Pathology Market By Product (Scanners, Communication Systems, Storage Systems, Software, Services, Instruments, Consumables), By Type (Human Digital Pathology, Animal Digital Pathology), By Application (Disease Diagnosis, Teleconsultation, Drug Discovery, Others), By End User (Pharma and Biotechnology Companies, Hospitals and Reference Laboratories, Academic and Government Research Institutes), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47826

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

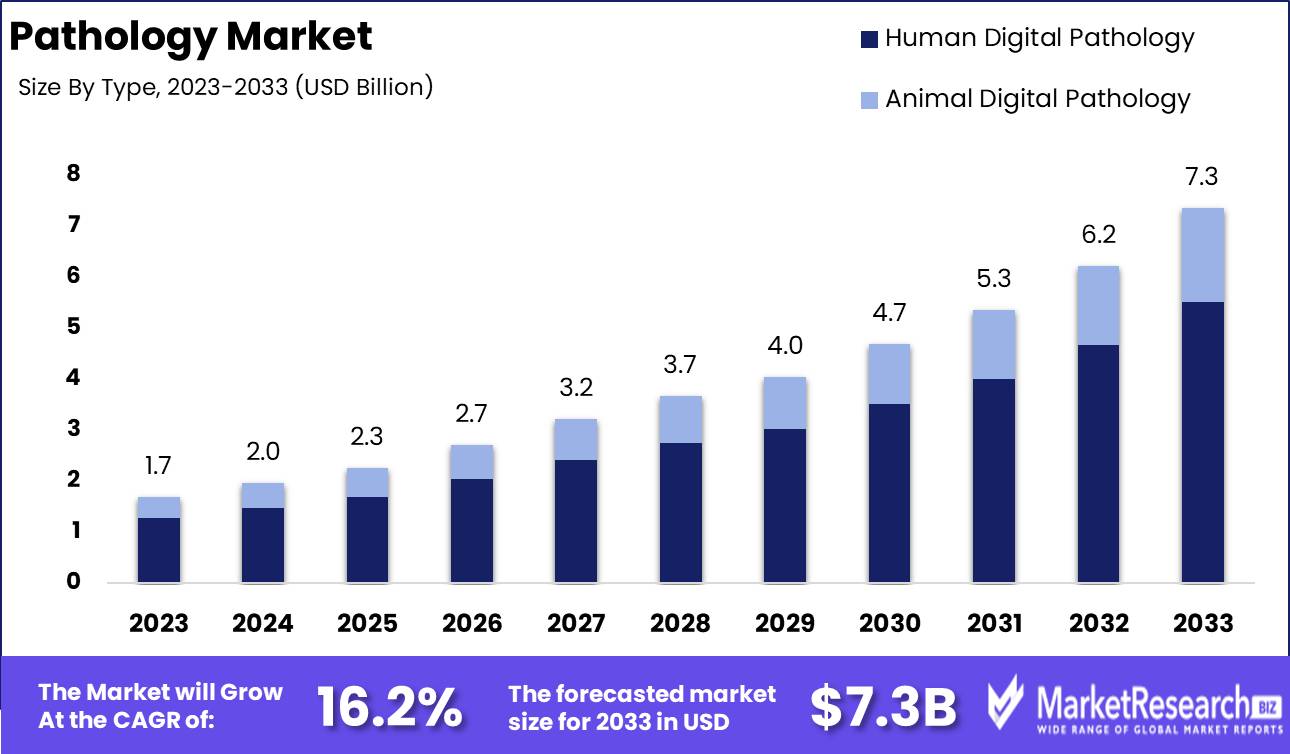

The Global Pathology Market was valued at USD 1.7 Bn in 2023. It is expected to reach USD 7.3 Bn by 2033, with a CAGR of 16.2% during the forecast period from 2024 to 2033.

The Pathology Market involves the global industry dedicated to the study and diagnosis of disease through laboratory examination of bodily fluids, tissues, and organs. This market includes services such as clinical pathology, anatomical pathology, and molecular pathology, leveraging advanced diagnostic technologies and techniques. Growth in this market is driven by increasing healthcare demands, advancements in diagnostic tools, and the rising prevalence of chronic diseases.

