Global Outsourced Software Testing Services Market By Type(Hardware, Software), By End User(BFSI, IT & Telecommunications, Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

12770

-

June 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

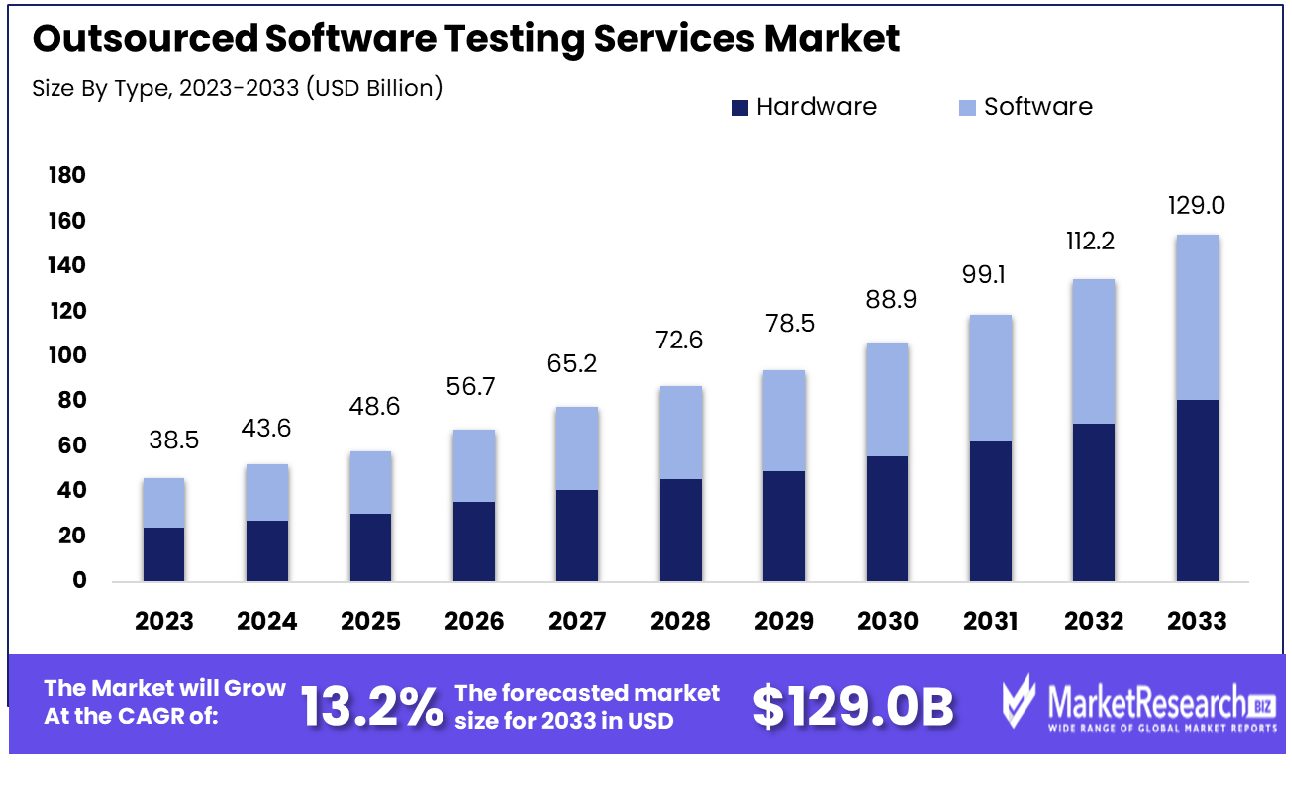

The Global Outsourced Software Testing Services Market was valued at USD 38.5 billion in 2023. It is expected to reach USD 129.0 billion by 2033, with a CAGR of 13.2% during the forecast period from 2024 to 2033.

The Outsourced Software Testing Services Market refers to the industry where businesses delegate their software testing activities to external, specialized service providers. This market encompasses a range of testing services, including functional, performance, security, and compliance testing, aimed at ensuring the quality and reliability of software applications.

