Global Orthopedic Consumables Market By Product Type(Surgical Orthopedic Consumables, Wound-Management Orthopedic Consumables, Others), By End Use(Hospitals, Ambulatory Surgical Centers, Clinics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

45517

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

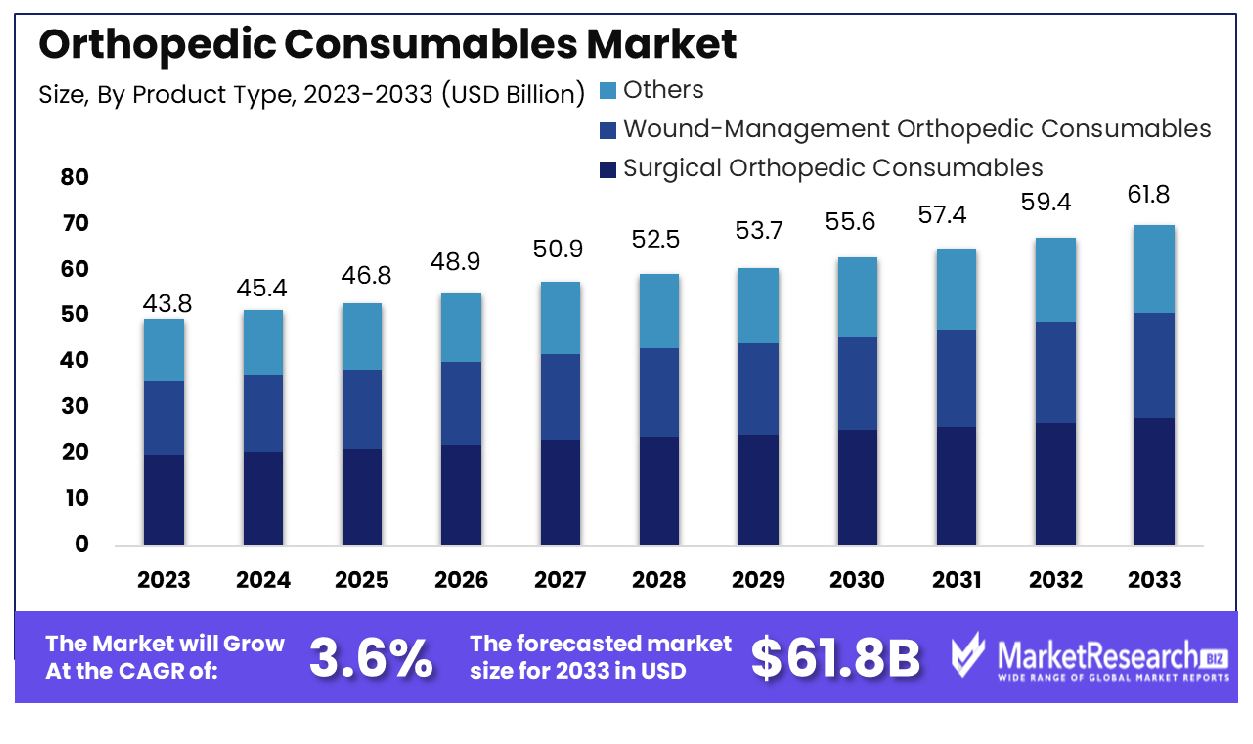

The Global Orthopedic Consumables Market was valued at USD 43.8 billion in 2023. It is expected to reach USD 61.8 billion by 2033, with a CAGR of 3.6% during the forecast period from 2024 to 2033.

The Orthopedic Consumables Market encompasses a broad spectrum of products essential for orthopedic procedures, ranging from implants and surgical instruments to braces and orthotics. As a pivotal segment within the healthcare industry, it addresses the increasing demand for solutions to musculoskeletal conditions and injuries.

Key drivers include advancements in minimally invasive techniques, a rising geriatric population, and escalating sports-related injuries. This market offers lucrative opportunities for stakeholders, driven by continual innovation, strategic partnerships, and expansion into emerging economies. With a focus on patient outcomes and cost-efficiency, it necessitates proactive strategies to navigate regulatory complexities and meet evolving customer needs.

