Refractory Material Market By Form (Shaped, Unshaped), By Chemical Composition (Alumina, Silica, Magnesia, Fireclay, Others), By Chemistry (Basic, Neutral, Acidic), By End Use (Cement, Metals & Metallurgy, Glass & Ceramics, Power Generation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47367

-

June 2023

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

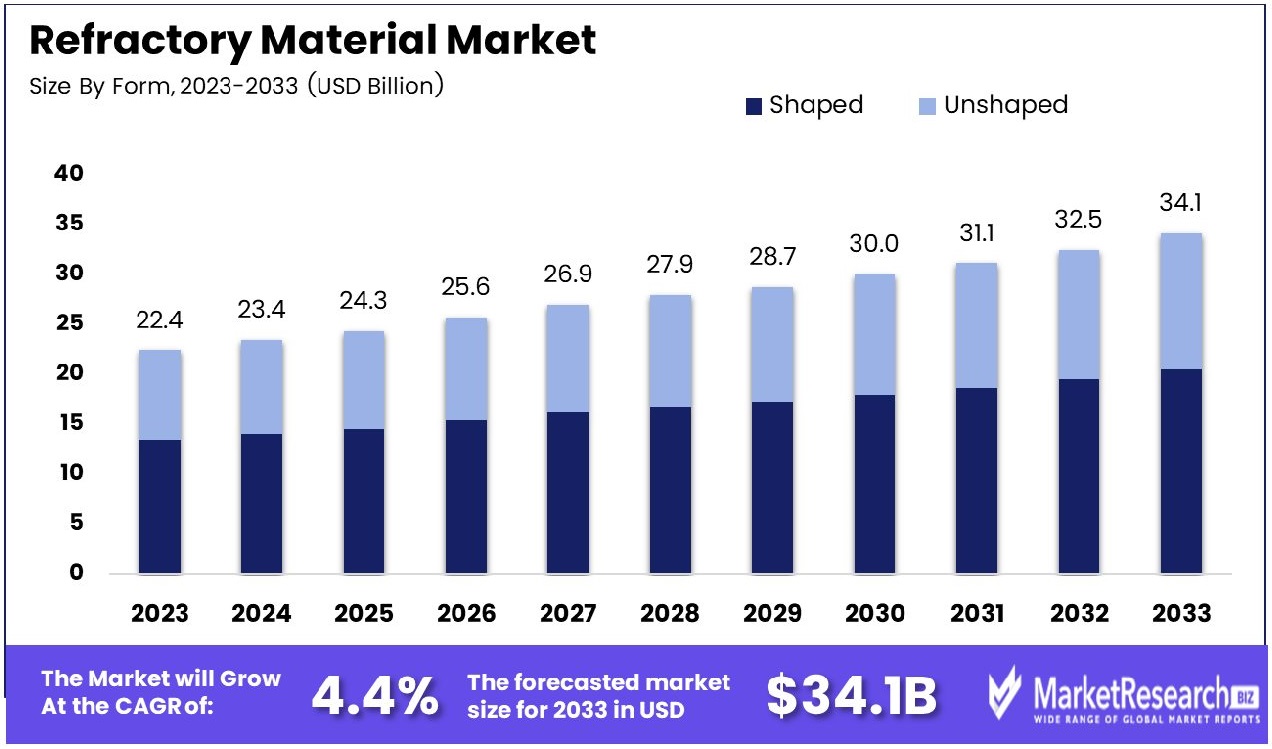

The Global Refractory Material Market was valued at USD 22.4 Bn in 2023. It is expected to reach USD 34.1 Bn by 2033, with a CAGR of 4.4% during the forecast period from 2024 to 2033.

The Refractory Material Market encompasses the global landscape of specialized materials crucial for high-temperature industrial processes. These materials, designed to withstand extreme heat and chemical exposure, find applications in diverse sectors such as steel, cement, glass, and petrochemical industries. As pivotal components in furnaces, reactors, and kilns, refractories ensure operational efficiency, durability, and safety in manufacturing operations. Market dynamics are influenced by technological advancements, environmental regulations, and fluctuations in end-user industries.

The Refractory Material Market continues to exhibit resilience and growth, propelled by escalating demand across key industries reliant on high-temperature processes. High alumina bricks, characterized by an Al2O3 content surpassing 48%, remain integral to this market, comprising corundum, mullite, and glass components. Their robust properties make them indispensable in furnaces and kilns within steel, cement, and glass manufacturing sectors. Additionally, silica bricks, boasting a SiO2 content exceeding 93%, reinforce market dynamics with their superior heat resistance. Comprising phosphorous quartz, cristobalite, residual quartz, and glass, silica bricks find extensive application in diverse industrial settings.

