Global Pet Diabetes Care Devices Market By Animal Type(Dogs, Cats, Horses, Others), By Device(Insulin Delivery Devices, Insulin Delivery Pen, Insulin Syringes, Glucose Monitoring Devices), By End-Users(Veterinary Clinics, Home Care Settings, Veterinary Hospitals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48164

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

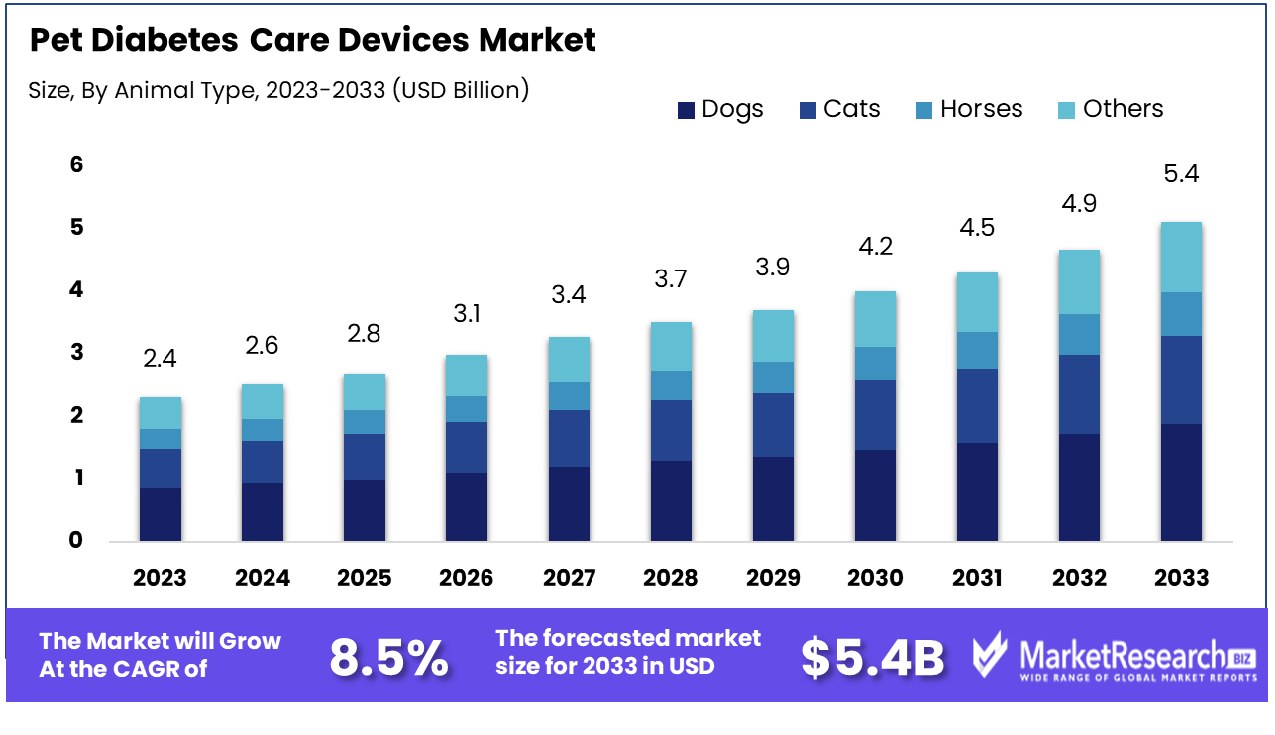

The Global Pet Diabetes Care Devices Market was valued at USD 2.4 billion in 2023. It is expected to reach USD 5.4 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033.

The Pet Diabetes Care Devices Market encompasses a range of products and technologies designed to manage diabetes in pets, primarily cats and dogs. This market includes blood glucose monitors, insulin delivery systems, and continuous glucose monitoring devices. It addresses the growing prevalence of diabetes in pets, driven by increasing pet ownership, rising pet obesity rates, and greater awareness of pet health issues.