The Orthopedic Consumables Market continues to show promising growth prospects, driven by an increasingly aging global population. As of 2022, there were approximately 1.1 billion individuals aged 60 years or above worldwide, constituting 13.9% of the total population. Projections indicate a doubling of this figure by 2050, reaching 2.1 billion individuals.

This demographic shift is particularly pronounced in India, where the elderly population is expected to double by 2050. In 2023, around 10% of Indians belonged to the 60+ age group, a percentage forecasted to exceed 20% within the next three decades.

This demographic trend is a key driver behind the sustained growth of the Orthopedic Consumables Market. With age, individuals become more susceptible to orthopedic conditions such as osteoarthritis, fractures, and degenerative joint diseases, leading to increased demand for orthopedic implants and related consumables. Moreover, advancements in healthcare infrastructure and rising disposable incomes in emerging economies further bolster market expansion.

Manufacturers and stakeholders in the Orthopedic Consumables Market are poised to capitalize on these opportunities through strategic product innovation, market expansion initiatives, and targeted marketing campaigns. By aligning product development with the evolving needs of the aging population and expanding their presence in high-growth regions like India, industry players can secure a competitive edge in this dynamic landscape.

Key Takeaways

- Market Growth: The Global Orthopedic Consumables Market was valued at USD 43.8 billion in 2023. It is expected to reach USD 61.8 billion by 2033, with a CAGR of 3.6% during the forecast period from 2024 to 2033.

- By Product Type: Surgical orthopedic consumables account for 60% of the market share, dominating product types.

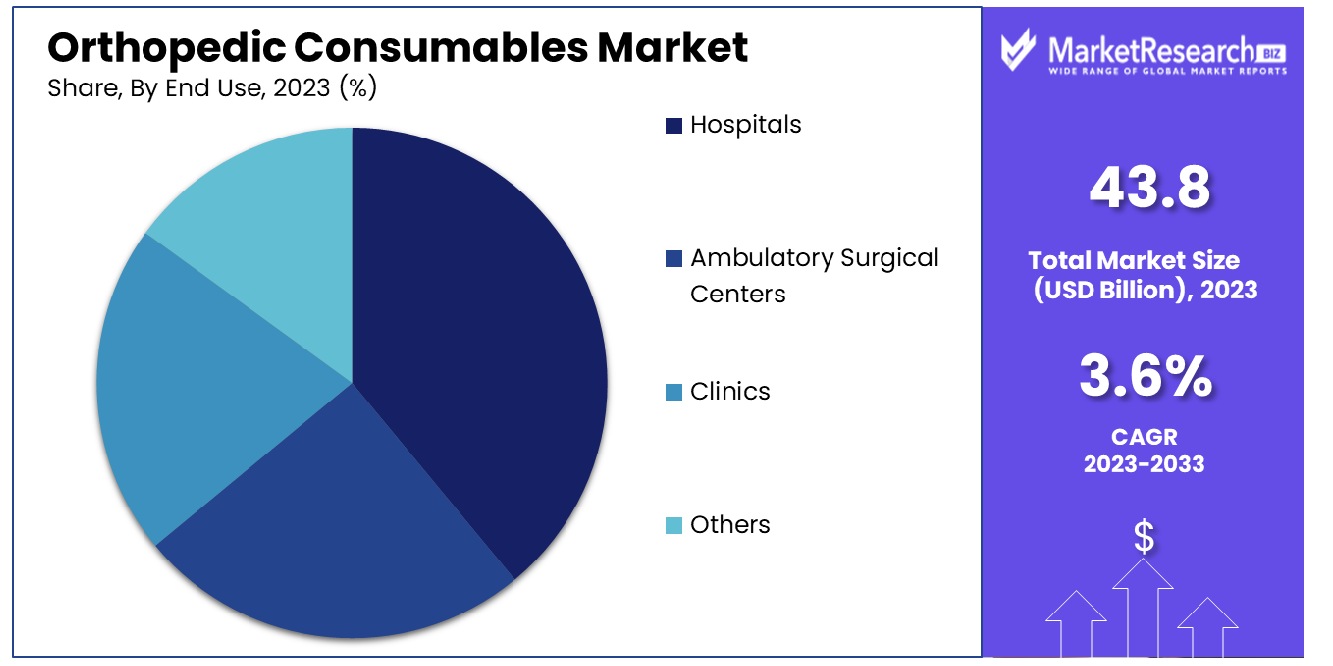

- By End Use: Hospitals constitute 60% of the end-use sector, showcasing their significant influence.

