Red Biotechnology Market By Product Type (Gene Therapy Products, Cell Therapy Products, Tissue-Engineered Products, Biopharmaceutical Production, Others), By Application (Pharmacogenomics, Biopharmaceutical Production, Gene Therapy, Genetic Testing), By End-user (Research Institutes, CMOs & CROs, Biopharmaceutical Industries, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47692

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

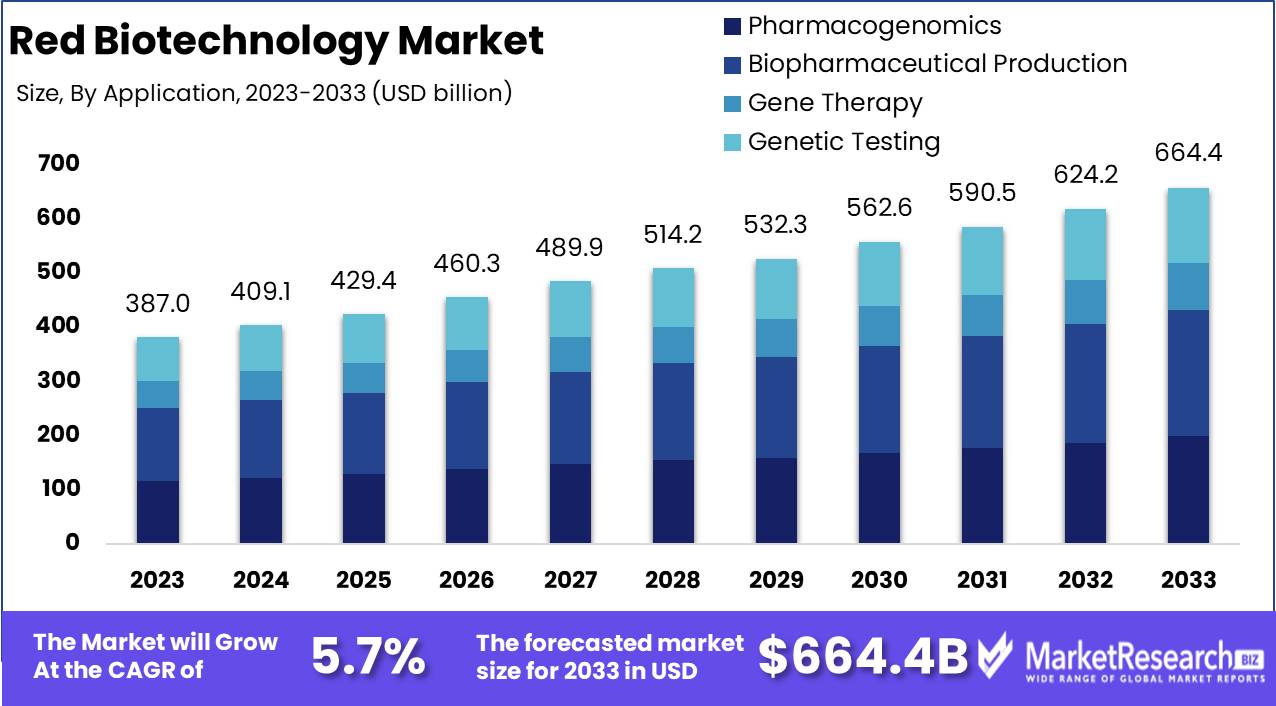

The Red Biotechnology Market was valued at USD 387.0 billion in 2023. It is expected to reach USD 664.4 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

The Red Biotechnology Market encompasses developing and applying biotechnological processes for medical and pharmaceutical purposes. It involves using organisms, cells, and biological molecules to produce therapeutics, vaccines, diagnostics, and genetically modified organisms. This market is pivotal in advancing personalized medicine, improving drug efficacy, and addressing unmet medical needs. Key areas include gene therapy, stem cell research, and biopharmaceuticals. The continuous innovation and growing demand for effective healthcare solutions drive significant investment and research in this sector, underscoring its critical importance in modern medicine and global health management.

