Procurement Outsourcing Services Market By Component(Solution , Services), By Deployment Mode(Cloud, On-Premise), By Enterprise Size(SMEs, Large Enterprise), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

22093

-

Jul 2023

-

170

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

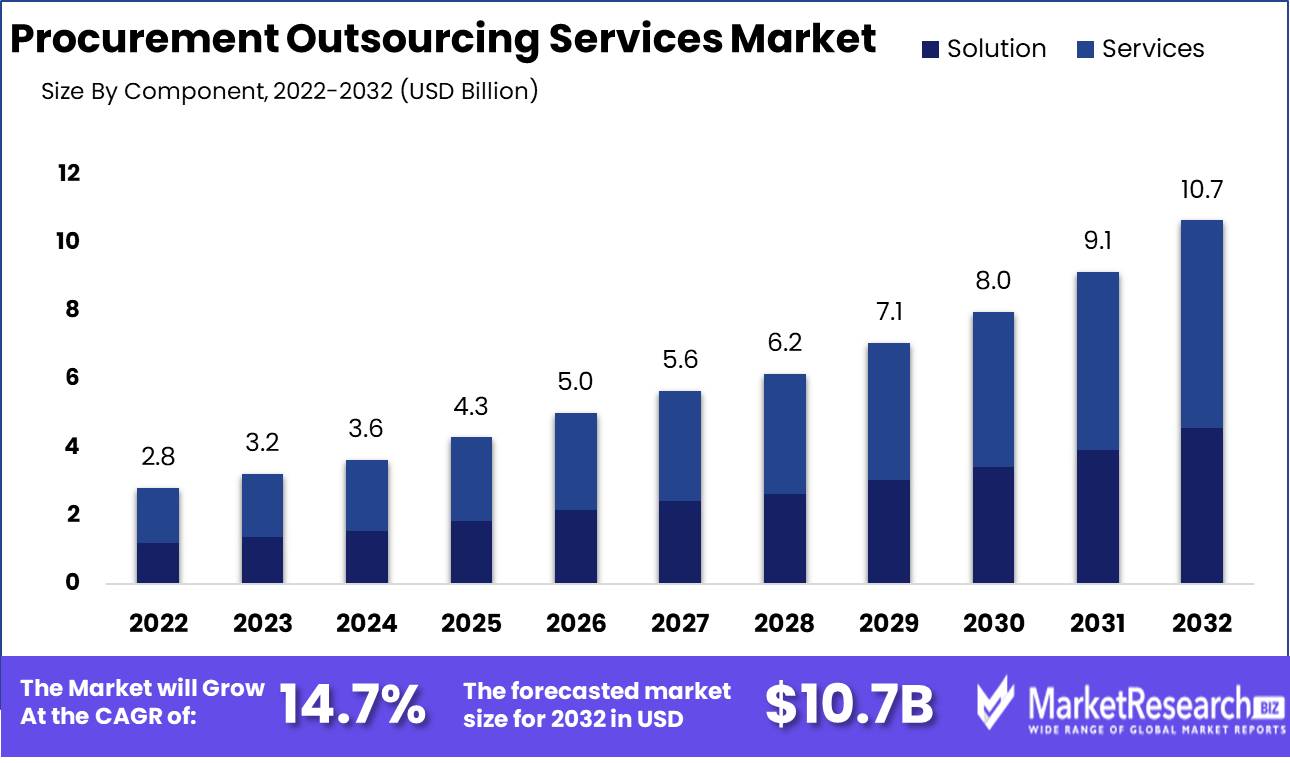

Procurement Outsourcing Services Market size is expected to be worth around USD 10.7 Bn by 2032 from USD 2.8 Bn in 2022, growing at a CAGR of 14.7% during the forecast period from 2023 to 2032.

The process of contracting out an organization's procuring and sourcing functions to a third-party service provider is known as procurement outsourcing services. The primary objective is to expedite and optimize the procurement procedure in order to achieve cost savings, increased productivity, and enhanced supplier relationships. By entrusting these responsibilities to a knowledgeable partner, organizations are able to concentrate on their primary competencies and strategic initiatives.

