Pos Terminals Market By Product (Fixed, Mobile), By Component (Hardware, Software, Services), By Deployment (Cloud, On-premise), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

6605

-

June 2023

-

142

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

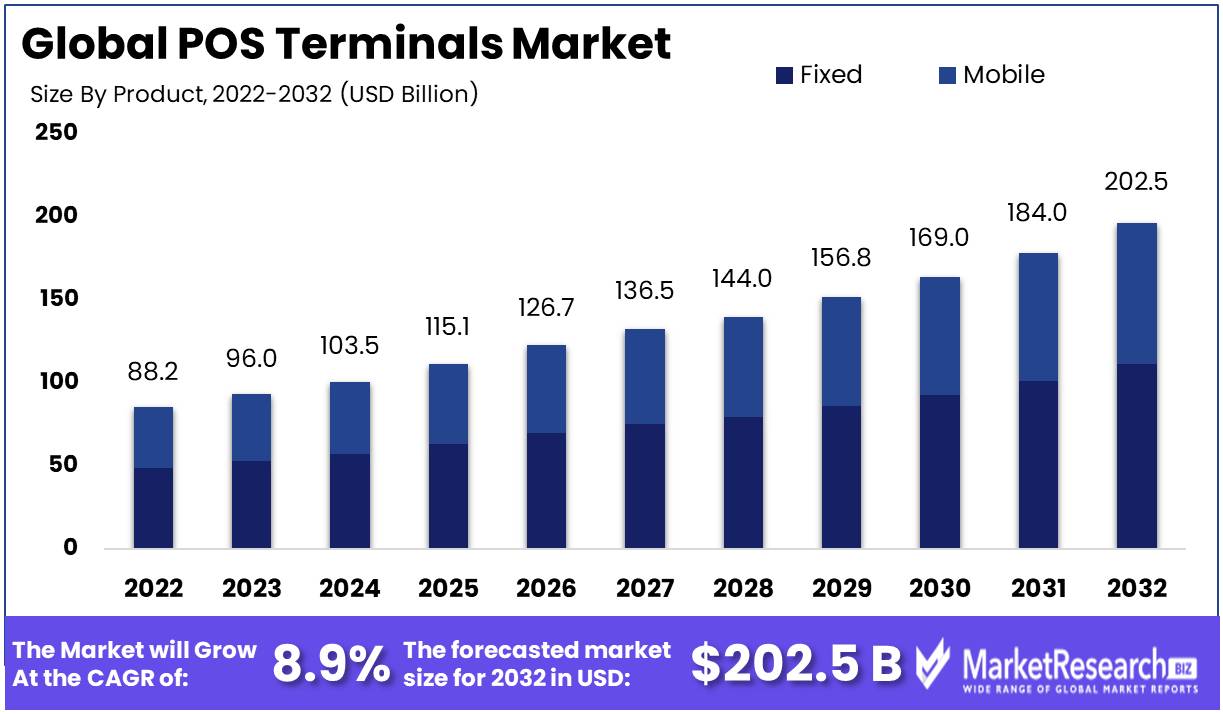

Pos Terminals Market size is expected to be worth around USD 202.5 Bn by 2032 from USD 88.2 Bn in 2022, growing at a CAGR of 8.9% during the forecast period from 2023 to 2032.

The Pos Terminals Market is a rapidly expanding and transforming industry that is sweeping the globe. The market for POS terminals has expanded exponentially due to technological advancements and the rising demand for seamless transactions. This report will provide an overview of the Pos Terminals Market, including its definition, significance, and benefits. In addition, we will discuss notable innovations in the industry, major investments, and incorporation into products/services, market growth, and applications, industries investing in the Pos Terminals Market, major market drivers, ethical concerns, and responsible Pos Terminals usage, and examples of Pos Terminals applications in the business world.

Pos Terminals, or Point-of-Sale Terminals, are electronic instruments used for card payment processing. They have become a crucial component of modern business transactions, as they facilitate quick, secure, and convenient payments without the need for physical currency. The primary objective of the Pos Terminals Market is to provide these payment processors to a diverse clientele in order to facilitate the simplification of their payment processes.