Key drivers include the need for cost efficiency, access to advanced testing tools, and the expertise of third-party testers. Outsourcing allows companies to focus on core competencies while leveraging external expertise to enhance software quality, reduce time-to-market, and mitigate risks. This market is essential for companies seeking robust, scalable, and efficient software testing solutions.

The Outsourced Software Testing Services Market has experienced significant growth due to the increasing complexity of software applications and the necessity for reliable and efficient quality assurance (QA). This market is driven by the need for specialized testing capabilities that in-house teams often lack.

Companies are seeking to optimize their software development life cycle, reduce costs, and enhance product quality, leading to a growing demand for outsourced testing services. Furthermore, the proliferation of digital transformation initiatives across various industries has necessitated robust testing frameworks to ensure seamless functionality and user experience.

The global market for outsourced services, including QA outsourcing services, has seen remarkable expansion, reaching an impressive $92.5 billion. This substantial growth underscores the increasing reliance on third-party providers for specialized testing services. Within the broader IT outsourcing sector, which generated over $400 billion in revenue, QA outsourcing services play a pivotal role in ensuring software quality and performance.

The global software testing market itself, encompassing software quality assurance testing services, was valued at approximately $42.52 billion. This valuation reflects the critical importance of rigorous testing processes in the software development lifecycle.

The competitive landscape of the outsourced software testing services market is characterized by the presence of numerous players offering a diverse range of services, from functional and performance testing to security and compliance testing. The market is also witnessing a trend towards the adoption of advanced testing methodologies such as automated testing, AI-driven testing, and continuous integration/continuous deployment (CI/CD) pipelines.

Key Takeaways

- Market Growth: The Global Outsourced Software Testing Services Market was valued at USD 38.5 billion in 2023. It is expected to reach USD 129.0 billion by 2033, with a CAGR of 13.2% during the forecast period from 2024 to 2033.

- By Type: Software dominated the market, accounting for 60% of the total share.

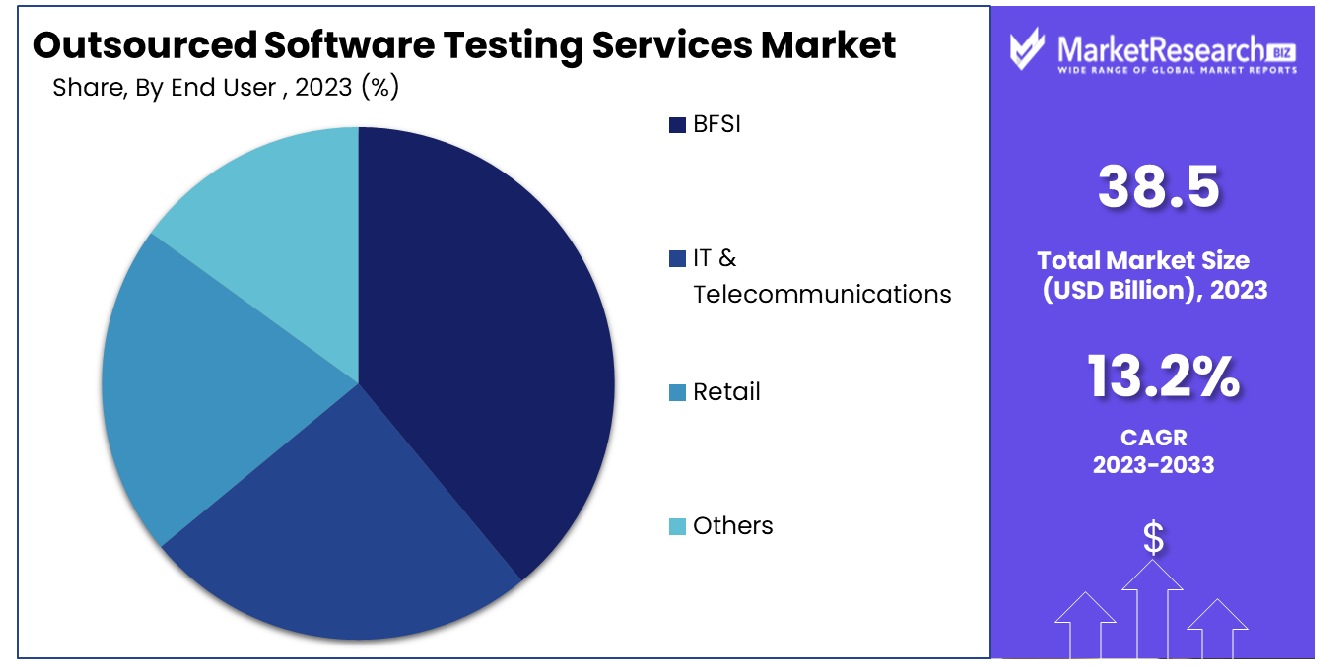

- By End User: The BFSI sector led with a 28% share in market adoption.