Market players must navigate evolving trends such as technological advancements and stringent environmental regulations. Understanding the intricate interplay between supply chain dynamics, raw material availability, and end-user preferences is pivotal for stakeholders. Moreover, emerging innovations in refractory materials present both challenges and opportunities, necessitating proactive strategies to stay competitive.

Key Takeaways

- Market Value: The Global Refractory Material Market was valued at USD 22.4 Bn in 2023. It is expected to reach USD 34.1 Bn by 2033, with a CAGR of 4.4% during the forecast period from 2024 to 2033.

- By Form: Shaped refractory materials hold the lion's share, capturing 60% of the market, indicating their prevalence in various industries.

- By Chemical Composition: Alumina-based materials constitute 30% of the market, showcasing their importance in high-temperature applications.

- By Chemistry: Basic refractories command a significant share, representing 35% of the market, reflecting their essential role in various industrial processes.

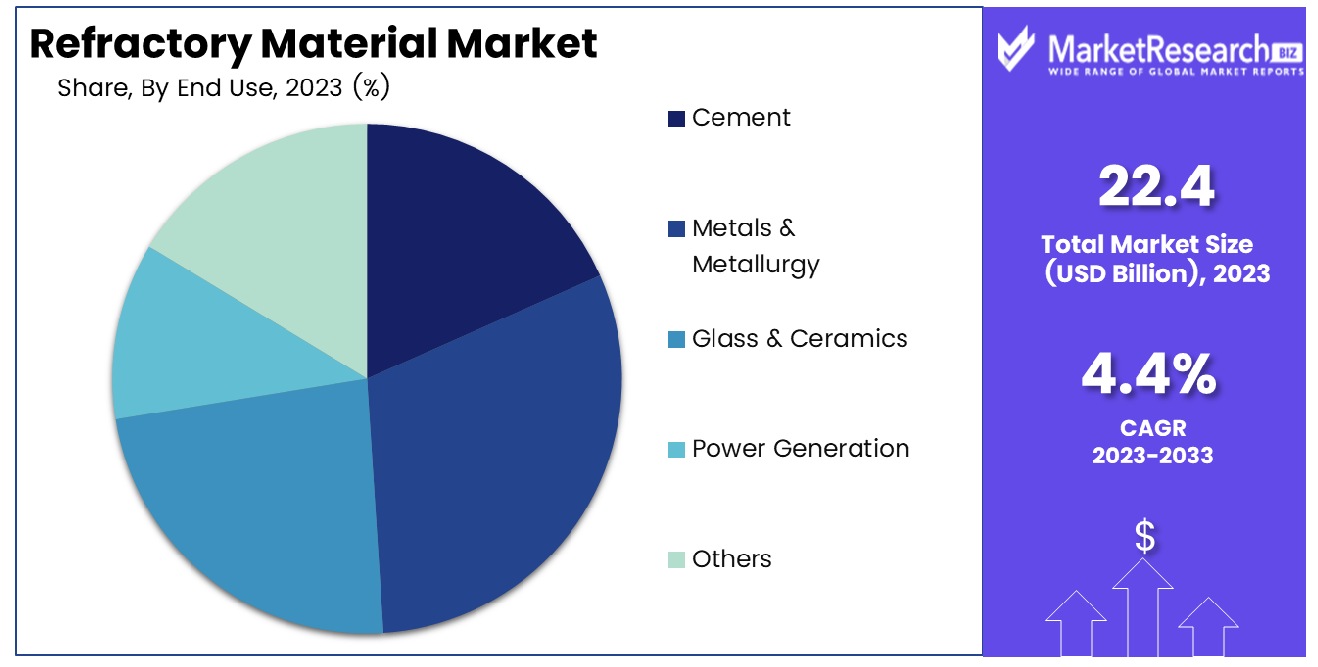

- By End Use: Metals & Metallurgy emerge as the dominant sector, with a market share of 30%, underscoring the crucial role of refractory materials in metal production and processing.

