Plate Heat Exchanger Market By Product Type (Gasketed Plate Heat Exchangers, Welded Plate Heat Exchangers, Brazed Plate Heat Exchangers, Others), By Application (HVAC & Refrigeration, Chemicals, Petrochemicals & Oil & Gas, Power Generation, Food & Beverage, Pulp & Paper, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48803

-

July 2024

-

137

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

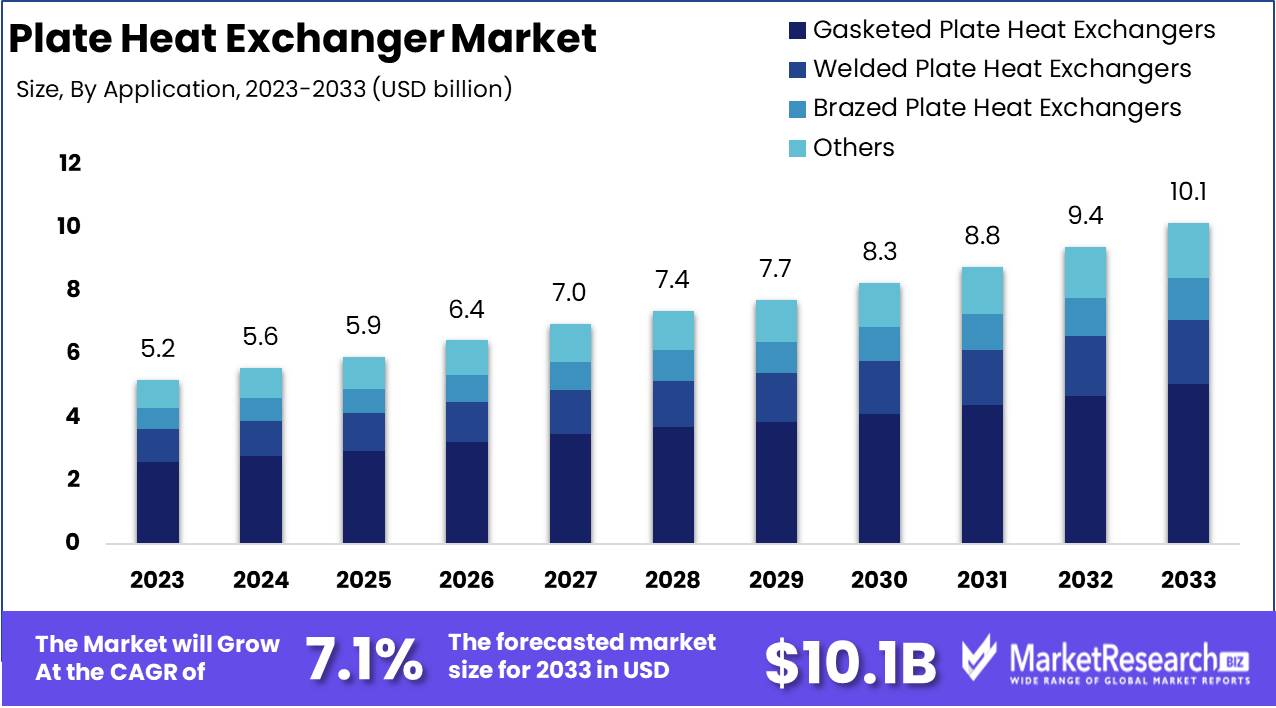

The Global Plate Heat Exchanger Market was valued at USD 5.2 Bn in 2023. It is expected to reach USD 10.1 Bn by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Plate Heat Exchanger Market encompasses the global industry focused on the development, manufacturing, and distribution of plate heat exchangers used for efficient thermal energy transfer across various sectors. These devices, crucial in industries such as HVAC, chemical processing, power generation, and food and beverage, facilitate effective heat exchange by utilizing multiple thin plates to maximize surface area. Driven by increasing demand for energy-efficient solutions, stringent environmental regulations, and technological advancements, the market is experiencing significant growth. Continuous innovation and integration of advanced materials and designs are pivotal in shaping the competitive landscape and meeting diverse industry needs.

