Global Ramen Noodles Market Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Others) Flavor (Chicken, Beef, Seafood, Vegetarian, Others) Packaging Type (Packets, Cup/Bowl, Tray, Others) End User (Household, Food Service, Industrial) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

29785

-

Feb 2024

-

158

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Ramen Noodles Market Size, Share, Trends Analysis

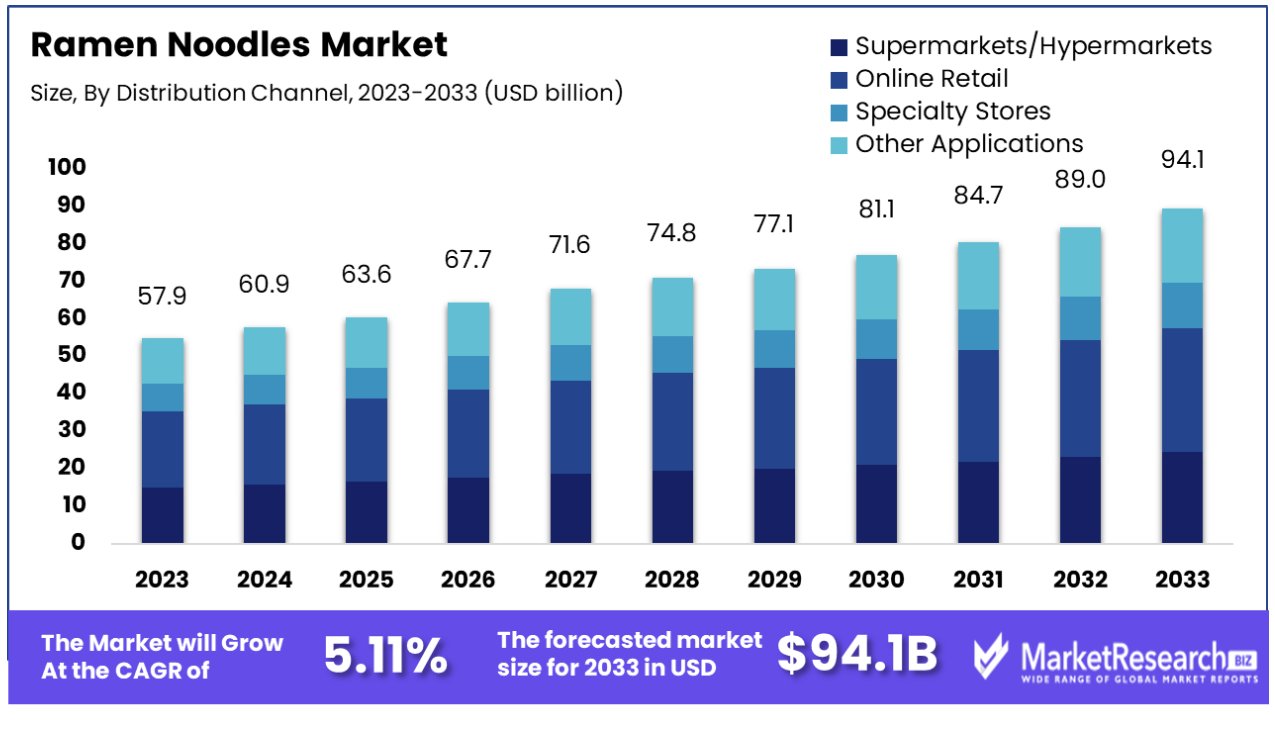

The Ramen Noodles Market was valued at USD 57.92 Billion in 2023. It is expected to reach USD 94.1 Billion by 2033, with a CAGR of 5.11% during the forecast period from 2024 to 2033.

The ramen noodles are Japanese noodles that have become popular globally. They include Chinese-style wheat noodles that are served in a fish or meat-based broth, which are flavored with miso, also called soy sauces, and are topped with food ingredients like sliced pork, green onions, dried seaweeds, and boiled eggs. These ramen come in different flavors and styles and it has transformed into a versatile and diverse food item with various regional changes. Instant ramen noodles are easily accessible and available in pre-packaged form that have also gained much popularity for their quick and easy preparations.

