose RFID vendors who follow industry standards and have a history of interoperability to handle this difficult issue.

System Incompatibility

RFID technology's interoperability with current infrastructure and systems also hinders large-scale deployments. RFID technology may not operate with inventory management and ERP systems in many organizations. Integrating RFID systems with infrastructure involves effort and money. RFID systems may need custom software interfaces or system upgrades to share data.

RFID Range and Accuracy Problems

The RFID tags market worries about reading range and accuracy. Reading range constraints may hinder large-scale deployments.RFID tags use radio waves, so interference, physical obstacles, and tag position might affect the reading range. In large warehouses or outdoors, reading range may be difficult. Accuracy issues can develop when several tags are closed.

Product Type Analysis

In the RFID tags market, active RFID tags are getting more and more popular. These tags employ batteries to transmit signals, allowing real-time tracking and a larger scan range. Due to its multiple advantages over other types of RFID tags, the active RFID tags segment has emerged as the dominant product type.

Emerging economies have driven the adoption of active RFID tags. Indian, Chinese, and Brazilian economies are rapidly industrializing and urbanizing. Active RFID tags can answer the requirement for efficient supply chain management and asset tracking systems.

Consumers are seeing the benefits of active RFID tags. These tags enable real-time asset tracking, improving inventory management and reducing losses. Active RFID tags are also useful for vehicle tracking, theft prevention, and access management. This adaptability has increased consumer adoption of Active RFID tags.

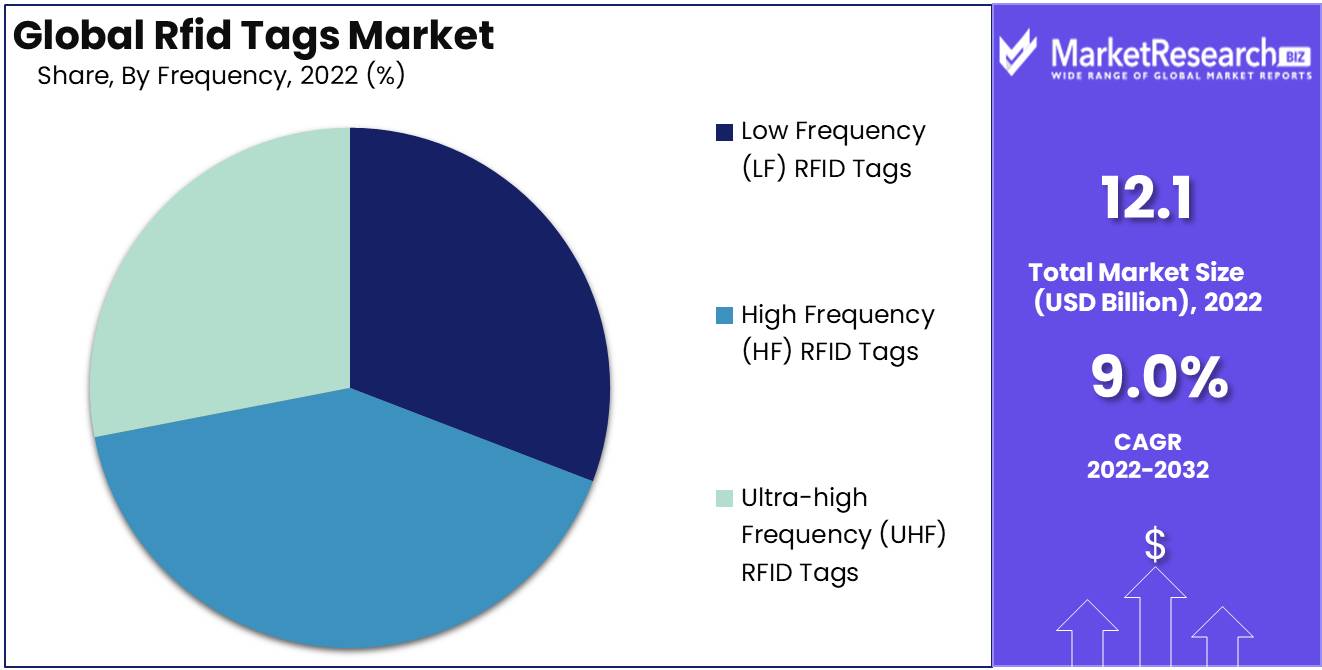

Frequency Analysis

UHF RFID tags are the market leader. UHF RFID tags run from 860 MHz to 960 MHz, allowing for a larger scan range and faster data transfer. This has led to the broad adoption of UHF RFID tags in numerous industries.

Emerging economies have driven the adoption of UHF RFID tags. Retail, healthcare, and logistics are growing rapidly in these economies, requiring effective inventory management and tracking systems. UHF RFID tags are cost-effective for various industries, leading to their rising adoption in emerging economies.

