Global Pharmaceutical Cdmo Market By Product(API, Drug Product), By Workflow(Clinical, Commercial), By Application(Oncology[Small Molecules, Biologics], Infectious Diseases, Neurological Disorders, Cardiovascular Disease, Metabolic Disorders, Autoimmune Diseases, Respiratory Diseases, Ophthalmology, Gastrointestinal Disorders, Hormonal Disorders, Hematological Disorders, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45768

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

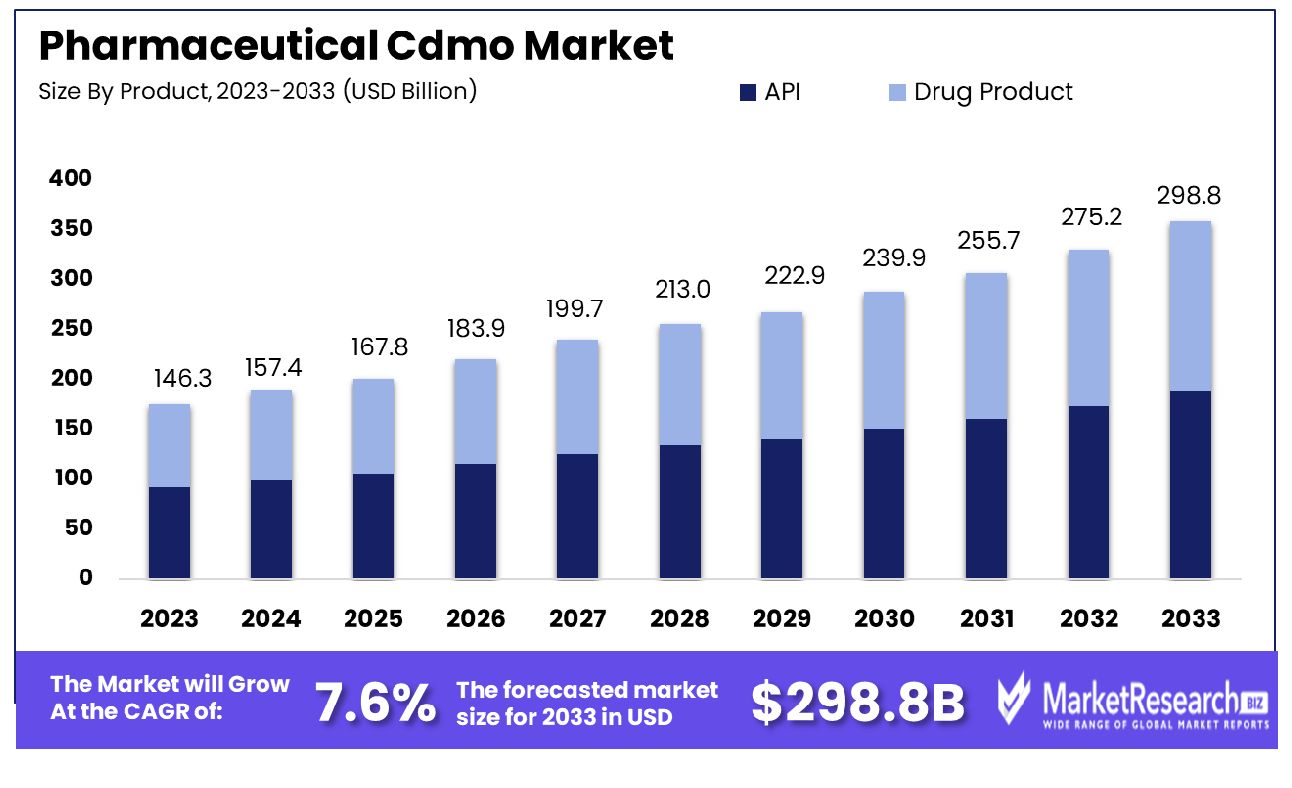

The Global Pharmaceutical Cdmo Market was valued at USD 146.3 billion in 2023. It is expected to reach USD 298.8 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033. The Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market encompasses entities that provide comprehensive services from drug development through to manufacturing for pharmaceutical companies. CDMOs offer an integrated solution, allowing pharmaceutical firms to outsource various stages of drug development and production, thereby optimizing operational efficiencies and accelerating time-to-market. This market is characterized by its critical role in scaling up production, ensuring regulatory compliance, and providing specialized expertise in formulation, analytics, and large-scale manufacturing. With a growing emphasis on innovation and cost-effectiveness, the CDMO market is pivotal in addressing the dynamic needs of the global pharmaceutical industry. The Contract Development and Manufacturing Organization (CDMO) market in the pharmaceutical sector is poised for significant growth, driven by a convergence of factors reshaping the global pharmaceutical landscape. A key driver is the increasing complexity and cost associated with drug development. The estimated full cost of bringing a new chemical or biological entity to market has escalated dramatically from $179 million in the 1970s-early 1980s to $2,558 million in the 2000s-mid 2010s.