The change in customer preference and rise in health consciousness has made the manufacturers introduce healthy noodles so that they can fulfill the customer’s demand. According to a report published by the world obesity organization in March 2023, the global levels of obesity and overweight suggest that there are more than 4 billion people who may be affected by 2035, as compared with over 2.6 billion in 2020. This also shows a rise in increase from 38% of the world’s population in 2020 to over 50% by 2035. The occurrences of obesity are projected to increase from 14% to 24% of the population over the same period by affecting nearly 2 billion adults and adolescents by 2035. It is also expected to be seen among children and adolescents by increasing from 10% to 20% of global boys during the period from 2020 to 2035 and increasing from 8% to 18% of global girls.

Moreover, according to a report published by Tastewise, there are 2.35% of food restaurants provide ramen noodles in their menus. The dominant diet for ramen noodles is the vegans. Many consumers are searching for innovative food products that can provide nutritional benefits along with a taste that will be good and healthy at the same time. Manufacturers found the potential in the product to be an effective food vehicle to have vitamins, calcium, iron, and other valuable nutrients. Similarly, the manufacturers have launched gluten-free, sun-dried food items and air-fried noodles which are healthy and can fulfill the food cravings of the consumers. These ramen noodles can be personalized and easy to cook. The demand for ramen noodles will increase due to its global popularity among the global populations as well as customer demand which will help in market expansion in the coming years.

Driving Factors

Convenience Propels Ramen Noodle Market Expansion

The evolution of fast-paced lifestyles globally has significantly bolstered the demand for convenient meal solutions, positioning ramen noodles as an indispensable option for consumers seeking quick, effortless nourishment. In 2022, the global consumption of instant noodles soared to a record 121.2 billion servings, evidencing a notable upsurge of approximately 2.6% from the preceding year, as highlighted by the World Instant Noodles Association. This uptick is attributed to shifting dietary preferences, where ramen noodles, with their minimal preparation time, cater adeptly to the accelerated rhythms of contemporary life, underscoring the product's integral role in meeting the modern consumer's culinary exigencies.

Premiumization Elevates Market Prospects

The ramen noodles sector is witnessing a significant shift towards premiumization, with manufacturers introducing gourmet variants that incorporate superior ingredients, authentic flavors, and health-conscious formulations. Nissin Foods USA's 21% revenue growth in 2023 underscores this trend, driven by the launch of premium lines such as GEKI™ and Cup Noodles Breakfast, manifesting consumer readiness to invest in upscale ramen products. This strategic focus on premiumization not only augments profitability but also diversifies the market, offering consumers enhanced choices that transcend traditional expectations.

Customization Enhances Consumer Engagement

The ability to personalize ramen orders, as exemplified by establishments like Ichiran Ramen, introduces a novel dimension to the dining experience, allowing patrons to tailor their meals to their specific preferences. This level of customization enriches the consumer interaction with the product, fostering a deeper connection and satisfaction. The emphasis on individualized culinary experiences reflects a broader industry movement towards accommodating diverse consumer tastes and preferences, further stimulating market growth.

Restraining Factors

Health Concerns Diminish Ramen Noodles Market Appeal

Ramen noodles face significant market resistance due to perceptions of being an unhealthy food choice. High in sodium and often laden with preservatives and monosodium glutamate (MSG), ramen noodles are increasingly scrutinized by health-conscious consumers. This scrutiny is reflected in the dietary choices of a growing segment of the population that prioritizes nutritional value over convenience, leading to a reduction in ramen noodle consumption or a complete avoidance of the product. Such health concerns directly impact the market's growth as consumers look for healthier meal solutions that do not compromise their dietary goals.

Diverse Meal Options Constrain Ramen Noodles Market Growth

The ramen noodles market is further challenged by the competition from a wide array of substitute products. With the availability of convenient meal options such as frozen entrees, instant soups, and a variety of snack foods, consumers have an extensive selection of alternatives. These alternatives not only offer convenience but also frequently present healthier or more varied dietary options compared to traditional ramen noodles. The abundance of choice allows consumers to easily substitute ramen with products that better meet their taste preferences or dietary restrictions, thereby limiting the potential for market expansion within the ramen sector.

