Posture Corrector Market By Product Type (Sitting Support Devices, Kinesiology Tape, Posture Braces, Others), By Distribution Channel (Pharmacies & Retail Stores, E-Commerce), By End User (Kids, Adults, Geriatric), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

29737

-

August 2024

-

300300300300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

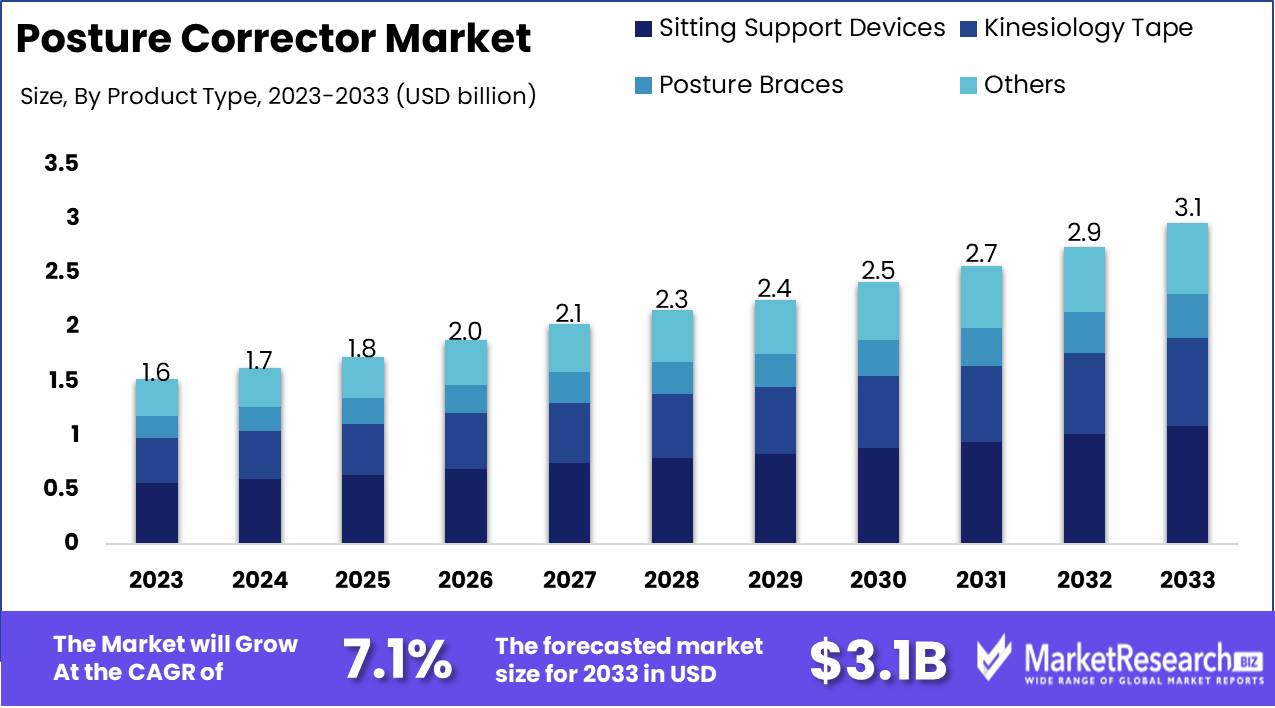

The Posture Corrector Market was valued at USD 1.6 billion in 2023. It is expected to reach USD 3.1 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Posture Corrector Market encompasses devices designed to improve and maintain proper body alignment by correcting poor posture. These products, which include wearable braces, supports, and ergonomic solutions, are utilized to address issues such as back pain, spinal misalignment, and muscle strain. The market's growth is driven by increasing awareness of posture-related health problems, rising adoption of ergonomic workplace solutions, and advancements in wearable technology.

The Posture Corrector market is poised for substantial growth driven by several pivotal factors. Increasing awareness of posture-related health issues is a primary catalyst, as consumers become more conscious of the long-term implications of poor posture on overall health. This heightened awareness is leading to a growing adoption of ergonomic solutions, including posture correctors, as individuals seek proactive measures to address and prevent musculoskeletal disorders. Additionally, the market is witnessing a positive growth trajectory, underpinned by ongoing advancements in posture correction technology and heightened emphasis on personal wellness.

