Organic Coagulant Market By type(Polyamine, PolyDADMAC, Others), By Application(Municipal water treatment, Industrial water treatment) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42843

-

Jan 2022

-

184

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Organic Coagulant Market Segmentation Analysis

- Organic Coagulant Industry Segments

- Growth Opportunities

- Organic Coagulant Market Regional Analysis

- Organic Coagulant Industry By Region

- Organic Coagulant Market Key Player Analysis

- Organic Coagulant Industry Key Players

- Organic Coagulant Market Recent Development

- Report Scope

Report Overview

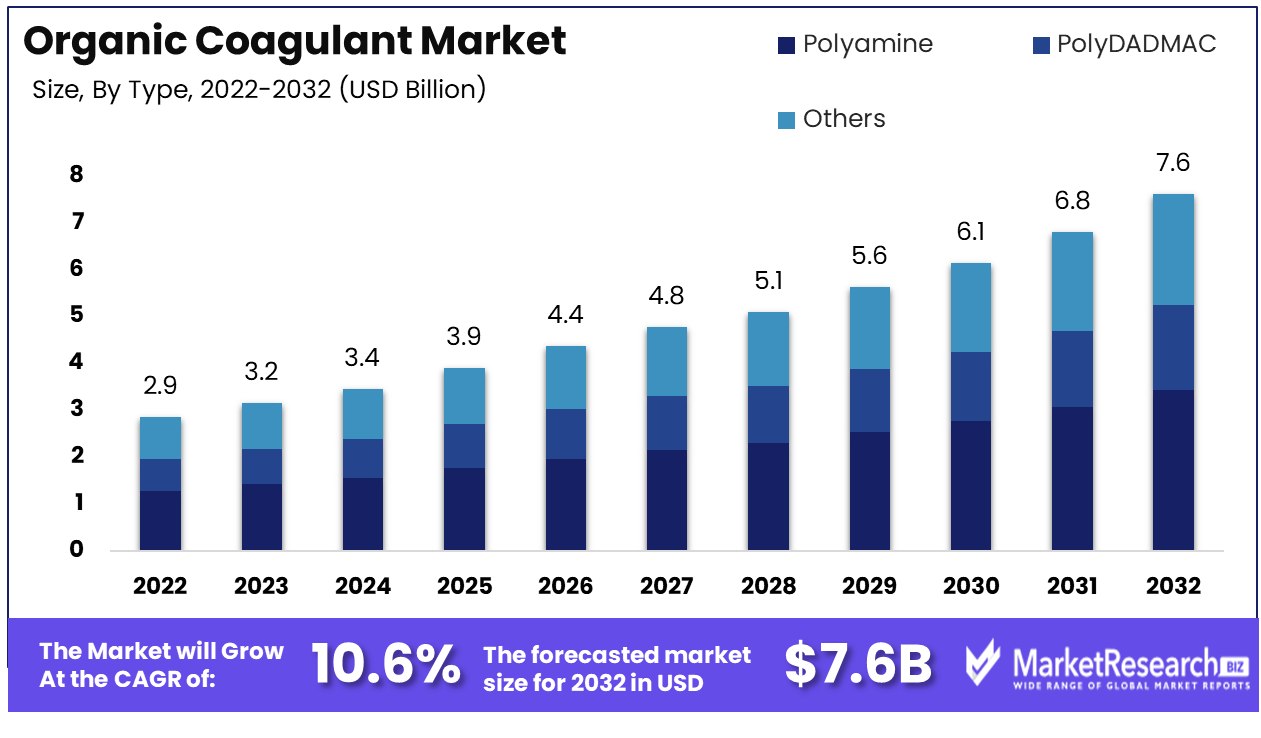

The organic coagulant market was valued at USD 2.85 billion in 2022. It is expected to reach USD 7.6 billion by 2032, with a CAGR of 10.6% during the forecast period from 2023 to 2032.

The surge in demand for wastewater treatment and industrialization are some of the main driving factors for the organic coagulant market expansion. Water and wastewater treatment is essential for maintaining equipment performance and durability.

A coagulation stage comprises several systems that boost small suspended particles to accumulate together which makes them easy to eliminate. Coagulants can eradicate many harmful contaminants from the water, including natural waste and pathogens, inorganic and dangerous compounds that include arsenic, chemical phosphorus, and other harmful chemicals.

