Polystyrene Packaging Market By Product (Bowls, Cups, Bags, Pouches, Boxes, Plates, Wraps & Films, Bottles), By Application (Fruits & Vegetables, Snacks, Cooked Food, Sea Products, Meat Products, Dairy Products, Bakery Products), By End User (Food & beverage, Pharmaceutical, Personal & Home Care), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46813

-

May 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

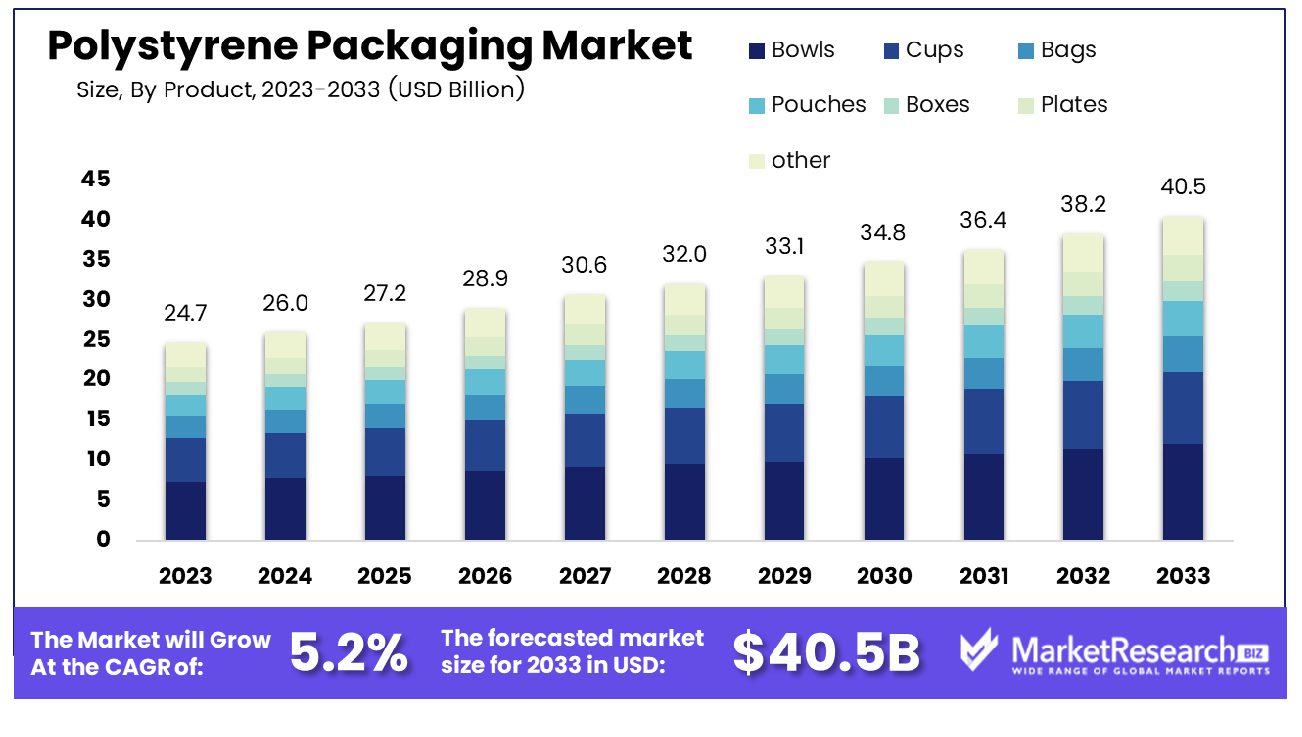

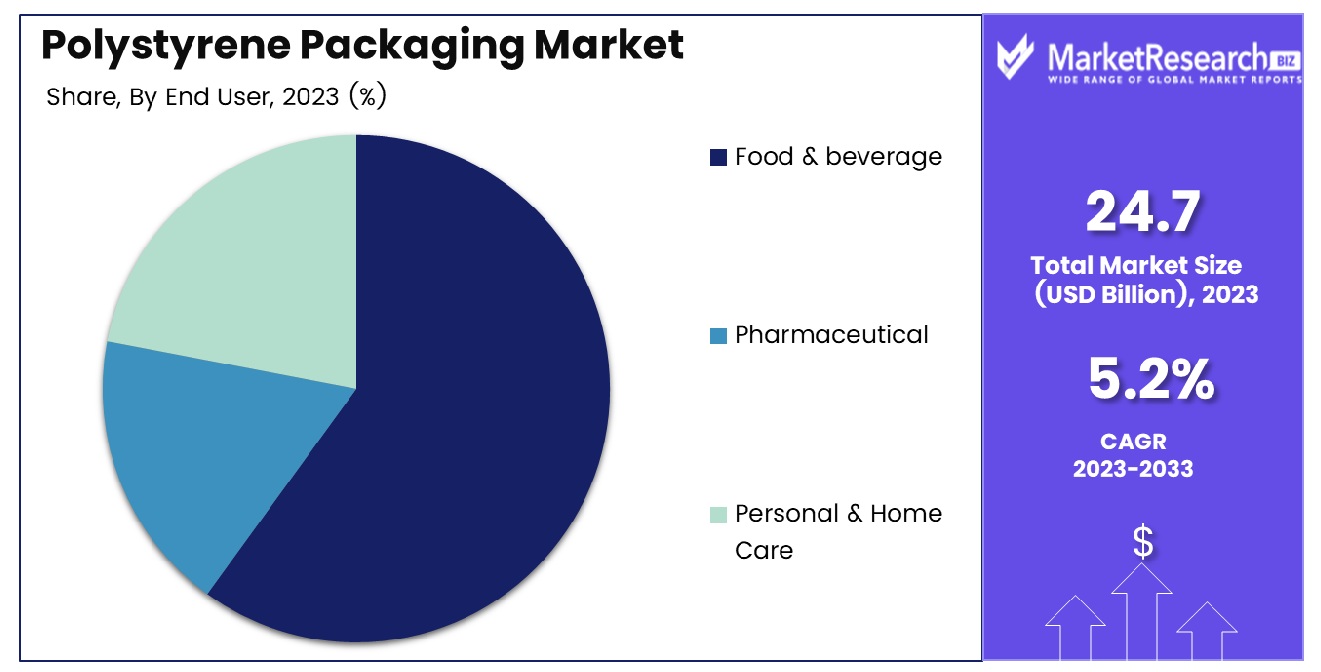

The Global Polystyrene Packaging Market was valued at USD 24.7 Bn in 2023. It is expected to reach USD 40.5 Bn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Polystyrene Packaging Market refers to the industry segment centered around the production and distribution of packaging solutions utilizing polystyrene, a versatile thermoplastic polymer known for its lightweight, insulating, and protective properties. This market encompasses a wide range of applications across various sectors, including food and beverage, pharmaceuticals, electronics, and consumer goods. As a cost-effective and efficient packaging material, polystyrene offers manufacturers and businesses the ability to safeguard products during transit while minimizing environmental impact.

The Polystyrene Packaging Market stands as a resilient cornerstone within the broader packaging industry, propelled by the enduring legacy of polystyrene and its evolution over time. Since its serendipitous discovery in 1839 by Eduard Simon, polystyrene has undergone significant advancements, notably through polymerization studies pioneered by eminent chemists such as Marcellin Berthelot and Hermann Staudinger. This