- Regional Dominance: North America holds 36.1% of the outsourced software testing services market.

- Growth Opportunity: The global outsourced software testing services market in 2023 will grow due to AI-driven automation and specialized testing services like usability, performance, and security, meeting evolving software development demands.

Driving factors

Capacity to Concentrate on Core Capabilities

The ability to concentrate on core capabilities significantly drives the growth of the Outsourced Software Testing Services Market. By outsourcing testing activities, companies can focus on their primary business functions, such as development and innovation, rather than allocating resources to non-core tasks. This strategic allocation allows organizations to enhance productivity and efficiency, fostering a competitive edge.

According to a survey by Deloitte, 59% of businesses outsource to reduce operational costs and focus on core activities, underscoring the importance of this factor. By delegating software testing to specialized firms, businesses can leverage expert knowledge and advanced tools, ensuring higher quality and reliability of their software products. This focus on core competencies and improved product quality ultimately drives market demand for outsourced testing services.

Increasingly Sophisticated Software Applications

The growing complexity and sophistication of software applications propel the need for outsourced software testing services. As software systems become more intricate, integrating various functionalities and technologies, the testing processes required to ensure their reliability and performance also become more complex. Specialized testing services are crucial to address these advanced needs, offering expertise in areas such as automated testing, security testing, and performance testing.

The International Data Corporation (IDC) predicts that global spending on digital transformation will reach $2.3 trillion by 2023, highlighting the rapid evolution and sophistication of software applications. This trend necessitates comprehensive testing solutions that outsourced providers are well-equipped to deliver, thereby driving market growth.

Growing Demand for Cloud-Based Services

The rising adoption of cloud-based services is another critical driver for the outsourced software testing services market. Cloud computing offers scalable and flexible testing environments, reducing the need for substantial investments in physical infrastructure. This shift allows companies to perform extensive testing efficiently and cost-effectively.

Cloud-based testing services enable continuous integration and continuous deployment (CI/CD) practices, enhancing the speed and quality of software delivery. The scalability and flexibility provided by cloud platforms make outsourced testing services an attractive option, thus contributing significantly to market expansion.

Restraining Factors

Security and Data Protection Concerns

Security and data protection concerns significantly restrain the growth of the Outsourced Software Testing Services Market. As companies outsource their software testing, they must share sensitive and proprietary information with third-party vendors. This data exchange raises significant risks related to data breaches, unauthorized access, and information leakage. The increasing frequency of cyber-attacks and data breaches intensifies these concerns, prompting companies to reconsider outsourcing decisions.

For instance, according to a report by IBM, the average cost of a data breach in 2021 was $4.24 million, highlighting the financial risks associated with inadequate data protection. These security challenges necessitate robust measures and compliance with data protection regulations, which can be resource-intensive and complicated to implement. Consequently, some organizations might hesitate to outsource their testing services, fearing potential security vulnerabilities, thereby restraining market growth.

Data Transfer and Storage Issues

Data transfer and storage issues further impede the expansion of the Outsourced Software Testing Services Market. The transfer of large volumes of test data across geographical boundaries can lead to latency, bandwidth limitations, and compliance with varying international data transfer regulations. These challenges complicate the seamless exchange of information required for effective testing. Additionally, the storage of test data on external servers poses risks related to data integrity and availability.

Companies must ensure that their data remains secure and accessible, adhering to regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Compliance with these regulations often requires significant investment in secure infrastructure and processes, adding to the overall costs of outsourcing. These data-related challenges can deter organizations from fully embracing outsourced software testing services, thereby constraining market growth.

