Pre-workout Supplements Market By Form (Powder, Capsule, Ready to Drink), By Distribution Channel (Online and Offline), By Application (Enterprises and Personal), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

16308

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

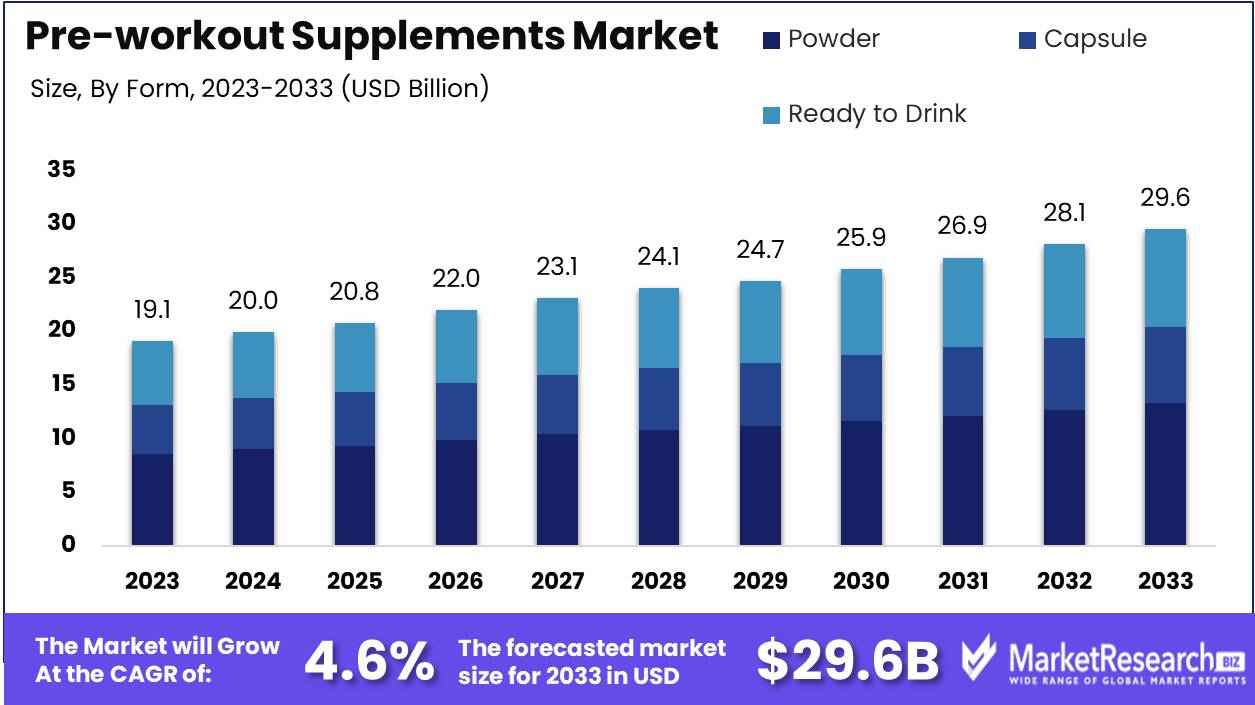

The Pre-workout Supplements Market was valued at USD 19.1 billion in 2023. It is expected to reach USD 29.6 billion by 2033, with a CAGR of 4.6% during the forecast period from 2024 to 2033.

The Pre-workout Supplements Market encompasses the production, distribution, and sale of dietary products designed to enhance athletic performance, energy, and endurance before exercise. These supplements typically include ingredients like caffeine, amino acids, creatine, and beta-alanine, which collectively aim to improve focus, strength, and overall workout efficacy. The market is driven by increasing health consciousness, the rise in fitness trends, and the growing demand for sports nutrition among both professional athletes and fitness enthusiasts.

The pre-workout supplements market is experiencing significant growth, driven primarily by increasing consumer awareness about health and fitness. With more individuals seeking to enhance their exercise performance and overall well-being, the demand for effective and safe pre-workout supplements has surged. This trend is further amplified by rising disposable incomes, enabling consumers to allocate more funds towards health supplements.

Additionally, advancements in product formulation and flavor enhancement have made these supplements more appealing to a broader audience, fostering market expansion. However, the market faces challenges such as regulatory scrutiny and varying standards across regions, which can complicate the global distribution of products. Furthermore, the high level of competition within the industry has led to intense price wars, affecting profit margins and market dynamics.