This surge in development costs underscores the critical role of CDMOs in providing cost-effective, scalable solutions to pharmaceutical companies. North America, which accounted for 52.3% of global pharmaceutical sales in 2022, remains a dominant player, largely due to its advanced R&D capabilities and robust regulatory framework. Europe, contributing 22.4% of global sales, is increasingly contending with competition from emerging markets like China and Korea. These emerging markets are rapidly advancing in technological capabilities and infrastructure, positioning them as formidable players in the CDMO space.

The shift towards biologics and personalized medicine further accentuates the importance of CDMOs, as these therapies often require specialized manufacturing processes. Consequently, pharmaceutical companies are increasingly outsourcing to CDMOs to leverage their expertise and advanced technologies, ensuring efficient and compliant production.

This trend is anticipated to intensify as the industry continues to innovate, emphasizing the strategic importance of CDMOs in the pharmaceutical value chain. Overall, the CDMO market is set to experience robust growth, underpinned by rising development costs, technological advancements, and the shifting dynamics of global pharmaceutical sales.

The Contract Development and Manufacturing Organization (CDMO) market in the pharmaceutical sector is poised for significant growth, driven by a convergence of factors reshaping the global pharmaceutical landscape. A key driver is the increasing complexity and cost associated with drug development. The estimated full cost of bringing a new chemical or biological entity to market has escalated dramatically from $179 million in the 1970s-early 1980s to $2,558 million in the 2000s-mid 2010s.

This surge in development costs underscores the critical role of CDMOs in providing cost-effective, scalable solutions to pharmaceutical companies. North America, which accounted for 52.3% of global pharmaceutical sales in 2022, remains a dominant player, largely due to its advanced R&D capabilities and robust regulatory framework. Europe, contributing 22.4% of global sales, is increasingly contending with competition from emerging markets like China and Korea. These emerging markets are rapidly advancing in technological capabilities and infrastructure, positioning them as formidable players in the CDMO space.

The shift towards biologics and personalized medicine further accentuates the importance of CDMOs, as these therapies often require specialized manufacturing processes. Consequently, pharmaceutical companies are increasingly outsourcing to CDMOs to leverage their expertise and advanced technologies, ensuring efficient and compliant production.

This trend is anticipated to intensify as the industry continues to innovate, emphasizing the strategic importance of CDMOs in the pharmaceutical value chain. Overall, the CDMO market is set to experience robust growth, underpinned by rising development costs, technological advancements, and the shifting dynamics of global pharmaceutical sales.

Key Takeaways

- Market Growth: The Global Pharmaceutical Cdmo Market was valued at USD 146.3 billion in 2023. It is expected to reach USD 298.8 billion by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

- By Product: API leads with an 82.3% dominance in the product category.