The Red Biotechnology Market is experiencing transformative growth, driven by groundbreaking advancements in CRISPR-Cas9, next-generation sequencing (NGS), and regenerative medicine. These innovations are propelling the market forward by enabling more precise genetic editing, improving diagnostic accuracy, and enhancing therapeutic efficacy. The increasing number of over 5,000 active clinical trials underscores the sector’s robust research and development activities, with a notable focus on addressing critical areas such as cancer, rare genetic disorders, and infectious diseases. This extensive clinical pipeline reflects the sector's potential to deliver revolutionary treatments and significantly improve patient outcomes.

However, the market faces substantial challenges that could impede its growth trajectory. The high costs and prolonged timelines associated with developing biopharmaceuticals and gene therapies are significant barriers. These factors not only impact the financial feasibility of companies but also influence the accessibility of these advanced therapies to patients. As the industry continues to navigate these hurdles, strategic collaborations and innovative financing models will be crucial in sustaining momentum.

Overall, the Red Biotechnology Market stands at a pivotal juncture where the balance between technological innovation and cost management will define its future success.

Key Takeaways

- Market Growth: The Red Biotechnology Market was valued at USD 387.0 billion in 2023. It is expected to reach USD 664.4 billion by 2033, with a CAGR of 5.7% during the forecast period from 2024 to 2033.

- By Product Type: Gene Therapy Products dominated the Red Biotechnology Market.

- By Application: Biopharmaceutical Production dominated the Red Biotechnology Market applications.

- By End-user: Research Institutes dominated the red biotechnology market segment.

- Regional Dominance: North America leads the Red Biotechnology Market with a 45% largest market share.

- Growth Opportunity: Harnessing personalized medicine and AI advancements will drive significant growth and improved outcomes in the red biotechnology market.

Driving factors

Advancements in Gene Editing Technologies: Catalyzing Precision Medicine and Therapeutic Innovation

The red biotechnology market is significantly propelled by advancements in gene editing technologies, such as CRISPR-Cas9. These innovations have revolutionized the ability to modify genetic material with unprecedented precision, enabling the development of targeted therapies for a myriad of genetic disorders. For instance, CRISPR technology's capacity to correct mutations at the DNA level offers potential cures for conditions previously deemed untreatable. This technological leap not only enhances the efficacy of treatments but also reduces the risk of off-target effects, thereby improving patient outcomes. The market for gene editing was valued at approximately USD 3.7 billion in 2020 and is expected to reach USD 14.9 billion by 2028, reflecting a compound annual growth rate (CAGR) of 19.8%. This growth trajectory underscores the transformative impact of gene editing technologies on the red biotechnology sector, fostering innovation and expanding therapeutic possibilities.

Rising Incidence of Chronic and Rare Diseases: Driving Demand for Advanced Biotherapeutics

The increasing prevalence of chronic and rare diseases is a critical driver for the red biotechnology market. Chronic conditions such as diabetes, cancer, and cardiovascular diseases, along with a multitude of rare genetic disorders, create a substantial and growing demand for advanced biotherapeutics. The World Health Organization (WHO) reports that chronic diseases account for approximately 71% of all deaths globally, highlighting the urgent need for effective treatments.

Similarly, rare diseases, affecting 300 million people worldwide, present unique therapeutic challenges and opportunities for biotechnology solutions. This escalating burden necessitates continuous innovation in red biotechnology to develop novel drugs and therapies that can address these complex health issues. Consequently, the biopharmaceutical sector is poised to see robust growth, driven by the imperative to provide efficacious and personalized treatment options.

Growing Investment in Research and Development: Fueling Innovation and Market Expansion

Investment in research and development (R&D) is a cornerstone for the growth of the red biotechnology market. Governments, private enterprises, and academic institutions are increasingly channeling funds into biotechnological research, fostering an environment conducive to scientific breakthroughs and the commercialization of new therapies. Global R&D spending in the biotechnology sector was estimated at USD 45 billion, with projections indicating continued growth driven by the need for innovative healthcare solutions. This financial influx supports the discovery and development of cutting-edge biotechnological applications, from novel gene therapies to advanced biopharmaceuticals.

