Pet DNA Testing Market By Sample type(Including semen ,Saliva ,Blood and others), By Animal(Primarily dogs ,Cats and others), By End-User(Veterinarians, Breeders, Pet owners)By Test Type(Genetic diseases ,Breed profile ,Health & wellness) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42520

-

Feb 2022

-

165

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

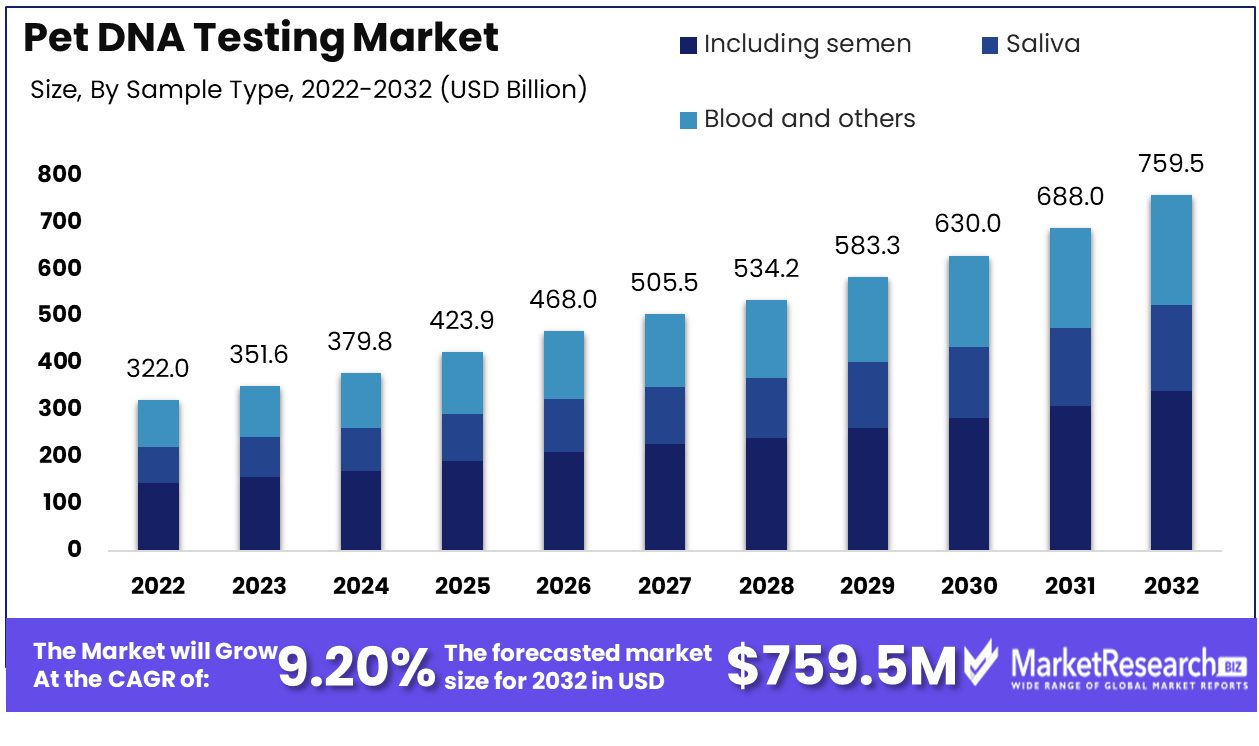

Pet DNA Testing Market size is estimated to reach USD 759.5 Mn by 2032, an increase from its USD 322.02 Mn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 9.20% during 2023-2032.

Pet DNA testing involves analyzing a pet's genetic material to determine ancestry, health predispositions, and other hereditary traits. Veterinarians and specialized labs can collect DNA samples from pets through simple cheek swabs and screen for over 150 genetic diseases.

DNA tests help pet owners understand their pet's expected health outlook and enable breeders to make informed mating selections that avoid propagating undesirable genes. Consumer DNA tests for pets provide owners insights into their pet's likely traits and behaviors based on breed ancestry.

