Reverse Osmosis Membrane Market Report By Membrane Type (Thin-Film Composite (TFC), Cellulose Acetate (CA), Others), By Material (Polyamide, Cellulose Acetate, Polysulfone, Polyethersulfone, Others), By Application (Residential, Commercial, Industrial, Municipal), By End-User (Healthcare, Food and Beverage, Chemical and Petrochemical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49378

-

July 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

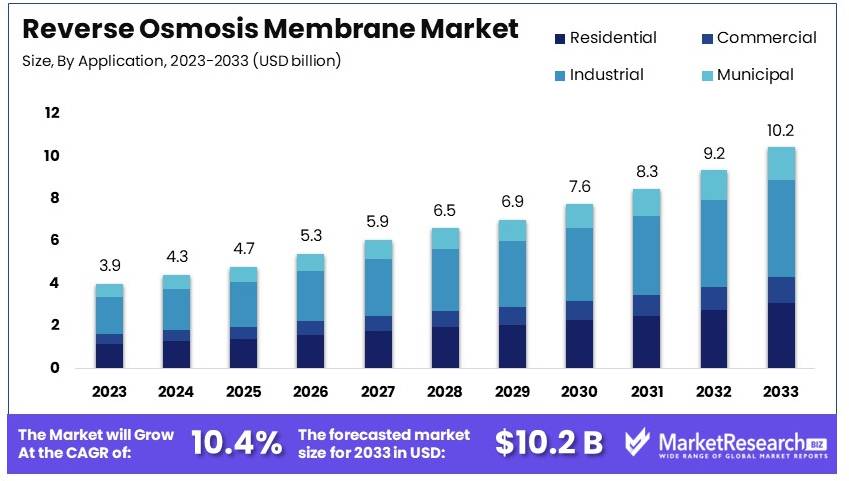

The Global Reverse Osmosis Membrane Market size is expected to be worth around USD 10.2 Billion by 2033, from USD 3.9 Billion in 2023, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

The Reverse Osmosis (RO) Membrane Market involves the production and sale of membranes used in RO water filtration systems. RO membranes are essential for purifying water by removing contaminants, including salts, bacteria, and chemicals. This market is driven by the increasing need for clean drinking water, industrial process water, and wastewater treatment.

Key applications include residential water filtration, industrial water treatment, and desalination plants. Major players in this market invest in advanced materials and technologies to enhance membrane efficiency and lifespan. The growth of the RO membrane market is supported by rising environmental regulations and the global demand for sustainable water management solutions.

The reverse osmosis (RO) membrane market is experiencing substantial growth driven by increasing demand for clean and safe drinking water. RO membranes are integral in residential water purification systems, known for their efficiency in removing up to 99% of dissolved salts, particles, organics, and other contaminants. These systems have become a staple in households due to rising concerns over water quality and health.

Residential RO systems typically offer capacities ranging from 25 to 100 gallons per day, tailored to meet varying household needs and influenced by factors such as water temperature and pressure. This versatility makes RO systems appealing to a broad consumer base. Additionally, the growing awareness of waterborne diseases and contaminants has bolstered the adoption of these systems, further driving market growth.

Technological advancements and innovations in membrane design have enhanced the efficiency and lifespan of RO systems, making them more cost-effective and accessible. Manufacturers are focusing on developing compact, user-friendly, and energy-efficient models to cater to the residential sector's demands.

Market dynamics indicate a positive trajectory, with the residential segment expected to witness continued growth. The increasing urbanization and rising disposable incomes in developing regions are also contributing to market expansion. Regulatory support for water purification and the emphasis on sustainable living solutions further underpin this growth.

The reverse osmosis membrane market is poised for robust expansion, supported by technological advancements, heightened consumer awareness, and favorable regulatory frameworks. The emphasis on water quality and safety continues to drive the demand for efficient and reliable water purification solutions in residential settings.