The significance and benefits of outsourcing procurement services are numerous. First, it enables businesses to leverage the expertise and experience of procurement specialists, obtaining access to best practices, market insights, and industry knowledge. In turn, this facilitates the making of informed decisions and the attainment of cost savings via negotiation and strategic procurement.

Scalability is a further advantage of procurement outsourcing services. Whether during periods of high demand or low activity, organizations can readily adjust their procurement resources to meet their needs. This flexibility assures efficient resource allocation and eliminates the need to maintain an internal procurement team during lean times.

In recent years, the procurement outsourcing services market has witnessed significant innovation. The incorporation of advanced technologies such as artificial intelligence, machine learning, and autonomous process automation has enabled automation, predictive analytics, and real-time monitoring in procurement processes. Algorithms capable of machine learning can analyze vast quantities of data to identify trends, risks, and opportunities, empowering organizations to make data-driven decisions and optimize procurement strategies.

In addition, significant investments have been made to integrate procurement outsourcing services into products and services. Providers of software have created procurement platforms and tools that integrate seamlessly with existing systems, thereby streamlining the procurement process and fostering greater collaboration between internal stakeholders and suppliers. These investments have resulted in enhanced user experiences and increased procurement lifecycle efficiency.

The expansion and applications of the procurement outsourcing services market span multiple industries. While outsourcing procurement has traditionally been popular in sectors such as manufacturing, healthcare, and retail, other industries such as technology, finance, and hospitality have recognized its benefits. By outsourcing non-core functions, businesses can reduce costs, increase operational efficiency, and enhance compliance with industry regulations.

Driving factors

Enhancing Concentration on Core Capabilities and Cost Reduction

Organizations are recognizing the significance of focusing on their core competencies to maintain a competitive edge in today's increasingly competitive business environment. Core competencies are the distinctive skills and areas of expertise that distinguish a company from its rivals. By identifying and leveraging these core competencies, organizations can optimize operations, streamline processes, and ultimately reduce costs.

In the domain of procurement outsourcing services, the growing emphasis on core competencies has become a motivating factor for organizations seeking to enhance their procurement processes. By outsourcing specific procurement functions to specialized service providers, businesses can refocus their internal resources and expertise on their core competencies.

Increase in Global Supply Chains and Procurement Complexity

The growth of global supply chains and the complexity of procurement processes have had a significant impact on the procurement outsourcing services market. As businesses expand internationally and engage with suppliers from various regions and countries, procurement management becomes more complex. Coordinating activities such as supplier identification, qualification, contracting, and performance management across these disparate supply chains is a formidable challenge.

Organizations seek the assistance of outsourcing service providers to address this challenge and ensure seamless procurement operations. These service providers have the necessary expertise, infrastructure, and global networks to manage complex procurement processes across multiple geographies. These providers are able to navigate regulatory frameworks, cultural nuances, and logistical complexities by leveraging their established relationships with suppliers worldwide.

Automation and advancements in procurement technology

The procurement outsourcing services market has been revolutionized by developments in procurement technology and automation. In the current digital age, organizations increasingly rely on technology-driven solutions to enhance their procurement processes and achieve greater efficiency and precision. E-procurement systems, supplier management software, and expenditure analytics platforms are examples of procurement automation tools that have gained significant market traction.

These innovative technologies allow organizations to automate a variety of procurement duties, streamline workflows, and collect valuable data for analysis. By leveraging procurement technology and automation, outsourcing service providers are able to offer enhanced services that increase process efficiency, reduce manual errors, and provide actionable insights. This enables organizations to make more informed decisions, optimize their procurement strategies, and achieve greater business results.

Restraining Factors

Data Security and Privacy Concerns

When a business decides to outsource its procurement operations, it is often necessary to share sensitive and confidential information with the selected service provider. This data may consist of pricing agreements, supplier contracts, supplier performance metrics, and other confidential information. For organizations, the potential hazards associated with sharing such information with a third party can be very concerning.

