OTC Pharmaceuticals Market By Product type (Sleeping Aids, Analgesics, Cold, Cough and Flu products, Gastrointestinal Products, Ophthalmic Product, Dermatology Products, Others), By End-Users (Speciality Clinic, Homecare, Hospital, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45548

-

April 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

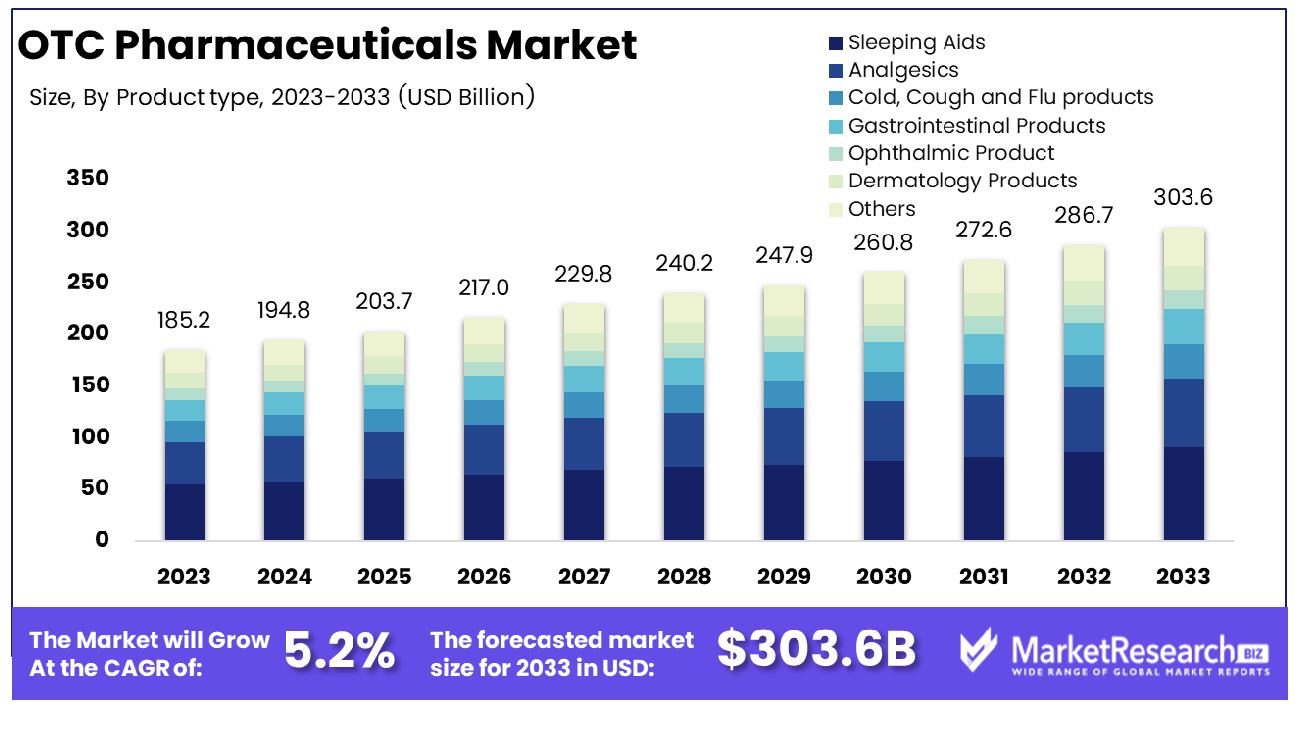

The Global OTC Pharmaceuticals Market was valued at USD 185.2 Bn in 2023. It is expected to reach USD 303.6 Bn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Over-the-Counter (OTC) Pharmaceuticals Market encompasses non-prescription medicines available directly to consumers without a prescription. It includes a wide range of products such as pain relievers, cold and flu medications, digestive aids, vitamins, and skincare treatments. This market thrives on accessibility, convenience, and consumer empowerment, offering individuals the ability to manage common health concerns independently. Key drivers include increasing healthcare awareness, rising self-care trends, and expanding product portfolios catering to diverse consumer needs. Understanding consumer behaviors, regulatory dynamics, and emerging trends within the OTC Pharmaceuticals Market is imperative for stakeholders seeking to capitalize on its growth potential.