By Type Analysis

Software dominated the market with a 60% share, showcasing its critical role and popularity.

In 2023, Software held a dominant market position in the "By Type" segment of the Outsourced Software Testing Services Market, capturing more than a 60% share. This dominance is attributed to the increased reliance on software solutions for ensuring high-quality and reliable software products in various industries.

The growing complexity of software applications, coupled with the rising demand for seamless integration and functionality across different platforms, has driven the adoption of outsourced software testing services. This segment is expected to continue its leadership due to ongoing advancements in software development methodologies and the increasing focus on delivering superior user experiences.

The hardware segment, while smaller in comparison, also plays a crucial role in the outsourced software testing services market. In 2023, the hardware segment accounted for a significant portion of the market, primarily driven by the need for rigorous testing of hardware components to ensure their compatibility and performance with various software applications.

The rise of the Internet of Things (IoT) and the proliferation of connected devices have further underscored the importance of hardware testing services. As industries continue to innovate with new hardware technologies, the demand for specialized hardware testing services is projected to grow steadily.

The overall market growth is propelled by the increasing complexity of IT infrastructure, necessitating comprehensive testing solutions to mitigate risks and ensure optimal performance. Companies are outsourcing their testing services to leverage specialized expertise, reduce operational costs, and accelerate time-to-market for their products.

The ongoing digital transformation across sectors such as healthcare, finance, and retail is expected to fuel further growth in the outsourced software testing services market. Moreover, advancements in automation and artificial intelligence (AI) are anticipated to enhance the efficiency and accuracy of testing processes, thereby driving the market forward.

By End User Analysis

The BFSI sector led with a 28% share, highlighting its significant demand and influence.

In 2023, BFSI held a dominant market position in the "By End User" segment of the Outsourced Software Testing Services Market, capturing more than a 28% share. The dominance of the BFSI (Banking, Financial Services, and Insurance) sector can be attributed to the critical need for high-quality software solutions that ensure security, compliance, and seamless customer experience.

Financial institutions are increasingly outsourcing their software testing to manage the complexities of regulatory requirements, cybersecurity threats, and the integration of advanced technologies such as blockchain and AI. The demand for rigorous testing to mitigate risks and ensure the reliability of financial applications has significantly driven the adoption of outsourced software testing services in this sector.

The IT & Telecommunications sector also represents a substantial portion of the market. In 2023, this segment accounted for a significant share, driven by the rapid evolution of communication technologies and the need for robust software testing to support seamless connectivity and data management. The proliferation of 5G technology and the expansion of cloud computing services have heightened the necessity for comprehensive testing solutions to ensure network reliability and performance.

The retail sector, marked by its growing e-commerce presence and digital transformation, has also embraced outsourced software testing services. Retailers are increasingly focusing on providing a seamless and secure shopping experience, necessitating the thorough testing of their software applications. This segment is expected to witness steady growth as retail companies continue to innovate and expand their digital capabilities.

Key Market Segments

By Type

- Hardware

- Software

By End User

- BFSI

- IT & Telecommunications

- Retail

- Others

Growth Opportunity

Artificial Intelligence (AI) and Automation Tools

The integration of artificial intelligence (AI) and automation tools represents a significant growth opportunity for the global outsourced software testing services market in 2023. AI-driven testing solutions are transforming traditional testing methodologies by enhancing accuracy, reducing time-to-market, and lowering costs. These tools can efficiently manage repetitive tasks, identify patterns, and predict potential defects, thereby improving overall testing quality. The adoption of AI in testing is expected to accelerate as organizations increasingly seek to leverage machine learning algorithms for predictive analytics and anomaly detection.

Furthermore, automation tools streamline the testing process, allowing for continuous integration and continuous deployment (CI/CD) practices, which are critical for agile development environments. This shift towards AI and automation is anticipated to drive substantial growth in the outsourced software testing market, as vendors offer more sophisticated and efficient testing solutions to meet the evolving demands of the software development lifecycle.

Specialized Testing Services (Usability, Performance, Security)

The demand for specialized testing services, including usability, performance, and security testing, is poised to grow in 2023. Usability testing ensures that software applications provide an intuitive and user-friendly experience, which is increasingly important as user expectations rise. Performance testing is crucial for identifying and addressing bottlenecks that could affect an application's speed and reliability under various conditions. With the increasing frequency and sophistication of cyber threats, security testing has become a top priority for organizations to protect their data and systems.