Due to its many benefits, consumers like UHF RFID tags. Businesses may streamline processes and cut expenses thanks to these tags, which enable precise and effective asset tracking. UHF RFID tags may interact with existing systems, making it easier for businesses to use this technology. This has led to customer acceptance and adoption of UHF RFID tags.

Key Market Segments

By Product Type

- Active RFID Tags

- Passive RFID Tags

By Frequency

- Low Frequency (LF) RFID Tags

- High Frequency (HF) RFID Tags

- Ultra-high Frequency (UHF) RFID Tags

By End-Use

- Agriculture

- Transportation

- Logistics and Supply Chain

- Healthcare

- Other End-Uses

Growth Opportunity

Entering Industries

RFID tags can improve operations, supply chain management, and customer experiences in many industries. Retail is a growth sector. RFID tags help retailers track inventory as customers want personalized shopping and fast checkouts. RFID technology helps merchants automate stock replenishment, eliminate out-of-stock, and improve inventory visibility, improving customer shopping experiences.RFID technology will also assist healthcare. Healthcare operations depend on tracking equipment, supplies, and patients.

Customized RFID Tag Solutions

Besides RFID tags' broad adoption, the market has seen the development of industry-specific solutions. Temperature-sensitive RFID tags have revolutionized the pharmaceutical and food industries. These tags track temperature changes, ensuring perishable goods' integrity and safety during shipping and storage. The RFID tags market is growing as demand for temperature-sensitive tags rises. Security-sensitive industries also favor tamper-proof RFID tags. These tags show tampering to deter theft and counterfeiting.

RFID Hardware/Software Providers

Collaboration with RFID hardware and software providers is essential to leverage RFID technology to its fullest extent. RFID hardware providers offer a variety of tag and reader solutions for certain industries. Companies in the RFID tags market can use their technical skills, get the newest RFID technology, and expedite innovation by working with these providers. Businesses can leverage extensive data analytics, reporting, and integration capabilities through collaboration with RFID software providers. The availability of comprehensive software solutions aids in the extraction of meaningful insights from RFID-generated data, enabling businesses to make educated decisions, improve processes, and increase productivity.

Cloud-Based RFID Adoption

The market's adoption of cloud-based RFID technologies has created new growth potential. For businesses adopting RFID technology, cloud-based solutions offer scalability, flexibility, and integration. These platforms offer real-time data collecting, analysis, and collaboration across locations and stakeholders. Businesses in the RFID tags market can leverage cloud computing benefits such as decreased infrastructure costs, improved data accessibility, and increased data security by shifting to the cloud.

RFID Sustainability & Recyclability

Businesses and customers now prioritize sustainability and recyclability. Thus, RFID tags' sustainability and recyclability offer market growth. Using eco-friendly materials and making RFID tags that can be recycled can attract green shoppers. Sustainable RFID tag manufacturing helps businesses meet global sustainability targets and stand out from the competition.

Latest Trends

Passive RFID Tags Transform Inventory

Due to their affordability and simplicity of use, passive RFID tags have become very popular among businesses. RFID readers power these tags to capture and transmit data. Passive RFID tags are changing inventory management in the context of item-level tracking. Businesses can now accurately track and manage their inventory, reducing stockouts and optimizing supply chain operations, thanks to the ability to uniquely identify each individual product.

Real-time RFID Tracking

Active and battery-assisted RFID tags take remote tracking to the next level, while passive RFID tags are perfect for item-level tracking. Active RFID tags use their own power to transmit signals. These battery-assisted tags provide real-time asset, person, and vehicle tracking. Logistics, healthcare, and manufacturing use this technology to improve security, avoid theft, and boost efficiency. Real-time asset tracking helps businesses make data-driven choices.

Seamless RFID-NFC Interactions

NFC-enabled RFID tags have revolutionized contactless interactions, resulting in widespread use across industries. This innovative technology lets smart gadgets seamlessly transport data across short distances. NFC-enabled RFID tags are changing how we interact with ordinary objects, from contactless payments and access control to interactive marketing. NFC technology combined with the RFID tags market improves daily ease, security, and efficiency.

Smart Packaging Enables Retail

RFID technology-enabled smart packaging is gaining popularity in retail and e-commerce. RFID-enabled smart packaging improves supply chain visibility, inventory management, and shrinkage. Businesses may track the full product lifetime, from manufacturing to the final user, by inserting RFID tags market into product packaging. Companies may optimize their supply chain, combat counterfeiting, and deliver an immersive client experience.

