Optoelectronic Component Market By Device Type (Light Emitting Diodes (LEDs), Laser Diodes, Photodiodes, Image Sensors, Solar Cells, Others), By End-User Industry (Automotive, Aerospace & Defense, Consumer Electronics, IT & Telecommunication, Healthcare, Energy & Power, Others), By Material (Gallium Nitride (GaN), Gallium Arsenide (GaAs), Indium Phosphide (InP), Silicon Carbide (SiC), Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50595

-

Aug 2024

-

302

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

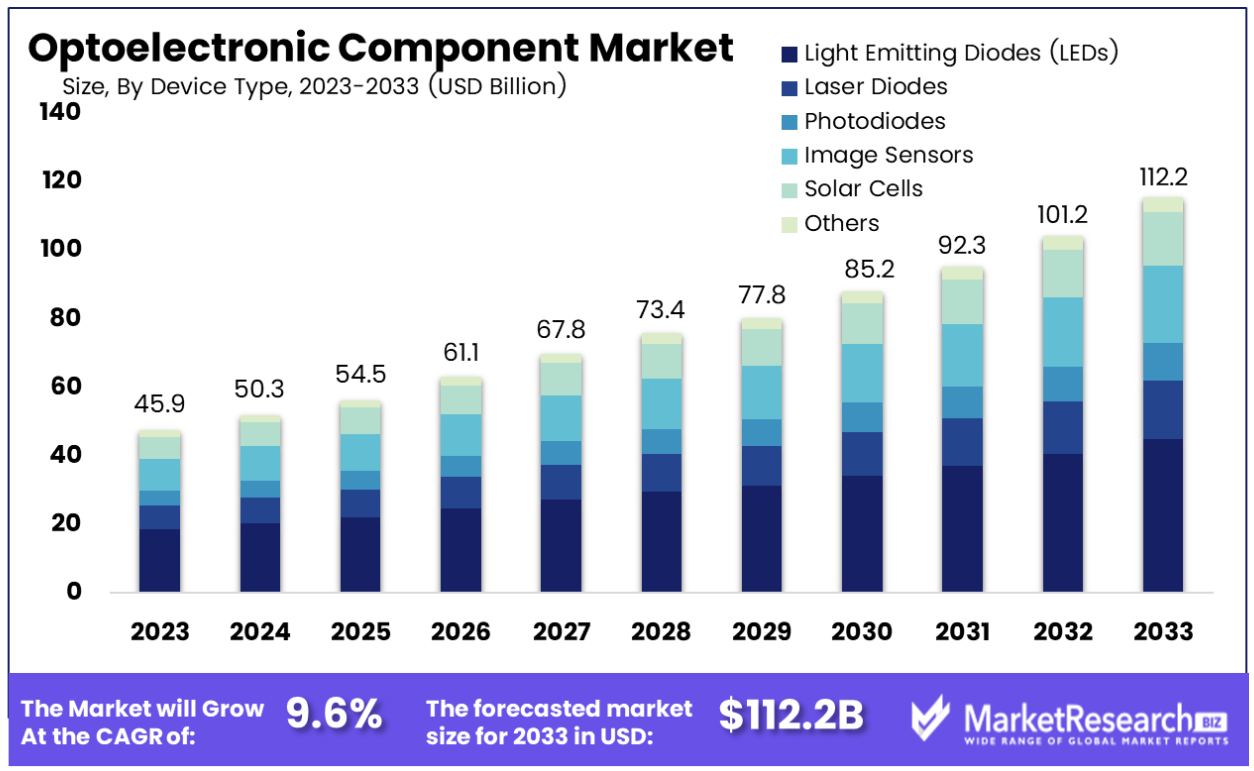

The Global Optoelectronic Component Market was valued at USD 45.9 Bn in 2023. It is expected to reach USD 112.2 Bn by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

The Optoelectronic Component Market involves the production, distribution, and application of components that convert electrical signals into light and vice versa. These components include LEDs, photodiodes, image sensors, and laser diodes, which are essential in various industries such as telecommunications, automotive, consumer electronics, and healthcare. The market is driven by advancements in technology, increasing demand for high-speed communication, and the growing adoption of optoelectronics in emerging applications like autonomous vehicles and smart devices, making it a crucial segment in the global electronics industry.