journey of scientific inquiry has led to the development of expanded polystyrene (EPS), a versatile closed-cell foam renowned for its rigidity, toughness, and insulating properties. With a normal density range spanning 11 to 32 kg/m3, EPS finds widespread application across diverse sectors, including food packaging, building insulation, and product protection.

The Polystyrene Packaging Market stands as a resilient cornerstone within the broader packaging industry, propelled by the enduring legacy of polystyrene and its evolution over time. Since its serendipitous discovery in 1839 by Eduard Simon, polystyrene has undergone significant advancements, notably through polymerization studies pioneered by eminent chemists such as Marcellin Berthelot and Hermann Staudinger. This journey of scientific inquiry has led to the development of expanded polystyrene (EPS), a versatile closed-cell foam renowned for its rigidity, toughness, and insulating properties. With a normal density range spanning 11 to 32 kg/m3, EPS finds widespread application across diverse sectors, including food packaging, building insulation, and product protection.The market's trajectory is shaped by a confluence of factors, including shifting consumer preferences, regulatory imperatives, and technological innovations. Amidst growing awareness of environmental sustainability, stakeholders in the Polystyrene Packaging Market are navigating towards greener alternatives while optimizing the inherent advantages of EPS. Strategies aimed at enhancing recyclability, reducing material usage, and optimizing supply chain efficiencies are paramount in addressing both market demands and environmental stewardship.