Moreover, partnerships and collaborations between biotech firms and research institutions accelerate the translation of scientific discoveries into marketable products, enhancing the overall pace of innovation. These investments are instrumental in maintaining the competitive edge of the red biotechnology sector, ensuring a steady pipeline of new therapies and diagnostics to meet the evolving healthcare demands.

Restraining Factors

High Cost of Drug Development: A Major Barrier to Market Expansion

The high cost of drug development is a significant restraining factor in the growth of the red biotechnology market. Developing new biopharmaceutical products involves substantial investment in research and development (R&D), clinical trials, and regulatory approval processes. According to a study of Drug Development, the average cost to bring a new drug to market is estimated to be around $2.6 billion, including the cost of failed trials. This immense financial burden limits the entry of new players into the market, consolidates the market power among established pharmaceutical giants, and often results in higher drug prices for consumers.

Moreover, these costs are further exacerbated by the lengthy timelines required for drug development, which can span over a decade from initial discovery to market launch. The extended duration of R&D not only ties up capital but also exposes companies to higher risks associated with technological failures and shifting regulatory landscapes. Consequently, the high cost of drug development creates a formidable barrier, slowing down the pace of innovation and market growth in the red biotechnology sector.

Technological Complexity: Impeding Market Progress

The technological complexity inherent in red biotechnology also plays a critical role in constraining market growth. Advanced biotechnological processes, such as genetic engineering, recombinant DNA technology, and cell culture techniques, require specialized knowledge and highly sophisticated equipment. The necessity for cutting-edge technology and expertise drives up the cost and time required for product development and scale-up.

Additionally, the complexity of these technologies poses significant challenges in terms of reproducibility and scalability. Ensuring that biotechnological processes can be consistently replicated at a commercial scale without loss of efficacy or safety is a major hurdle. These challenges are particularly pronounced in personalized medicine and gene therapy, where individualized treatments demand precise and reliable production methods.

By Product Type Analysis

In 2023, Gene Therapy Products dominated the Red Biotechnology Market.

In 2023, Gene Therapy Products held a dominant market position in the By Product Type segment of the Red Biotechnology Market. This dominance is attributed to significant advancements in genetic engineering technologies, which have led to the development of highly effective therapies for previously untreatable genetic disorders. Concurrently, Cell Therapy Products also demonstrated substantial growth, driven by the increasing adoption of regenerative medicine and personalized treatment approaches.

Tissue-engineered products, though at a nascent stage, showed promise in addressing complex tissue repair and organ replacement needs, reflecting advancements in scaffold development and biomaterials. The Biopharmaceutical Production segment witnessed robust expansion due to rising demand for biologics and biosimilars, leveraging biotechnological methods for more efficient and scalable production processes.

Additionally, the 'Others' category, encompassing a range of emerging technologies and applications, also contributed to market growth, spurred by continuous innovation and diversification within the biotechnology sector. Collectively, these segments underscore the dynamic and rapidly evolving nature of the Red Biotechnology Market, driven by technological breakthroughs and increasing healthcare demands.

By Application Analysis

In 2023, Biopharmaceutical Production dominated the Red Biotechnology Market applications.

In 2023, Biopharmaceutical Production held a dominant market position in the By Application segment of the Red Biotechnology Market, reflecting its critical role in advancing healthcare innovations. This segment, encompassing the manufacturing of therapeutic proteins, vaccines, and monoclonal antibodies, is driven by the increasing prevalence of chronic diseases and the growing demand for personalized medicine. Biopharmaceutical production benefits from advanced biotechnological methods, ensuring high efficiency and specificity in drug development.

Pharmacogenomics leverages genetic information to tailor drug therapies, enhancing efficacy and reducing adverse effects, thus experiencing substantial growth. Gene Therapy is gaining momentum due to its potential to treat genetic disorders at their root cause, representing a significant leap in therapeutic capabilities. Meanwhile, Genetic Testing continues to expand as it provides critical insights for disease prediction and management, aiding in early intervention strategies. Each of these applications collectively contributes to the robust landscape of the Red Biotechnology Market, yet biopharmaceutical production remains at the forefront due to its extensive application in creating life-saving therapies and its substantial investment in research and development.