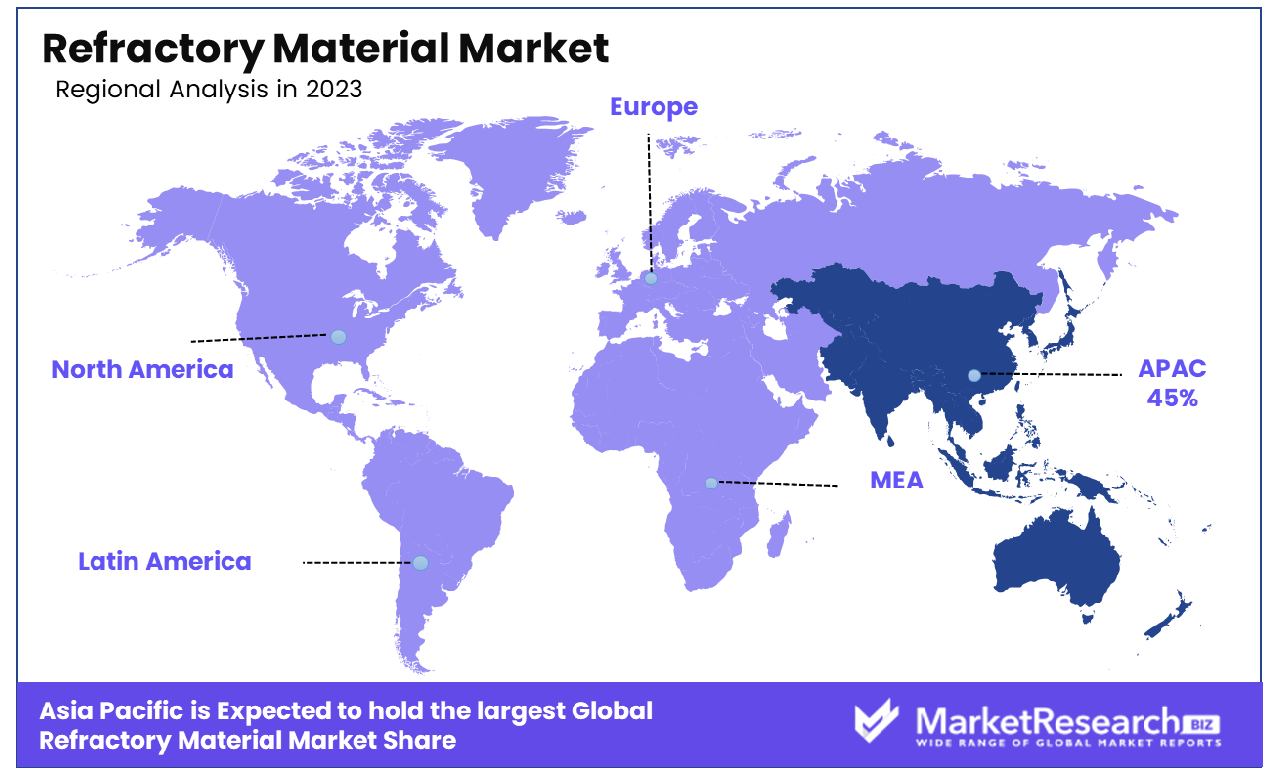

- Regional Dominance: Asia-Pacific dominates the market with a commanding share of 45%, driven by the booming industrial sector in countries like China and India, which require substantial quantities of refractory materials for infrastructure and manufacturing.

- Growth Opportunity: Advanced manufacturing technologies and developing eco-friendly refractory solutions could drive growth amidst increasing environmental regulations and sustainability concerns in industrial applications.

Driving factors

Glass Industry Demand

The demand for refractory materials is intricately linked with the growth and evolution of the glass industry. As the global glass sector continues to expand, so does the need for high-quality refractory materials to facilitate its operations. Glass production processes involve extreme temperatures and harsh environments, necessitating the use of refractories that can withstand such conditions. From furnaces to kilns, refractory linings are crucial for maintaining operational efficiency and product quality within glass manufacturing facilities.

Statistics from industry reports consistently highlight the robust growth of the global glass industry, further underlining the significant role it plays in propelling the refractory material market forward. For instance, data indicating increasing glass consumption in construction, automotive, and packaging sectors substantiates the sustained demand for refractories.

Non-Ferrous Metal Production

The non-ferrous metal production sector serves as a pivotal driving force behind the growth of the refractory material market. Industries involved in the extraction and processing of non-ferrous metals such as aluminum, copper, zinc, and nickel rely heavily on refractory materials to withstand the extreme temperatures and corrosive environments inherent in their operations.

An increase in global infrastructure development, coupled with growing demand for consumer electronics and electric vehicles, has fueled the demand for non-ferrous metals. As a result, the production capacity of non-ferrous metal facilities continues to expand, driving parallel growth in the demand for refractory materials.