Technological innovations in the pre-workout supplements market have played a crucial role in addressing consumer demands for improved efficacy and taste. Companies are investing in research and development to create products that not only boost energy and performance but also meet regulatory requirements and consumer preferences. Despite the competitive landscape, brands that can navigate regulatory complexities and offer superior products at competitive prices are well-positioned to capture a significant share of the market. The convergence of health consciousness, economic capability, and technological advancements presents a promising outlook for the pre-workout supplements market, albeit with the need for strategic maneuvering to overcome regulatory and competitive hurdles.

Key Takeaways

- Market Growth: The Pre-workout Supplements Market was valued at USD 19.1 billion in 2023. It is expected to reach USD 29.6 billion by 2033, with a CAGR of 4.6% during the forecast period from 2024 to 2033.

- By Form: The powder segment dominated the pre-workout supplements market by form.

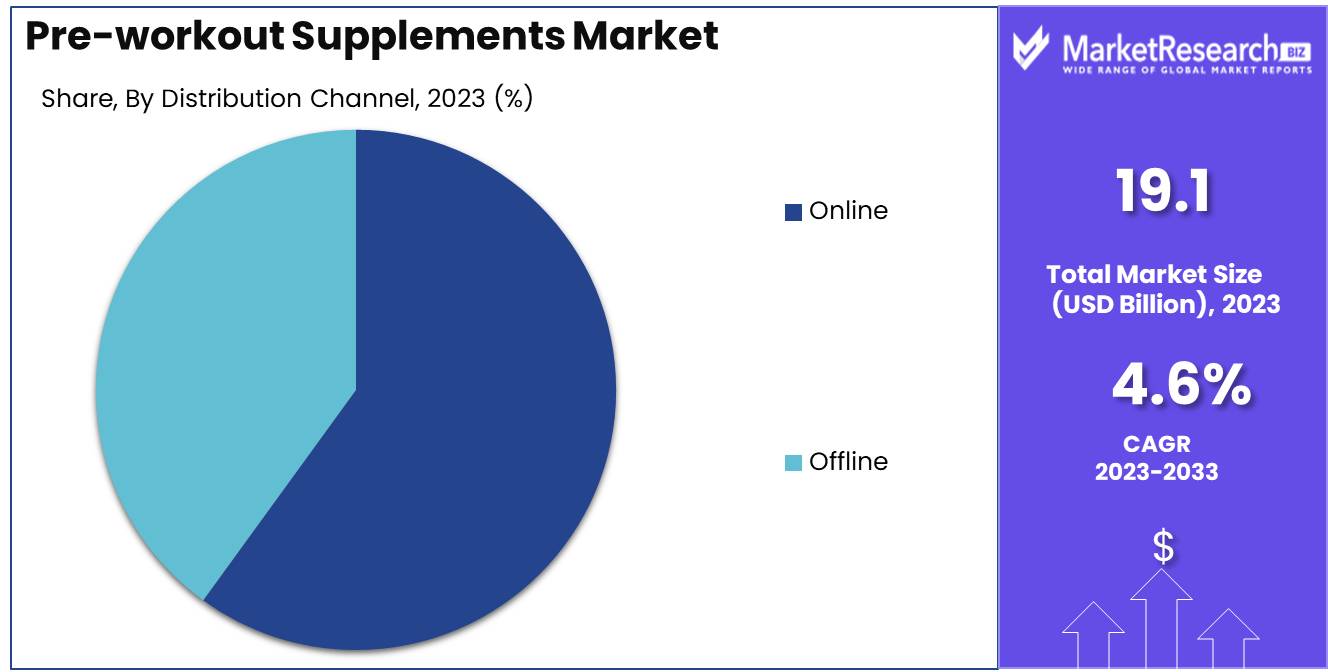

- By Distribution Channel: Online distribution is dominated, complemented by vital Offline channels.

- By Application: Enterprises dominated the pre-workout supplements market by application.