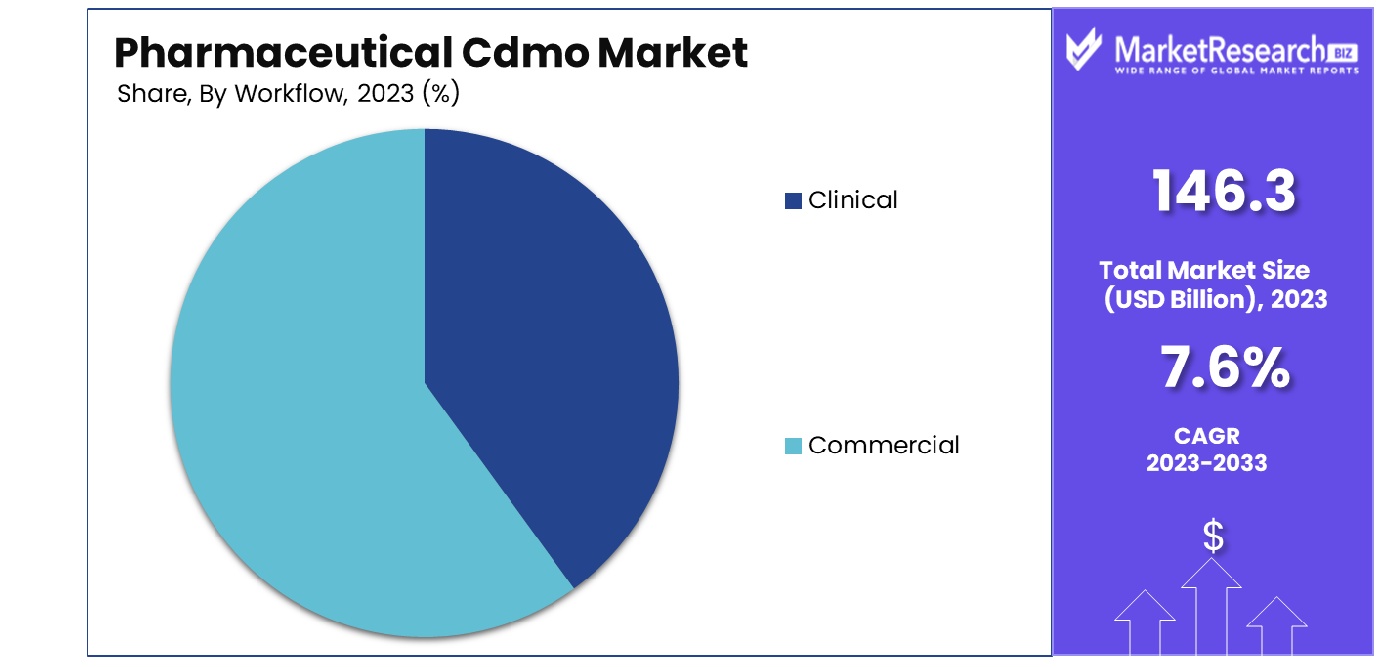

- By Workflow: Commercial workflow dominates significantly with an 88.1% share.

- By Application: Oncology applications show a strong lead at 22.3%.