A dynamic landscape characterized by a delicate balance between tradition and innovation. While the historical roots of polystyrene lay the foundation for market stability, its contemporary applications herald a future defined by adaptability and sustainability. The Polystyrene Packaging Market, thus, presents both challenges and opportunities for industry players to leverage scientific ingenuity and market insights in delivering solutions that resonate with evolving consumer expectations.

Key Takeaways

- Market Value: The Global Polystyrene Packaging Market was valued at USD 24.7 Bn in 2023. It is expected to reach USD 40.5 Bn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Product: Cups dominate the polystyrene packaging market, holding approximately 30% of the market share, driven by their widespread use in both commercial and consumer applications.

- By Application: Snacks lead the application segment of the polystyrene packaging market with 25% of the market share, primarily due to the increasing demand for convenient, ready-to-eat food options.

- By End User: The food and beverage sector dominates the polystyrene packaging market with a substantial 60% market share, reflecting the industry's extensive need for cost-effective, durable, and versatile packaging solutions.

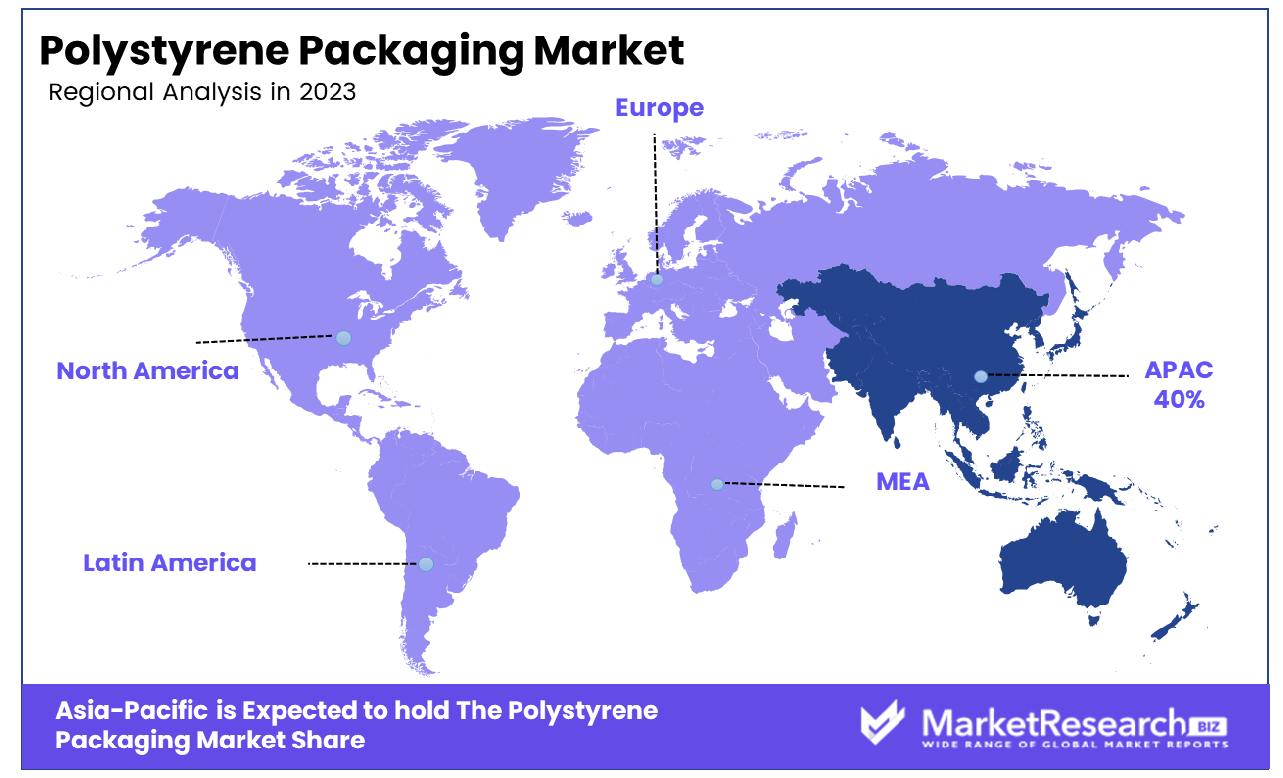

- Regional Dominance: Asia-Pacific holds the largest share with approximately 40%, driven by rapid industrialization, urbanization, and the booming food and beverage industry.

