Retail E-Commerce Market By Product (Apparel and Accessories, Groceries, Footwear, Personal and Beauty Care, Furniture and Household Decor, Electronic Goods, Others), By Type (Hybrid Marketplace, Pure Marketplace, Brand, Retail Chain), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49226

-

July 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

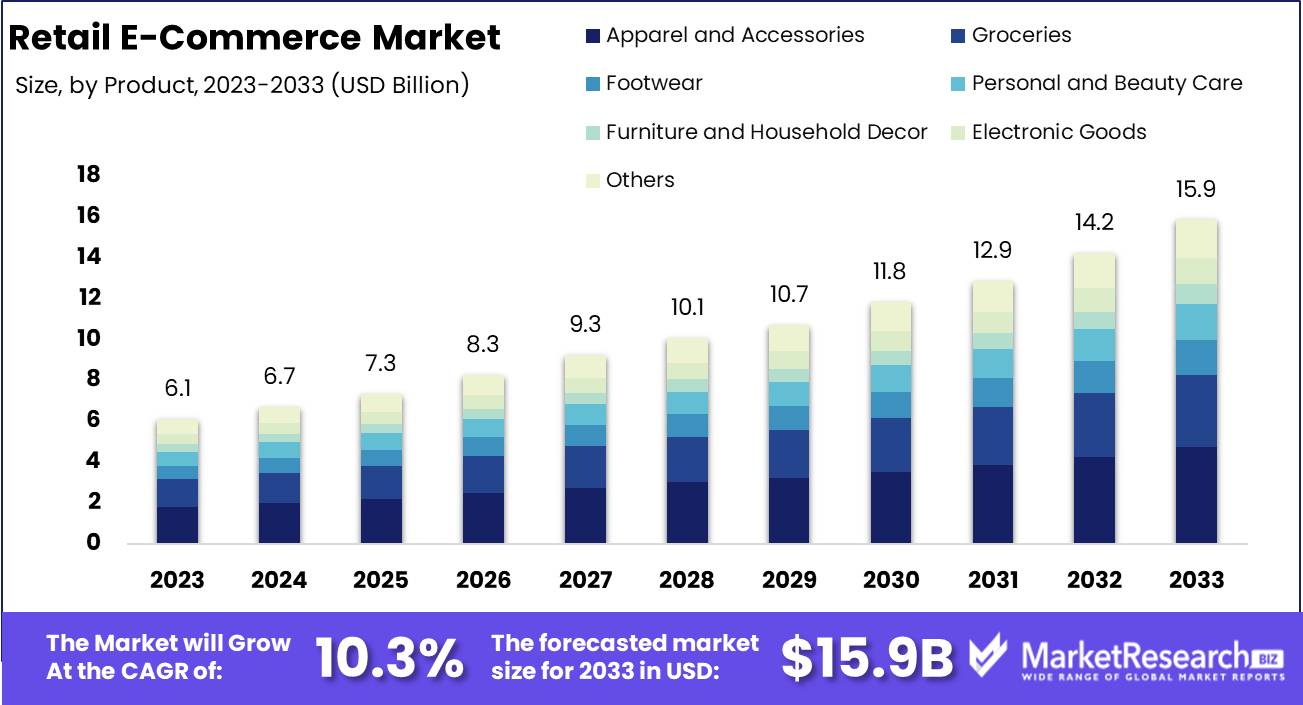

The Retail E-Commerce Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 15.9 billion by 2033 with a CAGR of 10.3% during the forecast period from 2024 to 2033.

The Retail E-Commerce Market encompasses the online sale of goods and services directly to consumers, facilitated through digital platforms. This market leverages advanced technologies such as mobile commerce, electronic funds transfer, internet marketing, and automated data collection systems. It is characterized by its broad product range, including electronics, apparel, and household items, and is driven by factors like increased internet penetration, changing consumer behavior, and advancements in payment technologies.

The retail e-commerce market is undergoing a transformative phase, driven by significant shifts in consumer behavior and technological advancements. The accelerated adoption of digital technologies by both consumers and retailers has catalyzed this transformation, leading to unprecedented growth and innovation. Notably, mobile commerce has emerged as a critical component of this ecosystem, with smartphones now accounting for over half of all e-commerce transactions. This shift underscores the need for retailers to optimize their mobile platforms to capture this growing segment.

