Oilseeds Market By Oilseed Type (Sunflower, Soybean, Sesame, Cottonseed, Rapeseed, Other), By Product (Animal Feed and Edible Oil), By Breeding (Genetically Modified and Conventional), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

6963

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

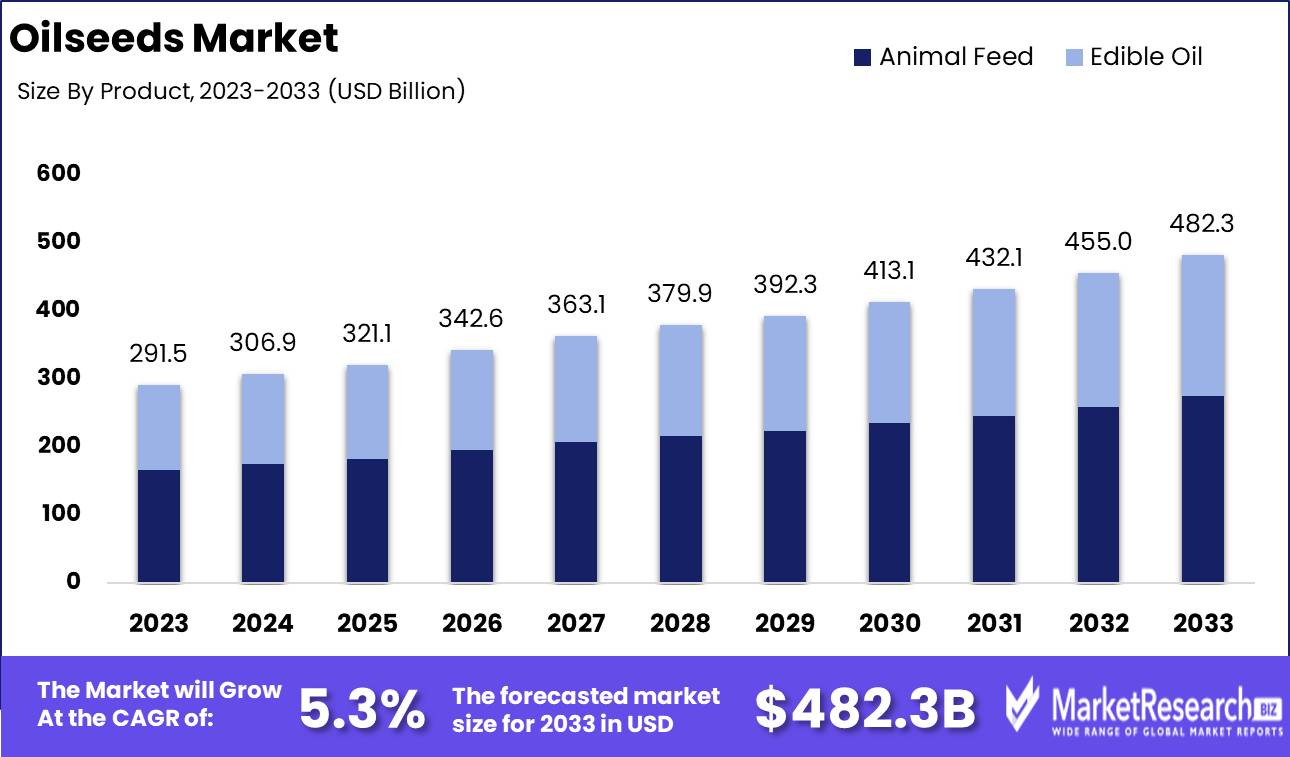

The Oilseeds Market was valued at USD 291.5 billion in 2023. It is expected to reach USD 482.3 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

The objective of the oilseeds market is to meet the rising global demand for oils and their byproducts. This market focuses on the cultivation of specific seed varieties optimized for oil extraction, ensuring high-quality oil and satisfying the diverse needs of industries and consumers around the globe.

Due to its adaptability and breadth of applications, the oilseeds market is of utmost importance. Primarily, it is a significant source of consumable oils, which serve as dietary staples for millions of people around the world. In addition, oilseeds play a significant role in the production of biofuels, which contributes to the pursuit of greener and more sustainable energy sources.

