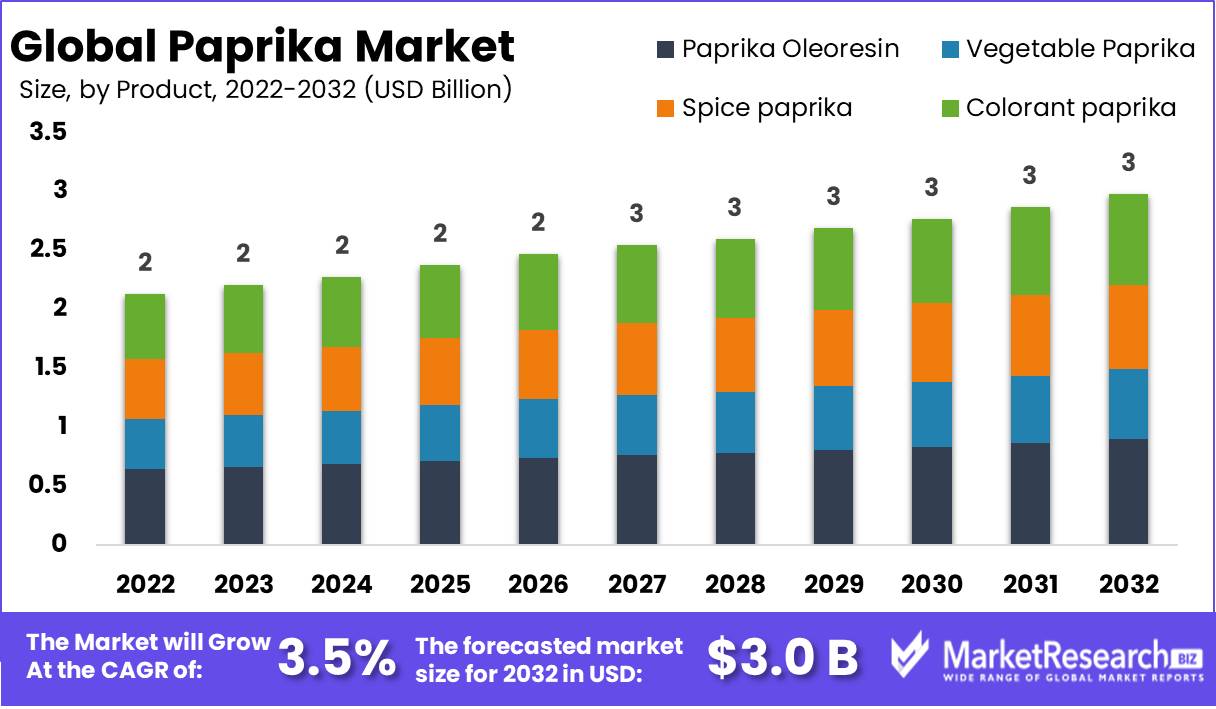

Paprika Market By Product Type (Paprika Oleoresin, Vegetable Paprika, Spice paprika, Colorant paprika), By Application (Cosmetics, Food, Pharmaceuticals), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