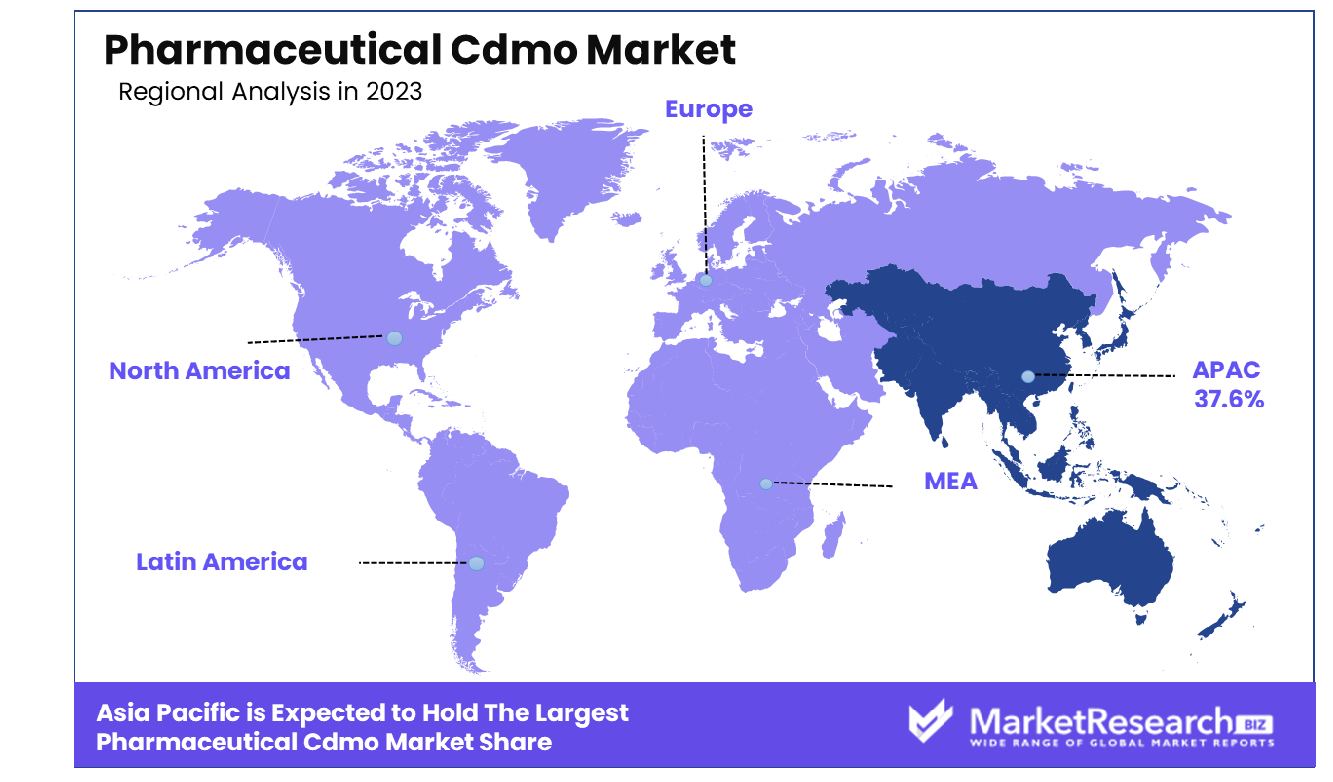

- Regional Dominance: The Asia-Pacific Pharmaceutical CDMO market accounts for 37.6% of the global share.

- Growth Opportunity: In 2023, the Pharmaceutical CDMO market grew due to enhanced regulatory compliance capabilities and the integration of continuous manufacturing, improving efficiency, product quality, and market attractiveness.

Driving factors

Expertise in Drug Development and Manufacturing

The expertise of Contract Development and Manufacturing Organizations (CDMOs) in drug development and manufacturing is a significant driver of the pharmaceutical CDMO market. CDMOs possess specialized knowledge and capabilities that enable pharmaceutical companies to streamline their development processes, reduce time-to-market, and mitigate risks associated with drug development. This expertise is crucial for handling complex manufacturing processes and ensuring compliance with stringent regulatory requirements. The comprehensive services provided by CDMOs, including formulation development, process optimization, and large-scale manufacturing, attract pharmaceutical companies looking to leverage external expertise and focus on core competencies. This growing reliance on CDMOs is a key factor propelling market growth.Integration of Advanced Drug Development and Manufacturing Technologies

The integration of advanced technologies in drug development and manufacturing is revolutionizing the pharmaceutical CDMO market. Technologies such as continuous manufacturing, single-use systems, and advanced analytics enhance efficiency, reduce costs, and improve product quality. For instance, continuous manufacturing allows for the consistent production of pharmaceuticals, minimizing variability and enhancing scalability. The adoption of single-use systems reduces contamination risks and speeds up production timelines. Advanced analytics and automation streamline quality control processes, ensuring higher precision and compliance. This technological advancement is driving the demand for CDMO services, as pharmaceutical companies seek to capitalize on these innovations to enhance their production capabilities and maintain a competitive edge.Increasing R&D Activities for Investigational Drugs and Innovations

The surge in research and development (R&D) activities for investigational drugs and innovations is a critical factor driving the growth of the pharmaceutical CDMO market. The increasing focus on developing novel therapies, including biologics and personalized medicines, has led to a rise in demand for specialized CDMO services. Pharmaceutical companies are investing heavily in R&D to address unmet medical needs and bring innovative drugs to market. According to industry reports, global R&D spending in the pharmaceutical sector reached approximately $200 billion in recent years, reflecting a strong commitment to innovation. CDMOs play a pivotal role in supporting these R&D efforts by providing expertise in clinical trial material production, regulatory compliance, and scale-up processes. This trend is expected to continue, further fueling the growth of the pharmaceutical CDMO market.Restraining Factors

Regulatory Compliance Challenges

Regulatory compliance challenges pose a significant restraint on the growth of the pharmaceutical CDMO market. CDMOs must adhere to stringent regulatory requirements set by agencies such as the FDA, EMA, and other global regulatory bodies. These regulations encompass various aspects, including Good Manufacturing Practices (GMP), quality control, and documentation standards. Compliance with these regulations demands substantial investment in quality assurance systems, staff training, and continuous monitoring. Failure to comply can lead to severe consequences, including product recalls, financial penalties, and loss of business credibility. Additionally, the evolving regulatory landscape requires CDMOs to stay updated with the latest guidelines, which can be resource-intensive. This regulatory burden can deter smaller CDMOs from entering the market and may limit the growth potential of existing players, thus impacting the overall market expansion.Pricing Pressure from Pharmaceutical Companies