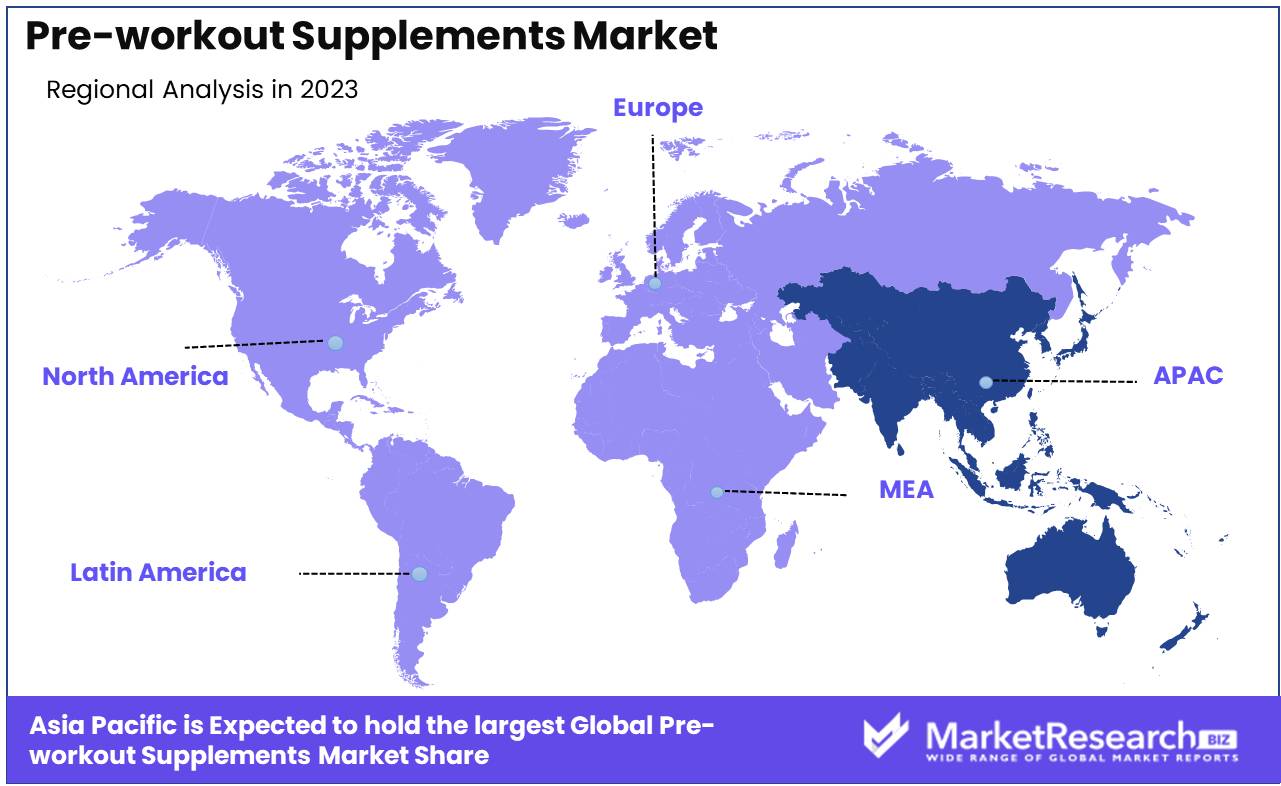

- Regional Dominance: Asia Pacific dominates pre-workout supplements market growth, highest CAGR of 8%.

- Growth Opportunity: The market growth will be driven by clean-label formulations and expanded e-commerce distribution.

Driving factors

Rising Demand for Nutritional Products to Enhance Performance

The pre-workout supplements market is significantly driven by the rising demand for nutritional products designed to enhance physical performance. As consumers increasingly seek products that can improve their workout efficiency and overall physical capabilities, there is a corresponding rise in the adoption of pre-workout supplements. According to recent market studies, this trend is fueled by a broader societal shift towards proactive health management and performance optimization. The growing consumer preference for products that offer tangible benefits in terms of energy, endurance, and recovery during workouts is a key factor bolstering market expansion. This demand is particularly pronounced among athletes and fitness enthusiasts who prioritize performance enhancement through scientifically formulated nutritional aids.

Increasing Importance of an Active Lifestyle and Growing Awareness Regarding the Benefits of Proteins

The increasing importance of an active lifestyle, coupled with growing awareness regarding the benefits of proteins, plays a crucial role in driving the pre-workout supplements market. Modern consumers are becoming more health-conscious and are integrating regular physical activity into their routines, which necessitates the use of supplements to sustain energy levels and optimize workout results. The advantages of proteins in particular are recognized for their essential role in muscle repair, growth, and overall bodily functions. This awareness has led to a surge in the consumption of protein-rich pre-workout supplements. The market is witnessing a robust increase in demand as consumers seek to leverage these benefits to achieve their fitness goals. The synergy between an active lifestyle and protein supplements is creating a favorable environment for market growth.

