Reverse Logistics Market Report By Return Type (Recalls, Commercial returns and B2B returns, Repairable returns, End of use returns, End of life returns), By End-User (Consumer electronics, Retail, Luxury goods, Reusable packaging, E-Commerce, Automotive, Pharmaceutical), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46857

-

May 2024

-

325

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

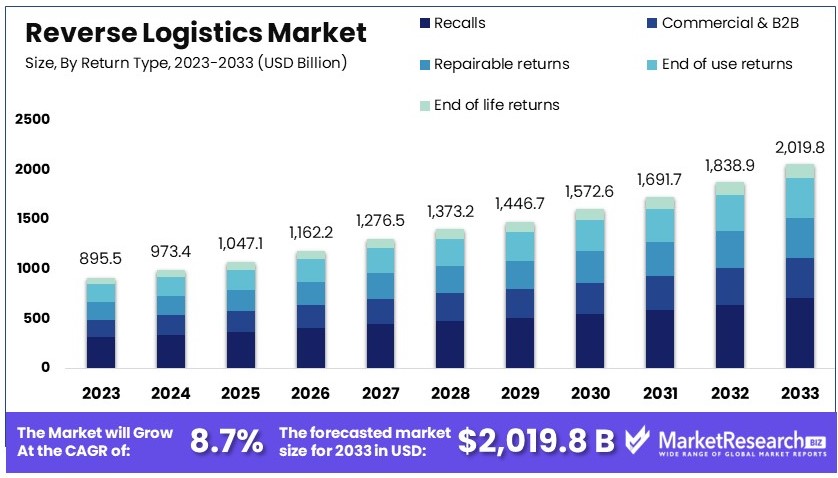

The Global Reverse Logistics Market size is expected to be worth around USD 2,019.8 Billion by 2033, from USD 895.5 Billion in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

The Reverse Logistics Market deals with the process of moving goods from consumers back to sellers. This includes returns, recycling, and refurbishing. It helps companies manage returned products efficiently. The market is growing due to e-commerce expansion and environmental regulations. Effective reverse logistics reduce costs and improve customer satisfaction.

Key sectors include retail, automotive, and electronics. Technology plays a significant role in tracking and managing returns. North America dominates the market, followed by Europe and Asia-Pacific. The market is driven by the need for sustainable practices and efficient supply chain management.

The reverse logistics market is set for robust growth, driven by the surge in e-commerce and increasing environmental consciousness among consumers. By 2025, the number of online shoppers is expected to reach approximately 2.77 billion. This growth is particularly notable in markets like China, where 82% of internet users engage in online shopping, underscoring the high penetration rate of e-commerce.

The rise in online shopping generates significant returns and product exchanges, driving the demand for efficient reverse logistics solutions. Companies are increasingly recognizing the importance of managing returns, refurbishments, and recycling to enhance customer satisfaction and meet sustainability goals. Advanced technologies, such as automated sorting systems and AI-driven analytics, are being adopted to streamline reverse logistics processes and improve efficiency.

Furthermore, regulatory pressures and corporate social responsibility initiatives are compelling businesses to adopt sustainable practices. Reverse logistics helps companies in smart waste management, recover value from returned goods, and reduce their environmental footprint. These factors are creating new opportunities for logistics providers and driving innovation in the sector.

In summary, the reverse logistics market is poised for substantial growth, fueled by the expansion of e-commerce and the rising emphasis on sustainability. Companies that invest in advanced technologies and sustainable practices are likely to gain a competitive edge in this evolving landscape.

Key Takeaways

- Market Value: The Global Reverse Logistics Market is expected to grow at a CAGR of 8.7%, reaching USD 2,019.8 Billion by 2033 from USD 895.5 Billion in 2023.

- Return Type Analysis: Commercial and B2B returns dominate with 25% of the market share, driven by their high volume and operational impact.