Pricing pressure from pharmaceutical companies significantly restrains the growth of the pharmaceutical CDMO market. As pharmaceutical companies strive to reduce operational costs and improve profit margins, they exert considerable pressure on CDMOs to lower their service prices. This pressure can lead to reduced profit margins for CDMOs, impacting their ability to invest in advanced technologies, infrastructure, and workforce development. The competitive pricing environment also forces CDMOs to continuously optimize their operations and enhance efficiency to maintain profitability. While larger CDMOs might have the resources to withstand pricing pressures, smaller and mid-sized CDMOs may struggle to sustain their operations under such conditions. This pricing dynamic can hinder market growth by limiting the financial flexibility and growth potential of CDMOs, thereby affecting their capacity to expand services and invest in innovative solutions.By Product Analysis

By Product, the API segment dominated the market, capturing 82.3% of the total share. In 2023, API held a dominant market position in the By Product segment of the Pharmaceutical CDMO Market, capturing more than an 82.3% share. This dominance is driven by various factors, including the rising demand for Traditional Active Pharmaceutical Ingredients (Traditional API) and the increasing utilization of Highly Potent Active Pharmaceutical Ingredients (HP-API). APIs can be broadly categorized into traditional APIs, Highly Potent APIs (HP-API), Antibody Drug Conjugates (ADC), and others, each contributing significantly to the market's expansion. Traditional APIs continue to be widely used due to their established efficacy and broad application in drug formulations. However, the HP-API segment is experiencing substantial growth, fueled by advancements in oncology treatments and the increasing development of targeted therapies. In terms of Synthesis, APIs are divided into Synthetic and Biotech categories. Synthetic APIs are predominant, with solid and liquid forms being the most common. However, there is a noticeable shift towards biotech APIs, driven by innovations in biotechnology and a growing focus on biologics and biosimilars. Drug categories within the API segment include Innovative and Generics. Innovative drugs are propelling market growth due to ongoing research and development activities aimed at introducing new therapeutic agents. Conversely, the Generics segment continues to expand, driven by cost-effectiveness and the increasing adoption of generic medicines globally. Manufacturing processes in the API segment are categorized into Continuous and Batch manufacturing. Continuous manufacturing is gaining traction due to its efficiency and ability to enhance production scalability, while batch manufacturing remains prevalent for its established methodologies and flexibility. The Drug Product segment includes Oral solid dose, Semi-solid dose, Liquid dose, and others. Oral solid doses remain the most preferred form due to ease of administration and patient compliance. However, semi-solid and liquid doses are also witnessing growth, particularly in specialized therapeutic areas requiring tailored delivery mechanisms.By Workflow Analysis

By Workflow, the Commercial segment held the majority, accounting for 88.1% of the market share. In 2023, Commercial held a dominant market position in the By Workflow segment of the Pharmaceutical CDMO Market, capturing more than an 88.1% share. This significant market share is attributed to the increasing demand for large-scale production and the continuous growth of the pharmaceutical industry’s commercial operations. Commercial workflows encompass various activities, including large-scale manufacturing, packaging, and distribution of pharmaceutical products. The high market share indicates the growing reliance on Contract Development and Manufacturing Organizations (CDMOs) for commercial-scale production, driven by pharmaceutical companies' need to optimize costs and enhance operational efficiencies. The Commercial segment's dominance is further supported by the rising number of drug approvals and the subsequent need for large-scale production capacities. With the pharmaceutical industry focusing on accelerating the time-to-market for new drugs, CDMOs play a crucial role in providing the necessary infrastructure and expertise for commercial manufacturing. Additionally, the trend towards outsourcing in the pharmaceutical industry has significantly contributed to the growth of the Commercial workflow segment. Pharmaceutical companies are increasingly partnering with CDMOs to leverage their specialized capabilities, including advanced manufacturing technologies and regulatory expertise, which are essential for large-scale production and global distribution. Moreover, the shift towards biologics and specialty drugs has led to an increased demand for commercial manufacturing services, particularly for complex formulations that require specialized manufacturing processes and stringent quality control measures. CDMOs are well-positioned to meet these demands, offering scalable solutions that ensure compliance with regulatory standards and meet the high-quality expectations of the pharmaceutical industry. The Commercial workflow segment’s robust growth is also driven by the expanding global pharmaceutical market, with increasing drug consumption and healthcare expenditure in emerging economies. This growth necessitates efficient and scalable manufacturing solutions, further cementing the importance of CDMOs in the pharmaceutical supply chain.