Due to technological advancements, the oilseeds market has witnessed remarkable innovations. The genetic modification of seeds to increase oil content and improve crop yield is a significant development. This innovation has enabled farmers to produce more oilseeds with fewer resources, thereby minimizing environmental impact and boosting productivity.

The oilseeds market has attracted substantial public and private sector investments. Numerous businesses have recognized the growth and profit potential of this market, which has led to the establishment of large-scale oilseed processing facilities and research and development centers. These investments have paved the way for oilseeds and their byproducts to be incorporated into a variety of products and services.

Numerous industries have made substantial investments in the development of the oilseeds market because they recognize its potential. Manufacturers of food and beverages rely on a steady supply of high-quality oils to produce their products. Additionally, oilseeds are utilized by the cosmetics industry for the production of skin care and beautification products. In addition, the pharmaceutical industry uses oilseeds in the production of numerous medications.

Key Takeaways

- Market Growth: The Oilseeds Market was valued at USD 291.5 billion in 2023. It is expected to reach USD 482.3 billion by 2033, with a CAGR of 5.3% during the forecast period from 2024 to 2033.

- By Oilseed Type: Sunflower dominated the Oilseeds Market with high demand.

- By Product: Animal Feed dominated the Oilseeds Market, outpacing Edible Oil.

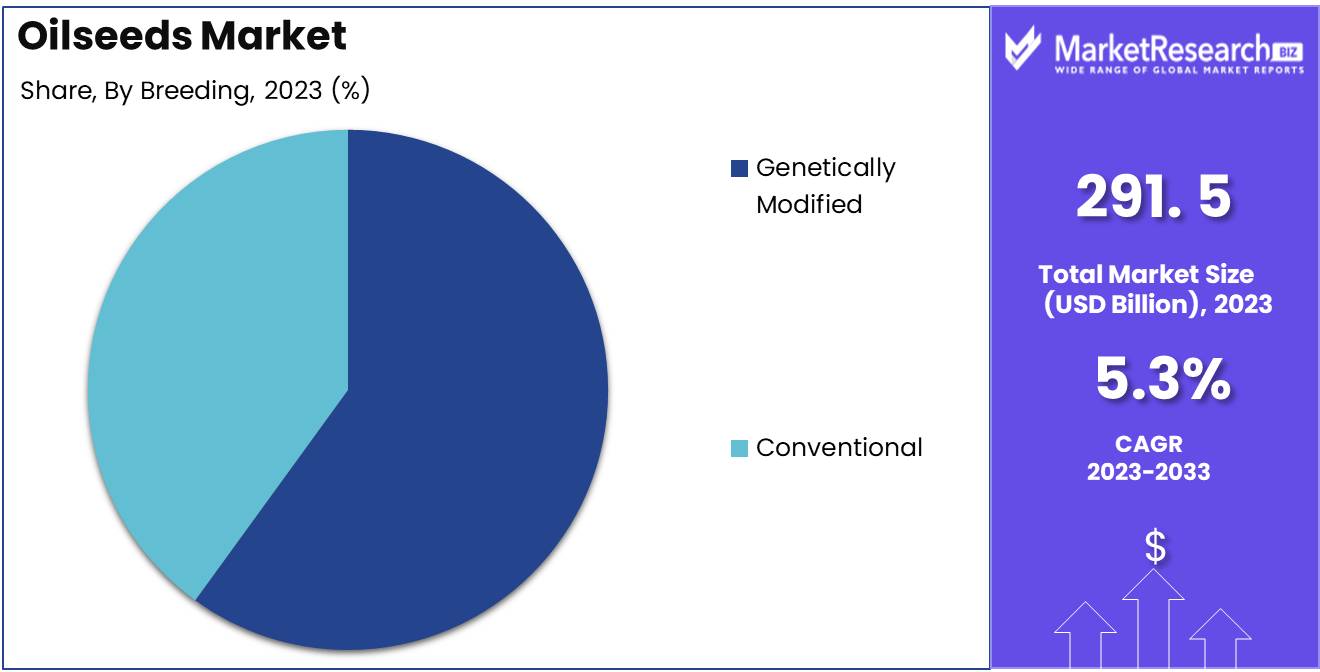

- By Breeding: Genetically Modified oilseeds dominated the Oilseeds Market segment.