Key players are focused on developing innovative diagnostic solutions and improving laboratory efficiencies. The market's expansion is also supported by the integration of digital pathology and AI-driven analytics, enhancing diagnostic accuracy and patient outcomes.

The Pathology Market is experiencing robust growth, driven by the critical role of pathology services in the healthcare ecosystem. In the UK alone, approximately 500 million biochemistry and 130 million haematology tests are conducted annually, underscoring the essential nature of pathology in diagnosing and managing health conditions. Moreover, in NHS England, around 95% of clinical pathways depend on access to pathology services, highlighting their foundational importance in patient care.

Advancements in diagnostic technologies, including molecular and digital pathology, are significantly enhancing the accuracy, efficiency, and scope of pathology services. The integration of artificial intelligence and machine learning in diagnostic processes is transforming the market, enabling faster and more precise interpretations of complex data. This technological evolution is crucial in managing the rising prevalence of chronic diseases and the growing demand for personalized medicine.

The increasing global healthcare burden, driven by an aging population and the rise of chronic conditions, necessitates efficient and reliable diagnostic services. The ongoing development and adoption of innovative diagnostic tools and techniques, including digital pathology and AI-driven analytics, are pivotal in meeting these demands.

Key Takeaways

- Market Value: The Global Pathology Market was valued at USD 1.7 Bn in 2023. It is expected to reach USD 7.3 Bn by 2033, with a CAGR of 16.2% during the forecast period from 2024 to 2033.

- By Product: Scanners represent 20% of the product segment, indicating significant utilization in modern diagnostic practices.

- By Type: Human digital pathology comprises 75% of the market, showcasing the growing shift towards digital solutions for enhanced diagnostic accuracy.

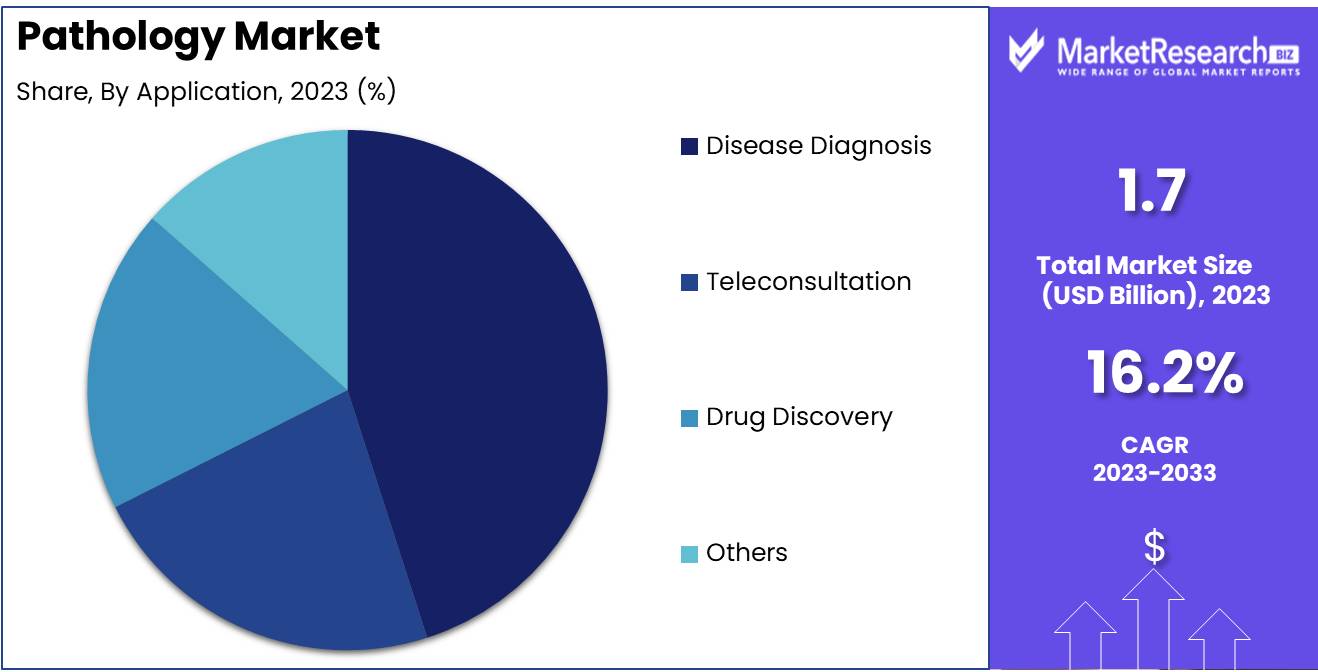

- By Application: Disease diagnosis constitutes 50% of the market application, emphasizing its central role in clinical pathology.