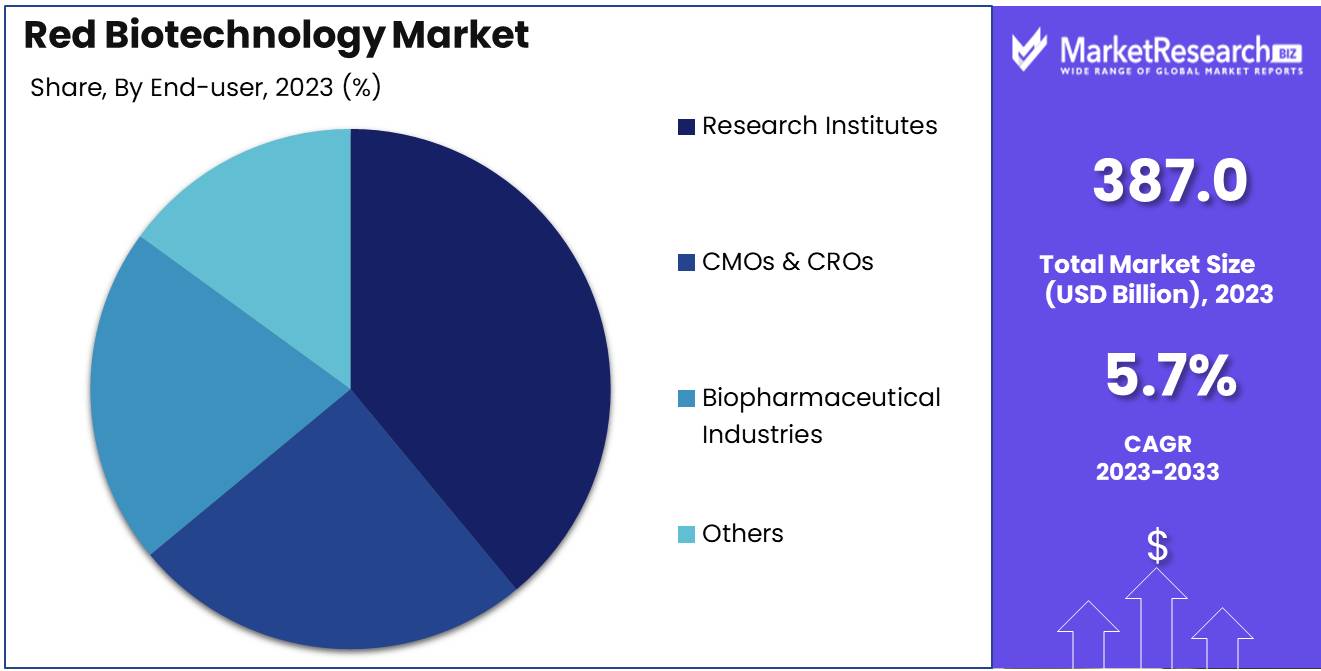

By End-user Analysis

In 2023, Research Institutes dominated the Red Biotechnology Market segment.

In 2023, Research Institutes held a dominant market position in the "By End-user" segment of the red biotechnology market. This preeminence is driven by their extensive involvement in pioneering genetic research, drug development, and innovative therapeutic techniques. Research institutes benefit from substantial funding, both public and private, enabling them to push the boundaries of biotechnology. Additionally, their collaborative efforts with biopharmaceutical industries and academic entities facilitate advanced research and development (R&D) capabilities, accelerating the discovery of novel treatments and biotechnological applications.

Contract manufacturing organizations (CMOs) and contract research organizations (CROs) also play a critical role, leveraging their specialized services to support research institutes and biopharmaceutical companies. Their expertise in clinical trials, regulatory compliance, and large-scale production contributes significantly to the commercialization of biotechnological products.