Concurrently, the complexity and cost of logistics and supply chain management have surged, posing significant challenges to maintaining efficient and timely deliveries. Retailers are increasingly investing in advanced logistics solutions to mitigate these issues, aiming to enhance operational efficiency and customer satisfaction.

However, this growth trajectory is not without its challenges. Cybersecurity risks have intensified, with data breaches and cyber-attacks posing substantial threats to consumer trust and business continuity. Retailers must prioritize robust cybersecurity measures to safeguard sensitive customer data and maintain trust. Moreover, the integration of advanced technologies such as artificial intelligence (AI), augmented reality/virtual reality (AR/VR), and blockchain is becoming pivotal in enhancing customer experience and operational efficiency. AI and machine learning are being leveraged for personalized marketing and inventory management, while AR/VR technologies are revolutionizing the online shopping experience by enabling virtual try-ons and interactive product demonstrations. Blockchain, on the other hand, is enhancing supply chain transparency and security.

Key Takeaways

- Market Growth: The Retail E-Commerce Market was valued at USD 6.1 billion in 2023. It is expected to reach USD 15.9 billion by 2033 with a CAGR of 10.3% during the forecast period from 2024 to 2033.

- By Product: Apparel and Accessories dominated the Retail E-Commerce Market segment.

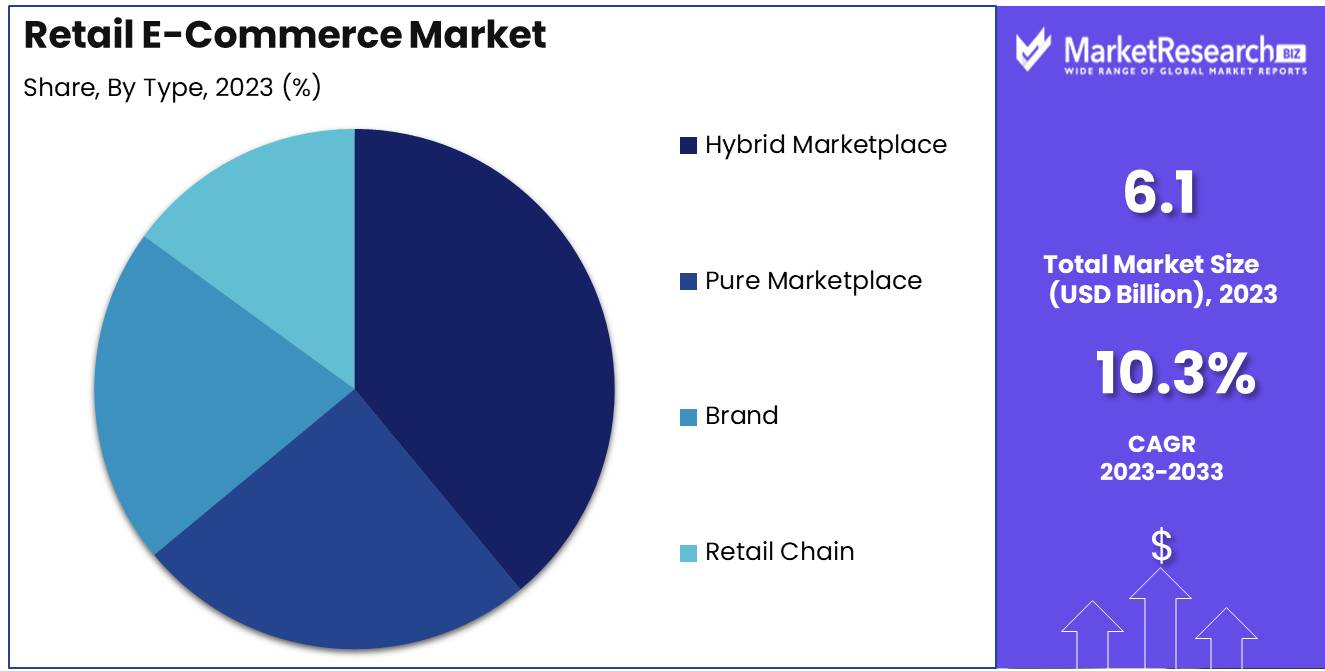

- By Type: The Hybrid Marketplace dominated the Retail E-Commerce Market.