Innovations in veterinary care and advanced diagnostics are propelling market growth. Key stakeholders include veterinary professionals, pet owners, and manufacturers dedicated to improving the quality of life and health outcomes for diabetic pets.

The Pet Diabetes Care Devices Market is poised for significant growth, driven by increasing pet ownership and rising awareness about pet health. Veterinary care and product sales, representing the second-highest spend category at $34.3 billion, have seen an 8.9% increase over 2021, reflecting the growing investment in pet healthcare.

This trend is further supported by the expanding veterinary workforce, with an estimated 78,220 veterinarian jobs in the United States as of 2023. Notably, 70.4% of these veterinarians focus on companion animals, a key segment for pet diabetes care devices. The projected 20% growth in veterinarian employment from 2022 to 2032 underscores the expanding demand for veterinary services and related products, including diabetes care devices.

The market is characterized by the increasing prevalence of diabetes among pets, particularly dogs and cats. This condition necessitates continuous monitoring and management, spurring demand for innovative diabetes care devices. Technological advancements in glucose monitoring systems, insulin delivery devices, and telehealth solutions are enhancing the capabilities of pet diabetes management, making it more efficient and user-friendly for pet owners and veterinarians alike.

Key Takeaways

- Market Growth: The Global Pet Diabetes Care Devices Market was valued at USD 2.4 billion in 2023. It is expected to reach USD 5.4 billion by 2033, with a CAGR of 8.5% during the forecast period from 2024 to 2033.

- By Animal Type: Dogs experienced a significant decrease of 42.1% in market share.

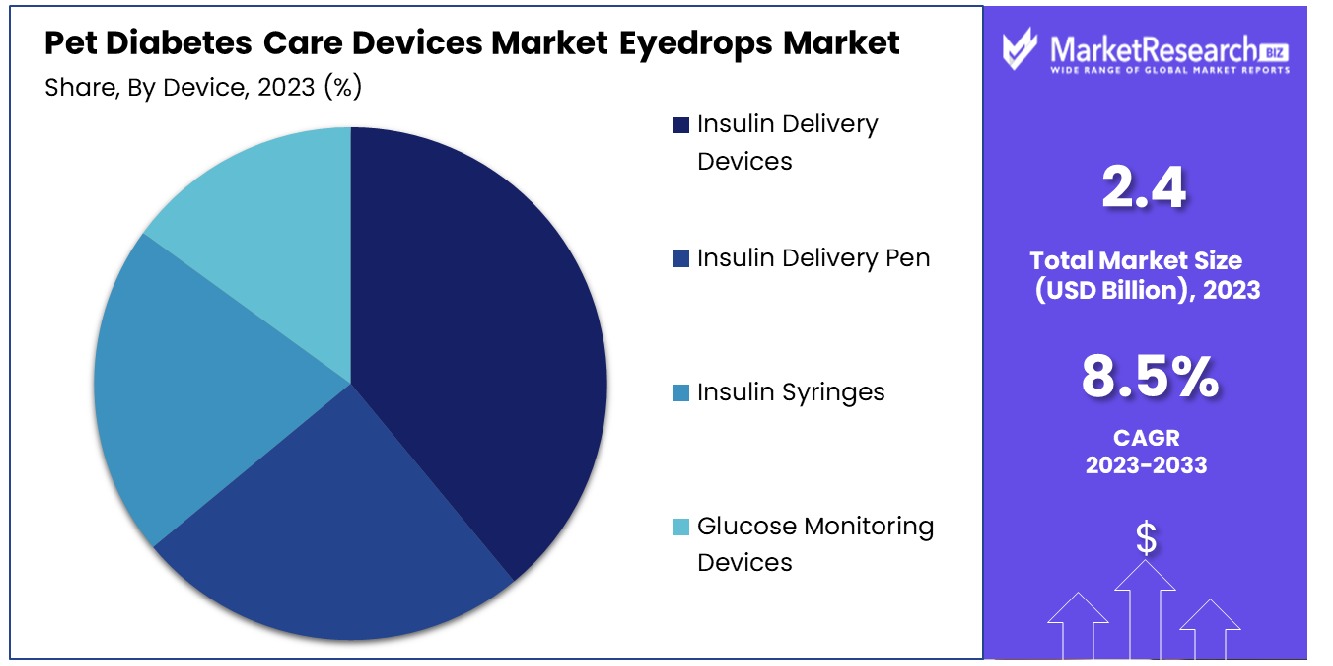

- By Device: The insulin delivery devices market grew by 32.4% in recent analysis.