Organic coagulants have become popular in the water and wastewater treatment industry as they are natural as compared to inorganic coagulants. It is extracted from plants, animals, or microorganisms. At the time of sludge formation, organic coagulants are used for separation of solid and liquid elements. They have two types of chemistries in organic coagulants like, as they are cationic by nature, polyamines are widely used organic coagulants. These cationic coagulants defuse the negative colloids that result in microflows.

Another type is to congeal colloidal elements in water, melamine formaldehyde and tannins are used. Such coagulant is effective and good for the treatment of harmful sludge as it absorbs natural or organic particles like oil and lubricant.

There are several benefits of using organic coagulants it is cost-effective as they can be utilized at lower concentrations while being active in many of the applications. Unlike any inorganic coagulants, they do not soak up the alkalinity from liquids as they are adjoined which will help in decreasing the pH value and conductivity variations.

When integrated organic coagulants help to overcome several problems of wastewater treatment that permit industries to run safely with more sustainable productions. Many organic coagulants are manufactured according to proprietary techniques and formulae.

Organic coagulants are demanded in the flocculation point of water treatment, where polyacrylamide is more successful. The demand for organic coagulants will gradually increase due to its high demand in wastewater and water treatment processes that will help in market expansion in the coming years.

Driving Factors

Scarcity & Population Drives Market Growth: Water Demand Fuels Organic Coagulant Use

As global water scarcity intensifies alongside a burgeoning population, the pressure mounts on water treatment solutions. Organic coagulants become essential in purifying water for consumption and industrial use, addressing both quality and quantity needs. This scarcity prompts technological advancements and increased adoption of efficient organic coagulants, thus propelling market growth.

As populations grow, especially in urban areas, the stress on existing water resources escalates, leading to a higher reliance on effective water treatment technologies. This dynamic interplays significantly with urbanization trends, enhancing the demand for organic coagulants. The long-term implication is a sustained market expansion as water scarcity and population growth continue to pose challenges, necessitating advanced, efficient, and sustainable water treatment solutions.

Industrialization & Urbanization Drive Market Growth: Expanding Cities, Expanding Markets

The rapid industrialization and urbanization observed in both developed and emerging nations amplify the need for efficient water treatment, directly boosting the organic coagulant market. As industries expand and urban populations swell, the resultant wastewater increase necessitates effective treatment methods to meet environmental regulations and public health standards.

Organic coagulants play a crucial role in this scenario, offering a viable solution for water purification and industrial waste management. This factor works in tandem with economic growth, leading to higher investment in infrastructure and technology for water treatment. The anticipated long-term effect is robust market growth driven by continuous urban expansion and industrial activities demanding sustainable and effective water management solutions.

Innovation Drives Market Growth: Evolution of Efficiency

The continuous development of new and more efficient organic coagulants marks a significant trend contributing to market growth. Innovations in chemical formulations and treatment technologies enhance the performance and eco-friendliness of coagulants, addressing both environmental concerns and regulatory standards. These advancements attract investment and encourage adoption across various sectors, including municipal and industrial water treatment.

The synergy between technological innovation and market demand fosters a cycle of improvement and expansion. As newer, more efficient products emerge, they capture market share, driving out older, less efficient options. Long-term, this trend is expected to lead to a more sustainable, efficient, and competitive market, with ongoing innovation fueling growth and adapting to emerging challenges in water treatment.

Restraining Factors

Higher Cost of Organic Coagulants Limits Market Adoption

The higher cost of organic coagulants compared to inorganic alternatives significantly limits their adoption in various industries. While organic coagulants offer environmental benefits and enhanced biodegradability, their production often involves more complex processes and costlier raw materials.

For industries operating on thin margins or in cost-sensitive markets, the higher price of organic coagulants can be prohibitive, leading them to continue using less expensive inorganic options. Until the cost of organic coagulants can be reduced, their higher price will continue to be a substantial barrier to wider market adoption.

Limited Availability of Raw Materials Restricts Organic Coagulant Market Growth

The growth of the organic coagulant market is restrained by the limited availability of raw materials required for their production. Organic coagulants are often derived from specific natural sources, and the availability of these sources can be affected by factors like agricultural production, seasonal variations, and environmental regulations.

This limitation can lead to fluctuations in supply and price, making it difficult for manufacturers to maintain consistent production levels and for consumers to rely on a steady supply. The market's growth is dependent on securing stable and sustainable sources for these raw materials.

