Plant Sterol Esters Market By Form (Oil, Powder), By Application (Food, Dairy, Bakery & Confectionery, Spreads & Dressings, Cereals & Snacks, Vegetable Oils, Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics), By Type (Campesterol, Sitosterol, Stigmasterol, Brassicasterol, Cargill Incorporated), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50683

-

Aug 2024

-

302

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

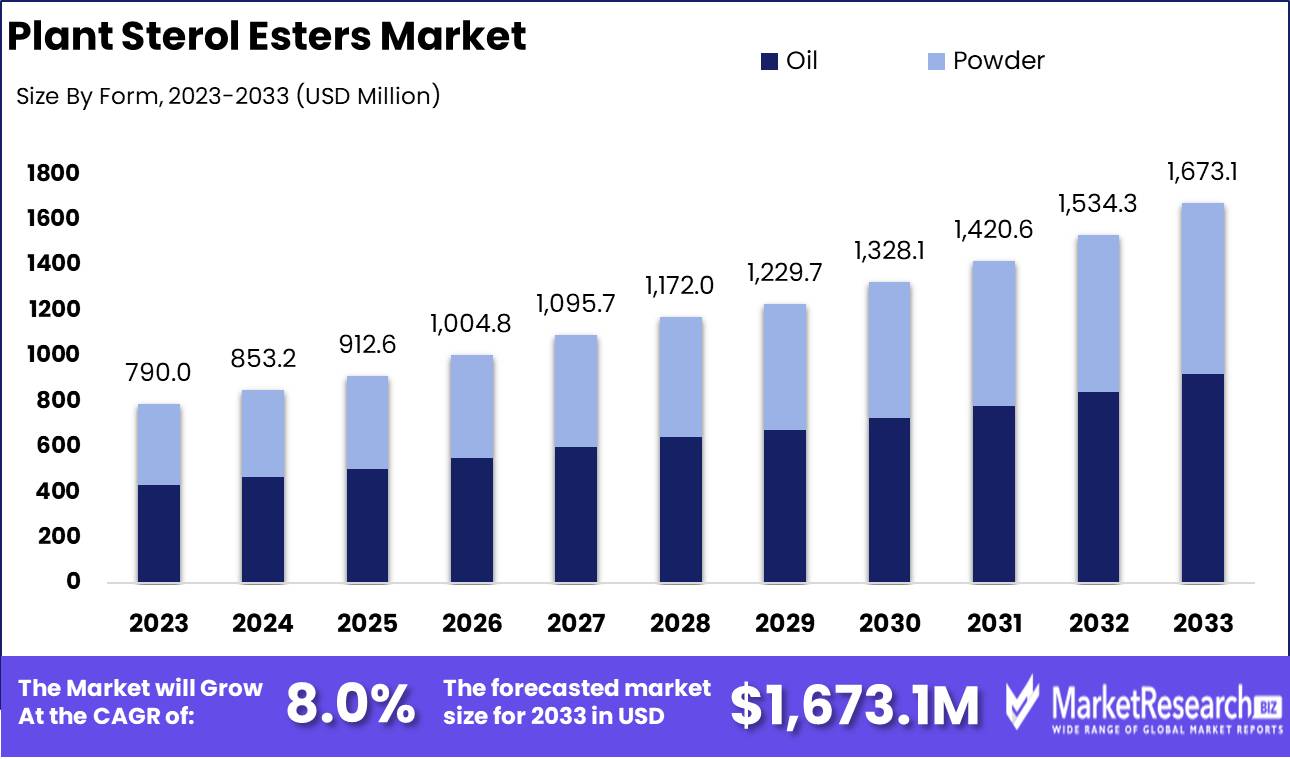

The Global Plant Sterol Esters Market was valued at USD 790 Mn in 2023. It is expected to reach USD 1673.1 Mn by 2033, with a CAGR of 8% during the forecast period from 2024 to 2033.

The Plant Sterol Esters Market involves the production, distribution, and application of plant sterol esters, compounds known for their cholesterol-lowering properties. These esters are commonly used in fortified foods such as spreads, yogurts, and dietary supplements to help reduce serum LDL cholesterol levels. The market is driven by growing consumer awareness of cardiovascular health, increasing demand for functional foods, and the expanding application of plant sterol esters in various food products. Regulatory support and clinical evidence of their health benefits further enhance the market's growth prospects.