In today's digital era, where online purchasing and card payments have become the norm, the POS Terminals Market has gained increasing significance. Businesses can improve the consumer experience by offering quick and convenient payment options, as well as streamline their operations, by utilizing PoS Terminals. Pos Terminals enable contactless transactions, which decreases the need for physical currency and improves accounting. In addition, the capacity to accept card payments expands a company's customer base, thereby increasing its market potential.

New technologies are constantly being developed to improve payment processing in the POS Terminals Market. One of the most notable innovations is the use of contactless payments, which allows customers to pay for transactions with their mobile devices or wearables, thereby reducing physical contact with POS terminals. The use of biometric technology, such as facial recognition and fingerprint scanners, for authentication and security, as well as the use of cloud-based software for data storage and management, are also notable innovations in the Pos Terminals Market.

With an increase in demand for digital payment systems, the POS Terminals Market has been steadily expanding over the years. It is anticipated that the market will continue to expand in the future years, as new technologies and features are developed to improve payment processing. As more businesses recognize the advantages of digital payment systems, the applications of POS Terminals in various industries, including healthcare, retail, hospitality, and finance, have expanded.

Driving Factors

Digital Payment Adoption

Digital payments offer faster, more convenient, and more secure transactions than traditional cash transactions. With the global expansion of e-commerce, businesses have prioritized digital payment methods. The adoption of digital payment solutions has provided businesses with an array of payment alternatives. Payment gateways such as PayPal, Stripe, and Square have increased the convenience of cashless transactions. They enable businesses to accept payments via various channels, including mobile devices, the Internet, and point-of-sale terminals, among others.

Demand for Secure Solutions

Security is a concern for both consumers and enterprises. Attempts by fraudsters to obtain payment card information are becoming increasingly common. Consequently, a secure and dependable payment solution is essential for businesses. Contactless payments and chip cards are common security solutions. Contactless payments provide consumers with a more secure transaction by obviating the need for physical contact with the POS terminal; instead, transactions are processed via a smartphone, card, or wearable device. The use of card processors eliminates opportunities for fraud, resulting in enhanced transaction security.

Payment Technology Advancements

Innovations in payment technology have been progressively incorporated into the adoption of payment solutions. The integration of Near Field Communication (NFC) technology into point-of-sale terminals has transformed the manner in which consumers pay merchants. NFC-enabled devices permit consumers to pay with a simple tap of their mobile device, smart card, or wearable device on the POS terminal. Other advancements in payment technology include the use of biometrics, such as facial recognition technology, to ensure the security of transactions, and blockchain technology, which increases transactional integrity.

Integration with Software

The integration of digital payment solutions with POS software has substantially increased business efficiency. Through a single digital platform, businesses can connect to payment gateways and customer data management systems, making transactions and data management simple and efficient. Square, PayPal, and Stripe all provide APIs that integrate payment and consumer data across multiple software platforms. This integration enhances the speed and precision of transaction processes and the management of customer data.

Restraining Factors

Security Concerns

Concerns about security continue to be one of the most significant restraints on the POS terminals market. As an increasing number of consumers adopt digital payment methods, merchants must ensure the security of their transaction data. The merchants' POS terminals must comply with PCI DSS (Payment Card Industry Data Security Standard) for secure payment processing. Any data breach or vulnerability could result in a substantial loss of consumer confidence, revenue, and brand reputation. Additionally, merchants must have an effective system in place to detect and respond swiftly to any attempted security breaches.

Implementation and Maintenance Costs

Costs associated with POS terminal installation and upkeep are also a major concern for merchants. Depending on the type and features of the terminal, the cost of implementing a modern POS system can be high. The price can range from a few hundred to several thousand dollars, depending on the hardware, software, and payment processing infrastructure required. Additionally, ongoing maintenance and updates of POS terminals can be costly, posing a significant obstacle for small businesses with limited budgets. Before choosing a POS system that best meets their business demands, merchants must evaluate their particular requirements and budgetary constraints with care.

Compatibility Challenges

Compatibility issues continue to be a significant restraint on the POS terminals market. Retailers must ensure that their POS systems are compatible with the diverse platforms, devices, and technologies employed by their customers. Compatibility issues arise primarily due to the fragmentation of the market and the availability of multiple payment methods to consumers. In addition, merchants must ensure that their POS terminals are compatible with the most recent mobile payment technologies, including Apple Pay, Samsung Pay, Google Pay, etc. To surmount compatibility issues, merchants must select a POS terminal that supports a variety of payment methods and is compatible with their unique business needs.

