Pigment Dispersion Market Report By Pigment Type (Inorganic Pigments, Organic Pigments), By Dispersion Type (Water-Based Dispersions, Solvent-Based Dispersions, Others), By Form (Liquid, Powder, Granular), By Application (Automotive Paints & Coatings, Others), By End-use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47275

-

June 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

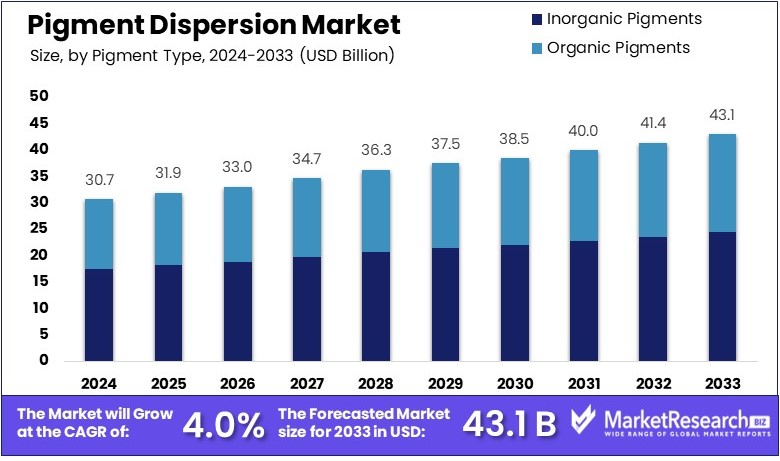

The Global Pigment Dispersion Market size is expected to be worth around USD 43.1 Billion by 2033, from USD 30.7 Billion in 2024, growing at a CAGR of 4.0% during the forecast period from 2024 to 2033.

The pigment dispersion market refers to the industry involved in creating and distributing pigment dispersions that are essential for imparting color in various products. This market primarily serves sectors like paints, coatings, inks, plastics, and cosmetics. The pigment dispersions are formulations of finely dispersed pigments in a liquid or paste, which ensure uniform color and stability in end products.

Key attributes of this market include innovations in durability, color consistency, and environmental compliance. As executives and product managers navigate this market, understanding these attributes helps in leveraging color technology to enhance product appeal and functionality.

The Pigment Dispersion Market is characterized by its dynamic evolution, driven by increasing demands across various industrial sectors such as automotive, construction, and personal care. The market is primarily propelled by the need for high-quality, durable pigments that offer superior color consistency and stability in diverse applications. Innovations in pigment technology and formulation have significantly enhanced the performance characteristics of these dispersions, making them integral to the production of paints, coatings, inks, and plastics.

In recent years, the market has seen a shift towards environmentally friendly and sustainable products, responding to global regulatory standards and consumer preferences for green alternatives. This has led to the development of water-based and bio-based pigment dispersions, which are gaining traction over solvent-based counterparts due to their lower environmental impact and compliance with stringent environmental regulations.

Financially, the Pigment Dispersion Market is on a growth trajectory, with projections indicating robust expansion. The market's growth is supported by the increasing urbanization and industrial activities in emerging economies, which are major consumers of paints and coatings. The rise in consumer spending on personal vehicles and residential properties also contributes to the market's expansion, as these sectors demand high-quality coatings and finishes.

The market's future looks promising with continued advancements in pigment technology and growing industrial applications, signaling lucrative opportunities for growth and investment.

Key Takeaways

- Market Value: The Pigment Dispersion Market was valued at USD 30.7 billion in 2024 and is expected to reach USD 43.1 billion by 2033, with a CAGR of 4.0%.

- Pigment Type Analysis: Inorganic Pigments dominate with 56.3%, highlighting their extensive use across various industries.

- Dispersion Type Analysis: Water-Based Dispersions lead at 67.4%, favored for their environmental benefits and regulatory compliance.

- Form Analysis:;Liquid forms prevail with 56.9%, due to their ease of application and efficient mixing properties.

- Application Analysis: Automotive Paints & Coatings represent 32.0%, driven by rising vehicle production and demand for high-quality finishes.

- End-Use Analysis: Building & Construction holds 35.6%, benefiting from global urbanization and infrastructural development.

- Dominant Region: Asia Pacific commands the market with 39%, propelled by rapid industrial growth and expanding manufacturing sectors.

- Analyst Viewpoint: The market is moderately saturated, with competition intensifying among key players. Future growth will hinge on innovation in product offerings and expansion in emerging markets.

- Growth Opportunities: Key players can differentiate by enhancing product durability and environmental sustainability, particularly in developing economies.