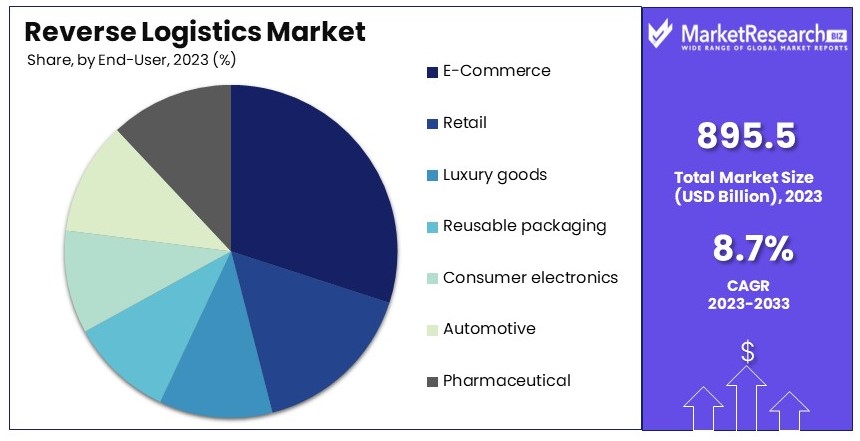

- End-User Analysis: E-commerce dominates with 30%, reflecting the need for efficient processes to handle the substantial volume of returns.

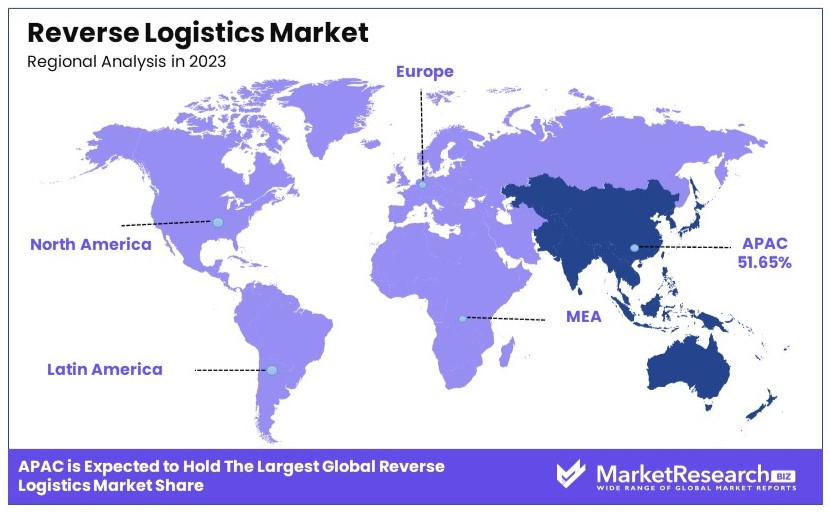

- Dominant Region: Asia-Pacific, capturing 51.65% of the market, propelled by rapid industrialization and the growth of e-commerce.

- High Growth Region: North America emerges as the high growth region with 22% market share, attributed to its well-established logistics infrastructure and widespread adoption of technology.

- Analyst Viewpoint: Market driven by e-commerce growth and regulatory compliance; increasing need for efficient return processes.

- Growth Opportunities: Automation and AI in reverse logistics; sustainability initiatives in returns management.

Driving Factors

Increasing Focus on Sustainability and Environmental Consciousness Drives Market Growth

Sustainability and environmental awareness are becoming critical concerns for companies. Consumers, stakeholders, and regulatory bodies are demanding reduced environmental impacts and more sustainable practices. This pressure has made reverse logistics essential for minimizing waste and promoting reuse and recycling. Reverse logistics helps companies reduce their carbon footprints by managing product returns, refurbishments, and the disposal of end-of-life products efficiently. Major retailers such as Walmart and Target have set up comprehensive reverse logistics programs to handle these processes. By implementing these programs, they can process returns, refurbish products, and dispose of items properly, thereby adhering to sustainability goals and reducing waste.

Walmart's program includes initiatives for electronic waste recycling and repurposing unsold goods, contributing significantly to waste reduction. Similarly, Target focuses on recycling and refurbishing returned products to extend their lifecycle. These initiatives not only help the environment but also improve the companies' reputations among environmentally conscious consumers.