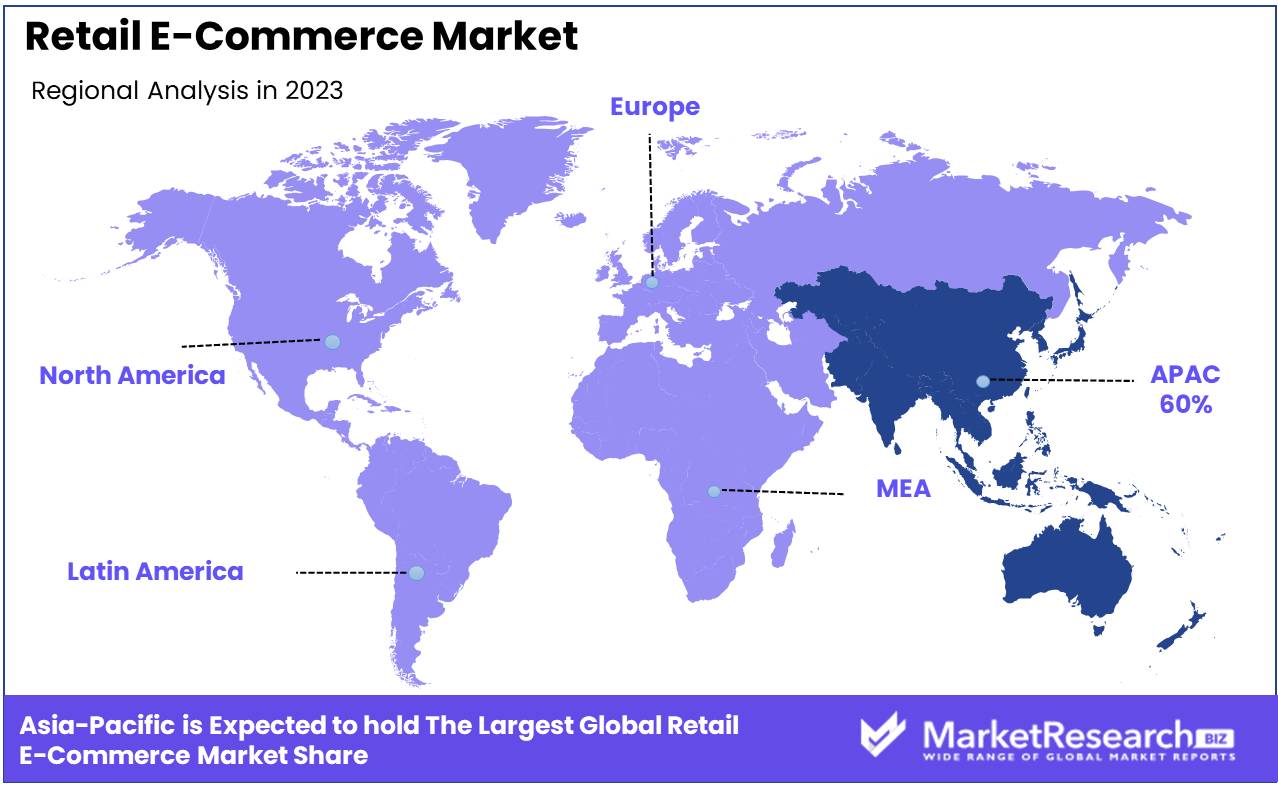

- Regional Dominance: Asia Pacific dominates retail e-commerce, driving the global market with a 60% largest share.

- Growth Opportunity: The global retail e-commerce market is poised for substantial growth driven by advancements in AR, VR, and voice search technologies.

Driving factors

Growing Popularity of Online Shopping: Shifting Consumer Behavior Drives Market Expansion

The growing popularity of online shopping is a primary driver of the Retail E-Commerce Market, fundamentally reshaping consumer behavior and retail strategies. As digital literacy and internet penetration increase globally, more consumers are turning to online platforms for their shopping needs. This shift is fueled by the convenience of shopping from home, a wider selection of products, competitive pricing, and the ability to easily compare options.

The COVID-19 pandemic has further accelerated this trend, with lockdowns and social distancing measures prompting even the most reluctant consumers to embrace online shopping. This behavioral shift is likely to persist post-pandemic, embedding e-commerce more deeply into the retail fabric.

