Pruritus Therapeutics Market Report By Disease Type (Atopic Dermatitis, Allergic Contact Dermatitis, Urticaria), By Product (Corticosteroids, Antihistamines), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

41673

-

Oct 2023

-

153

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

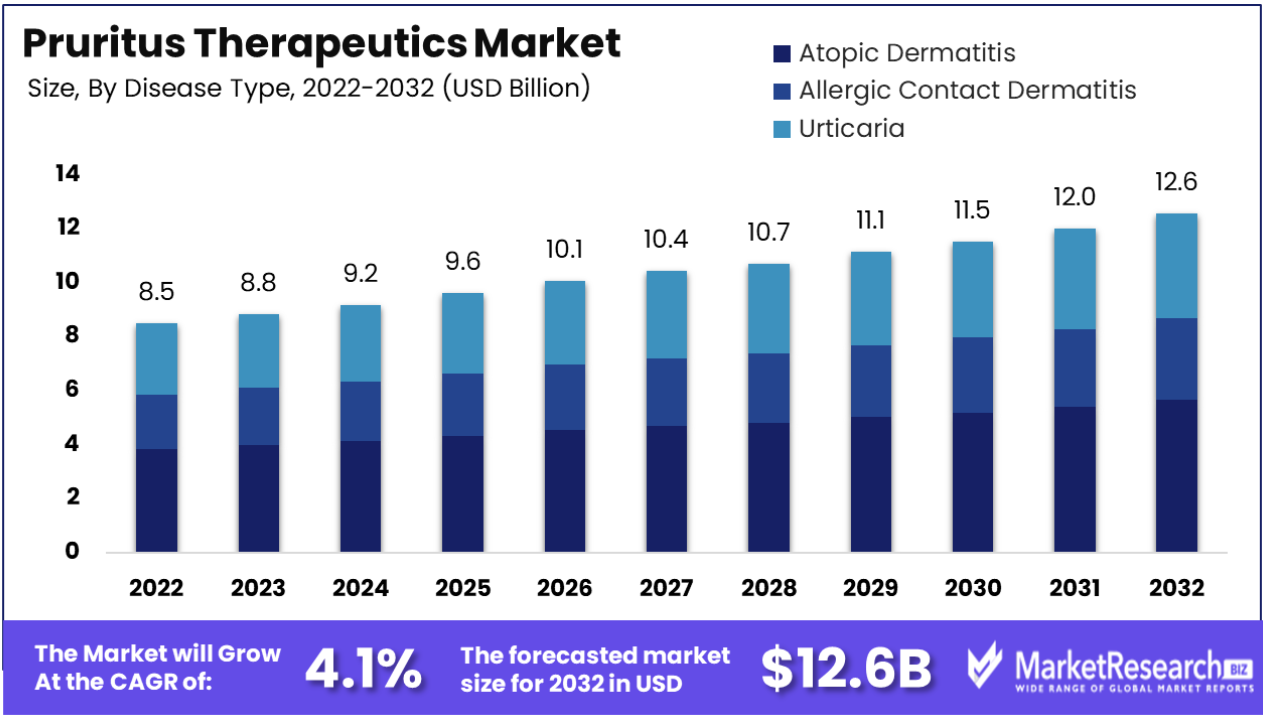

The global pruritus therapeutics market size was estimated at USD 8.5 billion in 2022 and is anticipated to grow at a CAGR of 4.1% from 2023 to 2032. It will be valued at USD 12.6 billion by 2032

The prevalence of pruritus-related diseases like atopic dermatitis, urticaria, and psoriasis is expected to increase, which will have a substantial impact on the market. In addition, there are significant unmet medical needs, and the upcoming introduction of specialized goods to meet these needs are expected to spur future growth.

Infections and eczema accounted for the majority of the 20% of skin ailments suffered by Indians in 2020, according to an IJCM study. In addition, a research published in the Life (Basel) Journal in 2021 found that 34% of Swedish children had atopic dermatitis. Given that pruritus frequently coexists with atopic dermatitis and eczema, the high prevalence of these skin disorders is predicted to increase demand for pruritus treatments.