- By End User: Hospitals and reference laboratories account for 45% of the end-user segment, reflecting their importance in delivering diagnostic services.

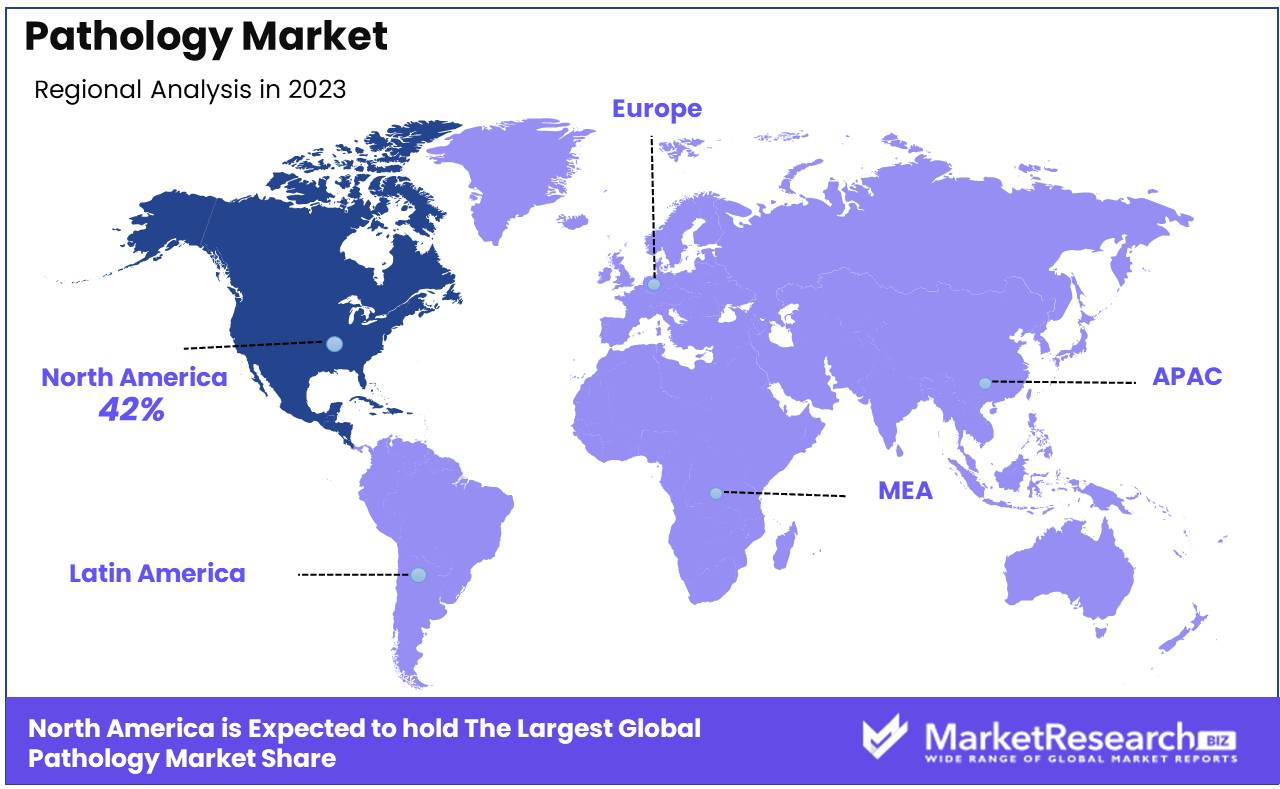

- Regional Dominance: North America dominates with 42% of the market share, driven by technological advancements and high investment in healthcare infrastructure.