Product Analysis

The use of electronic payment methods is increasing at an unprecedented rate in the current digital age. The point of sale (POS) terminals market is no exception. Among the numerous types of POS terminals on the market, the fixed segment is the most prevalent.

Fixed-segment POS terminals are devices that are permanently installed and connected to a power source. These are typically found in retail stores, supermarkets, and other businesses with a fixed counter or check-out point. Fixed-segment POS terminals are the most popular due to their dependability, durability, and usability.

An additional factor propelling the adoption of fixed-segment POS terminals is the rise of economic development in emerging economies. In these economies, disposable income has increased, resulting in greater consumer expenditure. This has led to an increase in retail and commercial establishments requiring POS terminals for payment processing. In addition, governments of emerging economies are promoting electronic payments and reducing reliance on cash transactions.

Component Analysis

The hardware segment of a POS terminal is the most important component. It refers to the system's tangible components, such as the display screen, card reader, and printer. The hardware segment of the POS terminals market holds the greatest share.

As economic growth in emerging economies increases, so does the demand for hardware-based POS terminals. In these economies, the expansion of retail and commercial establishments has increased demand for POS terminals. In addition, as more consumers use electronic payments, the demand for POS terminals with dependable and secure hardware increases.

Consumers today expect POS terminals to be outfitted with high-quality and dependable hardware. They desire POS terminals that are user-friendly, have quick processing periods, and are safe. The hardware segment plays a crucial role in meeting these expectations by delivering the necessary functionalities.

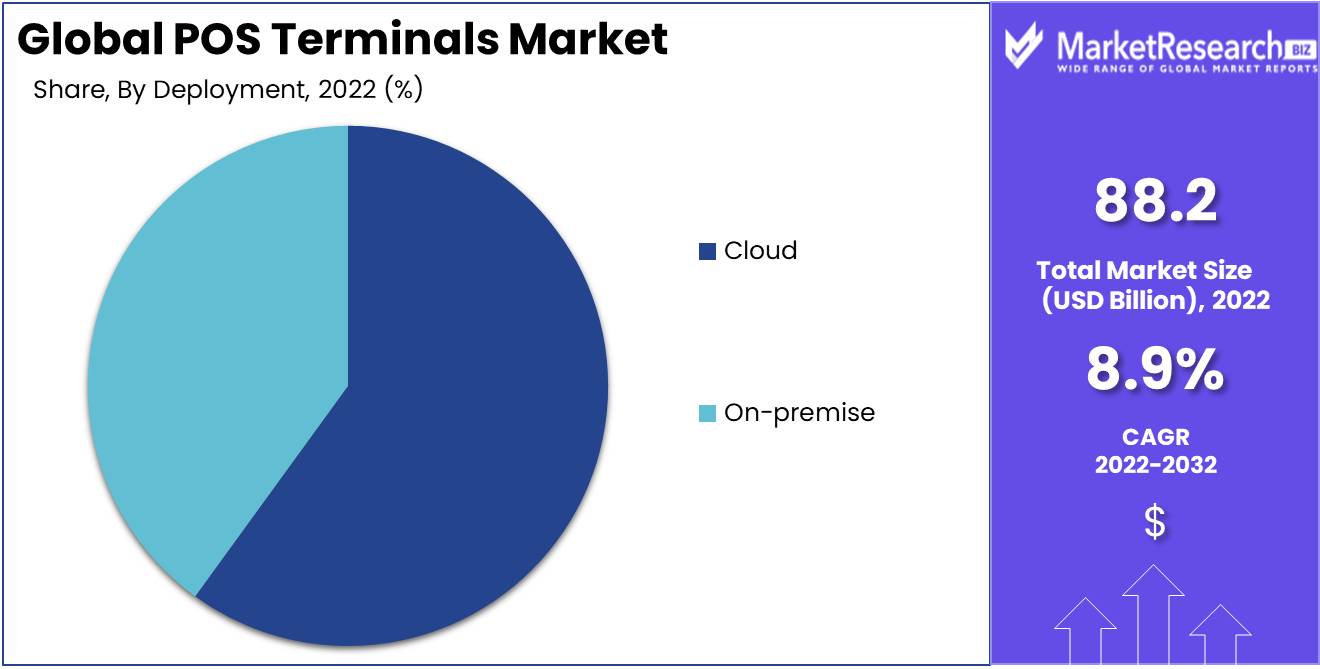

Deployment Analysis

The cloud segment is the most dynamic and fastest-growing segment of the POS terminals market. POS terminals utilizing cloud-based software have revolutionized the market by offering increased flexibility, scalability, and security.