The Plate Heat Exchanger Market is experiencing robust growth, driven by the need for efficient thermal management solutions across diverse industries such as HVAC, chemical processing, and power generation. One of the key advantages of plate heat exchangers is their significantly shorter installation time. For instance, the Heat Exchanger Service Module (TD1360V) can be connected in under a minute, which drastically reduces downtime and enhances operational efficiency. This speed of installation is a critical factor in industries where time and efficiency directly impact profitability and productivity.

The market's evolution has been significantly influenced by continuous innovation since the 1930s, with pioneers such as APV and Alfa Laval leading the charge. These companies have been instrumental in enhancing the efficiency and compactness of plate heat exchangers, making them indispensable in various industrial applications. The advancements in design and material technology have resulted in more compact, reliable, and efficient heat exchangers, catering to the growing demand for energy-efficient and sustainable solutions.

Furthermore, stringent environmental regulations are pushing industries to adopt more energy-efficient technologies, driving the demand for advanced plate heat exchangers. The competitive landscape is marked by significant R&D investments aimed at developing next-generation heat exchangers that offer superior performance and reliability. Companies are also focusing on strategic partnerships and acquisitions to expand their market presence and technological capabilities.

Key Takeaways

- Market Value: The Global Plate Heat Exchanger Market was valued at USD 5.2 Bn in 2023. It is expected to reach USD 10.1 Bn by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Product Type: Gasketed Plate Heat Exchangers hold a dominant position, comprising 50% of the market, critical for applications requiring efficient heat transfer and easy maintenance.

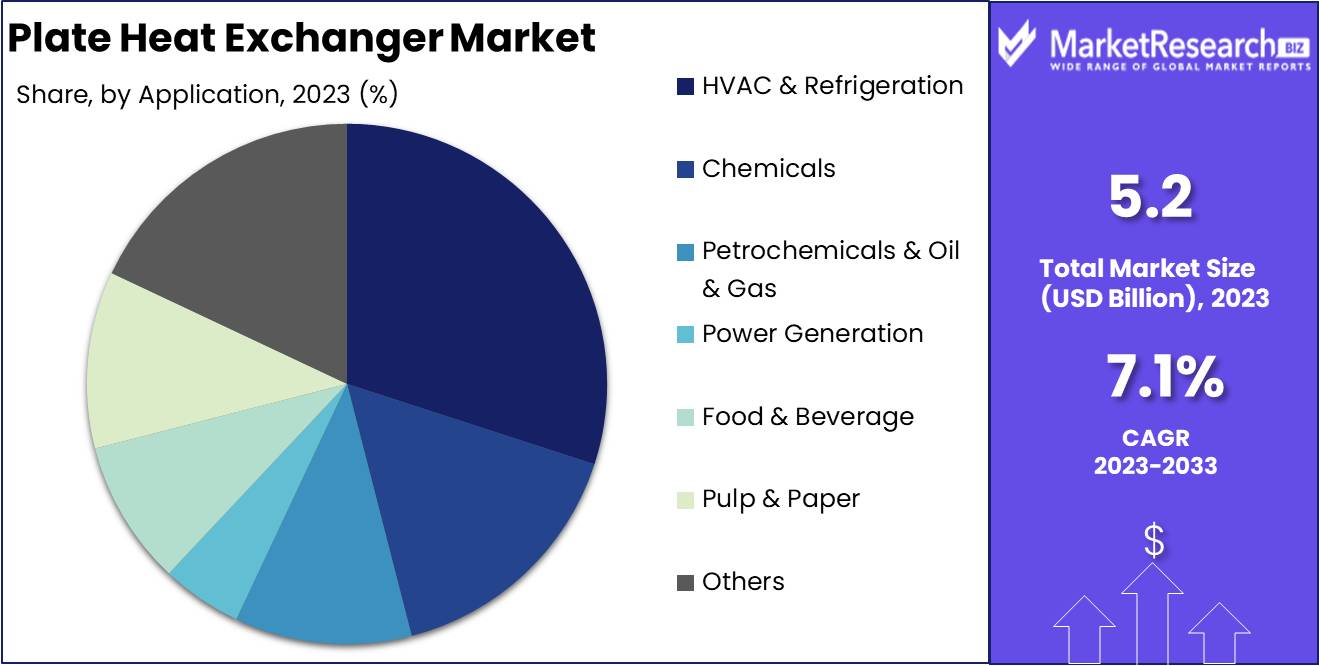

- By Application: HVAC & Refrigeration stands out as the largest application segment, accounting for 30%, highlighting its essential role in modern building management systems and commercial facilities.

