Oxygen Therapy Market By Product (Oxygen Delivery Devices, Oxygen Source Equipment), By Application (Lung Cancer, COPD, Asthma, Heart Failure, Others), By End-User (Hospitals, Specialty Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48802

-

July 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

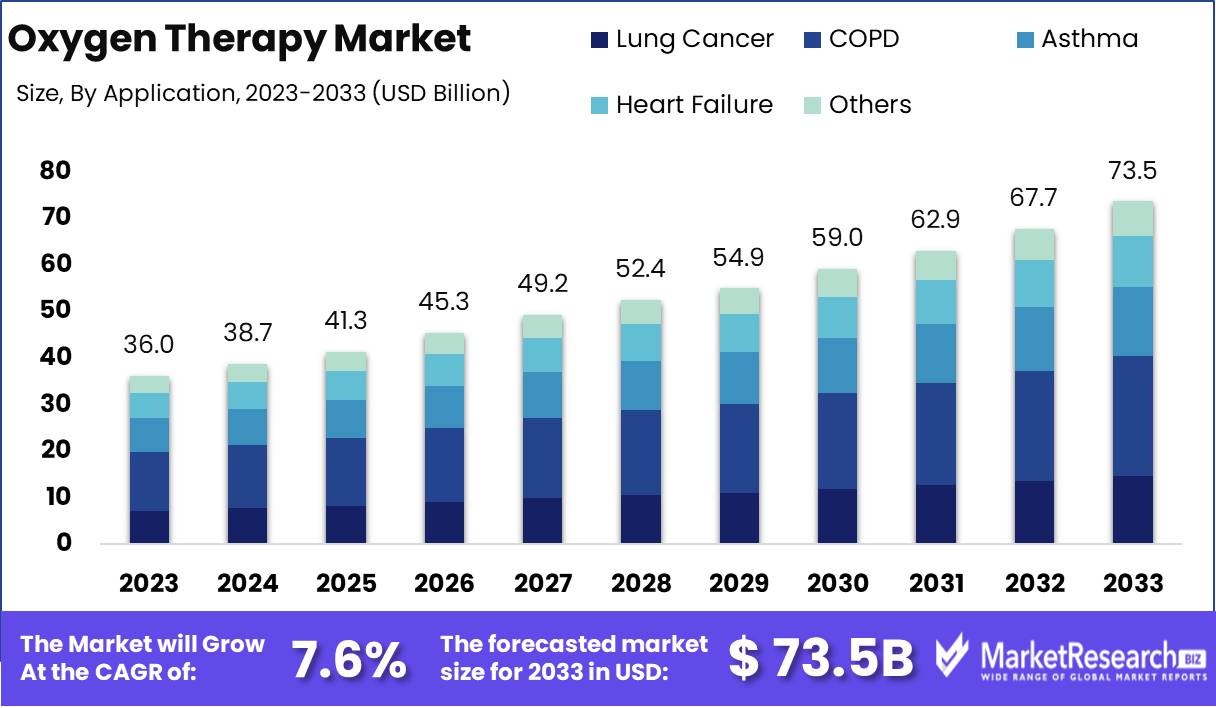

The Global Oxygen Therapy Market was valued at USD 36 Bn in 2023. It is expected to reach USD 73.5 Bn by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

The Plate Heat Exchanger Market encompasses the global industry focused on the development, manufacturing, and distribution of plate heat exchangers used for efficient thermal energy transfer across various sectors. These devices, crucial in industries such as HVAC, chemical processing, power generation, and food and beverage, facilitate effective heat exchange by utilizing multiple thin plates to maximize surface area. Driven by increasing demand for energy-efficient solutions, stringent environmental regulations, and technological advancements, the market is experiencing significant growth. Continuous innovation and integration of advanced materials and designs are pivotal in shaping the competitive landscape and meeting diverse industry needs.

The Plate Heat Exchanger Market is experiencing robust growth, driven by the need for efficient thermal management solutions across diverse industries such as HVAC, chemical processing, and power generation. One of the key advantages of plate heat exchangers is their significantly shorter installation time. For instance, the Heat Exchanger Service Module (TD1360V) can be connected in under a minute, which drastically reduces downtime and enhances operational efficiency. This speed of installation is a critical factor in industries where time and efficiency directly impact profitability and productivity.