Driving Factors

Increasing Demand from the Paints and Coatings Industry Drives Market Growth

The paints and coatings industry is a major driver of the pigment dispersion market. Growth in the construction and automotive sectors fuels the need for high-quality paint additives with enhanced properties such as color strength, opacity, and durability. These attributes are significantly improved through the use of pigment dispersions. For instance, specialized pigment dispersions in automotive coatings enhance scratch and weather resistance, boosting their adoption.

This expansion directly influences the demand for pigment dispersions. Additionally, the shift towards aesthetically appealing and protective coatings in residential and commercial construction further amplifies this demand. The combined impact of these factors ensures a steady growth trajectory for the pigment dispersion market, driven by the expanding paints and coatings sector.

Advancements in Printing Ink Formulations Drive Market Growth

The printing industry's shift towards eco-friendly and high-performance inks significantly drives the pigment dispersion market. Pigment dispersions are crucial in these formulations, offering superior color strength, brilliance, and resistance to fading and smudging. The rising demand for digital printing, especially in packaging and advertising, necessitates the use of advanced pigment dispersions. Organic pigment dispersions in inkjet printing inks have notably enhanced the quality and durability of printed materials.

This growth directly correlates with the increased demand for pigment dispersions. Furthermore, the trend towards customized and short-run printing jobs in the packaging industry requires high-performance inks, thereby boosting the market for pigment dispersions. The interaction of these trends highlights the significant role of advancements in printing ink formulations in driving market growth.

Rising Demand for Sustainable and Eco-friendly Products Drives Market Growth

Environmental concerns are pushing the demand for sustainable and eco-friendly products, significantly impacting the pigment dispersion market. There is a growing preference for pigment dispersions derived from natural sources or those with a lower environmental footprint. Manufacturers are investing in developing bio-based and biodegradable pigment dispersions to meet this demand.

The cosmetics and personal care industry, for instance, has seen an increase in the use of plant-based pigment dispersions due to their eco-friendly nature and enhanced performance. This shift towards sustainability is also evident in other industries like textiles and packaging, where the demand for eco-friendly pigments is rising. The combined impact of regulatory pressures, consumer preferences, and technological advancements in green chemistry underscores the importance of sustainable products in driving the growth of the pigment dispersion market.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

Stringent environmental regulations impact the pigment dispersion market significantly. Regulations aim to reduce the environmental and health risks associated with certain pigments and dispersants. These regulations vary by region, creating compliance challenges and raising production costs.

For example, the European Union restricts the use of some organic pigments and solvents. This forces manufacturers to seek alternative formulations, which can be both costly and time-consuming. Compliance with these regulations often requires investment in new technologies and processes, further increasing expenses. Consequently, these regulatory hurdles limit market growth by increasing operational costs and slowing down innovation and production efficiency.

Volatility in Raw Material Prices Restrains Market Growth

The pigment dispersion market faces challenges due to volatility in raw material prices. Key components such as pigments, dispersants, solvents, and additives often experience price fluctuations. For instance, the cost of crude oil, a primary feedstock for many organic pigments, is highly volatile. These price changes can disrupt production planning and affect profitability.

When raw material prices rise, manufacturers may face increased production costs, which can lead to higher product prices and reduced competitiveness. This instability in raw material costs creates uncertainty in the market, making it difficult for manufacturers to maintain stable pricing strategies and affecting overall market growth.

Pigment Type

Inorganic Pigments dominate with 56.3% due to their superior durability and stability in various applications.

In the pigment dispersion market, by pigment type, inorganic pigments hold a predominant position, accounting for 56.3% of the market share. This dominance can be attributed to their inherent characteristics of durability, lightfastness, and stability under exposure to environmental conditions. Inorganic pigments, including oxides, sulfides, and silicates, are widely favored in industries that demand long-lasting color and robust performance, such as automotive paints, silicone coatings, industrial coatings, and construction materials.

These pigments are preferred for their ability to withstand harsh chemicals and environmental factors without significant degradation. This makes them ideal for applications in exterior paints and coatings where longevity and resistance to weathering are crucial. Moreover, their non-toxic nature compared to some organic pigments enhances their appeal in sectors focusing on environmental sustainability and health safety standards.

Despite the dominance of inorganic pigments, the segment of organic pigments also plays a critical role in the market. Organic pigments, known for their vibrant colors and ease of application, are essential in applications requiring bright and vivid hues such as in decorative paints and plastics. Although they occupy a smaller share of the market, the development of new organic pigment formulations that are more stable and eco-friendly could see an increase in their application scope, thereby supporting the overall growth of the pigment dispersion market.