E-commerce Growth and Product Returns Drive Market Growth

The rapid expansion of e-commerce has significantly increased product returns, necessitating efficient reverse logistics processes. As online shopping grows, so do the instances of returns, which can account for up to 30% of online purchases. This trend has led online retailers like Amazon, eBay, and Zalando to establish robust reverse logistics systems. These systems are designed to manage returns, refurbishments, and restocking processes efficiently. For example, Amazon has set up numerous return centers and partnerships with third-party logistics providers to streamline its reverse logistics operations. These centers allow Amazon to handle returns quickly and cost-effectively, ensuring customer satisfaction and minimizing losses.

The increase in product returns from e-commerce platforms creates a substantial demand for reverse logistics services. Efficient logistics processes help companies manage the high volume of returns, refurbish products, and restock them promptly. This not only reduces waste but also ensures that products are quickly returned to the market, enhancing overall efficiency. The growth of e-commerce, coupled with the rise in product returns, directly contributes to the expansion of the reverse logistics market by increasing the need for specialized logistics solutions.

Regulatory Compliance and Extended Producer Responsibility (EPR) Initiatives Drive Market Growth

Stricter regulations and Extended Producer Responsibility (EPR) policies are compelling manufacturers to manage the entire lifecycle of their products. Governments worldwide are introducing regulations that require manufacturers to ensure the proper disposal or recycling of products at the end of their useful life. This has led companies to invest in reverse logistics capabilities to comply with these regulations. For example, the European Union's Waste Electrical and Electronic Equipment (WEEE) Directive mandates that manufacturers set up take-back and recycling systems for electronic products.

Compliance with these regulations ensures that companies are responsible for their products even after they are sold, driving the need for efficient reverse logistics systems. Investing in these systems helps companies avoid penalties and enhance their corporate social responsibility image. The introduction of EPR policies globally is increasing the demand for reverse logistics services as manufacturers seek to comply with these regulations and manage their products' end-of-life processes effectively. The enforcement of such regulatory measures drives the growth of the reverse logistics market by necessitating investments in comprehensive take-back and recycling systems.

Restraining Factors

Complexity and High Operational Costs Restrain Market Growth

Reverse logistics operations are complex and involve multiple stakeholders, such as manufacturers, retailers, logistics providers, and recyclers. Coordinating these intricate processes can be challenging and costly.

For instance, managing the reverse logistics of large and bulky products like furniture or appliances requires significant resources. Transportation, handling, and processing of returned or end-of-life products incur substantial operational costs. These high costs can deter companies from investing in efficient reverse logistics systems. The complexity and expense of managing these operations limit the market's growth by creating significant financial and logistical barriers for companies.

Lack of Standardized Processes and Technology Integration Restrains Market Growth

The reverse logistics industry often lacks standardized processes and seamless technology integration across different stakeholders. This leads to inefficiencies, data inconsistencies, and poor visibility throughout the reverse logistics chain. Implementing integrated technology solutions and adopting industry-wide standards are challenging and costly.

For example, the absence of standardized data exchange protocols between retailers and third-party logistics providers hinders the efficient tracking and management of product returns. These inefficiencies can result in delays, increased costs, and reduced customer satisfaction. The lack of standardization and integration restrains market growth by creating operational hurdles that impede the efficient flow of reverse logistics processes.

Return Type Analysis

Commercial returns and B2B returns dominate with 25% due to their high volume and critical impact on business operations.

The Reverse Logistics Market is segmented by return type, including recalls, commercial returns and B2B returns, repairable returns, end-of-use returns, and end-of-life returns. Among these, commercial returns and B2B returns dominate with a market share of 25%. This dominance is due to the significant volume of products exchanged between businesses and the need for efficient return processes to maintain operational efficiency and customer satisfaction. In the B2B sector, products often have higher value and require careful handling, making efficient reverse logistics crucial.