Additionally, the market is expanding as a result of technological developments, a rise in product approvals, and strategic alliances and acquisitions by important market participants. For instance, in August 2022, Maruho Co. Ltd, a subsidiary of Chugai Pharmaceutical Co. Ltd, unveiled Mitchga, a monoclonal antibody against the IL-31 receptor that is injected subcutaneously to treat atopic dermatitis-related itching. In May 2022, Mitchga was added to the national health insurance (NHI) reimbursement price list after receiving clearance from the Ministry of Health, Labour, and Welfare (MHLW) in March 2022. In the upcoming year, pruritus treatments are expected to become more and more popular due to these advances in research and development.

Initial stages of the COVID-19 pandemic had a detrimental impact on the market, due to widespread cancellations of elective procedures for pruritus treatment that significantly impaired market performance. This impact could be seen across various healthcare specialties - dermatology particularly where managing skin conditions like Urticaria presented unique challenges during this pandemic period. However as healthcare facilities gradually resumed operations and research and development efforts for innovative pruritus therapeutics resumed globally, market momentum slowly began regaining strength again.

Driving Factors

Modernized Methods of Treatment

Highly effective solutions for managing pruritus are provided by cutting-edge therapy techniques such biologics and targeted treatments. Patients with chronic illnesses like atopic dermatitis and psoriasis often find relief from their itching thanks to these treatments, which directly address the underlying causes of the condition.

Research and Development Activities are Expanding

Growing research and development spending results in the identification of cutting-edge pruritus treatments. As a result, there are now more alternatives for treating various types of pruritus and patient demographics, which may lead to more individualized care.

Patient-Centered Strategy

The healthcare sector is moving more and more toward a patient-centric strategy that emphasizes individualized treatment options. The emphasis on personalized care, taking into account things like the severity of the pruritus, comorbidities, and patient preferences, improves the market for pruritus therapeutics.

Increasing the Target Population

Pruritus affects people of all ages and socioeconomic backgrounds and is not restricted to any one set of people. With such a large target market, pruritus treatments are always in demand, resulting in a steady industry with room for expansion and innovation.

Restraining Factors

Limited Awareness and Education

More information is needed concerning pruritus and the available treatments. It's possible that many people are unaware of the potential effects of pruritus or the available treatments. Lack of knowledge may result in substandard or delayed treatment, which could impede market expansion.

Expensive Advanced Therapies

Expensive biologic therapies for pruritus are sometimes necessary. This could hinder market penetration and restrict access for some patient demographics or geographic areas with limited healthcare expenditures.

Regulation Obstacles and Approval Holdups

New pruritus therapies may not be approved right away due to strict regulatory procedures. Long approval processes can stifle market expansion and postpone patient access to cutting-edge treatments.

Growth Opportunities

Targeted Therapy Developments

Ongoing study and development are helping to identify brand-new pruritus treatment targets. Advanced targeted therapies provide more precise and effective treatment alternatives, which may increase the likelihood that patients will respond to their treatments and improve their overall health.

Expanding the Uses of Biotechnology

The management of pruritus has demonstrated encouraging outcomes from biologic medicines. Biologics may be used to treat a greater spectrum of pruritic disorders as research advances. This allows pharmaceutical businesses access to new markets and sources of income.

Integration of Telemedicine and Digital Health

Patients with pruritus can receive remote monitoring and consultation thanks to the integration of telemedicine and digital health technology. This increases access to healthcare services, especially for people living in distant or underdeveloped locations, which eventually spurs market expansion.

Untapped Regions and Emerging Markets

The market for treatments is still developing in some areas where pruritic disorders are highly prevalent. Pharmaceutical businesses can access new patient populations and considerably widen their market reach by expanding their operations and distribution networks into these underserved regions.

By Disease Type

The atopic dermatitis market segment held a roughly 31.0% market share. This chronic skin disorder, which usually develops in infancy, is frequently connected to allergic rhinitis, asthma, and food allergies. Young children's eczema can be brought on by specific foods including citrus fruits, eggs, tomatoes, milk, and eggs. 9.6 million American children under the age of 18 are estimated to have atopic dermatitis, with one-third exhibiting moderate to severe symptoms, according to the National Eczema Association.

