Railcar Leasing Market By Railcar Type (Hopper Cars, Boxcars, Tank Cars, Flat Cars, Gondolas, Refrigerated Box Cars, Others), By Leasing Type (Full-Service Leasing, Finance Leasing, Operating Leasing), By End Use Industry (Chemical Products, Agriculture & Food Products, Automotive, Mining, Energy & Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

28253

-

July 2024

-

159159159159159143792640

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

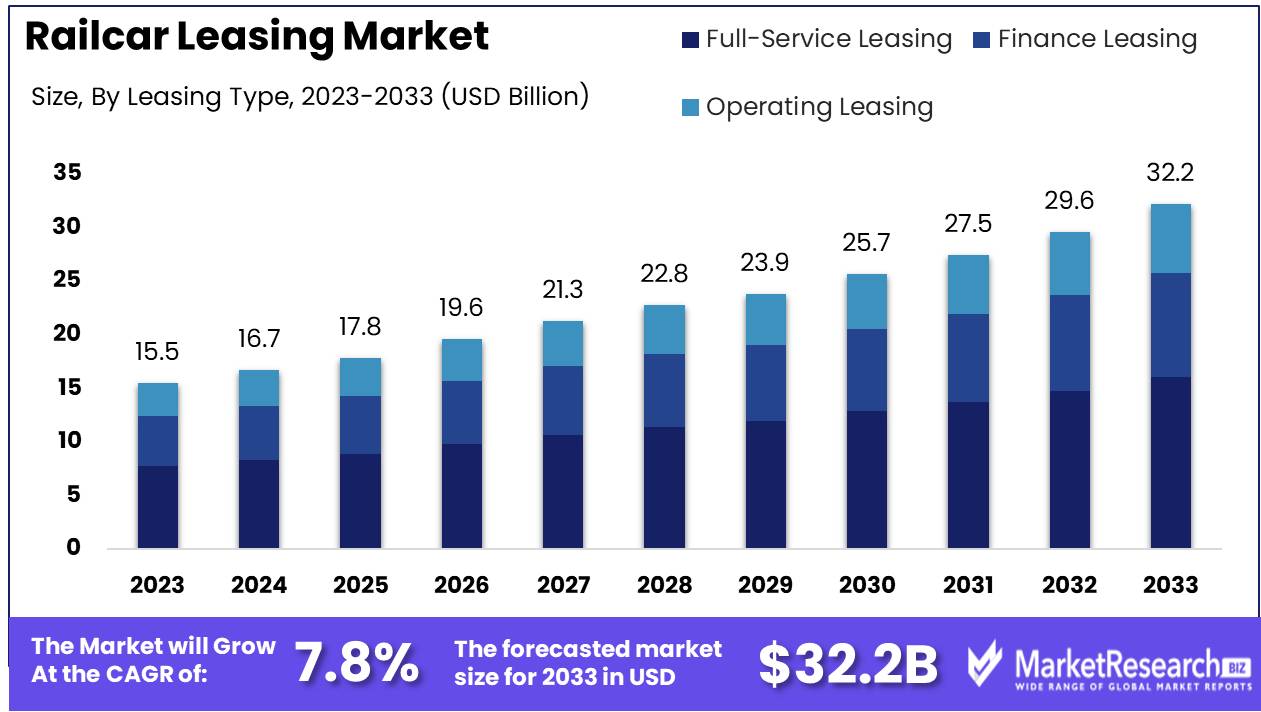

The Global Railcar Leasing Market was valued at USD 15.5 Bn in 2023. It is expected to reach USD 32.2 Bn by 2033, with a CAGR of 7.8% during the forecast period from 2024 to 2033.

The railcar leasing market involves the rental of railcars by companies to transport goods and materials across rail networks. Leasing railcars provides flexibility and cost efficiency, allowing companies to access a diverse range of railcar types without the capital expenditure of ownership. This market includes various railcar types such as tank cars, boxcars, flatcars, and hopper cars, catering to industries like oil and gas, agriculture, chemicals, and manufacturing. Growth in this market is driven by increasing rail freight activity, advancements in railcar technology, and a focus on operational efficiency and regulatory compliance.

The railcar leasing market is positioned for steady growth, driven by increasing demand for rail freight transportation and the need for operational flexibility. The capital-intensive nature of railcar ownership makes leasing an attractive option for companies seeking to optimize their logistics and supply chain operations without incurring substantial upfront costs. This trend is particularly prominent in industries such as oil and gas, agriculture, and chemicals, which require specialized railcar types for their diverse transportation needs.