The Plant Sterol Esters Market is witnessing substantial growth, largely driven by increasing consumer awareness of cardiovascular health and the proven efficacy of plant sterol esters in reducing serum LDL cholesterol levels. Clinical studies have shown that regular consumption of plant sterol esters can lead to a 3.9-fold greater reduction in LDL cholesterol, particularly in individuals with hypercholesterolemia. This significant health benefit is a key driver for the market, as more consumers seek functional foods that support heart health.

The Plant Sterol Esters Market is witnessing substantial growth, largely driven by increasing consumer awareness of cardiovascular health and the proven efficacy of plant sterol esters in reducing serum LDL cholesterol levels. Clinical studies have shown that regular consumption of plant sterol esters can lead to a 3.9-fold greater reduction in LDL cholesterol, particularly in individuals with hypercholesterolemia. This significant health benefit is a key driver for the market, as more consumers seek functional foods that support heart health.Fortified foods, such as spreads and yogurts, have become the primary delivery vehicles for plant sterol esters, enabling consumers to easily meet the recommended daily intake of 1.5g to 3g necessary for optimal cholesterol-lowering effects. The effectiveness of these fortified products in delivering measurable health benefits has bolstered their popularity, further propelling market growth.

The market is also supported by favorable regulatory frameworks that endorse the use of plant sterol esters in food products, providing a solid foundation for continued expansion. As the demand for functional foods continues to rise, the plant sterol esters market is expected to grow, with manufacturers focusing on product innovation and diversification to cater to a broader consumer base.

The plant sterol esters market is poised for significant growth, driven by the increasing demand for cholesterol-lowering functional foods and the strong clinical evidence supporting their health benefits. Companies that capitalize on these trends and invest in innovative product formulations will be well-positioned to capture market share in this expanding sector.

Key Takeaways

- By Form: Oil makes up 50% of the market, commonly used in food products for its cholesterol-lowering properties.

- By Application: Food represents 30%, reflecting the incorporation of plant sterol esters in functional foods.