The proliferation of cyberattacks and data intrusions has generated significant data security concerns. It is crucial for organizations to ensure that their procurement outsourcing service providers have robust cybersecurity measures in place to safeguard sensitive information from unauthorized access, theft, and misuse. Failure to address these concerns may result in reputational harm, monetary loss, and potential legal repercussions.

Difficulties in Vendor Selection and Administration

Another potential obstacle in vendor selection is assuring cultural fit and compatibility between the organization and the service provider. Vendors from various regions with diverse business practices and work cultures may make up the procurement outsourcing services market. To ensure a successful partnership, it is crucial to locate a vendor who shares the organization's values, objectives, and work ethic.

Once a vendor has been chosen, effective vendor administration becomes essential to ensure seamless collaboration and the achievement of desired results. It involves establishing explicit channels of communication, defining performance metrics, and regularly monitoring vendor performance. To maintain effective communication throughout the procurement process, organizations must also address potential language barriers and time zone differences.

Component Analysis

Services predominate in the procurement outsourcing services market.

The Services segment has dominated the procurement outsourcing services market for years. This segment consists of a vast array of services, including procurement consulting, strategic sourcing, category management, supplier management, and transactional services. These services are essential for organizations to achieve cost savings and operational efficiency, as well as to streamline their procurement processes.

Rapid economic growth in emerging economies drives the adoption of procurement outsourcing services. As these economies endeavor to compete on a global scale, businesses seek to optimize their procurement processes and gain a competitive edge. These services provide them with the knowledge and resources necessary to attain their objectives.

Consumers are demanding greater value for their money, resulting in a shift toward service-based procurement outsourcing. They anticipate that procurement service providers will deliver comprehensive solutions that not only emphasize cost reduction but also provide strategic guidance and support. This trend is propelling the adoption of Services in the outsourcing market for procurement.

Deployment Mode Analysis

The Cloud Segment dominates the global procurement outsourcing services market.

Cloud is the segment that has dominated the procurement outsourcing services market. Cloud-based procurement platforms provide numerous benefits to organizations, including scalability, adaptability, and accessibility. With cloud solutions, businesses can access procurement services at any time, from any location, and scale their operations to meet their changing requirements.

Emerging economies' economic growth is propelling the adoption of cloud-based procurement solutions. In these economies, organizations are increasingly embracing digital transformation and employing cloud technologies to improve procurement processes. Cloud solutions allow them to surmount infrastructure limitations and take advantage of cloud computing's scalability and cost-effectiveness.

Due to their numerous advantages, consumers are gravitating toward cloud-based procurement solutions. Cloud solutions provide enhanced visibility, real-time data analytics, and collaboration capabilities, empowering businesses to make informed decisions and streamline procurement processes. Consumers are attracted to cloud-based solutions due to their convenience and usability, resulting in increased adoption.