Dispersion Type Analysis

Water-Based Dispersions dominate with 67.4% due to environmental regulations and advancements in waterborne technology.

Within the dispersion type segment of the pigment dispersion market, water-based dispersions lead with a significant 67.4% market share. This dominance is largely driven by stringent environmental regulations that limit the use of solvent-based systems due to their volatile organic compound (VOC) content. Water-based dispersions offer a less toxic and environmentally friendly alternative, aligning with global sustainability trends and regulatory frameworks.

The growth in the water-based dispersion segment is supported by advancements in waterborne technology that improve the performance of these dispersions to rival that of solvent-based systems. These advancements include better pigment stabilization techniques and innovations in binder technology, which enhance the durability and color consistency of water-based products. This has expanded their use in high-end applications such as automotive and industrial coatings, where performance cannot be compromised.

Solvent-based dispersions, although now less preferred due to their environmental impact, still hold importance in specific applications where water-based alternatives might not provide the necessary performance attributes. For example, in high-temperature environments or applications requiring quick drying times, solvent-based dispersions are more suitable. This sub-segment’s role in the market continues to be relevant, especially in regions and applications where regulatory pressures are less stringent.

Form Analysis

Liquid dominates with 56.9% due to its ease of application and formulation flexibility.

Liquid form holds the majority share in the pigment dispersion market at 56.9%. This preference is due to the ease of application and formulation flexibility that liquid dispersions offer. They are easier to mix with other components of a formulation, providing better homogeneity and consistency in the final product. This is particularly valuable in the paints and coatings industry, where uniform application is critical to achieving desired finishes.

The dominance of liquid dispersions is also supported by their cost-effectiveness in production and transportation. Compared to powders and granules, liquid dispersions require less processing time and energy, leading to lower production costs. They also tend to be more efficient in terms of storage and shipping, as they can be handled in bulk using tanks and pipelines.

While liquid forms lead the market, powder and granular forms are essential in applications requiring controlled release of pigments or where liquid forms may pose challenges in handling and stability. Powder and granular forms are particularly significant in industries like plastics and printing inks, where they offer benefits in terms of ease of storage, longer shelf life, and versatility in usage across various applications. The ongoing developments in dry pigment technology could potentially increase their market share, contributing to the overall growth of the pigment dispersion industry.

Application Analysis

Automotive Paints & Coatings dominate with 32% due to technological advancements and increased global vehicle production.

The application of pigment dispersions in automotive paints and coatings dominates this segment, with a market share of 32%. This dominance is fueled by continuous technological advancements in paint formulations and an increase in global vehicle production. Automotive coatings must meet high standards of durability, color consistency, and resistance to environmental elements, making advanced pigment dispersions ideal for this application.

The growth in this sub-segment is supported by the automotive industry's push towards more eco-friendly coatings, including waterborne and high-solid formulations, which reduce VOC emissions. The transition towards electric vehicles and the need for specialized coatings also drive the demand for high-quality pigment dispersions that can deliver superior aesthetics and long-term performance.

While automotive paints and coatings hold the largest share, other applications such as decorative paints, industrial coatings, and inks also play significant roles in the market. These applications benefit from the diverse properties of pigment dispersions, including their adaptability to different bases and their ability to meet specific aesthetic and performance requirements. As global construction activity increases and consumer preferences shift towards more sustainable products, these other applications are poised to contribute significantly to the growth of the pigment dispersion market.

End-Use Analysis

Building & Construction dominates with 35.6% due to increasing construction activities and demand for sustainable products.

In the end-use segment of the pigment dispersion market, the building and construction industry leads with a 35.6% share. This is primarily driven by global urbanization trends and increasing construction activities, especially in emerging economies. Pigment dispersions are extensively used in this sector for applications such as exterior and interior paints, coatings for metal and wood, and architectural concrete.

The dominance of this segment is also influenced by the rising demand for environmentally sustainable and green building materials, which favor the use of water-based and eco-friendly pigment dispersions. These products reduce the environmental impact of construction projects and meet the stringent standards set by green building certifications such as LEED and BREEAM.

Other end-use sectors, such as automotive, packaging, paper and printing, and textiles, also significantly utilize pigment dispersions. These sectors demand high-quality color solutions that pigment dispersions provide, enhancing aesthetics and functionality. As these industries continue to grow and evolve, their increasing requirements for high-performance coloration solutions will further drive the growth of the pigment dispersion market, supporting its expansion across diverse applications and geographies.