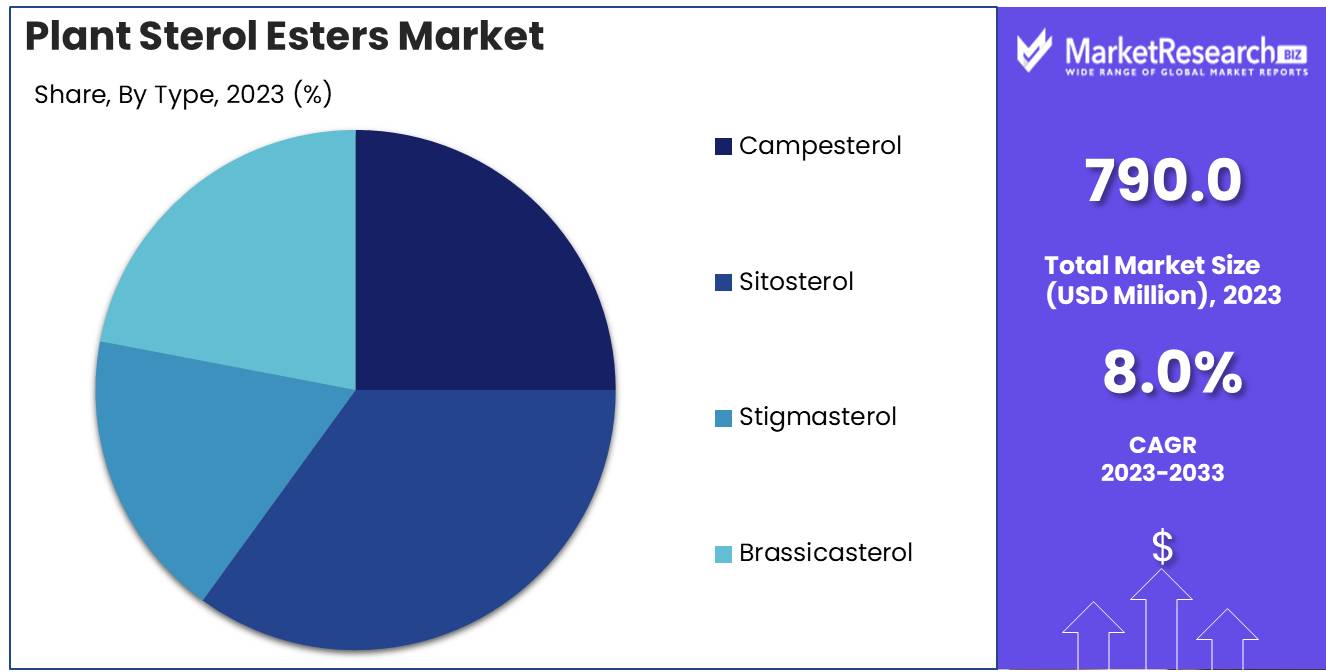

- By Type: Sitosterol constitutes 35%, known for its efficacy in reducing cholesterol absorption.

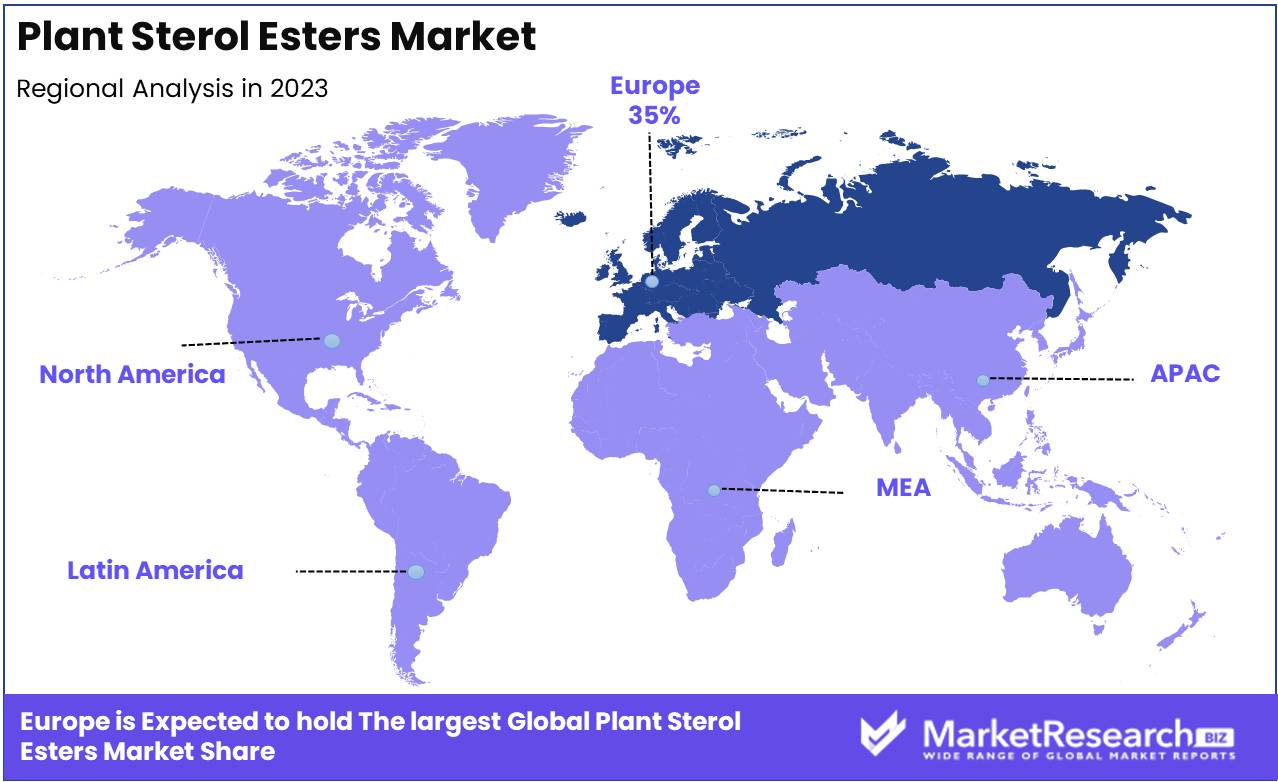

- Regional Dominance: Europe holds a 35% market share, driven by high consumer awareness and demand for heart-healthy products.