As of 2023, 66% of U.S. households (86.9 million homes) own a pet, with dogs being the most popular pets, followed by cats and freshwater fish. Pet ownership has increased significantly over the past three decades, and pet owners spend an average of $770 per year on their pets.

It's important to know the pet breed because different breeds have different needs, temperaments, and health issues. Understanding a pet's breed can help provide the best care for them, including proper nutrition, exercise, and medical care.

The Pet DNA Testing Market is expected to grow steadily in the coming years due to several key factors. One major driver is the increasing spending on pet healthcare and wellness products by pet owners. As pets are seen more and more as family members, owners are willing to invest more in their health, including DNA tests that can screen for hereditary diseases or provide insights into nutrition and exercise needs based on breed makeup.

Additionally, the Pet DNA Testing Market benefits from advancements in genomics and genetic testing capabilities. Improved accuracy and speed of test results, as well as falling costs of genetic testing over time, will make pet DNA tests more accessible and mainstream. Technological innovations that allow in-home testing with easy-to-use kits are also fueling market growth.

For Instance, on October 6, 2023, Basepaws, a leader in feline DNA testing and genetics, expanded into the canine market with the launch of the most extensive DNA test for dogs. The Basepaws Breed + Health Dog DNA Test aims to accelerate health genetic testing for dogs, allowing pet owners to shift from reactive to proactive care.

Moreover, on September 13, 2023, Ancestry launched Know Your Pet DNA, a dog DNA test that analyzes twice the amount of genetic information compared to other tests. It leverages Thermo Fisher Scientific's DNA microarray technology to identify each dog's unique genetic blueprint.

Other drivers for the Pet DNA Testing Market include increased awareness of pet testing through veterinary recommendations and marketing efforts. As more pet owners realize the potential benefits of pet DNA tests for early health interventions or better care, this emerging market is likely to see increased consumer demand as part of overall growth in expenditure on pet care and services globally. If product offerings continue improving while costs decrease, the outlook for the worldwide Pet DNA Testing Market appears positive.

Driving Factors

Pet Adoption Surge Spurs Demand for DNA Testing

The growing rate of pet adoption is significantly propelling the demand for pet DNA testing. As the number of pet owners increases, there's a heightened interest in understanding pets' genetic makeup and health predispositions. This curiosity stems from a desire to provide the best care for their pets, with DNA testing offering insights into potential genetic health risks, breed characteristics, and behavioral tendencies.

The trend of adopting pets, particularly during times when people seek companionship, like the recent pandemic, has led to a surge in demand for these tests. As pet adoption continues to grow, so too does the interest in their health and genetics, predicting sustained growth in the pet DNA testing market.

Awareness of Pet DNA Testing Kits Drives Market Growth

The rising awareness and sales of pet DNA testing kits are major drivers of market growth. Pet owners are becoming increasingly conscious of the benefits of genetic testing for their pets. These benefits include early detection of hereditary diseases, understanding breed-specific traits, and even identifying appropriate dietary needs.

This awareness is largely driven by the availability of information online and the marketing efforts of DNA testing companies. As pet owners become more informed about the health and well-being of their pets, their willingness to invest in DNA testing increases. This trend indicates a growing market, driven by an informed consumer base seeking to make well-informed decisions about their pet's health.

Increased Pet Expenditure Fuels DNA Testing Market

The increasing expenditure on pets and the large pet population are significant contributors to the growth of the pet DNA testing market. Pet owners today are willing to spend more on their pets' health and well-being, viewing them as integral family members. This shift in perspective has led to increased investment in various pet health products, including DNA testing kits.

As the pet population grows, so does the potential market for these tests. Pet owners' readiness to invest in health-related products for their pets, including genetic testing, suggests a market that is expanding in response to a deeper commitment to pet health and wellness. This trend is expected to continue, further driving the growth of the pet DNA testing market.

Restraining Factors

High Costs Limit Accessibility and Growth of Pet DNA Testing Market

The high costs associated with pet DNA testing can significantly limit market growth by restricting accessibility for many pet owners. These tests, used for various purposes like identifying breed heritage or predisposition to certain health conditions, often require sophisticated technology and expertise, leading to higher prices.