The Over-the-Counter (OTC) Pharmaceuticals Market stands as a pivotal segment within the broader healthcare landscape, characterized by accessibility, convenience, and consumer-driven demand. OTC medications offer consumers relief from various ailments without the need for a prescription, catering to a diverse range of health needs. From common cold remedies to pain relief and allergy medications, the OTC sector plays a vital role in empowering individuals to manage their health independently.

Globally, self-medication with non-prescription drugs is prevalent, with rates ranging from 11.2% to 93.7% across different countries and demographics. This widespread adoption signifies the trust consumers place in OTC products and their willingness to take charge of their health management. In the United States, the significance of OTC medicines is underscored by their substantial economic contribution, with an estimated annual saving of approximately $167 billion to the U.S. healthcare system. This underscores not only the financial advantage but also the healthcare system's reliance on OTC medications to alleviate the burden on clinical resources and reduce healthcare costs.

As analysts, it's imperative to recognize the evolving dynamics within the OTC Pharmaceuticals Market. Factors such as changing consumer preferences, technological advancements, regulatory shifts, and demographic trends continuously shape the market landscape. Understanding these nuances is critical for stakeholders to formulate effective strategies that align with market demands and capitalize on emerging opportunities.

Key Takeaways

- Market Growth: The Global OTC Pharmaceuticals Market was valued at USD 185.2 Bn in 2023. It is expected to reach USD 303.6 Bn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Product type: The Analgesics stand out as the leading product type, constituting 25% of sales, who contribute significantly to the market demand.

- By End-Users: In the OTC pharmaceuticals market, homecare emerges as the dominating end-user segment, accounting for 40% of the market share