- Growth Opportunity: Expanding the use of plant sterol esters in nutraceuticals and dietary supplements can meet the growing demand for cholesterol management solutions.

Driving factors

Growing Awareness of Cardiovascular Health Benefits

The increasing global awareness of cardiovascular health is a pivotal driver for the Plant Sterol Esters Market. Plant sterol esters have been scientifically proven to lower cholesterol levels, which in turn reduces the risk of heart disease—a leading cause of mortality worldwide. As consumers become more health-conscious and proactive in managing their heart health, the demand for ingredients that offer cardiovascular benefits is on the rise.

This trend is further supported by health organizations and government initiatives that promote the consumption of cholesterol-lowering products. Consequently, plant sterol esters are gaining prominence as a natural and effective solution for cardiovascular health, driving market growth.

Rising Demand for Functional Foods and Dietary Supplements

The functional foods and dietary supplements markets are experiencing significant growth, driven by consumers' increasing preference for products that provide health benefits beyond basic nutrition. Plant sterol esters, known for their cholesterol-lowering properties, are increasingly being incorporated into these products to meet consumer demand for heart-healthy options.

The growing interest in preventive healthcare and wellness has led to a surge in the consumption of functional foods and wellness supplements, particularly those enriched with bioactive compounds like plant sterol esters. This trend is expected to propel the market forward as more manufacturers incorporate these esters into a wide range of health-oriented products.

Increasing Incorporation of Plant Sterol Esters in Margarine and Dairy Products

The food industry's integration of plant sterol esters into everyday products like margarine and dairy is another significant factor contributing to market growth. Margarine, often used as a butter substitute, and various dairy products are ideal carriers for plant sterol esters, allowing consumers to effortlessly incorporate these heart-healthy compounds into their diets.

As manufacturers continue to innovate and expand their product offerings, the presence of plant sterol esters in these staple food items is becoming more widespread. This integration not only enhances the nutritional profile of these products but also aligns with the growing consumer demand for functional foods that support cardiovascular health.

Restraining Factors

High Cost of Production and Formulation Challenges

One of the key restraining factors for the Plant Sterol Esters Market is the high cost of production and the associated formulation challenges. The process of extracting and synthesizing plant sterol esters involves complex and expensive technology, which translates into higher production costs. Incorporating plant sterol esters into various food products without compromising taste, texture, or stability presents significant formulation challenges.

These issues can lead to increased product prices, making them less accessible to cost-sensitive consumers. As a result, the market's growth potential may be limited, particularly in regions where price sensitivity is a major consideration.

Limited Consumer Awareness in Certain Regions

Another significant restraint on the growth of the Plant Sterol Esters Market is the limited consumer awareness in certain regions, particularly in developing countries. While plant sterol esters are well-known in more developed markets for their cholesterol-lowering benefits, many consumers in other regions are not familiar with these compounds or their health benefits.

This lack of awareness hampers market penetration and adoption, as consumers are less likely to seek out or pay a premium for products containing plant sterol esters. Efforts to educate consumers and raise awareness about the health benefits of plant sterol esters are crucial for overcoming this challenge and unlocking the market's full potential.

By Form

Oil is the most common form, with a 50% market share.

In 2023, Oil held a dominant market position in the By Form segment of the Plant Sterol Esters Market, capturing more than a 50% share. The oil form of plant sterol esters is widely favored due to its superior solubility and ease of incorporation into various food and beverage products. This form is particularly popular in the production of margarine, spreads, and cooking oils, where it seamlessly blends with other ingredients, enhancing the nutritional profile of the products without altering their sensory attributes.

The growing consumer awareness of heart health and the cholesterol-lowering benefits of plant sterol esters has driven their demand, particularly in liquid forms, across the food industry. The versatility of oil-based plant sterol esters in applications beyond food, such as in dietary supplements and pharmaceuticals, further strengthens its leading market position. As the trend towards functional foods continues to rise, the demand for oil-based plant sterol esters is expected to maintain its growth trajectory.

By Application

Food applications account for 30% of the market.