The Optoelectronic Component Market is on a trajectory of significant growth, propelled by continuous technological innovations and the expanding demand for high-speed communication and data transmission. A key development in this market is the introduction of the all-silicon avalanche photodiode chip, capable of achieving data rates of 1.28 Tb/s. This advancement enhances telecommunications efficiency, enabling faster and more reliable network capabilities, which are critical in the era of 5G and beyond.

The Optoelectronic Component Market is on a trajectory of significant growth, propelled by continuous technological innovations and the expanding demand for high-speed communication and data transmission. A key development in this market is the introduction of the all-silicon avalanche photodiode chip, capable of achieving data rates of 1.28 Tb/s. This advancement enhances telecommunications efficiency, enabling faster and more reliable network capabilities, which are critical in the era of 5G and beyond.Further driving this market is the breakthrough in self-homodyne fronthaul architecture using broadband electro-optic combs, which has achieved data speeds of 0.879 Pb/s and can support 150,000 simultaneous 5G channels. This technology not only sets new standards for data transmission but also underscores the market's pivotal role in supporting the infrastructure of future communication networks.

The market's growth is also influenced by the increasing adoption of optoelectronics in automotive applications, particularly in autonomous vehicles where components such as LiDAR systems and advanced sensors are essential. Additionally, consumer electronics continue to be a major driver, with optoelectronic components being integral to the functionality of smartphones, cameras, and other smart devices.

As industries continue to digitize and demand for faster, more efficient communication solutions grows, the optoelectronic component market is expected to see sustained expansion. Companies that focus on innovation and the integration of cutting-edge technologies are well-positioned to capitalize on the opportunities within this dynamic market.

Key Takeaways

- Market Value: The Global Optoelectronic Component Market was valued at USD 45.9 Bn in 2023. It is expected to reach USD 112.2 Bn by 2033, with a CAGR of 9.6% during the forecast period from 2024 to 2033.

- By Device Type: Light Emitting Diodes (LEDs) represent 40% of the market, widely used for their energy efficiency and long lifespan.

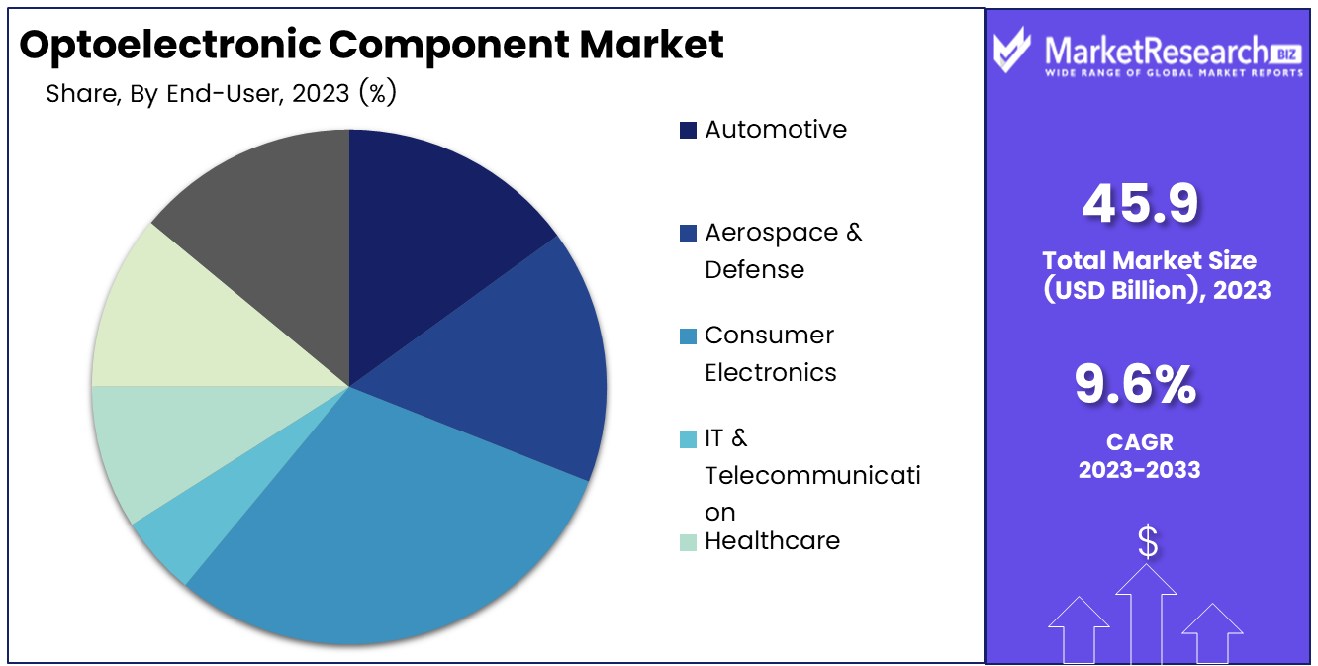

- By End-User Industry: Consumer Electronics constitutes 35%, reflecting the integration of optoelectronics in a wide range of devices.