Key Takeaways

- Market Value: The Reverse Osmosis Membrane market was valued at USD 3.9 billion in 2023, and is expected to reach USD 10.2 billion by 2033, with a CAGR of 10.4%.

- By Membrane Type Analysis: Thin-Film Composite (TFC) dominated with 55%; Dominated due to superior performance and wide application in desalination.

- By Material Analysis: Polyamide dominated with 60%; Preferred for its high durability and efficiency in water filtration.

- By Application Analysis: Industrial dominated with 45%; Significant for large-scale water treatment processes.

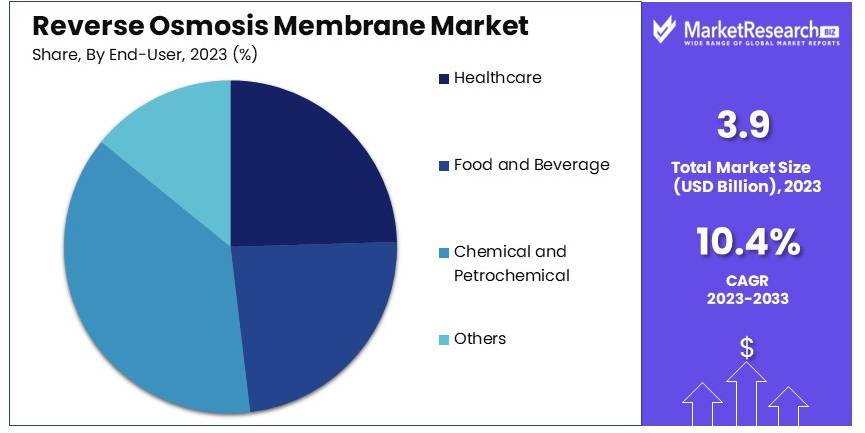

- By End-User Analysis: Chemical and Petrochemical dominated with 40%; High demand for purified water in chemical processes.

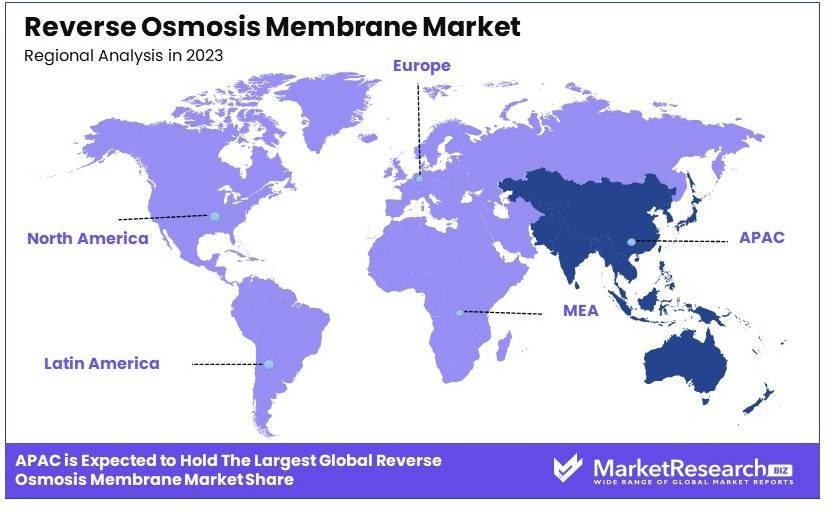

- Dominant Region: APAC dominated with 42.6%; Driven by rapid industrialization and increasing demand for clean water.

- High Growth Region: North America; Increasing investments in water treatment infrastructure.

- Analyst Viewpoint: The market shows strong growth potential due to rising water scarcity and technological advancements, with increasing competition among key players.

- Growth Opportunities: Companies can leverage advancements in membrane technology and expand into emerging markets to gain a competitive edge.

Driving Factors

Increasing Water Scarcity and Deteriorating Water Quality Drive Market Growth

Water scarcity and declining water quality are pressing global challenges exacerbated by population growth, urbanization, and climate change. These issues create a critical need for efficient water treatment technologies. Reverse Osmosis (RO) membranes are highly effective in removing contaminants and desalinating water, making them indispensable for addressing these challenges.