In 2023, Food held a dominant market position in the By Application segment of the Plant Sterol Esters Market, capturing more than a 30% share. The food industry remains the largest consumer of plant sterol esters, driven by the increasing consumer preference for functional foods that offer health benefits beyond basic nutrition. Plant sterol esters are extensively used in food products such as margarine, spreads, dairy products, and snack foods to help reduce cholesterol monitors level, aligning with the growing trend of heart-healthy diets.

The incorporation of plant sterol esters into a wide range of food categories, including dairy, bakery, and cereals, highlights their versatility and the broadening scope of applications within the food industry. As consumers become more health-conscious, the demand for food products enriched with plant sterol esters is expected to rise, reinforcing this segment's market leadership.

By Type

Sitosterol leads in type, representing 35% of the market.

In 2023, Sitosterol held a dominant market position in the By Type segment of the Plant Sterol Esters Market, capturing more than a 35% share. Sitosterol is the most prevalent type of plant sterol ester, known for its potent cholesterol-lowering properties, making it highly desirable in the formulation of functional foods, dietary supplements, and pharmaceuticals. Its high efficacy in reducing low-density lipoprotein (LDL) cholesterol levels has positioned sitosterol as the preferred choice among manufacturers aiming to cater to the health-conscious consumer market.

The dominance of sitosterol in the plant sterol esters market is also attributed to its wide availability and cost-effectiveness compared to other types, such as campesterol and stigmasterol. As demand for heart-health products continues to grow, sitosterol's market share is likely to expand further, maintaining its leading position in the industry.

Key Market Segments

By Form

- Oil

- Powder

By Application

- Food

- Dairy

- Bakery & Confectionery

- Spreads & Dressings

- Cereals & Snacks

- Vegetable Oils

- Beverages

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

By Type

- Campesterol

- Sitosterol

- Stigmasterol

- Brassicasterol

Growth Opportunity

Development of Plant Sterol Ester-Fortified Food Products

One of the most promising opportunities for the Plant Sterol Esters Market in 2024 is the development of fortified food products. As consumers increasingly seek out foods with added health benefits, manufacturers are exploring ways to incorporate plant sterol esters into a broader range of products beyond traditional margarine and dairy. This includes the fortification of healthy snacks, beverages, and even convenience foods with plant sterol esters, providing consumers with more diverse options to support cardiovascular health.

The ongoing innovation in food formulation technologies is enabling manufacturers to overcome previous challenges related to taste, texture, and stability, making it easier to create appealing and effective fortified products. This trend is expected to drive significant growth in the market as more consumers adopt these functional foods as part of their daily diet.

Expansion in Emerging Markets with Rising Health Consciousness

The expansion of the Plant Sterol Esters Market into emerging markets presents another substantial growth opportunity for 2024. As health consciousness rises in regions such as Asia-Pacific, Latin America, and the Middle East, there is a growing demand for products that promote heart health. Consumers in these regions are becoming more aware of the importance of managing cholesterol levels, which is driving interest in plant sterol ester-fortified foods and supplements.

Increasing urbanization and income levels in these markets are contributing to higher spending on health and wellness products. Companies that can effectively tap into these emerging markets by offering affordable and accessible plant sterol ester products are well-positioned to capitalize on the growing demand and expand their market presence.

Latest Trends

Use of Plant Sterol Esters in Non-Dairy and Vegan Products

A significant trend in the Plant Sterol Esters Market for 2024 is the increasing incorporation of plant sterol esters into non-dairy and vegan collagen products. As the global demand for plant-based and vegan-friendly products continues to rise, manufacturers are exploring new ways to fortify these products with health-promoting ingredients like plant sterol esters. Non-dairy milk alternatives, vegan spreads, and plant-based snacks are becoming popular carriers for these cholesterol-lowering compounds.

This trend aligns with the broader consumer shift towards plant-based diets, driven by concerns over health, sustainability, and animal welfare. The integration of plant sterol esters into vegan and non-dairy products not only enhances their nutritional value but also broadens the market reach, catering to the growing segment of health-conscious consumers.

Increasing Focus on Clinical Research to Substantiate Health Claims

Another key trend shaping the Plant Sterol Esters Market in 2024 is the growing emphasis on clinical research to substantiate health claims. As consumers become more discerning about the health benefits of the products they consume, there is a rising demand for scientifically-backed claims. Companies are investing in rigorous clinical studies to validate the efficacy of plant sterol esters in lowering cholesterol and reducing the risk of cardiovascular diseases.