These specialized services require expertise and advanced tools, which many organizations find cost-prohibitive to develop in-house. Consequently, the outsourcing of these services to specialized providers is expected to increase, driving market growth. Providers that can offer comprehensive, high-quality testing services across these areas will be well-positioned to capitalize on this trend, ensuring robust and secure software solutions for their clients.

Latest Trends

Increased Use of Test Automation Tools

In 2023, the global outsourced software testing services market is experiencing a significant trend toward the increased use of test automation tools. Automation tools are being broadly adopted to enhance testing efficiency, coverage, and accuracy. These tools allow for the rapid execution of large volumes of tests, enabling continuous integration and continuous delivery (CI/CD) processes essential for agile and DevOps methodologies. By automating repetitive and time-consuming tasks, organizations can allocate more resources to complex and critical testing activities.

The rise of AI-powered automation tools further augments this trend, offering predictive analytics and intelligent defect detection capabilities. This shift towards automation not only accelerates the development lifecycle but also reduces costs and human error, leading to higher-quality software releases. As companies strive to meet the growing demands for faster and more reliable software, the adoption of test automation tools is expected to remain a key driver of market growth.

Demand for Specialized Testing Services

The demand for specialized testing services is another prominent trend in the 2023 global outsourced software testing services market. As software applications become more complex and diverse, there is a growing need for niche testing services that address specific requirements such as mobile, usability, and accessibility testing. Mobile testing is critical as mobile applications proliferate, requiring rigorous validation across various devices and operating systems. Usability testing ensures that applications are user-friendly and intuitive, enhancing user satisfaction and engagement.

Accessibility testing is increasingly important to ensure compliance with global standards and regulations, making software accessible to users with disabilities. Outsourcing these specialized services to experts with advanced tools and methodologies allows organizations to achieve higher quality and compliance without significant in-house investment. This trend towards specialized testing services highlights the evolving complexity of software applications and the need for targeted expertise to ensure optimal performance, user experience, and accessibility.

Regional Analysis

North America holds a significant 36.1% share of the outsourced software testing services market in 2023.

The global outsourced software testing services market exhibits distinct regional trends and dynamics, reflecting the varying degrees of technology adoption, economic development, and industry practices across different geographies. North America stands out as the dominant region, holding 36.1% of the market share. This dominance can be attributed to the high concentration of technology-driven enterprises and the widespread adoption of advanced software solutions.

The presence of key market players and a robust IT infrastructure further bolster North America's leading position. The region's emphasis on quality assurance and the increasing complexity of software systems drive the demand for outsourced testing services. Additionally, stringent regulatory standards and the need for cost-effective testing solutions are significant growth factors.

In Europe, the outsourced software testing services market is characterized by steady growth, driven by the region's strong industrial base and the widespread adoption of digital transformation initiatives. Countries such as Germany, the United Kingdom, and France are at the forefront, contributing significantly to the market. The European market benefits from a well-established IT sector and a growing trend of nearshoring, where companies prefer outsourcing to nearby countries to mitigate cultural and time zone differences. Regulatory compliance and data privacy laws in Europe, such as GDPR, necessitate rigorous software testing, thereby fueling market demand.

The Asia Pacific region is experiencing rapid growth in the outsourced software testing services market, driven by the proliferation of IT services and the presence of a vast talent pool in countries like India and China. The cost advantages offered by these countries make Asia Pacific a preferred outsourcing destination for global enterprises. The increasing adoption of mobile and web applications, along with the expansion of e-commerce and digital services, contributes to the region's market expansion. Furthermore, government initiatives promoting digitalization and IT development play a crucial role in enhancing the market's growth prospects.

In the Middle East & Africa, the outsourced software testing services market is gradually gaining traction, supported by the growing adoption of technology and digital solutions across various sectors. Countries such as the United Arab Emirates and South Africa are leading the charge, with increasing investments in IT infrastructure and a focus on improving software quality. The region's evolving regulatory landscape and the need for cost-efficient testing solutions are driving the demand for outsourced services.