The Plate Heat Exchanger Market is experiencing robust growth, driven by the need for efficient thermal management solutions across diverse industries such as HVAC, chemical processing, and power generation. One of the key advantages of plate heat exchangers is their significantly shorter installation time. For instance, the Heat Exchanger Service Module (TD1360V) can be connected in under a minute, which drastically reduces downtime and enhances operational efficiency. This speed of installation is a critical factor in industries where time and efficiency directly impact profitability and productivity.The market's evolution has been significantly influenced by continuous innovation since the 1930s, with pioneers such as APV and Alfa Laval leading the charge. These companies have been instrumental in enhancing the efficiency and compactness of plate heat exchangers, making them indispensable in various industrial applications. The advancements in design and material technology have resulted in more compact, reliable, and efficient heat exchangers, catering to the growing demand for energy-efficient and sustainable solutions.

Stringent environmental regulations are pushing industries to adopt more energy-efficient technologies, driving the demand for advanced plate heat exchangers. The competitive landscape is marked by significant R&D investments aimed at developing next-generation heat exchangers that offer superior performance and reliability. Companies are also focusing on strategic partnerships and acquisitions to expand their market presence and technological capabilities.

Key Takeaways

- Market Value: The Global Oxygen Therapy Market was valued at USD 36 Bn in 2023. It is expected to reach USD 73.5 Bn by 2033, with a CAGR of 7.6% during the forecast period from 2024 to 2033.

- By Product: Oxygen Source Equipment significantly dominates the market, holding a substantial 60% share, reflecting its vital role in delivering medical-grade oxygen across various settings.

- By Application: COPD treatments prominently constitute 35% of the market's applications, underscoring the growing need for effective respiratory care solutions within this patient demographic.

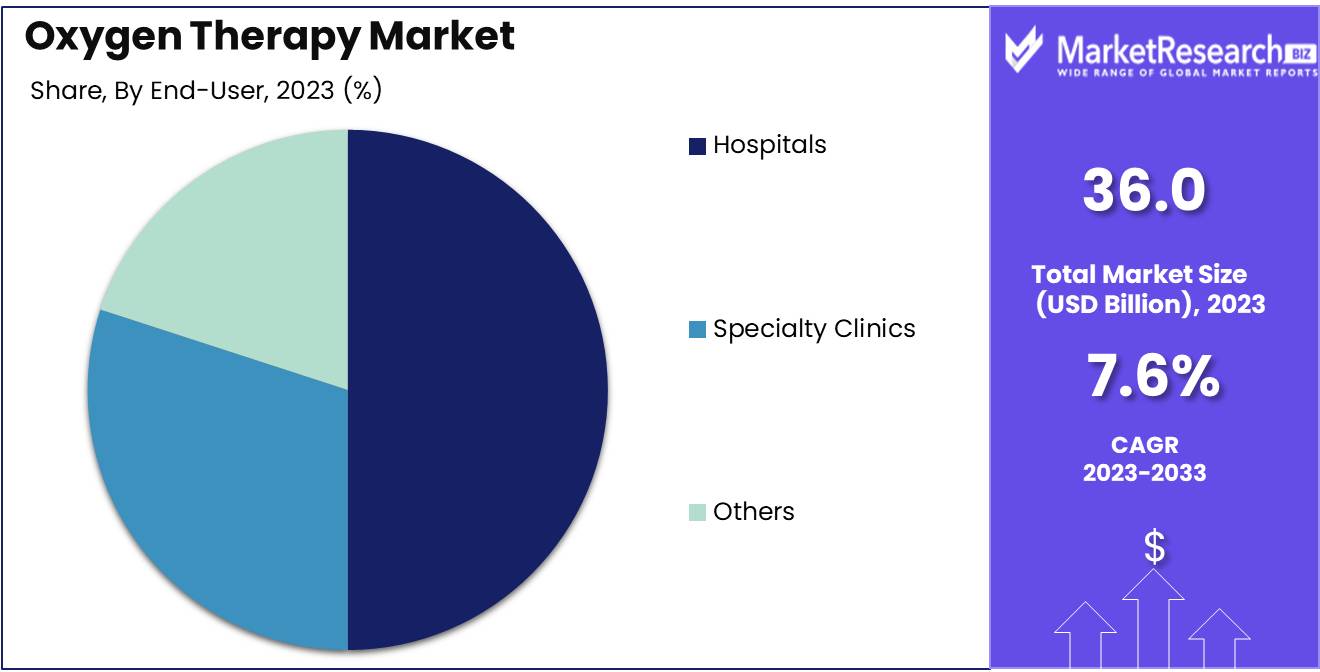

- By End-User: Hospitals are the primary end-users of oxygen therapy solutions, representing 50% of the market, indicative of the essential role these facilities play in acute care.