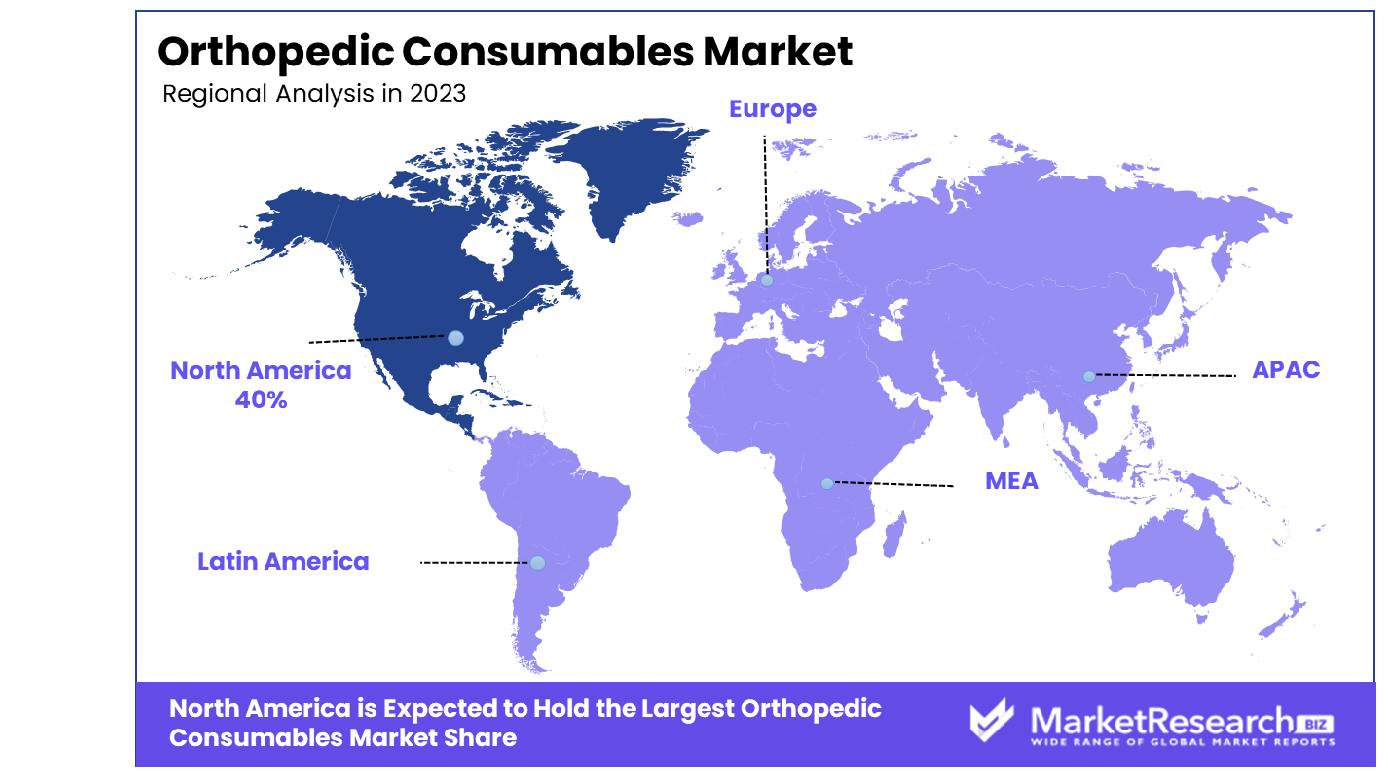

- Regional Dominance: In North America, the orthopedic consumables market dominates with a 40% share.

- Growth Opportunity: The 2023 growth prospects for the global orthopedic consumables market are driven by increasing sports participation and improving healthcare infrastructure, creating significant opportunities for manufacturers and stakeholders.