Restraining Factors

Environmental Concerns

Environmental concerns play a pivotal role in shaping the landscape of the refractory material market, driving a shift towards sustainable practices and eco-friendly solutions. As industries worldwide face increasing pressure to minimize their carbon footprint and mitigate environmental impact, the demand for refractory materials that offer superior thermal performance while adhering to stringent environmental standards has surged. Manufacturers and end-users alike are increasingly prioritizing the adoption of refractory materials that not only withstand high temperatures and harsh operating conditions but also demonstrate eco-conscious attributes such as reduced emissions, minimal waste generation, and extended service life.

The push towards environmental sustainability has spurred innovation within the refractory material sector, leading to the development of new materials and manufacturing processes that prioritize energy efficiency, recyclability, and reduced environmental footprint. For example, advancements in refractory technology have enabled the production of lightweight, insulating materials that enhance energy efficiency and reduce greenhouse gas emissions in industrial applications.

Regulatory Compliance

Regulatory compliance stands as a foundational driver shaping the growth trajectory of the refractory material market, influencing industry standards, manufacturing practices, and product innovation. As governments worldwide enact stringent regulations aimed at safeguarding worker safety, environmental protection, and product quality, manufacturers of refractory materials must continuously adapt to evolving compliance requirements to remain competitive in the global marketplace.

Regulatory frameworks governing the use of refractory materials encompass a wide range of aspects, including occupational health and safety standards, emissions regulations, material composition guidelines, and waste management protocols. Compliance with these regulations not only ensures the safety of workers and surrounding communities but also fosters trust and confidence among customers and stakeholders.

By Form Analysis

Shaped forms are the prevalent choice, making up 60% of the market.

In 2023, Shaped held a dominant market position in the By Form segment of the Refractory Material Market, capturing more than a 60% share. Shaped refractories, characterized by their predetermined shapes and sizes prior to installation, are extensively used across various industries such as steel, cement, and glass manufacturing. The dominance of Shaped refractories can be attributed to their precise fitting, ease of installation, and superior thermal insulation properties, which make them indispensable in high-temperature applications.

Unshaped refractories, while holding a smaller share compared to Shaped, represent a significant segment within the Refractory Material Market. Unshaped refractories, also known as monolithic refractories, are composed of powders, granules, and aggregates that are mixed with binders and applied in situ. This segment includes products such as castables, gunning mixes, and ramming mixes, which offer flexibility in installation and are ideal for complex shapes and areas that require repair or maintenance.

The dominance of Shaped refractories in the Refractory Material Market underscores the importance of precision engineering and tailored solutions in industries where high temperatures, corrosive environments, and mechanical stress are prevalent. However, the Unshaped segment continues to gain traction due to its versatility, cost-effectiveness, and ability to adapt to diverse applications and operational requirements.

By Chemical Composition Analysis

Alumina-based compositions represent 30% of the market.

In 2023, Alumina held a dominant market position in the By Chemical Composition segment of the Refractory Material Market, capturing more than a 30% share. Alumina-based refractories are widely favored across various industries for their excellent thermal stability, corrosion resistance, and mechanical strength. Their versatility makes them suitable for applications in high-temperature environments such as metal smelting, petrochemical processing, and power generation.

Following Alumina, Silica emerged as another significant player in the By Chemical Composition segment. Specialty Silica refractories, composed primarily of silicon dioxide, offer good resistance to thermal shock and chemical attack, making them suitable for use in glass manufacturing, ceramics production, and other industries where rapid temperature changes are common.

Magnesia-based refractories constituted another notable segment within the Refractory Material Market. Magnesia refractories, derived from magnesium oxide, are renowned for their high refractoriness and resistance to basic slag corrosion, rendering them ideal for applications in steelmaking, cement kilns, and non-ferrous metal processing.

Fireclay and other refractory materials also held shares in the By Chemical Composition segment, catering to specific industrial requirements and niche applications. Fireclay refractories, derived from natural clay minerals, offer good thermal insulation and resistance to abrasion, making them suitable for use in furnaces, kilns, and incinerators.

By Chemistry Analysis

Basic chemistry holds a share of 35%.

In 2023, Basic held a dominant market position in the By Chemistry segment of the Refractory Material Market, capturing more than a 35% share. Basic refractories, characterized by their high content of basic oxides such as magnesia (MgO) and calcium oxide (CaO), are widely acclaimed for their exceptional resistance to basic slag and high-temperature environments. This makes them indispensable in industries such as steelmaking, where they are used in applications like steel ladles, converters, and lime kilns.