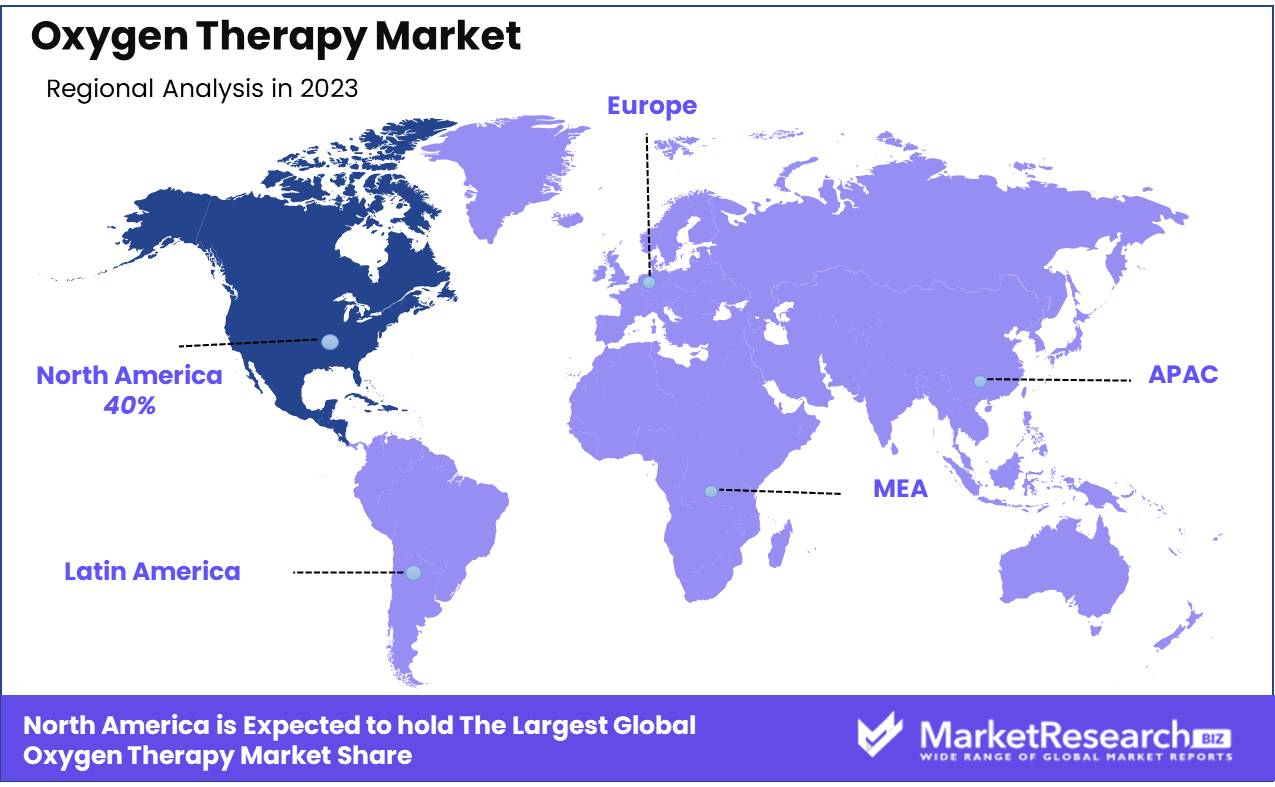

- Regional Dominance: North America leads the market with a 40% share, demonstrating its advanced healthcare infrastructure's capacity to adopt and integrate oxygen therapy solutions.

- Growth Opportunity: The growth opportunity in the Oxygen Therapy Market is driven by the rising prevalence of respiratory disorders and the increasing adoption of portable oxygen concentrators among aging populations.