Organic Coagulant Market Segmentation Analysis

By Type

In the organic coagulant market, Polyamine emerges as the dominant segment. Polyamine coagulants are widely used due to their high efficiency in treating a variety of water qualities, their effectiveness over a broad pH range, and their ability to work quickly. Their popularity is bolstered by the growing necessity for cleaner water and more stringent environmental regulations. Polyamine coagulants are particularly valued in applications where minimal alteration to water pH is essential and where a rapid settlement of particles is required.

While Polyamine leads the market, polyDADMAC is another significant coagulant known for its robust performance in water clarification and sedimentation processes. The 'Others' category includes a variety of organic coagulants, each offering unique properties for specific applications, contributing to the diversity and adaptability of the market.

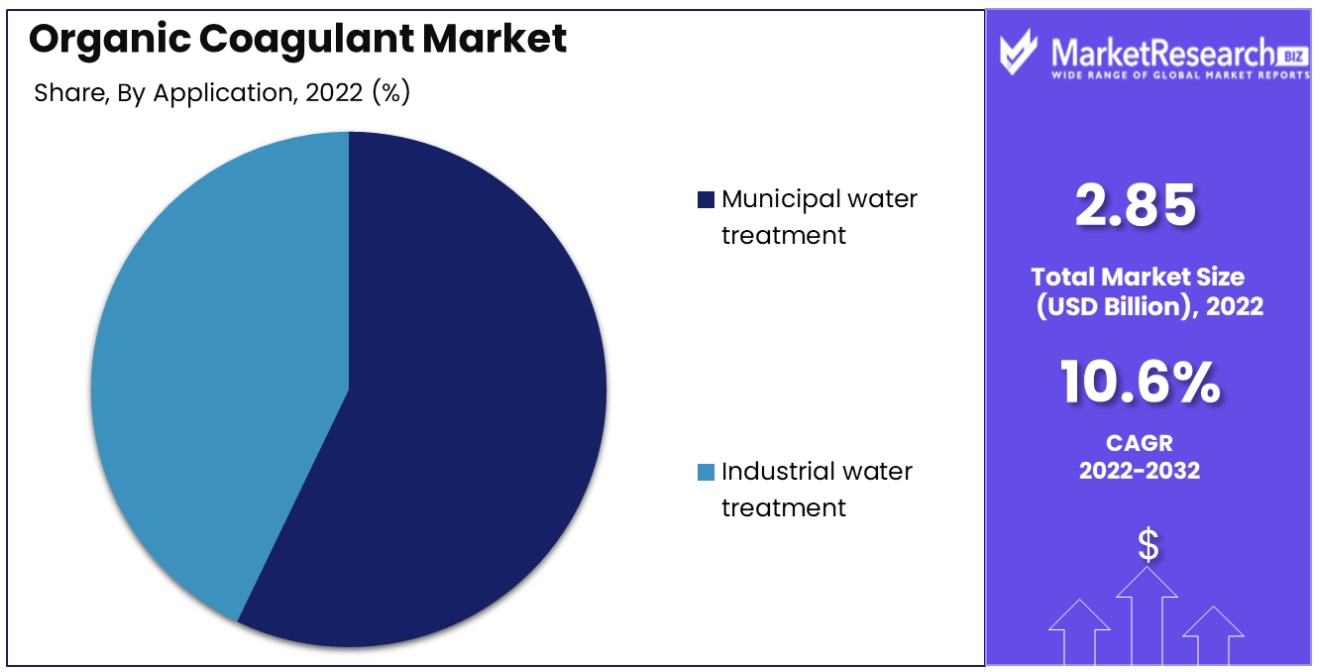

By Application

Municipal water treatment is the cornerstone of the organic coagulant market. Urbanization and an increasing need for clean drinking water necessitate effective solutions that provide clean water to cities. Organic coagulants play a crucial role in the municipal water treatment process by facilitating the removal of contaminants and improving water clarity. Their use helps in meeting the stringent standards set for drinking water and wastewater discharge, making them indispensable in modern water treatment facilities. The importance of ensuring a safe water supply for growing populations further solidifies this segment's dominance.

Industrial water treatment also represents a significant portion of the market. Industries such as pharmaceuticals, textiles, and chemicals require high-purity water and also need to treat their wastewater to comply with environmental regulations. Organic coagulants play a crucial role in industrial water treatment processes, offering tailored solutions tailored to suit each industry's requirements. With industrial activities expanding and regulations becoming tighter, the role of organic coagulants in industrial water treatment continues to expand.