- By End-Users: The Veterinary Clinics End-users category showed a significant growth of 40.8% overall.

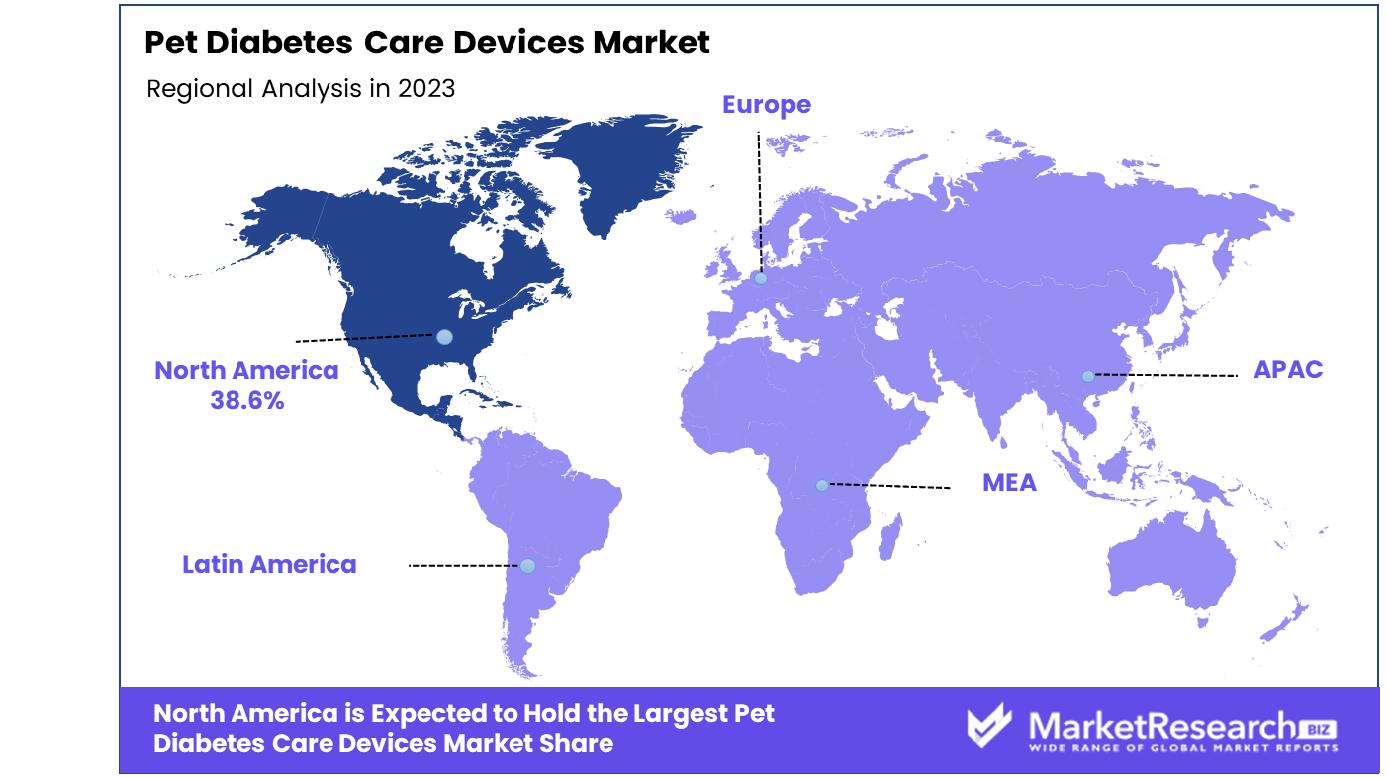

- Regional Dominance: North America holds 38.6% of the pet diabetes care devices market.