Technological advancements are significantly shaping the market landscape. GATX Corporation, a leading player in the railcar leasing industry, has equipped over 75% of its leased fleet with IoT-enabled telematics and monitoring systems. These systems enhance real-time tracking, maintenance scheduling, and operational efficiency. Similarly, Chicago Freight Car Leasing has integrated advanced security features and monitoring systems in 90% of its railcars, underscoring a broader industry shift towards enhanced safety and regulatory compliance.

The integration of these advanced technologies not only improves the operational reliability of leased railcars but also aligns with the growing regulatory requirements for safety and environmental standards. Companies in the railcar leasing market must therefore prioritize technological innovation and regulatory compliance to maintain competitive advantage.

Strategically, expanding service offerings to include comprehensive fleet management solutions can provide additional value to clients. Partnerships with technology providers and rail operators can further enhance service capabilities and market reach. Additionally, investing in sustainable and energy-efficient railcar designs can meet the increasing demand for environmentally responsible transportation solutions.

Key Takeaways

- Market Value: The Global Railcar Leasing Market was valued at USD 15.5 Bn in 2023. It is expected to reach USD 32.2 Bn by 2033, with a CAGR of 7.8% during the forecast period from 2024 to 2033.

- By Railcar Type: Tank Cars make up 30% of the market, essential for transporting liquids and gases.

- By Leasing Type: Full-Service Leasing accounts for 50%, offering maintenance and management services, enhancing convenience for lessees.

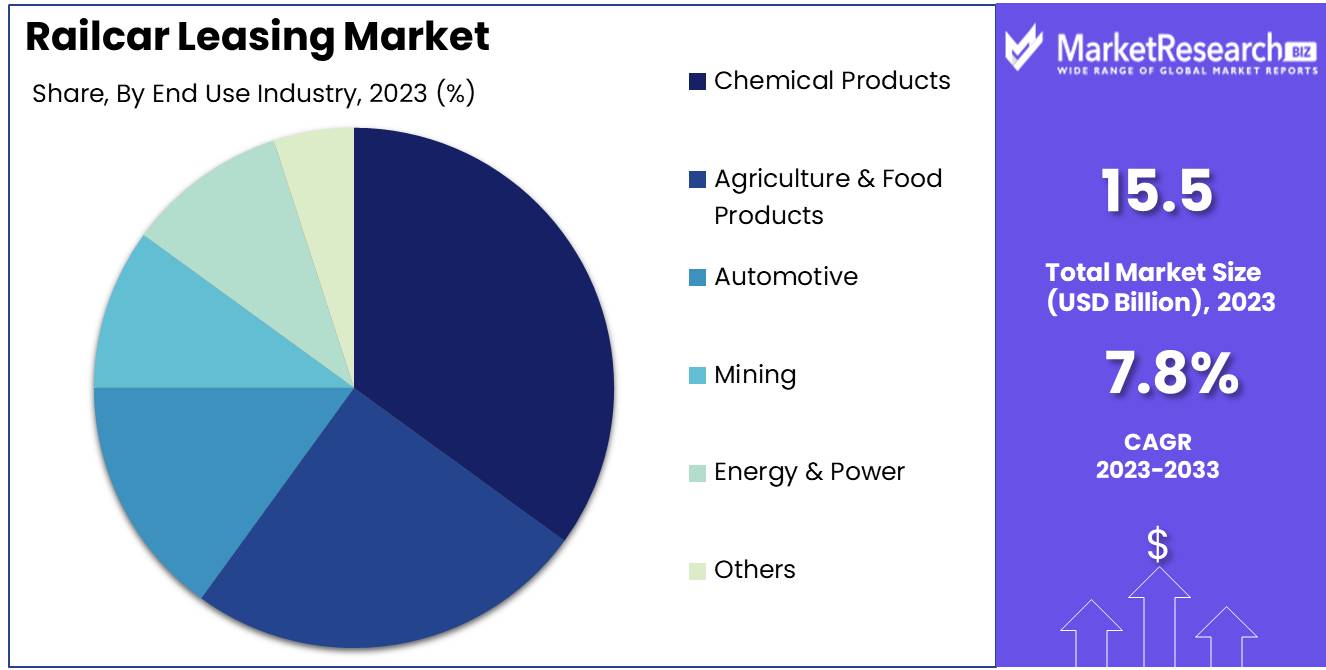

- By End Use Industry: Chemical Products are the top industry served, comprising 35%, due to the need for specialized transport solutions.

