Global Polycarbonate Sheet Market By Product Type (Solid, Corrugated and Multiwall), By End-Use (Buildings and Construction, Agriculture, Interior Design, Automotive, Defense and Aerospace) and By Regions - Global Forecast to 2030

-

9365

-

April 2023

-

231

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Polycarbonate Sheet Market Report Overview:

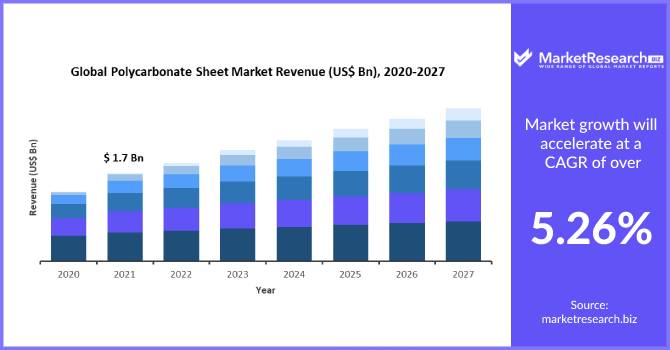

The Global Polycarbonate Sheet Market was valued at UЅD $3,687.6 Мn in 2020 and is projected to achieve a valuation of UЅD $5,476.2 Мn by 2030, at a САGR of 4.4%.

The report contains information, data, and inputs from both primary and secondary data sources that have been verified and validated by experts in the target market. The report presents a thorough study of revenues, historical data, information, key developments, and strategies by major players that offer vital insights and perspectives into various scenarios market.

Besides critical data and related information, the report includes key trends (both present and future), factors that are driving market growth, factors that are or could be potential restraints to market growth, as well as opportunities that can be leveraged for potential revenue generation in untapped regions and countries.

It also covers threats or challenges for existing as well as new entrants in the market. The global polycarbonate sheet market has been segmented on the basis of product type, end-use, as well as regions, and countries.

Polycarbonate is a thermoplastic that comes in a transparent sheet. It is incredibly tough and absorbs minimal moisture, making it resistant to impact damage as well as water damage. It is also chemical resistant and flame-retardant.

Dynamics:

Polycarbonate sheets offer numerous favorable properties, such as being high-impact, lightweight materials that also possess superior durability, making them extremely safe and increasingly suitable for various applications in the electrical & electronics sectors.

This is a major factor that is anticipated to continue to fuel the revenue growth of the global polycarbonate sheet market over the next decade. Moreover, the versatile physical characteristics of this material such as its resistance to temperatures, high flexibility, etc., make these products ideal for several applications in the automotive industry as well, such as lenses, bezel trim, etc. this is also a factor that is slated to have an impact on the market growth of this global industry in the years to come.

Furthermore, polycarbonate sheets are used in numerous other applications in various industries, from the manufacture of greenhouses to the production of anti-riot gear, prison windows, etc., none more prominent than in the building & construction industry.

Owing to the steady growth of these end-use industries, especially over the last few years, is a primary factor that is expected to continue to boost the revenue growth of the global polycarbonate sheet market in the foreseeable future.

However, in light of the recent COVID-19 outbreak, the operations of numerous industries have either been temporarily halted or are functioning with a minimal workforce due to enforced lockdowns and imposed restrictions by respective governing bodies.

The global polycarbonate sheet market is no different, and this factor is anticipated to have a significantly negative impact on the revenue growth of this industry.

Moreover, the many adverse effects of polycarbonate sheets, specifically when they come in contact with food items, water sources, the threat they pose to aquatic life, etc., is also a significant factor that may restrain the revenue growth of the global polycarbonate sheet market in the coming years.

Nonetheless, the superior characteristics of this material, irrespective of varying climate conditions, make this a product that is increasingly being incorporated into various industrial, commercial, and residential applications, and this is a major factor that is expected to continue to fuel the revenue growth of the global polycarbonate sheet market over the next 10 years.

Segmentation of the Global Polycarbonate Sheet Market is as follows:

In terms of product type, the corrugated segment accounted for the maximum number of revenue shares of the global polycarbonate sheet market in 2020 and is expected to continue doing so over the forecast period. However, the multiwall segment is anticipated to index the highest CAGR over the next 10 years.

On the basis of end-use, the building & construction segment accounted for the maximum number of revenue shares of the global polycarbonate sheet market in 2020, and this segment is slated to continue to do so over the next 10 years. The automotive segment is also expected to register a high CAGR over the forecast period.

Regional Segmentation and Analysis:

Markets in the Asia Pacific region accounted for the maximum number of revenue shares of the global polycarbonate sheet market in 2020, and are indicative of remaining this industry’s front-runner over the next decade. Europe is also anticipated to register a high CAGR over the course of the forecast period.

Segmentation of the Global Polycarbonate Sheet Market:

Segmentation by Product Type:

- Solid

- Corrugated

- Multiwall

- Other Product Types

Segmentation by End-Use:

- Buildings and Construction

- Agriculture

- Interior Design

- Automotive

- Defense and Aerospace

- Other End-Use

Segmentation by Regions:

- North America

- Europe

- APAC

- South America

- MEA

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Saudi Aramco (SABIC)

- Teijin Limited

- Mitsubishi Gas Chemical Company Inc.

- Roehm

- Schweiter Technologies AG (3A Composites)

- Palram Industries Ltd.

- Brett Martin Ltd.

- Arla Plast AB

- Dott Gallina Srl

- Suzhou OMAY Optical Materials Co. Ltd.