Latin America presents a promising outlook for the outsourced software testing services market, with Brazil and Mexico being key contributors. The region's growing IT sector, coupled with the increasing adoption of digital transformation strategies by enterprises, underpins market growth. The availability of a skilled workforce and competitive cost structures make Latin America an attractive outsourcing destination. Additionally, the region's focus on improving software quality and adhering to international standards further propels the market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global outsourced software testing services market in 2023 showcases a diverse array of key players, each contributing uniquely to market dynamics through innovation, strategic acquisitions, and expansive service portfolios. Among the prominent entities, HCL Technologies Limited and Wipro Limited leverage their vast IT service ecosystems, offering comprehensive testing solutions integrated with advanced technologies like AI and machine learning development, thereby enhancing efficiency and reducing time-to-market.

Hewlett Packard Enterprise (HPE) and IBM Corporation maintain their stronghold through continuous advancements in cloud-based testing environments and AI-driven analytics, ensuring robust quality assurance processes. Their extensive global networks facilitate seamless service delivery across multiple geographies, catering to diverse client needs.

Accenture Plc and Cognizant Solutions Corp stand out with their consultative approaches, combining domain expertise with innovative testing frameworks to address complex business challenges. Their strategic investments in digital transformation initiatives bolster their positions as leaders in the market.

Capgemini SE and Atos SE capitalize on their extensive experience in digital and cloud services, offering tailored testing solutions that meet the evolving demands of industries undergoing digital transformation. Their focus on sustainability and cybersecurity further enhances their competitive edge.

Emerging players like Cigniti Technologies Limited and ThinkSoft are gaining traction by specializing in niche testing services and offering high-quality, cost-effective solutions to a global clientele. Sutherland Services, Inc. and Mindtree emphasize customer-centric approaches, utilizing agile methodologies to deliver timely and effective testing services.

Tech Mahindra Limited and Larsen & Toubro Limited are leveraging their engineering prowess to provide end-to-end testing solutions, integrating new-age technologies such as blockchain and IoT, thereby addressing the growing demand for comprehensive testing frameworks.

Market Key Players

- HCL Technologies Limited

- Logica

- Hewlett Packard Enterprise

- ThinkSoft

- Larsen & Toubro Limited

- Accenture Plc

- Cigniti Technologies Limited

- Sutherland Servies, Inc.

- Mindtree

- Capgemini SE

- Tech Mahindra Limited

- Atos SE

- IBM Corporation

- CGI Inc.

- Software Quality Systems

- Wipro Limited Amdocs

- Cognizant Solutions Corp

Recent Development

- In June 2024, Inspired Testing appointed a Software Testing Architecture Team led by CTO Leon Lodewyks, aiming to deliver bespoke testing solutions and stay ahead of industry trends, enhancing client services and test maturity.

- In July 2023, HCL Group plans a $300 million semiconductor venture, focusing on assembly, testing, marking, and packaging (ATMP) units, aligning with India's semiconductor initiative to reduce reliance on Northeast Asia.

Report Scope

Report Features Description Market Value (2023) USD 38.5 Billion Forecast Revenue (2033) USD 129.0 Billion CAGR (2024-2032) 13.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Hardware, Software), By End User(BFSI, IT & Telecommunications, Retail, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape HCL Technologies Limited, Logica, Hewlett Packard Enterprise, ThinkSoft, Larsen & Toubro Limited, Accenture Plc, Cigniti Technologies Limited, Sutherland Servies, Inc., Mindtree, Capgemini SE, Tech Mahindra Limited, Atos SE, IBM Corporation, CGI Inc., Software Quality Systems, Wipro Limited Amdocs, Cognizant Solutions Corp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- HCL Technologies Limited

- Logica

- Hewlett Packard Enterprise

- ThinkSoft

- Larsen & Toubro Limited

- Accenture Plc

- Cigniti Technologies Limited

- Sutherland Servies, Inc.

- Mindtree

- Capgemini SE

- Tech Mahindra Limited

- Atos SE

- IBM Corporation

- CGI Inc.

- Software Quality Systems

- Wipro Limited Amdocs

- Cognizant Solutions Corp