For a considerable number of pet owners, especially in regions with lower disposable income, the cost of DNA testing for pets may not be justifiable or affordable. This financial barrier can result in a narrower market base, as only a segment of pet owners are able or willing to invest in such testing for their pets.

Ethical and Privacy Concerns Impact Adoption of Pet DNA Testing Services

Ethical and privacy concerns surrounding genetic testing for pets also pose potential constraints on the market. There are debates over the ethical implications of using DNA testing to make breeding decisions or for other purposes that could affect the welfare of the pets.

Additionally, concerns about data privacy and how genetic information might be stored, shared, or used are prominent. These issues can lead to hesitancy among pet owners to use DNA testing services, impacting the adoption rate. The market's growth is thus potentially limited by these ethical and privacy considerations, as they influence public perception and acceptance of pet DNA testing.

Pet DNA Testing Market Segmentation Analysis

By Sample Type

Semen samples dominate the Pet DNA Testing Market, primarily due to their extensive use in breeding programs. This segment's prominence is driven by the need to identify and manage genetic diseases and traits in breeding animals, ensuring the health and quality of future generations. Semen testing is particularly crucial in controlled breeding environments, where the goal is to enhance desirable traits while minimizing the risk of inherited disorders.

Saliva and blood samples are also widely used for DNA testing, offering non-invasive collection methods. They are particularly popular among pet owners for ease of use. Other sample types, including hair and tissue, are used depending on the test requirements and animal species.

By Animal

Dog DNA testing is the most prominent segment, reflecting the popularity of dogs as pets and the high interest in understanding their genetic makeup. This testing is used for breed identification, genetic disease screening, and understanding behavioral traits. The growth in this segment is fueled by the increasing awareness among dog owners about the benefits of DNA testing for health and wellness management.

Cat DNA testing is experiencing notable growth, propelled by cat owners' growing curiosity about their pet's breed, ancestry, and potential health issues. Other animals, such as horses and exotic pets, though currently representing a smaller segment, are witnessing a gradual increase in market interest for DNA testing, reflecting a broader trend of pet owners seeking deeper insights into the genetic makeup and health of a diverse range of animal companions.