Cloud-based POS systems operate on an Internet-connected server, allowing businesses to access their POS data from any location with an Internet connection. This eliminates the need for a local server and provides greater management flexibility for POS systems.

The emergence of cloud-based POS terminals has been substantially influenced by the economic development of emergent economies. As more businesses expand in these economies, there is a growing demand for POS systems that are adaptable, scalable, and cost-effective. These benefits are offered by cloud-based POS systems in comparison to on-premises systems.

Today's consumers are more cautious regarding the security of their data. The security measures of cloud-based POS systems are superior to those of on-premises systems. Moreover, cloud-based systems enable businesses to provide a more efficient and convenient consumer experience with shorter checkout lines.

Key Market Segments

By Product

- Fixed

- Mobile

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-premise

Growth Opportunity

Emerging market expansion

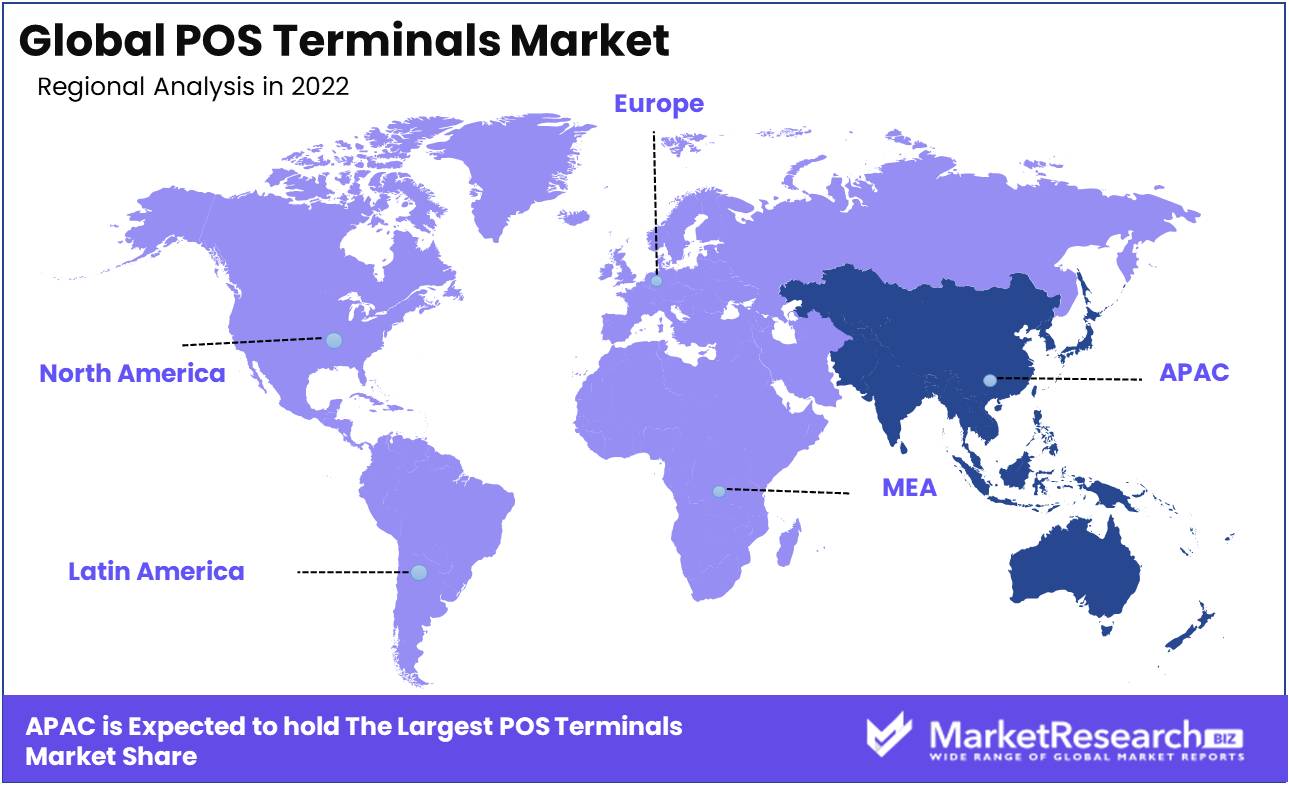

In emerging markets such as Latin America, Asia-Pacific, and the Middle East, the demand for POS terminals is growing. This is a result of the expansion of small and medium-sized businesses (SMEs), which are increasingly implementing the most advanced technological solutions for financial transactions. In addition, rapid urbanization and the increasing adoption of intelligent technologies are fueling demand for POS terminals that serve a variety of industries.

Analytics integration

Increasingly, POS terminals are being integrated with analytics solutions. This enables businesses to access detailed information regarding consumer transaction histories, product preferences, and behavior patterns. This information can be used to develop customized marketing campaigns and provide personalized services to clients, resulting in an enhanced customer experience.

Collaboration

Collaboration is a significant growth driver in the POS terminals market. Multiple parties, including banks, payment gateway providers, and technology companies, are collaborating to improve the payment ecosystem as a whole. For example, banks are collaborating with technology companies to develop contactless payment solutions, and payment gateway providers are collaborating with merchants to offer payment solutions that are tailored to specific customer requirements.

Cloud and mobile solutions

Cloud and mobile solutions are revolutionizing the POS terminals market. The emergence of cloud-based POS terminals has obviated the need for cumbersome hardware and software infrastructure, thereby reducing costs for businesses and enhancing their efficacy. Mobile POS terminals, on the other hand, enable businesses to receive payments on the go and integrate seamlessly with existing systems.

Latest Trends

Transition to Contactless Payment Solutions