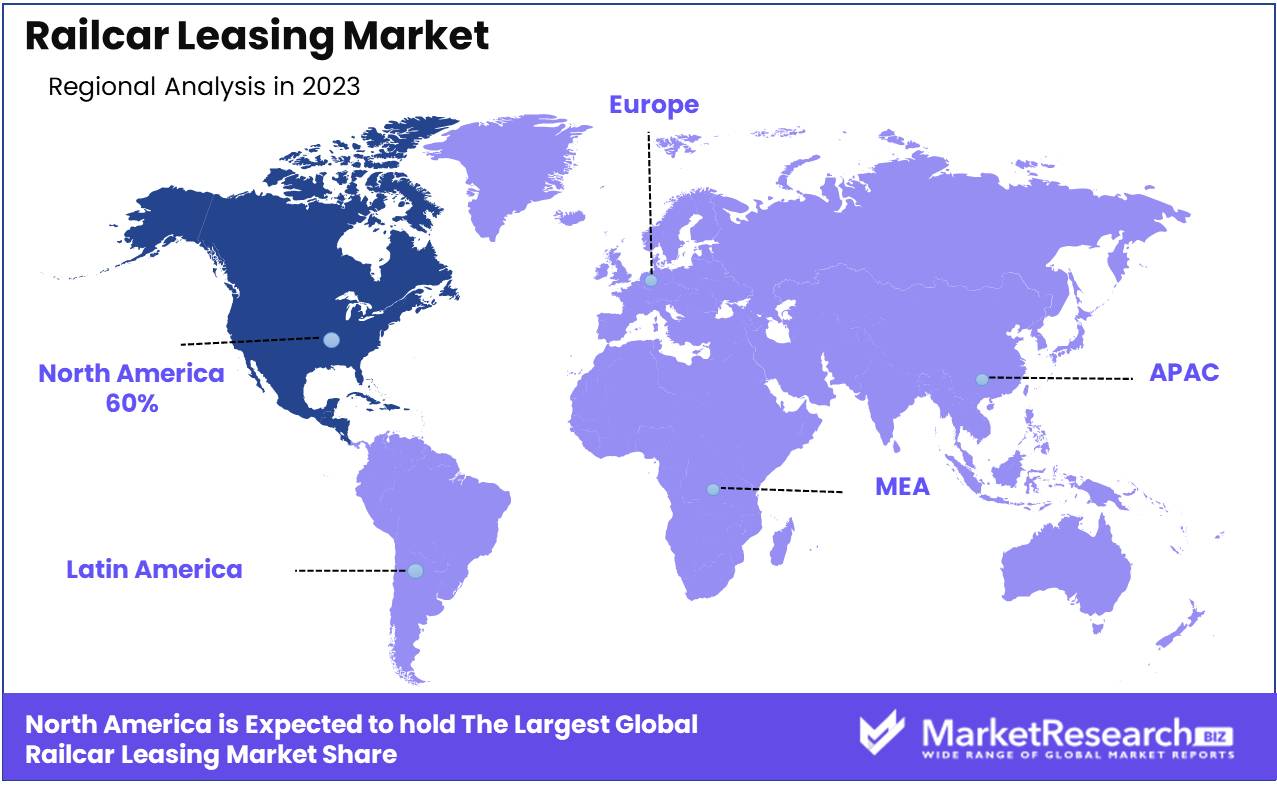

- Regional Dominance: North America dominates with 60%, supported by a large chemical manufacturing sector and extensive rail infrastructure.

- Growth Opportunity: Expanding shale gas production and the chemical sector in emerging markets could drive further demand for leased railcars.

Driving factors

Increasing Demand for Rail Transportation

The growing demand for rail transportation is a key driver for the global rail freight market. Rail transportation offers a reliable and efficient means of moving large volumes of goods over long distances. With increasing urbanization and industrialization, there is a heightened need for robust transportation networks. According to recent statistics, rail freight accounts for approximately 30% of the total freight transportation globally, emphasizing its critical role in the supply chain. This demand is expected to rise as businesses seek cost-effective and efficient logistics solutions.