Key Market Segments

By Pigment Type

- Inorganic Pigments

- Organic Pigments

By Dispersion Type

- Water-Based Dispersions

- Solvent-Based Dispersions

- Others

By Form

- Liquid

- Powder

- Granular

By Application

- Automotive Paints & Coatings

- Decorative Paints & Coatings

- Industrial Paints & Coatings

- Inks

- Plastics

- Others

By End-use

- Building & Construction

- Automotive

- Packaging Paper & Printing

- Textile

- Others

Growth Opportunities

Expansion in Emerging Markets Offers Growth Opportunity

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the pigment dispersion market. Rapid industrialization, urbanization, and increasing disposable incomes in these regions drive the demand for consumer goods and construction activities. This growth, in turn, boosts the demand for pigment dispersions in paints, coatings, plastics, and printing industries.

For instance, the construction sector in the Asia-Pacific region is experiencing substantial growth. Manufacturers can capitalize on these opportunities by establishing local production facilities and customizing products to meet regional needs. The expanding middle class and the rise in housing projects further fuel market demand, making these emerging markets highly attractive for investment and expansion.

Development of High-Performance and Specialized Pigment Dispersions Offers Growth Opportunity

There is a rising demand for high-performance and specialized pigment dispersions in various industries. These dispersions offer enhanced color strength, better stability, improved weatherability, and resistance to harsh environments. The aerospace, automotive, and electronics sectors particularly benefit from these advanced materials. For example, the automotive coatings market is projected to grow significantly in the coming years.

Manufacturers can leverage their R&D capabilities to innovate and create tailored pigment dispersions for specific applications, thereby meeting the advanced material needs of these industries. This focus on high-performance products presents significant growth opportunities by addressing the increasing demand for superior quality and performance.

Trending Factors

Digitalization and Industry 4.0 Are Trending Factors

The pigment dispersion industry is embracing digitalization and Industry 4.0 concepts to enhance operational efficiency and product quality. Technologies like IoT solutions, automation, and data analytics are being adopted to optimize production processes and monitor real-time performance. This trend improves productivity, reduces costs, and enhances market competitiveness.

The adoption of smart manufacturing technologies is driving significant improvements in production efficiency and product quality. Predictive maintenance enabled by these technologies helps in reducing downtime and improving the lifespan of equipment, thereby offering a significant competitive edge.

Focus on Sustainability and Circular Economy Are Trending Factors

The focus on sustainability and the circular economy is growing across the pigment dispersion market. Manufacturers are adopting sustainable practices such as using renewable energy sources, implementing waste reduction strategies, and exploring recycling and reusing materials.

This trend is driven by stringent environmental regulations, consumer demand for eco-friendly products, and the need for long-term business sustainability. For example, the global market for sustainable packaging is expected to grow significantly. By adopting these practices, companies can reduce their environmental footprint and meet regulatory requirements, while also appealing to environmentally conscious consumers.

Regional Analysis

Asia Pacific Dominates with 39% Market Share

Asia Pacific holds a dominant position in the Pigment Dispersion Market, accounting for 39% of the market share. This region's dominance is driven by several key factors, including rapid industrialization, urbanization, and increasing disposable incomes. The burgeoning construction and automotive industries in countries like China and India significantly contribute to the high demand for pigment dispersions. Additionally, the presence of numerous manufacturing hubs and a growing population further bolster market growth in this region.

Asia Pacific's high market share is primarily driven by rapid economic growth and industrialization. The region's extensive manufacturing base for paints, coatings, plastics, and printing industries boosts the demand for pigment dispersions. Furthermore, increasing urbanization leads to higher construction activities, driving the need for high-quality paints and coatings. The automotive industry's growth in China and India also contributes significantly, with increased production and sales of vehicles requiring advanced coatings.

The regional characteristics of Asia Pacific, such as large-scale infrastructure projects and a robust manufacturing sector, play a crucial role in the pigment dispersion market. The availability of raw materials and lower production costs attract international manufacturers to set up facilities in this region. Moreover, supportive government policies and investments in industrial development enhance the market's performance. The region's dynamic consumer market also fuels demand for diverse applications of pigment dispersions in various industries.

North America: 25% Market Share

North America holds a 25% share of the pigment dispersion market. The region benefits from a strong industrial base, particularly in the automotive and construction sectors. Technological advancements and high demand for eco-friendly products drive market growth. The presence of major manufacturers and a focus on R&D contribute to the region's market dynamics.