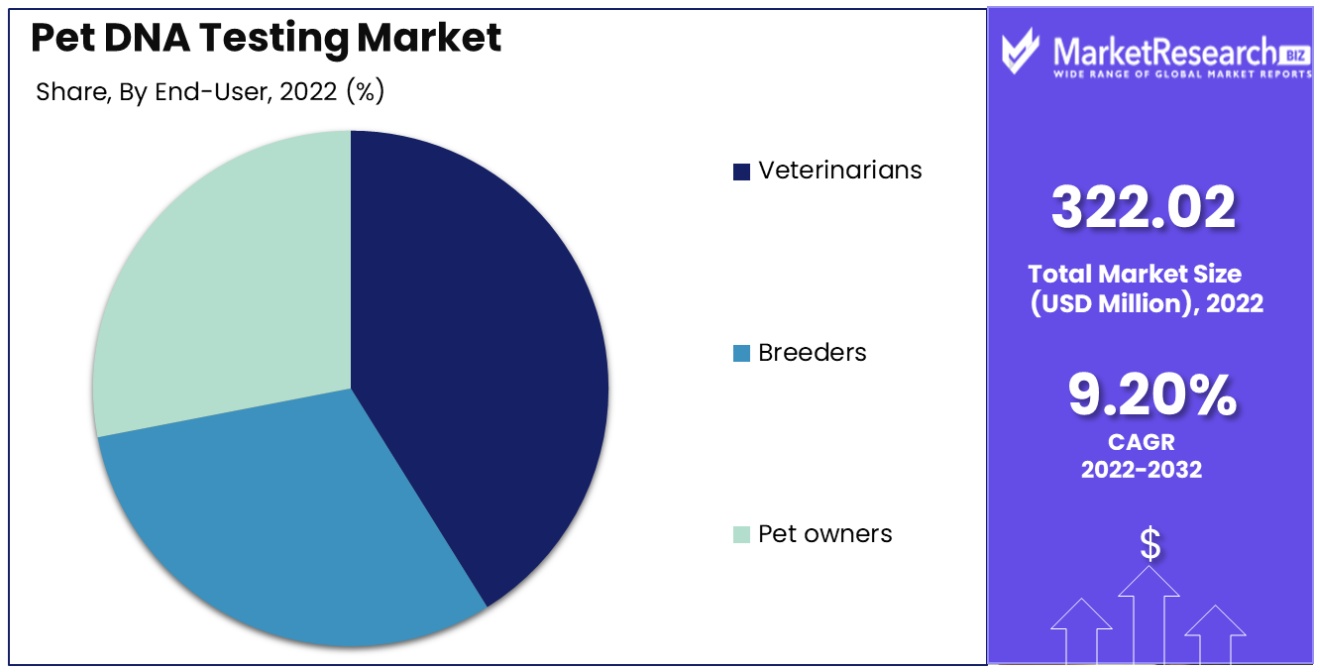

By End-User

Breeders are the primary end-users in the pet DNA testing market, employing these tests for critical breeding decisions, promoting genetic diversity, and mitigating inheritable diseases. This segment's growth is bolstered by an increasing market for pedigree and purebred pets, as breeders seek to meet this demand with genetically sound animals. Additionally, breeders use these tests to adhere to breed standards and enhance the overall quality of their breeding programs.

Veterinarians integrate DNA tests into comprehensive health assessments, providing valuable insights into a pet's genetic predispositions. Pet owners' growing interest in understanding their pets’ breed composition and potential health risks has expanded the market's reach beyond traditional users, reflecting a broader trend of pet humanization and proactive pet care.

By Test Type

Breed profiling dominates the Pet DNA Testing Market, attracting pet owners interested in uncovering their pet's lineage and breed-specific traits. This knowledge is not only fascinating for pet owners but also crucial for understanding potential breed-specific health issues and behaviors, aiding in more tailored and effective pet care. The appeal of breed profiling extends to adopters of mixed-breed pets, who are often keen to discover the unique blend of breeds in their pets.

Genetic disease testing is fundamental in preemptively identifying hereditary health conditions, enabling early intervention strategies. Health and wellness tests extend beyond disease detection, offering insights into optimal dietary, exercise, and lifestyle choices for pets, thus contributing to a holistic approach to pet health management. This category of testing resonates with pet owners who are increasingly invested in maintaining the long-term health and quality of life of their pets.

Pet DNA Testing Market Key Segments

By Sample type

- Including semen

- Saliva

- Blood and others

By Animal- Primarily dogs

- Cats and others

By End-User

- Veterinarians

- Breeders

- Pet owners

By Test Type

- Genetic diseases

- Breed profile

- Health & wellness

Pet DNA Testing Market Growth Opportunities

Consumer Genomics Popularity Boosts Growth in Pet DNA Testing Market

The increasing popularity of consumer genomics significantly contributes to the growth of the pet DNA testing market. As individuals become more interested in understanding their genetic makeup, this curiosity extends to their pets. Pet owners are increasingly seeking DNA tests to uncover their pets' genetic composition, including breed identification, health predispositions, and behavioral traits.

The rising trend of treating pets as family members fuels this interest, leading to a growing demand for pet DNA testing services. This surge reflects a broad market expansion opportunity, as consumer interest in pet genetics continues to rise.

R&D Activities Propel Advanced Technologies in the Pet DNA Testing Market

The pet DNA testing market is experiencing substantial growth, driven by increasing research and development (R&D) activities by key companies and academic researchers. These efforts are leading to the development of advanced testing technologies and services. Innovations in genetic testing technology, including more comprehensive and accurate tests, are enhancing the appeal of pet DNA testing.

The investment in R&D is not only improving the quality of existing services but also enabling the introduction of new testing capabilities. This trend signifies a dynamic market growth, propelled by technological advancements and the continuous evolution of genetic testing methodologies in the veterinary field.