As a result of the global COVID-19 pandemic, people have become more cautious about handling objects such as cash, payment terminals, etc. This has led to a rise in the use of contactless payment solutions, which has ushered in a new era of transactional privacy. Traditional payments are slower, riskier, and more expensive than contactless transactions. Numerous retailers, including premium labels, have begun implementing contactless payment solutions as a means of enhancing their customer experience and interacting with modern consumers.

Adoption of Mobile POS Systems in Retail and Hospitality

mPOS systems are portable devices that enable businesses to conduct transactions using smartphones or tablets. Historically, local small enterprises were the primary users of mobile point-of-sale (mPOS) systems. With technological advancements, mobile point-of-sale (mPOS) systems are becoming increasingly sophisticated, dependable, and adaptable, leading to their increased adoption by large retail and hospitality chains.

Integration of POS Terminals With Inventory Management Software

Proper inventory management is crucial to operating a successful business, and it becomes even more crucial when dealing with large quantities of inventory. POS terminals that are integrated with inventory management software enable businesses to monitor inventory in real time, enabling them to make informed decisions regarding the purchase and sale of goods. This integration also assists in minimizing waste, optimizing storage space, and preventing stock-outs.

Expansion of POS Terminals in Emerging Economies

Emerging societies are experiencing gradual market growth and expansion. As these economies continue to grow, they will require cutting-edge POS systems that can accommodate their expanding retail markets. This has resulted in an increase in the use of POS terminals in these regions, as they provide a quicker and more efficient method of conducting transactions.

Regional Analysis

Asia-Pacific, which includes China, Japan, India, and Australia, dominates the Global POS Terminals Market and is one of the fastest-growing markets for POS terminals worldwide. Several emerging economies are located in the region, which is experiencing a rise in retail sales and a rise in the adoption of advanced payment technologies. The growth of the POS terminals market in this region is fueled by the region's rising population, rising disposable income, and technological advancements. POS technology has become an integral part of the digital transformation of the retail industry, enabling retailers to enhance consumer engagement, reduce costs, and increase operational efficiency.

China, the largest economy in the world, has become a major contributor to the expansion of the POS terminals market in the Asia-Pacific region, accounting for a sizeable portion of the market. In addition, the adoption of QR code payments in China has provided a substantial boost to the development of the POS terminals market, with QR code POS terminals becoming the preferred payment method for merchants across the country.