10675

-

May 2023

-

189

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

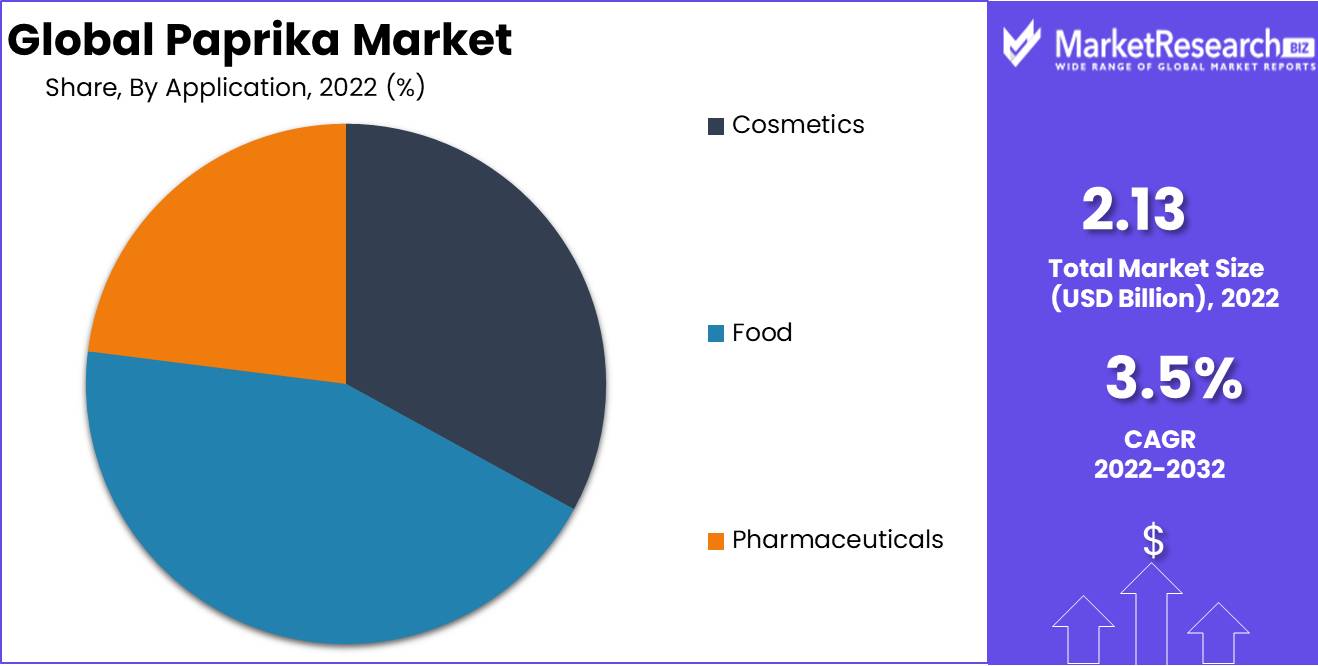

Paprika Market size is expected to be worth around USD 3.0 Bn by 2032 from USD 2.13 Bn in 2022, growing at a CAGR of 3.5% during the forecast period from 2023 to 2032.

Report Overview

Businesses use paprika in a variety of products and services, making the market dynamic and ever-changing. This article will cover the Paprika market's relevance, developments, growth patterns, ethics, and business applications. The paprika market research report covers market size, share, trends, and growth factors worldwide. The research explores paprika's uses in food, cosmetics, and pharmaceuticals in industrial and consumer markets.

Drying and crushing sweet chilies yields paprika. It is used in many cuisines, from Hungarian goulash to Spanish chorizo. Paprika has anti-inflammatory and antioxidant effects in addition to its culinary usage. Paprika's flavour- and color-enhancing characteristics make it an essential ingredient in snacks, beverages, sauces, and seasonings. Cosmetics and pharmaceuticals use it as a natural colour and flavouring agent to add pigmentation and mask chemical tastes.

Recent advances in the paprika market include extracts and oleoresins that better standardise the spice's flavour and colour. The potential therapeutic uses of paprika and its compounds are also being studied by experts. Preliminary research suggests paprika may boost metabolism and prevent obesity and diabetes. Due to demand for natural and healthful ingredients, many food and beverage industries use paprika. Paprika is used in chips and energy drinks because of its versatility. Cosmetic and pharmaceutical businesses are also using paprika-based formulations for their colour and flavour.

Many industries use paprika because of its natural and healthy properties. The largest market segment is food and beverage, followed by cosmetics and medicines. In the culinary market, paprika is most commonly used in snacks and sauces, whereas in the cosmetic industry, lipsticks and makeup are most popular. Demand for natural and transparent label components and customer awareness of paprika's health benefits drive the paprika market. The food and beverage industry's drive for ethnic and unusual flavours has also boosted the spice's popularity.

Child labour and exploitation plague the paprika market. Some companies have adopted responsible procurement policies to ensure fair labour and sustainable agriculture. Consumers also want transparent and accountable supply chains from corporations.

Driving factors

Rising Demand for Spicy and Mediterranean Cuisine

The paprika market is growing due to a convergence of multiple factors, including, but not limited to, the rising demand for spicy cuisine, the increased consumption of processed food products, and the growing prominence of Mediterranean cuisine. Increasing awareness and emphasis on maintaining a healthy lifestyle has had a positive impact on the sales of paprika due to its natural constituents, further accelerating its growth trajectory. Moreover, the exponential growth of the market for natural food colours and flavours has substantially contributed to the expansion of the paprika industry.

Stringent Regulatory Standards Pose Potential Disruption

Nonetheless, the regulatory landscape may undergo a significant shift that may have an effect on the paprika market. The implementation of stringent quality standards by regulatory authorities, prompted by the rising demand for natural ingredients, has the potential to disrupt the market dynamics. How the paprika industry adapts to these regulatory changes, which could cause market volatility, remains to be seen.