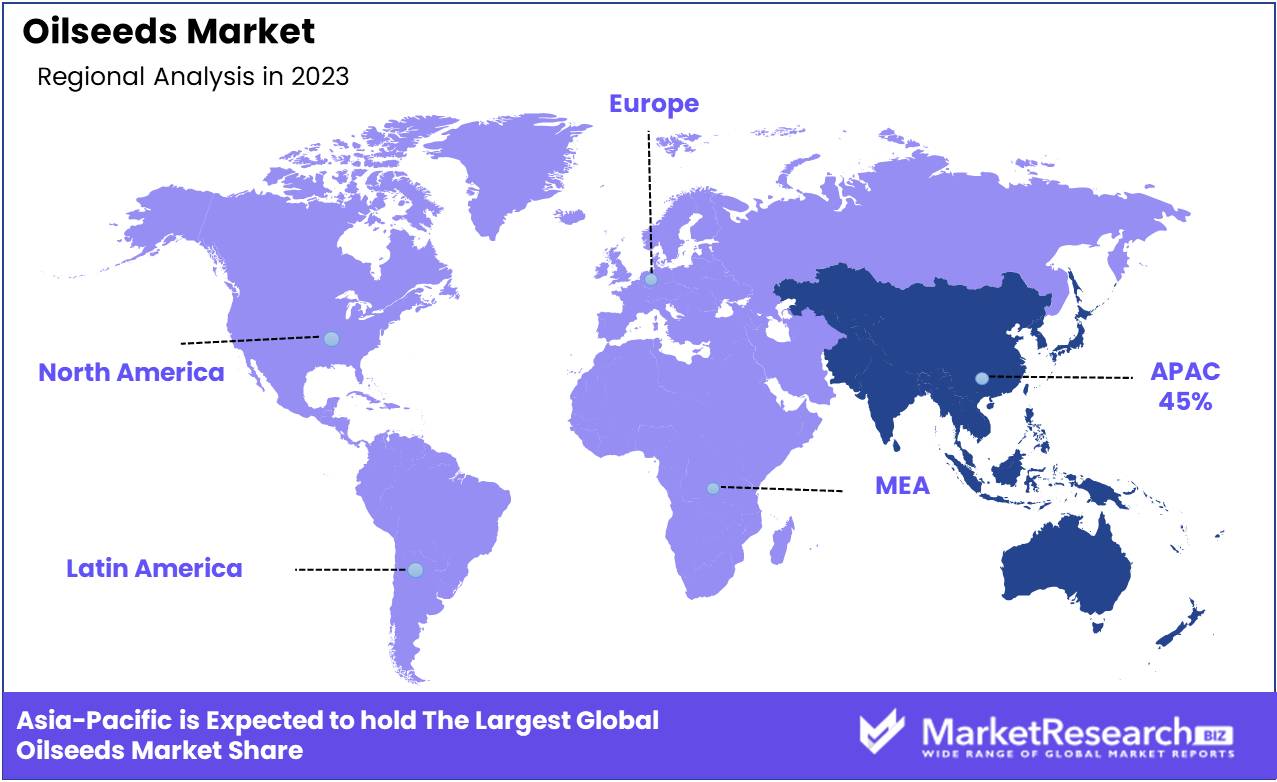

- Regional Dominance: Asia Pacific leads the global oilseeds market with a 45% largest share.

- Growth Opportunity: The global oilseeds market is poised for growth, supported by advancements in biotechnology and strategic market diversification.

Driving factors

Growing Demand for Vegetable Oils and Foods Rich in Protein

The escalating global demand for vegetable oils and protein-rich foods has been a major catalyst for the growth of the oilseeds market. As consumer preferences shift towards healthier diets, the demand for vegetable oils, which are commonly derived from oilseeds such as soybeans, sunflowers, and canola, has surged. According to recent industry reports, the global vegetable oil market is expected to reach USD 267.6 billion by 2028, driven by increased consumption of plant-based oils in cooking and food processing. This heightened demand for vegetable oils directly propels the oilseeds market, as oilseeds are the primary raw materials used in producing these oils.