Commercial returns and B2B returns are vital for businesses as they directly impact inventory management, cost control, and customer relationships. Efficient handling of these returns helps businesses reduce waste, recover value from returned products, and maintain a seamless supply chain. The high return rates in industries such as electronics, automotive, and pharmaceuticals contribute to this segment's prominence. For instance, electronic products have high return rates due to defects, upgrades, or customer dissatisfaction. Similarly, in the automotive sector, parts and components often need to be returned for repairs or replacements, adding to the volume of B2B returns.

Other segments in this category also play significant roles. Recalls are critical for maintaining product safety and compliance with regulatory standards. While not as frequent as commercial returns, recalls involve substantial costs and logistical challenges, particularly in the automotive and pharmaceutical industries. Repairable returns focus on products that can be refurbished and resold, reducing waste and contributing to sustainability. End-of-use returns involve products that are no longer needed by consumers but can still be reused or recycled, such as old electronics. End-of-life returns pertain to products that have reached the end of their lifecycle and require proper disposal or recycling to minimize environmental impact.

End-User Analysis

E-commerce dominates with 30% due to the high volume of returns and the critical need for efficient processes.

The Reverse Logistics Market by end-user includes consumer electronics, retail, luxury goods, reusable packaging, e-commerce, automotive, and pharmaceutical sectors. Among these, the e-commerce sector stands out, accounting for 30% of the market. The rapid growth of e-commerce has significantly increased the volume of product returns, making efficient reverse logistics crucial for online retailers. E-commerce platforms handle a vast array of products, leading to high return rates. For instance, fashion and electronics sectors experience returns of up to 30%, driven by issues like size mismatches, defects, or buyer remorse.

Efficient reverse logistics in e-commerce ensures quick processing of returns, which is essential for maintaining customer satisfaction and operational efficiency. Companies like Amazon, eBay, and Alibaba have developed robust reverse logistics systems to manage the high volume of returns. These systems involve dedicated return centers, partnerships with third-party logistics providers, and advanced technology solutions for tracking and managing returns. The importance of customer experience in e-commerce also drives the need for seamless and hassle-free return processes.

Other end-user segments also contribute to market growth. The consumer electronics sector sees a high volume of returns due to product defects and upgrades. Retail, particularly brick-and-mortar stores, faces returns from unsold inventory and customer dissatisfaction. The luxury goods sector deals with returns related to high-value items, requiring careful handling and processing. Reusable packaging is a growing segment, focusing on sustainable practices and reducing waste. The automotive sector involves returns of parts and components for repairs and replacements, while the pharmaceutical industry deals with returns of expired or defective drugs, requiring stringent regulatory compliance.

Key Market Segments

By Return Type

- Recalls

- Commercial returns and B2B returns

- Repairable returns

- End of use returns

- End of life returns

By End-User

- Consumer electronics

- Retail

- Luxury goods

- Reusable packaging

- E-Commerce

- Automotive

- Pharmaceutical

Growth Opportunities

Circular Economy and Closed-Loop Supply Chains Offer Growth Opportunity

The transition towards a circular economy is driving the adoption of reverse logistics practices. In this system, resources are kept in use for as long as possible, minimizing waste. Companies are implementing closed-loop supply chains where end-of-life products are recovered, refurbished, or recycled and reintroduced into the supply chain.

For example, Patagonia and Adidas have programs to collect and recycle used clothing and shoes, creating new products from recovered materials. This approach not only reduces environmental impact but also creates new revenue streams. The increasing emphasis on sustainability and resource efficiency is generating significant growth opportunities in the reverse logistics market by promoting circular economy practices.

Digitalization and Technology Advancements Offer Growth Opportunity

The adoption of digital technologies is transforming reverse logistics operations. Technologies like the IoT solutions, artificial intelligence (AI), and blockchain enable real-time tracking, automated sorting, predictive analytics, and enhanced supply chain visibility.

Companies like UPS and DHL are leveraging IoT sensors and data analytics to optimize their reverse logistics networks, providing customers with better visibility and insights. These advancements lead to improved efficiency and cost savings. The integration of digital technologies in reverse logistics presents a substantial growth opportunity by enhancing operational efficiency and customer satisfaction.