- By Material: Gallium Nitride (GaN) makes up 30%, valued for its high efficiency and performance in optoelectronic applications.

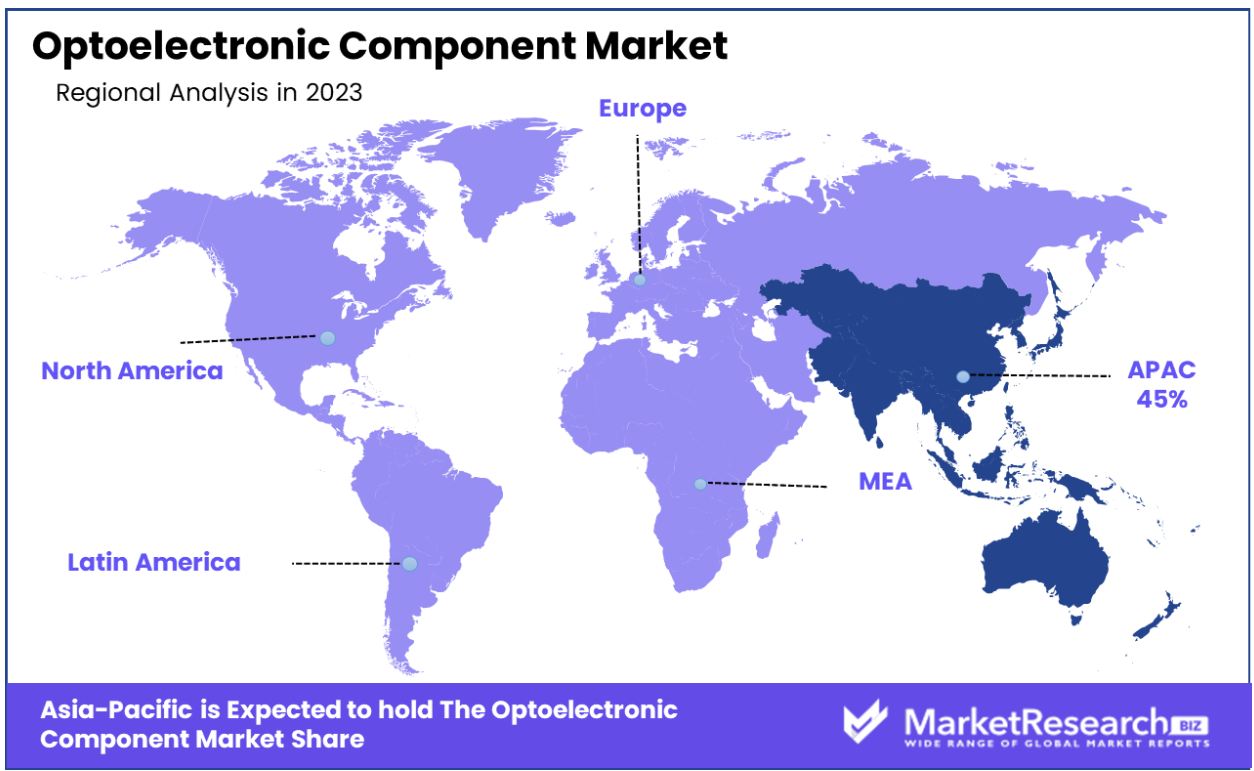

- Regional Dominance: Asia Pacific holds a 45% market share, driven by the region's strong electronics manufacturing base.

- Growth Opportunity: Expanding applications of GaN in next-generation displays and high-efficiency power devices can drive significant growth in the optoelectronic component market.

Driving factors

Advanced Consumer Electronics Drives Optoelectronic Innovation

The rapid advancement and proliferation of consumer electronics are central to the growth of the optoelectronic component market. Devices such as smartphones, tablets, and wearables increasingly require advanced optoelectronic components, including image sensors, light-emitting diodes (LEDs), and photodetectors, to enhance functionality, efficiency, and user experience.