Growth in the Logistics and Supply Chain Industry

The expansion of the logistics and supply chain industry significantly boosts the rail freight market. As global trade volumes increase, there is a parallel need for efficient and reliable freight services. The logistics sector is driven by e-commerce, manufacturing, and international trade. Rail freight provides a vital link in the supply chain, ensuring timely delivery of goods and reducing bottlenecks, thus facilitating smoother trade flows and market growth.

Rising Emphasis on Cost-Effective Freight Solutions

Businesses are increasingly focusing on cost-effective freight solutions to enhance their competitiveness. Rail freight is often more economical compared to other modes of transportation, especially for bulk goods over long distances. It offers lower fuel costs, higher capacity, and reduced environmental impact. The rising fuel prices and the push for sustainable logistics are further propelling the demand for rail freight as a cost-efficient and environmentally friendly alternative, driving market growth.

Restraining Factors

High Initial Investment Costs

The high initial investment costs associated with rail infrastructure and rolling stock are significant barriers to market growth. Establishing new rail lines, upgrading existing tracks, and purchasing railcars require substantial capital expenditure. This financial burden can deter new entrants and limit expansion efforts, particularly in regions with limited financial resources.

Stringent Regulatory Requirements

The rail freight industry is subject to stringent regulatory requirements that can impede market growth. These regulations ensure safety, environmental protection, and fair competition but can also result in lengthy approval processes and additional compliance costs. Navigating the complex regulatory landscape requires significant investment in legal and administrative resources, posing a challenge for market participants.

By Railcar Type Analysis

Tank Cars dominated the By Railcar Type segment of the Railcar Leasing Market in 2023, capturing more than a 30% share.

In 2023, Tank Cars held a dominant market position in the By Railcar Type segment of the Railcar Leasing Market, capturing more than a 30% share. The significant market share is driven by the extensive use of tank cars for transporting a variety of liquid and gaseous commodities, including chemicals, petroleum products, and liquefied gases. Tank cars are preferred for their ability to safely and efficiently transport hazardous and non-hazardous materials across long distances.

Hopper Cars are also vital in the railcar leasing market, particularly for transporting bulk commodities such as grains, coal, and fertilizers. Their market share, however, is smaller compared to tank cars due to the more specialized and varied nature of the goods transported in tank cars.

Boxcars are essential for shipping a wide range of general cargo, including manufactured goods and packaged products. While versatile, their market share is less dominant than tank cars due to competition from other transportation modes like trucking for certain cargo types.

Flat Cars are used for transporting oversized and heavy goods, such as machinery and construction materials. Despite their importance in specific sectors, their market share is smaller compared to tank cars because of their more limited application.

Gondolas are utilized for carrying bulk materials like scrap metal, aggregates, and waste. Their market share is relatively modest due to the niche nature of their cargo and the competition from other specialized railcar types.

Refrigerated Box Cars are critical for transporting perishable goods that require temperature control. Although essential for the food and pharmaceutical industries, their market share is smaller compared to tank cars due to the specific requirements and limited volume of perishable goods transported by rail.

Others include specialized railcars designed for specific purposes, which collectively hold a smaller market share due to their specialized and limited use cases.

By Leasing Type Analysis

Full-Service Leasing dominated the By Leasing Type segment of the Railcar Leasing Market in 2023, capturing more than a 50% share.

In 2023, Full-Service Leasing held a dominant market position in the By Leasing Type segment of the Railcar Leasing Market, capturing more than a 50% share. This dominance is attributed to the comprehensive benefits it offers, including maintenance, repair, and operational support, which appeal to lessees looking for hassle-free and cost-effective railcar management solutions. Full-service leasing allows companies to focus on their core operations without the burden of managing railcar maintenance and regulatory compliance, driving its widespread adoption and substantial market share.

Finance Leasing provides an option for companies to lease railcars with the eventual intention of ownership. While attractive for some businesses looking to acquire assets over time, its market share is smaller compared to full-service leasing due to the higher financial commitment and responsibility for maintenance falling on the lessee.

Operating Leasing offers flexibility with shorter-term agreements and the option to return the railcars at the end of the lease term. This leasing type appeals to companies with fluctuating transportation needs. However, its market share is less than full-service leasing because it does not include the extensive support services that many businesses find beneficial in full-service agreements.