- Growth Opportunity: The polystyrene packaging market offers significant growth opportunities driven by increasing demand for lightweight, durable, and cost-effective packaging solutions across various industries worldwide.

Driving factors

Cosmetics and Personal Goods

The functional cosmetics and personal goods industry stands as a potent driving force behind the growth of the Polystyrene Packaging Market. With an increasing emphasis on aesthetics and product presentation, manufacturers in this sector heavily rely on packaging solutions that offer both protection and visual appeal. Polystyrene, with its lightweight nature and versatility, emerges as a favored choice for packaging these items.

Polystyrene packaging provides excellent clarity, allowing consumers to view the product inside, which is crucial for cosmetic products where visual appeal plays a pivotal role in consumer purchasing decisions. Additionally, its durability ensures that fragile items such as perfume bottles or makeup compacts remain intact during transit, reducing the likelihood of damage or breakage.

Medical and Pharmaceutical Industry

In the realm of healthcare, the importance of maintaining sterility, safety, and integrity of medical supplies cannot be overstated. The medical and pharmaceutical industry relies heavily on packaging materials that ensure the preservation of product efficacy while safeguarding against contamination and tampering. Polystyrene emerges as a dependable ally in meeting these stringent requirements.

The medical and pharmaceutical packaging market has witnessed steady growth over the years, driven by factors such as the increasing prevalence of chronic diseases, advancements in drug delivery systems, and the rising demand for personalized medicine. Polystyrene's inherent properties, such as chemical inertness and resistance to moisture, make it an ideal choice for packaging pharmaceutical products ranging from tablets and capsules to syringes and vials. Its ability to maintain product sterility and integrity throughout the supply chain ensures that medicines reach end-users in optimal condition, thereby bolstering patient safety and satisfaction.

Recyclability

Amid growing environmental consciousness and regulatory pressures, sustainability has emerged as a defining factor shaping consumer preferences and industry practices across various sectors. In this context, the recyclability of packaging materials has become a focal point for businesses seeking to minimize their environmental footprint. Polystyrene, despite historical concerns regarding its environmental impact, has made significant strides in the realm of recyclability, contributing to the growth of the Polystyrene Packaging Market.

The development of advanced recycling technologies has enabled the conversion of used polystyrene packaging into reusable materials, thereby mitigating concerns related to waste disposal and resource depletion. Innovations such as chemical recycling and mechanical recycling have expanded the scope of polystyrene recycling, allowing manufacturers to adopt more sustainable practices without compromising on performance or cost-efficiency.

Restraining Factors

Environmental Concerns

In an era marked by heightened environmental awareness, the Polystyrene Packaging Market is undergoing a transformative shift driven by growing concerns over ecological sustainability. Environmental consciousness among consumers, coupled with stringent regulations aimed at plastic waste management and mitigating environmental degradation, has prompted industries to seek alternative packaging solutions that minimize their carbon footprint and environmental impact. Polystyrene, traditionally associated with concerns regarding non-biodegradability and persistence in the environment, has faced scrutiny for its perceived contribution to plastic pollution.

As a response to environmental concerns, stakeholders within the Polystyrene Packaging Market are increasingly investing in research and development initiatives to enhance the recyclability and biodegradability of polystyrene products. Innovations such as chemical recycling, mechanical recycling, and the incorporation of bio-based or recycled content in polystyrene formulations are driving the industry towards a more sustainable future.

Pollution and Recyclability

The issue of pollution, particularly plastic pollution, has emerged as a pressing global challenge, prompting stakeholders across industries to reassess their packaging strategies and embrace sustainable alternatives. Within the Polystyrene Packaging Market, the dual considerations of pollution mitigation and recyclability are shaping industry dynamics and driving innovation towards more environmentally responsible solutions. Polystyrene, characterized by its lightweight and durable properties, has long been favored for packaging applications across various sectors.