Following Basic, Neutral emerged as another significant player in the By Chemistry segment. Neutral refractories, also known as alumina-silica refractories, offer a balanced composition of acidic and basic oxides, providing good resistance to both acidic and basic slags. They find applications in industries such as glass manufacturing, where they are utilized in glass tanks, furnaces, and regenerators.

Acidic refractories constituted another notable segment within the Refractory Material Market. Acidic refractories, characterized by their high silica (SiO2) content, offer excellent resistance to acidic slags and are commonly used in industries such as non-ferrous metal production, where they are employed in smelting furnaces, reactors, and crucibles.

By End Use Analysis

In terms of end-use, metals and metallurgy comprise 30% of the market.

In 2023, Metals & Metallurgy held a dominant market position in the By End Use segment of the Refractory Material Market, capturing more than a 30% share. Within the Metals & Metallurgy sector, refractory materials are essential for withstanding extreme temperatures and harsh conditions during various processes such as steelmaking, aluminum smelting, and foundry operations. The durability and high heat resistance of refractories make them indispensable for lining furnaces, converters, ladles, and other equipment crucial for metal production.

Following Metals & Metallurgy, Cement emerged as another significant player in the By End Use segment. Refractory materials are vital in the cement industry for lining kilns and other high-temperature equipment used in the clinker production process. The ability of refractories to withstand the intense heat and chemical reactions occurring in cement kilns ensures the efficient and continuous operation of cement plants.

Glass & Ceramics constituted another notable segment within the Refractory Material Market's By End Use category. Refractory materials play a critical role in glass melting furnaces, regenerators, and tank furnaces, where they help maintain consistent temperatures and protect against thermal shock. In the ceramics industry, refractories are used in kilns and furnaces for firing ceramic products, providing insulation and heat retention capabilities.

Power Generation also represented a significant portion of the By End Use segment. Refractory materials are utilized in boilers, furnaces, and gasifiers in power plants, where they withstand extreme temperatures and chemical environments associated with combustion processes. The reliability and longevity of refractories contribute to the efficiency and safety of power generation facilities, ensuring uninterrupted electricity supply.

Key Market Segments

By Form

- Shaped

- Unshaped

By Chemical Composition

- Alumina

- Silica

- Magnesia

- Fireclay

- Others

By Chemistry

- Basic

- Neutral

- Acidic

By End Use

- Cement

- Metals & Metallurgy

- Glass & Ceramics

- Power Generation

- Others

Growth Opportunity

Harnessing Recyclability

The year 2024 presents significant opportunities for the global refractory material market, particularly in leveraging recyclability as a driver for sustainable growth. As environmental concerns continue to shape industry dynamics, the emphasis on sustainable practices and eco-friendly solutions has intensified. Refractory materials, traditionally associated with high energy consumption and waste generation, are undergoing a transformation towards circular economy principles. The ability to recycle and reuse refractory materials not only reduces environmental impact but also offers cost savings and resource efficiency benefits for manufacturers and end-users alike.

Industry data reveals a growing trend towards the adoption of recyclable refractory materials, supported by advancements in recycling technologies and processes. Manufacturers are investing in R&D to develop innovative solutions that enable the repurposing of spent refractories, extending their lifecycle and minimizing the need for raw material extraction. This shift towards recyclability aligns with regulatory mandates for waste reduction and resource conservation, positioning companies at the forefront of sustainable innovation to capitalize on emerging market opportunities.

Technological Advancements

Technological advancements serve as another key opportunity driver for the refractory material market in 2024. Innovations in material science, manufacturing techniques, and digitalization are revolutionizing the way refractories are designed, produced, and utilized across various industries. Advanced materials engineered for superior thermal performance, durability, and corrosion resistance are gaining traction among end-users seeking enhanced operational efficiency and product reliability.

Supportive data indicates a surge in research and development initiatives focused on next-generation refractory technologies, including nanomaterials, composite structures, and additive manufacturing processes. These innovations not only address existing industry challenges but also unlock new application possibilities in emerging sectors such as renewable energy, aerospace, and electronics manufacturing. Companies that invest in technology-driven solutions and collaborate with industry partners to pioneer breakthroughs are poised to gain a competitive edge and capitalize on the expanding market landscape.