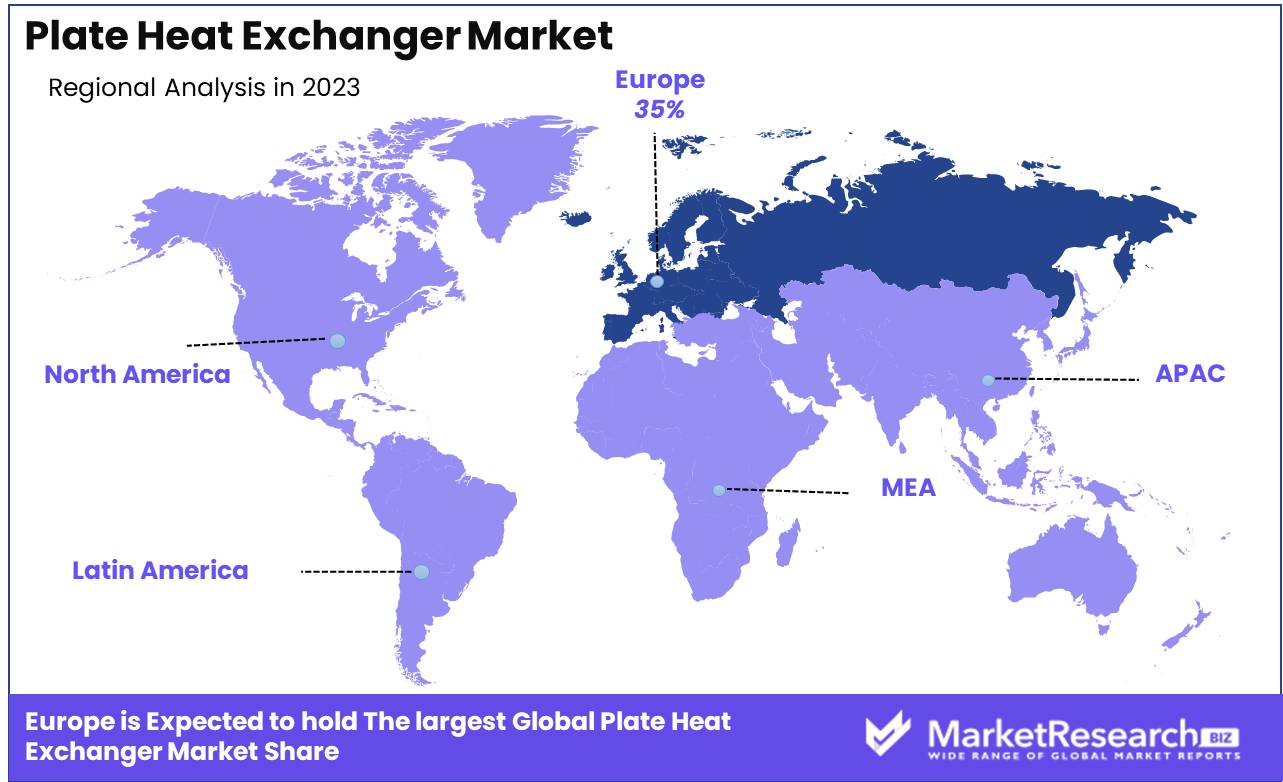

- Regional Dominance: Europe holds the largest market share at 35%, reflecting its strong focus on energy efficiency and sustainable heating solutions in industrial and residential sectors.

- Growth Opportunity: Enhanced demand for energy efficiency in heating and cooling systems across industrial sectors presents significant growth opportunities for the Plate Heat Exchanger Market.

Driving factors

Rising Industrialization in Developing Countries

The rapid industrialization in developing countries is a primary driving factor for the growth of the Plate Heat Exchanger Market. Nations such as China, India, and Brazil are witnessing significant expansion in industrial activities across sectors like chemical processing, power generation, and oil and gas accumulators. This surge in industrialization necessitates efficient thermal management solutions to optimize processes and reduce operational costs.