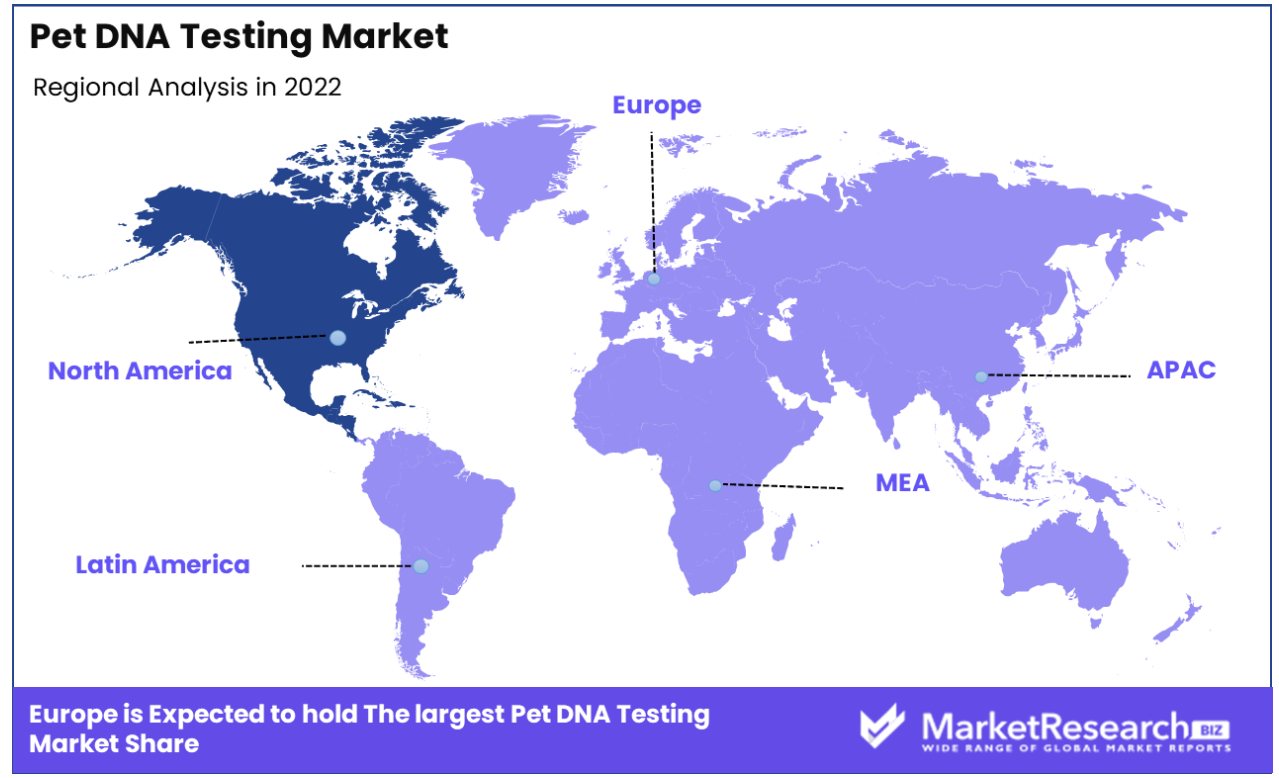

Pet DNA Testing Market Regional Analysis

North America Dominates with a 42.10% Market Share

North America's substantial 42.10% share in the global Pet DNA Testing Market is primarily driven by the region's strong culture of pet ownership and the increasing emphasis on pet health and wellness. The United States and Canada, with their high rates of pet ownership, see a significant demand for pet DNA testing services. These services are sought for various reasons, including breed identification, genetic health risk assessment, and the curiosity of pet owners. Additionally, the presence of major companies specializing in genetic testing contributes to the region's market dominance.

The market dynamics in North America are influenced by the growing awareness among pet owners about the benefits of DNA testing for proactive health management of pets. The increasing availability of direct-to-consumer genetic testing kits and the rising trend of adopting rescue animals also drive the market. Furthermore, advancements in genetic testing technology and the integration of AI and machine learning for more accurate and comprehensive results enhance the appeal of pet DNA testing.