Mechanical recycling processes, which involve shredding and melting used polystyrene products to produce recycled resin, represent a key strategy for diverting polystyrene waste from landfills and reducing its environmental footprint. Advancements in chemical recycling technologies enable the conversion of polystyrene waste into feedstock for the production of new packaging materials, further bolstering the circularity of polystyrene packaging systems.

By Product Analysis

Cups dominated the Bowls segment in the Polystyrene Packaging Market with over a 30% share.

In 2023, Cups held a dominant market position in the Bowls segment of the Polystyrene Packaging Market, capturing more than a 30% share. Cups are an indispensable part of the food service industry, offering convenience and practicality for serving soups, salads, and various other dishes. With their versatile nature and ease of disposal, cups have emerged as a preferred choice among consumers and businesses alike.

Bowls, a quintessential component of the food packaging landscape, have witnessed a substantial uptake owing to the growing demand for on-the-go meals and snacks. As consumers increasingly opt for convenience and mobility in their dining experiences, bowls serve as an ideal solution for packaging a wide array of food items, including noodles, rice, and salads.

The dominance of Cups in the Bowls segment can be attributed to their widespread usage across various food service establishments, including restaurants, cafes, and fast-food chains. The affordability and recyclability of polystyrene cups further bolster their appeal among both consumers and businesses.

The durability and insulation properties of polystyrene cups ensure that food remains fresh and hot, enhancing the overall dining experience for consumers. This, coupled with their lightweight design and stackability, makes polystyrene cups a preferred choice for both single-use and reusable packaging solutions in the food service industry.

By Application Analysis

Snacks led the Fruits & Vegetables segment, capturing more than a 25% share.

In 2023, Snacks held a dominant market position in the Fruits & Vegetables segment of the Polystyrene Packaging Market, capturing more than a 25% share. The Fruits & Vegetables segment within the polystyrene packaging market encompasses a wide range of fresh produce, including fruits, vegetables, and salads, which require effective packaging solutions to maintain their freshness and quality during storage and transportation.

Snacks, being a ubiquitous part of modern lifestyles, have emerged as a key driver in the Fruits & Vegetables packaging segment. With the increasing demand for convenient, on-the-go snack options, there has been a significant surge in the consumption of packaged fruits and vegetable snacks. These snacks offer consumers a convenient and healthy alternative to traditional junk food options, driving their popularity across various demographics.

The dominance of Snacks in the Fruits & Vegetables segment can be attributed to their widespread availability, diverse product offerings, and consumer preference for healthy snacking options. Packaged fruits and vegetable snacks packaged in polystyrene containers offer several advantages, including extended shelf life, protection from external contaminants, and enhanced visual appeal, thereby catering to the evolving preferences of health-conscious consumers.

The lightweight and durable nature of polystyrene packaging make it an ideal choice for packaging snacks, ensuring convenience and portability without compromising on product quality. The versatility of polystyrene packaging solutions also allows for innovative packaging designs and formats, further driving the adoption of snacks in the Fruits & Vegetables segment.

By End User Analysis

Food & Beverage sector held a dominant 60% share in its respective segment.

In 2023, Food & Beverage held a dominant market position in the Food & Beverage segment of the Polystyrene Packaging Market, capturing more than a 60% share. The Food & Beverage segment constitutes a significant portion of the overall polystyrene packaging market, encompassing a wide range of products from packaged food items to beverages.

The dominance of Food & Beverage in this segment can be attributed to the extensive usage of polystyrene packaging across various categories within the food and beverage industry. Polystyrene packaging offers numerous advantages such as excellent insulation properties, lightweight construction, and cost-effectiveness, making it an ideal choice for packaging a diverse array of food and beverage products.

In the food sector, polystyrene packaging is widely utilized for packaging perishable items such as meat, poultry, seafood, dairy products, and bakery goods. Its ability to maintain the freshness and quality of these products during storage and transportation contributes to its popularity among food manufacturers and retailers.

In the beverage sector, polystyrene packaging is commonly used for packaging both alcoholic and non-alcoholic beverages such as carbonated drinks, juices, water, and alcoholic beverages. The durability and protective properties of polystyrene packaging ensure that beverages remain intact and undamaged throughout the supply chain, thereby preserving their taste and quality.