Enhancing Production and Efficiency

Emerging technologies such as precision cultivation, advanced breeding techniques, and sophisticated monitoring systems offer the paprika industry a glimmer of hope. These innovative technologies could improve the production, quality, and distribution of paprika, thereby catering to the growing demand and augmenting the efficiency of the supply chain. Consequently, the market's growth momentum can be sustained, allowing paprika producers to effectively meet market demand.

Substitutes and Shifting Consumer Preferences

A multitude of potential disruptors could have a significant impact on the competitive landscape of the paprika industry. For example, the introduction of substitutes for paprika, such as other spices or natural food colorings, or a shift in consumer preferences towards synthetic foods colorings could reduce demand for natural paprika. Therefore, it is essential for businesses to remain proactive and adaptable to market changes.

Embracing Emerging Trends and Changing Consumer Behaviors

Emerging trends, such as the growing preference for preservative-free and natural foods and the growing number of health-conscious consumers, augur well for the paprika industry, presenting a veritable development and expansion opportunity. In addition, the changing consumer behaviour, fueled by the demand for convenient and ready-to-eat foods, may pave the way for new product developments, thereby propelling the paprika market to new heights.

Restraining Factors

Fluctuating Prices of Raw Materials

In addition to fluctuating raw material costs, the paprika market faces a significant obstacle in the form of intense market competition. The market is highly fragmented, with a large number of minor players competing with a small number of large ones. Low product differentiation leads to price battles, which reduces profitability and makes it difficult for new entrants to establish themselves and create market space.

Seasonal Supply Shortages

In addition, the paprika market is extremely reliant on seasonal supply, which presents a significant obstacle. The majority of chilli pepper crops are harvested at specific times throughout the year, resulting in seasonal availability of dried chilli peppers. The administration of the supply chain by paprika manufacturers is highly sensitive to seasonal fluctuations in supply. Seasonal supply shortages cause price and demand fluctuations for paprika, leading to stock-outs and influencing the industry's overall profitability.

Government Import/Export Regulations

Moreover, import/export regulations impose difficulties on manufacturers, particularly those engaged in cross-border trade, thereby influencing business operations and profitability. Different countries' regulations on the imports and exports of chilli peppers and paprika powder require manufacturers to comply with the rules and regulations of the country they conduct business with, which can be time-consuming and expensive.

Limited Accessibility to International Markets

The paprika market suffers from restricted access to international markets. Exporting paprika products overseas is hindered by trade barriers, high tariffs, and stringent regulations, resulting in a low demand for paprika on international markets. The overabundance of paprika on the domestic market has a negative impact on pricing, exacerbating the market's difficulties.

By Product Type Analysis

Paprika Oleoresin Segment dominates paprika market. Paprika oleoresin segment is a concentrated version of paprika extract used as a food colour. Due to food processing needs, it dominates the paprika market. The paprika market, especially the oleoresin component, has grown tremendously in recent years. Due to its versatility and affordability, the paprika oleoresin market is expected to grow rapidly. It's used to make sauces, gravies, appetisers, and confections. The introduction of paprika oleoresin in the food sector is being driven by the rising demand for processed, packaged, and convenience foods.

Consumers are more conscious of food ingredients and chemicals. Natural and healthful foods are becoming more popular. Health-conscious consumers like Paprika oleoresin section as a natural food colour. The food industry's quest for high-quality, tasty, and attractive food products is also driving paprika oleoresin demand.

The paprika oleoresin market is expected to develop the fastest in the next years as a result of its widespread use in the culinary industry. The food processing industry's paprika oleoresin market is driven by increased demand for processed foods, consumer preferences for natural and healthful food, and emerging economies' rapid economic expansion. Food processing industries love paprika oleoresin segment's versatility and affordability. These reasons should drive paprika oleoresin market expansion in the approaching years.

By Application Analysis

Food segment dominates the paprika market due to its extensive use. The food segment of the paprika market is growing because paprika is used in candies, snacks, sauces, and gravies. Demand for processed, packaged, and convenience foods is increasing the food processing industry's adoption of the food segment.

Consumers care more about food quality and safety. Natural, healthy eating is in. Health-conscious consumers like the food section of the paprika market because it is natural. High-quality, tasty, and attractive food products are propelling the food processing industry's food segment.