Moreover, the rising interest in protein-rich diets, including plant-based protein sources, further boosts the demand for oilseeds. Oilseeds are integral to the production of protein-rich meals and snacks, catering to the growing segment of health-conscious and vegetarian consumers. The global plant-based protein market, which encompasses oilseed-derived proteins, is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. This growth reflects a broader trend towards plant-based diets and contributes significantly to the expansion of the oilseeds market.

Industry Expansion in the Food and Beverage Sector

The expansion of the food and beverage sector has notably influenced the growth of the oilseeds market. As the global population increases and urbanization accelerates, there is a greater demand for processed and packaged foods, which frequently utilize vegetable oils and oilseed derivatives. The food and beverage industry's growth is closely tied to the increasing consumption of ready-to-eat meals, snacks, and baked goods, all of which require substantial quantities of vegetable oils for production.

Statistics indicate that the global food and beverage sector is projected to reach USD 8.3 trillion by 2026. This expansion creates a robust market for oilseeds, as manufacturers require a steady supply of oilseed products to meet production needs. The demand for oilseeds in the food industry is also driven by the need for cost-effective and versatile ingredients that can enhance the flavor, texture, and shelf-life of food products. Consequently, the burgeoning food and beverage sector underpins sustained growth in the oilseeds market.

Technological Advances in Oilseed Cultivation and Processing

Technological advancements in oilseed cultivation and processing have significantly contributed to the growth of the oilseeds market. Innovations such as genetically modified (GM) crops, precision agriculture, and advanced processing techniques have enhanced crop yields, reduced production costs, and improved oil extraction efficiency. These technological improvements have made oilseed farming more productive and sustainable, addressing challenges such as pest management, soil health, and climate variability.

For instance, the adoption of GM oilseed varieties, such as herbicide-tolerant soybeans, has increased resistance to pests and diseases, leading to higher yields. Furthermore, advancements in processing technologies, including solvent extraction and cold pressing, have optimized oil extraction and quality. As a result, the oilseeds market benefits from increased supply and reduced production costs, which contribute to its overall growth.

Restraining Factors

Impact of Commodity Price Fluctuations on Oilseeds Market Growth

Changes in commodity prices significantly affect the oilseeds market by influencing production costs and market stability. Fluctuations in global commodity prices, particularly for inputs like fertilizers and energy, can lead to increased operational costs for oilseed producers. These cost increases can, in turn, result in higher prices for oilseeds and their derivatives, impacting consumer demand and market growth.

For instance, if the price of fertilizers rises, oilseed producers may face higher production costs, which could reduce profit margins or lead to higher prices for end products. This scenario could suppress demand, especially in price-sensitive markets. Conversely, if commodity prices drop, it could temporarily boost production and lower prices, potentially increasing market consumption but affecting producer revenues negatively.

The volatility in commodity prices creates uncertainty in investment decisions and can impact long-term planning and production stability within the oilseeds sector. This instability can hinder market growth by creating an unpredictable business environment for producers and investors.

Challenges in Pest and Disease Management Affecting Oilseeds Market Expansion

Pest and disease control issues are critical factors restraining the growth of the oilseeds market. The presence of pests and diseases can severely impact crop yields and quality, leading to reduced production volumes and increased costs for pest management solutions.

Outbreaks of pests and diseases can lead to significant crop losses, which directly affects the supply chain and can cause price increases for oilseeds. These supply disruptions can lead to market instability and reduced consumer confidence. Additionally, the cost of implementing effective pest and disease control measures adds to the overall expense of oilseed production, further impacting profitability and market growth.

By Oilseed Type Analysis

In 2023, Sunflower dominated the Oilseeds Market with high demand.

In 2023, Sunflower held a dominant market position in the By Oilseed Type segment of the Oilseeds Market. Sunflower seeds are renowned for their high oil content and favorable fatty acid profile, which has driven their widespread adoption in various food and industrial applications. This has contributed to their leading position in the market. The sunflower oil's light flavor and high smoke point make it a preferred choice for cooking and frying, further bolstering its demand. Additionally, the oil's use in salad dressings and as an ingredient in processed foods underscores its versatility.