The surge in demand for high-resolution displays, biometric sensors, and energy-efficient lighting solutions has propelled innovation in optoelectronics, directly contributing to market expansion. As manufacturers strive to meet consumer expectations for faster, smarter, and more energy-efficient devices, the optoelectronic component market is expected to see sustained growth.

Automotive Applications, Including ADAS and Lighting, Fuel Market Expansion

The automotive sector's growing reliance on optoelectronics, particularly in advanced driver assistance systems (ADAS) and vehicle lighting, is a significant driver of market growth. The integration of optoelectronic components in ADAS, such as LiDAR and camera systems, enhances vehicle safety and automation capabilities.

The shift towards energy-efficient and aesthetically appealing LED lighting in vehicles has increased the demand for optoelectronic components. As the automotive industry continues to advance towards autonomous driving and sustainable technologies, the demand for optoelectronics in this sector is expected to rise, further driving market growth.

Optoelectronics in Communication and Healthcare Sectors Boosts Market Growth

The expanding use of optoelectronic components in communication and healthcare sectors is another critical factor contributing to market growth. In communication, optoelectronics are essential in fiber optic networks, where they enable high-speed data transmission and improve network efficiency. The healthcare sector has seen a growing adoption of optoelectronics in medical imaging, diagnostics, and monitoring devices, driven by the need for more accurate and non-invasive solutions.

As these industries continue to evolve and demand more sophisticated technologies, the optoelectronic component market is poised for significant growth, driven by innovations tailored to meet the specific needs of these sectors.

Restraining Factors

High Costs of Advanced Optoelectronic Components Constrain Market Accessibility

The high cost associated with advanced optoelectronic components is a significant restraining factor for the market. These components, which include cutting-edge technologies like high-performance LEDs, image sensors, and photodetectors, often require complex manufacturing processes and expensive raw materials. The elevated costs can limit their adoption, particularly among small and medium-sized enterprises (SMEs) and in price-sensitive markets.

The high initial investment required for the development and deployment of optoelectronic systems can be a barrier for companies, slowing down the overall market growth. As a result, the market's expansion may be tempered by these cost-related challenges, particularly in regions or sectors with budget constraints.

Technical Challenges in Integrating Optoelectronics into Complex Systems Impede Market Progress

The integration of optoelectronic components into complex systems presents significant technical challenges that can restrain market growth. These challenges include issues related to compatibility, miniaturization, thermal management, and signal interference, all of which can complicate the design and implementation of optoelectronic systems.

The complexity of integrating optoelectronics into advanced applications, such as autonomous vehicles, smart grids, and medical devices, often requires specialized expertise and substantial R&D investments. These technical hurdles can delay product development timelines, increase costs, and reduce the speed of market adoption. Consequently, while the potential for optoelectronics is vast, these integration challenges may act as a bottleneck, limiting the pace of market growth.

By Device Type Analysis

In the Optoelectronic Component Market, Light Emitting Diodes (LEDs) account for 40% by device type.

In 2023, Light Emitting Diodes (LEDs) held a dominant market position in the By Device Type segment of the Optoelectronic Component Market, capturing more than a 40% share. LEDs have become increasingly prevalent due to their energy efficiency, long lifespan, and versatility across various applications, from consumer electronics to automotive lighting. Their adoption is driven by the growing demand for energy-saving solutions and the continuous innovation in LED technology, which has resulted in enhanced performance and reduced costs.The surge in smart home devices and the expansion of digital displays across multiple industries have also contributed to the growth of LEDs within the optoelectronic component market. Additionally, government regulations promoting energy efficiency and sustainability further support the widespread use of LEDs, solidifying their market dominance.

By End-User Industry Analysis

The Consumer Electronics industry holds a 35% share by end-user in the Optoelectronic Component Market.

In 2023, Consumer Electronics held a dominant market position in the By End-User Industry segment of the Optoelectronic Component Market, capturing more than a 35% share. The consumer electronics industry has been a major driver of demand for optoelectronic components, particularly LEDs, image sensors, and laser diodes, due to their integral role in smartphones, televisions, computers, and other smart devices. The proliferation of high-definition displays, augmented reality (AR) devices, and wearable technology has significantly increased the need for advanced optoelectronic components, fueling this segment's growth.The rapid pace of technological advancements in consumer electronics, coupled with rising consumer expectations for higher performance and better user experiences, has bolstered the adoption of optoelectronic components. As consumers continue to seek more sophisticated and connected devices, the consumer electronics sector is expected to remain a key end-user industry in the optoelectronic component market.

