Peptides And Heparin Market By Type (Insulin, Teriparatide, Liraglutide, Leuprolide, Exenatide, Calcitonin, Others), By Application (Diabetes, Infectious Diseases, Cancer, Osteoporosis), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47297

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

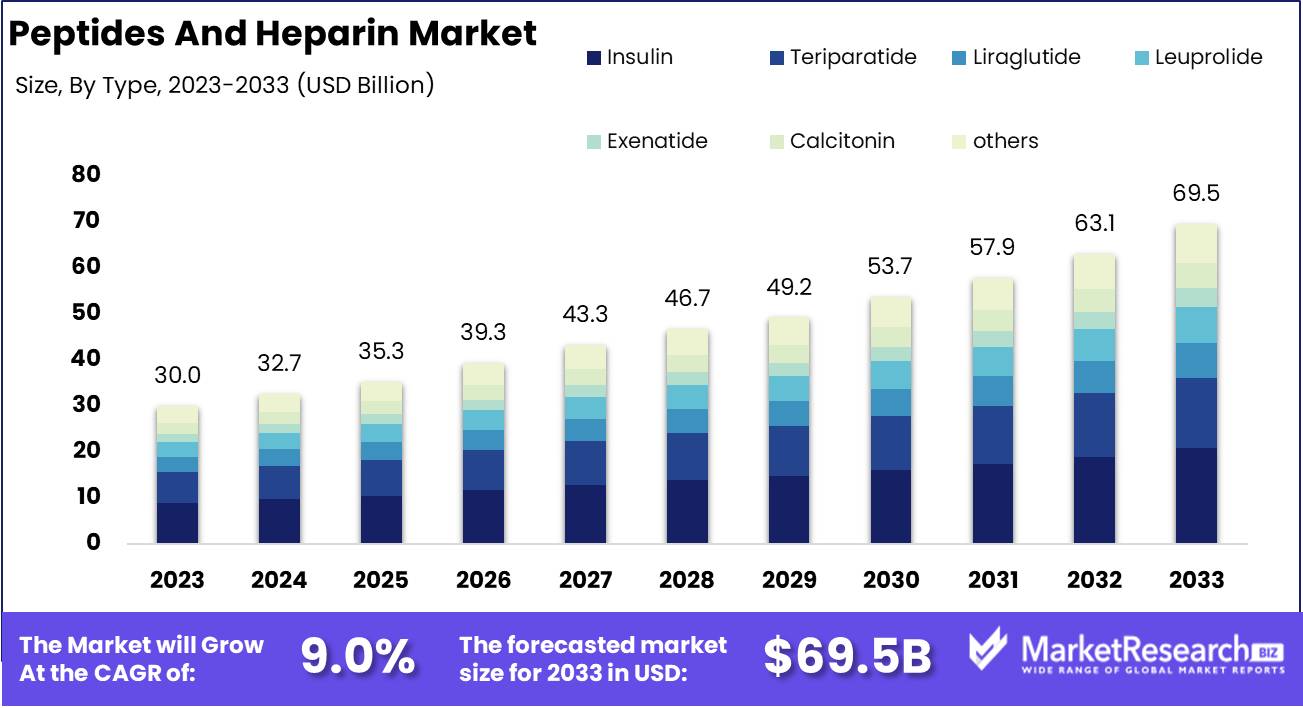

The Peptides And Heparin Market was valued at USD 30.0 Billion in 2023. It is expected to reach USD 69.5 Billion by 2033, with a CAGR of 9.0% during the forecast period from 2024 to 2033.

The Peptides and Heparin Market encompasses developing, producing, and commercializing peptides and heparin-based products for pharmaceutical and therapeutic applications. Peptides, short chains of amino acids, are pivotal in drug development due to their specificity and effectiveness in targeting various medical conditions, including cancer, diabetes, and infectious diseases. Heparin, an anticoagulant, is crucial in preventing and treating blood clots. The market is driven by advancements in biotechnology, the increasing prevalence of chronic diseases, and the growing demand for targeted therapies.

The Peptides and Heparin market is experiencing robust growth, propelled by significant advancements in therapeutic applications and research initiatives. In the peptides sector, demand is primarily driven by their therapeutic utility in critical areas such as oncology, metabolic disorders, and cardiovascular diseases. The versatility of peptides in targeting specific molecular pathways makes them invaluable in these high-need medical fields.