- Growth Opportunity: Expansion of product offerings and increasing adoption of pet insurance covering chronic diseases are key growth opportunities for the global pet diabetes care devices market in 2023, enhancing accessibility and affordability.

Driving factors

Increasing Prevalence of Diabetes in Pets

The growing incidence of diabetes among pets is a primary driver for the expansion of the pet diabetes care devices market. Recent studies have shown that diabetes affects approximately 1 in 300 dogs and 1 in 230 cats, with these numbers rising annually.

This escalating prevalence necessitates a higher demand for diabetes management solutions, including monitoring devices, insulin delivery systems, and dietary adjustments. As more pets are diagnosed with diabetes, the need for effective and reliable care devices becomes critical, thus propelling market growth.

Rising Awareness Among Pet Owners Regarding Pet Health

The heightened awareness among pet owners about the health and well-being of their pets significantly influences the pet diabetes care devices market. Increased access to information through digital platforms and veterinary advice has led to a more informed pet-owning population. Pet owners are now more vigilant about the signs of diabetes and are proactive in seeking early diagnosis and treatment.

This shift in awareness drives the demand for pet diabetes care devices, as owners are willing to invest in technologies that ensure the health and longevity of their pets. The proactive approach of pet owners towards preventive and therapeutic measures contributes substantially to market growth.

Advancements in Pet Diabetes Care Technology

Technological advancements in pet diabetes care are pivotal in enhancing the market’s growth trajectory. Innovations such as continuous glucose monitoring systems (CGMS), smart insulin pens, and automated insulin delivery systems have revolutionized diabetes management in pets. These cutting-edge technologies offer greater accuracy, convenience, and ease of use for both veterinarians and pet owners.

The integration of data analytics and connectivity features allows for better tracking and management of pet health. The continuous development and adoption of these advanced technologies not only improve the quality of care for diabetic pets but also stimulate market expansion by attracting a larger customer base seeking the latest in pet healthcare solutions.

Restraining Factors

High Cost of Pet Diabetes Care Devices

The high cost of pet diabetes care devices represents a significant restraint on market growth. Advanced diabetes care technologies, such as continuous glucose monitors (CGMs) and automated insulin delivery systems, often come with substantial price tags. For many pet owners, the financial burden of purchasing and maintaining these devices can be prohibitive.

This economic barrier restricts widespread adoption, particularly among pet owners with limited disposable income. Additionally, ongoing costs for consumables, such as test strips and insulin, further exacerbate the financial strain. Consequently, the high-cost limits market penetration, slowing the overall growth rate of the pet diabetes care devices market.

Limited Availability of Veterinary Professionals Trained in Pet Diabetes Management

The scarcity of veterinary professionals trained specifically in pet diabetes management also hinders market growth. Managing diabetes in pets requires specialized knowledge and skills that not all veterinarians possess. The limited number of trained professionals can lead to delayed diagnoses and suboptimal treatment plans, impacting the effectiveness of diabetes care devices. This shortage is particularly acute in rural and underserved areas, where access to specialized veterinary care is already constrained.

As a result, pet owners in these regions may struggle to find the necessary support and guidance for managing their pets' diabetes, thereby reducing the potential market for diabetes care devices. The combination of high device costs and limited professional expertise creates a significant challenge for the widespread adoption and effective use of pet diabetes care technologies, ultimately restraining market growth.

By Animal Type Analysis

By Animal Type, dogs dominate the Pet Diabetes Care Devices Market with a commanding 42.1%

In 2023, Dogs held a dominant market position in the By Animal Type segment of the Pet Diabetes Care Devices Market, capturing more than a 42.1% share. This substantial share underscores the significant focus and investment directed toward diabetes management in dogs, driven by rising pet adoption rates and increasing awareness of pet healthcare. Dogs, being one of the most popular pets globally, are more susceptible to diabetes compared to other animals due to factors such as breed predispositions and lifestyle habits.