- Growth Opportunity: Growth in the Pathology Market is driven by advancements in diagnostic technologies and an increasing demand for early and accurate disease detection.

Driving factors

Growing Tele-consultations

The advent of tele-consultations has significantly transformed the pathology market by broadening access to diagnostic services. This technology allows pathologists to consult with patients and other healthcare providers remotely, leading to increased demand for pathology services, particularly in underserved and rural areas.

Tele-consultations facilitate quicker diagnosis and treatment planning, thus improving patient outcomes. As telehealth infrastructure continues to develop, the convenience and efficiency of remote consultations are expected to drive further growth in the pathology market.

Improved Lab Efficiency

The implementation of advanced technologies and automation in pathology labs has markedly improved lab efficiency. Automated processes in sample handling, staining, and analysis have reduced human error and enhanced the accuracy and speed of diagnostic results.

These improvements lead to a higher throughput of tests, reducing turnaround times and increasing the overall capacity of pathology labs. The efficiency gains not only enhance the profitability of pathology services but also meet the growing demand for faster diagnostics in clinical settings.

Drug Discovery and Companion Diagnostics

Advancements in drug discovery and the development of companion diagnostics have significantly impacted the pathology market. Companion diagnostics are crucial in the personalized medicine approach, allowing for the identification of specific biomarkers that predict a patient’s response to targeted therapies. This integration of diagnostics with therapeutic decision-making enhances the precision and effectiveness of treatments, particularly in oncology.

The growing emphasis on personalized medicine and the increasing number of targeted therapies in the pharmaceutical pipeline are driving the demand for specialized pathology services. The collaboration between pharmaceutical companies and pathology labs for the development and validation of companion diagnostics is expected to further stimulate market growth.

Restraining Factors

Regulatory Concerns for Primary Diagnosis

Regulatory concerns play a crucial role in the primary diagnosis sector of the pathology market. Stringent regulations are in place to ensure the accuracy, reliability, and validity of diagnostic results, given their critical impact on patient care. Compliance with these regulations often involves rigorous validation processes, regular quality control assessments, and adherence to standard operating procedures, all of which can be resource-intensive.

The necessity for regulatory compliance can slow down the adoption of new technologies and methodologies, thereby affecting the market's growth rate. Adherence to these regulations is essential to maintain trust in diagnostic services, and successful navigation of these regulatory landscapes can enhance market credibility and encourage broader acceptance of advanced diagnostic tools.

High Initial and Maintenance Costs

The pathology market is characterized by substantial initial and ongoing costs associated with advanced diagnostic equipment, laboratory infrastructure, and specialized training. High initial capital investment is required to set up state-of-the-art laboratories equipped with the latest technology. Additionally, ongoing maintenance costs, including regular updates, calibration, and servicing of equipment, as well as the need for highly skilled personnel, add to the financial burden. These costs can be prohibitive, particularly for smaller labs and new entrants, potentially limiting market expansion.

Despite these financial challenges, the long-term benefits of improved diagnostic accuracy and efficiency can justify the investment, particularly for larger institutions and established labs. Over time, economies of scale and technological advancements may help reduce these costs, making advanced pathology services more accessible.

By Product Analysis

Scanners make up 20% of the product segment in the Pathology Market.

In 2023, Scanners held a dominant market position in the "By Product" segment of the Pathology Market, capturing more than a 20% share. This dominance is attributed to the critical role of scanners in digital pathology, facilitating high-resolution imaging and efficient workflow integration in pathological analysis.Scanners are essential for digitizing glass slides, enabling pathologists to examine high-quality digital images. The increased adoption of digital pathology, driven by advancements in imaging technology and the need for remote diagnostics, has significantly boosted the demand for scanners.

Communication systems facilitate the seamless exchange of information between pathologists and other healthcare providers. This segment is essential for ensuring collaborative diagnostics and timely decision-making.

The need for secure and scalable storage solutions is critical in managing the vast amounts of data generated by digital pathology. Storage systems, including cloud-based and on-premises options, are vital for maintaining data integrity and accessibility.

Software solutions play a pivotal role in enhancing the efficiency and accuracy of pathological analysis. This includes image analysis software, laboratory information management systems (LIMS), and artificial intelligence (AI) tools.