Blockchain Improves Supply Chain

Blockchain technology's immutable record is ideal for supply chain transparency. Businesses may make a permanent record of every transaction and shipment by combining RFID technology with blockchain technology. This integration eliminates counterfeit products, allows accurate provenance tracking, and ensures ethical sourcing. RFID and blockchain technology build confidence and help people choose items.

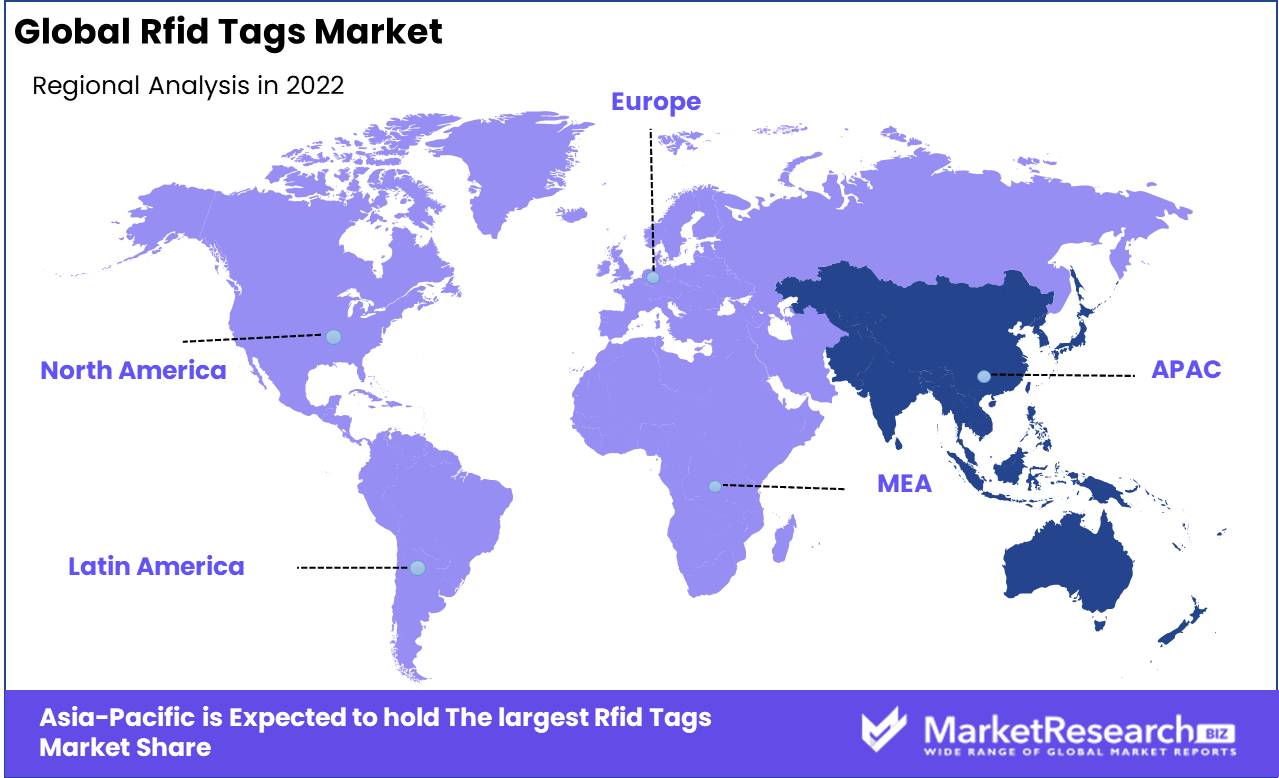

Regional Analysis

Radio frequency identification (RFID) technology has emerged as a game-changer in today's fast-expanding technological landscape, allowing firms to streamline processes, improve efficiency, and provide an unmatched customer experience. Asia Pacific (APAC) has emerged as a major force in the RFID tags market. APAC's robust infrastructure, technical advances, and growing market are poised to alter how businesses use RFID technology.

The APAC region, including China, Japan, India, South Korea, and Australia, dominates the RFID tags market. The region's exponential growth in this arena can be attributed to numerous factors. The demand for RFID tags in APAC has been fueled by the expanding retail sector and the necessity for efficient inventory management. This region's retailers have swiftly discovered RFID technology's benefits in supply chain visibility, automation, and cost reduction.

RFID technology adoption in APAC has also increased due to government attempts to modernize various industries. The Indian government's Make in India drive, for instance, has sparked the growth of manufacturing industries and, consequently, the adoption of RFID tags for inventory control and logistics management. Similar to China's ambitious Industrial Internet of Things (IIoT) strategy, RFID technology has been integrated into manufacturing, agriculture, and healthcare.

The demand for RFID tags has also been fueled by APAC's dominance in e-commerce. Supply chain management, real-time inventory tracking, and improved consumer experiences are in high demand on online marketplaces and retailers. APAC e-commerce titans use RFID tags to meet these needs.