Trending Factors

Omnichannel Retail and Flexible Returns Policies Are Trending Factors

Omnichannel retail strategies are increasing the complexity of reverse logistics operations. Customers can purchase and return products through multiple channels, such as online, in-store, and mobile. To enhance customer experience and loyalty, retailers are implementing flexible returns policies.

Major retailers like Best Buy and Nordstrom offer convenient and hassle-free return options across their online and physical store channels. This trend drives the need for efficient reverse logistics processes to manage returns from various channels seamlessly. The rise of omnichannel retail and flexible returns policies is a trending factor in the reverse logistics market, emphasizing the importance of adaptable and customer-friendly return processes.

Automation and Robotics in Reverse Logistics Facilities Are Trending Factors

The adoption of automation and robotics technologies in reverse logistics facilities is gaining traction. Automated sorting, grading, and processing systems improve efficiency, accuracy, and productivity in handling returned or end-of-life products.

Companies like GENCO and Inmar Reverse Logistics have implemented advanced automation solutions to streamline operations and reduce labor costs. These technologies help manage the growing volume of returns more effectively and reduce operational costs. The increasing use of automation and robotics in reverse logistics facilities is a trending factor, highlighting the potential for significant improvements in operational efficiency and cost reduction.

Regional Analysis

Asia-Pacific Dominates with 51.65% Market Share

Asia-Pacific leads the reverse logistics market due to its booming e-commerce sector and high consumer electronics demand. The region's vast manufacturing base, especially in China and India, drives the need for efficient reverse logistics. Governments are also promoting sustainability, enhancing recycling and reuse practices. Major companies like Alibaba and Flipkart contribute significantly to the region's market share by implementing advanced reverse logistics systems.

The region's large population and growing middle class boost product consumption and returns. Rapid urbanization and digitalization further support reverse logistics growth. Infrastructure development in countries like China and India enhances logistics efficiency. The region's diverse economic landscape creates a dynamic market environment, fostering innovation and investment in reverse logistics technologies.

North America Market Share and Growth

North America holds a significant market share of 22%. The region benefits from advanced technological adoption and a strong focus on sustainability. The presence of major e-commerce players like Amazon drives reverse logistics demand. Continued investment in technology and sustainable practices will support market growth.

Europe Market Share and Growth

Europe accounts for 17% of the market. Stringent regulatory frameworks, such as the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, drive reverse logistics activities. The region's commitment to sustainability and circular economy practices supports market expansion. Growth is expected to remain steady, supported by regulatory compliance and technological advancements.

Middle East & Africa Market Share and Growth

The Middle East & Africa region holds a smaller market share of 5%. However, increasing e-commerce activities and improving logistics infrastructure are driving growth. Governments' focus on sustainability and recycling initiatives also supports market expansion. The region's market share is expected to gradually increase as these trends continue.

Latin America Market Share and Growth

Latin America has a market share of 4.35%. The region's growing e-commerce sector and increasing consumer awareness of sustainability drive reverse logistics activities. Infrastructure challenges and economic instability can hinder growth, but ongoing improvements and technological adoption are expected to support gradual market expansion.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Reverse Logistics Market is highly competitive, with several key players making significant impacts through strategic positioning and market influence. Major companies like C.H. Robinson Worldwide Inc., United Parcel Service of America Inc. (UPS), and FedEx are leading the industry with their extensive logistics networks and advanced technological solutions. These companies offer comprehensive reverse logistics services, including product returns management, refurbishments, and recycling, thereby catering to diverse industry needs.

DB Schenker, Deutsche Post AG, and Yusen Logistics Co. Ltd. also hold strong positions in the market, leveraging their global presence and robust supply chain capabilities. These companies focus on integrating innovative technologies like IoT and AI to enhance reverse logistics efficiency and visibility, which helps them maintain competitive advantages.

Core Logistic Private Limited, Kintetsu World Express Inc., and SAFEXPRESS are prominent in their respective regions, offering tailored reverse logistics solutions to meet local market demands. Their strategic regional focus allows them to provide specialized services that cater to unique customer needs.