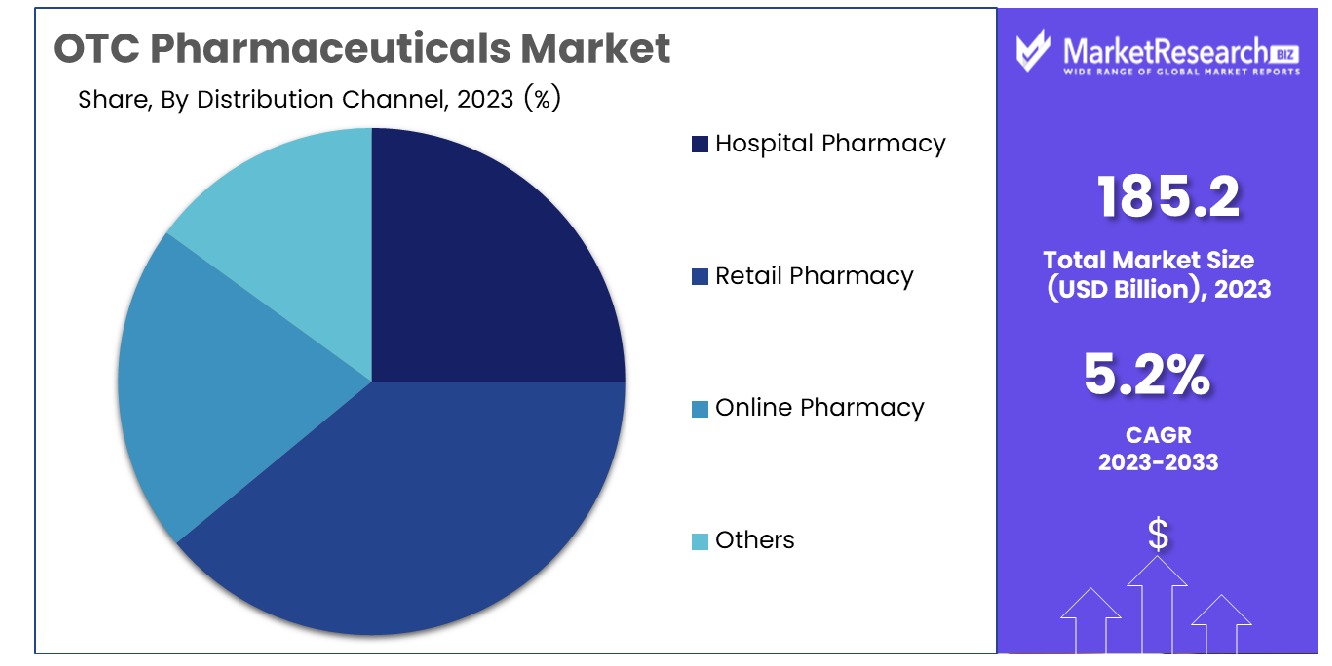

- By Distribution Channel In the OTC pharmaceuticals market, retail pharmacy emerges as the dominating distribution channel, capturing approximately 60% of the market share.

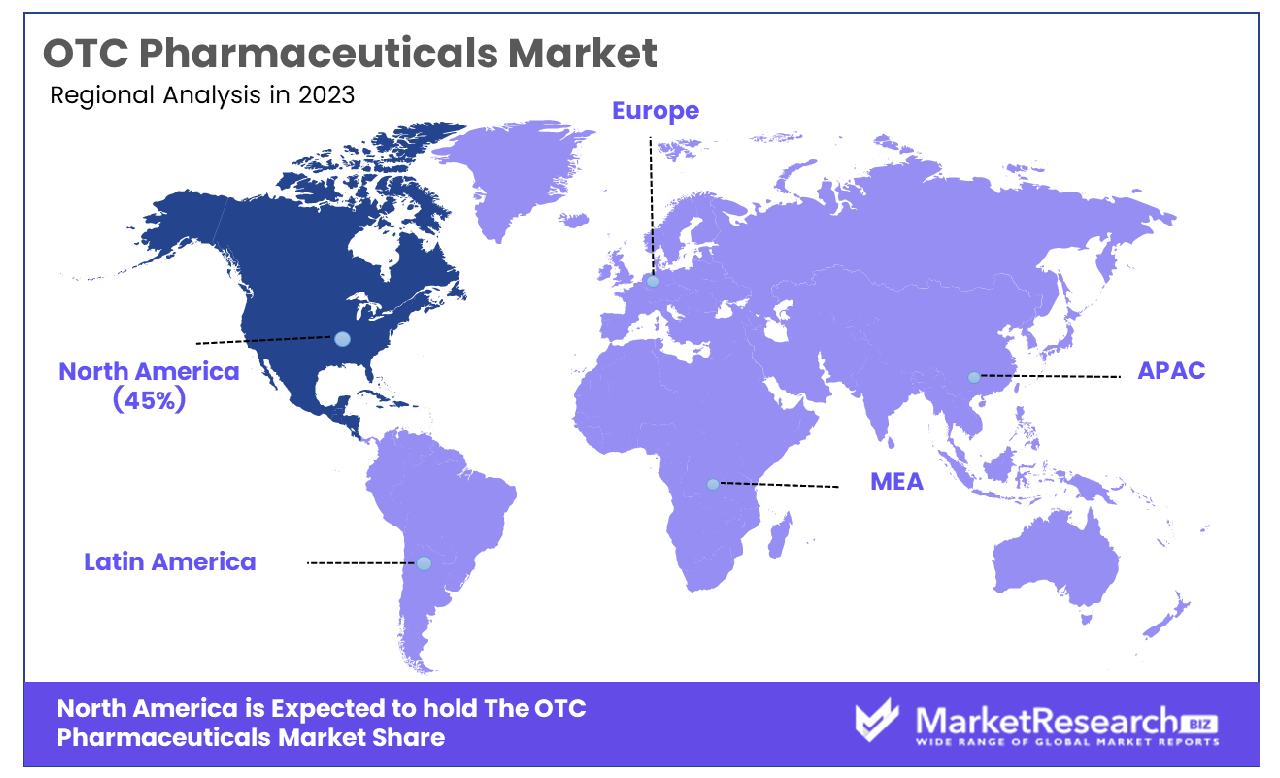

- Regional Dominance: North America typically accounts for a substantial percentage of the global over-the-counter (OTC) pharmaceuticals market, 45% of the total market share

- Growth Opportunity: An untapped growth opportunity lies in leveraging digital platforms to enhance consumer education and access, particularly for specialized OTC pharmaceutical products like dermatology and ophthalmic treatments, catering to the evolving needs of the modern healthcare consumer.