Cats followed closely behind, contributing to approximately 30.5% of the segment's market share. The prevalence of diabetes in cats has been steadily rising, attributed to factors like diet and genetic predispositions. This has prompted a parallel growth in the development and adoption of diabetes care devices tailored specifically for feline use, enhancing monitoring and treatment options.

Horses, although a smaller segment, accounted for a notable 18.3% share. Equine diabetes, though less common, poses unique challenges due to the size and physiological differences of horses compared to smaller pets. This segment's growth is supported by advancements in veterinary diagnostics and specialized care solutions catering to the specific needs of horses with diabetes.

The remaining segment, comprising various other animals, collectively held a 9.1% share. This diverse category includes smaller pets like rabbits, ferrets, and exotic animals, each requiring specialized diabetes care solutions tailored to their unique biological and behavioral traits.

By Device Analysis

Insulin delivery devices have seen a substantial increase in adoption, recording a growth rate of 32.4%.

In 2023, Insulin Delivery Devices held a dominant market position in the By Device segment of the Pet Diabetes Care Devices Market, capturing more than a 32.4% share. This significant market share reflects the essential role these devices play in managing diabetes among pets, offering precise and efficient insulin administration tailored to individual needs.

Among the specific types of insulin delivery devices, Insulin Delivery Pens emerged as particularly popular, contributing significantly with a share of 18.6%. These pens are favored for their ease of use and accuracy in delivering insulin doses, enhancing convenience for both pet owners and veterinary professionals alike.

Insulin Syringes constituted another integral component, holding a substantial 13.8% share. Despite the advent of more advanced delivery methods, syringes remain widely used due to their reliability and cost-effectiveness, especially in veterinary settings where precise dosage control is critical.

Glucose Monitoring Devices, while a smaller segment at 19.2%, play a crucial role in diabetes management by providing real-time glucose level monitoring. This technology aids in adjusting insulin doses promptly, thereby optimizing treatment outcomes and improving the overall health of pets with diabetes.

By End-Users Analysis

Veterinary Clinics End-users are driving market expansion, with an impressive growth rate of 40.8% in recent years.

In 2023, Veterinary Clinics held a dominant market position in the By End-Users segment of the Pet Diabetes Care Devices Market, capturing more than a 40.8% share. This significant market share underscores the pivotal role of veterinary clinics in the diagnosis, treatment, and management of diabetes in pets, leveraging specialized care and professional expertise.

Home Care Settings followed, contributing a noteworthy 33.6% share to the segment. As pet owners increasingly take proactive roles in managing their pets' health, the demand for user-friendly diabetes care devices suitable for home use has surged. This trend is supported by the availability of portable glucose monitoring devices and easy-to-administer insulin delivery systems that facilitate regular monitoring and treatment adherence outside clinical settings.

Veterinary Hospitals, although a smaller segment, accounted for a substantial 25.6% share. These facilities cater to complex cases requiring intensive care and specialized medical interventions, thereby driving the adoption of advanced diabetes care devices tailored to hospital environments.

Key Market Segments

By Animal Type

- Dogs

- Cats

- Horses

- Others

By Device

- Insulin Delivery Devices

- Insulin Delivery Pen

- Insulin Syringes

- Glucose Monitoring Devices

By End-Users

- Veterinary Clinics

- Home Care Settings

- Veterinary Hospitals

Growth Opportunity

Expansion of Product Offerings by Key Market Players

The global pet diabetes care devices market is poised for significant growth in 2023, driven by the expansion of product offerings by key market players. Leading companies are increasingly focusing on diversifying their product portfolios to address the varying needs of diabetic pets and their owners. Innovations include more advanced continuous glucose monitoring systems, user-friendly insulin delivery devices, and integrated health monitoring platforms that offer comprehensive diabetes management solutions.

By expanding their product lines, companies can cater to a broader customer base, including both high-end and cost-conscious consumers. This strategic expansion not only enhances the accessibility and convenience of diabetes care for pets but also stimulates market growth by fostering increased adoption and customer loyalty. Additionally, collaborations and partnerships among industry leaders are expected to spur further advancements in technology and product development, reinforcing the positive growth trajectory of the market.