The APAC region has also noticed RFID technology's promise in waste management and recycling. Waste disposal, recycling, and environmental effect can be improved with RFID-enabled bins and waste-collecting systems. RFID technology in waste management has been pioneered by Japan and South Korea.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

NXP Semiconductors is a global leader in secure embedded connection solutions. NXP offers a wide range of high-performance RFID tags for diverse industries, focusing on RFID technology. Their innovative solutions ensure seamless integration, increased security, and reliable performance. NXP's ingenuity has made it one of the RFID tags market's leading players.

Singapore-based RFID solutions provider Invengo Technology is trusted globally. Their RFID tags cover inventory management and asset tracking. Businesses seeking reliable RFID solutions select Invengo's high-quality, durable tags.

Honeywell International Inc., a multinational corporation, dominates the RFID tags market. Their full range of RFID tags is designed to enhance supply chain operations, boost asset visibility, and improve inventory accuracy. Businesses seeking efficiency and productivity trust Honeywell's cutting-edge solutions.

HID Global Corporation, a leading RFID technology vendor, offers secure identity solutions. Their RFID tags promote security, efficiency, and customer satisfaction. HID Global leads the RFID tags market with its cutting-edge solutions.

Applied Wireless, Inc., a wireless technology solutions provider, dominates the RFID tags market. Their range of RFID tags is designed to survive extreme environments, assuring reliable performance. Applied Wireless is known for providing innovative solutions to the global industry.

Top Key Players in Rfid Tags Market

- NXP Semiconductors (Netherlands)

- Invengo Technology Pte. Ltd (Singapore)

- Honeywell International Inc (US)

- HID Global Corporation (US)

- Applied Wireless, Inc (US)

- OMNI-ID (US)

- CORERFID (UK)

- GAO RFID Inc (US)

- Caen RFID S.R.L (Italy)

- Alien Technology, LLC (US)

- Impinj, Inc (US)

- Avery Dennison Corporation (US)

- Zebra Technologies Corp (US)

- Tageos (France)

- Identiv, Inc. (US)

- GlobeRanger (US)

- Motorola Mobility LLC (US)

- Vizinex RFID (US)

- ASSA ABLOY (Sweden)

- RFID Global Solution (US)

- Checkpoint Systems, Inc (US)

Recent Development

- In 2023, Avery Dennison Corporation proudly unveiled its innovative RFID tag 2023, leading the pack.

- In 2022, Impinj, a leading manufacturer of RFID tags, purchased ThingMagic strengthening its market position.

- In 2021, RFID tags market leader Zebra Technologies Corporation announced its major growth ambitions in China.

- In 2020, Alien Technology unveiled its latest RFID tags 2020, designed to withstand water exposure.

Report Scope:

Report Features Description Market Value (2022) USD 12.1 Bn Forecast Revenue (2032) USD 27.4 Bn CAGR (2023-2032) 9.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Active RFID Tags, Passive RFID Tags), By Frequency (Low Frequency (LF) RFID Tags, High Frequency (HF) RFID Tags, Ultra-high Frequency (UHF) RFID Tags), By End-Use (Agriculture, Transportation, Logistics and Supply Chain, Healthcare, Other End-Uses) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NXP Semiconductors (Netherlands), Invengo Technology Pte. Ltd (Singapore), Honeywell International Inc (US), HID Global Corporation (US), Applied Wireless, Inc (US), OMNI-ID (US), CORERFID (UK), GAO RFID Inc (US), Caen RFID S.R.L (Italy), Alien Technology, LLC (US), Impinj, Inc (US), Avery Dennison Corporation (US), Zebra Technologies Corp (US), Tageos (France), Identiv, Inc. (US), GlobeRanger (US), Motorola Mobility LLC (US), Vizinex RFID (US), ASSA ABLOY (Sweden), RFID Global Solution (US), Checkpoint Systems, Inc (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NXP Semiconductors (Netherlands)

- Invengo Technology Pte. Ltd (Singapore)

- Honeywell International Inc (US)

- HID Global Corporation (US)

- Applied Wireless, Inc (US)

- OMNI-ID (US)

- CORERFID (UK)

- GAO RFID Inc (US)

- Caen RFID S.R.L (Italy)

- Alien Technology, LLC (US)

- Impinj, Inc (US)

- Avery Dennison Corporation (US)

- Zebra Technologies Corp (US)

- Tageos (France)

- Identiv, Inc. (US)

- GlobeRanger (US)

- Motorola Mobility LLC (US)

- Vizinex RFID (US)

- ASSA ABLOY (Sweden)

- RFID Global Solution (US)

- Checkpoint Systems, Inc (US)