Latest Trends

Embracing Sustainability

In 2024, the global refractory material market is experiencing a profound shift towards sustainability, driven by heightened environmental consciousness and regulatory pressures. Sustainability has become a central theme guiding industry practices, product development, and market strategies. Manufacturers and end-users alike are prioritizing eco-friendly solutions that minimize carbon footprint, reduce waste generation, and promote responsible resource management throughout the entire product lifecycle.

Industry data underscores the growing importance of sustainability-focused initiatives within the refractory material market. Companies are investing in renewable energy sources, optimizing manufacturing processes to minimize environmental impact, and exploring innovative materials that offer superior performance while aligning with sustainability objectives. Additionally, collaborations and partnerships between industry stakeholders are fostering knowledge exchange and driving collective action towards achieving sustainability goals.

Advanced materials

Another notable trend shaping the refractory material market in 2024 is the rapid adoption of advanced materials engineered for enhanced performance and versatility. Technological advancements in material science, coupled with innovations in manufacturing techniques, are fueling the development of next-generation refractory solutions that offer superior thermal resistance, mechanical strength, and chemical stability.

Supportive data highlights a surge in demand for advanced refractory materials across diverse industries such as steel, cement, glass, and petrochemicals. End-users are seeking materials that can withstand increasingly harsh operating conditions while optimizing energy efficiency and prolonging equipment lifespan. From nanostructured ceramics to refractory composites, these advanced materials are revolutionizing traditional applications and unlocking new opportunities in emerging sectors such as renewable energy storage and high-temperature electronics.

Regional Analysis

Asia-Pacific dominates the Refractory Material market, capturing 45% of the global market share.

The refractory material market exhibits a robust segmentation across key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Among these, Asia-Pacific emerges as the dominating region, capturing a significant market share of 45%. This dominance can be attributed to the region's burgeoning industrial sector, particularly in countries like China and India, where rapid infrastructural development and industrialization are driving the demand for refractory materials.

In North America, stringent regulations pertaining to emission control and the presence of a mature industrial base contribute to a steady demand for refractory materials. Europe, with its focus on sustainability and energy efficiency, witnesses a notable demand for high-quality refractory materials to support its industrial operations.

The Middle East & Africa region showcases promising growth prospects, fueled by investments in the oil & gas sector, which necessitate advanced refractory solutions for high-temperature applications.

Latin America, while exhibiting moderate growth, benefits from increasing industrial activities and investments in infrastructure. Overall, Asia-Pacific stands out as the dominant force in the global refractory material market, with other regions displaying varying degrees of growth potential and demand dynamics.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global refractory material market remains dynamic, with several key players shaping its landscape through innovation, strategic expansion, and technological advancements. Among these, notable companies stand out for their significant contributions to the industry.

Calderys, a leading player in the refractory industry, continues to assert its dominance through a combination of product excellence and global reach. With a diverse portfolio of refractory solutions catering to various industries such as iron & steel, cement, and non-ferrous metals, Calderys maintains a strong foothold in key markets worldwide.

SHINAGAWA REFRACTORIES CO., LTD. stands as a prominent player renowned for its cutting-edge technology and high-quality refractory products. With a focus on research and development, SHINAGAWA consistently introduces innovative solutions tailored to meet the evolving needs of industries, thus bolstering its position in the global market.

Dalmia Bharat Refractory, with its strategic focus on sustainability and environmental stewardship, emerges as a key player driving the adoption of eco-friendly refractory materials. Through initiatives such as green manufacturing practices and the development of recyclable refractories, Dalmia Bharat establishes itself as a frontrunner in the pursuit of sustainable solutions.

Companies like IFGL Refractories Ltd. and Krosaki Harima Corporation leverage their expertise in advanced materials and manufacturing processes to deliver high-performance refractory solutions. Their commitment to quality and customer satisfaction further enhances their competitiveness in the global market.

Market Key Players

- Calderys

- SHINAGAWA REFRACTORIES CO., LTD.

- Dalmia Bharat Refractory

- Lanexis

- IFGL Refractories Ltd.

- Krosaki Harima Corporation

- Morgan Advanced Materials

- RHI Magnesita GmbH

- Saint Gobain

- Vitcas

Recent Development

- In April 2024: RefraTech Innovations unveiled a novel refractory material with enhanced heat resistance, targeting industrial applications.

- In March 2024: Ceramix Industries announced a breakthrough in eco-friendly refractory materials production, aligning with sustainability initiatives.