Concurrently, the peptides market is benefiting from vigorous research and development activities to enhance drug formulations and delivery systems. These efforts are crucial in improving therapeutic efficacy and patient compliance, addressing one of the longstanding challenges in peptide-based therapies.

Similarly, the heparin market is underpinned by intensive research focused on mitigating side effects and enhancing anticoagulant profiles. This is particularly significant given the widespread use of heparin in preventing and treating thromboembolic disorders. Innovations in heparin formulations are poised to reduce adverse effects, thus broadening their clinical applications and improving patient outcomes. The convergence of advanced research in both peptides and heparin highlights a dynamic landscape characterized by innovation and a strong pipeline of next-generation therapeutics. This environment not only promises enhanced treatment modalities but also positions the Peptides and Heparin market as a critical segment within the broader pharmaceutical industry, poised for sustained growth and development.

Key Takeaways

- Market Growth: The Peptides And Heparin Market was valued at USD 30.0 Billion in 2023. It is expected to reach USD 69.5 Billion by 2033, with a CAGR of 9.0% during the forecast period from 2024 to 2033.

- By Type: Insulin dominated due to high global diabetes prevalence.

- By Application: Diabetes dominated the Peptides and Heparin market by application.

- Regional Dominance: North America leads the peptides and heparin market with a 35% share.

- Growth Opportunity: The peptides and heparin market is set to grow due to rising disease prevalence and improved delivery methods.

Driving factors

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases, such as diabetes, cancer, and cardiovascular conditions, is a primary factor fueling the growth of the peptides and heparin market. Chronic diseases often require long-term and specialized treatment protocols, creating a significant demand for innovative therapeutic solutions. Peptides, known for their high specificity and potency, are increasingly used in targeted therapies for these conditions, offering improved efficacy and reduced side effects compared to traditional treatments.

Advancements in Peptide Synthesis Technology: Catalyzing Market Innovation

Technological advancements in peptide synthesis have significantly impacted the peptides and heparin market, fostering innovation and enhancing production efficiency. Innovations such as solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS) have revolutionized the field by enabling the production of complex peptide structures with high purity and yield. These technologies have reduced production costs and time, making peptide-based drugs more accessible and economically viable. For example, automated peptide synthesizers can produce peptides with high accuracy and repeatability, facilitating the large-scale manufacturing required to meet increasing demand.

Additionally, advancements in peptide purification techniques, such as high-performance liquid chromatography (HPLC), have further improved the quality of peptide therapeutics. These technological strides not only enhance the scalability of peptide production but also enable the development of novel peptide drugs, thus expanding the therapeutic applications and market potential of peptides and heparin.

Mounting Challenges with Small Molecules: Shifting Focus to Peptide Therapeutics

The pharmaceutical industry faces increasing challenges with small-molecule drugs, including issues related to drug resistance, limited specificity, and adverse side effects. These limitations have led to a paradigm shift towards peptide-based therapeutics, which offer several advantages over small molecules. Peptides can mimic natural biological processes more closely, providing higher specificity and efficacy with fewer off-target effects. This transition is evident in the growing pipeline of peptide drugs, with over 60 peptide therapeutics currently approved and many more in various stages of clinical development. The preference for peptide drugs is driven by their ability to address complex diseases that small molecules struggle to treat effectively. For example, peptide-based treatments for cancer and metabolic disorders are gaining traction due to their targeted action and improved safety profiles.

Restraining Factors

Availability of Alternative Drugs: Limiting Market Expansion for Peptides and Heparin

The presence of alternative drugs significantly restrains the growth of the peptides and heparin market. These alternatives often come with benefits such as lower costs, easier administration, or reduced side effects, which can make them more attractive to both healthcare providers and patients. For instance, newer oral anticoagulants (NOACs) have gained traction over traditional heparin due to their ease of use and reduced monitoring requirements. Similarly, alternative therapeutic peptides are being developed with improved stability and bioavailability, challenging existing peptide therapies.

According to market data, the adoption rate of these alternative treatments is increasing steadily, with some studies indicating that NOACs could capture a substantial portion of the anticoagulant market, potentially reducing the demand for heparin. This shift is driven by extensive clinical trials demonstrating the efficacy and safety of these alternatives, supported by strong marketing campaigns from pharmaceutical companies.