Pathology services encompass a broad range of support functions, including technical support, maintenance, training, and consulting. These services ensure the optimal performance of pathology equipment and software, thereby enhancing laboratory efficiency.

Instruments used in pathology, such as microscopes, tissue processors, and staining systems, are fundamental to conducting various diagnostic procedures. The ongoing advancements in instrumentation technology contribute to improved diagnostic capabilities and workflow efficiency, supporting steady growth in this segment.

Consumables, including reagents, slides, cover slips, and biopsy kits, are critical for daily pathology operations. The consumables segment is driven by the high turnover rate and the consistent demand for these products to perform routine diagnostic tasks.

By Type Analysis

Human digital pathology comprises 75% of the type segment in the Pathology Market.

In 2023, Human Digital Pathology held a dominant market position in the "By Type" segment of the Pathology Market, capturing more than a 75% share. This overwhelming market share is driven by the extensive application of digital pathology in human healthcare. The Human Digital Pathology segment includes the digitization of human tissue samples for diagnostic and research purposes. The widespread adoption of digital pathology in human medicine is propelled by the increasing demand for precise and rapid diagnostics, the need for remote consultations, and the integration of advanced technologies such as artificial intelligence (AI) and machine learning.

Animal Digital Pathology, while holding a smaller share of the market, is an emerging field with substantial growth potential. This segment caters to veterinary medicine, pharmaceutical research, and academic studies involving animal models. The growing emphasis on animal health, alongside advancements in veterinary diagnostics, is expected to drive the adoption of digital pathology in this area.

By Application Analysis

Disease diagnosis represents 50% of the application segment in the Pathology Market.

In 2023, Disease Diagnosis held a dominant market position in the "By Application" segment of the Pathology Market, capturing more than a 50% share. This significant market share is driven by the critical role of pathology in diagnosing a wide range of diseases, ensuring accurate and timely patient care. Disease diagnosis is the primary application of pathology, encompassing the detection and identification of various medical conditions, including cancers, infectious diseases, and chronic illnesses.

Teleconsultation is an emerging application that leverages digital pathology to facilitate remote consultations and second opinions. This segment is growing due to the increasing adoption of telemedicine, which enables pathologists to provide expert diagnostic services to remote or underserved areas.

Drug discovery involves the use of pathology to study disease mechanisms and evaluate the efficacy and safety of new therapeutics. This application is critical in the pharmaceutical industry and research institutions, where pathology provides valuable insights into the biological effects of drugs.

The "Others" category includes applications such as academic research, forensic pathology, and environmental pathology. These applications, while diverse, contribute to the overall pathology market by supporting various specialized fields of study and practice.

By End User Analysis

Hospitals and reference laboratories account for 45% of the end user segment in the Pathology Market.

In 2023, Hospitals and Reference Laboratories held a dominant market position in the "By End User" segment of the Pathology Market, capturing more than a 45% share. This significant market share is attributed to the comprehensive diagnostic services provided by these institutions, which are essential for patient care and clinical decision-making.

Pharma and biotechnology companies rely heavily on pathology for drug development, clinical trials, and biomarker discovery. This segment's growth is driven by the increasing focus on personalized medicine and the need for robust diagnostic tools to support therapeutic innovations.

Hospitals and reference laboratories are pivotal in the pathology market due to their extensive range of diagnostic services, including histopathology, cytopathology, and molecular diagnostics. These institutions are equipped with advanced technologies and skilled professionals, ensuring accurate and timely diagnoses. The dominance of this segment is further supported by the integration of digital pathology and telepathology, which enhance diagnostic capabilities and streamline workflows.

Academic and government research institutes play a crucial role in advancing pathology through research, education, and innovation. This segment is vital for developing new diagnostic techniques and understanding disease mechanisms.