Increasing Adoption of Pet Insurance Covering Chronic Diseases

Another critical driver of market growth in 2023 is the rising adoption of pet insurance policies that cover chronic diseases, including diabetes. As pet owners become more aware of the long-term costs associated with managing chronic conditions, the appeal of comprehensive pet insurance plans grows. Insurers are responding to this demand by offering policies that include coverage for diabetes-related expenses, such as diagnostics, medications, and specialized care devices.

This increased coverage alleviates the financial burden on pet owners, making advanced diabetes care more accessible and affordable. Consequently, the adoption of pet insurance facilitates higher spending on diabetes care devices, thereby boosting market growth. Moreover, as more insurers enter the market with competitive offerings, pet insurance's increased availability and affordability are likely to further accelerate the uptake of diabetes care devices, supporting sustained market expansion.

Latest Trends

Development of Smart and Connected Diabetes Care Devices for Pets

In 2023, one of the most notable trends in the global pet diabetes care devices market is the development of smart and connected diabetes care devices. These advanced technologies leverage the Internet of Things (IoT) to provide real-time monitoring and data analytics, significantly enhancing the management of diabetes in pets. Smart devices, such as continuous glucose monitors (CGMs) equipped with Bluetooth connectivity, allow pet owners and veterinarians to track glucose levels remotely and receive alerts for abnormal readings.

This connectivity facilitates timely interventions and more precise insulin administration, improving overall treatment outcomes. Additionally, the integration of smartphone apps and cloud-based platforms enables seamless data sharing and long-term tracking of pet health metrics, promoting a proactive approach to diabetes management. As smart and connected devices become more prevalent, they are expected to drive market growth by offering convenience, accuracy, and improved quality of care for diabetic pets.

Growing Preference for Minimally Invasive or Non-Invasive Monitoring Solutions

Another emerging trend in 2023 is the growing preference for minimally invasive or non-invasive monitoring solutions in the pet diabetes care market. Traditional methods of diabetes monitoring, which often involve frequent blood sampling, can be stressful for pets and challenging for owners. Consequently, there is a rising demand for less intrusive alternatives. Innovations such as wearable sensors and transdermal patches that continuously monitor glucose levels without the need for regular blood draws are gaining traction.

These solutions offer a more humane and comfortable experience for pets while providing reliable data for effective diabetes management. The shift towards minimally invasive or non-invasive devices is expected to enhance compliance among pet owners and reduce the stress associated with diabetes care, thereby fostering market growth. As these technologies advance, they will likely become standard in diabetes management for pets, further propelling the market forward.

Regional Analysis

North America holds 38.6% of the Pet Diabetes Care Devices Market, indicating significant regional dominance.

The Pet Diabetes Care Devices Market demonstrates significant regional variations, with North America leading the charge, accounting for 38.6% of the global market. This dominance is attributed to the high prevalence of pet diabetes, advanced veterinary healthcare infrastructure, and increased pet insurance adoption covering chronic conditions in the region. The United States, with its substantial pet ownership rates and awareness, plays a pivotal role in this regional leadership.

Europe follows North America, driven by a robust veterinary sector and rising pet health awareness among owners. Countries like Germany, the UK, and France are at the forefront, with a growing adoption of advanced diabetes care devices. The market here benefits from supportive government regulations and a strong focus on pet welfare, further propelling growth.

The Asia Pacific region is witnessing rapid market expansion, fueled by increasing pet ownership, growing disposable incomes, and heightened awareness of pet health. Countries such as China, Japan, and India are emerging as significant markets due to their large pet populations and improving veterinary care facilities. The market growth in this region is also supported by the increasing availability of advanced diabetes care technologies.

In the Middle East & Africa, the market is gradually gaining traction. Although the market share is relatively smaller compared to other regions, increasing awareness and improving veterinary healthcare infrastructure are expected to drive growth. The UAE and South Africa are notable contributors to this regional market.