Driving factors

Increasing Demand for Orthopedic Consumables Driven by Rising Incidence of Joint Disorders and Injuries

The Orthopedic Consumables Market is experiencing significant growth propelled by the escalating demand stemming from the prevalence of joint disorders and orthopedic injuries. As musculoskeletal conditions become increasingly common across demographics, the need for orthopedic consumables, such as implants, braces, and surgical instruments, continues to surge.

According to recent statistics, the global burden of musculoskeletal disorders has been on the rise, with over 1.71 billion people affected worldwide. This substantial patient pool necessitates a corresponding increase in the availability and utilization of orthopedic consumables.

Expanding Market Scope Due to a Surge in Arthritis and Joint Disorders Among the Aging Population

The Orthopedic Consumables Market is witnessing remarkable expansion driven by a burgeoning adult population diagnosed with arthritis and joint disorders. As life expectancy increases globally, the prevalence of age-related musculoskeletal conditions rises proportionately.

Recent data indicates a steady rise in the aging population diagnosed with arthritis, with over 54 million adults in the United States alone affected by this condition. This demographic shift translates into a heightened demand for orthopedic consumables tailored to address the unique needs of older individuals, such as joint replacement implants and supportive orthoses.

Accelerated Growth Through Increased Adoption of Orthopedic Consumables in Surgical Procedures

The Orthopedic Consumables Market is experiencing accelerated growth fueled by the widespread adoption of orthopedic consumables in orthopedic surgeries. With advancements in surgical techniques and an expanding array of orthopedic implants and instruments, orthopedic surgeries have become increasingly prevalent worldwide. Recent trends indicate a rising number of orthopedic procedures, such as joint replacements and fracture fixations, driving the demand for associated consumables.

The market is witnessing a paradigm shift towards minimally invasive procedures, further augmenting the consumption of orthopedic implants and instruments. This surge in surgical interventions underscores the indispensable role of orthopedic consumables in modern orthopedic practice, propelling market growth to unprecedented levels.

Restraining Factors

Impediment to Growth: Higher Cost Associated with Orthopedic Consumables

The Orthopedic Consumables Market encounters a significant impediment to growth due to the higher costs associated with these products. The pricing dynamics of orthopedic consumables, including implants, prosthetics, and surgical instruments, pose a substantial challenge for both patients and healthcare providers.

Recent statistics indicate that the average cost of joint replacement surgeries, which often require orthopedic consumables, can range from $30,000 to $50,000 in the United States. This high cost of treatment acts as a deterrent for patients seeking orthopedic interventions, particularly in regions with limited healthcare coverage or affordability constraints.

Market Constraint: Preference for Non-Surgical Treatment Options in Certain Cases

The Orthopedic Consumables Market faces a notable constraint stemming from the preference for non-surgical treatment options in specific cases. While orthopedic surgeries remain a cornerstone of musculoskeletal care, there is a growing trend towards conservative management approaches, such as physical therapy, medications, and lifestyle modifications.

Recent studies suggest that up to 30% of orthopedic conditions can be effectively managed through non-surgical interventions alone. This shift towards non-invasive treatment modalities poses a challenge for the orthopedic consumables market, as it reduces the demand for surgical implants and instruments.

By Product Type Analysis

Surgical orthopedic consumables account for 60% of the market, highlighting their pivotal role in orthopedic procedures.

In 2023, Surgical Orthopedic Consumables held a dominant market position in the By Product Type segment of the Orthopedic Consumables Market, capturing more than a 60% share. This segment encompasses a wide array of products crucial in orthopedic surgical procedures, including implants, screws, plates, and surgical instruments. The substantial market share of Surgical Orthopedic Consumables can be attributed to the increasing prevalence of orthopedic disorders and the rising number of surgical procedures globally.

Wound-Management Orthopedic Consumables, another significant segment within the Orthopedic Consumables Market, accounted for a notable share of the market. These products are essential for post-operative wound care and management, including dressings, adhesive bandages, and wound closure devices. The growing emphasis on infection control and wound healing optimization has fueled the demand for advanced wound-management orthopedic consumables.

The "Others" category, comprising various orthopedic consumables such as casting materials, traction equipment, and orthotics, also contributed to the market landscape. While holding a smaller share compared to Surgical and Wound-Management Orthopedic Consumables, this segment remains vital in catering to diverse clinical needs and preferences.