By Application Analysis

By Application, Oncology dominated with a 22.3% share, leading among other application segments. In 2023, Oncology held a dominant market position in the By Application segment of the Pharmaceutical CDMO Market, capturing more than a 22.3% share. This leadership is driven by the escalating prevalence of cancer and the consequent rise in demand for innovative cancer therapies, encompassing both Small Molecules and Biologics. Oncology encompasses a broad range of treatments, including Small Molecules and Biologics, each playing a pivotal role in addressing various types of cancers. The surge in oncology-related drug development is propelled by ongoing research and the introduction of novel therapies aimed at improving patient outcomes and survival rates. Small Molecules remain crucial due to their targeted action and ease of production, while Biologics are gaining prominence for their specificity and effectiveness in treating complex cancer types. The dominance of the Oncology segment is further reinforced by substantial investments in cancer research and development, leading to a robust pipeline of oncology drugs. This has spurred the demand for Contract Development and Manufacturing Organizations (CDMOs), which provide essential support in drug development, manufacturing, and commercialization processes. In addition to Oncology, other therapeutic areas such as Infectious Diseases, Neurological Disorders, and Cardiovascular Disease also contribute to the market, albeit to a lesser extent. Infectious Diseases are significant due to ongoing global health challenges, while Neurological Disorders and Cardiovascular Disease remain critical focus areas due to their high prevalence and impact on public health. The market’s growth in the Oncology segment is also influenced by the increasing adoption of personalized medicine and immunotherapies, which require specialized manufacturing capabilities provided by CDMOs. The trend towards precision medicine in oncology underscores the need for advanced manufacturing techniques and regulatory expertise, which CDMOs are well-equipped to offer. Furthermore, the global increase in cancer incidence has heightened the demand for oncology drugs, driving pharmaceutical companies to rely more on CDMOs for scalable and efficient production solutions. This reliance ensures that new cancer therapies can reach the market more swiftly, meeting the urgent needs of patients worldwide.Key Market Segments

- By Product

- API

- Type

- Traditional Active Pharmaceutical Ingredient (Traditional API)

- Highly Potent Active Pharmaceutical Ingredient (HP-API)

- Antibody Drug Conjugate (ADC)

- Others

- Synthesis

- Synthetic

- Solid

- Liquid

- Biotech

- Synthetic

- Drug

- Innovative

- Generics

- Manufacturing

- Continuous manufacturing

- Batch manufacturing

- Type

- Drug Product

- Oral solid dose

- Semi-solid dose

- Liquid dose

- Others

- API

- By Workflow

- Clinical

- Commercial

- By Application

- Oncology

- Small Molecules

- Biologics

- Infectious Diseases

- Neurological Disorders

- Cardiovascular Disease

- Metabolic Disorders

- Autoimmune Diseases

- Respiratory Diseases

- Ophthalmology

- Gastrointestinal Disorders

- Hormonal Disorders

- Hematological Disorders

- Others

- Oncology

Growth Opportunity

Enhancement of Regulatory Compliance Capabilities

The global Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market witnessed significant growth in 2023, driven by an increased emphasis on regulatory compliance capabilities. The pharmaceutical industry faces stringent regulatory requirements, necessitating CDMOs to enhance their compliance frameworks. This enhancement ensures that CDMOs can meet diverse regulatory standards across different regions, facilitating smoother market access for their clients. The improvement in compliance capabilities not only mitigates risks associated with regulatory breaches but also enhances the reputation and reliability of CDMOs, making them more attractive to pharmaceutical companies seeking to outsource manufacturing and development processes. Consequently, CDMOs with robust regulatory frameworks are better positioned to capitalize on market opportunities, thereby driving growth in the sector.Integration of Continuous Manufacturing