Rise of E-Commerce Platforms: Enhanced Access and Experience Propel Market Growth

The rise of e-commerce platforms is another crucial factor driving the growth of the Retail E-Commerce Market. Platforms like Amazon, Alibaba, and eBay have revolutionized the online shopping experience by providing robust, user-friendly interfaces that enhance the customer journey from browsing to purchase. These platforms offer vast product selections, reliable logistics, secure payment gateways, and customer review systems, creating a trustworthy shopping environment that attracts and retains customers.

Moreover, these platforms leverage advanced technologies such as artificial intelligence and big data analytics to personalize shopping experiences, optimize supply chains, and predict consumer trends, thereby driving sales and improving customer satisfaction. This technological integration is critical in maintaining competitive advantage and fostering market growth.

Increasing Number of Mobile Users: Mobile Commerce as a Key Growth Vector

The increasing number of mobile users is a pivotal factor contributing to the expansion of the Retail E-Commerce Market. The proliferation of smartphones and the improvement of mobile internet infrastructure have made it easier for consumers to shop online anytime and anywhere. Mobile commerce, or m-commerce, now accounts for a significant portion of e-commerce sales. As of 2023, mobile devices were responsible for approximately 54% of e-commerce sales globally, highlighting the critical role of mobile technology in driving market growth.

The convenience of mobile shopping apps, push notifications for deals and discounts, and seamless mobile payment solutions are encouraging more consumers to engage in mobile commerce. Retailers are increasingly optimizing their e-commerce websites for mobile use and developing dedicated shopping apps to capitalize on this trend. Additionally, the integration of mobile wallets and one-click payment options has streamlined the purchasing process, enhancing user experience and boosting conversion rates.

Restraining Factors

Impact of Slow Loading Speed on Retail E-Commerce Market Growth

One of the most critical restraining factors in the retail e-commerce market is slow loading speed. Research indicates that a one-second delay in page load time can result in a 7% reduction in conversions. In a competitive market where user expectations for quick and seamless online experiences are high, slow loading speeds can significantly impact customer satisfaction and retention.

Slow loading speed directly affects the user experience, often leading to increased bounce rates. Data shows that 53% of mobile site visits are abandoned if pages take longer than three seconds to load. This impatience can be attributed to the increasing speed and accessibility of internet connections, setting a high bar for e-commerce platforms to meet. Moreover, slow websites can damage the brand's reputation, leading to a decrease in customer trust and loyalty.

Increased Security Risks and Consumer Trust Issues

Inadequate authentication methods are another critical factor restraining the growth of the retail e-commerce market. With the rise of cyber threats and online fraud, robust authentication mechanisms are essential to safeguard customer data and build trust. E-commerce platforms that fail to implement strong authentication measures are at a higher risk of data breaches, which can have severe repercussions for both the business and its customers.

Statistics indicate that approximately 16.7 million Americans were victims of identity fraud in 2017, with e-commerce transactions being a significant target. The financial losses and reputational damage resulting from such breaches can be devastating for e-commerce businesses. Inadequate authentication not only exposes customers to fraud but also undermines their confidence in online shopping. A survey revealed that 87% of consumers would take their business elsewhere if they felt a retailer was not handling their data securely.

By Product Analysis

In 2023, Apparel and Accessories dominated the Retail E-Commerce Market segment.

In 2023, Apparel and Accessories held a dominant market position in the by-product segment of the Retail E-Commerce Market. This category's prominence is driven by several factors, including the increasing consumer shift towards online shopping for fashion items, the influence of social media, and the rapid adoption of digital payment solutions. Groceries followed closely, propelled by the rising preference for convenience and contactless shopping, a trend accelerated by the COVID-19 pandemic. Footwear also maintained a significant share, benefiting from innovative product offerings and personalized online shopping experiences.

Personal and Beauty Care products experienced robust growth, fueled by the increasing consumer focus on health, wellness, and self-care routines. Furniture and Household Decor saw a surge in online sales as more consumers invested in home improvements and interior design projects during extended periods at home. The Electronic Goods segment continued to thrive, driven by high demand for gadgets and home office equipment amid the growing work-from-home culture.

Lastly, the 'Others' category, encompassing a diverse range of products, also contributed to the market dynamics, reflecting the broadening scope of e-commerce.

By Type Analysis

In 2023, The Hybrid Marketplace dominated the Retail E-Commerce Market.