Ramen Noodles Market Segmentation Analysis

Distribution Channel Analysis

The Supermarkets/Hypermarkets segment holds the dominant position in the distribution of ramen noodles, serving as the primary retail outlet for consumers seeking convenience and variety. This dominance is attributed to the wide range of product offerings, competitive pricing, and the physical accessibility of these stores to the general population. Supermarkets and hypermarkets offer an extensive selection of ramen noodles across various brands, flavors, and pack sizes, catering to diverse consumer preferences.

Online Retail, Specialty Stores, and other distribution channels also play significant roles in the ramen noodles market but do not match the sheer volume of sales and consumer footfall seen in supermarkets/hypermarkets. Online retail has been growing steadily, driven by the convenience of home delivery and the availability of niche products. Specialty stores cater to consumers looking for gourmet or imported varieties of ramen noodles, offering a curated selection not commonly found in larger retail outlets. Despite their growth, these segments have not yet surpassed the traditional dominance of supermarkets/hypermarkets.

Flavor Analysis

The chicken flavor stands out as the most popular and dominant segment within the ramen noodles market. This preference is largely due to the universal appeal of chicken as a flavor, which resonates with a wide consumer base across different cultural and geographic demographics. Chicken-flavored ramen offers a familiar and comforting taste, making it a staple choice for many consumers.

Other flavors like Beef, Seafood, and Vegetarian also have significant market shares, catering to varied taste preferences. Beef-flavored ramen appeals to those seeking a hearty and robust taste, while Seafood-flavored ramen is preferred by consumers looking for a lighter, umami-rich option. Vegetarian ramen caters to the growing segment of health-conscious and plant-based diet followers, offering alternatives without compromising on flavor. Despite the availability and popularity of these other flavors, Chicken remains the leading choice, underpinned by its broad appeal and established presence in the market.