However, the market also faces challenges, notably the high cost associated with advanced posture correctors. Premium products, while offering advanced features and enhanced efficacy, may limit accessibility for a broader consumer base. Despite this, the overall trend remains optimistic, with the market demonstrating resilience and adaptability. As innovations continue to emerge and consumer education deepens, the Posture correction market is expected to expand, driven by both demand for ergonomic solutions and the increasing recognition of the benefits associated with proper posture management.

Key Takeaways

- Market Growth: The Posture Corrector Market was valued at USD 1.6 billion in 2023. It is expected to reach USD 3.1 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Product Type: Sitting Support Devices led the Posture Corrector Market.

- By Distribution Channel: Pharmacies & Retail Stores dominated Posture Corrector distribution.

- By End User: The "Kids" segment dominated the Posture Corrector Market.

- Regional Dominance: North America dominates the posture corrector market with a 40% largest share.

- Growth Opportunity: The global posture corrector market is set for substantial growth, driven by rising health consciousness and innovative products.

Driving factors

Rising Back and Spine Disorders: A Critical Driver for Market Expansion

The increasing prevalence of back and spine disorders is a significant catalyst for the growth of the Posture correction market. According to recent studies, back pain affects approximately 80% of individuals at some point in their lives, with chronic conditions becoming more common due to aging and lifestyle factors. The rising incidence of spinal disorders, such as herniated discs and scoliosis, is directly fueling demand for effective solutions like posture correctors. As individuals seek relief and preventive measures for these conditions, the market for posture correctors is expanding to accommodate this growing need.

Sedentary Lifestyles: Amplifying the Need for Posture Correction Solutions

The prevalence of sedentary lifestyles is another crucial factor driving the growth of the Posture Corrector Market. With increasing numbers of people engaged in desk-bound jobs and prolonged screen time, there is a corresponding rise in posture-related issues. Data indicates that sedentary behavior contributes significantly to musculoskeletal disorders, including poor posture and back pain. The widespread adoption of office-based work and the lack of physical activity exacerbate these issues, creating a heightened demand for posture correctors designed to mitigate the effects of prolonged sitting and improve overall spinal health.

Growing Awareness of Health and Fitness: Fostering Market Growth Through Informed Consumer Choices

Growing awareness of health and fitness is a pivotal factor contributing to the Posture Corrector Market's expansion. As more individuals become conscious of the importance of maintaining good posture for overall well-being, there is a rising interest in products that support spinal health. Educational campaigns and increased availability of information on the benefits of proper posture have led to a more informed consumer base. This heightened awareness is driving consumers to invest in posture correctors as part of their broader health and fitness routines, thereby bolstering market growth.

Restraining Factors

Restriction Due to Long-Term Use Limitations

The growth of the Posture Corrector Market is significantly affected by concerns regarding the long-term use of these devices. Prolonged reliance on posture correctors can lead to a variety of issues, including dependency on the device and potential weakening of the body's natural posture-supporting muscles. This restriction impacts consumer adoption rates, as individuals are often hesitant to commit to a long-term solution that may not address their posture issues permanently.

According to market research, the reluctance to use posture correctors over extended periods has resulted in a slower growth rate in certain regions, where alternative solutions or temporary fixes are preferred. Consequently, manufacturers are facing challenges in sustaining market momentum, as the perceived limitations of long-term use deter potential buyers.

Low Awareness about Proper Usage and Its Market Implications

Low awareness regarding the proper usage of posture correctors in various regions further constrains market growth. Many consumers are unfamiliar with how to effectively use these devices, leading to suboptimal results and dissatisfaction. Inadequate knowledge can result in incorrect application, reducing the efficacy of the posture correctors and contributing to a decline in consumer trust. This lack of education affects sales, as potential users may be dissuaded from purchasing due to concerns about ineffective use. Market surveys indicate that regions with lower awareness levels experience slower adoption rates, impacting the overall expansion of the market.

By Product Type Analysis

In 2023, Sitting Support Devices led the Posture Corrector Market.

In 2023, Sitting Support Devices held a dominant market position in the Posture Corrector Market, particularly within the By Product Type segment. Sitting Support Devices, which include ergonomic chairs and lumbar supports, accounted for a substantial share due to their widespread adoption in both home and office settings. These devices offer effective support by promoting proper spinal alignment and reducing the risk of posture-related issues, thus driving their popularity.