Organic Coagulant Industry Segments

By type

- Polyamine

- PolyDADMAC

- Others

By Application

- Municipal water treatment

- Industrial water treatment

Growth Opportunities

Increasing Awareness About Environmental and Health Impacts Spurs Growth in Organic Coagulant Market

An increase in awareness about the harmful impacts of chemical coagulants on both the environment and health has fueled the growth of the organic coagulant market. Consumers and industries are increasingly seeking sustainable and safer alternatives due to the potential risks associated with chemical coagulants.

This shift is bolstered by heightened environmental consciousness and a focus on health and safety standards. As awareness continues to rise, the demand for organic coagulants, perceived as eco-friendly and less harmful, is growing, offering significant market expansion opportunities for products that can provide effective treatment without the negative impacts of their chemical counterparts.

Stringent Regulations Drive Demand for Organic Coagulants

Government policies regarding chemical coagulants have greatly increased the demand for organic coagulants, creating more of an urgency to use organic options as chemical ones become harder and harder to use. As governments worldwide implement stricter environmental regulations to protect ecosystems and public health, industries are compelled to adopt more environmentally friendly practices.

These regulations often favor the use of organic coagulants over traditional chemical ones, as they typically pose less risk to the environment and human health. The increasing regulatory pressure is encouraging industries to transition to organic coagulants, presenting a growth opportunity for market players who offer compliant and sustainable solutions.