Soybeans followed closely, driven by their significant role in animal feed and their high protein content, which supports its substantial demand in the livestock industry. Sesame seeds are valued for their distinctive flavor and nutritional benefits, including high levels of essential fatty acids and antioxidants. Cottonseed and Rapeseed oils also occupy significant market shares, with cottonseed oil known for its stability and rapeseed oil appreciated for its low saturated fat content. Other oilseeds, including niche varieties, contribute to the market, although they represent a smaller segment compared to the aforementioned types.

By Product Analysis

In 2023, Animal Feed dominated the Oilseeds Market, outpacing Edible Oil.

In 2023, Animal Feed held a dominant market position in the Oilseeds Market. This segment's prominence can be attributed to the rising global demand for livestock products, which drives the need for high-quality animal feed. Oilseeds, particularly soybeans, and canola, are crucial in animal feed formulations due to their high protein content, which supports the growth and health of various livestock species. This segment benefits from the expansion of the livestock sector and increasing meat consumption worldwide.

Conversely, Edible Oil also represents a significant segment of the Oilseeds Market. The demand for edible oils, such as soybean oil, canola oil, and sunflower oil, has been propelled by changing consumer preferences toward healthier cooking oils and the growing food industry. The rise in health-conscious eating habits and the expansion of the processed food sector have significantly boosted the demand for edible oils. Both segments contribute substantially to the overall market dynamics, with Animal Feed maintaining a larger share due to its essential role in agriculture and food production.

By Breeding Analysis

In 2023, Genetically Modified oilseeds dominated the Oilseeds Market segment.

In 2023, Genetically Modified (GM) oilseeds held a dominant market position in the Breeding segment of the Oilseeds Market. This dominance can be attributed to the increasing adoption of GM crops due to their enhanced traits such as improved resistance to pests, diseases, and environmental stresses, which significantly boosts yield and profitability for farmers. GM oilseeds, particularly soybeans, canola, and corn, are engineered to withstand herbicides and insects, offering farmers the advantage of reduced pesticide usage and higher crop productivity. This has led to their widespread acceptance and preference in various agricultural regions, particularly in North America and South America, where large-scale commercial farming practices are prevalent.

In contrast, Conventional oilseeds, while still holding a portion of the market, face growing challenges due to the lower yields and higher susceptibility to pests and diseases compared to their genetically modified counterparts. Conventional breeding methods do not offer the same level of resistance or productivity enhancements, which impacts their competitiveness in the modern agricultural landscape. Thus, the shift towards GM oilseeds continues to shape the market dynamics in favor of genetically modified varieties.

Key Market Segments

By Oilseed Type

- Sunflower

- Soybean

- Sesame

- Cottonseed

- Rapeseed

- Other

By Product

- Animal Feed

- Edible Oil

By Breeding

- Genetically Modified

- Conventional

Growth Opportunity

Utilizing Advances in Genetic Engineering and Biotechnology

One of the most significant opportunities in the oilseeds market lies in the application of genetic engineering and biotechnology. Advances in these fields are enabling the development of high-yield, disease-resistant, and climate-resilient oilseed varieties. These innovations are critical as they address challenges related to crop productivity and sustainability. Genetically modified (GM) oilseeds can offer improved nutritional profiles and higher oil content, meeting the rising demand for healthier and more efficient oilseed products. Companies investing in biotechnological research and development are well-positioned to capture substantial market share by introducing innovative products that enhance agricultural productivity and sustainability.

Market Diversification and Niche Market Opportunities

Another promising avenue for growth is market diversification and the exploration of niche market opportunities. The oilseeds sector is increasingly focusing on diversifying its product offerings to cater to specialized markets, such as plant-based oils and biofuels. Additionally, there is a growing demand for organic and non-GMO oilseed products, driven by consumer preferences for healthier and more sustainable options. Companies that successfully tap into these niche segments can differentiate themselves from competitors and capitalize on the expanding market for premium and specialized oilseed products.

Latest Trends

Rising Demand for Edible Oils

The Oilseeds Market is experiencing significant growth driven by an increasing global demand for edible oils. This surge is largely attributed to the rising consumption of vegetable oils in developing economies, where urbanization and changing lifestyles are driving higher food consumption.