This focus on research not only strengthens consumer trust but also helps manufacturers navigate regulatory requirements in different markets. By providing credible, evidence-based health claims, companies can differentiate their products in a crowded marketplace, driving consumer adoption and market growth.

Regional Analysis

Europe commands 35% of the market share.

In 2023, Europe dominated the Plant Sterol Esters Market, capturing more than a 35% share. This leadership is primarily attributed to the region's strong emphasis on health and wellness, coupled with a well-established food and beverage industry that has widely adopted plant sterol esters in functional foods. The increasing consumer awareness regarding the benefits of plant sterol esters in lowering cholesterol levels and promoting cardiovascular health has driven significant demand in countries such as Germany, France, and the United Kingdom.

Europe's regulatory environment, particularly the European Food Safety Authority (EFSA) approvals for health claims related to plant sterol esters, has further bolstered their incorporation into food products like margarine, yogurt, and dietary supplements. The region's mature market for functional foods and nutraceuticals has positioned it as a key player in the global plant sterol esters market. Additionally, the rising trend of preventive healthcare and the growing geriatric population have contributed to the sustained demand for cholesterol-lowering products, further solidifying Europe's market dominance.

North America and the Asia Pacific regions also exhibit substantial growth potential, driven by increasing health consciousness and the expanding functional food markets. However, Europe's early adoption of plant sterol esters and its comprehensive regulatory support give it a competitive edge, making it the leading region in the global market. The region's focus on innovation and development in the food industry is expected to sustain its leadership in the plant sterol esters market in the coming years.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Plant Sterol Esters market in 2024 is poised for significant expansion, driven by the increasing consumer awareness of heart health and the rising demand for functional foods. Leading companies such as Cargill Incorporated and BASF SE are expected to capitalize on this trend through their advanced formulations and strong presence in the nutraceuticals market. These firms' focus on innovation and sustainability, coupled with their extensive distribution networks, positions them well to meet the growing demand for plant sterol esters.

Archer Daniels Midland Company (ADM) and Bunge Limited are anticipated to leverage their extensive agricultural supply chains to dominate the market, particularly in North America and Europe. Their ability to offer high-quality, cost-effective plant sterol esters, coupled with strategic partnerships and acquisitions, will likely enhance their market share. Raisio Plc is also expected to maintain a strong market position, particularly in Europe, due to its specialization in plant-based health ingredients and its established brand reputation.

Smaller players such as Fenchem Enterprises Ltd. and Arboris LLC are expected to continue gaining traction by focusing on niche markets and offering customized solutions. These companies' agility in responding to market demands and their emphasis on product differentiation will likely contribute to their growth in the coming years. As consumer preferences shift towards healthier and more natural ingredients, companies that prioritize innovation and sustainability are expected to lead the market.

Market Key Players

- Cargill Incorporated

- BASF SE

- Archer Daniels Midland Company

- Raisio Plc

- Bunge Limited

- Fenchem Enterprises Ltd.

- Enzymotech Ltd.

- Arboris LLC

- DSM Nutritional Products

- Kemin Industries, Inc.

- BioCare Copenhagen A/S

- E. I. du Pont de Nemours and Company

- Unilever

- The Archer Daniels Midland Company

- Kalsec Inc.

Recent Development

- In March 2024, Cargill Incorporated launched a sustainability initiative focused on the ethical sourcing of plant sterol esters, aiming to reduce environmental impact by 20% over the next five years.

- In January 2024, BASF SE introduced a new line of plant sterol esters aimed at the functional foods market, targeting a 15% increase in consumer reach.