Key Market Segments

By Product

- Bowls

- Cups

- Bags

- Pouches

- Boxes

- Plates

- Wraps & Films

- Bottles

By Application

- Fruits & Vegetables

- Snacks

- Cooked Food

- Sea Products

- Meat Products

- Dairy Products

- Bakery Products

By End User

- Food & beverage

- Pharmaceutical

- Personal & Home Care

Growth Opportunity

E-commerce and Food Outlets

The year 2024 presents a promising landscape for the global Polystyrene Packaging Market, with significant opportunities emerging from the burgeoning e-commerce sector and the ever-evolving food outlets industry. E-commerce continues to reshape consumer habits and supply chain dynamics, driving demand for robust packaging solutions that ensure product protection and presentation during transit. As online shopping becomes increasingly prevalent, polystyrene packaging offers unparalleled versatility and durability, making it an ideal choice for safely transporting a wide range of goods, from electronics to cosmetics.

The food outlets industry, encompassing quick-service restaurants, food delivery services, and convenience stores, presents lucrative opportunities for polystyrene packaging manufacturers. With consumers seeking convenience and on-the-go dining options, the demand for takeaway and delivery packaging is on the rise. Polystyrene's lightweight nature, thermal insulation properties, and customizable design options make it a preferred choice for food packaging, ensuring that meals remain fresh and visually appealing during transportation.

Material Versatility

In addition to market expansion driven by e-commerce and food outlets, the inherent versatility of polystyrene as a packaging material positions it at the forefront of innovation and adaptation. Polystyrene's ability to be molded into various shapes and sizes, coupled with advancements in material engineering, enables the development of tailored packaging solutions that meet the diverse needs of different industries.

From protective cushioning for fragile electronic components to sleek containers for cosmetic products, polystyrene packaging offers unparalleled versatility, allowing manufacturers to cater to a wide spectrum of applications. By capitalizing on this inherent flexibility, stakeholders in the Polystyrene Packaging Market can seize new opportunities for product differentiation and market expansion, driving sustained growth and competitive advantage in 2024 and beyond.

Latest Trends

Shift to Eco-friendly Packaging

In 2024, the global Polystyrene Packaging Market is poised to witness a significant shift towards eco-friendly packaging solutions, driven by escalating environmental concerns and evolving consumer preferences. As sustainability takes center stage in the packaging industry, stakeholders are increasingly prioritizing materials and practices that minimize environmental impact and promote circularity.

Polystyrene, traditionally scrutinized for its perceived contribution to plastic pollution, is undergoing a transformation with a focus on recyclability and biodegradability. Manufacturers are investing in research and development initiatives to enhance the eco-friendliness of polystyrene packaging, leveraging innovations such as bio-based additives and recycled content.

Thermal Insulation Applications

Another prominent trend shaping the Polystyrene Packaging Market in 2024 is the increasing demand for thermal insulation applications across various industries. Polystyrene's exceptional thermal insulation properties make it an ideal choice for packaging perishable goods, pharmaceuticals, and temperature-sensitive products. With the rise of online grocery delivery services, pharmaceutical logistics, and cold chain transportation, the need for reliable insulation solutions has intensified.

Polystyrene packaging, in the form of insulated boxes, containers, and trays, provides efficient temperature control, prolonging the shelf life of goods and ensuring product integrity during transit. This trend underscores the critical role of polystyrene in facilitating the seamless distribution of perishable and temperature-sensitive products, driving its adoption in specialized packaging applications.

Regional Analysis

Asia Pacific emerges as the dominating region in the global polystyrene packaging market, holding a substantial share of 40%.

The polystyrene packaging market in Asia Pacific is experiencing rapid expansion, primarily driven by the booming e-commerce industry, urbanization, and changing consumer preferences. According to recent statistics, Asia-Pacific holds the dominant share of 40% in the global polystyrene packaging market, indicating its significant contribution to the overall market. The increasing consumption of packaged food and beverages, expansion of retail chains, and growing investments in infrastructure development.

The polystyrene packaging market in North America is witnessing steady growth, attributed to the flourishing food and beverage industry and the increasing demand for lightweight and durable packaging solutions. Factors such as the presence of key market players, technological advancements in packaging materials, and stringent regulations regarding food safety drive market growth in this region.