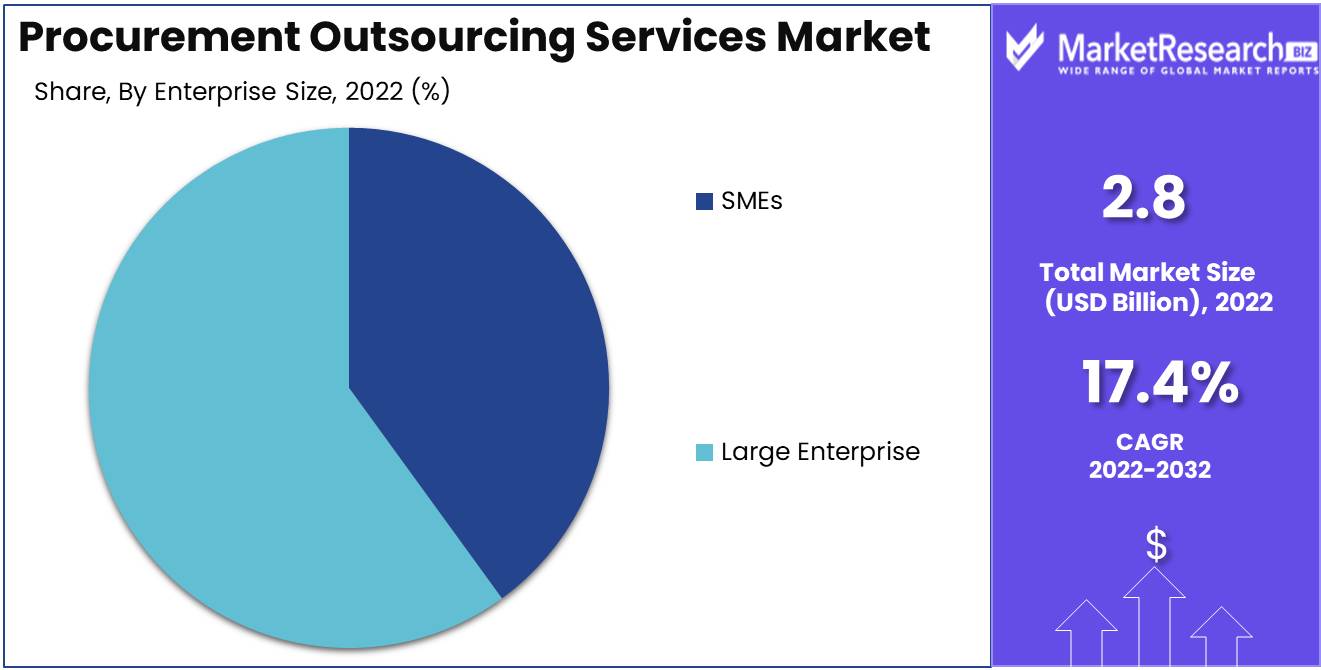

Enterprise Size Analysis

The Large Enterprises Segment dominates the procurement outsourcing services market.

The Large Enterprises Segment dominates the Procurement Outsourcing Services market. Complex procurement functions in large organizations necessitate specialized knowledge to optimize and manage effectively. In order to expedite their procurement processes, these organizations frequently rely on outsourcing services due to their global presence and large number of suppliers.

Large corporations' adoption of procurement outsourcing services is being driven by the economic growth in emerging economies. As a result of their expansion into new markets and accelerated growth, these businesses require scalable and effective procurement solutions to support their operations. They can utilize the expertise and resources of service providers to meet their procurement requirements through outsourcing.

Consumers have high expectations of large businesses, especially regarding sustainability and responsible procurement. Large corporations are progressively utilizing procurement outsourcing services to improve their ethical sourcing practices and ensure regulatory compliance. Moreover, consumers anticipate that large businesses will be at the vanguard of innovation and digital transformation, necessitating the adoption of outsourcing services.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud

- On-Premise

By Enterprise Size

- SMEs

- Large Enterprise

By Application

- Marketing Related Services

- HR Related Services

- Facilities Management & Office Services

- Other

By End-User

- BFSI

- Banking & Financial Services

- Healthcare

- IT & Telecom

- Professional Services

- Manufacturing

- Other

Growth Opportunity

Digital Transformation

As businesses embrace digital transformation, the procurement outsourcing services market is poised to profit from emerging technologies. Advanced procurement software and automation solutions can be integrated to streamline procurement processes, reduce costs, and improve overall productivity. By leveraging emerging technologies such as robotic process automation (RPA), blockchain, and the Internet of Things (IoT), procurement outsourcing service providers can provide their clients with unprecedented levels of precision, speed, and data-driven decision-making.

In addition, the use of cloud-based procurement platforms enables real-time collaboration, efficient contract administration, and increased supply chain visibility. As a result of the transition toward more sustainable and digitally-driven procurement practices, organizations now seek partners who can provide end-to-end solutions that incorporate modern technologies, thereby increasing the demand for procurement outsourcing services.