In water-scarce regions such as the Middle East, large-scale desalination plants employing RO technology have become vital for providing potable water. Saudi Arabia's Ras Al Khair desalination plant, one of the largest globally, utilizes RO membranes to produce over 1 million cubic meters of freshwater daily. This underscores the significant role of RO technology in ensuring a reliable water supply in arid regions.

Moreover, the increasing demand for clean water due to deteriorating water quality drives the adoption of RO systems. These systems are essential for producing safe drinking water and meeting the needs of various sectors, including agriculture and industry. As freshwater resources become more stressed, the reliance on RO membranes for water purification and desalination is expected to grow, driving the market for these technologies.

Stringent Water Quality Regulations Drive Market Growth

Governments around the world are enacting stricter water quality regulations for industrial and municipal use, propelling the adoption of advanced water treatment technologies such as Reverse Osmosis (RO) systems. The European Union's Water Framework Directive, for instance, sets rigorous standards for water quality, leading to increased implementation of RO systems across various industries.

Industries and municipalities are investing in RO technology to comply with these stringent regulations. In Europe, numerous food and beverage companies have integrated RO systems to ensure their process water meets high-quality standards. This regulatory push not only ensures safer water for consumers but also drives the market for RO membranes as industries seek to meet compliance requirements.

Furthermore, these regulations encourage innovation in water treatment technologies, fostering advancements in RO systems. As regulations become more comprehensive and enforcement intensifies, the demand for efficient water purification solutions like RO membranes is likely to increase, reinforcing market growth.

Industrial Growth and Demand for Ultrapure Water Drive Market Growth

The growing need for ultrapure water in industries such as pharmaceuticals, electronics, and power generation significantly drives the Reverse Osmosis (RO) membrane market. These industries require extremely high water quality for their processes, and RO membranes are exceptionally effective in achieving this level of purity.

The semiconductor industry is a prominent driver of this trend. As the demand for advanced chips rises, so does the need for ultrapure water in the manufacturing process. Taiwan Semiconductor Manufacturing Company (TSMC), a leading chip manufacturer, uses large quantities of ultrapure water produced by RO systems in its fabrication plants. This demand for ultrapure water in high-tech industries highlights the critical role of RO technology.

Additionally, industrial growth globally boosts the need for ultrapure water, further driving the market for RO membranes. As industries expand and technological advancements continue, the reliance on high-quality water produced by RO systems is expected to grow, supporting the market's expansion.

Restraining Factors

High Initial Capital Investment Restrains Market Growth

The high initial capital investment required for Reverse Osmosis (RO) systems is a significant barrier. Large-scale RO installations, such as desalination plants, need substantial upfront costs. For example, a medium-sized desalination plant producing 50,000 cubic meters of water daily can cost over USD 100 million.

This steep initial investment can deter smaller municipalities or industries with limited budgets from adopting RO technology. Developing countries and smaller communities, in particular, may struggle to secure the necessary financing for such projects. As a result, the adoption of RO systems is limited, slowing market growth.

Energy Intensity of RO Processes Restrains Market Growth

The energy-intensive nature of RO processes is another major challenge. RO systems require a lot of energy to operate, mainly because of the high pressure needed to force water through the membranes. In some Middle Eastern countries, desalination plants can consume up to 20% of the nation's energy production.

This high energy requirement leads to increased operational costs and environmental concerns due to higher carbon emissions. Consequently, regions with limited or expensive energy resources, or those focused on reducing their carbon footprint, may be less likely to adopt RO technology, thus hindering market expansion.