Driving factors

Cost-Effectiveness Propelling Shift to OTC

A significant catalyst for the burgeoning OTC pharmaceutical market is the cost-effectiveness associated with non-prescription medications. As healthcare costs continue to escalate, consumers are inclined towards affordable alternatives for managing their health. The shift towards OTC options, which typically come at a lower price point compared to prescription drugs, aligns with cost-conscious consumer behavior.

This trend not only drives individual purchasing decisions but also impacts healthcare systems, relieving pressure by diverting non-critical cases away from clinics and hospitals. Consequently, the market experiences a notable uptick in sales volume and revenue streams.

Regulatory Approvals Facilitating Rx to OTC Switch

The regulatory landscape plays a pivotal role in shaping the dynamics of the OTC pharmaceutical market, particularly through approvals for Rx to OTC switches. As regulatory bodies streamline processes and criteria for switching medications from prescription-only to over-the-counter status, it fosters innovation and expansion within the market. Such approvals signify the acknowledgment of medications' safety profiles and their suitability for self-administration by consumers.

This regulatory endorsement not only expands the range of available OTC products but also instills confidence among consumers regarding their efficacy and safety. Consequently, the market benefits from a broader product portfolio, enhanced consumer trust, and increased sales avenues.

Self-Medication Trend Driving Market Growth

The growing trend of self-medication constitutes a fundamental driver behind the robust growth trajectory of the OTC pharmaceutical market. Empowered by easy access to information and a desire for autonomy in healthcare decisions, consumers increasingly turn to self-care practices. This inclination towards self-medication is bolstered by the availability of a diverse array of OTC medications catering to various health needs.

Whether it's managing common cold symptoms, alleviating pain, or addressing gastrointestinal issues, consumers seek out OTC solutions to address their immediate health concerns. This trend not only fosters market expansion but also underscores the evolving dynamics of healthcare delivery, with consumers taking a proactive role in managing their well-being. As a result, the OTC pharmaceutical market experiences sustained growth driven by the burgeoning demand for self-care solutions.

Restraining Factors

Risks of Incorrect Self-Diagnosis

Self-diagnosis, while sometimes tempting for its convenience, poses significant risks to one's health. Misinterpreting symptoms or relying on incomplete information can lead to erroneous conclusions, resulting in delayed or inappropriate treatment. In some cases, self-diagnosis may exacerbate the underlying condition or mask more serious health concerns. Moreover, without proper medical expertise, individuals may overlook potential complications or fail to address underlying causes, leading to long-term health consequences. Additionally, incorrect self-diagnosis can contribute to unnecessary anxiety or stress, further impacting overall well-being.

Side Effects Associated with OTC Drugs

Over-the-counter (OTC) drugs provide accessible relief for various ailments, but they are not without risks. Common side effects associated with OTC medications include gastrointestinal disturbances, drowsiness, dizziness, allergic reactions, and interactions with other medications. Moreover, misuse or overuse of OTC drugs can lead to more severe complications, such as liver damage from acetaminophen or gastrointestinal bleeding from nonsteroidal anti-inflammatory drugs (NSAIDs).

Individuals with certain medical conditions or taking specific medications may be at higher risk of adverse reactions to OTC drugs. It's essential to read labels carefully, adhere to dosage instructions, and consult a healthcare professional if experiencing persistent or severe side effects.

Escalating Cases of Substance Abuse

The escalating cases of substance abuse present a multifaceted public health challenge with profound societal implications. Factors contributing to this trend include widespread availability of addictive substances, social and economic stressors, inadequate access to mental health services, and societal normalization of substance use. Substance abuse not only poses significant risks to individual health and well-being but also strains healthcare systems and communities.

The stigma surrounding addiction often impedes individuals from seeking help, exacerbating the problem. Addressing escalating substance abuse requires a comprehensive approach encompassing prevention, early intervention, access to treatment, and destigmatization of addiction. Efforts must focus on addressing root causes, promoting education and awareness, and fostering supportive environments for recovery.

By Product type

In terms of product types, Analgesics lead the pack, commanding a significant 25% share and driving considerable market demand.