RLG (Reverse Logistics Group) stands out by specializing in circular economy solutions, emphasizing sustainability and compliance with environmental regulations. This specialization helps them attract clients focused on reducing environmental impact.

These key players collectively drive the reverse logistics market by continuously improving their service offerings, investing in advanced technologies, and expanding their global reach. Their strategic initiatives and market influence contribute significantly to the overall growth and development of the reverse logistics industry.

Market Key Players

- C.H. Robinson Worldwide Inc.

- United Parcel Service of America Inc.

- DB Schenker

- Core Logistic Private Limited

- Yusen Logistics Co. Ltd.

- FedEx

- RLG

- Deutsche Post AG

- Kintetsu World Express Inc.

- Safexpress

- Other Key Players

Recent Developments

- February 2024: Returns management platform Loop announced new services for merchants and logistics providers. These offerings include features, integrations, and partnerships that enable faster return processing, lower shipping costs, better insight and control over return policy abusers, fewer unnecessary returns, and improved sustainability.

- October 2023: Blubirch, a SaaS and AI-based reverse supply chain management platform for enterprises, raised $6.4 million in its Series A funding round led by Cornerstone Ventures and Capital2B. The fresh funds will be used to accelerate Blubirch's growth and deepen its market presence across various retailer marketplaces and original equipment manufacturers' (OEMs) ecosystems.

Report Scope

Report Features Description Market Value (2023) USD 895.5 Billion Forecast Revenue (2033) USD 2,019.8 Billion CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Return Type (Recalls, Commercial returns and B2B returns, Repairable returns, End of use returns, End of life returns), By End-User (Consumer electronics, Retail, Luxury goods, Reusable packaging, E-Commerce, Automotive, Pharmaceutical) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape C.H. Robinson Worldwide Inc., United Parcel Service of America Inc., DB Schenker, Core Logistic Private Limited, YUSEN LOGISTICS CO. LTD., FedEx, RLG, Deutsche Post AG, Kintetsu World Express Inc., SAFEXPRESS, Other Key Player Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Reverse Logistics Market Overview

- 2.1. Reverse Logistics Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Reverse Logistics Market Dynamics

- 3. Global Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Reverse Logistics Market Analysis, 2016-2021

- 3.2. Global Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 3.3. Global Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 3.3.1. Global Reverse Logistics Market Analysis by Return Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 3.3.3. Recalls

- 3.3.4. Commercial returns and B2B returns

- 3.3.5. Repairable returns

- 3.3.6. End of use returns

- 3.3.7. End of life returns

- 3.4. Global Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 3.4.1. Global Reverse Logistics Market Analysis by End-User: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 3.4.3. Consumer electronics

- 3.4.4. Retail

- 3.4.5. Luxury goods

- 3.4.6. Reusable packaging

- 3.4.7. E-Commerce

- 3.4.8. Automotive

- 3.4.9. Pharmaceutical

- 4. North America Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Reverse Logistics Market Analysis, 2016-2021

- 4.2. North America Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 4.3. North America Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 4.3.1. North America Reverse Logistics Market Analysis by Return Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 4.3.3. Recalls

- 4.3.4. Commercial returns and B2B returns

- 4.3.5. Repairable returns

- 4.3.6. End of use returns

- 4.3.7. End of life returns

- 4.4. North America Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 4.4.1. North America Reverse Logistics Market Analysis by End-User: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 4.4.3. Consumer electronics

- 4.4.4. Retail

- 4.4.5. Luxury goods

- 4.4.6. Reusable packaging

- 4.4.7. E-Commerce

- 4.4.8. Automotive

- 4.4.9. Pharmaceutical

- 4.5. North America Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Reverse Logistics Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Reverse Logistics Market Analysis, 2016-2021

- 5.2. Western Europe Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 5.3.1. Western Europe Reverse Logistics Market Analysis by Return Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 5.3.3. Recalls

- 5.3.4. Commercial returns and B2B returns

- 5.3.5. Repairable returns

- 5.3.6. End of use returns

- 5.3.7. End of life returns

- 5.4. Western Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 5.4.1. Western Europe Reverse Logistics Market Analysis by End-User: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 5.4.3. Consumer electronics