Membrane Type Analysis

Thin-Film Composite (TFC) Membrane dominates with 55% due to high efficiency and durability

The reverse osmosis membrane market is segmented by membrane type into Thin-Film Composite (TFC), Cellulose Acetate (CA), and others. The Thin-Film Composite (TFC) membranes dominate this segment with a significant 55% market share. This dominance is attributed to the superior efficiency and durability of TFC membranes. These membranes are highly efficient in removing contaminants, including salts, microorganisms, and organic molecules, making them ideal for a wide range of applications, from residential to industrial water treatment.

TFC membranes are preferred due to their high permeability to water while maintaining a high rejection rate for dissolved solids. This results in lower energy consumption and operational costs, which are crucial factors for industries and municipalities looking to optimize their water treatment processes. Moreover, TFC membranes exhibit greater resistance to chemical and biological fouling, enhancing their longevity and reducing maintenance costs. This has driven their adoption in industries where high purity water is essential, such as pharmaceuticals, food and beverage, and electronics manufacturing.

Other membrane types, such as Cellulose Acetate (CA) and others, also play vital roles in the market. CA membranes, although less dominant, are favored in specific applications due to their natural resistance to chlorine, making them suitable for municipal water treatment where chlorine is used as a disinfectant. The 'others' category includes emerging membrane technologies that cater to niche markets and specialized applications. These membranes often offer unique properties such as higher temperature resistance or specific chemical resistance, addressing particular needs within the water treatment industry. Despite their smaller market share, these sub-segments contribute to the overall growth and diversification of the reverse osmosis membrane market.

Material Analysis

Polyamide dominates with 60% due to high selectivity and chemical resistance

The reverse osmosis membrane market is segmented by material into Polyamide, Cellulose Acetate, Polysulfone, Polyethersulfone, and others. Polyamide membranes dominate this segment with a commanding 60% market share. This dominance is due to the high selectivity and chemical resistance of polyamide membranes. They are capable of removing a wide range of contaminants while providing high water flux, making them ideal for both residential and industrial applications.

Polyamide membranes are extensively used in seawater desalination, wastewater treatment services, and high-purity water production for industrial processes. Their ability to withstand harsh chemical environments and high operational pressures makes them highly versatile and reliable. Additionally, advancements in polyamide membrane technology have led to the development of low-energy membranes that reduce operational costs, further boosting their market adoption.

Cellulose Acetate and other materials such as Polysulfone and Polyethersulfone also hold significant positions in the market. Cellulose Acetate membranes are valued for their chlorine resistance and cost-effectiveness, making them suitable for municipal and residential water treatment applications. Polysulfone and Polyethersulfone membranes are known for their thermal stability and mechanical strength, catering to specific industrial applications that require robust performance under challenging conditions. These materials, while not as dominant as polyamide, contribute to the overall market growth by addressing diverse application needs and driving innovation in membrane technology.

By Application Analysis

Industrial application dominates with 45% due to high demand for water purification

The reverse osmosis membrane market is segmented by application into Residential, Commercial, Industrial, and Municipal. The industrial application segment dominates with a 45% market share. This dominance is driven by the high demand for water purification in various industrial sectors. Industries such as power generation, pharmaceuticals, food and beverage, and electronics require large volumes of high-purity water for their processes, making reverse osmosis an essential technology.

In industrial applications, reverse osmosis membranes are used for boiler feedwater treatment, process water production, and wastewater treatment. The ability to provide consistent and high-quality water is crucial for maintaining product quality and operational efficiency. Moreover, stringent environmental regulations and sustainability goals have prompted industries to adopt advanced water treatment technologies, further driving the demand for reverse osmosis membranes.

Residential, commercial, and municipal applications also play significant roles in the market. Residential applications benefit from reverse osmosis systems for drinking water purification, providing safe and clean water for households. Commercial applications, including restaurants, hotels, and offices, utilize these systems to ensure the quality of water for various purposes. Municipal applications involve large-scale water treatment plants that supply clean water to urban and rural communities. Although these segments are not as dominant as the industrial sector, they contribute to the market's overall growth by addressing the water quality needs of diverse end-users.