Report Scope

Report Features Description Market Value (2023) USD 790 Mn Forecast Revenue (2033) USD 1673.1 Mn CAGR (2024-2033) 8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Oil, Powder), By Application (Food, Dairy, Bakery & Confectionery, Spreads & Dressings, Cereals & Snacks, Vegetable Oils, Beverages, Dietary Supplements, Pharmaceuticals, Cosmetics), By Type (Campesterol, Sitosterol, Stigmasterol, Brassicasterol, Cargill Incorporated) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Archer Daniels Midland Company, Raisio Plc, Bunge Limited, Fenchem Enterprises Ltd., Enzymotech Ltd., Arboris LLC, DSM Nutritional Products, Kemin Industries, Inc., BioCare Copenhagen A/S, E. I. du Pont de Nemours and Company, Unilever, The Archer Daniels Midland Company, Kalsec Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Plant Sterol Esters Market Overview

- 2.1. Plant Sterol Esters Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Plant Sterol Esters Market Dynamics

- 3. Global Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Plant Sterol Esters Market Analysis, 2016-2021

- 3.2. Global Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 3.3. Global Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 3.3.1. Global Plant Sterol Esters Market Analysis by By Form: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 3.3.3. Oil

- 3.3.4. Powder

- 3.4. Global Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Plant Sterol Esters Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Food

- 3.4.4. Dairy

- 3.4.5. Bakery & Confectionery

- 3.4.6. Spreads & Dressings

- 3.4.7. Cereals & Snacks

- 3.4.8. Vegetable Oils

- 3.4.9. Beverages

- 3.4.10. Dietary Supplements

- 3.4.11. Pharmaceuticals

- 3.4.12. Cosmetics

- 3.5. Global Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.5.1. Global Plant Sterol Esters Market Analysis by By Type: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.5.3. Campesterol

- 3.5.4. Sitosterol

- 3.5.5. Stigmasterol

- 3.5.6. Brassicasterol

- 4. North America Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Plant Sterol Esters Market Analysis, 2016-2021

- 4.2. North America Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 4.3. North America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 4.3.1. North America Plant Sterol Esters Market Analysis by By Form: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 4.3.3. Oil

- 4.3.4. Powder

- 4.4. North America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Plant Sterol Esters Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Food

- 4.4.4. Dairy

- 4.4.5. Bakery & Confectionery

- 4.4.6. Spreads & Dressings

- 4.4.7. Cereals & Snacks

- 4.4.8. Vegetable Oils

- 4.4.9. Beverages

- 4.4.10. Dietary Supplements

- 4.4.11. Pharmaceuticals

- 4.4.12. Cosmetics

- 4.5. North America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.5.1. North America Plant Sterol Esters Market Analysis by By Type: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.5.3. Campesterol

- 4.5.4. Sitosterol

- 4.5.5. Stigmasterol

- 4.5.6. Brassicasterol

- 4.6. North America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Plant Sterol Esters Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Plant Sterol Esters Market Analysis, 2016-2021

- 5.2. Western Europe Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 5.3.1. Western Europe Plant Sterol Esters Market Analysis by By Form: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 5.3.3. Oil

- 5.3.4. Powder

- 5.4. Western Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Plant Sterol Esters Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Food

- 5.4.4. Dairy

- 5.4.5. Bakery & Confectionery

- 5.4.6. Spreads & Dressings

- 5.4.7. Cereals & Snacks

- 5.4.8. Vegetable Oils

- 5.4.9. Beverages

- 5.4.10. Dietary Supplements

- 5.4.11. Pharmaceuticals

- 5.4.12. Cosmetics

- 5.5. Western Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.5.1. Western Europe Plant Sterol Esters Market Analysis by By Type: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.5.3. Campesterol

- 5.5.4. Sitosterol

- 5.5.5. Stigmasterol

- 5.5.6. Brassicasterol

- 5.6. Western Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Plant Sterol Esters Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Plant Sterol Esters Market Analysis, 2016-2021

- 6.2. Eastern Europe Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 6.3.1. Eastern Europe Plant Sterol Esters Market Analysis by By Form: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 6.3.3. Oil

- 6.3.4. Powder

- 6.4. Eastern Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Plant Sterol Esters Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Food

- 6.4.4. Dairy

- 6.4.5. Bakery & Confectionery

- 6.4.6. Spreads & Dressings

- 6.4.7. Cereals & Snacks

- 6.4.8. Vegetable Oils

- 6.4.9. Beverages

- 6.4.10. Dietary Supplements

- 6.4.11. Pharmaceuticals

- 6.4.12. Cosmetics

- 6.5. Eastern Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.5.1. Eastern Europe Plant Sterol Esters Market Analysis by By Type: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.5.3. Campesterol