Key Market Segments

By Product

- Scanners

- Communication Systems

- Storage Systems

- Software

- Services

- Instruments

- Consumables

By Type

- Human Digital Pathology

- Animal Digital Pathology

By Application

- Disease Diagnosis

- Teleconsultation

- Drug Discovery

- Others

By End User

- Pharma and Biotechnology Companies

- Hospitals and Reference Laboratories

- Academic and Government Research Institutes

Growth Opportunity

Demand for Personalized Medicines

The growing demand for personalized medicines is a significant driver for the pathology market in 2024. Personalized medicine, which tailors treatment to individual patient profiles, relies heavily on precise and accurate diagnostic tools. Pathology services are integral in identifying specific biomarkers that guide treatment decisions, particularly in oncology. This trend is expected to accelerate as more pharmaceutical companies invest in developing targeted therapies.

The integration of companion diagnostics with therapeutic solutions will enhance the demand for specialized pathology services, presenting a substantial growth opportunity.

Advancements in Imaging and Software

Technological advancements in imaging and software are transforming the pathology landscape. Digital pathology, powered by high-resolution imaging and sophisticated software algorithms, allows for the efficient analysis and interpretation of pathological data. These advancements enable remote consultations and collaborative diagnostics, expanding the reach of pathology services globally.

Improved imaging technologies enhance diagnostic accuracy and reduce turnaround times, making pathology services more efficient and reliable. The ongoing innovation in this area promises to drive market growth by improving diagnostic capabilities and expanding service offerings.

Increasing Chronic Disease Prevalence

The rising prevalence of chronic diseases such as cancer, diabetes, and cardiovascular conditions is another critical factor fueling the growth of the pathology market. These conditions require regular monitoring and diagnostic testing, increasing the demand for pathology services. The aging global population further exacerbates this trend, as older adults are more prone to chronic illnesses.

The heightened need for continuous and accurate diagnostic services to manage these diseases effectively underscores the vital role of pathology in healthcare, driving market expansion.

Latest Trends

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into pathology is one of the most transformative trends in 2024. AI and ML algorithms are revolutionizing the way pathological data is analyzed, enabling faster and more accurate diagnostics. These technologies assist pathologists in detecting patterns and anomalies in large datasets that may not be immediately apparent through traditional methods.

AI-driven tools are particularly beneficial in areas such as digital pathology and image analysis, where they enhance the precision of diagnoses and reduce human error. As AI and ML continue to advance, their adoption in pathology labs is expected to grow, driving efficiency and improving patient outcomes.

Focus on Improving Diagnostic Accuracy

Improving diagnostic accuracy remains a core focus in the pathology market for 2024. With the increasing complexity of diseases and the critical importance of early and accurate diagnosis, pathology labs are continually seeking ways to enhance their diagnostic capabilities. Advances in imaging technology, digital pathology, and AI integration are all contributing to higher accuracy rates.

Stringent regulatory standards ensure that diagnostic processes are constantly refined and validated. This focus on accuracy not only improves patient care but also boosts the credibility and reliability of pathology services, fostering trust among healthcare providers and patients.

Regional Analysis

North America holds a 42% regional dominance in the Pathology Market.

The North American pathology market dominates globally, accounting for approximately 42% of the market share. This dominance can be attributed to the presence of advanced healthcare infrastructure, a high prevalence of chronic diseases, and significant investments in research and development. The region's market is driven by the United States, which boasts a large number of accredited laboratories and robust healthcare policies supporting pathology services.

In Europe, the pathology market is driven by countries like Germany, the UK, and France, which collectively contribute to a significant portion of the regional market share. Europe’s strong emphasis on early disease detection and the integration of advanced diagnostic technologies foster market expansion. The European market benefits from extensive government healthcare initiatives and substantial funding for pathology research.

The Asia Pacific pathology market is experiencing rapid growth due to increasing healthcare expenditures, rising awareness about early disease diagnosis, and a growing aging population. The region’s market is bolstered by a surge in healthcare infrastructure development and the adoption of modern diagnostic technologies.

The pathology market in the Middle East & Africa is steadily growing, supported by advancements in healthcare infrastructure and increasing investments in medical research. The United Arab Emirates and Saudi Arabia are leading markets within this region, with substantial government support for healthcare modernization.