Europe represents another significant market for polystyrene packaging, driven by factors such as the expanding retail sector, increasing demand for convenience food products, and growing environmental concerns. The rising focus on reducing carbon footprint and minimizing food wastage propels the demand for eco-friendly polystyrene packaging alternatives in this region.

While still in the developing stage, the polystyrene packaging market in the Middle East & Africa region is witnessing steady growth, driven by factors such as the expanding foodservice industry, rising urbanization, and increasing investments in the retail sector.

Latin America presents promising opportunities for the polystyrene packaging market, fueled by factors such as the growing food and beverage industry, expanding consumer goods sector, and increasing urbanization. Significant market growth, driven by the rising disposable income levels, changing consumer lifestyles, and the growing preference for convenience packaging solutions.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Polystyrene Packaging Market sees a diverse landscape with key players like ACH Foam Technologies, Huebach Corporation, Alpek SAB de CV, Huhtamaki Oyj, Jackon, Monotez, NEFAB GROUP, Ohishi Sangyo Co., Ltd., Rogers Foam, Sealed Air Corp, Sonoco Products Company, Styrochem, Sunpor Kunststoff, and Versalis influencing market dynamics. Each company brings its unique strengths and strategies to the table, shaping the market's trajectory.

ACH Foam Technologies, for instance, is likely leveraging its expertise in foam packaging solutions to offer lightweight, durable, and environmentally friendly packaging options. Huebach Corporation, with its focus on innovation, might be introducing advanced polystyrene packaging solutions tailored to specific industry needs. Alpek SAB de CV, being a prominent player in the chemical industry, might emphasize sustainability and recyclability in its packaging offerings.

Huhtamaki Oyj, a well-known name in the packaging industry, could be driving growth through strategic partnerships and expansions into emerging markets. Meanwhile, companies like Jackon and Monotez might focus on niche segments or specialized applications, carving out their unique market niches.

In this competitive landscape, companies such as NEFAB GROUP, Sealed Air Corp, and Sonoco Products Company may differentiate themselves through superior product quality, reliability, and customer service. Additionally, players like Styrochem, Sunpor Kunststoff, and Versalis could innovate with new materials or manufacturing processes, catering to evolving customer preferences and regulatory requirements.

Market Key Players

- ACH Foam Technologies

- Huebach Corporation

- Alpek SAB de CV

- Huhtamaki Oyj

- Jackon

- Monotez

- NEFAB GROUP

- Ohishi Sangyo Co.,Ltd.

- Rogers Foam

- Sealed Air Corp

- Sonoco Products Company

- Styrochem

- Sunpor Kunststoff

- Versalis

Recent Development

- In March 2024, Cruz Foam, partnering with Atlantic Packaging, Verve Coffee, and Real Good Fish, produces bio-based packaging, reducing CO2 emissions by 17,000 tons annually and offering compostable alternatives for e-commerce.

- In March 2024, Cosmo Plastech, led by Sanjay Chincholikar, highlights the growth of eco-friendly rigid plastic packaging in APAC, emphasizing recyclability and reduced environmental impact for future packaging solutions.

Report Scope

Report Features Description Market Value (2023) USD 24.7 Bn Forecast Revenue (2033) USD 40.5 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bowls, Cups, Bags, Pouches, Boxes, Plates, Wraps & Films, Bottles), By Application (Fruits & Vegetables, Snacks, Cooked Food, Sea Products, Meat Products, Dairy Products, Bakery Products), By End User (Food & beverage, Pharmaceutical, Personal & Home Care) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ACH Foam Technologies, Huebach Corporation, Alpek SAB de CV, Huhtamaki Oyj, Jackon, Monotez, NEFAB GROUP, Ohishi Sangyo Co.,Ltd., Rogers Foam, Sealed Air Corp, Sonoco Products Company, Styrochem, Sunpor Kunststoff, Versalis Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ACH Foam Technologies

- Huebach Corporation

- Alpek SAB de CV

- Huhtamaki Oyj

- Jackon

- Monotez

- NEFAB GROUP

- Ohishi Sangyo Co.,Ltd.

- Rogers Foam

- Sealed Air Corp

- Sonoco Products Company

- Styrochem

- Sunpor Kunststoff

- Versalis