Plate heat exchangers, known for their compact design and high efficiency, are increasingly being adopted to meet these demands. The robust industrial growth in these regions is expected to significantly boost the demand for plate heat exchangers, contributing to market expansion.

Increased Adoption in HVAC Systems and Commercial Applications

The increased adoption of plate heat exchangers in HVAC systems and commercial applications is another critical growth driver. With the growing focus on energy efficiency and cost savings, plate heat exchangers are becoming a preferred choice for HVAC systems in residential, commercial, and industrial buildings.

Their ability to provide efficient heat transfer in compact spaces makes them ideal for modern HVAC applications. Additionally, plate heat exchangers are being utilized in commercial applications such as food and beverage processing, pharmaceuticals, and data centers, where precise temperature control is crucial. This widespread adoption across various sectors is expected to drive substantial market growth.

Stringent Environmental Regulations Promoting Energy-Efficient Solutions

Stringent environmental regulations aimed at reducing energy consumption and greenhouse gas emissions are propelling the demand for energy-efficient technologies, including plate heat exchangers. Governments and regulatory bodies worldwide are implementing policies that mandate the use of energy-efficient equipment in industrial processes and building systems. Plate heat exchangers, with their superior energy efficiency and heat recovery capabilities, align perfectly with these regulatory requirements.

The European Union's stringent energy efficiency directives have led to increased adoption of plate heat exchangers in industrial and commercial applications across Europe. This regulatory push is significantly driving market growth by promoting the adoption of environmentally friendly and energy-efficient solutions.

Restraining Factors

High Initial Installation and Maintenance Costs

High initial installation and maintenance costs are significant challenges for the Plate Heat Exchanger Market. Despite their efficiency and compact design, plate heat exchangers can be expensive to install, particularly in large-scale industrial settings where multiple units may be required. Additionally, regular maintenance is necessary to ensure optimal performance and prevent fouling, which can lead to increased operational costs.

These financial barriers can deter smaller businesses and operations with limited budgets from adopting plate heat exchangers, thereby slowing market penetration and growth. While the long-term benefits and energy savings of plate heat exchangers often justify the initial investment, the upfront costs remain a notable obstacle for many potential users.

Availability of Alternative Heat Exchange Technologies

The availability of alternative heat exchange technologies also poses a challenge to the growth of the Plate Heat Exchanger Market. Technologies such as shell and tube heat exchangers, air-cooled heat exchangers, and others offer different advantages that can appeal to various industries depending on their specific requirements. Shell and tube heat exchangers, for example, are well-suited for high-pressure applications and are often preferred in certain industrial processes.

Air-cooled heat exchangers, on the other hand, are advantageous in environments where water availability is limited. The presence of these alternatives provides industries with a range of options, which can limit the adoption of plate heat exchangers despite their efficiency and compactness.

By Product Type Analysis

Gasketed Plate Heat Exchangers dominate, comprising 50% of the market.

In 2023, Gasketed Plate Heat Exchangers held a dominant market position in the By Product Type segment of the Plate Heat Exchanger Market, capturing more than a 50% share. This commanding market share is primarily due to their versatility, efficiency, and ease of maintenance. Gasketed plate heat exchangers are extensively used across various industries such as HVAC, chemical processing, and food and beverage, where they provide effective thermal management solutions. Their modular design allows for easy cleaning and flexibility in capacity adjustments, making them a preferred choice in applications requiring frequent maintenance and high performance.

Welded Plate Heat Exchangers are also a significant segment in the market, known for their robustness and ability to handle high-pressure and high-temperature applications. These exchangers are ideal for use in industries such as petrochemicals and oil and gas, where operating conditions are more stringent. The demand for welded plate heat exchangers is driven by their ability to provide efficient heat transfer while withstanding harsh operational environments, making them indispensable in heavy industrial applications.

Brazed Plate Heat Exchangers, another important segment, are characterized by their compact design and high efficiency in heat transfer. They are widely utilized in refrigeration and air conditioning systems, as well as in residential and small commercial applications. The increasing demand for energy-efficient and space-saving solutions in urban areas has bolstered the growth of this segment.

By Application Analysis

HVAC & Refrigeration is the largest application segment, accounting for 30%.