By End Use Industry Analysis

Chemical Products dominated the By End Use Industry segment of the Railcar Leasing Market in 2023, capturing more than a 35% share.

In 2023, Chemical Products held a dominant market position in the By End Use Industry segment of the Railcar Leasing Market, capturing more than a 35% share. The substantial market share is driven by the high volume of chemical goods requiring safe and efficient transportation. Railcars, particularly tank cars, are essential for moving large quantities of chemicals, ensuring compliance with stringent safety regulations, and minimizing the risk of spills and contamination. The continuous growth in the chemical industry, coupled with the expansion of global trade, reinforces the leading position of chemical products in the railcar leasing market.

Agriculture & Food Products also represent a significant segment, with a need for railcars to transport bulk grains, fertilizers, and perishable goods. The market share for this segment, while substantial, is smaller than that of chemical products due to the seasonal nature of agricultural transportation and the diversity of food products requiring different railcar types.

Automotive industry relies on railcar leasing for the transport of vehicles and parts. Despite its importance, the market share is lower compared to chemical products due to the specific logistics needs and the higher frequency of using other transportation modes like trucks.

Mining sector uses railcars for transporting ores, coal, and minerals. The market share for mining is relatively modest due to the niche nature of the industry and the competition from bulk shipping methods like conveyor belts and barges.

Energy & Power industry demands railcar leasing primarily for transporting fuels and raw materials for power generation. While crucial, its market share is less dominant compared to chemical products because of the more specialized and region-specific needs of the energy sector.

Others include various industries that utilize railcar leasing for different transportation needs. This category holds a smaller market share due to the diverse and specialized nature of their requirements.

Key Market Segments

By Railcar Type

- Hopper Cars

- Boxcars

- Tank Cars

- Flat Cars

- Gondolas

- Refrigerated Box Cars

- Others

By Leasing Type

- Full-Service Leasing

- Finance Leasing

- Operating Leasing

By End Use Industry

- Chemical Products

- Agriculture & Food Products

- Automotive

- Mining

- Energy & Power

- Others

Growth Opportunity

Development of Specialized Railcars for Diverse Industries

The development of specialized railcars tailored to the needs of various industries presents a significant growth opportunity. Industries such as chemicals, automotive, and agriculture have specific requirements for freight transportation. Customized railcars that cater to these needs can enhance efficiency and safety, making rail freight a more attractive option. This specialization can open new market segments and drive growth by providing tailored solutions for different sectors.

Advancements in Railcar Tracking and Management Technologies

Advancements in railcar tracking and management technologies offer promising opportunities for the rail freight market. Modern tracking systems provide real-time data on railcar location, status, and cargo conditions. These technologies enhance operational efficiency, reduce delays, and improve supply chain visibility. The integration of advanced tracking and management systems can lead to optimized chemical logistics operations, higher customer satisfaction, and increased market share for rail freight operators.

Latest Trends

Integration of IoT for Real-Time Monitoring

The integration of the Internet of Things (IoT) for real-time monitoring is a key trend shaping the rail freight market. IoT devices can provide continuous tracking of railcars, monitor cargo conditions, and predict maintenance needs. This real-time data enhances operational efficiency, reduces downtime, and improves cargo security. The adoption of IoT in rail freight is expected to revolutionize the industry by enabling more proactive and responsive logistics management, driving market growth.

Adoption of Sustainable and Energy-Efficient Railcars

The adoption of sustainable and energy-efficient railcars is another important trend in the rail freight market. With increasing environmental regulations and a global push towards sustainability, there is a growing demand for greener transportation solutions. Energy-efficient railcars that reduce fuel consumption and emissions are becoming more prevalent. These innovations not only help meet regulatory requirements but also appeal to environmentally conscious customers, positioning rail freight as a sustainable alternative and driving market growth.

Regional Analysis

North America dominated the Railcar Leasing Market in 2023, capturing 60% of the market share.

In 2023, North America held a dominant position in the Railcar Leasing Market, capturing a substantial 60% share. This dominance is driven by the extensive rail network and the high demand for freight transportation across the United States and Canada. The region's strong industrial base, particularly in sectors such as chemicals, agriculture, and energy, drives the need for specialized railcars, making leasing an attractive option for many companies.

Europe holds a significant market share in the railcar leasing sector, driven by the region's extensive rail infrastructure and the increasing emphasis on sustainable and efficient freight transport. Europe’s market share is smaller compared to North America due to regional economic disparities and varying levels of investment in rail infrastructure.