High Degree of Consolidation: Stifling Innovation and Competitive Dynamics

The high degree of consolidation within the peptides and heparin market also acts as a significant restraining factor. Large pharmaceutical companies dominate the market, which can lead to reduced competition and potentially slower innovation. This consolidation often results in fewer smaller companies entering the market due to high barriers to entry, such as significant R&D investments and regulatory challenges.

In highly consolidated markets, major players can influence pricing strategies and control supply chains, which may not always favor rapid market growth or the introduction of novel therapies. Furthermore, these companies may focus on protecting their market share through patents and extensive legal strategies, potentially stifling the development of new and improved drugs.

Market statistics reveal that a small number of companies hold substantial market shares in the peptides and heparin segments. This consolidation can lead to higher prices for end-users and potentially limit the availability of cost-effective treatments. Additionally, the strategic mergers and acquisitions prevalent in this industry can sometimes prioritize short-term financial gains over long-term innovation and market expansion.

By Type Analysis

In 2023, Insulin dominated due to high global diabetes prevalence.

In 2023, Insulin held a dominant market position in the "By Type" segment of the Peptides and Heparin Market. This leadership is primarily attributed to the high prevalence of diabetes globally, driving substantial demand for insulin as a critical therapeutic agent. Teriparatide, the second major player, is gaining traction due to its effectiveness in treating osteoporosis, particularly in postmenopausal women. Liraglutide follows, bolstered by its dual benefits in managing type 2 diabetes and obesity, appealing to a broad patient base. Leuprolide, widely used in oncology for conditions such as prostate cancer, holds a significant market share due to rising cancer incidences.

Exenatide is noted for its role in type 2 diabetes management, offering a robust alternative for glycemic control. Calcitonin, utilized in treating hypercalcemia and osteoporosis, continues to maintain a steady market presence. The "Others" category, encompassing a range of peptides with varied therapeutic applications, contributes to market diversity, though each with relatively smaller shares. The comprehensive growth of these segments underscores the expanding therapeutic applications and increasing adoption of peptide-based treatments in modern medicine.