The integration of continuous manufacturing techniques has emerged as a pivotal growth driver for the global Pharmaceutical CDMO market in 2023. Continuous manufacturing, characterized by its efficiency and consistency, offers significant advantages over traditional batch manufacturing. It allows for the production of pharmaceuticals in a continuous flow, reducing production times and improving product quality. This integration is particularly beneficial in meeting the growing demand for pharmaceutical products while maintaining cost-effectiveness and flexibility. CDMOs that have adopted continuous manufacturing technologies are gaining a competitive edge, as they can offer enhanced production capabilities to their clients. This trend is expected to further propel the market growth, as more pharmaceutical companies seek CDMOs equipped with advanced manufacturing technologies to streamline their production processes.Latest Trends

Integration of Digital Technologies in CDMO Operations

In 2023, the global Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market experienced notable advancements due to the integration of digital technologies. CDMOs increasingly adopted digital tools such as artificial intelligence (AI), machine learning (ML), and data analytics to enhance their operational efficiency, quality control, and decision-making processes. The implementation of these technologies facilitated real-time monitoring and predictive maintenance, significantly reducing downtime and improving the overall reliability of manufacturing processes. Moreover, digital solutions enabled better data management and regulatory compliance, streamlining the documentation and reporting processes. This trend towards digitalization is expected to drive further innovation and efficiency in CDMO operations, making them more agile and capable of meeting the evolving demands of the pharmaceutical industry. Consequently, CDMOs that have embraced digital technologies are better positioned to offer enhanced value propositions to their clients, thereby gaining a competitive advantage in the market.Expansion of Capacity for Viral Vector Production

The expansion of capacity for viral vector production emerged as a critical trend in the Pharmaceutical CDMO market in 2023. Viral vectors are essential components in the development of gene therapies and vaccines, which have seen increased demand due to the growing focus on advanced therapies and personalized medicine. CDMOs are investing heavily in expanding their viral vector production capabilities to cater to this rising demand. This expansion includes the development of state-of-the-art manufacturing facilities and the adoption of advanced production technologies to enhance scalability and efficiency. The increased capacity for viral vector production not only supports the pharmaceutical industry’s need for innovative therapeutic solutions but also positions CDMOs as key players in the burgeoning field of gene therapy and vaccine development. This trend is likely to continue driving growth and diversification in the CDMO market, aligning with the broader shift towards more complex and specialized pharmaceutical products.Regional Analysis

The Asia-Pacific Pharmaceutical CDMO market holds a significant 37.6% share, indicating robust growth. The Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market exhibits notable regional variations, with Asia-Pacific leading the market at 37.6%. This dominance is driven by the region’s robust manufacturing infrastructure, lower operational costs, and increasing pharmaceutical investments, particularly in countries like China and India. The Asia-Pacific region’s growth is further bolstered by favorable government policies and a skilled workforce, positioning it as a key player in the global CDMO landscape. In North America, the CDMO market is characterized by advanced technological integration and a strong focus on innovation. The region benefits from a high concentration of pharmaceutical companies, well-established regulatory frameworks, and significant R&D investments. The United States, as a major contributor, drives the market with its emphasis on biologics and personalized medicine. North America’s mature market infrastructure supports steady growth, making it a critical region for CDMO services. Europe follows closely, with a substantial market share supported by a strong pharmaceutical industry, stringent regulatory standards, and increasing demand for biopharmaceuticals. Countries such as Germany, the United Kingdom, and Switzerland are pivotal in driving the European CDMO market, focusing on high-quality manufacturing and development capabilities. The region’s emphasis on sustainable and compliant manufacturing practices enhances its competitive edge in the global market. The Middle East & Africa region, while smaller in market share, is witnessing gradual growth due to rising healthcare investments and improving pharmaceutical infrastructure. Countries like the UAE and South Africa are emerging as potential hubs for CDMO activities, driven by increasing demand for pharmaceutical products and regional collaborations. Latin America, led by Brazil and Mexico, shows promising growth in the CDMO market, attributed to the expanding pharmaceutical industry and favorable economic conditions. The region is increasingly focusing on enhancing its manufacturing capabilities and attracting foreign investments to boost its CDMO sector.