- 5.4.4. Retail

- 5.4.5. Luxury goods

- 5.4.6. Reusable packaging

- 5.4.7. E-Commerce

- 5.4.8. Automotive

- 5.4.9. Pharmaceutical

- 5.5. Western Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Reverse Logistics Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Reverse Logistics Market Analysis, 2016-2021

- 6.2. Eastern Europe Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 6.3.1. Eastern Europe Reverse Logistics Market Analysis by Return Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 6.3.3. Recalls

- 6.3.4. Commercial returns and B2B returns

- 6.3.5. Repairable returns

- 6.3.6. End of use returns

- 6.3.7. End of life returns

- 6.4. Eastern Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 6.4.1. Eastern Europe Reverse Logistics Market Analysis by End-User: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 6.4.3. Consumer electronics

- 6.4.4. Retail

- 6.4.5. Luxury goods

- 6.4.6. Reusable packaging

- 6.4.7. E-Commerce

- 6.4.8. Automotive

- 6.4.9. Pharmaceutical

- 6.5. Eastern Europe Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Reverse Logistics Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Reverse Logistics Market Analysis, 2016-2021

- 7.2. APAC Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 7.3.1. APAC Reverse Logistics Market Analysis by Return Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 7.3.3. Recalls

- 7.3.4. Commercial returns and B2B returns

- 7.3.5. Repairable returns

- 7.3.6. End of use returns

- 7.3.7. End of life returns

- 7.4. APAC Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 7.4.1. APAC Reverse Logistics Market Analysis by End-User: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 7.4.3. Consumer electronics

- 7.4.4. Retail

- 7.4.5. Luxury goods

- 7.4.6. Reusable packaging

- 7.4.7. E-Commerce

- 7.4.8. Automotive

- 7.4.9. Pharmaceutical

- 7.5. APAC Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Reverse Logistics Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Reverse Logistics Market Analysis, 2016-2021

- 8.2. Latin America Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 8.3.1. Latin America Reverse Logistics Market Analysis by Return Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 8.3.3. Recalls

- 8.3.4. Commercial returns and B2B returns

- 8.3.5. Repairable returns

- 8.3.6. End of use returns

- 8.3.7. End of life returns

- 8.4. Latin America Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 8.4.1. Latin America Reverse Logistics Market Analysis by End-User: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 8.4.3. Consumer electronics

- 8.4.4. Retail

- 8.4.5. Luxury goods

- 8.4.6. Reusable packaging

- 8.4.7. E-Commerce

- 8.4.8. Automotive

- 8.4.9. Pharmaceutical

- 8.5. Latin America Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Reverse Logistics Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Reverse Logistics Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Reverse Logistics Market Analysis, 2016-2021

- 9.2. Middle East & Africa Reverse Logistics Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Reverse Logistics Market Analysis, Opportunity and Forecast, By Return Type, 2016-2032

- 9.3.1. Middle East & Africa Reverse Logistics Market Analysis by Return Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Return Type, 2016-2032

- 9.3.3. Recalls

- 9.3.4. Commercial returns and B2B returns

- 9.3.5. Repairable returns

- 9.3.6. End of use returns

- 9.3.7. End of life returns

- 9.4. Middle East & Africa Reverse Logistics Market Analysis, Opportunity and Forecast, By End-User, 2016-2032

- 9.4.1. Middle East & Africa Reverse Logistics Market Analysis by End-User: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-User, 2016-2032

- 9.4.3. Consumer electronics

- 9.4.4. Retail

- 9.4.5. Luxury goods

- 9.4.6. Reusable packaging

- 9.4.7. E-Commerce

- 9.4.8. Automotive

- 9.4.9. Pharmaceutical

- 9.5. Middle East & Africa Reverse Logistics Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Reverse Logistics Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Reverse Logistics Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Reverse Logistics Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Reverse Logistics Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. C.H. Robinson Worldwide Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. (US$ Mn & Units)ed Parcel Service of America Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. DB Schenker

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Core Logistic Private Limited

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. YUSEN LOGISTICS CO. LTD.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. FedEx