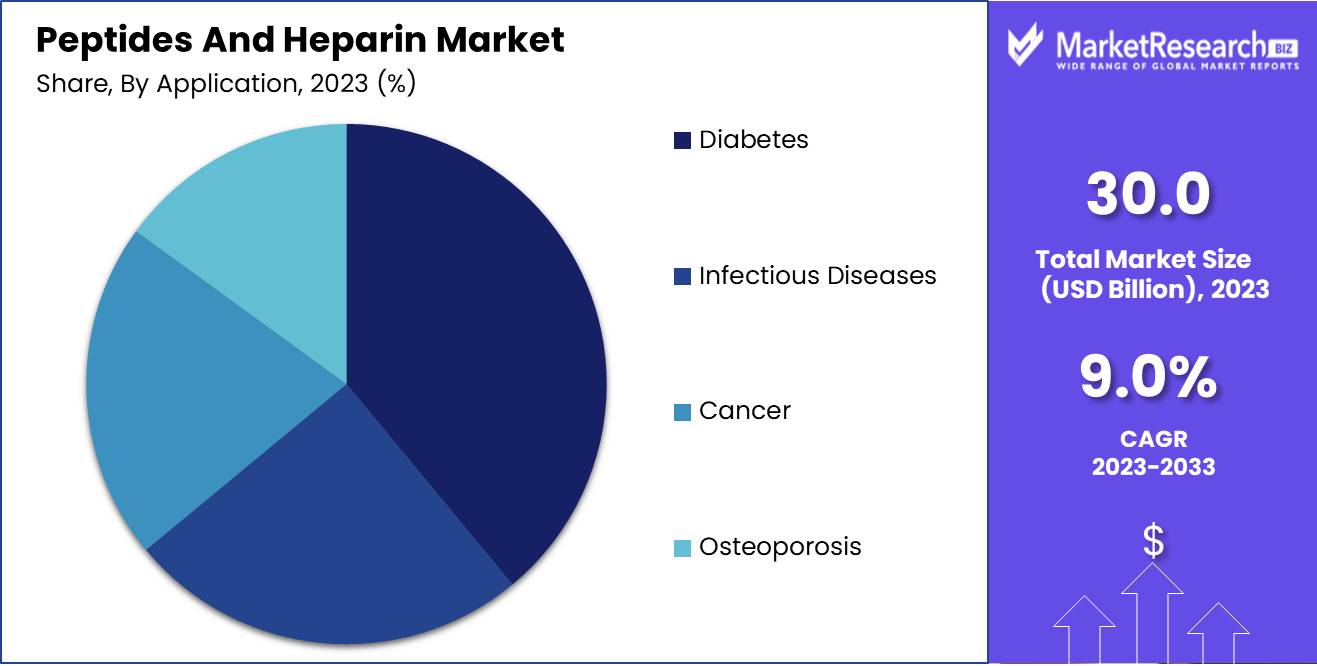

By Application Analysis

In 2023, Diabetes dominated the Peptides and Heparin market by application.

In 2023, Diabetes held a dominant market position in the By Application segment of the Peptides and Heparin Market. This dominance is attributed to the rising prevalence of diabetes globally, necessitating innovative therapeutic approaches. Peptides, known for their high specificity and efficacy, have become essential in diabetes management, particularly in the development of novel insulin analogs and incretin-based therapies. Additionally, the increasing incidence of diabetes-related complications has spurred demand for advanced treatment options, further driving market growth. Infectious diseases also represent a significant segment, with peptides playing a crucial role in developing antimicrobial agents and vaccines, essential in combating rising antibiotic resistance.

Cancer therapies leverage peptides for targeted drug delivery systems and immunotherapy, addressing the need for precision medicine in oncology. Osteoporosis treatments benefit from peptides’ ability to stimulate bone growth and improve bone density, offering promising solutions for an aging population.

Key Market Segments

By Type

- Insulin

- Teriparatide

- Liraglutide

- Leuprolide

- Exenatide

- Calcitonin

- Others

By Application

- Diabetes

- Infectious Diseases

- Cancer

- Osteoporosis

Growth Opportunity

Rising Incidence of Cancer and Metabolic Disorders

The global peptides and heparin market is poised for substantial growth primarily driven by the escalating prevalence of cancer and metabolic disorders. According to recent data, the incidence of cancer is expected to increase by 12% annually, while metabolic disorders such as diabetes and obesity are also on the rise. This trend underscores the growing demand for peptide-based therapeutics and anticoagulants like heparin, which are crucial in managing these conditions. Peptides, with their high specificity and efficacy, are becoming increasingly favored in oncology for targeted therapy. Similarly, heparin remains a cornerstone in the prevention and treatment of thrombosis, a common complication in cancer and metabolic disorder patients.

Development of Patient-Friendly Administration Methods

Another significant growth driver for the peptides and heparin market is the advancement in patient-friendly administration methods. Traditionally, the administration of peptides and heparin has been invasive, often requiring intravenous delivery. However, recent innovations have led to the development of oral, transdermal, and inhalable formulations. These advancements not only improve patient compliance but also broaden the market scope by making these therapies more accessible and convenient. For instance, oral peptide drugs are gaining traction due to their ease of use, which is particularly beneficial for chronic conditions requiring long-term treatment. Furthermore, transdermal patches and inhalable formulations offer non-invasive alternatives that enhance patient experience and adherence to therapy regimens.

Latest Trends

Advancements in Peptide Synthesis Technology

The peptides market is experiencing a significant transformation driven by advancements in synthesis technology. In 2024, innovations in solid-phase peptide synthesis (SPPS) and liquid-phase peptide synthesis (LPPS) are expected to enhance efficiency, scalability, and cost-effectiveness. These advancements are reducing production time and increasing yield, which is critical for meeting the growing demand for therapeutic peptides in oncology, metabolic disorders, and infectious diseases. Enhanced automation and integration of AI in peptide design and synthesis are further streamlining processes, enabling the rapid development of novel peptides with improved stability and bioavailability.

Growing Demand for Oral Anticoagulants

The heparin market is witnessing a paradigm shift towards oral anticoagulants, driven by patient preference for non-invasive administration routes and the convenience of oral dosing. In 2024, this trend is expected to accelerate as more oral formulations enter the market, offering an alternative to traditional injectable heparins. These advancements are fueled by ongoing research and development efforts aimed at improving the pharmacokinetic profiles of oral anticoagulants to ensure efficacy and safety comparable to injectable forms. The market is also seeing increased investments in novel delivery mechanisms and formulation technologies to enhance the stability and absorption of oral anticoagulants.