Kinesiology Tape, known for its flexibility and therapeutic benefits, followed as a significant segment. It aids in improving posture through muscle support and pain relief, appealing to both athletes and individuals seeking non-invasive solutions. Posture Braces also contributed notably, offering more structured support and correction for various postural problems.

The "Others" category, encompassing diverse products like posture-correcting wearables, demonstrated growth but remained a smaller segment compared to the primary categories. Overall, the Posture Corrector Market's segmentation reflects a diverse range of solutions catering to different user needs, with Sitting Support Devices leading due to their extensive application and efficacy.

By Distribution Channel Analysis

In 2023, Pharmacies & Retail Stores dominated Posture Corrector distribution.

In 2023, Pharmacies & Retail Stores held a dominant market position in the distribution channel segment of the Posture Corrector Market. This dominance can be attributed to the widespread consumer preference for physical retail locations where they can physically inspect and try posture correctors before purchasing. Pharmacies, in particular, offer the added advantage of professional advice from healthcare providers, which enhances consumer trust and facilitates informed purchasing decisions. Additionally, the availability of posture correctors in well-established retail chains ensures high product visibility and accessibility, further driving sales in this channel.

In contrast, the E-Commerce segment, while growing, did not surpass the traditional retail channels in market share in 2023. However, E-Commerce is gaining traction due to the convenience of online shopping and the increasing penetration of digital platforms. The growth of E-Commerce is driven by its ability to provide a wide range of options, competitive pricing, and home delivery services, appealing to a tech-savvy consumer base that values ease of access and time savings. Both channels play significant roles in the market, catering to different consumer preferences and needs.

By End User Analysis

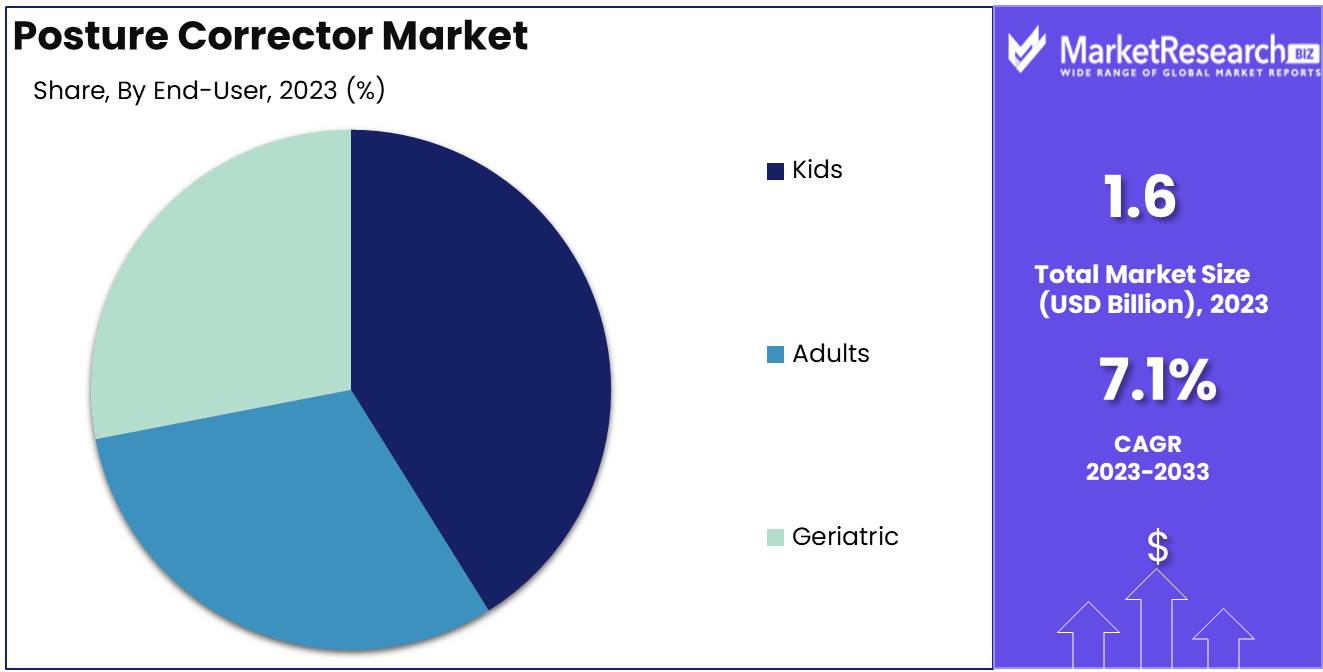

In 2023, The "Kids" segment dominated the Posture Corrector Market.