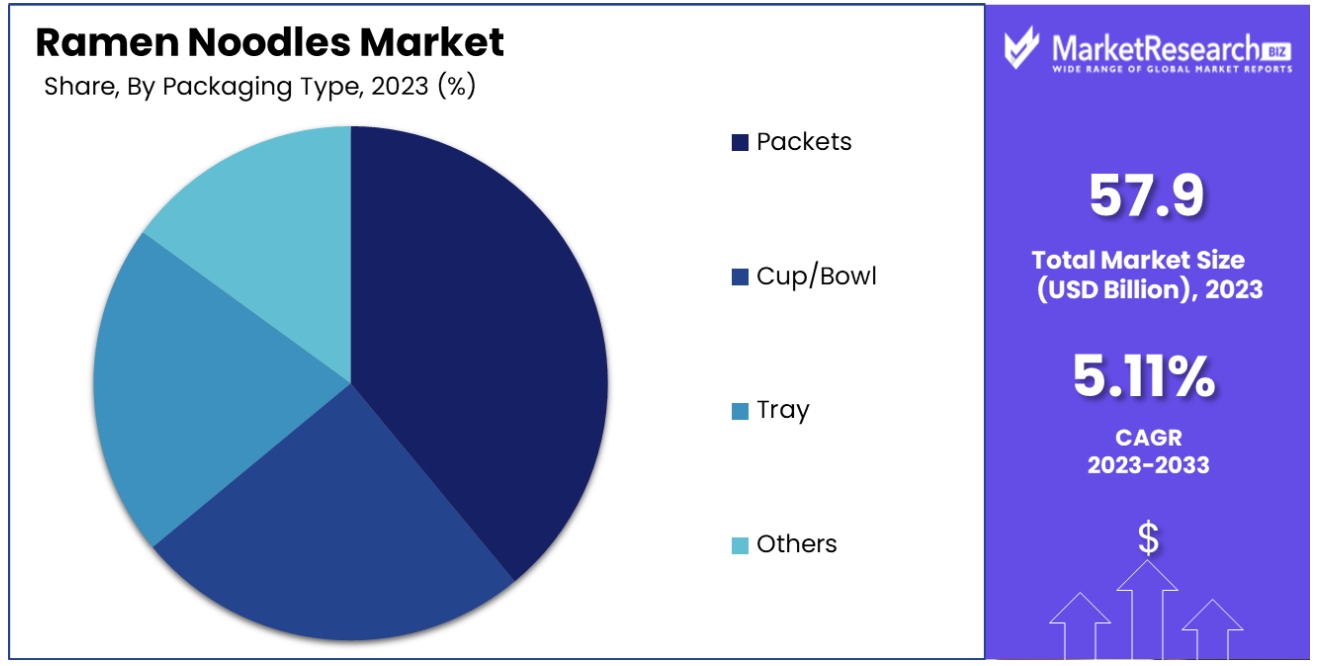

Packaging Type Analysis

Packets have emerged as the dominant packaging type in the ramen noodles market. This dominance is attributed to their affordability, convenience, and wide availability. Packet ramen offers consumers a quick and easy meal solution that aligns with the fast-paced lifestyles of many individuals. The packaging’s lightweight nature and compact design also facilitate easy storage and transport, making it a favored choice for both households and food service providers.

Cup/Bowl, Tray, and other packaging types like bulk packages serve specific consumer needs and preferences. Cup or Bowl ramen provides the added convenience of serving as both the packaging and the eating vessel, appealing to those with on-the-go lifestyles or limited access to kitchen facilities. Tray ramen typically targets the food service sector, offering a ready-to-serve option that reduces preparation time. Despite the practical advantages of these alternative packaging forms, Packets retain their position as the market leader due to their universal appeal, cost-effectiveness, and entrenched consumer habits.

End User Analysis

The Household segment is the primary end-user of ramen noodles, underscoring the product's role as a staple food item in domestic settings. Households favor ramen noodles for their convenience, affordability, and ease of preparation, making them a popular choice for quick meals, snacks, and even creative home-cooked dishes. The versatility of ramen noodles, complemented by the variety of flavors and packaging options, enhances their appeal to a broad range of consumers, from students to busy families.

The Food Service and Industrial segments also contribute to the consumption of ramen noodles but to a lesser extent compared to the household segment. Food service establishments, including restaurants and cafeterias, incorporate ramen noodles into their menu offerings, capitalizing on the growing consumer interest in Asian cuisine and noodle-based dishes. The industrial segment, though smaller, includes the use of ramen noodles in ready-to-eat meals and other processed food products. Despite the significant roles these segments play, the household segment's dominance is anchored by the widespread and everyday consumption of ramen noodles within domestic environments.

Ramen Noodles Industry Segments

Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Specialty Stores

- Others

Flavor

- Chicken

- Beef

- Seafood

- Vegetarian

- Others

Packaging Type

- Packets

- Cup/Bowl

- Tray

- Others

End User

- Household

- Food Service

- Industrial

Ramen Noodles Market Growth Opportunities

Innovative Flavors: A Growth Opportunity in the Ramen Noodles Market

The introduction of innovative flavors is a key driver for expansion in the ramen noodles market. Brands like Nissin Cup Noodle are leading the charge with unique flavor combinations such as seafood, imitation crab meal, pork stock, green onion, scrambled eggs, miso soup, and European cheese curry. These novel offerings cater to the evolving consumer demand for variety and gourmet experiences within the convenience food sector. By stepping beyond traditional flavors to embrace global culinary trends, ramen noodle brands can attract a broader consumer base, including those in search of new taste experiences and culinary adventures, thereby expanding market reach and consumer engagement.

Packaging Innovations: Enhancing Consumer Convenience in the Ramen Noodles Market

Packaging innovations represent a significant growth opportunity in the ramen noodles market. The development of on-the-go friendly cups with easy peel lids and microwavable bowls directly addresses consumer needs for convenience and ease of preparation. This evolution in packaging not only enhances the product's appeal to a wider audience, including busy professionals, students, and families seeking quick meal solutions but also positions ramen as a versatile option for various consumption scenarios. By prioritizing convenience and adaptability in packaging, ramen noodle brands can increase product accessibility and consumption frequency, contributing to market growth and consumer satisfaction.