The food segment of the paprika market is expected to grow the fastest due to its widespread use in meals. The demand for processed, packaged, and convenient food products, shifting consumer behaviour towards natural and healthful food, and emerging economies' economic growth drive the food processing industry's food segment. Food processing companies like the food sector's versatility and cost-effectiveness. These factors are expected to boost the food paprika market in the approaching years.

Key Market Segments

By Product Type:

- Paprika Oleoresin

- Vegetable Paprika

- Spice paprika

- Colorant paprika

By Application:

- Cosmetics

- Food

- Pharmaceuticals

Growth Opportunity

Growth Potential in Paprika Market Invigorated by Opportunity

The market for paprika is expanding at an unprecedented rate and has enormous development potential over the next few years. The market is driven by a number of factors, including an increase in demand for organic products, a rise in health-conscious consumers, expanding urbanisation, and a shift in consumer lifestyles. To capitalise on this opportunity, companies in the paprika market can concentrate on diversifying their product line, expanding internationally through partnerships, introducing new packaging options, boosting production efficiency, and establishing a strong online presence.

Expand Product Portfolio to Include Organic Paprika

In recent years, consumers have become increasingly health-conscious, and awareness of organic produce has increased. Consequently, demand for organic paprika has increased substantially. Paprika market players can capitalise on this trend by expanding their product offerings to include organic paprika. This will allow them to attract a larger consumer base and distinguish their product offering from that of their competitors.

Expand internationally by forming alliances

Expanding internationally is an excellent method to access new markets and reach a larger audience. This can be accomplished by forming partnerships with international distributors with a strong presence in the target markets. By doing so, they can leverage the distributor's knowledge, network, and resources to penetrate new markets. This can assist them in expanding their market share, revenues, and profits.

Introduce New Packaging Options to Appeal to Consumers

Today's consumers are more health-conscious than ever, and they expect their cuisine to be nutritious as well. To meet this demand, businesses in the paprika market may introduce novel packaging options that appeal to health-conscious customers. For instance, they can use eco-friendly, recyclable, or biodegradable packaging materials. Additionally, they can use packaging that emphasises the health advantages of paprika and encourages consumers to make healthier choices.

Automation will increase production efficiency and decrease expenses

To remain competitive in the paprika market, businesses must increase production efficiency and reduce expenses. This can be accomplished through automation. By automating their production processes, businesses can increase output, reduce labour expenses, enhance quality control, and reduce the likelihood of errors. This can help them maintain a competitive advantage and increase their profits.

Develop a Powerful Online Presence and Boost E-commerce Sales

In today's digital era, it is essential for businesses to have a strong online presence. Companies in the paprika market can use online channels to reach a larger audience, engage customers, and increase sales. They can accomplish this by optimising their website for search engines, developing compelling content, and promoting their products via social media. They can also invest in e-commerce platforms to facilitate the online purchase of their products by consumers. By establishing a robust online presence, businesses can position themselves as market leaders for paprika and obtain a competitive edge.

Latest Trends

Increasing popularity of exotic cuisines

Due to the growing prevalence of exotic cuisines, the paprika market is experiencing significant growth. Paprika is commonly used in dishes from Morocco, Spain, and Hungary, among others. Its distinctive flavour, dark hue, and versatility in preparation make it a popular ingredient in a variety of ethnic cuisines.

Innovations in the food industry encourage the incorporation

The advancements in the culinary industry encourage the incorporation of paprika into new products, such as sauces, marinades, and dressings. The market for paprika is growing due to the rising demand for natural and organic food products. Paprika is acquiring popularity as a natural food colouring, particularly in the meat industry.

Increasing Home Cooking and Flavour Experimentation

As people become more daring in the kitchen, sales of paprika have increased as a result of the rising popularity of home cookery and flavour experimentation. As more people cook at home, there is an increased demand for flavorful, high-quality ingredients, which paprika provides. Furthermore, daring home cooks are using paprika to create new and thrilling flavour combinations, thereby increasing its demand.

Increasing Vegan and Vegetarian Consumption

The rising number of vegan and vegetarian consumers is driving the demand for paprika, a ubiquitous seasoning in vegan and vegetarian cuisine. Various vegetable dishes, sauces, and stews are flavoured with paprika. Additionally, it is used as a meat substitute in vegetarian dishes to impart a smoky and savoury flavour.

Increasing consumer interest in ethnic foods and flavours

The increasing consumer interest in ethnic food and flavours is driving the development of the paprika market, as it is a key ingredient in many ethnic dishes. As consumers become more daring in their food preferences, the demand for ethnic flavours and ingredients is increasing. Paprika, with its distinctive flavour and dark hue, is a popular ingredient in a variety of ethnic cuisines and is likely to continue to propel the market's expansion.