In 2023, The "Kids" segment held a dominant market position in the Posture Corrector Market. This segment's prominence can be attributed to the growing awareness of posture-related issues among children, driven by increased screen time and sedentary lifestyles. Educational campaigns and parental concerns about spinal health have significantly contributed to the demand for posture correctors designed specifically for younger users.

In the "Adults" segment, the market is driven by heightened awareness of posture's impact on overall health, including back pain and ergonomic issues related to long working hours. The rise in office-based jobs and remote work has led to an increased focus on products that alleviate posture-related discomfort among adults.

The "Geriatric" segment is influenced by the aging population's susceptibility to posture problems due to weakened muscles and bone density. The demand in this segment is supported by the growing geriatric demographic and a focus on enhancing mobility and reducing discomfort in older adults.

Key Market Segments

By Product Type

- Sitting Support Devices

- Kinesiology Tape

- Posture Braces

- Others

By Distribution Channel

- Pharmacies & Retail Stores

- E-Commerce

By End User

- Kids

- Adults

- Geriatric

Growth Opportunity

Increasing Adoption of Posture Correction Exercises and Yoga

The growing awareness of health and wellness has significantly influenced consumer behavior, leading to an increased adoption of posture correction exercises and yoga. As more individuals incorporate these practices into their daily routines, the demand for supportive accessories, including posture correctors, is rising. This trend is particularly noticeable among office workers and young adults who spend extended periods in sedentary positions. The integration of posture correction exercises in workplace wellness programs and fitness regimes is expected to drive substantial growth in the posture corrector market. The trend reflects a shift towards preventive healthcare, emphasizing the importance of maintaining proper posture to avoid long-term musculoskeletal issues.

Surging Demand for Posture Correction Products

The global posture corrector market is witnessing a surge in demand, fueled by the rising prevalence of back and neck pain due to poor posture. The increasing use of digital devices has exacerbated posture-related problems, prompting a higher uptake of corrective products. Innovations in posture corrector designs, offering enhanced comfort and efficacy, are attracting a broader consumer base. Products that integrate technology, such as smart posture correctors with real-time monitoring and feedback, are particularly gaining traction. This surge is not confined to any single demographic but spans across various age groups, indicating a universal acknowledgment of the benefits of maintaining good posture.

Latest Trends

Aging Population Driving Market Growth

The aging population is a significant trend influencing the posture corrector market. As the global demographic shifts towards an older age, the prevalence of musculoskeletal issues, such as poor posture and back pain, is increasing. Older adults are particularly vulnerable to these problems due to age-related muscle weakness and spinal degeneration. This demographic is increasingly seeking solutions to alleviate discomfort and improve quality of life, thereby driving the demand for posture correctors. Companies are responding by developing advanced, ergonomic posture correction devices tailored to the needs of this age group, incorporating features such as adjustable support and customizable fit. The growing awareness of posture-related health issues among the elderly further propels market expansion, as health professionals advocate for preventive measures and interventions.

Government Initiatives Promoting Spinal Health and Ergonomics

Government initiatives are playing a crucial role in shaping the posture corrector market. The various national and regional health programs are focusing on improving spinal health and ergonomics. Governments are increasingly recognizing the impact of poor posture on public health and productivity, leading to campaigns that promote ergonomic practices and preventive measures. These initiatives often include subsidies or incentives for health and wellness products, including posture correctors, as part of broader wellness programs.

Additionally, regulations and guidelines related to workplace ergonomics are being enforced more rigorously, encouraging both employers and employees to invest in posture correction solutions. Such policies not only boost market demand but also enhance consumer awareness regarding the importance of posture correction, thereby contributing to sustained market growth.