In 2023, HVAC & Refrigeration held a dominant market position in the By Application segment of the Plate Heat Exchanger Market, capturing more than a 30% share. This leadership is driven by the widespread adoption of plate heat exchangers in heating, ventilation, air conditioning, and refrigeration systems, where they provide efficient thermal management and energy conservation. The growing demand for energy-efficient and environmentally friendly HVAC systems in residential, commercial, and industrial buildings has significantly boosted this segment's market share. The increasing emphasis on reducing carbon footprints and enhancing energy efficiency further propels the adoption of plate heat exchangers in HVAC applications.

The Chemicals sector also represents a substantial segment in the plate heat exchanger market, benefiting from the critical role these devices play in various chemical processes. Plate heat exchangers are essential in managing the heat exchange needs of chemical reactions, cooling, and heating processes, ensuring operational efficiency and safety. The continuous expansion of the chemical industry, driven by the rising demand for specialty chemicals and the growth of industrial production, supports the robust demand for efficient heat transfer solutions.

Petrochemicals & Oil & Gas, Power Generation, Food & Beverage, Pulp & Paper, and the "Others" category collectively contribute to the dynamic landscape of the plate heat exchanger market. In the Petrochemicals & Oil & Gas industry, plate heat exchangers are vital for efficient heat recovery and processing operations.

Key Market Segments

By Product Type

- Gasketed Plate Heat Exchangers

- Welded Plate Heat Exchangers

- Brazed Plate Heat Exchangers

- Others

By Application

- HVAC & Refrigeration

- Chemicals

- Petrochemicals & Oil & Gas

- Power Generation

- Food & Beverage

- Pulp & Paper

- Others

Growth Opportunity

Adoption in Renewable Energy Systems

The adoption of plate heat exchangers in renewable energy systems presents a significant growth opportunity for the market in 2024. As the world shifts towards sustainable energy sources, technologies that enhance the efficiency of renewable energy systems are in high demand. Plate heat exchangers play a crucial role in optimizing thermal management in solar thermal plants, geothermal systems, and biomass energy production.

Their ability to efficiently transfer heat and withstand varying temperatures makes them ideal for these applications. The increasing investments in renewable energy infrastructure globally, supported by government incentives and environmental policies, are expected to drive substantial demand for plate heat exchangers in this sector.

Expansion into Marine and Offshore Applications

Another promising growth area for the Plate Heat Exchanger Market is the expansion into marine and offshore applications. The maritime industry requires efficient thermal management solutions for various systems, including engine cooling, HVAC, and desalination processes. Plate heat exchangers, with their compact size and high efficiency, are well-suited for the confined spaces and rigorous demands of marine environments.

Offshore oil and gas platforms benefit from the robust performance and reliability of plate heat exchangers. As the global marine and offshore industries continue to expand, driven by increasing trade and energy exploration activities, the demand for advanced heat exchanger technologies is set to rise.

Latest Trends

Advancements in Gasket and Brazed Plate Heat Exchangers

One of the most significant trends in the Plate Heat Exchanger Market for 2024 is the continued advancements in gasket and brazed plate heat exchangers. These improvements focus on enhancing efficiency, durability, and ease of maintenance. Innovations in gasket materials are leading to better sealing and longer service life, reducing downtime and operational costs.

Advancements in brazed plate heat exchangers are making them more robust and efficient, suitable for high-pressure and high-temperature applications. These developments are crucial for industries such as chemical processing, power generation, and HVAC, where reliable and efficient heat exchangers are essential for optimizing processes and energy use.

Sustainable and Energy-Efficient Designs

The push towards sustainable and energy-efficient designs is another key trend shaping the Plate Heat Exchanger Market in 2024. As global industries increasingly prioritize sustainability, there is a growing demand for heat exchangers that minimize energy consumption and environmental impact. Manufacturers are responding by developing plate heat exchangers that offer higher heat transfer efficiency, reduced carbon footprints, and compatibility with renewable energy systems.

These sustainable designs not only help industries meet stringent environmental regulations but also contribute to cost savings through improved energy efficiency. The focus on green technologies is expected to drive significant market growth as industries seek to enhance their environmental performance and operational efficiency.

Regional Analysis

Europe holds the largest market share at 35%.