End-User Analysis

Chemical and Petrochemical end-user dominates with 40% due to stringent water quality requirements

The reverse osmosis membrane market is segmented by end-user into Healthcare, Food and Beverage, Chemical and Petrochemical, and others. The Chemical and Petrochemical end-user segment dominates with a 40% market share. This dominance is due to the stringent water quality requirements in these industries. High-purity water is essential for various chemical processes, cooling systems, and as a feedstock for the production of chemicals and petrochemicals.

In the chemical and petrochemical industries, reverse osmosis membranes are used for process water treatment, wastewater recycling, and desalination. The ability to consistently produce high-quality water with minimal impurities is critical for ensuring product quality and operational efficiency. Additionally, the adoption of advanced water treatment technologies is driven by regulatory compliance and sustainability goals, further boosting the demand for reverse osmosis membranes in these industries.

Healthcare and food and beverage sectors also significantly contribute to the market. In healthcare, reverse osmosis systems are used for producing high-purity water for medical applications, dialysis, and laboratory use. The food and beverage industry relies on these systems for ensuring the quality and safety of water used in manufacturing processes and product formulation. Other end-users, including power generation and textiles, also utilize reverse osmosis membranes for various water treatment applications. While not as dominant as the chemical and petrochemical sector, these end-users play crucial roles in the overall market dynamics, driving innovation and adoption of advanced membrane technologies.

Key Market Segments

By Membrane Type

- Thin-Film Composite (TFC)

- Cellulose Acetate (CA)

- Others

By Material

- Polyamide

- Cellulose Acetate

- Polysulfone

- Polyethersulfone

- Others

By Application

- Residential

- Commercial

- Industrial

- Municipal

By End-User

- Healthcare

- Food and Beverage

- Chemical and Petrochemical

- Others

Growth Opportunities

Emerging Markets in Developing Countries Offer Growth Opportunity

As developing nations face increasing water stress and work to improve their water infrastructure, there's significant potential for Reverse Osmosis (RO) membrane market growth. Countries like India, China, and many African nations are investing heavily in water treatment infrastructure.

For example, India's Jal Jeevan Mission aims to provide clean tap water to all rural households by 2024. This initiative creates a massive opportunity for RO membrane suppliers to contribute to small-scale and community-level water purification systems. Additionally, China is focusing on enhancing its water treatment capabilities to address pollution and ensure sustainable water resources. African countries, facing severe water scarcity, are also turning to RO technology to improve water access and quality.

These investments not only boost demand for RO membranes but also stimulate technological advancements and production efficiency in the industry. Consequently, suppliers and manufacturers of RO membranes can expand their market presence and tap into these emerging opportunities, fostering significant market growth.

Expanding Applications in Wastewater Recycling Offer Growth Opportunity

With a growing emphasis on circular economy principles, there is increasing interest in wastewater recycling and reuse, providing substantial growth opportunities for the RO membrane market. RO membranes are essential in treating wastewater to standards suitable for reuse in various applications.

A prime example is Singapore's NEWater project, where highly treated wastewater is purified using RO membranes to produce water that meets drinking water standards. This initiative contributes significantly to the nation's water security and demonstrates the critical role of RO technology in sustainable water management. Similar projects are being undertaken globally, driven by the need to conserve freshwater resources and reduce environmental impact.

The trend towards wastewater recycling is further supported by stringent regulations on industrial effluents and the need for cost-effective water treatment solutions. As industries and municipalities increasingly adopt these practices, the demand for efficient and reliable RO membranes is set to rise, fostering market growth and innovation in the sector.

Trending Factors

Smart Membrane Systems and IoT Integration Are Trending Factors

The integration of Internet of Things (IoT) technology and artificial intelligence in Reverse Osmosis (RO) systems is a growing trend. These smart systems can optimize performance, predict maintenance needs, and reduce operational costs.