Leveraging Industry-Specific Expertise

By catering to specialized industries that require specialist expertise, the procurement outsourcing services market has the potential to grow even further. With the proliferation of niche markets and vertical-specific requirements, organizations in industries such as healthcare, retail, and manufacturing are seeking dedicated procurement outsourcing providers with a comprehensive understanding of their unique supply chain dynamics.

By concentrating on industry-specific expertise, procurement outsourcing service providers are able to offer customized solutions to meet the complex needs and regulatory compliance requirements of these sectors. This targeted strategy improves customer satisfaction, fosters long-term partnerships, and creates new growth opportunities in underserved markets.

Adopting Data Analytics for Wise Decision Making

In an era characterized by an abundance of data, the procurement outsourcing services market can leverage the power of sophisticated analytics and predictive modeling to inform strategic decisions. By adopting artificial intelligence (AI) and machine learning (ML) algorithms, service providers can analyze immense quantities of data, identify trends, and predict future market developments, empowering clients to make informed procurement decisions in real-time.

In addition to facilitating preventative maintenance, inventory optimization, and risk management, data analytics can also facilitate predictive maintenance. By providing comprehensive insights derived from analytics, procurement outsourcing service providers can distinguish themselves as trusted advisors, empowering businesses to make proactive decisions that optimize their procurement processes, reduce costs, and maximize efficiencies.

Latest Trends

Strategic Sourcing and Category Management Services Expansion

Effective strategic sourcing and category management are essential elements of any prosperous procurement operation. In recent years, the demand for strategic sourcing and category management services has increased noticeably. This growth is attributable to organizations recognizing the advantages of collaborating with external specialists who possess specialized knowledge and resources to optimize their procurement processes. Organizations can strategically source suppliers, negotiate favorable contracts, and manage their procurement categories by leveraging the profound strategic insights and industry expertise of these service providers.

Demand for Automation and Digital Transformation in Procurement

Manual and paper-based procurement processes are becoming obsolete in the digital age. As organizations strive to streamline and improve procurement operations, the demand for procurement automation and digital transformation has skyrocketed. With the assistance of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and cloud-based software solutions, organizations can automate repetitive and time-consuming tasks, improve data accuracy, and decrease cycle times. Additionally, these technologies enable real-time data analysis, generate valuable insights, and facilitate improved procurement decision-making.

Use of Data Analytics and Predictive Modeling in Purchasing

Data has become the lifeblood of contemporary enterprises, including procurement. For organizations looking to obtain a competitive advantage, the utilization of data analytics and predictive modeling in procurement has proven to be a game-changer. By utilizing historical procurement data, organizations are able to identify patterns, trends, and anomalies that provide invaluable insights into supplier performance, pricing dynamics, market volatility, and demand forecasting. Armed with this intelligence, organizations can make data-driven decisions, optimize sourcing strategies, minimize supply chain disruptions, and maximize the value extracted from supplier relationships.

Increase in Procurement-as-a-Service and On-Demand Sourcing Assistance

As organizations seek greater flexibility and scalability in their procurement operations, the rise of procurement-as-a-service (PaaS) and on-demand sourcing support has garnered significant momentum. PaaS providers offer organizations subscription-based access to a comprehensive array of procurement services, eliminating the need for substantial up-front investments in infrastructure, technology, and talent. Without the burden of long-term commitments, this model enables organizations to scale their procurement capabilities based on their evolving business requirements. On the other hand, on-demand sourcing support provides organizations with the flexibility to rapidly access specialized procurement expertise for specific projects and initiatives.