Surging Number of Health and Fitness Centers

The surging number of health and fitness centers globally is another pivotal factor contributing to the growth of the pre-workout supplements market. The proliferation of gyms, fitness clubs, and specialized training centers has expanded access to fitness facilities, encouraging more individuals to pursue structured workout regimens. As the fitness industry grows, so does the customer base for pre-workout supplements. These establishments often promote the use of such supplements to enhance exercise performance and results, thereby directly influencing consumer purchasing behavior. The increase in fitness center memberships and the associated rise in health consciousness among the population are significant drivers of market expansion. This trend is reinforced by the strategic partnerships and marketing initiatives undertaken by supplement manufacturers and fitness centers to promote the benefits of pre-workout products.

Restraining Factors

Potential Side Effects: A Significant Barrier to Market Expansion

The growth of the pre-workout supplements market is notably hindered by concerns regarding potential side effects associated with these products. Common side effects include jitteriness, digestive issues, increased heart rate, and sleep disturbances. These adverse effects can be attributed to the high caffeine content and other stimulants commonly found in pre-workout formulas. For instance, a study indicated that approximately 30% of users experience at least one side effect after consuming a pre-workout supplement. The prevalence of these side effects raises consumer apprehension and skepticism, which subsequently dampens market demand. Furthermore, negative media coverage and online reviews emphasizing these risks contribute to a cautious consumer base, thereby restricting market growth.

Lack of Regulation: Undermining Consumer Confidence and Market Credibility

The pre-workout supplements market is also constrained by a lack of stringent regulation. Unlike pharmaceuticals, dietary supplements, including pre-workout products, are not subject to rigorous pre-market approval processes by regulatory bodies such as the FDA. This regulatory gap results in significant variability in product quality, efficacy, and safety. For example, a market survey found that up to 20% of pre-workout supplements contained undisclosed ingredients, leading to potential health risks and legal issues. The absence of consistent regulatory oversight undermines consumer confidence, as individuals are unsure of the authenticity and safety of the products they consume. This lack of trust stifles market growth, as potential customers may opt for alternatives with more transparent and reliable regulatory backgrounds.

By Form Analysis

In 2023, Powder Segment dominated the pre-workout supplements market by form.

In 2023, Powder held a dominant market position in the By Form segment of the Pre-workout Supplements Market, encompassing powders, capsules, and ready-to-drink formats. This dominance can be attributed to several factors. Pre-workout powders offer flexibility in dosage and can be easily mixed with various beverages, providing consumers with a customizable pre-workout solution. The market for powder supplements benefits from lower manufacturing costs and extended shelf life compared to ready-to-drink options, making it a cost-effective choice for both producers and consumers.

Capsules, although less prevalent, cater to a niche market segment seeking convenience and precise dosing. They are particularly appealing to consumers who prefer a straightforward, no-mix option. However, their uptake is limited by the perception that they may be less effective than powders due to slower absorption rates.

Ready-to-drink pre-workout supplements, while gaining traction, face challenges related to higher production costs and shorter shelf life. Despite these drawbacks, they are popular among consumers prioritizing convenience and portability, particularly in urban settings where on-the-go consumption is prevalent. Collectively, these subcategories reflect diverse consumer preferences, but powder form remains the frontrunner due to its versatility and economic advantages.

By Distribution Channel Analysis

In 2023, Online distribution dominated, complemented by vital Offline channels.

In 2023, The Online distribution channel held a dominant market position in the Pre-workout Supplements Market. This dominance can be attributed to several key factors. The convenience of online shopping, coupled with an extensive range of product options, has significantly contributed to this trend. Consumers increasingly prefer the ease of comparing prices, reading reviews, and accessing a broader array of supplements from various brands through online platforms. Additionally, strategic partnerships between supplement manufacturers and e-commerce giants have further bolstered online sales. Promotional strategies, including discounts and subscription models, have also enhanced customer retention and acquisition.