Regional Analysis

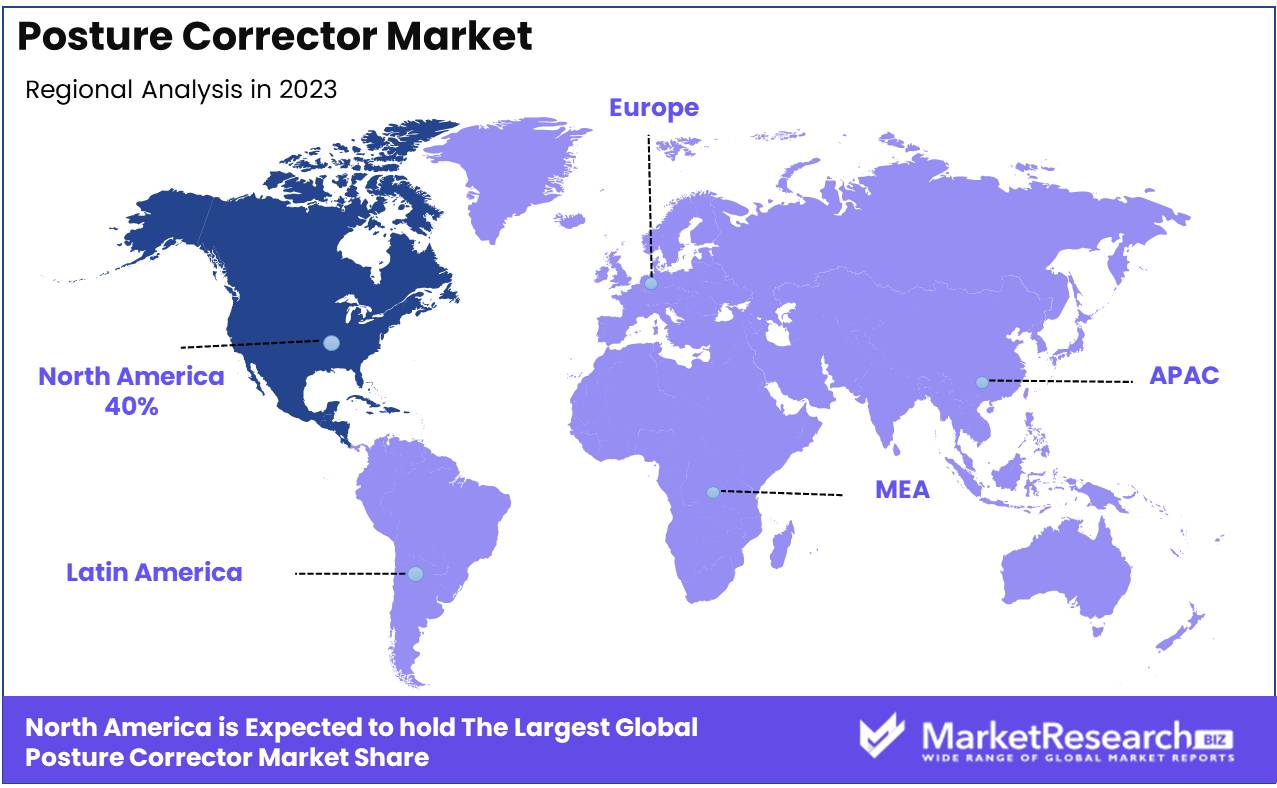

North America dominates the posture corrector market with a 40% largest share.

North America: North America is the leading region in the global posture corrector market, holding a substantial share of approximately 40%. This dominance can be attributed to the high awareness of health and wellness among consumers, coupled with significant investments in advanced healthcare and wellness products. The United States and Canada are major contributors to this market segment, driven by increasing incidences of posture-related issues due to sedentary lifestyles and extensive office work.

Europe: Europe holds a significant share of around 25% of the global market. The region's strong healthcare infrastructure and rising consumer inclination towards preventive health measures support this market's growth. Countries like Germany, the UK, and France are prominent contributors, with increasing adoption of posture correctors driven by heightened awareness of musculoskeletal health.

Asia Pacific: Asia Pacific is witnessing rapid growth in the posture corrector market, accounting for approximately 20% of the market share. The region's expanding population, increasing disposable incomes, and growing awareness about posture correction are pivotal drivers.

Middle East & Africa: This region represents a smaller segment of the market, with a share of around 10%, attributed to emerging healthcare trends and increasing consumer awareness.

Latin America: Latin America holds a market share of about 5%, reflecting moderate growth influenced by rising health consciousness and gradual adoption of wellness products.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Posture Corrector Market is characterized by a diverse group of prominent players, each contributing to the sector’s growth and innovation.