Report Scope

Report Features Description Market Value (2023) USD 22.4 Bn Forecast Revenue (2033) USD 34.1 Bn CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Shaped, Unshaped), By Chemical Composition (Alumina, Silica, Magnesia, Fireclay, Others), By Chemistry (Basic, Neutral, Acidic), By End Use (Cement, Metals & Metallurgy, Glass & Ceramics, Power Generation, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Calderys, SHINAGAWA REFRACTORIES CO., LTD., Dalmia Bharat Refractory, Lanexis, IFGL Refractories Ltd., Krosaki Harima Corporation, Morgan Advanced Materials, RHI Magnesita GmbH, Saint Gobain, Vitcas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Refractory Material Market Overview

- 2.1. Refractory Material Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Refractory Material Market Dynamics

- 3. Global Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Refractory Material Market Analysis, 2016-2021

- 3.2. Global Refractory Material Market Opportunity and Forecast, 2023-2032

- 3.3. Global Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 3.3.1. Global Refractory Material Market Analysis by By Form: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 3.3.3. Shaped

- 3.3.4. Unshaped

- 3.4. Global Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 3.4.1. Global Refractory Material Market Analysis by By Chemical Composition: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 3.4.3. Alumina

- 3.4.4. Silica

- 3.4.5. Magnesia

- 3.4.6. Fireclay

- 3.4.7. Others

- 3.5. Global Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 3.5.1. Global Refractory Material Market Analysis by By Chemistry: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 3.5.3. Basic

- 3.5.4. Neutral

- 3.5.5. Acidic

- 3.6. Global Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 3.6.1. Global Refractory Material Market Analysis by By End Use: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 3.6.3. Cement

- 3.6.4. Metals & Metallurgy

- 3.6.5. Glass & Ceramics

- 3.6.6. Power Generation

- 3.6.7. Others

- 4. North America Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Refractory Material Market Analysis, 2016-2021

- 4.2. North America Refractory Material Market Opportunity and Forecast, 2023-2032

- 4.3. North America Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 4.3.1. North America Refractory Material Market Analysis by By Form: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 4.3.3. Shaped

- 4.3.4. Unshaped

- 4.4. North America Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 4.4.1. North America Refractory Material Market Analysis by By Chemical Composition: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 4.4.3. Alumina

- 4.4.4. Silica

- 4.4.5. Magnesia

- 4.4.6. Fireclay

- 4.4.7. Others

- 4.5. North America Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 4.5.1. North America Refractory Material Market Analysis by By Chemistry: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 4.5.3. Basic

- 4.5.4. Neutral

- 4.5.5. Acidic

- 4.6. North America Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 4.6.1. North America Refractory Material Market Analysis by By End Use: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 4.6.3. Cement

- 4.6.4. Metals & Metallurgy

- 4.6.5. Glass & Ceramics

- 4.6.6. Power Generation

- 4.6.7. Others

- 4.7. North America Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Refractory Material Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Refractory Material Market Analysis, 2016-2021

- 5.2. Western Europe Refractory Material Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 5.3.1. Western Europe Refractory Material Market Analysis by By Form: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 5.3.3. Shaped

- 5.3.4. Unshaped

- 5.4. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 5.4.1. Western Europe Refractory Material Market Analysis by By Chemical Composition: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 5.4.3. Alumina

- 5.4.4. Silica

- 5.4.5. Magnesia

- 5.4.6. Fireclay

- 5.4.7. Others

- 5.5. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 5.5.1. Western Europe Refractory Material Market Analysis by By Chemistry: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 5.5.3. Basic

- 5.5.4. Neutral

- 5.5.5. Acidic

- 5.6. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 5.6.1. Western Europe Refractory Material Market Analysis by By End Use: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 5.6.3. Cement

- 5.6.4. Metals & Metallurgy

- 5.6.5. Glass & Ceramics

- 5.6.6. Power Generation

- 5.6.7. Others

- 5.7. Western Europe Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Refractory Material Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Refractory Material Market Analysis, 2016-2021

- 6.2. Eastern Europe Refractory Material Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 6.3.1. Eastern Europe Refractory Material Market Analysis by By Form: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 6.3.3. Shaped

- 6.3.4. Unshaped

- 6.4. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 6.4.1. Eastern Europe Refractory Material Market Analysis by By Chemical Composition: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 6.4.3. Alumina

- 6.4.4. Silica

- 6.4.5. Magnesia

- 6.4.6. Fireclay

- 6.4.7. Others

- 6.5. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 6.5.1. Eastern Europe Refractory Material Market Analysis by By Chemistry: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 6.5.3. Basic