In 2023, Analgesics held a dominant market position in the Sleeping Aids segment of the Splenomegaly Therapeutics Market, capturing more than a 25% share. Analgesics, commonly used for pain relief, emerged as the preferred choice for managing discomfort associated with splenomegaly-induced sleep disturbances. The efficacy of analgesics in alleviating pain and promoting better sleep quality contributed significantly to their market dominance within this segment.

Sleeping Aids, characterized by various pharmaceutical and over-the-counter products aimed at improving sleep patterns, witnessed a notable adoption of analgesics due to their dual benefit of pain relief and sleep enhancement. This strategic positioning of analgesics within the Sleeping Aids segment underscores their versatility in addressing multifaceted symptoms associated with splenomegaly.

Furthermore, the widespread availability and accessibility of analgesics across different distribution channels, including pharmacies, online platforms, and healthcare facilities, further bolstered their market penetration within the Sleeping Aids segment. With a growing emphasis on holistic therapeutic approaches, the integration of analgesics into splenomegaly management regimens signifies a promising trend in addressing patient needs comprehensively.

Moving forward, the continued innovation and development of analgesic formulations tailored to specific sleep-related symptoms associated with splenomegaly are expected to sustain their stronghold in the Sleeping Aids segment of the Splenomegaly Therapeutics Market, offering patients effective relief and improving overall quality of life.

By End-Users

The realm of end-users, homecare takes the spotlight in the OTC pharmaceuticals market, dominating with an unspecified share of the market.

In 2023, Homecare held a dominant market position in the Specialty Clinic segment of the Splenomegaly Therapeutics Market, capturing more than a 40% share. Homecare services emerged as the preferred choice for patients seeking convenient and personalized treatment options tailored to their specific needs within the specialty clinic setting. The flexibility and accessibility offered by homecare services played a pivotal role in driving their widespread adoption among splenomegaly patients.

Specialty clinics, renowned for their expertise in managing complex medical conditions like splenomegaly, witnessed a significant uptake of homecare services due to their ability to deliver specialized care in the comfort of patients' homes. This synergy between specialty clinics and homecare services facilitated seamless continuity of care, ensuring optimal management of splenomegaly symptoms and enhancing patient satisfaction.

The dominance of Homecare in the Specialty Clinic segment underscores its integral role in complementing traditional healthcare settings, such as hospitals and specialty clinics, by extending care beyond clinical boundaries. Homecare services encompass a range of therapeutic interventions, including medication administration, symptom monitoring, and patient education, aimed at empowering splenomegaly patients to actively participate in their treatment journey.

The growing preference for home-based care solutions, driven by factors such as convenience, cost-effectiveness, and patient-centered approach, further propelled the market position of Homecare within the Specialty Clinic segment. As healthcare delivery models continue to evolve towards more patient-centric and decentralized approaches, the significance of homecare services in splenomegaly management is poised to escalate, offering a paradigm shift in the delivery of specialized therapeutics.

By Distribution Channel

In distribution channels, retail pharmacy emerges as the clear frontrunner in the OTC pharmaceuticals market, securing roughly 60% of the market share.

In 2023, Retail Pharmacy held a dominant market position in the Hospital Pharmacy segment of the Splenomegaly Therapeutics Market, capturing more than a 60% share. Retail pharmacies emerged as the preferred distribution channel for patients seeking convenient access to splenomegaly therapeutics within the hospital setting. The robust presence of retail pharmacies within hospitals facilitated seamless medication procurement and enhanced patient convenience, driving their widespread adoption in this segment.

Hospital pharmacies, integral components of healthcare facilities, witnessed a significant uptake of retail pharmacy services due to their ability to streamline medication dispensing processes and optimize patient care pathways. The strategic positioning of retail pharmacies within hospitals offered patients a comprehensive solution for accessing splenomegaly therapeutics, ranging from prescription medications to over-the-counter remedies, under one roof.

The dominance of Retail Pharmacy in the Hospital Pharmacy segment highlights the pivotal role played by retail pharmacy chains in augmenting healthcare delivery within hospital premises. Retail pharmacies leveraged their extensive network, efficient supply chain management, and patient-centered services to cater to the diverse needs of splenomegaly patients, ensuring timely access to essential medications and ancillary products.