Key Regions and Countries

North America- The US

- Canada

- Rest of North America

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

- Mexico

- Brazil

- Rest of Latin America

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market is significantly shaped by key players who have demonstrated robust capabilities and strategic expansions. Bushu Pharmaceuticals Ltd. stands out in the Asia-Pacific region, leveraging its advanced manufacturing facilities and strong regulatory compliance to cater to a growing demand for pharmaceutical outsourcing. Nipro Corporation, known for its diversified healthcare portfolio, has enhanced its CDMO services by integrating cutting-edge technologies and expanding its production capacities. Thermo Fisher Scientific Inc. continues to lead with its comprehensive CDMO services, including biologics and small molecules, supported by significant investments in advanced manufacturing technologies and global infrastructure. Samsung Biologics remains a dominant force in the biologics segment, excelling in large-scale production and innovative biomanufacturing solutions, bolstered by its strategic partnerships and extensive facility expansions. Laboratory Corporation of America Holdings has strengthened its position through a broad range of clinical development and laboratory testing services, integrating advanced analytics to support efficient drug development processes. Siegfried Holding AG is recognized for its expertise in complex formulations and high-potency APIs, driving growth through strategic acquisitions and capacity enhancements. Catalent, Inc. and Lonza Group AG are pivotal in the biologics and gene therapy sectors, with Catalent focusing on expanding its cell and gene therapy capabilities and Lonza investing heavily in state-of-the-art facilities to meet increasing demand. Recipharm AB and Piramal Pharma Solutions continue to expand their global footprint through strategic acquisitions and investments in advanced manufacturing technologies. CordenPharma International and Cambrex Corporation have reinforced their market presence by enhancing their service portfolios in specialty APIs and innovative drug delivery systems. Wuxi AppTec, a key player from China, has rapidly expanded its CDMO services, emphasizing integrated solutions and global reach to cater to a diverse client base.Market Key Players

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Samsung Biologics

- Laboratory Corporation of America Holdings

- Siegfried Holding Ag

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Piramal Pharma Solutions

- Cordenpharma International

- Cambrex Corporation

- Wuxi Apptec

Recent Development

- In April 2024, Indian CDMOs like Aurigene Pharmaceutical Services and Aragen Life Sciences are expanding, aiming to become global players in contract development and manufacturing for pharmaceuticals and biotech drugs.

- In March 2024, Ratio Therapeutics, post a $50 million Series B funding, expands collaboration with PharmaLogic to accelerate development of radiotherapeutics, focusing on FAP-targeted radiotherapy for soft tissue sarcoma.

- In July 2022, EY-Parthenon GmbH., CDMOs are leveraging M&A to invest in technology and capabilities, responding to evolving customer demands and shifting towards innovation leadership in pharmaceutical manufacturing.

Report Scope

Report Features Description Market Value (2023) USD 146.3 Billion Forecast Revenue (2033) USD 298.8 Billion CAGR (2024-2032) 7.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (([[API, [Type(Traditional Active Pharmaceutical Ingredient (Traditional API), Highly Potent Active Pharmaceutical Ingredient (HP-API), Antibody Drug Conjugate (ADC), Others)], [Synthesis, [Synthetic, (Solid, Liquid),Biotech]], [Drug, (Innovative, Generics)], [Manufacturing, (Continuous manufacturing, Batch manufacturing)]], Drug Product(Oncology(Small Molecules, Biologics), Infectious Diseases, Neurological Disorders, Cardiovascular Disease, Metabolic Disorders, Autoimmune Diseases, Respiratory Diseases, Ophthalmology, Gastrointestinal Disorders, Hormonal Disorders, Hematological Disorders, Others))), By Workflow(Clinical, Commercial), By Application(Oncology[Small Molecules, Biologics], Infectious Diseases, Neurological Disorders, Cardiovascular Disease, Metabolic Disorders, Autoimmune Diseases, Respiratory Diseases, Ophthalmology, Gastrointestinal Disorders, Hormonal Disorders, Hematological Disorders, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bushu Pharmaceuticals Ltd., Nipro Corporation, Thermo Fisher Scientific Inc., Samsung Biologics, Laboratory Corporation of America Holdings, Siegfried Holding Ag, Catalent, Inc, Lonza Group AG, Recipharm Ab, Piramal Pharma Solutions, Cordenpharma International, Cambrex Corporation, Wuxi Apptec Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bushu Pharmaceuticals Ltd.

- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Samsung Biologics

- Laboratory Corporation of America Holdings

- Siegfried Holding Ag

- Catalent, Inc

- Lonza Group AG

- Recipharm Ab

- Piramal Pharma Solutions

- Cordenpharma International

- Cambrex Corporation

- Wuxi Apptec