Additionally, the growth of the food processing industry, which utilizes oilseeds for the production of various edible oils, is contributing to this trend. Major oilseed-producing countries, including Brazil, the United States, and Argentina, are expanding their production capacities to meet this demand. Innovations in extraction technologies and the development of high-yielding oilseed varieties are further expected to boost supply and stabilize prices.

Health-Conscious Consumer Trends

A notable trend influencing the Oilseeds Market is the shift toward health-conscious consumer behavior. As awareness of the health benefits of various oils increases, consumers are increasingly seeking products that offer nutritional advantages. This trend is prompting a rise in the consumption of oils rich in omega-3 and omega-6 fatty acids, such as flaxseed and canola oil. The market is witnessing a growing preference for non-GMO and organic oilseed products, reflecting broader concerns about health and sustainability.

Furthermore, the impact of diet-related health issues, such as cardiovascular diseases and obesity, is driving demand for healthier oil alternatives. Companies are responding to these trends by introducing products that cater to the health-conscious consumer, thereby shaping the market dynamics.

Regional Analysis

Asia Pacific leads the global oilseeds market with a 45% largest share.

The global oilseeds market exhibits significant regional variations, driven by diverse agricultural practices and consumption patterns. North America holds a substantial share of the market, with the United States and Canada being major producers. In 2023, North America accounted for approximately 22% of global oilseeds production, driven by the extensive cultivation of soybeans and canola.

Europe represents a key region in the oilseeds market, contributing around 18% to global production. The European Union's focus on sustainable agriculture and crop diversification supports a steady output of rapeseed and sunflower seeds.

Asia Pacific dominates the oilseeds market, with a notable largest market share of approximately 45%. This dominance is attributed to major producers like China and India, which together account for a significant portion of global oilseeds output. The region's rapid industrialization and growing population drive both production and consumption.

Middle East & Africa contributes around 8% to the global market, with oilseed production primarily focused on sunflowers and soybeans in select countries. Latin America holds about 12% of the global market, with Brazil and Argentina leading in soybean production.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global oilseeds market will be shaped by several key players that leverage their expertise and resources to drive growth and innovation. Leading the charge is Cargill Incorporated (U.S.), renowned for its extensive supply chain network and significant investments in technology and sustainability. Cargill's commitment to enhancing the efficiency and environmental impact of oilseed production positions it as a major influence in the market.

Dow (U.S.) and BASF SE (Germany) continue to be pivotal, offering advanced solutions in agrochemicals that enhance oilseed yield and resilience. Dow’s innovations in crop protection and BASF's advancements in genetic crop modification and crop protection products underscore their strategic importance in optimizing oilseed production.

DuPont (U.S.) and Evonik Industries AG (Germany) contribute through their focus on agricultural biotechnology and nutritional solutions. DuPont’s emphasis on seed development and Evonik’s expertise in feed additives play a crucial role in improving oilseed productivity and feed efficiency. Chr. Hansen Holding A/S (Denmark) and DSM (Netherlands) bring critical expertise in natural ingredients and fermentation technologies, essential for enhancing oilseed quality and processing.

Charoen Pokphand Foods PCL (Thailand) and SunOpta (Canada) leverage their regional strengths to supply high-quality oilseed products across various markets. Charoen Pokphand’s extensive distribution network and SunOpta’s focus on organic and non-GMO oilseeds highlight their market relevance. European players like Nutreco, ForFarmers, and De Heus Animal Nutrition (Netherlands) maintain a strong presence with their emphasis on animal nutrition and feed solutions, crucial for integrating oilseeds into the agricultural supply chain.

Market Key Players

- Cargill Incorporated (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)

Recent Development

- In June 2024, Archer Daniels Midland Company (ADM) announced the expansion of its oilseeds processing operations in Egypt. This strategic move aims to enhance ADM's supply chain capabilities and meet the increasing demand for oilseed products in the Middle East and North Africa region.

- In May 2024, Cargill inaugurated a new biodiesel production facility in Mato Grosso, Brazil. This plant will utilize oilseeds like soybeans to produce biodiesel, supporting Brazil's renewable energy initiatives and expanding Cargill's footprint in the biofuels market.