Conversely, the Offline distribution channel remains vital, particularly among consumers who value personalized service and immediate product availability. Health and fitness retailers, along with specialty nutrition stores, offer expert advice and tailored recommendations, which are highly valued by a segment of the market. Physical stores also facilitate brand visibility through in-store promotions and sampling events. Despite the growing online trend, the tactile experience and trust associated with physical stores continue to sustain a significant share of the pre-workout supplement market. The balance between these channels ensures comprehensive market coverage and caters to diverse consumer preferences.

By Application Analysis

In 2023, Enterprises dominated the pre-workout supplements market by application.

In 2023, Enterprises held a dominant market position in the "By Application" segment of the pre-workout supplements market. The enterprise segment encompasses gyms, fitness centers, and health clubs, which have been instrumental in driving the demand for pre-workout supplements. This dominance is attributed to the rising trend of health and wellness, leading to an increase in gym memberships and fitness club enrollments. Enterprises often purchase nutritional supplements in bulk, catering to a large consumer base, and thereby, significantly contributing to market revenue.

Simultaneously, the personal application segment, which includes individual consumers purchasing supplements for personal use, exhibited substantial growth. This growth can be linked to the increasing awareness of fitness and the benefits of pre-workout supplements among individuals. The convenience of online retail channels and the proliferation of fitness influencers promoting these products have further fueled the demand in this segment. Consumers are increasingly opting for personalized fitness regimes, which often include pre-workout supplements to enhance performance and endurance.

Key Market Segments

By Form

- Powder

- Capsule

- Ready to Drink

By Distribution Channel

- Online

- Offline

By Application

- Enterprises

- Personal

Growth Opportunity

Growth Potential in Clean-Label Formulations

The global pre-workout supplements market is poised for significant growth, driven by the increasing consumer demand for innovative and clean-label formulations. As health-conscious consumers become more vigilant about ingredient transparency and product purity, there is a growing preference for supplements that eschew artificial additives, preservatives, and synthetic ingredients. This trend offers a substantial opportunity for manufacturers to develop and market clean-label pre-workout supplements that cater to this discerning consumer base. The emphasis on natural, non-GMO, and organic ingredients can differentiate products in a crowded market, enhancing brand loyalty and expanding market share.

E-commerce Expansion as a Key Distribution Strategy

The expansion of distribution channels through e-commerce platforms is another critical factor contributing to the market's growth. The convenience, variety, and competitive pricing offered by online retail channels have increasingly attracted consumers, particularly those seeking specific product features or niche brands. Leveraging e-commerce can provide manufacturers with a broader reach, enabling them to tap into previously inaccessible markets and consumer segments. Effective online marketing strategies, including targeted digital advertising and influencer partnerships, can further drive sales and brand visibility.

Latest Trends

Growing Influence of Healthy Lifestyle Trends and Rising Number of Non-Traditional Users

The pre-workout supplements market is expected to witness significant growth driven by the increasing influence of healthy lifestyle trends. The consumer base is expanding beyond traditional athletes and bodybuilders to include a broader demographic interested in maintaining general fitness and wellness. This shift is largely due to the global emphasis on healthy living and the integration of fitness into daily routines. Consequently, the demand for pre-workout supplements that support energy, endurance, and overall performance is rising among non-traditional users such as office workers, casual gym-goers, and even seniors.

Increasing Awareness About the Benefits of Nutrition-Based Pre-Workout Products

Awareness about the benefits of nutrition-based pre-workout products is also contributing to market growth. Consumers are becoming more educated about the importance of proper nutrition in enhancing workout performance and recovery. This knowledge is driving the preference for supplements that offer clean, natural ingredients and scientifically-backed formulations. As a result, products featuring plant-based ingredients, low sugar content, and free from artificial additives are gaining popularity. Moreover, the trend towards personalized nutrition is fostering the development of tailored pre-workout supplements that cater to specific dietary needs and fitness goals, further propelling market expansion.

Regional Analysis

Asia Pacific dominates pre-workout supplements market growth, highest CAGR of 8%.

The pre-workout supplements market exhibits significant regional variations in demand, driven by diverse consumer preferences and economic conditions. North America remains a dominant force, accounting for approximately 35% of the global market share. This dominance is attributed to the high awareness of fitness and wellness, coupled with a robust retail infrastructure. In Europe, the market holds around 25% of the global share, with countries like Germany, the UK, and France leading due to increasing health consciousness and disposable incomes.