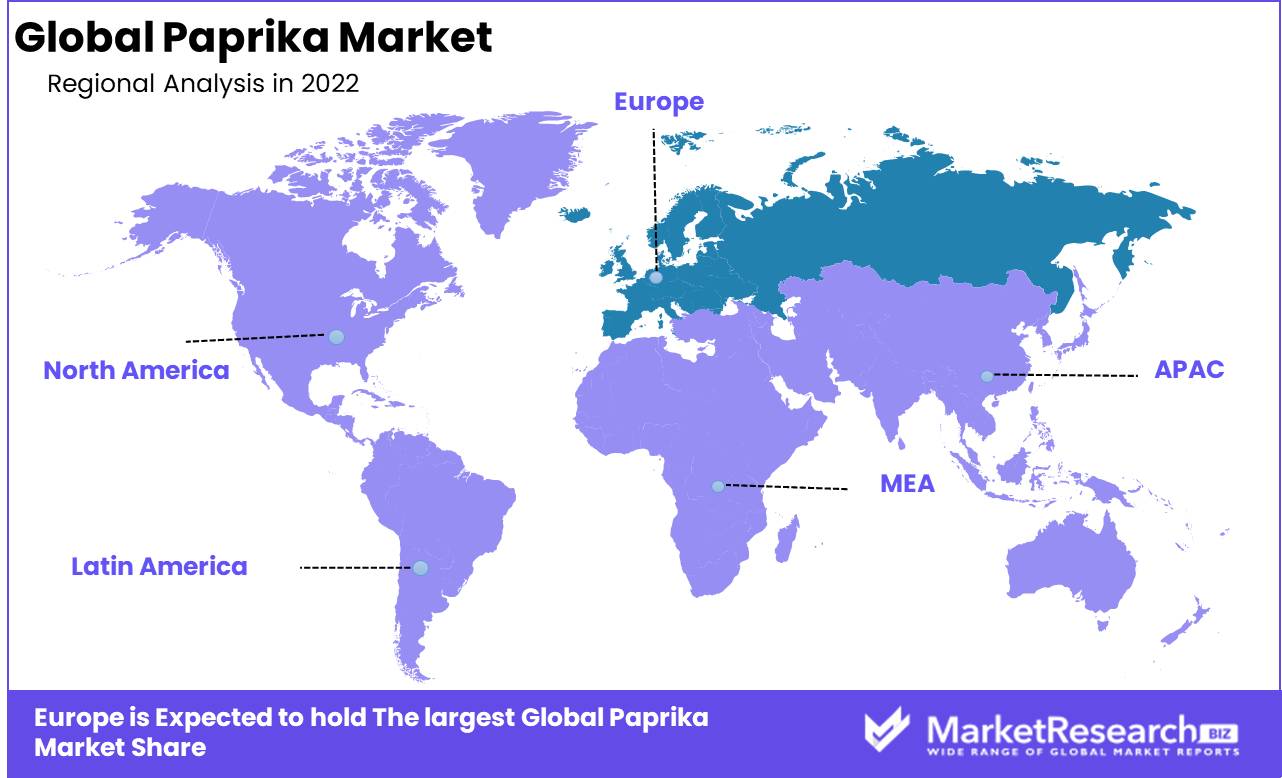

Regional Analysis

The paprika market has been growing, with Europe holding the greatest share. Europe's dominance is projected to increase even further over the coming years. The continent's market share in the paprika industry is supported by a number of factors, such as favourable weather conditions and rising consumer demand for the spice's various applications.

Paprika is extensively used in the food and beverage industry to add flavour, colour, and aroma to a variety of dishes, such as BBQ rubs, sauces, marinades, and more. In recent years, demand has increased due to rising awareness of the spice's health benefits. Due to its high concentrations of vitamins A, C, and E, carotenoids, and antioxidants, paprika is also used in cosmetic and pharmaceutical products.

Europe is the world's foremost producer and exporter of paprika, with Hungary, Romania, Spain, and Serbia playing the most significant roles in the region's market dominance. According to the Food and Agriculture Organisation (FAO), Hungary produces over fifty percent of the world's paprika.

Several factors contribute to the expansion of the European paprika market, including favourable climatic conditions, advanced cultivation techniques, and increased consumer demand. The peculiar soil composition in Hungary, one of the leading producers of paprika, enhances the spice's flavour and pungency.