In Latin America, the pathology market is primarily driven by Brazil, Mexico, and Argentina. The region is witnessing growth due to the increasing prevalence of chronic diseases and a rising demand for advanced diagnostic services. Government initiatives to enhance healthcare infrastructure and improve access to diagnostic technologies are significant growth drivers.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Sacroiliitis Treatment Market in 2024 is being significantly shaped by advancements in digital pathology and imaging technologies, driven by key players contributing to improved diagnostic accuracy and treatment planning. Huron Digital Pathology Inc. and microDimensions GmbH are leading innovators in digital imaging solutions, offering sophisticated software for pathology that enhances the detection and monitoring of sacroiliitis through high-resolution imaging.

Apollo Enterprise Imaging and Ventana Medical Systems Inc. provide integrated digital pathology solutions that streamline workflows, enabling precise and efficient diagnosis. Their platforms facilitate collaboration among healthcare professionals, improving patient outcomes. Leica Biosystems Nussloch GmbH and Indica Labs bring advanced imaging and analysis tools to the market, offering comprehensive solutions that aid in the early detection and management of sacroiliitis.

Koninklijke Philips N.V. Healthcare and Hamamatsu Photonics K.K. are major players in the medical imaging sector, leveraging their expertise to offer cutting-edge diagnostic technologies that support the accurate assessment of sacroiliac joint inflammation. Objective Pathology Services and Omnyx LLC. focus on delivering pathology services and solutions that integrate seamlessly with existing healthcare infrastructure, enhancing diagnostic capabilities.

3DHISTECH and Corista are recognized for their contributions to digital slide scanning and pathology workflow solutions, which are crucial for the detailed examination of tissue samples. Philips and Leica Biosystems continue to lead with their robust portfolios in imaging and diagnostic tools, ensuring high standards of care.

Mikroscan Technologies Inc. and GE Healthcare are pivotal in providing advanced imaging equipment that enhances the visualization of sacroiliac joint pathology. Visiopharm's image analysis software offers powerful tools for quantifying and interpreting complex pathology data, aiding in the development of personalized treatment plans.

Market Key Players

- Huron Digital Pathology Inc.

- microDimensions GmbH

- Apollo Enterprise Imaging

- Ventana Medical Systems Inc.

- Leica Biosystems Nussloch GMBH

- Indica Labs.

- Koninklijke Philips N.V. Healthcare

- Hamamatsu Photonics K.K

- Objective Pathology Services

- Omnyx LLC.

- 3DHISTECH

- Corista

- Philips

- Leica Biosystems

- Mikroscan Technologies Inc.

- GE Healthcare

- Visiopharm

Recent Development

- In June 2024, Agilent Technologies advances in CDx development, focusing on digital pathology integration, regulatory frameworks, and AI-driven multiplexing assays to enhance diagnostic accuracy and collaboration in life sciences.

- In May 2024, Reliance Retail Ventures is planning to expand into the diagnostic healthcare sector by acquiring a majority stake in a dedicated diagnostic services firm, investing Rs 1,000-3,000 crore.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Bn Forecast Revenue (2033) USD 7.3 Bn CAGR (2024-2033) 16.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Scanners, Communication Systems, Storage Systems, Software, Services, Instruments, Consumables), By Type (Human Digital Pathology, Animal Digital Pathology), By Application (Disease Diagnosis, Teleconsultation, Drug Discovery, Others), By End User (Pharma and Biotechnology Companies, Hospitals and Reference Laboratories, Academic and Government Research Institutes) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Huron Digital Pathology Inc., microDimensions GmbH, Apollo Enterprise Imaging, Ventana Medical Systems Inc., Leica Biosystems Nussloch GMBH, Indica Labs., Koninklijke Philips N.V. Healthcare, Hamamatsu Photonics K.K, Objective Pathology Services, Omnyx LLC., 3DHISTECH, Corista, Philips, Leica Biosystems, Mikroscan Technologies Inc., GE Healthcare, Visiopharm Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Huron Digital Pathology Inc.

- microDimensions GmbH

- Apollo Enterprise Imaging

- Ventana Medical Systems Inc.

- Leica Biosystems Nussloch GMBH

- Indica Labs.

- Koninklijke Philips N.V. Healthcare

- Hamamatsu Photonics K.K

- Objective Pathology Services

- Omnyx LLC.

- 3DHISTECH

- Corista

- Philips

- Leica Biosystems

- Mikroscan Technologies Inc.

- GE Healthcare

- Visiopharm