By Material Analysis

Gallium Nitride (GaN) represents 30% of the material share in the Optoelectronic Component Market.

In 2023, Gallium Nitride (GaN) held a dominant market position in the By Material segment of the Optoelectronic Component Market, capturing more than a 30% share. GaN is increasingly preferred for its superior properties, including high electron mobility, thermal stability, and efficiency, which make it ideal for high-power and high-frequency applications. These advantages have driven its adoption in LEDs, power electronics, and RF (radio frequency) components, particularly in sectors such as automotive, telecommunications, and defense.The shift towards 5G technology, electric vehicles, and advanced defense systems has further accelerated the demand for GaN-based optoelectronic components. As industries continue to prioritize performance and efficiency, GaN is expected to maintain its leading position in the material segment of the optoelectronic component market.

Key Market Segments

By Device Type

- Light Emitting Diodes (LEDs)

- Laser Diodes

- Photodiodes

- Image Sensors

- Solar Cells

- Others

By End-User Industry

- Automotive

- Aerospace & Defense

- Consumer Electronics

- IT & Telecommunication

- Healthcare

- Energy & Power

- Others

By Material

- Gallium Nitride (GaN)

- Gallium Arsenide (GaAs)

- Indium Phosphide (InP)

- Silicon Carbide (SiC)

- Others

Growth Opportunity

Development of Energy-Efficient and Miniaturized Components

The ongoing development of energy-efficient and miniaturized optoelectronic components is expected to be a significant growth driver in 2024. As industries strive for sustainability and reduced energy consumption, the demand for components that offer high performance with minimal energy use is on the rise. Miniaturization, particularly, is crucial in applications like wearables, portable medical devices, and compact consumer electronics.

The ability to integrate smaller, yet more powerful, optoelectronic components into these devices will open new avenues for market expansion. Manufacturers investing in research and development to create these advanced components are likely to see substantial opportunities in emerging markets.

Expansion in 5G and IoT Applications

The global rollout of 5G networks and the proliferation of IoT devices are poised to create significant opportunities for the optoelectronic component market in 2024. Optoelectronic components are integral to the high-speed data transmission and connectivity required by 5G and IoT ecosystems. As 5G networks expand globally, the need for advanced photodetectors, optical sensors, and other optoelectronic components will surge, driving market growth.

The increasing integration of IoT devices across industries, from smart homes to industrial automation, will further fuel demand for optoelectronics, as these components are essential for data acquisition, processing, and communication in IoT networks.

Latest Trends

Use of Optoelectronics in Smart Home Devices

In 2024, the integration of optoelectronic components into smart home devices is expected to be a major trend shaping the global market. As the smart home ecosystem expands, the demand for advanced sensors, cameras, and LEDs will grow, driven by consumer preferences for enhanced security, convenience, and energy efficiency.

Optoelectronic components play a crucial role in enabling features such as facial recognition, gesture control, and smart lighting systems. The proliferation of smart home devices, from security cameras to connected lighting solutions, is set to significantly boost the demand for optoelectronic components, positioning this market segment for accelerated growth.

Integration with AI for Enhanced Sensor and Imaging Applications

The integration of artificial intelligence (AI) with optoelectronics is emerging as a transformative trend in 2024. AI-powered optoelectronic components, particularly in sensor and imaging applications, are enhancing the capabilities of various devices, from smartphones to industrial robots. This integration allows for more precise and intelligent data processing, enabling applications such as real-time image recognition, advanced biometric systems, and autonomous navigation.

The combination of AI with optoelectronics is expected to drive innovation across multiple industries, including automotive, healthcare, and consumer electronics, leading to the development of more sophisticated and adaptive systems.

Regional Analysis

Asia Pacific dominates the Optoelectronic Component market with a 45% share.

In 2023, Asia Pacific dominated the Optoelectronic Component Market, capturing approximately 45% of the global market share. This region's leadership is driven by its robust electronics manufacturing industry, particularly in countries like China, Japan, South Korea, and Taiwan, which are global hubs for semiconductor production and consumer electronics. The high demand for optoelectronic components in applications such as telecommunications, automotive, consumer electronics, and industrial automation has further bolstered Asia Pacific's market position.Asia Pacific's dominance is also supported by significant investments in research and development (R&D) and the region's focus on innovation in optoelectronics, including advancements in LED technology, photovoltaic cells, and laser components. Moreover, the increasing adoption of 5G technology, smart devices, and energy-efficient lighting solutions in this region has accelerated the demand for optoelectronic components, contributing to its leading market share.