In addition, the increased use of paprika in the foodservice and retail sectors helps to support Europe's paprika industry. As consumers become more knowledgeable about the culinary uses and health benefits of paprika, the demand for the spice continues to rise.

Europe's dominance in the paprika industry can be attributed to its favourable climate conditions, unique soil compositions, rising consumer demand, and innovative cultivation techniques. During the forecast period, the continent's market share is anticipated to increase as the food and beverage industry's demand for the spice rises.

As other regions invest in the production and cultivation of paprika, it is anticipated that the global market will experience substantial expansion. Nonetheless, Europe is anticipated to maintain its dominant position on the market due to its favourable conditions and paprika cultivation expertise.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Paprika Market is a common ingredient in many cuisines around the globe, and it is crucial for adding colour and flavour to food. In recent years, the global paprika market has experienced significant expansion due to a growing demand for paprika in the culinary industry.

Givaudan, Ajinomoto Co., Inc., McCormick & Company, Inc., Olam International, Unilever, Associated British Foods plc, and Everest Spices are key participants in the paprika market. Givaudan is the dominant participant in the paprika market, accounting for a substantial market share. The company offers an extensive selection of paprika products, including smoked and spicy varieties.

Offering a variety of paprika products, Ajinomoto Co., Inc. is also a major participant in the paprika market. The company is known for its high-quality paprika, which has grown in popularity over the past few years. Red paprika products manufactured by McCormick & Company, Inc. are highly sought after on the market.

Other market participants, such as Olam International, Unilever, and Associated British Foods plc, are also substantially contributing to the expansion of the paprika market. These businesses offer a vast selection of paprika products to clients worldwide.

Top Key Players in Paprika Market

- Synthite Industries Ltd., Chr.

- Hansen Holding A/S

- Ungerer & Company Unilever Food Solutions

- Plant Lipids

- DDW The Color House

- Ingredientes Naturales Seleccionados

- Kalsec Natural Ingredients

- Yunnan Honglv Capsaicin

- Xinjiang Longping High-Tech Hongan Seeds, Chr.

- Mane Investissements (Kancor Ingredients)

- Synthite Industries

- Plant Lipids

- Chenguang Biotech Group

Recent Development

In 2021, Kancor Ingredients Ltd. made waves in the paprika market with their latest announcement: the launch of a new line of paprika oleoresins made from high-quality Indian paprika. With their expertise and reputation in the industry, Kancor is set to take the market by storm.

In 2019, Olam International, a leading food and agri-business company, partnered with Agropolis Fondation to develop sustainable paprika farming practices in Africa. Through this partnership, Olam aims to improve the livelihoods of local farmers while also promoting the growth of the paprika industry in the continent.

In 2020, McCormick & Company, a global leader in spices and seasonings, made their mark in the paprika market with the launch of a new line of premium smoked paprika products under its McCormick Gourmet brand. This line is sure to entice customers with its unique and high-quality flavors.

In 2021, La Dalia, a Spanish company specializing in smoked paprika, announced an expansion of its production facility in La Vera Spain. With this expansion, La Dalia aims to meet the growing demand for their popular smoked paprika products.

Report Scope:

Report Features Description Market Value (2022) USD 2.13 Bn Forecast Revenue (2032) USD 3.0 Bn CAGR (2023-2032) 3.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type: Paprika Oleoresin, Vegetable Paprika, Spice paprika, Colorant paprika

By Application: Cosmetics, Food, PharmaceuticalsRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Synthite Industries Ltd., Chr., Hansen Holding A/S, Ungerer & Company Unilever Food Solutions, Plant Lipids, DDW The Color House, Ingredientes Naturales Seleccionados, Kalsec Natural Ingredients, Yunnan Honglv Capsaicin, Xinjiang Longping High-Tech Hongan Seeds, Chr., Mane Investissements (Kancor Ingredients), Synthite Industries, Plant Lipids, Chenguang Biotech Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Synthite Industries Ltd., Chr.

- Hansen Holding A/S

- Ungerer & Company Unilever Food Solutions

- Plant Lipids

- DDW The Color House

- Ingredientes Naturales Seleccionados

- Kalsec Natural Ingredients

- Yunnan Honglv Capsaicin

- Xinjiang Longping High-Tech Hongan Seeds, Chr.

- Mane Investissements (Kancor Ingredients)

- Synthite Industries

- Plant Lipids

- Chenguang Biotech Group