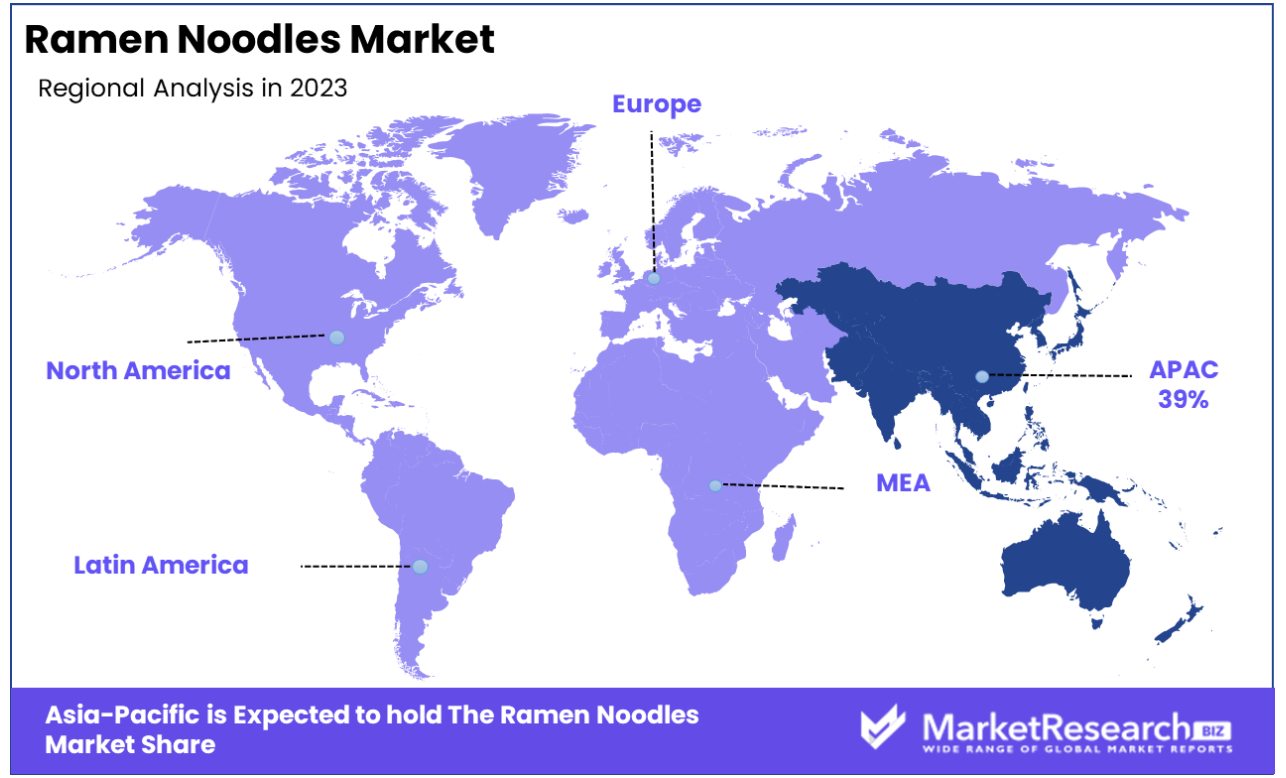

Ramen Noodles Market Regional Analysis

Asia Pacific Dominates with a 39% Market Share

The Asia Pacific's commanding 39% share in the global ramen noodles market can be attributed to a confluence of cultural, economic, and industrial dynamics. Predominantly, the intrinsic cultural affinity for ramen across countries like Japan, South Korea, and China sets a robust foundation for consumer demand. Economically, the region's burgeoning middle class, with increasing disposable incomes, is more inclined towards convenient, yet culturally resonant food options. Industrially, Asia Pacific benefits from a matured ramen manufacturing ecosystem, characterized by extensive distribution networks and innovative product offerings that cater to local tastes and preferences.