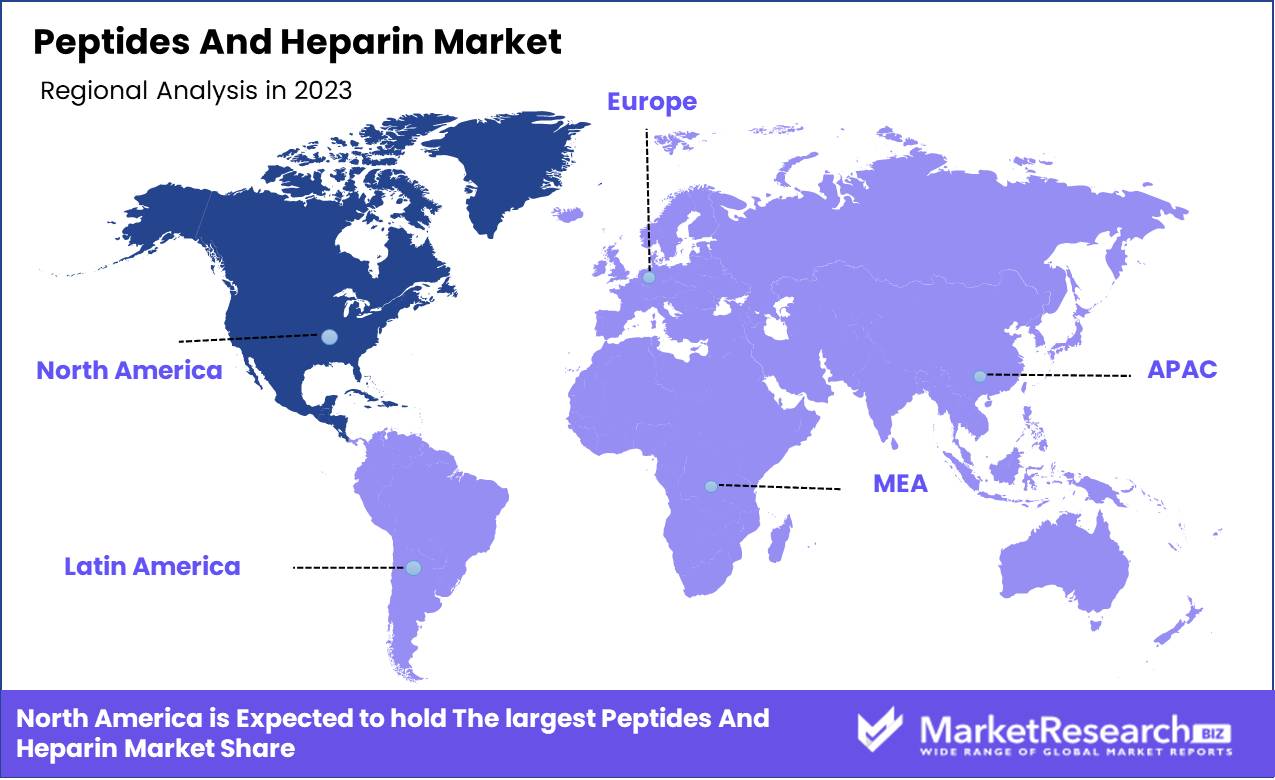

Regional Analysis

North America leads the peptides and heparin market with a 35% share.

The global peptides and heparin market exhibits diverse regional dynamics, with North America leading the market, accounting for approximately 35% of the global share. This dominance is primarily attributed to the robust healthcare infrastructure, high prevalence of chronic diseases, and significant R&D investments in biopharmaceuticals. The United States, as a major contributor, boasts advanced technological capabilities and a strong presence of key market players, driving growth in the region.

Europe follows closely, capturing around 30% of the market share, driven by the increasing adoption of peptide-based therapies and a supportive regulatory framework. Countries like Germany, the UK, and France are pivotal, with substantial government funding for medical research and a well-established pharmaceutical industry.

The Asia-Pacific region is experiencing the fastest growth, projected to expand at a CAGR of over 8% during the forecast period. This is fueled by rising healthcare expenditures, an expanding patient pool, and growing biotechnological advancements, particularly in China and India. The increasing focus on biosimilars and generic drugs also contributes significantly to market growth in this region.