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. RLG

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Deutsche Post AG

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Kintetsu World Express Inc.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. SAFEXPRESS

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Other Key Players

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- "

- Figure 1: Global Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Type in 2022

- Figure 2: Global Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 3: Global Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 4: Global Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 5: Global Reverse Logistics Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Reverse Logistics Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 10: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 11: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 13: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 14: Global Reverse Logistics Market Share Comparison by Region (2016-2032)

- Figure 15: Global Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 16: Global Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 17: North America Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 18: North America Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 19: North America Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 20: North America Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 21: North America Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 26: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 27: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 29: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 30: North America Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 31: North America Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 32: North America Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 33: Western Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 34: Western Europe Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 35: Western Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 36: Western Europe Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 37: Western Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 42: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 43: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 45: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 46: Western Europe Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 48: Western Europe Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 49: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 50: Eastern Europe Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 51: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 52: Eastern Europe Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 53: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 58: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 59: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 61: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 62: Eastern Europe Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 64: Eastern Europe Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 65: APAC Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 66: APAC Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 67: APAC Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 68: APAC Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 69: APAC Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 74: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 75: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 77: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 78: APAC Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 80: APAC Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 81: Latin America Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 82: Latin America Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 83: Latin America Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 84: Latin America Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 85: Latin America Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 90: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 91: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 93: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 94: Latin America Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 96: Latin America Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Figure 97: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Market Share by Return Typein 2022

- Figure 98: Middle East & Africa Reverse Logistics Market Attractiveness Analysis by Return Type, 2016-2032

- Figure 99: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Market Share by End-Userin 2022

- Figure 100: Middle East & Africa Reverse Logistics Market Attractiveness Analysis by End-User, 2016-2032

- Figure 101: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Reverse Logistics Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Figure 106: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Figure 107: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Figure 109: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Figure 110: Middle East & Africa Reverse Logistics Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Figure 112: Middle East & Africa Reverse Logistics Market Share Comparison by End-User (2016-2032)

- List of Tables

- Table 1: Global Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 2: Global Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 3: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 7: Global Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 8: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 10: Global Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 11: Global Reverse Logistics Market Share Comparison by Region (2016-2032)

- Table 12: Global Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 13: Global Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 14: North America Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 15: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 19: North America Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 20: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 22: North America Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 23: North America Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 24: North America Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 25: North America Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 26: Western Europe Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 27: Western Europe Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 28: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 32: Western Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 33: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 35: Western Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 36: Western Europe Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 38: Western Europe Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 39: Eastern Europe Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 40: Eastern Europe Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 41: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 45: Eastern Europe Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 46: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 48: Eastern Europe Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 49: Eastern Europe Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 51: Eastern Europe Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 52: APAC Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 53: APAC Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 54: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 58: APAC Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 59: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 61: APAC Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 62: APAC Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 63: APAC Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 64: APAC Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 65: Latin America Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 66: Latin America Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 67: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 71: Latin America Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 72: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 74: Latin America Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 75: Latin America Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 77: Latin America Reverse Logistics Market Share Comparison by End-User (2016-2032)

- Table 78: Middle East & Africa Reverse Logistics Market Comparison by Return Type (2016-2032)

- Table 79: Middle East & Africa Reverse Logistics Market Comparison by End-User (2016-2032)

- Table 80: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by Return Type (2016-2032)

- Table 84: Middle East & Africa Reverse Logistics Market Revenue (US$ Mn) Comparison by End-User (2016-2032)

- Table 85: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by Return Type (2016-2032)

- Table 87: Middle East & Africa Reverse Logistics Market Y-o-Y Growth Rate Comparison by End-User (2016-2032)

- Table 88: Middle East & Africa Reverse Logistics Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Reverse Logistics Market Share Comparison by Return Type (2016-2032)

- Table 90: Middle East & Africa Reverse Logistics Market Share Comparison by End-User (2016-2032)

- 1. Executive Summary

-

- C.H. Robinson Worldwide Inc.

- United Parcel Service of America Inc.

- DB Schenker

- Core Logistic Private Limited

- Yusen Logistics Co. Ltd.

- FedEx

- RLG

- Deutsche Post AG

- Kintetsu World Express Inc.

- Safexpress

- Other Key Players