The market dynamics within the Asia Pacific are heavily influenced by the region's demographic trends and urbanization patterns. Rapid urbanization has led to a lifestyle that favors convenience, making instant ramen a staple for the fast-paced life of urban dwellers. Furthermore, the region's dominance is bolstered by extensive research and development activities aimed at product diversification, including health-oriented ramen options, which appeal to a broader consumer base. These factors, combined with strong retail and online distribution channels, ensure the Asia Pacific's continued leadership in the market.

North America: A Growing Appetite for Convenience

North America, with its increasing multicultural population, has shown a growing appetite for ramen, reflecting a diversification in consumer food preferences. The region's market share is bolstered by the rising trend of premiumization of ramen products, with consumers willing to pay more for gourmet, healthier options. The strong presence of Asian diasporas also contributes to the steady demand. However, the region faces challenges in market penetration and competition with local convenience food products.

Europe: Culturally Curious, Health-Conscious Consumers

In Europe, the ramen noodles market is expanding, driven by a growing curiosity about Asian cultures and cuisines among European consumers. This has led to an increased demand for authentic, high-quality ramen products. Additionally, the region's strong focus on health and wellness has spurred the introduction of organic and vegan ramen options, catering to a health-conscious consumer base. However, the market's growth is tempered by the need for cultural adaptation and competition with traditional European convenience foods.

Ramen Noodles Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Ramen Noodles Market Competitive Analysis

The ramen noodles market, a dynamic and culturally rich segment of the global food industry, is dominated by several pivotal companies that have significantly influenced both consumer preferences and the industry's evolution.

Nissin Foods, widely recognized as the pioneer of instant ramen, continues to lead with innovative flavors and packaging, appealing to a broad international audience. Maruchan follows closely, with its extensive product range catering to the American market's taste preferences, emphasizing convenience and variety.

Samyang Foods, known for its fiery "Hot Chicken Flavor Ramen," has successfully capitalized on the global trend towards spicier foods, while Nongshim has solidified its position through premium offerings that emphasize Korean flavors, appealing to consumers seeking authentic Asian cuisine.

Ramen Noodles Industry Key Players

- Nissin Foods

- Maruchan

- Samyang Foods

- Nongshim

- Ottogi

- Sapporo Ichiban

- Indomie

- Myojo

- Acecook

- Koka

- Mama

- Vedan

- Paldo

- Bachelors

- Nissin-Universal Robina Corporation

Ramen Noodles Market Recent Development

- In Sept 2023, CG Foods, a company that manufactures instant noodles in Nepal invested more than USD 16.93 million to support capacities to increase in India. The company has production facilities situated in Guwahati, Ajmer, and Andhra Pradesh.

- In Feb 2023, Marico Limited, an Indian multinational manufacturer of consumer goods was the first to enter the instant noodles space with the launch of "Saffola Oodles." The company initially offered the products on e-commerce platforms such as Saffola Stores, Amazon, Flipkart, BigBasket, and Grofers throughout India.

Report Scope

Report Features Description Market Value (2023) USD 57.92 Billion Forecast Revenue (2033) USD 80.29 Billion CAGR (2024-2032) 5.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Specialty Stores, Others) Flavor (Chicken, Beef, Seafood, Vegetarian, Others) Packaging Type (Packets, Cup/Bowl, Tray, Others) End User (Household, Food Service, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Nissin Foods, Maruchan, Samyang Foods, Nongshim, Ottogi, Sapporo Ichiban, Indomie, Myojo, Acecook, Koka, Mama, Vedan, Paldo, Bachelors, Nissin-Universal Robina Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Nissin Foods

- Maruchan

- Samyang Foods

- Nongshim

- Ottogi

- Sapporo Ichiban

- Indomie

- Myojo

- Acecook

- Koka

- Mama

- Vedan

- Paldo

- Bachelors

- Nissin-Universal Robina Corporation