Factors such as technological advancements in orthopedic devices, increasing healthcare expenditure, and a growing aging population have collectively propelled the demand for orthopedic consumables across the globe. Furthermore, the expansion of healthcare infrastructure in emerging economies and the rising adoption of minimally invasive surgical techniques are anticipated to further augment market growth in the coming years.

By End-Use Analysis

Hospitals dominate consumption, reflecting their central role in providing orthopedic care.

In 2023, Hospitals held a dominant market position in the By End Use segment of the Orthopedic Consumables Market, capturing more than a 60% share. Hospitals represent the primary healthcare setting for orthopedic procedures, offering comprehensive diagnostic, surgical, and post-operative care services. The substantial market share of Hospitals can be attributed to their extensive infrastructure, specialized orthopedic departments, and the ability to handle complex surgical cases effectively.

Ambulatory Surgical Centers (ASCs) emerged as another significant segment within the Orthopedic Consumables Market, accounting for a notable share. ASCs provide outpatient surgical procedures, including orthopedic surgeries, conveniently and cost-effectively. The growing preference for outpatient settings, driven by factors such as shorter recovery times and reduced healthcare costs, has fueled the demand for orthopedic consumables in ASCs.

Clinics, comprising specialty orthopedic clinics and physician offices, also contributed to the market landscape. These facilities offer orthopedic consultations, diagnostic services, and minor surgical interventions, catering to patients with orthopedic conditions on an outpatient basis. While holding a smaller share compared to Hospitals and ASCs, Clinics play a vital role in delivering accessible and personalized orthopedic care to patients.

The "Others" category encompasses diverse healthcare settings such as rehabilitation centers, nursing homes, and trauma centers, which also utilize orthopedic consumables to varying degrees. Although representing a minor share of the market, these facilities serve specific patient populations with orthopedic needs, contributing to the overall demand for orthopedic consumables.

Key Market Segments

By Product Type

- Surgical Orthopedic Consumables

- Wound-Management Orthopedic Consumables

- Others

By End Use

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

Growth Opportunity

Increasing Sports Participation Driving Demand

The burgeoning interest in sports and fitness activities worldwide is fueling a surge in sports-related injuries, consequently driving the demand for orthopedic consumables. As more individuals engage in physical activities, the likelihood of orthopedic injuries escalates, necessitating orthopedic care and leading to a heightened demand for associated consumables. This trend signifies a significant growth opportunity for manufacturers and stakeholders in the orthopedic consumables market.

Healthcare Infrastructure Development Propelling Market Expansion

Developing economies are prioritizing the enhancement of their healthcare infrastructure, which includes bolstering orthopedic care facilities. As a result, there is an increase in access to orthopedic surgeries and treatments in these regions. This strategic investment in healthcare infrastructure is expected to drive the demand for orthopedic consumables, presenting a substantial growth avenue for market players.

Latest Trends

Adoption of 3D Printing Technology

The orthopedic consumables market is witnessing a notable trend with the increasing adoption of 3D printing technology in orthopedic device manufacturing. This innovative approach allows for the production of customized implants and prosthetics with greater precision and efficiency. By leveraging 3D printing technology, manufacturers can offer patients tailored orthopedic solutions that better align with their anatomical needs, leading to improved clinical outcomes and patient satisfaction.

Emphasis on Personalized Orthopedic Solutions

Another prominent trend shaping the orthopedic consumables market is the emphasis on personalized orthopedic solutions. Healthcare providers and manufacturers are increasingly focusing on developing customized implants and devices to address the unique requirements of individual patients. By tailoring orthopedic solutions to specific patient demographics, such as age, activity level, and medical history, providers can optimize treatment outcomes and enhance patient quality of life.

Regional Analysis

In North America, the orthopedic consumables market commands 40% of the total market share.

In the global orthopedic consumables market, regional dynamics play a pivotal role in shaping market trends and growth trajectories. Across North America, comprising the United States and Canada predominantly, the market exhibits robust growth, capturing a dominant share of approximately 40%. This stronghold is propelled by several factors including a well-established healthcare infrastructure, increasing incidences of musculoskeletal disorders, and high adoption rates of advanced orthopedic consumables. Moreover, the presence of key market players and ongoing technological advancements contribute significantly to the region's market dominance.