- 6.5.4. Neutral

- 6.5.5. Acidic

- 6.6. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 6.6.1. Eastern Europe Refractory Material Market Analysis by By End Use: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 6.6.3. Cement

- 6.6.4. Metals & Metallurgy

- 6.6.5. Glass & Ceramics

- 6.6.6. Power Generation

- 6.6.7. Others

- 6.7. Eastern Europe Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Refractory Material Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Refractory Material Market Analysis, 2016-2021

- 7.2. APAC Refractory Material Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 7.3.1. APAC Refractory Material Market Analysis by By Form: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 7.3.3. Shaped

- 7.3.4. Unshaped

- 7.4. APAC Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 7.4.1. APAC Refractory Material Market Analysis by By Chemical Composition: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 7.4.3. Alumina

- 7.4.4. Silica

- 7.4.5. Magnesia

- 7.4.6. Fireclay

- 7.4.7. Others

- 7.5. APAC Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 7.5.1. APAC Refractory Material Market Analysis by By Chemistry: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 7.5.3. Basic

- 7.5.4. Neutral

- 7.5.5. Acidic

- 7.6. APAC Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 7.6.1. APAC Refractory Material Market Analysis by By End Use: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 7.6.3. Cement

- 7.6.4. Metals & Metallurgy

- 7.6.5. Glass & Ceramics

- 7.6.6. Power Generation

- 7.6.7. Others

- 7.7. APAC Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Refractory Material Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Refractory Material Market Analysis, 2016-2021

- 8.2. Latin America Refractory Material Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 8.3.1. Latin America Refractory Material Market Analysis by By Form: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 8.3.3. Shaped

- 8.3.4. Unshaped

- 8.4. Latin America Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 8.4.1. Latin America Refractory Material Market Analysis by By Chemical Composition: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 8.4.3. Alumina

- 8.4.4. Silica

- 8.4.5. Magnesia

- 8.4.6. Fireclay

- 8.4.7. Others

- 8.5. Latin America Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 8.5.1. Latin America Refractory Material Market Analysis by By Chemistry: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 8.5.3. Basic

- 8.5.4. Neutral

- 8.5.5. Acidic

- 8.6. Latin America Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 8.6.1. Latin America Refractory Material Market Analysis by By End Use: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 8.6.3. Cement

- 8.6.4. Metals & Metallurgy

- 8.6.5. Glass & Ceramics

- 8.6.6. Power Generation

- 8.6.7. Others

- 8.7. Latin America Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Refractory Material Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Refractory Material Market Analysis, 2016-2021

- 9.2. Middle East & Africa Refractory Material Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 9.3.1. Middle East & Africa Refractory Material Market Analysis by By Form: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 9.3.3. Shaped

- 9.3.4. Unshaped

- 9.4. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, By By Chemical Composition, 2016-2032

- 9.4.1. Middle East & Africa Refractory Material Market Analysis by By Chemical Composition: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemical Composition, 2016-2032

- 9.4.3. Alumina

- 9.4.4. Silica

- 9.4.5. Magnesia

- 9.4.6. Fireclay

- 9.4.7. Others

- 9.5. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, By By Chemistry, 2016-2032

- 9.5.1. Middle East & Africa Refractory Material Market Analysis by By Chemistry: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Chemistry, 2016-2032

- 9.5.3. Basic

- 9.5.4. Neutral

- 9.5.5. Acidic

- 9.6. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, By By End Use, 2016-2032

- 9.6.1. Middle East & Africa Refractory Material Market Analysis by By End Use: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End Use, 2016-2032

- 9.6.3. Cement

- 9.6.4. Metals & Metallurgy

- 9.6.5. Glass & Ceramics

- 9.6.6. Power Generation

- 9.6.7. Others

- 9.7. Middle East & Africa Refractory Material Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Refractory Material Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Refractory Material Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Refractory Material Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Refractory Material Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Calderys

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. SHINAGAWA REFRACTORIES CO., LTD.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Dalmia Bharat Refractory

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Lanexis

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. IFGL Refractories Ltd.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Krosaki Harima Corporation

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Morgan Advanced Materials

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. RHI Magnesia GmbH

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Saint-Gobain

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Vitcas

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Calderys

- SHINAGAWA REFRACTORIES CO., LTD.

- Dalmia Bharat Refractory

- Lanexis

- IFGL Refractories Ltd.

- Krosaki Harima Corporation

- Morgan Advanced Materials

- RHI Magnesia GmbH

- Saint-Gobain

- Vitcas