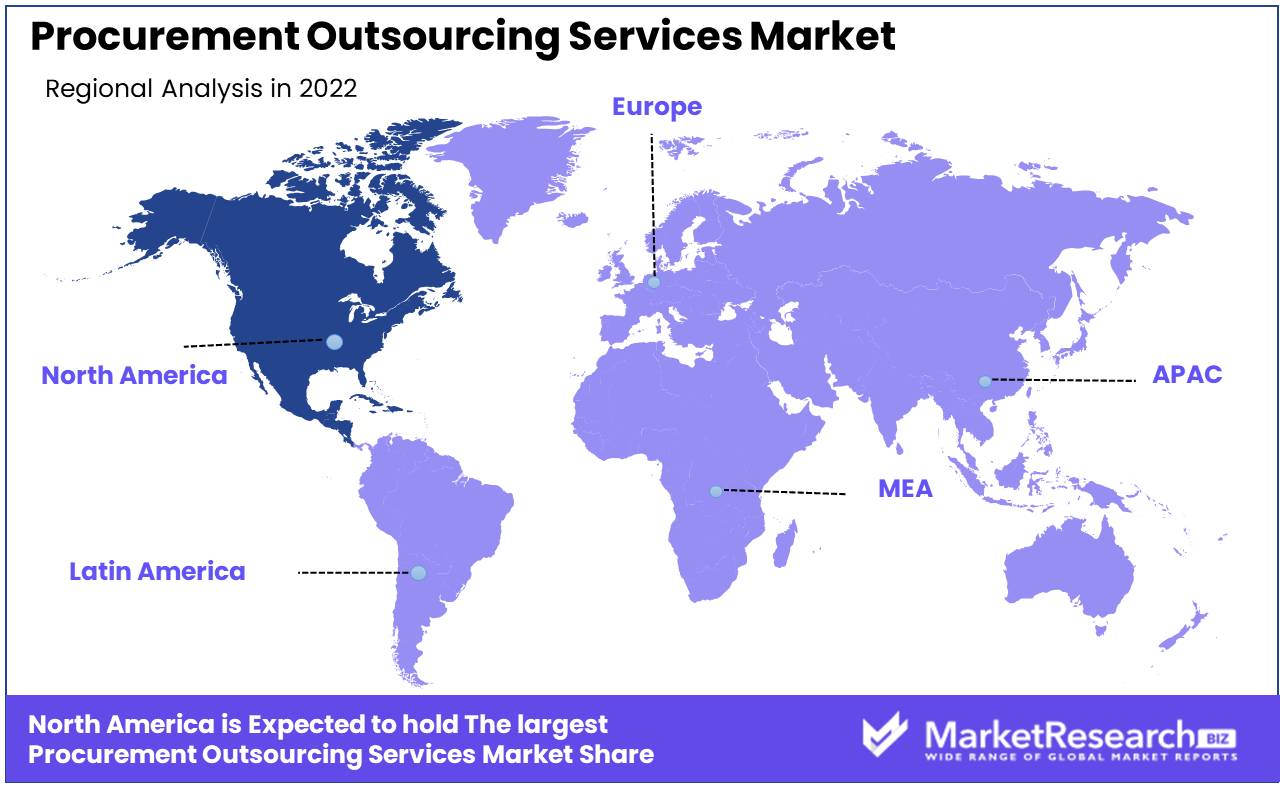

Regional Analysis

North America Dominates the Procurement Outsourcing Services Market.

By delegating certain procurement tasks to a third-party service provider, procurement outsourcing is accomplished. This strategic approach enables organizations to capitalize on the expertise, resources, and economies of scale offered by outsourcing firms. By doing so, businesses can improve their procurement processes, lower costs, increase transparency, and concentrate on their primary business functions.

For a variety of factors, the North American region has emerged as a leader in the market for procurement outsourcing services. First, the region has a highly developed infrastructure, which allows for the efficient and seamless delivery of services. With advanced technology, robust transportation networks, and well-established legal frameworks, North America provides an ideal environment for the growth of procurement outsourcing providers.