Biopharmaceutical industries are pivotal in translating research breakthroughs into marketable therapies and driving innovation through substantial R&D investments and strategic partnerships. They are instrumental in advancing personalized medicine and developing targeted treatments.

Lastly, the "Others" category encompasses a diverse range of stakeholders, including healthcare providers, regulatory bodies, and non-profit organizations, all contributing to the dynamic growth and evolution of the red biotechnology market.

Key Market Segments

By Product Type

- Gene Therapy Products

- Cell Therapy Products

- Tissue-Engineered Products

- Biopharmaceutical Production

- Others

By Application

- Pharmacogenomics

- Biopharmaceutical Production

- Gene Therapy

- Genetic Testing

By End-user

- Research Institutes

- CMOs & CROs

- Biopharmaceutical Industries

- Others

Growth Opportunity

Increasing Adoption of Personalized Medicine

The global red biotechnology market is poised for significant growth driven primarily by the increasing adoption of personalized medicine. Personalized medicine tailors treatment to individual patient characteristics, leading to more effective and efficient healthcare solutions. This approach is gaining traction due to its potential to enhance patient outcomes, minimize adverse effects, and optimize therapeutic efficacy.

As healthcare systems worldwide shift towards value-based care, the demand for personalized medicine is expected to surge, providing a substantial growth opportunity for the red biotechnology sector. Companies investing in genomics, proteomics, and bioinformatics are particularly well-positioned to capitalize on this trend, as these fields are integral to the development and implementation of personalized treatment strategies.

Advancements in AI and Big Data Analytics

The integration of artificial intelligence (AI) and big data analytics into red biotechnology is another key driver of market growth. AI and big data analytics facilitate the rapid analysis of large datasets, enabling the identification of complex biological patterns and the acceleration of drug discovery processes. These technologies are transforming how research is conducted, leading to more efficient and cost-effective development of biopharmaceuticals.

In companies leveraging AI and big data will likely gain a competitive edge by speeding up the R&D pipeline, improving diagnostic accuracy, and enhancing patient stratification in clinical trials. The convergence of AI, big data, and red biotechnology is anticipated to unlock new therapeutic avenues and significantly boost market growth.

Latest Trends

Advancements in 3D Printing

The red biotechnology market is poised for significant transformation driven by cutting-edge advancements in 3D printing technology. This innovation is revolutionizing the development and production of biological materials and structures, offering unprecedented precision and customization. In particular, 3D bioprinting is emerging as a game-changer for tissue engineering and regenerative medicine. It allows for the creation of complex tissue structures that closely mimic natural biological environments, enhancing the potential for successful transplantation and reducing reliance on donor organs.

Additionally, 3D printing is streamlining the drug development process by enabling the production of precise, patient-specific dosage forms and drug delivery systems, ultimately accelerating the journey from laboratory research to clinical application.

Growing Demand for Biopharmaceuticals

The demand for biopharmaceuticals is anticipated to surge, driven by their efficacy and specificity in treating a wide array of chronic and complex diseases. Biopharmaceuticals, including monoclonal antibodies, vaccines, and recombinant proteins, offer targeted therapeutic solutions with fewer side effects compared to traditional pharmaceuticals. This trend is fueled by the increasing prevalence of chronic diseases, aging populations, and heightened awareness and accessibility of advanced therapies.

Furthermore, the biopharmaceutical industry is benefiting from regulatory support and significant R&D investments, fostering innovation and expediting the introduction of novel therapies. As a result, companies in the red biotechnology market are focusing on expanding their biopharmaceutical portfolios, optimizing production processes, and enhancing distribution channels to meet growing global demand.