Companies like Suez Water Technologies are developing AI-driven RO management systems that adjust operational parameters in real-time based on feed water quality and demand. This innovation significantly improves efficiency and reduces downtime, making RO systems more reliable and cost-effective.

The adoption of smart membrane systems is driven by the need for enhanced operational efficiency and better resource management in water treatment processes. IoT-enabled RO systems provide real-time data and analytics, enabling proactive maintenance and timely decision-making. This trend is expected to revolutionize the water treatment industry by offering advanced solutions that cater to the evolving needs of various sectors, thereby driving market growth and technological advancements in RO membranes.

Development of Chlorine-Resistant Membranes Are Trending Factors

Traditional RO membranes are sensitive to chlorine, a common disinfectant in water treatment. The development of chlorine-resistant membranes is a significant trend that could expand the use of RO in municipal water treatment.

For example, Nanostone Water has developed ceramic ultrafiltration membranes that offer high chlorine resistance, potentially revolutionizing pre-treatment processes for RO systems in municipal applications. These advanced membranes provide robust performance and longer lifespan, reducing the need for frequent replacements and maintenance.

The shift towards chlorine-resistant membranes addresses the limitations of conventional RO technology, enabling broader adoption in various water treatment applications. This innovation is particularly beneficial for municipalities looking to enhance their water treatment processes while minimizing operational costs. As more water treatment facilities adopt chlorine-resistant membranes, the demand for these advanced solutions is expected to rise, driving growth and technological progress in the RO membrane market.

Regional Analysis

APAC Dominates with 42.6% Market Share in the Reverse Osmosis Membrane Market

The Asia-Pacific region holds a substantial 42.6% share in the reverse osmosis membrane market, primarily driven by robust industrialization and increasing demand for clean water. Significant investments in water infrastructure and technological advancements in water treatment methods further bolster this dominance. Additionally, governmental initiatives across APAC countries to promote water purification to meet the rising water needs of their growing populations also play a critical role.

APAC’s demographic and economic landscape significantly influences the reverse osmosis membrane market. The region's large and growing population increases the demand for purified water, driving the adoption of reverse osmosis technologies. Furthermore, the presence of key industries that require purified water, such as pharmaceuticals and food and beverage, enhances market growth in this region.

The future impact of APAC in the reverse osmosis membrane market is expected to grow further. With ongoing industrial growth and urbanization, coupled with environmental regulations becoming stricter, the demand for efficient and effective water treatment solutions like reverse osmosis will likely continue to rise, securing APAC’s lead in the market.

Regional Market Shares and Dynamics:

- North America: Holding approximately 24% of the market, North America benefits from advanced technological adoption and stringent environmental regulations driving the need for efficient water treatment solutions. The market is anticipated to see steady growth due to increasing industrial and residential demand for purified water.

- Europe: Europe accounts for around 21% of the market share. The region's focus on sustainable practices and the high importance of regulatory compliances are pivotal to its market growth. The increasing scarcity of potable water in several European countries also pushes for advancements in water treatment technologies.

- Middle East & Africa: With a market share of about 6.4%, this region's market dynamics are influenced by its critical need for water desalination solutions due to the natural scarcity of fresh water. Investments in water infrastructure and the adoption of reverse osmosis in desalination plants are expected to drive market growth.

- Latin America: Representing 6% of the market, Latin America shows potential for growth in reverse osmosis membrane adoption, driven by improving economic conditions and a focus on enhancing water purity standards to support its agricultural and industrial sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Reverse Osmosis (RO) Membrane Market is experiencing significant growth due to the increasing demand for clean and safe water. Leading companies such as Dow Water & Process Solutions (DuPont) and Toray Industries, Inc. drive market innovation with their strong research and development capabilities. These firms set industry standards by developing advanced membrane technologies and focusing on sustainability.