Europe's Growing Interest in Pet Genetics and Health

Europe’s pet DNA testing market is expanding, driven by growing interest in pet genetics and health. European pet owners are increasingly recognizing the value of DNA testing for understanding their pets' heritage and potential health risks. The region's stringent animal welfare regulations and the focus on responsible pet ownership contribute to the market's growth.

Asia-Pacific Is An Emerging Market with Increasing Pet Ownership

In Asia-Pacific, the pet DNA testing market is emerging, fueled by increasing pet ownership and a growing interest in pet care. Countries like China and Japan are witnessing a surge in pet-related expenditures, including health and wellness products. The region's expanding middle class and the humanization of pets trend are significant factors contributing to the market's potential growth in Asia-Pacific.

Pet DNA Testing Market By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Pet DNA Testing Market Key Player Analysis

In the Pet DNA Testing Market, key players exhibit diverse strategic positioning and varying degrees of market influence. Embark Veterinary and Wisdom Panel (Mars, Inc.) are notable for their comprehensive testing options, leveraging advanced genetic analysis technologies. DNA My Dog (Canadian Dog Group Ltd.) and Orivet Genetic Pet Care Ltd. offer unique, breed-specific insights, appealing to pet owners seeking detailed heritage information. MGI and Bioinformatics contribute through their focus on innovation in DNA sequencing and analysis tools.

Basepaws, Inc. (Zoetis) and Neogen Corp. stand out for integrating pet health insights with DNA testing, aligning their services with broader pet healthcare trends. GenSol Diagnostics, LLC, specializes in affordable, breed-specific genetic testing, catering to a niche market segment.

Emerging players like FidoCure (OHC), PetDx, and Dognomics (Clinomics) are expanding the market's scope, introducing novel DNA-based solutions for pet health management and disease prediction. This diversification of services and specialization among key players is driving competition, fostering innovation, and significantly influencing market dynamics in the Pet DNA Testing sector.

Major Market Players in Pet DNA Testing Market

Embark Veterinary

Wisdom Panel (Mars, Inc.)

DNA My Dog (Canadian Dog Group Ltd.)

Orivet Genetic Pet Care Ltd.

MGI

Bioinformatics

Basepaws, Inc. (Zoetis)

Neogen Corp.

GenSol Diagnostics, LLC

FidoCure (OHC)

PetDx

Dognomics (Clinomics)Recent Developments

- In January 2023, DNA My Dog, a leading consumer-based dog DNA testing service provider, announced the company’s latest canine breed-analysis service using the Premium Breed ID test and Essential Breed ID test. Both of these methods will use a database of more than 350 breeds

- In December 2022, Prenetics Global Limited, a leading biotechnology firm, announced the launch of CirclePaw which is an advanced canine DNA test that will cover more than 200 sets of information on various behavioral and genetic aspects of dogs

Report Scope

Report Features Description Market Value (2022) USD 322.02 Million Forecast Revenue (2032) USD 759.5 Million CAGR (2023-2032) 9.20% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sample type(Including semen ,Saliva ,Blood and others), By Animal(Primarily dogs ,Cats and others), By End-User(Veterinarians, Breeders, Pet owners)By Test Type(Genetic diseases ,Breed profile ,Health & wellness) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Embark Veterinary, Wisdom Panel (Mars, Inc.), DNA My Dog (Canadian Dog Group Ltd.), Orivet Genetic Pet Care Ltd., MGI, Bioinformatics, Basepaws, Inc. (Zoetis), Neogen Corp., GenSol Diagnostics, LLC, FidoCure (OHC), PetDx, Dognomics (Clinomics) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Including semen

-

-

Embark Veterinary Wisdom Panel (Mars, Inc.) DNA My Dog (Canadian Dog Group Ltd.) Orivet Genetic Pet Care Ltd. MGI Bioinformatics Basepaws, Inc. (Zoetis) Neogen Corp. GenSol Diagnostics, LLC FidoCure (OHC) PetDx Dognomics (Clinomics)