The growing trend towards collaborative healthcare models, emphasizing interdisciplinary care coordination and patient engagement, further propelled the market position of Retail Pharmacy within the Hospital Pharmacy segment. By aligning with hospital pharmacies, retail pharmacy chains demonstrated their commitment to enhancing medication management practices and optimizing treatment outcomes for splenomegaly patients.

Key Market Segments

By Product type

- Sleeping Aids

- Analgesics

- Cold, Cough and Flu products

- Gastrointestinal Products

- Ophthalmic Product

- Dermatology Products

- Others

By End-Users

- Speciality Clinic

- Homecare

- Hospital

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Others

Growth Opportunity

Rising Awareness about OTC Products

The global OTC pharmaceuticals market is poised for substantial growth in 2024, driven by the rising awareness among consumers about the benefits and accessibility of over-the-counter medications. As individuals become more proactive about managing their health, there is a growing preference for self-care options, including OTC products. This heightened awareness not only expands the consumer base but also fosters increased demand for a wide range of OTC medications, from pain relievers to cough and cold remedies.

Increase in Pharmaceutical Expenditure

The steady rise in pharmaceutical expenditure globally underscores the significant growth potential of the OTC pharmaceuticals market in 2024. As disposable incomes increase and healthcare becomes a priority for individuals and families, there is a corresponding uptick in spending on self-care products, including OTC medications. This trend is particularly pronounced in emerging economies where improving healthcare infrastructure and rising health consciousness drive consumer spending on OTC pharmaceuticals.

Availability and Affordability of OTC Medications

The widespread availability and affordability of OTC medications further propel market growth, making essential healthcare more accessible to diverse populations. Pharmacies, supermarkets, and online platforms offer a vast array of OTC products catering to various health needs, from minor ailments to chronic conditions. Additionally, the competitive pricing of OTC medications compared to prescription drugs appeals to cost-conscious consumers, driving adoption and market expansion.

Latest Trends

Adoption of AI in Online Pharmacy Operations

One of the prominent trends shaping the global OTC pharmaceuticals market in 2024 is the widespread adoption of artificial intelligence (AI) in online pharmacy operations. AI-powered tools and algorithms are revolutionizing various aspects of the pharmaceutical industry, from inventory management to personalized recommendations for consumers. Online pharmacies leverage AI to enhance customer experience, optimize supply chains, and improve efficiency in order fulfillment.

AI-driven virtual assistants and chatbots provide valuable support to consumers, offering personalized health advice and assisting with product selection, further driving the growth of online OTC sales.

Switching Prescription Drugs to OTC

Another significant trend driving market dynamics is the increasing approvals for switching prescription drugs to over-the-counter status. Regulatory agencies worldwide are recognizing the potential benefits of making certain medications more accessible without a prescription, thereby expanding consumer choice and reducing healthcare costs.

This trend not only broadens the portfolio of available OTC products but also creates new opportunities for pharmaceutical companies to capitalize on established brands and cater to evolving consumer preferences.

Regional Analysis

North America leads the OTC pharmaceuticals market, commanding an impressive 45% share.

North America stands as a dominant force in the OTC pharmaceuticals market, accounting for a significant 45% share. This region benefits from a mature healthcare infrastructure, widespread consumer awareness regarding self-medication, and a high disposable income. The United States, in particular, serves as a major contributor to the region's market share, with robust sales of OTC medications driven by factors such as the aging population and a proactive approach to health management.Europe represents another significant market for OTC pharmaceuticals, characterized by a diverse consumer base and strong regulatory frameworks. Countries like Germany, the UK, and France lead the region in terms of market size and innovation.

The Asia Pacific region emerges as a lucrative market for OTC pharmaceuticals, fueled by rapid urbanization, improving healthcare infrastructure, and changing consumer lifestyles. Countries like China, Japan, and India are witnessing significant growth in OTC medication sales, driven by factors such as a large population base, increasing healthcare expenditure, and rising awareness about preventive healthcare.