Companies like Hydranautics (Nitto Denko Corporation) and LG Chem Ltd. have carved out a competitive edge by concentrating on the development of high-performance membranes. Their innovations enhance the overall efficiency and effectiveness of RO systems. Meanwhile, Koch Membrane Systems and GE Water & Process Technologies offer extensive product portfolios that cater to various industrial and commercial needs, broadening their market appeal.

Toyobo Co., Ltd. and Membranium (JSC RM Nanotech) are recognized for their high-quality products, which have gained substantial market share due to their reliability and performance. Lanxess AG and Pure Aqua, Inc. leverage robust distribution networks to increase their market presence, ensuring their products reach a wide range of customers. Applied Membranes, Inc. and Pall Corporation focus on customer service and customization, attracting clients with specific needs and requirements.

Axeon Water Technologies and SUEZ Water Technologies & Solutions utilize strategic acquisitions to expand their market footprint, thereby enhancing their competitive positions. Pentair PLC benefits from its global reach and strong brand recognition, offering a wide range of solutions to various markets. These companies employ strategies such as product innovation, strategic partnerships, and acquisitions to strengthen their positions in the market.

Leaders like DuPont and Toray significantly influence the market through their technological advancements and sustainability initiatives. Their efforts in research and development and commitment to customer service set industry standards, impacting trends and competitive dynamics within the RO membrane market.

Market Key Players

- Dow Water & Process Solutions (DuPont)

- Toray Industries, Inc.

- Hydranautics (Nitto Denko Corporation)

- LG Chem Ltd.

- Koch Membrane Systems

- GE Water & Process Technologies

- Toyobo Co., Ltd.

- Membranium (JSC RM Nanotech)

- Lanxess AG

- Pure Aqua, Inc.

- Applied Membranes, Inc.

- Pall Corporation

- Axeon Water Technologies

- SUEZ Water Technologies & Solutions

- Pentair PLC

Recent Developments

March 2023: LG Chem announced the supply of over 10,000 reverse osmosis (RO) membranes to the Guoan lithium extraction project led by CITIC Group in Qinghai province, China. This project, the largest of its kind, aims to produce 20,000 tons of lithium carbonate annually, enough to manufacture batteries for nearly half a million electric vehicles. The RO membranes significantly reduce energy consumption in the lithium extraction process by filtering water without applying heat.

November 2023: ZwitterCo launched an Early Access Program for its new brackish water reverse osmosis (BWRO) membranes. These membranes are designed to handle organic fouling, a common issue in water treatment processes. The launch is part of ZwitterCo's efforts to improve water treatment efficiency and durability, particularly in challenging environments.

Report Scope

Report Features Description Market Value (2023) USD 3.9 Billion Forecast Revenue (2033) USD 10.2 Billion CAGR (2024-2033) 10.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Membrane Type (Thin-Film Composite (TFC), Cellulose Acetate (CA), Others), By Material (Polyamide, Cellulose Acetate, Polysulfone, Polyethersulfone, Others), By Application (Residential, Commercial, Industrial, Municipal), By End-User (Healthcare, Food and Beverage, Chemical and Petrochemical, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dow Water & Process Solutions (DuPont), Toray Industries, Inc., Hydranautics (Nitto Denko Corporation), LG Chem Ltd., Koch Membrane Systems, GE Water & Process Technologies, Toyobo Co., Ltd., Membranium (JSC RM Nanotech), Lanxess AG, Pure Aqua, Inc., Applied Membranes, Inc., Pall Corporation, Axeon Water Technologies, SUEZ Water Technologies & Solutions, Pentair PLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Dow Water & Process Solutions (DuPont)

- Toray Industries, Inc.

- Hydranautics (Nitto Denko Corporation)

- LG Chem Ltd.

- Koch Membrane Systems

- GE Water & Process Technologies

- Toyobo Co., Ltd.

- Membranium (JSC RM Nanotech)

- Lanxess AG

- Pure Aqua, Inc.

- Applied Membranes, Inc.

- Pall Corporation

- Axeon Water Technologies

- SUEZ Water Technologies & Solutions

- Pentair PLC