- 6.5.4. Sitosterol

- 6.5.5. Stigmasterol

- 6.5.6. Brassicasterol

- 6.6. Eastern Europe Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Plant Sterol Esters Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Plant Sterol Esters Market Analysis, 2016-2021

- 7.2. APAC Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 7.3.1. APAC Plant Sterol Esters Market Analysis by By Form: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 7.3.3. Oil

- 7.3.4. Powder

- 7.4. APAC Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Plant Sterol Esters Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Food

- 7.4.4. Dairy

- 7.4.5. Bakery & Confectionery

- 7.4.6. Spreads & Dressings

- 7.4.7. Cereals & Snacks

- 7.4.8. Vegetable Oils

- 7.4.9. Beverages

- 7.4.10. Dietary Supplements

- 7.4.11. Pharmaceuticals

- 7.4.12. Cosmetics

- 7.5. APAC Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.5.1. APAC Plant Sterol Esters Market Analysis by By Type: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.5.3. Campesterol

- 7.5.4. Sitosterol

- 7.5.5. Stigmasterol

- 7.5.6. Brassicasterol

- 7.6. APAC Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Plant Sterol Esters Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Plant Sterol Esters Market Analysis, 2016-2021

- 8.2. Latin America Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 8.3.1. Latin America Plant Sterol Esters Market Analysis by By Form: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 8.3.3. Oil

- 8.3.4. Powder

- 8.4. Latin America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Plant Sterol Esters Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Food

- 8.4.4. Dairy

- 8.4.5. Bakery & Confectionery

- 8.4.6. Spreads & Dressings

- 8.4.7. Cereals & Snacks

- 8.4.8. Vegetable Oils

- 8.4.9. Beverages

- 8.4.10. Dietary Supplements

- 8.4.11. Pharmaceuticals

- 8.4.12. Cosmetics

- 8.5. Latin America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.5.1. Latin America Plant Sterol Esters Market Analysis by By Type: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.5.3. Campesterol

- 8.5.4. Sitosterol

- 8.5.5. Stigmasterol

- 8.5.6. Brassicasterol

- 8.6. Latin America Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Plant Sterol Esters Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Plant Sterol Esters Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Plant Sterol Esters Market Analysis, 2016-2021

- 9.2. Middle East & Africa Plant Sterol Esters Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Form, 2016-2032

- 9.3.1. Middle East & Africa Plant Sterol Esters Market Analysis by By Form: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Form, 2016-2032

- 9.3.3. Oil

- 9.3.4. Powder

- 9.4. Middle East & Africa Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Plant Sterol Esters Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Food

- 9.4.4. Dairy

- 9.4.5. Bakery & Confectionery

- 9.4.6. Spreads & Dressings

- 9.4.7. Cereals & Snacks

- 9.4.8. Vegetable Oils

- 9.4.9. Beverages

- 9.4.10. Dietary Supplements

- 9.4.11. Pharmaceuticals

- 9.4.12. Cosmetics

- 9.5. Middle East & Africa Plant Sterol Esters Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.5.1. Middle East & Africa Plant Sterol Esters Market Analysis by By Type: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.5.3. Campesterol

- 9.5.4. Sitosterol

- 9.5.5. Stigmasterol

- 9.5.6. Brassicasterol

- 9.6. Middle East & Africa Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Plant Sterol Esters Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Plant Sterol Esters Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Plant Sterol Esters Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Plant Sterol Esters Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Cargill Incorporated

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. BASF SE

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Archer Daniels Midland Company

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Raisio Plc

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Bunge Limited

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Fenchem Enterprises Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Enzymotech Ltd.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Arboris LLC

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. DSM Nutritional Products

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Kemin Industries, Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. BioCare Copenhagen A/S

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Unilever

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. The Archer Daniels Midland Company

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Kalsec Inc.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Cargill Incorporated

- BASF SE

- Archer Daniels Midland Company

- Raisio Plc

- Bunge Limited

- Fenchem Enterprises Ltd.

- Enzymotech Ltd.

- Arboris LLC

- DSM Nutritional Products

- Kemin Industries, Inc.

- BioCare Copenhagen A/S

- E. I. du Pont de Nemours and Company

- Unilever

- The Archer Daniels Midland Company

- Kalsec Inc.