- In April 2024, Bunge Limited entered into a joint venture with BP to develop sustainable aviation fuel (SAF) derived from oilseeds. This collaboration focuses on leveraging Bunge's extensive oilseeds processing infrastructure and BP's expertise in fuel technology to produce SAF, targeting the aviation industry's shift towards greener alternatives.

Report Scope

Report Features Description Market Value (2023) USD 291.5 Billion Forecast Revenue (2033) USD 482.3 Billion CAGR (2024-2032) 5.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Oilseed Type (Sunflower, Soybean, Sesame, Cottonseed, Rapeseed, Other), By Product (Animal Feed and Edible Oil), By Breeding (Genetically Modified and Conventional) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Cargill Incorporated (U.S.), Dow (U.S.), BASF SE (Germany), Chr. Hansen Holding A/S (Denmark), DSM (Netherlands), DuPont (U.S.), Evonik Industries AG (Germany), NOVUS INTERNATIONAL (U.S.), Alltech (Nicholasville), Associated British Foods plc (U.K.), Charoen Pokphand Foods PCL (Thailand), Nutreco (Netherlands), ForFarmers. (Netherlands), De Heus Animal Nutrition (Netherlands), Land O'Lakes (U.S.), Kent Nutrition Group (U.S.), J. D. HEISKELL & CO. (U.S.), Perdue Farms (U.S.), SunOpta (Canada), Scratch Peck Feeds (U.S.), De Heus Animal Nutrition (Netherlands), MEGAMIX (Russia), Agrofeed (Hungary) Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Oilseeds Market Overview

- 2.1. Oilseeds Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Oilseeds Market Dynamics

- 3. Global Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Oilseeds Market Analysis, 2016-2021

- 3.2. Global Oilseeds Market Opportunity and Forecast, 2023-2032

- 3.3. Global Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 3.3.1. Global Oilseeds Market Analysis by By Oilseed Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 3.3.3. Sunflower

- 3.3.4. Soybean

- 3.3.5. Sesame

- 3.3.6. Cottonseed

- 3.3.7. Rapeseed

- 3.3.8. Other

- 3.4. Global Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.4.1. Global Oilseeds Market Analysis by By Product: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.4.3. Animal Feed

- 3.4.4. Edible Oil

- 3.5. Global Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 3.5.1. Global Oilseeds Market Analysis by By Breeding: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 3.5.3. Genetically Modified

- 3.5.4. Conventional

- 3.6. Global Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 3.6.1. Global Oilseeds Market Analysis by : Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 4. North America Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Oilseeds Market Analysis, 2016-2021

- 4.2. North America Oilseeds Market Opportunity and Forecast, 2023-2032

- 4.3. North America Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 4.3.1. North America Oilseeds Market Analysis by By Oilseed Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 4.3.3. Sunflower

- 4.3.4. Soybean

- 4.3.5. Sesame

- 4.3.6. Cottonseed

- 4.3.7. Rapeseed

- 4.3.8. Other

- 4.4. North America Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.4.1. North America Oilseeds Market Analysis by By Product: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.4.3. Animal Feed

- 4.4.4. Edible Oil

- 4.5. North America Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 4.5.1. North America Oilseeds Market Analysis by By Breeding: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 4.5.3. Genetically Modified

- 4.5.4. Conventional

- 4.6. North America Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 4.6.1. North America Oilseeds Market Analysis by : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 4.7. North America Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Oilseeds Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Oilseeds Market Analysis, 2016-2021

- 5.2. Western Europe Oilseeds Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 5.3.1. Western Europe Oilseeds Market Analysis by By Oilseed Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 5.3.3. Sunflower

- 5.3.4. Soybean

- 5.3.5. Sesame

- 5.3.6. Cottonseed

- 5.3.7. Rapeseed

- 5.3.8. Other

- 5.4. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.4.1. Western Europe Oilseeds Market Analysis by By Product: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.4.3. Animal Feed

- 5.4.4. Edible Oil

- 5.5. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 5.5.1. Western Europe Oilseeds Market Analysis by By Breeding: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 5.5.3. Genetically Modified