Driving factors

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and pneumonia significantly drives the growth of the Oxygen Therapy Market. According to recent data, COPD remains one of the leading causes of morbidity and mortality worldwide. For instance, in-hospital mortality was higher in COPD patients receiving supplemental oxygen with saturation levels of 97-100% (14% mortality) compared to those maintained at 88-92% (28% mortality).

This alarming statistic underscores the critical need for effective oxygen therapy management to optimize patient outcomes. As the prevalence of these respiratory conditions continues to escalate, the demand for reliable and advanced oxygen therapy solutions is expected to surge, thus propelling market growth.

Rising Aging Population Globally

The global aging population is another crucial factor contributing to the expansion of the Oxygen Therapy Market. Elderly individuals are more susceptible to chronic respiratory conditions, necessitating long-term oxygen therapy. The increasing incidence of age-related respiratory ailments heightens the demand for oxygen therapy devices.

According to the World Health Organization (WHO), the global population aged 60 years and older is expected to reach 2.1 billion by 2050. This demographic shift will likely lead to a substantial increase in the patient population requiring oxygen therapy, thereby driving the market forward.

Growing Demand for Home Healthcare Services

The growing demand for home healthcare services plays a pivotal role in the burgeoning Oxygen Therapy Market. The preference for home-based care is rising due to its cost-effectiveness and convenience for patients. Technological advancements in portable and user-friendly oxygen therapy devices have made it feasible for patients to receive continuous care at home.

The national incidence of domiciliary oxygen therapy in Sweden increased from 3.9 to 14.7 per 100,000 population between 1987 and 2015, reflecting a broader global trend towards home-based treatment. This shift not only alleviates the burden on healthcare facilities but also enhances patient quality of life, further stimulating market growth.

Restraining Factors

High Cost of Oxygen Therapy Equipment

The high cost of oxygen therapy equipment is a significant barrier to the growth of the Oxygen Therapy Market. Advanced oxygen therapy devices, such as portable oxygen concentrators and liquid oxygen systems, come with substantial upfront costs, which can be prohibitive for many patients and healthcare providers. This financial burden is further exacerbated by the ongoing maintenance and replacement costs associated with these devices.

Home oxygen therapy equipment can cost thousands of dollars, making it inaccessible to a portion of the patient population, particularly in low- and middle-income countries. Consequently, the high cost limits widespread adoption, impacting the overall market expansion despite the growing demand for oxygen therapy solutions.

Regulatory and Reimbursement Challenges

Regulatory and reimbursement challenges also play a crucial role in shaping the Oxygen Therapy Market. Navigating the complex regulatory landscape requires manufacturers to comply with stringent safety and efficacy standards, which can delay the approval and market entry of new oxygen therapy devices.

Variations in regulatory requirements across different regions add another layer of complexity for global market players. For example, obtaining approval from the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA) involves rigorous clinical testing and documentation, which can be time-consuming and costly.

By Product Analysis

Oxygen Source Equipment accounts for 60% of the market.

In 2023, the Oxygen Source Equipment segment held a dominant market position in the By Product segment of the Oxygen Therapy Market, capturing more than a 60% share. This segment's prominence is driven by the critical role of oxygen source devices such as concentrators, cylinders, and liquid oxygen systems in delivering essential oxygen therapy to patients with respiratory disorders. The reliability, technological advancements, and widespread adoption of these devices have significantly contributed to their market leadership.

Oxygen Delivery Devices, another crucial segment, also showed robust growth, driven by the increasing prevalence of chronic respiratory diseases and the rising demand for efficient oxygen delivery mechanisms. Devices such as nasal cannulas, masks, and non-rebreather masks are essential for the effective administration of oxygen, ensuring patients receive the precise oxygen concentration required. The integration of smart technologies and improved ergonomic designs has further enhanced the usability and efficiency of these delivery devices, propelling their adoption in both homecare and clinical-trial-management system.

The oxygen therapy market's expansion is underpinned by the growing aging population, the rising incidence of chronic obstructive pulmonary disease (COPD) and other respiratory conditions, and the increasing awareness of home-based oxygen therapy benefits. The competitive landscape is characterized by continuous innovation, strategic collaborations, and the entry of new market players, all contributing to the dynamic growth trajectory of the oxygen source equipment and delivery devices segments. As healthcare systems worldwide continue to prioritize respiratory health, the market is poised for sustained growth, driven by ongoing advancements and the escalating need for effective oxygen therapy solutions.