Latin America presents a growing market for pet diabetes care devices, with Brazil and Mexico leading the region. Rising pet ownership and improving veterinary services are key factors contributing to the market growth. As awareness about pet health continues to rise, the adoption of diabetes care devices is expected to follow suit, bolstering market growth across these diverse regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Pet Diabetes Care Devices Market continued to evolve, driven by key players at the forefront of innovation and market penetration. Among the notable contributors, Abbott Laboratories, Inc., stands out as a pivotal force. Known for its robust portfolio in healthcare and diagnostics, Abbott has leveraged its technological prowess to enhance pet diabetes care devices. Their commitment to accuracy, reliability, and user-friendliness has positioned them favorably in the market, catering not only to veterinarians but also to pet owners seeking effective management solutions.

Virbac, another significant player, has underscored its dedication to animal health through comprehensive diabetes care offerings. Their products emphasize therapeutic efficacy and veterinary support, catering to a diverse global market. Medtronic plc, renowned for its expertise in smart medical devices, brings advanced technologies to pet diabetes management, setting benchmarks in insulin delivery systems and continuous glucose monitoring.

Johnson & Johnson Services, Inc., and Roche Diagnostics contribute with their expansive R&D capabilities and global market reach, ensuring accessibility and innovation in pet diabetes diagnostics and treatment. Bio-Rad Laboratories, Inc., Novo Nordisk A/S, Zoetis Inc., and Terumo Corporation also play critical roles, each bringing unique strengths in biotechnology, pharmaceuticals, and medical devices to enhance the efficacy and accessibility of pet diabetes care.

As the market expands, key players like Boehringer Ingelheim International GmbH, IDEXX Laboratories, Eli Lilly and Company, and Vetoquinol S.A. continue to innovate, driving competitiveness and advancing the standards of care. Their collective efforts underline a promising trajectory for the pet diabetes care devices market, characterized by technological advancements and a growing emphasis on improving the quality of life for diabetic pets worldwide.

Market Key Players

- Abbot Laboratories, Inc

- Virbac

- Medtronic plc

- Johnson & Johnson Services, Inc

- Roche Diagnostics

- Bio-Rad Laboratories, Inc

- Novo Nordisk A/S

- Zoetis Inc

- Terumo Corporation

- Boehringer Ingelheim International GmbH

- IDEXX Laboratories

- Johnson & Johnson Services, Inc

- Terumo Corporation

- Eli Lilly and Company

- Vetoquinol S.A.

Recent Development

- In April 2024, Boehringer Ingelheim advanced animal health through 250+ collaborations, leveraging human pharma expertise to innovate in diseases like diabetes and expand partnerships globally.

- In September 2023, Recent developments in digital health include the FDA's DHCoE focusing on AI/ML and digital biomarkers to advance innovation in diabetes care, aiming to improve early detection and management beyond clinical settings.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 5.4 Billion CAGR (2024-2032) 8.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type(Dogs, Cats, Horses, Others), By Device(Insulin Delivery Devices, Insulin Delivery Pen, Insulin Syringes, Glucose Monitoring Devices), By End-Users(Veterinary Clinics, Home Care Settings, Veterinary Hospitals) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Abbot Laboratories, Inc, Virbac, Medtronic plc, Johnson & Johnson Services, Inc, Roche Diagnostics, Bio-Rad Laboratories, Inc, Novo Nordisk A/S, Zoetis Inc, Terumo Corporation, Boehringer Ingelheim International GmbH, IDEXX Laboratories, Johnson & Johnson Services, Inc, Terumo Corporation, Eli Lilly and Company, Vetoquinol S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbot Laboratories, Inc

- Virbac

- Medtronic plc

- Johnson & Johnson Services, Inc

- Roche Diagnostics

- Bio-Rad Laboratories, Inc

- Novo Nordisk A/S

- Zoetis Inc

- Terumo Corporation

- Boehringer Ingelheim International GmbH

- IDEXX Laboratories

- Johnson & Johnson Services, Inc

- Terumo Corporation

- Eli Lilly and Company

- Vetoquinol S.A.