ViboCare, BodyRiteTraining, and Restore Health Solutions, all based in the U.S., are major contributors to the market, leveraging their extensive research and development capabilities to enhance posture correction technologies. UPRIGHT from Israel stands out for its advanced digital solutions that integrate posture correction with real-time feedback mechanisms.

Indian companies such as Hexaform, eDila, and COMFYMEDOstoplast Wellness Pvt. Ltd. are gaining traction with cost-effective and region-specific solutions, tapping into the growing awareness of posture-related issues in Asia. Marakym and BodyRite also offer innovative products that cater to a broad consumer base, focusing on ergonomic designs and comfort.

European players like Swedish Posture and Inspirera & Co. AB are known for their high-quality, research-backed products that cater to the European market’s unique preferences. Additionally, Thermo Fisher Scientific Inc., Novartis AG, Johnson & Johnson Services, Inc., and Bayer AG bring their vast resources and expertise to the market, offering scientifically validated solutions and integrating posture correction within broader health and wellness initiatives.

Market Key Players

- ViboCare (U.S.)

- BodyRiteTraining (U.S.)

- Hexaform (India)

- Restore Health Solutions (U.S.)

- UPRIGHT (Israel)

- BackJoy (U.S.)

- Marakym (U.S.)

- eDila (India)

- FUYERLI (U.S.)

- Inspirera & Co. AB (Sweden)

- IntelliSkin (U.S)

- Alignmed (U.S.)

- COMFYMEDOstoplast Wellness Pvt. Ltd. (India)

- BodyRite (U.S.)

- Swedish Posture (Sweden)

- Thermo Fisher Scientific Inc. (U.S.)

- Novartis AG (Switzerland)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- BD (U.S.)

Recent Development

- In June 2024, AlignRight Inc. released a new line of posture correctors that incorporate smart fabric technology. These posture correctors feature built-in sensors that provide users with data on their posture habits and offer corrective exercises through a mobile app.

- In March 2024, Sitting Pretty Solutions announced a new partnership with WellnessTech to integrate their posture correction technology into the WellnessDesk, an ergonomic office workstation designed to promote better posture and reduce back pain.

- In February 2024, Upright Technologies launched the Upright PRO, an advanced posture corrector with real-time feedback and AI-driven guidance. This device offers enhanced features such as integrated posture correction exercises and personalized reminders.

Report Scope

Report Features Description Market Value (2023) USD 1.6 Billion Forecast Revenue (2033) USD 3.1 Billion CAGR (2024-2032) 7.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sitting Support Devices, Kinesiology Tape, Posture Braces, Others), By Distribution Channel (Pharmacies & Retail Stores, E-Commerce), By End User (Kids, Adults, Geriatric) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ViboCare (U.S.), BodyRiteTraining (U.S., Hexaform (India), Restore Health Solutions (U.S.), UPRIGHT (Israel), BackJoy (U.S.), Marakym (U.S.), eDila (India), FUYERLI (U.S.), Inspirera & Co. AB (Sweden), IntelliSkin (U.S), Alignmed (U.S.), COMFYMEDOstoplast Wellness Pvt. Ltd. (India), BodyRite (U.S.), Swedish Posture (Sweden), Thermo Fisher Scientific Inc. (U.S.), Novartis AG (Switzerland), Abbott (U.S.), Johnson & Johnson Services, Inc. (U.S.), GSK plc (U.K.), Bayer AG (Germany), BD (U.S.) Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ViboCare (U.S.)

- BodyRiteTraining (U.S.)

- Hexaform (India)

- Restore Health Solutions (U.S.)

- UPRIGHT (Israel)

- BackJoy (U.S.)

- Marakym (U.S.)

- eDila (India)

- FUYERLI (U.S.)

- Inspirera & Co. AB (Sweden)

- IntelliSkin (U.S)

- Alignmed (U.S.)

- COMFYMEDOstoplast Wellness Pvt. Ltd. (India)

- BodyRite (U.S.)

- Swedish Posture (Sweden)

- Thermo Fisher Scientific Inc. (U.S.)

- Novartis AG (Switzerland)

- Abbott (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- GSK plc (U.K.)

- Bayer AG (Germany)

- BD (U.S.)