By Application Analysis

COPD treatments make up 35% of the market's applications.

In 2023, COPD held a dominant market position in the By Application segment of the Oxygen Therapy Market, capturing more than a 35% share. This significant market share underscores the high prevalence and clinical burden of chronic obstructive pulmonary disease, which necessitates ongoing oxygen therapy for effective management. The increasing incidence of COPD, driven by factors such as aging populations and rising smoking rates, has propelled the demand for reliable oxygen therapy solutions, cementing this segment's leading position.

Other key applications in the oxygen therapy market include Lung Cancer, Asthma, Heart Failure, and various other respiratory and cardiac conditions. Lung Cancer, with its associated complications, requires comprehensive oxygen therapy management, driving steady demand in this segment. Asthma patients benefit from oxygen therapy during severe exacerbations, ensuring sufficient oxygenation and preventing respiratory failure. The Heart Failure segment also demonstrates significant growth potential, as oxygen therapy plays a vital role in alleviating symptoms and improving the quality of life for patients with advanced cardiac conditions.

The overall oxygen therapy market is influenced by the rising awareness of oxygen therapy benefits, technological advancements in delivery devices, and an increasing emphasis on home-based healthcare solutions. Innovations such as portable oxygen concentrators and enhanced delivery systems have improved patient compliance and expanded market reach. The dynamic interplay between these factors and the growing need for effective respiratory care solutions ensures a robust growth trajectory for the oxygen therapy market, particularly within the COPD application segment. As healthcare providers and patients continue to recognize the critical importance of oxygen therapy, the market is expected to witness sustained expansion and diversification.

By End-User Analysis

Hospitals are the primary end-users, representing 50% of the market.

In 2023, Hospitals held a dominant market position in the By End-User segment of the Oxygen Therapy Market, capturing more than a 50% share. This dominance is attributed to hospitals' critical role in providing comprehensive and acute care for patients requiring oxygen therapy, particularly in emergency and intensive care units. The advanced infrastructure, availability of skilled healthcare professionals, and integration of cutting-edge oxygen therapy devices in hospital settings have significantly contributed to this segment's leading position.

Specialty Clinics also play a crucial role in the oxygen therapy market, particularly for managing chronic respiratory conditions such as COPD, asthma, and lung cancer diagnostics. These clinics offer specialized and often outpatient care, which is essential for the ongoing management of patients who require long-term oxygen therapy. The increasing prevalence of chronic respiratory diseases and the shift towards specialized, patient-centric care models have driven growth in this segment. Furthermore, the adoption of portable and home-based oxygen therapy devices has enhanced the ability of specialty clinics to deliver tailored and continuous care to their patients.

The "Others" category, encompassing home care settings and long-term care facilities, has shown significant growth potential as well. The rise of home healthcare services, driven by the increasing preference for in-home treatment options and the advancements in portable oxygen therapy technologies, has expanded the market reach of this segment. Long-term care facilities also contribute to the market by providing essential oxygen therapy to elderly and chronically ill patients. Overall, the increasing focus on patient comfort, the shift towards decentralized healthcare delivery, and the continuous innovation in oxygen therapy devices are expected to drive sustained growth across all end-user segments of the oxygen therapy market.

Key Market Segments

By Product

- Oxygen Delivery Devices

- Oxygen Masks

- Nasal Cannulas

- Venturi Masks

- Non-rebreather Masks

- Other Oxygen Delivery Devices

- Oxygen Source Equipment

- Oxygen Concentrators

- PAP Devices

- Liquid Oxygen Devices

- Oxygen Cylinders

By Application

- Lung Cancer

- COPD

- Asthma

- Heart Failure

- Others

By End-User

- Hospitals

- Specialty Clinics

- Others

Growth Opportunity

Technological Advancements in Oxygen Delivery Systems

The global Oxygen Therapy Market is poised for significant growth in 2024, largely driven by technological advancements in oxygen delivery systems. Innovations such as portable oxygen concentrators, liquid oxygen systems, and smart oxygen therapy devices are revolutionizing patient care by offering more efficient, user-friendly, and mobile solutions.