North American outsourcing firms have cultivated a reputation for maintaining stringent quality standards and adhering to best practices in order to strengthen their position. These companies employ highly qualified professionals who have an in-depth understanding of procurement strategies and local and international markets. This allows them to navigate complex supply chains, identify cost-saving opportunities, negotiate favorable terms with suppliers, and ultimately provide superior results to their clients.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

IBM's Procurement Outsourcing Services encompass Strategic Sourcing, Contract Management, Supplier Relationship Management, and Procurement Analytics. Their cutting-edge technologies allow businesses to optimize their supplier network, automate manual processes, and gain valuable insights for improved decision-making. In addition, IBM's global presence and broad industry expertise make them a reliable partner for organizations worldwide.

Broadcom's procurement outsourcing services encompass source-to-pay solutions, supplier enablement, and spend analysis. Their emphasis on digitizing procurement processes, utilizing cloud-based platforms, and leveraging the power of automation guarantees seamless integration and streamlines the procurement lifecycle. Broadcom empowers businesses to attain procurement excellence through a customer-centric approach and a commitment to continuous innovation.

Oracle's procurement outsourcing services encompass spend management, sourcing and procurement, contract lifecycle management, and supplier management. They employ intelligent technologies, including machine learning and predictive analytics, to provide real-time visibility, enhance compliance, and streamline supplier collaborations. Oracle's customer-centric approach and commitment to delivering best-in-class solutions have positioned them as a partner of choice for businesses in a variety of industries.

Top Key Players in Procurement Outsourcing Services Market

- IBM (U.S.)

- Broadcom (U.S.)

- Oracle. (U.S.)

- Accenture (Ireland)

- Infosys Limited (India)

- GEP (U.S.)

- Genpact (U.S.)

- Proxima (U.K.)

- WNS (Holdings) Ltd. (India)

- Capgemini (France)

- Wipro Limited (India)

- HCL Technologies Limited (India)

- Tata Consultancy Services Limited. (India)

- DXC Technology Company (U.K.)

- AEGIS Company. (India)

- Corbus

- LLC. (India)

- Aquanima S.A. (Spain)

Recent Development

- In 2023, Ariba, a prominent player in the procurement outsourcing industry, announced plans to establish a procurement outsourcing platform of the next generation. The new platform, which is anticipated to reach the market, is designed to provide a more user-friendly and intuitive experience.

- In 2022, Aptean, a leading global provider of enterprise software solutions, disclosed its intention to acquire Proactis in a strategic acquisition. Proactis, a pioneering company in the field of procurement outsourcing solutions, has a solid reputation and a vast selection of services.

- In 2021, GEP, a well-known provider of procurement and supply chain solutions, recently announced its intention to expand its procurement outsourcing portfolio. GEP's expansion strategy includes the introduction of new products and services as part of its commitment to providing comprehensive and innovative services.

Report Scope

Report Features Description Market Value (2022) USD 2.8 Bn Forecast Revenue (2032) USD 10.7 Bn CAGR (2023-2032) 14.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Solution , Services), By Deployment Mode(Cloud, On-Premise), By Enterprise Size(SMEs, Large Enterprise), By Application(Marketing Related Services, HR Related Services, Other), By End-User(BFSI, Banking & Financial Services, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IBM (U.S.), Broadcom (U.S.), Oracle. (U.S.), Accenture (Ireland), Infosys Limited (India), GEP (U.S.), Genpact (U.S.), Proxima (U.K.), WNS (Holdings) Ltd. (India), Capgemini (France), Wipro Limited (India), HCL Technologies Limited (India), Tata Consultancy Services Limited. (India), DXC Technology Company (U.K.), AEGIS Company. (India), Corbus, LLC. (India), Aquanima S.A. (Spain) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM (U.S.)

- Broadcom (U.S.)

- Oracle. (U.S.)

- Accenture (Ireland)

- Infosys Limited (India)

- GEP (U.S.)

- Genpact (U.S.)

- Proxima (U.K.)

- WNS (Holdings) Ltd. (India)

- Capgemini (France)

- Wipro Limited (India)

- HCL Technologies Limited (India)

- Tata Consultancy Services Limited. (India)

- DXC Technology Company (U.K.)

- AEGIS Company. (India)

- Corbus

- LLC. (India)

- Aquanima S.A. (Spain)