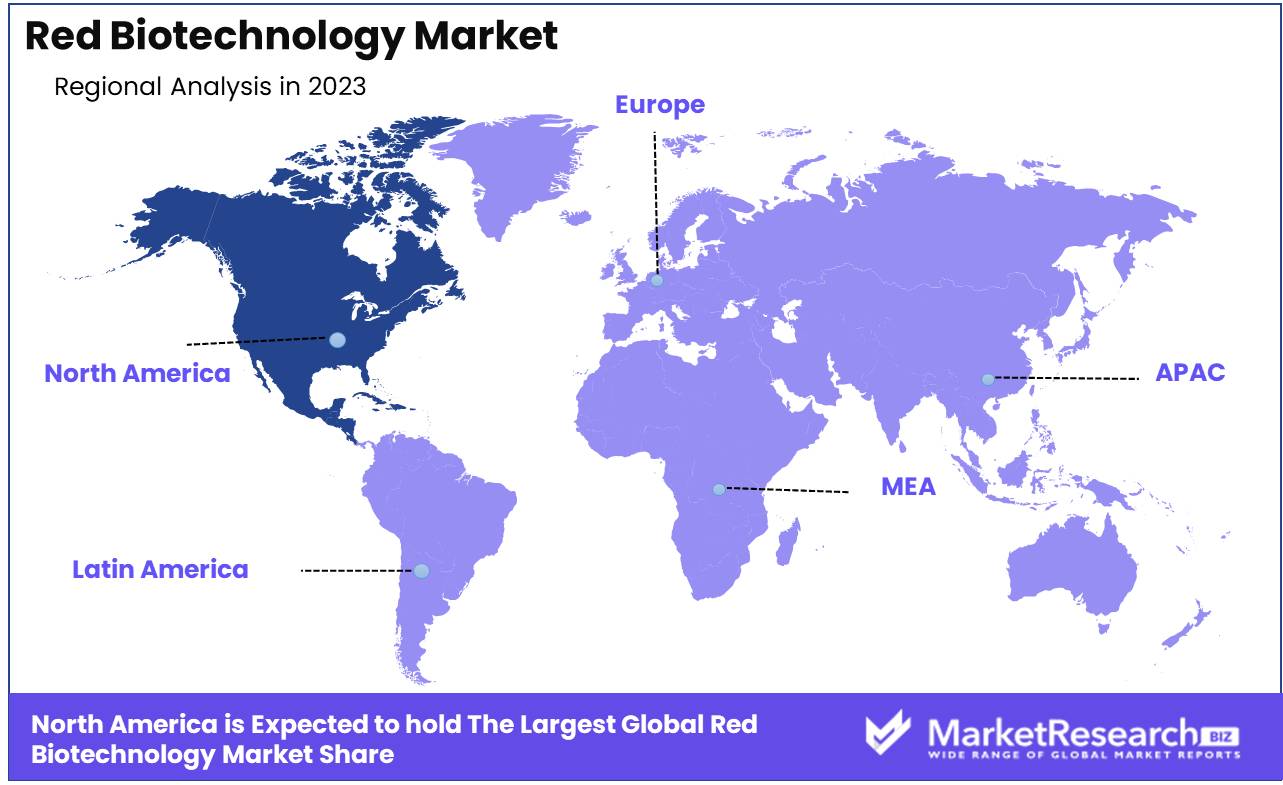

Regional Analysis

North America leads the Red Biotechnology Market with a 45% largest market share.

The global Red Biotechnology Market exhibits significant regional variations, driven by differing levels of technological adoption, healthcare infrastructure, and investment in research and development. North America, particularly the United States, dominates the market with a substantial share of approximately 45%, attributed to its advanced biotechnological research facilities, robust healthcare system, and high expenditure on R&D. The region's leadership is further bolstered by strong government support and well-established pharmaceutical industry.

In Europe, the market is propelled by countries such as Germany, the United Kingdom, and France, which collectively account for a notable market share. Europe benefits from a high level of investment in biotechnology research, favorable regulatory environments, and a collaborative network of academic and research institutions.

The Asia Pacific region is experiencing rapid growth, driven by increasing healthcare expenditure, expanding biotechnological research, and a growing number of biotechnology startups. Key markets include China, India, and Japan, where government initiatives and investments are accelerating market development.