The development of lightweight, compact, and battery-operated devices has enabled patients to maintain their mobility and lead more active lives while receiving continuous oxygen therapy. These advancements not only improve patient compliance and quality of life but also reduce the burden on healthcare facilities by supporting home-based care. Continued R&D in this area promises to introduce even more sophisticated and cost-effective solutions, further expanding the market.

Expansion in Emerging Markets

Emerging markets present a substantial growth opportunity for the Oxygen Therapy Market in 2024. Regions such as Asia Pacific, Latin America, and parts of Africa are experiencing rising incidences of respiratory diseases due to increasing urbanization, pollution, and smoking rates. Additionally, these regions are witnessing improvements in healthcare infrastructure and rising healthcare expenditure, which enhance the accessibility and affordability of oxygen therapy.

The national incidence of domiciliary oxygen therapy in Sweden increased from 3.9 to 14.7 per 100,000 population between 1987 and 2015, reflecting a global trend towards home-based treatment solutions. Companies that strategically invest in these emerging markets, by establishing local manufacturing units and distribution networks, stand to capitalize on the growing demand for oxygen therapy.

Latest Trends

Development of Portable Oxygen Concentrators

One of the most significant trends in the Oxygen Therapy Market for 2024 is the continued development and adoption of portable oxygen concentrators (POCs). These devices offer unparalleled mobility and convenience for patients requiring long-term oxygen therapy. Advances in battery life, weight reduction, and oxygen output efficiency are making POCs increasingly popular, particularly for patients who wish to maintain an active lifestyle.

Manufacturers are focusing on enhancing the portability and functionality of these devices, which not only improve patient compliance but also reduce healthcare costs by enabling more home-based care solutions. As the demand for mobility and independence grows among patients, POCs are expected to dominate the oxygen therapy landscape.

IoT in Oxygen Therapy Systems for Monitoring and Compliance

The integration of Internet of Things (IoT) technology into oxygen therapy systems is another pivotal trend expected to shape the market in 2024. IoT-enabled devices allow for real-time monitoring of patient oxygen levels, device performance, and usage patterns, which are crucial for ensuring effective and compliant therapy. These smart systems can alert healthcare providers to any deviations from prescribed therapy, enabling timely interventions and adjustments.

IoT technology facilitates remote monitoring and telehealth applications, aligning with the broader trend towards digital health solutions. By improving patient outcomes and adherence to therapy protocols, IoT in oxygen therapy enhances the overall effectiveness and efficiency of treatment.

Regional Analysis

North America leads with a 40% share of the market.

In 2023, the North America region held a dominant position in the Oxygen Therapy Market, capturing a significant 40% share. This leadership is driven by the high prevalence of respiratory diseases such as COPD and asthma, coupled with the region's advanced healthcare infrastructure and high healthcare expenditure. The United States, in particular, has a substantial patient pool requiring long-term oxygen therapy, contributing to the market's growth. Additionally, the presence of key market players and continuous innovation in oxygen therapy devices further bolster North America's market dominance.

Europe represents another crucial region in the oxygen therapy market, supported by a growing elderly population and increasing incidence of respiratory conditions. The adoption of home-based oxygen therapy solutions is also rising in Europe, driven by patient preference for non-hospital settings and the availability of portable oxygen concentrators.

The Asia Pacific region is witnessing rapid growth in the oxygen therapy market, attributed to the increasing healthcare awareness, rising healthcare expenditure, and expanding access to advanced medical technologies. The region's large population base and improving healthcare infrastructure present significant opportunities for market expansion. The Middle East & Africa and Latin America regions are also emerging as important markets, driven by improving healthcare facilities and rising awareness of oxygen therapy's benefits.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global oxygen therapy market in 2024 is poised for significant growth, driven by technological advancements, increasing prevalence of respiratory diseases, and rising healthcare expenditure. Key players in this market are expected to leverage their innovation capabilities, extensive product portfolios, and strategic partnerships to maintain and enhance their market positions.

Draegerwerk AG & Co. KGaA and Philips Respironics are anticipated to lead the market due to their strong global presence and continuous product innovations. Their focus on integrating advanced technologies such as AI and IoT into oxygen therapy devices is likely to set them apart in a competitive landscape.