Japan, the second-largest market in Asia-Pacific, has one of the most advanced POS systems in the world, with merchants adopting sophisticated payment technologies to enhance the customer experience. Despite demographic challenges such as an aging population, the country's retail sector is expanding, creating ample growth opportunities for POS terminals. In addition, the government's efforts to promote cashless transactions and enhance payment infrastructure have boosted the growth of the country's POS terminals market.

India, the third-largest market in the Asia-Pacific region, is experiencing rapid development in the POS terminals market as a result of government initiatives to promote digital payments and reduce cash transactions. Increasing consumer demand for cashless payment options is propelling the national adoption of POS terminals in the retail sector, which is also on the rise.

The Asia-Pacific POS terminals market is anticipated to maintain a high growth rate in the coming years, driven by the increasing adoption of digital transactions, growth in e-commerce sales, and technological advances in payment technologies. The region's dominance in the global POS terminals market is anticipated to continue, supported by the development prospects of emerging economies and the merchant adoption of advanced payment technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Ingenico Group is a prominent player in the POS terminal market and a French company headquartered in France. The company provides a variety of products, such as countertops, mobile, and wireless POS terminals. Ingenico has a significant global presence and serves critical markets including retail, hospitality, and transportation.

Verifone Systems is an American provider of payment and POS systems. The company's product lineup consists of countertop, mobile, and self-service POS solutions. Verifone serves numerous industries, including retail, hospitality, healthcare, and transportation.

PAX Technology is a Chinese company that operates in over 120 countries and provides payment solutions. The company offers an extensive selection of products, such as countertops, mobile, and wireless POS terminals. PAX Technology serves critical industries including retail, hospitality, transportation, and healthcare.

Newland Payment Technology is a Chinese corporation with a presence in over 50 countries that provides payment solutions. The company provides a variety of products, such as countertops, mobile, and wireless POS terminals. Retail, hospitality, transportation, and healthcare are essential markets that Newland Payment Technology serves.

Top Key Players in Pos Terminals Market

- Ingenico Group

- VeriFone Inc.

- Fujian Newland Payment Technology Co. Ltd.

- Fujian LANDI Commercial Equipment Co. Ltd.

- Shenzhen Xinguodu Technology Co. Ltd.

- New Pos Technology Ltd.

- Bitel LLC

- Cybernet Manufacturing Inc.

- Castles Technology Co. Ltd.

- PAX Technology Inc.

- SZZT Electronics Shenzhen Co. Ltd.

Recent Development

- In 2022, Ingenico introduced the Ingenico iZ320 POS terminal, emphasizing improved usability and security over its predecessors.

- In 2022, Verifone also introduced the Verifone V200 POS terminal, emphasizing its affordability in comparison to earlier POS terminals.

- In 2023, PAX introduced the PAX S300 POS terminal, emphasizing its enhanced versatility in comparison to earlier models.

- In 2023, Similarly, Newland introduced the Newland N300 POS terminal, highlighting its superior durability relative to previous POS terminals.

Report Scope

Report Features Description Market Value (2022) USD 88.2 Bn Forecast Revenue (2032) USD 202.5 Bn CAGR (2023-2032) 8.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Fixed, Mobile)

By Component (Hardware, Software, Services)

By Deployment (Cloud, On-premise)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Ingenico Group, VeriFone Inc., Fujian Newland Payment Technology Co. Ltd., Fujian LANDI Commercial Equipment Co. Ltd., Shenzhen Xinguodu Technology Co. Ltd., New Pos Technology Ltd., Bitel LLC, Cybernet Manufacturing Inc., Castles Technology Co. Ltd., PAX Technology Inc., SZZT Electronics Shenzhen Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Ingenico Group

- VeriFone Inc.

- Fujian Newland Payment Technology Co. Ltd.

- Fujian LANDI Commercial Equipment Co. Ltd.

- Shenzhen Xinguodu Technology Co. Ltd.

- New Pos Technology Ltd.

- Bitel LLC

- Cybernet Manufacturing Inc.

- Castles Technology Co. Ltd.

- PAX Technology Inc.

- SZZT Electronics Shenzhen Co. Ltd.