In 2023, The Hybrid Marketplace held a dominant market position in the By Type segment of the Retail E-Commerce Market. This category, which seamlessly integrates third-party sellers with direct sales from the platform itself, has leveraged its dual approach to offer consumers a diverse array of products while maintaining stringent quality control. The Hybrid Marketplace model's ability to balance wide-ranging inventory with robust customer service has been a key differentiator, attracting a broad customer base and fostering loyalty.

Conversely, the Pure Marketplace segment, solely dependent on third-party sellers, has faced challenges related to quality assurance and seller reliability, which have hampered its growth potential despite its extensive product listings. Brands operating their own e-commerce platforms have focused on delivering a curated, brand-specific shopping experience, emphasizing premium customer engagement and exclusive offerings. However, their reach remains limited compared to marketplace models.

Retail Chains, traditionally reliant on physical storefronts, have rapidly expanded their e-commerce capabilities, integrating online and offline experiences to cater to evolving consumer preferences. While they have made significant strides, their online presence is still overshadowed by established marketplaces.

Key Market Segments

By Product

- Apparel and Accessories

- Groceries

- Footwear

- Personal and Beauty Care

- Furniture and Household Decor

- Electronic Goods

- Others

By Type

- Hybrid Marketplace

- Pure Marketplace

- Brand

- Retail Chain

Growth Opportunity

Embracing Augmented Reality (AR) and Virtual Reality (VR)

The integration of Augmented Reality (AR) and Virtual Reality (VR) presents a transformative opportunity for the global retail e-commerce market. AR and VR technologies enable consumers to visualize products in their own environment before making a purchase, significantly enhancing the online shopping experience. This immersive technology reduces return rates and increases customer satisfaction by providing a more accurate representation of products. Companies investing in AR and VR can differentiate themselves by offering unique, interactive experiences that drive customer engagement and loyalty. According to recent market data, the global AR and VR market is projected to grow to $209.2 billion by 2024, underscoring the potential for a significant impact on retail e-commerce.

Leveraging Voice Search and Shopping

Voice search and shopping are rapidly emerging as critical drivers of growth in the e-commerce sector. As smart speakers and voice assistants become ubiquitous in households, consumers are increasingly using voice commands to search for and purchase products. This trend offers retailers an opportunity to streamline the purchasing process, making it more convenient for consumers. Integrating voice search capabilities can enhance customer experience by providing faster, hands-free interaction, which is particularly appealing for mobile shoppers. It is estimated that by 2024, 55% of all households are expected to own smart speaker devices, highlighting the urgency for e-commerce platforms to optimize for voice search and capture this growing market segment.

Latest Trends

Sustainability and Ethical Practices

Sustainability and ethical practices are set to dominate the retail e-commerce landscape. Consumers increasingly prioritize environmental and social responsibility, compelling retailers to adopt more sustainable business models. This shift manifests in various ways, including the reduction of carbon footprints, adoption of recyclable packaging, and commitment to fair trade practices. Brands that transparently communicate their sustainability initiatives are likely to gain a competitive edge, as consumers reward those who align with their values. Retailers must invest in eco-friendly technologies and sustainable supply chains to meet this growing demand.

Personalization and Hyper-Targeted Marketing

The era of one-size-fits-all marketing is rapidly fading. Personalization and hyper-targeted marketing are paramount for engaging and retaining customers. Advances in artificial intelligence and data analytics enable retailers to deliver highly personalized shopping experiences. By leveraging customer data, e-commerce platforms can offer tailored product recommendations, personalized discounts, and targeted content. This not only enhances customer satisfaction but also drives higher conversion rates and loyalty. The use of predictive analytics to anticipate customer needs before they arise will differentiate leading e-commerce players from the rest.

Regional Analysis

Asia Pacific dominates retail e-commerce, driving the global market with a 60% largest share.

The global retail e-commerce market exhibits significant regional variations, each characterized by unique growth drivers and market dynamics. In North America, the market is propelled by high internet penetration, advanced logistics infrastructure, and consumer preference for online shopping, with e-commerce sales reaching approximately $1.2 trillion in 2023. Europe follows closely, driven by strong growth in markets such as the UK, Germany, and France, collectively accounting for nearly 25% of global e-commerce sales, with a focus on seamless cross-border transactions and diverse payment methods.