Teleflex Medical GmBH and Vapotherm, Inc. are expected to expand their market share through targeted acquisitions and the development of specialized oxygen delivery solutions. Their emphasis on improving patient outcomes through innovative and user-friendly devices will drive their growth.

ResMed and Vyaire Medical, Inc. are positioned to capitalize on the increasing demand for home-based oxygen therapy solutions. With a robust pipeline of portable and wearable devices, these companies are well-suited to meet the needs of an aging population and the shift towards decentralized healthcare.

Fisher & Paykel Healthcare Corporation Ltd. and Hamilton Medical Inc. are likely to continue their strong performance by offering high-quality, reliable oxygen therapy systems. Their focus on research and development and maintaining rigorous quality standards will be key to sustaining their competitive edge.

Smaller players such as Armstrong Medical, Flexicare Medical, and Inspired Medical will likely drive niche market segments with specialized products and regional strategies. Companies like Intersurgical Inc., WILAMed GmBH, and Besmed Health Business Corp are anticipated to enhance their market presence through strategic collaborations and expanding their distribution networks.

Market Key Players

- Draegerwerk AG & Co. KGaA

- Teleflex Medical GmBH

- Philips Respironics

- Vapotherm, Inc.

- ResMed

- Vyaire Medical, Inc.

- Fisher & Paykel Corporation Ltd.

- Armstrong Medical

- Flexicare Medical

- Hamilton Medical Inc.

- Intersurgical Inc.

- Inspired Medical

- WILAMed GmBH

- Besmed Health Business Corp

Recent Development

- January 2024: Philips Respironics acquired Vesper Medical to expand its peripheral vascular offerings, enhancing integrated health solutions and patient care.

- September 2023: Fisher & Paykel collaborated with ResMed to develop and market advanced high-flow nasal cannulas, improving comfort and performance for respiratory care patients.

Report Scope

Report Features Description Market Value (2023) USD 36 Bn Forecast Revenue (2033) USD 73.5 Bn CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Oxygen Delivery Devices, Oxygen Source Equipment), By Application (Lung Cancer, COPD, Asthma, Heart Failure, Others), By End-User (Hospitals, Specialty Clinics, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Draegerwerk AG & Co. KGaA, Teleflex Medical GmBH, Philips Respironics, Vapotherm, Inc., ResMed, Vyaire Medical, Inc., Fisher & Paykel Corporation Ltd., Armstrong Medical, Flexicare Medical, Hamilton Medical Inc., Intersurgical Inc., Inspired Medical, WILAMed GmBH, Besmed Health Business Corp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Oxygen Therapy Market Overview

- 2.1. Oxygen Therapy Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Oxygen Therapy Market Dynamics

- 3. Global Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Oxygen Therapy Market Analysis, 2016-2021

- 3.2. Global Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 3.3. Global Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Oxygen Therapy Market Analysis by By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Oxygen Delivery Devices

- 3.3.4. Oxygen Source Equipment

- 3.4. Global Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Oxygen Therapy Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Lung Cancer

- 3.4.4. COPD

- 3.4.5. Asthma

- 3.4.6. Heart Failure

- 3.4.7. Others

- 3.5. Global Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 3.5.1. Global Oxygen Therapy Market Analysis by By End-User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 3.5.3. Hospitals

- 3.5.4. Specialty Clinics

- 3.5.5. Others

- 4. North America Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Oxygen Therapy Market Analysis, 2016-2021

- 4.2. North America Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 4.3. North America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Oxygen Therapy Market Analysis by By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Oxygen Delivery Devices

- 4.3.4. Oxygen Source Equipment

- 4.4. North America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Oxygen Therapy Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Lung Cancer

- 4.4.4. COPD

- 4.4.5. Asthma

- 4.4.6. Heart Failure

- 4.4.7. Others

- 4.5. North America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 4.5.1. North America Oxygen Therapy Market Analysis by By End-User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 4.5.3. Hospitals

- 4.5.4. Specialty Clinics

- 4.5.5. Others

- 4.6. North America Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Oxygen Therapy Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Oxygen Therapy Market Analysis, 2016-2021

- 5.2. Western Europe Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Oxygen Therapy Market Analysis by By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Oxygen Delivery Devices