The Asia Pacific region, the fastest-growing market, currently captures about 20% of the market share. Rapid urbanization, increasing disposable incomes, and a growing fitness culture in countries like China, Japan, and India are propelling demand. The region is projected to witness the highest CAGR of 8% over the next five years, potentially shifting market dynamics significantly.

Latin America, with a market share of approximately 10%, is seeing gradual growth driven by Brazil and Mexico, where increasing awareness about fitness benefits supports market expansion. The Middle East & Africa, holding the remaining 10%, show steady growth, with South Africa and the UAE leading due to rising disposable incomes and growing fitness trends.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global pre-workout supplements market is poised for robust growth, driven by increasing consumer awareness regarding fitness and the rising trend of gym culture. Key players in this market, such as Optimum Nutrition, BSN, Cellucor, and MusclePharm, have established strong brand recognition and extensive distribution networks, which provide them with a competitive advantage.

Optimum Nutrition and BSN are anticipated to maintain their leadership positions through continued innovation and product diversification. These companies are known for their high-quality formulations and strong presence in both online and offline retail channels. Cellucor, with its flagship C4 pre-workout product, is expected to leverage its brand strength and expand its market share by targeting various consumer segments through new product launches and strategic partnerships.

MusclePharm and ProSupps are likely to focus on enhancing their product portfolios by incorporating scientifically backed ingredients and improving taste profiles to attract a broader consumer base. Nutrabolt, GAT Sport, and EVLution Nutrition are projected to capitalize on the growing demand for clean and transparent labeling, appealing to health-conscious consumers.

Emerging brands such as Kaged Muscle, JYM Supplement Science, and Ghost are expected to challenge the established players by emphasizing unique formulations and leveraging social media and influencer marketing. Companies like Redcon1, Blackstone Labs, and Universal Nutrition are anticipated to continue targeting hardcore fitness enthusiasts with their high-intensity pre-workout products.

Overall, the pre-workout supplements market is characterized by intense competition and rapid innovation. Success in this market will be driven by the ability to adapt to changing consumer preferences, invest in research and development, and execute effective marketing strategies. Key players must navigate these dynamics to sustain their growth and maintain market share in an evolving landscape.

Market Key Players

- BSN

- Cellucor

- MusclePharm

- ProSupps

- Nutrabolt

- GAT Sport

- EVLution Nutrition

- Kaged Muscle

- JYM Supplement Science

- Ghost

- RSP Nutrition

- Redcon1

- Blackstone Labs

- Universal Nutrition

- Nutrex Research

- Primeval Labs

- Inspired Nutraceuticals

- Alpha Lion

- MuscleTech

- Finaflex

- EFX Sports

- JNX Sports

- SynTech Nutrition

Recent Development

- In May 2024, Transparent Labs launched new pre-workout formulas featuring clean labels, emphasizing transparency in ingredients and catering to consumer preferences for natural and minimally processed products.

- In April 2024, Nutrabolt announced its strategic expansion into key European markets with a range of pre-workout supplements, capitalizing on the growing demand for fitness and wellness products in the region.

- In March 2024, Glanbia Nutritionals introduced new innovative ingredients tailored for pre-workout supplements, aiming to enhance performance and energy levels for athletes and fitness enthusiasts.

Report Scope

Report Features Description Market Value (2023) USD 19.1 Billion Forecast Revenue (2033) USD 29.6 Billion CAGR (2024-2032) 4.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Capsule, Ready to Drink), By Distribution Channel (Online and Offline), By Application (Enterprises and Personal) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Optimum Nutrition, BSN, Cellucor, MusclePharm, ProSupps, Nutrabolt, GAT Sport, EVLution Nutrition, Kaged Muscle, JYM Supplement Science, Ghost, RSP Nutrition, Redcon1, Blackstone Labs, Universal Nutrition, Nutrex Research, Primeval Labs, Inspired Nutraceuticals, Alpha Lion, MuscleTech, Finaflex, EFX Sports, JNX Sports, SynTech Nutrition Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BSN

- Cellucor

- MusclePharm

- ProSupps

- Nutrabolt

- GAT Sport

- EVLution Nutrition

- Kaged Muscle

- JYM Supplement Science

- Ghost

- RSP Nutrition

- Redcon1

- Blackstone Labs

- Universal Nutrition

- Nutrex Research

- Primeval Labs

- Inspired Nutraceuticals

- Alpha Lion

- MuscleTech

- Finaflex

- EFX Sports

- JNX Sports

- SynTech Nutrition