The Middle East & Africa and Latin America regions are emerging markets with significant potential. Growth in these regions is primarily fueled by improving healthcare infrastructure, rising awareness of biotechnological advancements, and increasing investments in the healthcare sector. While these regions currently hold a smaller share compared to North America and Europe, ongoing developments suggest a positive growth trajectory in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global red biotechnology market is poised for significant growth, driven by the continued innovation and strategic positioning of leading companies. Hoffmann-La Roche Ltd. and Merck KGaA remain at the forefront, leveraging robust R&D pipelines and extensive global reach. Roche’s strategic focus on personalized medicine and diagnostics, combined with Merck’s advancements in biopharmaceuticals, solidify their leadership.

Regeneron Pharmaceuticals, Inc. and Pfizer, Inc. continue to excel through groundbreaking biologics and monoclonal antibodies, addressing critical unmet medical needs. Regeneron’s proprietary VelociSuite® technologies and Pfizer’s expansive portfolio, particularly in oncology and immunotherapy, underscore their competitive edge.

Biogen Inc. and Amgen Inc. are pivotal in the neurology and oncology sectors, respectively. Biogen’s commitment to neurodegenerative diseases and Amgen’s innovative cancer treatments highlight their market influence. AstraZeneca Plc. and Takeda Pharmaceutical Company Ltd. enhance their positions through strategic mergers and acquisitions, expanding their therapeutic areas and geographic presence.

Gilead Sciences, Inc. and Celgene Corporation (a Bristol-Myers Squibb company) focus on transformative therapies for viral diseases and hematologic malignancies, respectively. Gilead’s expertise in antiviral therapies and Celgene’s stronghold in hematology reinforce their pivotal roles in the market.

Overall, these companies’ continuous innovation, strategic collaborations, and diversified portfolios drive the red biotechnology market's advancement, promising improved patient outcomes and sustained industry growth.

Market Key Players

- Hoffmann-La Roche, Ltd.

- Merck KGaA

- Regeneron Pharmaceuticals, Inc.

- Pfizer Inc.

- Biogen Inc.

- Amgen Inc.

- AstraZeneca Plc.

- Takeda Pharmaceutical Company Ltd.

- Gilead Sciences, Inc.

- CELGENE CORPORATION

Recent Development

- In March 2024, Merck and Moderna announced a strategic collaboration to develop and commercialize personalized cancer vaccines. This partnership leverages Moderna's mRNA technology and Merck's extensive cancer immunotherapy expertise, aiming to bring innovative cancer treatments to market more rapidly.

- In February 2024, Janssen Pharmaceuticals received FDA approval for CARVYKTI, a BCMA-directed CAR-T cell therapy for patients with relapsed or refractory multiple myeloma. This development highlights the progress in cell therapies within the red biotechnology sector.

- In January 2024, Eli Lilly entered into a research and collaboration agreement with Entos Pharmaceuticals. This partnership, valued at $400 million, focuses on developing nucleic acid-based therapies for neurological conditions using Entos' Fusogenix delivery technology. This agreement is expected to drive significant advancements in therapeutic applications within red biotechnology.

Report Scope

Report Features Description Market Value (2023) USD 387.0 Billion Forecast Revenue (2033) USD 664.4 Billion CAGR (2024-2032) 5.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gene Therapy Products, Cell Therapy Products, Tissue-Engineered Products, Biopharmaceutical Production, Others), By Application (Pharmacogenomics, Biopharmaceutical Production, Gene Therapy, Genetic Testing), By End-user (Research Institutes, CMOs & CROs, Biopharmaceutical Industries, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Hoffmann-La Roche, Ltd., Merck KGaA, Regeneron Pharmaceuticals, Inc., Pfizer Inc., Biogen Inc., Amgen Inc., AstraZeneca Plc., Takeda Pharmaceutical Company Ltd., Gilead Sciences, Inc., CELGENE CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hoffmann-La Roche, Ltd.

- Merck KGaA

- Regeneron Pharmaceuticals, Inc.

- Pfizer Inc.

- Biogen Inc.

- Amgen Inc.

- AstraZeneca Plc.

- Takeda Pharmaceutical Company Ltd.

- Gilead Sciences, Inc.

- CELGENE CORPORATION