In 2023, Europe held a dominant position in the Plate Heat Exchanger Market, capturing a significant 35% share. This dominance is driven by the region's advanced industrial infrastructure, strong focus on energy efficiency, and stringent environmental regulations. Key countries such as Germany, France, and the UK are major contributors, with extensive applications in industries like chemical processing, power generation, and HVAC. The European Union's emphasis on reducing carbon emissions and improving energy efficiency further propels the demand for advanced heat exchanger technologies.

North America is another significant region in the plate heat exchanger market, characterized by its robust industrial base and ongoing investments in energy-efficient technologies. The United States and Canada are leading the market, driven by strong demand from sectors such as oil and gas, petrochemicals, and food and beverage. The focus on sustainable industrial practices and the adoption of innovative heat exchanger solutions to optimize energy use are key factors contributing to market growth in this region.

The Asia Pacific region is experiencing rapid growth in the plate heat exchanger market, fueled by expanding industrial activities, urbanization, and increasing investments in infrastructure development. The region's emphasis on energy efficiency and sustainable industrial practices, coupled with the availability of cost-effective manufacturing, positions Asia Pacific as a key growth area. Additionally, the Middle East & Africa and Latin America regions are emerging markets, driven by increasing industrialization and the need for efficient thermal management solutions in various applications.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global plate heat exchanger market in 2024 is expected to witness robust growth, driven by increasing industrialization, rising demand for energy-efficient solutions, and advancements in heat exchanger technologies. Key players in this market are likely to maintain their competitive edge through innovation, strategic acquisitions, and expanding their global footprint.

Alfa Laval AB and Danfoss A/S are projected to remain market leaders due to their extensive product portfolios and strong emphasis on research and development. Their continuous investment in innovative heat exchanger solutions, including advancements in materials and design, will help them address the evolving needs of diverse industries such as HVAC, chemical processing, and food and beverage.

Kelvion Holding GmbH and SPX Flow, Inc. are expected to capitalize on their global reach and comprehensive service offerings. By focusing on customer-centric solutions and expanding their presence in emerging markets, these companies can tap into new growth opportunities and enhance their market positions.

Xylem Inc. and API Heat Transfer Inc. are anticipated to leverage their expertise in water and heat transfer technologies to drive growth. Their ability to provide customized and efficient heat exchanger solutions will be critical in meeting the increasing demand for sustainable and energy-efficient industrial processes.

H. Guntner (UK) Ltd. and Boyd Corporation are likely to focus on niche applications and specialized markets. Their strengths in delivering high-performance, reliable heat exchangers tailored to specific industry requirements will support their growth in the competitive landscape.

Johnson Controls International plc and Wabtec Corporation are expected to strengthen their market positions through strategic acquisitions and partnerships. By enhancing their technological capabilities and expanding their product offerings, these companies can address the growing demand for advanced and efficient heat exchange solutions.

Market Key Players

- Alfa Laval AB

- Danfoss A/S

- Kelvion Holding GmbH

- SPX Flow, Inc.

- Xylem Inc.

- API Heat Transfer Inc.

- H. Guntner (UK) Ltd.

- Boyd Corporation

- Johnson Controls International plc

- Wabtec Corporation

Recent Development

- In May 2023: Alfa Laval expanded its brazed plate heat exchangers production capacity globally to support the energy transition, enhancing manufacturing efficiency and product diversity.

- In March 2023: Xylem's Bell & Gossett introduced 'X' plates for improved thermal performance in various applications.

Report Scope

Report Features Description Market Value (2023) USD 5.2 Bn Forecast Revenue (2033) USD 10.1 Bn CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gasketed Plate Heat Exchangers, Welded Plate Heat Exchangers, Brazed Plate Heat Exchangers, Others), By Application (HVAC & Refrigeration, Chemicals, Petrochemicals & Oil & Gas, Power Generation, Food & Beverage, Pulp & Paper, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alfa Laval AB, Danfoss A/S, Kelvion Holding GmbH, SPX Flow, Inc., Xylem Inc., API Heat Transfer Inc., H. Guntner (UK) Ltd., Boyd Corporation, Johnson Controls International plc, Wabtec Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alfa Laval AB

- Danfoss A/S

- Kelvion Holding GmbH

- SPX Flow, Inc.

- Xylem Inc.

- API Heat Transfer Inc.

- H. Guntner (UK) Ltd.

- Boyd Corporation

- Johnson Controls International plc

- Wabtec Corporation