Asia Pacific is experiencing rapid growth in the railcar leasing market, fueled by the expanding industrial base and the increasing focus on enhancing logistics and transportation efficiency. Despite this growth, the market share in Asia Pacific remains developing compared to the established markets in North America and Europe.

Middle East & Africa show promising potential in the railcar leasing market, supported by increasing investments in rail infrastructure and the need for efficient transportation solutions in the energy and mining sectors. The region's market growth is driven by economic diversification efforts and the development of rail networks to support industrial activities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The railcar leasing market in 2024 is influenced by increasing global trade, industrial output, and the need for efficient freight transportation. Key players in this market include Berkshire Hathaway, Inc. (ULTX), Wells Fargo, Sumitomo Mitsui Financial Group, Inc., Trinity Industries, Inc. (TrinityRail), VTG, GATX Corp, CIT Group Inc., American Railcar Industries, Inc., and Chicago Freight Car Leasing Co.

Berkshire Hathaway, Inc. (ULTX) maintains a strong position in the railcar leasing market through strategic investments and a diversified portfolio. Their extensive fleet and commitment to service excellence ensure their leadership in the industry.

Wells Fargo, with its robust financial services background, provides comprehensive leasing solutions that cater to a wide range of industries. Their financial strength and expertise enable them to offer competitive leasing terms.

Sumitomo Mitsui Financial Group, Inc. leverages its global financial network to provide flexible and reliable railcar leasing options. Their focus on customer-centric solutions drives their market presence.

Trinity Industries, Inc. (TrinityRail) is a key player known for its extensive manufacturing capabilities and leasing services. Their integrated approach ensures a seamless experience for clients, from production to leasing.

VTG is a leading player in the European market, offering a wide range of railcar leasing and logistics solutions. Their focus on innovation and sustainability positions them well in a market increasingly conscious of environmental impacts.

GATX Corp stands out with its global presence and diverse fleet. Their emphasis on high-quality service and maintenance ensures long-term client relationships and market trust.

CIT Group Inc. provides tailored leasing solutions that meet specific client needs. Their expertise in financial services and asset management enhances their competitive edge in the railcar leasing market.

American Railcar Industries, Inc. offers comprehensive leasing and repair services, ensuring optimal performance and reliability of their railcars. Their focus on customer satisfaction drives their market success.

Chicago Freight Car Leasing Co. specializes in flexible and cost-effective leasing solutions, catering to various industries. Their commitment to innovation and customer service supports their strong market position.

Market Key Players

- Berkshire Hathaway, Inc (ULTX)

- Wells Fargo

- Sumitomo Mitsui Financial Group, Inc.

- Trinity Industries, Inc. (TrinityRail)

- VTG

- GATX Corp

- CIT Group Inc.

- American Railcar Industries, Inc.

- Chicago Freight Car Leasing Co.

- Others

Recent Development

- In May 2024, VTG AG introduced a digital platform for enhanced railcar leasing management, improving operational efficiency and customer service.

- In April 2024, American Railcar Industries entered into a long-term leasing agreement with a major logistics company, increasing its market presence.

Report Scope

Report Features Description Market Value (2023) USD 15.5 Bn Forecast Revenue (2033) USD 32.2 Bn CAGR (2024-2033) 7.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Railcar Type (Hopper Cars, Boxcars, Tank Cars, Flat Cars, Gondolas, Refrigerated Box Cars, Others), By Leasing Type (Full-Service Leasing, Finance Leasing, Operating Leasing), By End Use Industry (Chemical Products, Agriculture & Food Products, Automotive, Mining, Energy & Power, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Berkshire Hathaway, Inc (ULTX), Wells Fargo, Sumitomo Mitsui Financial Group, Inc., Trinity Industries, Inc. (TrinityRail), VTG, GATX Corp, CIT Group Inc., American Railcar Industries, Inc., Chicago Freight Car Leasing Co., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Berkshire Hathaway, Inc (ULTX)

- Wells Fargo

- Sumitomo Mitsui Financial Group, Inc.

- Trinity Industries, Inc. (TrinityRail)

- VTG

- GATX Corp

- CIT Group Inc.

- American Railcar Industries, Inc.

- Chicago Freight Car Leasing Co.

- Others