Organic Coagulant Market Regional Analysis

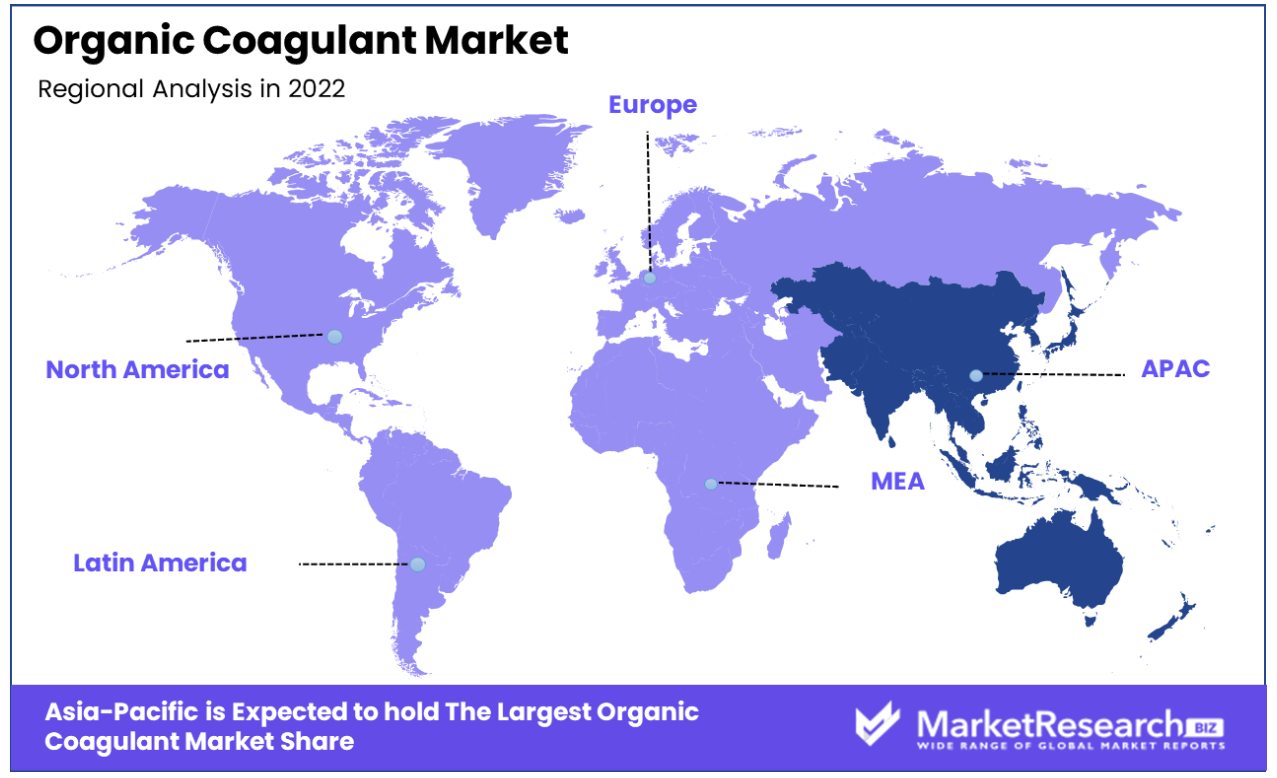

Asia-Pacific Dominates with 45.10% Market Share in Organic Coagulant Market

Asia-Pacific's 45.10% share in the organic coagulant market is driven by the region's extensive industrial activities, particularly in water-intensive sectors like textiles, paper, and chemicals. The increasing environmental regulations and the growing need for water treatment solutions in rapidly developing economies such as China and India significantly contribute to this dominance. The region's focus on sustainable water management practices and the shift towards using organic coagulants over synthetic alternatives due to their eco-friendly nature also bolsters the market.

The market dynamics in Asia-Pacific are influenced by rapid urbanization and industrialization, leading to a heightened need for efficient water treatment and waste management systems. The growing awareness of environmental sustainability among industries and the increasing governmental emphasis on pollution control standards drive the demand for organic coagulants. Additionally, the region's expanding research and development efforts aimed at improving water treatment technologies and the availability of raw materials for organic coagulants further stimulate the market.

North America: Advanced Environmental Regulations and Technology Adoption

North America's organic coagulant market is driven by stringent environmental regulations and an emphasis on sustainable industrial practices, technological innovations and adoption of eco-friendly water treatment solutions all contribute to market expansion. Furthermore, increased demand for clean water as well as more efficient industrial waste management systems further support organic coagulant use.

Europe: Focus on Sustainability and Water Quality

Europe's organic coagulant market stands out with a commitment to sustainability and high water quality standards, featuring strong environmental policies and an emphasis on green chemicals in water treatment processes that have spurred demand for organic coagulants. Europe's well-established industrial sector and growing awareness of environmental impacts on water resources contribute further to market demand, while their commitment to reducing chemical footprints in water treatment should continue promoting their use.

Organic Coagulant Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Organic Coagulant Market Key Player Analysis

Organic Coagulant Market companies play a critical role in water purification and treatment processes, supporting environmental sustainability initiatives while providing optimal water management solutions. Kemira Oyj and BASF SE are industry leaders, known for their extensive range of water treatment chemicals, including organic coagulants. Their strategic positioning emphasizes innovation and environmental stewardship, significantly influencing market standards and practices.

SNF Group and Veolia, with their global presence, are pivotal in providing comprehensive water treatment solutions. Their focus on research and development in organic coagulants underlines the industry's shift towards more eco-friendly and efficient water purification methods.

ECOLAB and Kurita Water Industries Ltd, renowned for their water, hygiene, and energy technologies, contribute significantly to the market with their specialized products and services, catering to a wide range of industrial and municipal needs. Baker Hughes Company and Solenis, with their advanced chemical solutions, play crucial roles in enhancing the performance and sustainability of water treatment processes.

Organic Coagulant Industry Key Players

- Kemira Oyj (Finland)

- SNF Group (France)

- BASF SE (Germany)

- Veolia (France)

- ECOLAB (US)

- Kurita Water Industries Ltd (Japan)

- Baker Hughes Company (US)

- Solenis (US)

- USALCO (US)

- Buckman (US)

Organic Coagulant Market Recent Development

- In April 2022, Kurita Water Industries Ltd. launched a new research and development facility in Akisthis-shi, Tokyo. This has aided the business in diversifying its offerings to include cutting-edge technologies and all-encompassing environmental and water solutions.

- n Pujiang Town in Shanghai, China, Kemira Ojy launched an R&D facility in September 2021. This has aided the business in developing renewable, biodegradable, and recyclable products in the Asia-Pacific region and in meeting the demand of a market that is expanding quickly.

- A contract for the treatment of hazardous industrial waste was signed by Veolia, Vision Invest, and ADQ with the Abu Dhabi National Oil Company Refining (ADNOC Refining) in November 2022. The company’s market position in the Middle East has been strengthened by this deal.

Report Scope

Report Features Description Market Value (2023) USD 2.85 Billion Forecast Revenue (2033) USD 7.6 Billion CAGR (2024-2032) 10.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By type(Polyamine, PolyDADMAC, Others), By Application(Municipal water treatment, Industrial water treatment) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Kemira Oyj (Finland), SNF Group (France), BASF SE (Germany), Veolia (France), ECOLAB (US), Kurita Water Industries Ltd (Japan), Baker Hughes Company (US), Solenis (US), USALCO (US), Buckman (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-