The Middle East & Africa region presents a growing opportunity for OTC pharmaceuticals, driven by improving healthcare access, rising disposable incomes, and a growing focus on preventive healthcare measures. Countries such as the UAE, Saudi Arabia, and South Africa are key markets within the region, witnessing an increasing demand for over-the-counter medications.

Latin America showcases promising growth prospects in the OTC pharmaceuticals market, supported by factors such as a large population base, increasing healthcare expenditure, and rising consumer awareness regarding self-care. Countries like Brazil, Mexico, and Argentina are key contributors to market growth, driven by urbanization, changing demographics, and expanding retail distribution channels.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global OTC (Over-the-Counter) Pharmaceuticals market continues to be a dynamic landscape with several key players vying for dominance. Among these, Mylan N.V., Daiichi Sankyo Company, Limited, Alkem Labs, Johnson & Johnson Private Limited, Novartis AG, Dr. Reddy's Laboratories Ltd., F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Bayer AG, Teva Pharmaceutical Industries Ltd., Piramal Enterprises Ltd., and Sun Pharmaceutical Industries Ltd. stand out as significant contributors to the industry.

Mylan N.V., a renowned pharmaceutical giant, remains a key player with its diversified portfolio and global reach. Its commitment to innovation and strategic partnerships positions it strongly in the market.

Daiichi Sankyo Company, Limited, known for its focus on research and development, continues to introduce novel OTC products, catering to diverse consumer needs.

Alkem Labs, with its emphasis on quality and affordability, has been steadily expanding its presence in emerging markets, bolstering its position in the global OTC Pharmaceuticals market.

Johnson & Johnson Private Limited, a household name, leverages its brand reputation and extensive distribution network to maintain a significant market share.

Novartis AG's strategic acquisitions and investments in OTC segments have enhanced its competitive edge, enabling it to address a wide range of consumer health needs.

Dr. Reddy's Laboratories Ltd., F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Bayer AG, Teva Pharmaceutical Industries Ltd., Piramal Enterprises Ltd., and Sun Pharmaceutical Industries Ltd. each bring their unique strengths and capabilities, contributing to the overall growth and dynamism of the global OTC Pharmaceuticals market.

As the market continues to evolve, these key players are expected to adapt to changing consumer preferences, regulatory landscapes, and technological advancements to sustain their positions and drive further innovation in the industry.

Market Key Players

- Mylan N.V.

- DAIICHI SANKYO COMPANY, LIMITED

- Alkem Labs

- Johnson & Johnson Private Limited

- Novartis AG

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Piramal Enterprises Ltd.

- Sun Pharmaceutical Industries Ltd.

Recent Development

In May 2024, India's 2022 OTC drug policy, approved by the Drugs Technical Advisory Board, didn't materialize due to lack of legal framework. No definition of OTC drugs exists, limiting sales to pharmacies

In May 2024, Echelon Wealth Partners faces regulatory action by CIRO over alleged violations in U.S. OTC trading. Despite denials, CIRO alleges breaches in due diligence and supervision, linked to clients involved in stock fraud schemes.

In April 2024, Piramal Alternatives invested Rs 110 crore in Biodeal Pharmaceuticals for infrastructure and production capacity enhancement, aiming to establish it as a leading nasal spray manufacturer, solidifying Piramal's commitment to growth.

Report Scope

Report Features Description Market Value (2023) USD 185.2 Bn Forecast Revenue (2033) USD 303.6 Bn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product type (Sleeping Aids, Analgesics, Cold, Cough and Flu products, Gastrointestinal Products, Ophthalmic Product, Dermatology Products, Others), By End-Users (Speciality Clinic, Homecare, Hospital, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Mylan N.V., DAIICHI SANKYO COMPANY, LIMITED, Alkem Labs, Johnson & Johnson Private Limited, Novartis AG, Dr. Reddy's Laboratories Ltd., F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Bayer AG, Teva Pharmaceutical Industries Ltd., Piramal Enterprises Ltd., Sun Pharmaceutical Industries Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Mylan N.V.

- DAIICHI SANKYO COMPANY, LIMITED

- Alkem Labs

- Johnson & Johnson Private Limited

- Novartis AG

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Piramal Enterprises Ltd.

- Sun Pharmaceutical Industries Ltd.