The Asia Pacific region stands out as the dominant force, commanding over 60% of the global market share, driven by China and India’s burgeoning digital economy, expanding middle class, and rapid mobile commerce adoption, contributing to an estimated $2.8 trillion in sales. In the Middle East & Africa, the market is witnessing robust growth due to increasing smartphone penetration and improving payment infrastructure, with the UAE and Saudi Arabia leading regional e-commerce activities.

Latin America is experiencing accelerated growth, with Brazil and Mexico at the forefront, driven by increased internet connectivity and a youthful, tech-savvy population, pushing regional e-commerce sales to exceed $100 billion. Collectively, these regions highlight the diverse and dynamic nature of the retail e-commerce landscape, with the Asia Pacific region distinctly at the helm.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global retail e-commerce market is experiencing robust growth, driven by a blend of innovation, customer-centric strategies, and expanded digital infrastructure. Key players such as Amazon.com Inc. and Alibaba Group Holding Limited continue to dominate, leveraging vast logistics networks and AI-driven personalization to enhance customer experiences. Amazon’s focus on Prime services and logistics expansion remains unparalleled, setting industry standards. Alibaba’s integration of online and offline retail, coupled with its robust ecosystem in China and Southeast Asia, solidifies its market leadership.

Walmart Inc. and Kroger Co. are intensifying their e-commerce efforts, emphasizing grocery delivery and seamless omnichannel experiences. Walmart’s investments in technology and its partnership with delivery platforms are pivotal to its competitive edge. Kroger's digital strategy, including its advanced data analytics for inventory and customer preferences, positions it well against purely digital competitors.

Etsy Inc. and Wayfair Inc. are carving out significant niches. Etsy’s focus on unique, handmade goods attracts a loyal customer base, while Wayfair’s specialization in home goods, coupled with augmented reality tools, enhances online shopping.

Coupang Corp and Rakuten are strengthening their foothold in Asia through rapid delivery services and extensive product offerings. Coupang’s "Rocket Delivery" is a key differentiator in South Korea, while Rakuten leverages its ecosystem, including financial services, to drive customer loyalty.

European giants Otto GmbH & Co KG and Inter IKEA Systems B.V. are also scaling their e-commerce operations, integrating sustainability into their value propositions, which resonates well with the eco-conscious consumer segment.

Market Key Players

- Walmart Inc.

- E Bay Inc.

- The Kroger Co.

- Wayfair Inc.

- Coupang Corp

- Etsy Inc.

- ALIBABA GROUP HOLDING LIMITED

- Otto GmbH & Co KG.

- Dba Rakuten

- Amazon. Com Inc.

- Albertsons Companies, Inc.

- Inter IKEA Systems B.V.

Recent Development

- In April 2024, Shopify entered into a partnership with TikTok to enable in-app purchases directly through TikTok videos. This integration allows merchants to sell products seamlessly within the social media platform, tapping into TikTok's vast user base and enhancing social commerce opportunities.

- In March 2024, Walmart introduced a new AI-driven personal shopping assistant integrated into its mobile app. This feature uses machine learning to provide personalized product recommendations, optimize shopping lists, and offer real-time price comparisons, enhancing the customer shopping experience and driving engagement.

- In February 2024, Amazon announced its expansion into healthcare products, launching an extensive line of over-the-counter medications and wellness products under its own brand. This move is part of Amazon's strategy to diversify its e-commerce portfolio and capitalize on the growing demand for online healthcare shopping.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Billion Forecast Revenue (2033) USD 15.9 Billion CAGR (2024-2032) 10.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Apparel and Accessories, Groceries, Footwear, Personal and Beauty Care, Furniture and Household Decor, Electronic Goods, Others), By Type (Hybrid Marketplace, Pure Marketplace, Brand, Retail Chain) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Walmart Inc., E Bay Inc., The Kroger Co., Wayfair Inc., Coupang Corp, Etsy Inc., ALIBABA GROUP HOLDING LIMITED, Otto GmbH & Co KG., Dba Rakuten, Amazon. Com Inc., Albertsons Companies, Inc., Inter IKEA Systems B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Walmart Inc.

- E Bay Inc.

- The Kroger Co.

- Wayfair Inc.

- Coupang Corp

- Etsy Inc.

- ALIBABA GROUP HOLDING LIMITED

- Otto GmbH & Co KG.

- Dba Rakuten

- Amazon. Com Inc.

- Albertsons Companies, Inc.

- Inter IKEA Systems B.V.