On the other hand, the Urticaria sector is anticipated to develop at a CAGR of over 4.2% over the course of the projection year. Hives, or Urticaria, appear as red, itchy lumps that range in size from a few millimetres to several centimetres. They can appear anywhere on the body and afflict 20% of people at some point in their lifespan. To treat the symptoms of Urticaria, most allergists commonly recommend antihistamines such cetirizine, fexofenadine, and loratadine.

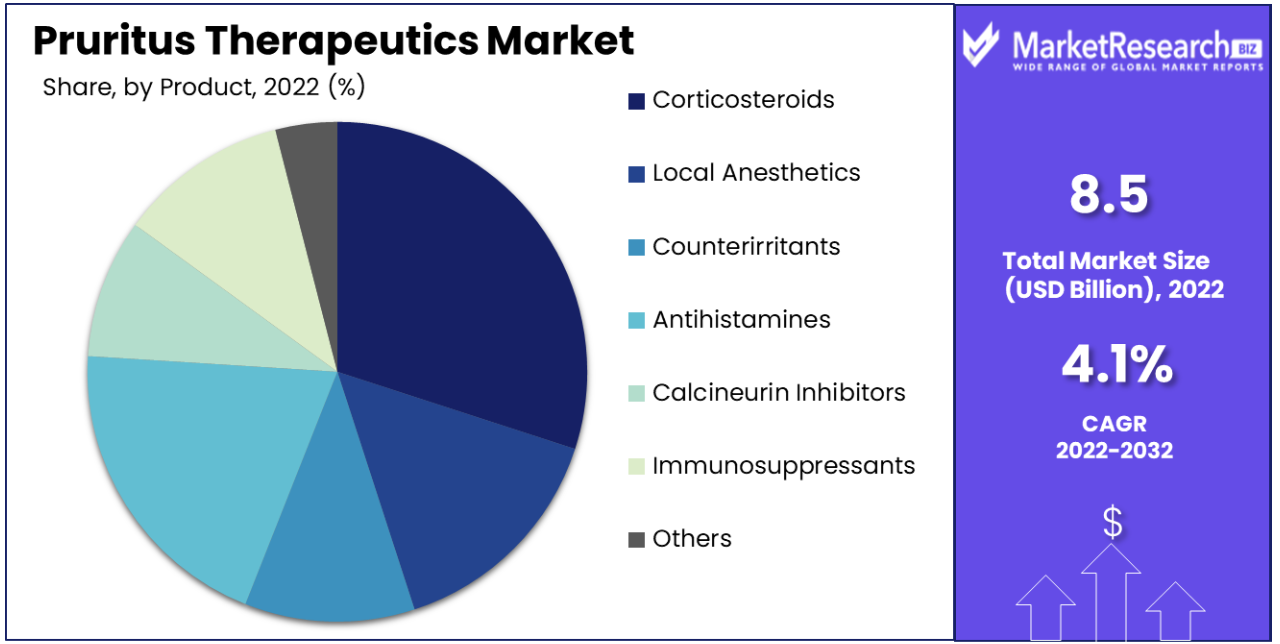

By Product Type

Corticosteroids, local anaesthetics, counterirritants, antihistamines, calcineurin inhibitors, immunosuppressant, and other products are included in market segments. With a sizable revenue share of 25.2%, corticosteroids, which are well-known for their anti-inflammatory effects, topped the market. Cortisone, dexamethasone, prednisolone, and hydrocortisone are some of the medications that provide comfort by lowering inflammation, lessening allergic reactions, and minimizing stinging, swelling, and redness. Because of its adaptability, corticosteroids are widely used to treat a variety of pruritus conditions, thus strengthening their market dominance.

In contrast, the calcineurin inhibitors market is anticipated to register a respectable CAGR of 4.8% over the course of the forecast year due to a strong pipeline and an excellent rate of response. By preventing calcineurin, a major factor in eczema flare-ups, Tacrolimus, a well-known calcineurin inhibitor, lessens severe immunological reactions.