In the Middle East & Africa, the market is gradually gaining traction, supported by improving healthcare facilities and rising awareness about peptide-based treatments. Latin America showcases moderate growth, driven by Brazil and Mexico, where healthcare reforms and increased access to advanced medical treatments are key growth factors.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Peptides and Heparin Market continues to be shaped by leading pharmaceutical and biotechnology companies, leveraging advanced R&D capabilities and strategic collaborations. Eli Lilly, Novo Nordisk, and Sanofi remain at the forefront, driven by robust pipelines and significant investments in peptide therapeutics, particularly for diabetes and obesity management. These companies' extensive global reach and strong market presence underscore their leadership positions.

Pfizer Inc. and Abbott Laboratories capitalize on their diversified portfolios and innovative approaches to expand their peptide-based treatments, targeting a range of chronic diseases. Takeda and Teva Pharmaceutical Industries Ltd. emphasize biosimilars and generic peptides, enhancing affordability and access in emerging markets.

Specialized firms like Leo Pharma and Aspen focus on niche areas such as dermatology and anticoagulation therapies, respectively. Bachem and Hemmo Pharma, key players in peptide manufacturing, contribute to the supply chain's efficiency and quality, supporting broader market growth.

Sun Pharmaceutical Industries Ltd., Wockhardt Ltd., and AmbioPharm leverage their strong manufacturing capabilities and strategic partnerships to penetrate new markets. Cipla Ltd. and Emcure Pharmaceuticals Pvt. Ltd. continue to drive innovation in cost-effective peptide formulations, catering to the increasing demand for affordable therapeutics.

Market Key Players

- Eli Lilly

- Novo Nordisk

- Sanofi

- Pfizer Inc.

- Abbott Laboratories

- Takeda

- Teva Pharmaceutical Industries Ltd.

- Leo Pharma

- Aspen

- Bachem

- Hemmo Pharma

- Sun Pharmaceutical Industries Ltd.

- Wockhardt Ltd.

- AmbioPharm

- Cipla Ltd.

- Emcure Pharmaceuticals Pvt. Ltd.

Recent Development

- In March 2024, Sanofi launched a new peptide-based therapy for type 2 diabetes, named Zynquista. This therapy leverages a GLP-1 receptor agonist to improve glycemic control in patients, representing a significant advancement in diabetes management. The launch is part of Sanofi's broader strategy to innovate within the metabolic disorder treatment space.

- In February 2024, Pfizer and BioNTech expanded their strategic collaboration to develop a new generation of peptide-based vaccines targeting infectious diseases. This initiative builds on their successful partnership in mRNA vaccine development, focusing now on combining peptide epitopes with mRNA technology to enhance immune responses and vaccine efficacy.

- In January 2024, Novo Nordisk announced the acquisition of Emisphere Technologies to enhance its capabilities in oral peptide delivery. This acquisition is aimed at leveraging Emisphere's proprietary Eligen SNAC technology, which facilitates the absorption of peptides and proteins in the gastrointestinal tract, potentially expanding Novo Nordisk's pipeline of orally administered peptide-based drugs.

Report Scope

Report Features Description Market Value (2023) USD 30.0 Billion Forecast Revenue (2033) USD 69.5 Billion CAGR (2024-2032) 9.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Insulin, Teriparatide, Liraglutide, Leuprolide, Exenatide, Calcitonin, Others), By Application (Diabetes, Infectious Diseases, Cancer, Osteoporosis) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Eli Lilly, Novo Nordisk, Sanofi, Pfizer Inc., Abbott Laboratories, Takeda, Teva Pharmaceutical Industries Ltd., Leo Pharma, Aspen, Bachem, Hemmo Pharma, Sun Pharmaceutical Industries Ltd., Wockhardt Ltd., AmbioPharm, Cipla Ltd., Emcure Pharmaceuticals Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Eli Lilly

- Novo Nordisk

- Sanofi

- Pfizer Inc.

- Abbott Laboratories

- Takeda

- Teva Pharmaceutical Industries Ltd.

- Leo Pharma

- Aspen

- Bachem

- Hemmo Pharma

- Sun Pharmaceutical Industries Ltd.

- Wockhardt Ltd.

- AmbioPharm

- Cipla Ltd.

- Emcure Pharmaceuticals Pvt. Ltd.