North America and Europe also play significant roles in the Optoelectronic Component Market. North America, particularly the United States, is a key player due to its strong presence in the aerospace and defense sectors, where optoelectronics are crucial. Meanwhile, Europe, with its focus on automotive innovation and renewable energy initiatives, also contributes substantially to the global market. However, Asia Pacific's manufacturing capacity, coupled with its growing consumer base and rapid technological advancements, ensures its continued dominance in the optoelectronic component market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Hamamatsu Photonics K.K. is expected to maintain its strong leadership in the global optoelectronic component market in 2024, driven by its cutting-edge photomultiplier tubes and image sensors. The company's focus on research and development in photonics technology ensures its products remain at the forefront of innovation, particularly in medical imaging and scientific instrumentation. As demand for high-performance optoelectronic components increases, Hamamatsu's extensive product portfolio positions it well to capture a significant market share.

Osram GmbH continues to be a dominant force in the optoelectronic market, leveraging its expertise in LED technology and semiconductor products. With the ongoing transition to energy-efficient lighting solutions and the integration of smart technologies in various applications, Osram is likely to see substantial growth. The company's strategic partnerships and acquisitions in the automotive and industrial sectors further strengthen its market position, enabling it to address the evolving demands of these industries effectively.

TT Electronics plc and Vishay Intertechnology, Inc. are also key players in the optoelectronic component market, each bringing unique strengths. TT Electronics' focus on custom design and engineering services allows it to cater to specific client needs in the aerospace and defense industries. In contrast, Vishay's broad product range, including infrared emitters and detectors, positions it well to benefit from the rising demand for consumer electronics and industrial automation. Both companies are poised for steady growth as the market for optoelectronic components continues to expand globally.

Market Key Players

- Hamamatsu Photonics K.K.

- Osram GmbH

- TT Electronics plc

- Vishay Intertechnology, Inc.

- ON Semiconductor Corporation

- Cree, Inc.

- TRUMPF

- SICK AG

- Samsung Electronics Co., Ltd.

- Sony Group Corporation

- Broadcom Inc.

- OmniVision Technologies, Inc.

- Micropac Industries, Inc.

- ROHM Co., Ltd.

- Lite-On Technology Corporation

Recent Development

- In January 2024, Hamamatsu Photonics K.K. launched a new high-speed photodiode aimed at enhancing optical communication systems, increasing data transmission speed by 25%.

- In March 2024, Osram GmbH announced the acquisition of a laser technology startup to boost its optoelectronic component portfolio, expecting to enhance production capacity by 30%.

Report Scope

Report Features Description Market Value (2023) USD 45.9 Bn Forecast Revenue (2033) USD 112.2 Bn CAGR (2024-2033) 9.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered , By Device Type (Light Emitting Diodes (LEDs), Laser Diodes, Photodiodes, Image Sensors, Solar Cells, Others), By End-User Industry (Automotive, Aerospace & Defense, Consumer Electronics, IT & Telecommunication, Healthcare, Energy & Power, Others), By Material (Gallium Nitride (GaN), Gallium Arsenide (GaAs), Indium Phosphide (InP), Silicon Carbide (SiC), Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hamamatsu Photonics K.K., Osram GmbH, TT Electronics plc, Vishay Intertechnology, Inc., ON Semiconductor Corporation, Cree, Inc., TRUMPF, SICK AG, Samsung Electronics Co., Ltd., Sony Group Corporation, Broadcom Inc., OmniVision Technologies, Inc., Micropac Industries, Inc., ROHM Co., Ltd., Lite-On Technology Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Hamamatsu Photonics K.K.

- Osram GmbH

- TT Electronics plc

- Vishay Intertechnology, Inc.

- ON Semiconductor Corporation

- Cree, Inc.

- TRUMPF

- SICK AG

- Samsung Electronics Co., Ltd.

- Sony Group Corporation

- Broadcom Inc.

- OmniVision Technologies, Inc.

- Micropac Industries, Inc.

- ROHM Co., Ltd.

- Lite-On Technology Corporation