In Europe, the orthopedic consumables market demonstrates steady expansion, driven by the rising geriatric population and consequent surge in orthopedic procedures. Countries like Germany, France, and the United Kingdom emerged as key contributors, fostering innovation and adoption of orthopedic consumables. Europe commands a substantial market share, bolstered by favorable reimbursement policies and increasing healthcare expenditure.

The Asia Pacific region emerges as a promising frontier for orthopedic consumables, characterized by rapid urbanization, improving healthcare infrastructure, and growing awareness regarding orthopedic treatments. Countries such as China, India, and Japan are witnessing a surge in demand for orthopedic consumables owing to the escalating prevalence of orthopedic disorders and expanding access to healthcare services. The region exhibits a notable growth trajectory, supported by government initiatives aimed at enhancing healthcare facilities and addressing unmet medical needs.

In the Middle East & Africa and Latin America regions, the orthopedic consumables market is poised for considerable growth, albeit at a relatively slower pace compared to other regions. Factors such as increasing healthcare investments, rising disposable incomes, and expanding medical tourism contribute to market development in these regions. However, challenges related to infrastructure limitations and economic uncertainties may impede growth to some extent.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Orthopedic Consumables Market witnessed significant growth, driven by a multitude of factors including technological advancements, increasing prevalence of orthopedic disorders, and a growing aging population. Among the key players shaping this landscape, Orthopedic Innovation Co., Ltd. stands out as a noteworthy entity. With a strong focus on innovation and product development, Orthopedic Innovation Co., Ltd. has consistently introduced cutting-edge solutions to address the evolving needs of patients and healthcare professionals alike.

Stryker, another prominent player, has maintained its stronghold in the market through strategic acquisitions and partnerships, bolstering its product portfolio and expanding its global reach. Meanwhile, Smith and Nephew have continued to thrive by leveraging their expertise in advanced wound management and orthopedic reconstruction technologies.

Zimmer Biomet, DJO Global, and DePuy Synthes have also played pivotal roles in shaping the market landscape, offering a diverse range of orthopedic implants, instruments, and consumables. Their commitment to research and development, coupled with their extensive distribution networks, has enabled them to capture significant market share.

Furthermore, the emergence of regional players such as Shaanxi Ansen Medical Technology Development Co., Ltd. and Medical Supplies in The United Arab Emirates underscores the increasing globalization of the orthopedic consumables market. These companies bring unique insights and solutions tailored to local preferences and healthcare needs.

Market Key Players

- Orthopedic Innovation Co., Ltd.

- Stryker

- Smith and Nephew

- Zimmer Biomet

- DJO Global

- DePuy Synthes

- Wright Medical

- Medtronic Spine

- Shaanxi Ansen Medical Technology Development Co., Ltd.

- NuVasive Inc.

- Medical Supplies in The United Arab Emirates

Recent Development

- In December 2023, WHO delivered urgent health supplies to Al-Shifa Hospital in north Gaza, facing severe shortages and operational challenges. Urgent restoration is needed to provide critical care amid an escalating health crisis.

- In December 2023, Sweef Capital invested strategically in Vietnam's USM Healthcare, promoting affordable medical devices and orthopedic products. Supporting women-led enterprises, they aim to enhance healthcare accessibility and economic empowerment.

Report Scope

Report Features Description Market Value (2023) USD 43.8 Billion Forecast Revenue (2033) USD 61.8 Billion CAGR (2024-2032) 3.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Surgical Orthopedic Consumables, Wound-Management Orthopedic Consumables, Others), By End Use(Hospitals, Ambulatory Surgical Centers, Clinics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Orthopedic Innovation Co., Ltd., Stryker, Smith and Nephew, Zimmer Biomet, DJO Global, DePuy Synthes, Wright Medical, Medtronic Spine, Shaanxi Ansen Medical Technology Development Co., Ltd., NuVasive Inc., Medical Supplies in The United Arab Emirates Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Orthopedic Innovation Co., Ltd.

- Stryker

- Smith and Nephew

- Zimmer Biomet

- DJO Global

- DePuy Synthes

- Wright Medical

- Medtronic Spine

- Shaanxi Ansen Medical Technology Development Co., Ltd.

- NuVasive Inc.

- Medical Supplies in The United Arab Emirates