Key Market Segments

By Disease Type

- Atopic Dermatitis

- Allergic Contact Dermatitis

- Urticaria

By Product

- Corticosteroids

- Local Anesthetics

- Counterirritants

- Antihistamines

- Calcineurin Inhibitors

- Immunosuppressants

- Others

Latest Trends

Targeted Treatments and Biologic Therapies

A noteworthy development in pruritus medicines is the emergence of biologic medications and targeted therapies. These therapies are made to tackle the root causes of pruritus, bringing about more targeted and efficient alleviation. With fewer adverse effects than drugs with a larger spectrum of action, biologic treatments provide a more individualized approach to treating pruritus. The fundamental reasons can be addressed, which can provide patients with more enduring and long-lasting relief.

Approaches in Personalized Medicine

The development of tailored medication for the treatment of pruritus is made possible by improvements in genetic profiling and biomarker identification. The effectiveness of medicines can be improved by adjusting them in accordance with a patient's genetic profile and unique pruritus triggers.

Personalized medicine reduces the amount of trial-and-error that is frequently used in conventional therapies. Patients are more likely to receive quicker and more lasting relief from pruritus symptoms when therapies are customized.

Tools for Diagnosis Powered by AI

Algorithms based on artificial intelligence (AI) are being used to assist in the diagnosis and evaluation of pruritic disorders. To deliver more precise insights, these systems can evaluate patient data as well as image data.

AI-driven diagnostics increase the speed and accuracy of pruritus diagnosis, enabling quick and specific treatment strategies.

Herbal & Natural Treatments

The use of herbal and natural treatments for pruritus is becoming more popular. For their calming and anti-inflammatory characteristics, ingredients including colloidal oatmeal, chamomile, and calendula are being added to topical applications. Natural therapies provide patients looking for holistic alternatives an alternative or supplement to traditional medicines, frequently with fewer side effects.

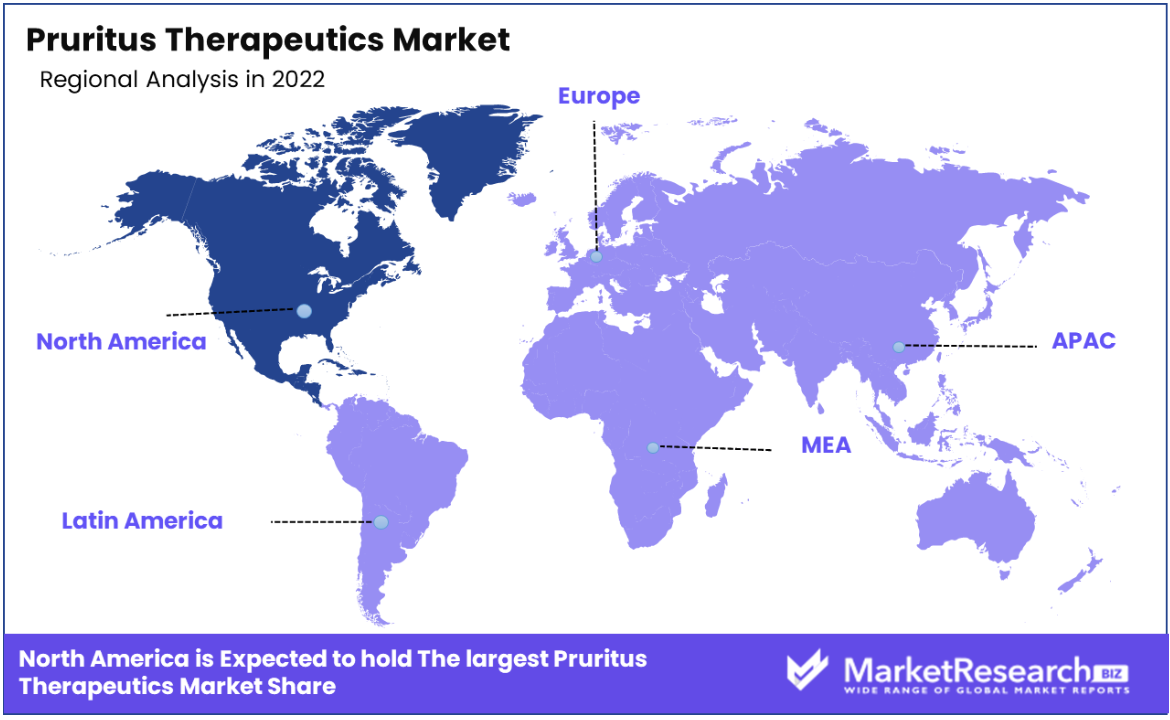

Regional Analysis

With a sizable revenue share of 40.3%, North America emerged as the market leader. The development of cutting-edge products and helpful government efforts are to thank for this dominant position. Throughout the projection period, it is also projected that the region's greater prevalence of target diseases and the existence of environmental factors that promote pruritus would drive additional market expansion.