- 5.3.4. Oxygen Source Equipment

- 5.4. Western Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Oxygen Therapy Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Lung Cancer

- 5.4.4. COPD

- 5.4.5. Asthma

- 5.4.6. Heart Failure

- 5.4.7. Others

- 5.5. Western Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 5.5.1. Western Europe Oxygen Therapy Market Analysis by By End-User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 5.5.3. Hospitals

- 5.5.4. Specialty Clinics

- 5.5.5. Others

- 5.6. Western Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Oxygen Therapy Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Oxygen Therapy Market Analysis, 2016-2021

- 6.2. Eastern Europe Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Oxygen Therapy Market Analysis by By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Oxygen Delivery Devices

- 6.3.4. Oxygen Source Equipment

- 6.4. Eastern Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Oxygen Therapy Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Lung Cancer

- 6.4.4. COPD

- 6.4.5. Asthma

- 6.4.6. Heart Failure

- 6.4.7. Others

- 6.5. Eastern Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 6.5.1. Eastern Europe Oxygen Therapy Market Analysis by By End-User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 6.5.3. Hospitals

- 6.5.4. Specialty Clinics

- 6.5.5. Others

- 6.6. Eastern Europe Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Oxygen Therapy Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Oxygen Therapy Market Analysis, 2016-2021

- 7.2. APAC Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Oxygen Therapy Market Analysis by By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Oxygen Delivery Devices

- 7.3.4. Oxygen Source Equipment

- 7.4. APAC Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Oxygen Therapy Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Lung Cancer

- 7.4.4. COPD

- 7.4.5. Asthma

- 7.4.6. Heart Failure

- 7.4.7. Others

- 7.5. APAC Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 7.5.1. APAC Oxygen Therapy Market Analysis by By End-User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 7.5.3. Hospitals

- 7.5.4. Specialty Clinics

- 7.5.5. Others

- 7.6. APAC Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Oxygen Therapy Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Oxygen Therapy Market Analysis, 2016-2021

- 8.2. Latin America Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Oxygen Therapy Market Analysis by By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Oxygen Delivery Devices

- 8.3.4. Oxygen Source Equipment

- 8.4. Latin America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Oxygen Therapy Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Lung Cancer

- 8.4.4. COPD

- 8.4.5. Asthma

- 8.4.6. Heart Failure

- 8.4.7. Others

- 8.5. Latin America Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 8.5.1. Latin America Oxygen Therapy Market Analysis by By End-User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 8.5.3. Hospitals

- 8.5.4. Specialty Clinics

- 8.5.5. Others

- 8.6. Latin America Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Oxygen Therapy Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Oxygen Therapy Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Oxygen Therapy Market Analysis, 2016-2021

- 9.2. Middle East & Africa Oxygen Therapy Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Oxygen Therapy Market Analysis by By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Oxygen Delivery Devices

- 9.3.4. Oxygen Source Equipment

- 9.4. Middle East & Africa Oxygen Therapy Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Oxygen Therapy Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Lung Cancer

- 9.4.4. COPD

- 9.4.5. Asthma

- 9.4.6. Heart Failure

- 9.4.7. Others

- 9.5. Middle East & Africa Oxygen Therapy Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 9.5.1. Middle East & Africa Oxygen Therapy Market Analysis by By End-User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 9.5.3. Hospitals

- 9.5.4. Specialty Clinics

- 9.5.5. Others

- 9.6. Middle East & Africa Oxygen Therapy Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Oxygen Therapy Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Oxygen Therapy Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Oxygen Therapy Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Oxygen Therapy Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Draegerwerk AG & Co. KGaA

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Teleflex Medical GmBH

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Philips Respironics

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Vapotherm, Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. ResMed

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Vyaire Medical, Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Fisher & Paykel Corporation Ltd.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Armstrong Medical

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Flexicare Medical

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Hamilton Medical Inc.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Intersurgical Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. WILAMed GmBH

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Besmed Health Business Corp

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Draegerwerk AG & Co. KGaA

- Teleflex Medical GmBH

- Philips Respironics

- Vapotherm, Inc.

- ResMed

- Vyaire Medical, Inc.

- Fisher & Paykel Corporation Ltd.

- Armstrong Medical

- Flexicare Medical

- Hamilton Medical Inc.

- Intersurgical Inc.

- Inspired Medical

- WILAMed GmBH

- Besmed Health Business Corp