Europe: 20% Market Share

Europe accounts for 20% of the pigment dispersion market share. The region's market is driven by stringent environmental regulations and a strong emphasis on sustainable products. The automotive industry's demand for high-performance coatings and the construction sector's growth in countries like Germany and France contribute to market expansion. Europe's focus on innovation and quality also plays a key role.

Middle East & Africa: 10% Market Share

The Middle East & Africa region holds a 10% market share in the pigment dispersion market. Economic development and infrastructure projects drive demand for paints and coatings. The region's construction boom, particularly in Gulf Cooperation Council (GCC) countries, supports market growth. However, political instability and economic fluctuations can pose challenges.

Latin America: 6% Market Share

Latin America accounts for 6% of the pigment dispersion market share. The region's market is influenced by industrial growth and urbanization. Countries like Brazil and Mexico drive demand through their expanding construction and automotive sectors. However, economic instability and regulatory challenges can impact market performance in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Pigment Dispersion Market features prominent companies that significantly influence its growth and dynamics. Leading players like BASF SE and Clariant Ltd. leverage their extensive R&D capabilities and global presence to innovate and expand their product portfolios. These companies are strategically positioned to meet the increasing demand for high-performance and eco-friendly pigment dispersions.

Sun Chemical and Heubach GmbH are notable for their comprehensive range of pigment dispersions, catering to various industries, including automotive, construction, and printing. Their strong distribution networks and customer-centric approaches enhance their market influence.

Emerging companies such as Trust Chem Co., Ltd., and Sudarshan Chemical Industries Limited are rapidly gaining market share through competitive pricing and localized production facilities. They focus on tapping into the growing markets of Asia-Pacific and Latin America, capitalizing on regional demand.

Specialized firms like Organic Dyes and Pigments and Reitech Corporation offer niche products tailored for specific applications, providing flexibility and customization that appeal to a diverse customer base.

Overall, these key players drive market expansion through innovation, strategic partnerships, and a focus on sustainable solutions, positioning themselves to meet the evolving needs of the global pigment dispersion market.

Market Key Players

- Trust Chem Co., Ltd.

- Sun Chemical

- Sudarshan Chemical Industries Limited

- Reitech Corporation

- Pidilite Industries Ltd.

- Organic Dyes and Pigments

- Kama Pigments

- Heubach GmbH

- Flint Group

- Ferro Corporation

- DyStar Singapore Pte. Ltd

- Decorative Color & Chemical, Inc.

- Clariant Ltd.

- BASF SE

- Aum Farbenchem

- Aralon Color GmbH

- American Element

- AArbor Colorants Corporation

Recent Developments

- Grolman Group expands partnership with Oxerra, formerly Cathay Industries, to distribute their pigment and pigment dispersion products in several European countries for coatings, plastics, and construction industries.

- Vipul Organics receives environmental clearance to expand production capacity from 10 MT to 508 MT at their Ambernath facility.

- Vipul Organics achieves ZDHC Level 3 certification for their pigment dispersions and reactive dyes.

- Covestro and Kronos validate the benefits of digital printing, demonstrating its potential for the textile industry.

Report Scope

Report Features Description Market Value (2023) USD 30.7 Billion Forecast Revenue (2033) USD 43.1 Billion CAGR (2024-2033) 4.0% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pigment Type (Inorganic Pigments, Organic Pigments), By Dispersion Type (Water-Based Dispersions, Solvent-Based Dispersions, Others), By Form (Liquid, Powder, Granular), By Application (Automotive Paints & Coatings, Decorative Paints & Coatings, Industrial Paints & Coatings, Inks, Plastics, Others), By End-use (Building & Construction, Automotive, Packaging Paper & Printing, Textile, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Trust Chem Co., Ltd., Sun Chemical, Sudarshan Chemical Industries Limited, Reitech Corporation, Pidilite Industries Ltd., Organic Dyes and Pigments, Kama Pigments, Heubach GmbH, Flint Group, Ferro Corporation, DyStar Singapore Pte. Ltd, Decorative Color & Chemical, Inc., Clariant Ltd., BASF SE, Aum Farbenchem, Aralon Color GmbH, American Element, AArbor Colorants Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Trust Chem Co., Ltd.

- Sun Chemical

- Sudarshan Chemical Industries Limited

- Reitech Corporation

- Pidilite Industries Ltd.

- Organic Dyes and Pigments

- Kama Pigments

- Heubach GmbH

- Flint Group

- Ferro Corporation

- DyStar Singapore Pte. Ltd

- Decorative Color & Chemical, Inc.

- Clariant Ltd.

- BASF SE

- Aum Farbenchem

- Aralon Color GmbH

- American Element

- AArbor Colorants Corporation