The predicted CAGR of 5.4% during the projection period, Asia Pacific is expected to have extraordinary growth. This increase is caused by urgent healthcare infrastructure requirements as well as an increase in atopic dermatitis and urticaria cases. Notably, a study published in the Indian Journal of Community Medicine found that eczema and infections accounted for the vast majority of skin ailments among Indians in 2020, affecting 20% of the population.

Additionally, manufacturers have a bright future because to progressive government initiatives, notably in nations like Australia and Japan, aimed at regulating medicine prices and creating brand-new therapies for skin disorders. For instance, Maruho Co., Ltd. (Japan) introduced the Mitchga Subcutaneous Injection 60mg Syringes in August 2022 to alleviate the itching brought on by atopic dermatitis. The World Health Organization anticipates a 28% increase in China's old population by 2040, which will pave the way for significant market expansion for pruritus therapies in the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Pfizer, Cara Therapeutics, Sanofi, UCB, and Actavis are a few of the leading market participants. These organizations work to maintain their supremacy by engaging in extensive R&D projects to develop novel treatments with greater efficacies. In addition, neglected medical needs are taken into account when developing new products. A wide number of medicines are currently in the pipeline for the pruritus therapeutics market, and it is anticipated that their eventual commercialization will accelerate market growth during the next years.

Key Players in Pruritus Therapeutics Market

- Abbvie, Inc.

- Actavis Plc

- Amgen, Inc.

- Astellas Pharma

- Bristol-Myers Squibb

- Cara Therapeutics

- GlaxoSmithKline, Plc

- Myaln NV

- Novartis AG

- Pfizer Inc.

- Sanofi

- Teva Pharmaceuticals

Recent Developments

- The phase 3 trial of Dupixent conducted by Regeneron Pharmaceuticals, Inc. and Sanofi had a substantial effect on itch in just 12 weeks by October 2022.

- Results from the oral difelikefalin Phase 2 clinical trial for the treatment of moderate-to-severe pruritus in notalgia paresthetica (NP) were released by Cara Therapeutics Inc. in September 2022. At the 31st European Academy of Dermatology and Venereology (EADV) Congress, data on 125 individuals with NP were presented.

- In August 2022, The European Commission granted marketing permission to Vifor Fresenius Medical Care Renal Pharma and Cara Therapeutics Inc. for Kapruvia (difelikefalin), which is used to treat moderate-to-severe pruritus linked to chronic kidney disease (CKD) in adult hemodialysis patients.

Report Scope

Report Features Description Market Value (2022) US$ 8.5 Bn Forecast Revenue (2032) US$ 12.6 Bn CAGR (2023-2032) 4.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Pruritus Therapeutics Market Report By Disease Type (Atopic Dermatitis, Allergic Contact Dermatitis, Urticaria), By Product (Corticosteroids, local anaesthetics, counterirritants, antihistamines, calcineurin inhibitors, immunosuppressant, and others), By Region, And Segment Forecasts, 2023 – 2032 Regional Analysis North America – The US, Canada, Mexico, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Eastern Europe – Russia, Poland, The Czech Republic, Greece, Rest of Eastern Europe, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, Rest of Western Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of APAC, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, Rest of MEA Competitive Landscape Abbvie, Inc., Actavis Plc, Amgen, Inc., Astellas Pharma, Bristol-Myers Squibb, Cara Therapeutics, GlaxoSmithKline, Plc, Mylan NV, Novartis AG, Pfizer Inc., Sanofi, Teva Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbvie, Inc.

- Actavis Plc

- Amgen, Inc.

- Astellas Pharma

- Bristol-Myers Squibb

- Cara Therapeutics

- GlaxoSmithKline, Plc

- Myaln NV

- Novartis AG

- Pfizer Inc.

- Sanofi

- Teva Pharmaceuticals