- 5.5.4. Conventional

- 5.6. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 5.6.1. Western Europe Oilseeds Market Analysis by : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 5.7. Western Europe Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Oilseeds Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Oilseeds Market Analysis, 2016-2021

- 6.2. Eastern Europe Oilseeds Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 6.3.1. Eastern Europe Oilseeds Market Analysis by By Oilseed Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 6.3.3. Sunflower

- 6.3.4. Soybean

- 6.3.5. Sesame

- 6.3.6. Cottonseed

- 6.3.7. Rapeseed

- 6.3.8. Other

- 6.4. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.4.1. Eastern Europe Oilseeds Market Analysis by By Product: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.4.3. Animal Feed

- 6.4.4. Edible Oil

- 6.5. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 6.5.1. Eastern Europe Oilseeds Market Analysis by By Breeding: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 6.5.3. Genetically Modified

- 6.5.4. Conventional

- 6.6. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 6.6.1. Eastern Europe Oilseeds Market Analysis by : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 6.7. Eastern Europe Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Oilseeds Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Oilseeds Market Analysis, 2016-2021

- 7.2. APAC Oilseeds Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 7.3.1. APAC Oilseeds Market Analysis by By Oilseed Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 7.3.3. Sunflower

- 7.3.4. Soybean

- 7.3.5. Sesame

- 7.3.6. Cottonseed

- 7.3.7. Rapeseed

- 7.3.8. Other

- 7.4. APAC Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.4.1. APAC Oilseeds Market Analysis by By Product: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.4.3. Animal Feed

- 7.4.4. Edible Oil

- 7.5. APAC Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 7.5.1. APAC Oilseeds Market Analysis by By Breeding: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 7.5.3. Genetically Modified

- 7.5.4. Conventional

- 7.6. APAC Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 7.6.1. APAC Oilseeds Market Analysis by : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 7.7. APAC Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Oilseeds Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Oilseeds Market Analysis, 2016-2021

- 8.2. Latin America Oilseeds Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 8.3.1. Latin America Oilseeds Market Analysis by By Oilseed Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 8.3.3. Sunflower

- 8.3.4. Soybean

- 8.3.5. Sesame

- 8.3.6. Cottonseed

- 8.3.7. Rapeseed

- 8.3.8. Other

- 8.4. Latin America Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.4.1. Latin America Oilseeds Market Analysis by By Product: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.4.3. Animal Feed

- 8.4.4. Edible Oil

- 8.5. Latin America Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 8.5.1. Latin America Oilseeds Market Analysis by By Breeding: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 8.5.3. Genetically Modified

- 8.5.4. Conventional

- 8.6. Latin America Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 8.6.1. Latin America Oilseeds Market Analysis by : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 8.7. Latin America Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Oilseeds Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Oilseeds Market Analysis, 2016-2021

- 9.2. Middle East & Africa Oilseeds Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, By By Oilseed Type, 2016-2032

- 9.3.1. Middle East & Africa Oilseeds Market Analysis by By Oilseed Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Oilseed Type, 2016-2032

- 9.3.3. Sunflower

- 9.3.4. Soybean

- 9.3.5. Sesame

- 9.3.6. Cottonseed

- 9.3.7. Rapeseed

- 9.3.8. Other

- 9.4. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.4.1. Middle East & Africa Oilseeds Market Analysis by By Product: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.4.3. Animal Feed

- 9.4.4. Edible Oil

- 9.5. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, By By Breeding, 2016-2032

- 9.5.1. Middle East & Africa Oilseeds Market Analysis by By Breeding: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Breeding, 2016-2032

- 9.5.3. Genetically Modified

- 9.5.4. Conventional

- 9.6. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, By , 2016-2032

- 9.6.1. Middle East & Africa Oilseeds Market Analysis by : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By , 2016-2032

- 9.7. Middle East & Africa Oilseeds Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Oilseeds Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Oilseeds Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Oilseeds Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Oilseeds Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Cargill Incorporated (U.S.)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Dow (U.S.)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. BASF SE (Germany)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Chr. Hansen Holding A/S (Denmark)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. DSM (Netherlands)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. DuPont (U.S.)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Evonik Industries AG (Germany)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. NOVUS INTERNATIONAL (U.S.)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Alltech (Nicholasville)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Associated British Foods plc (U.K.)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Charoen Pokphand Foods PCL (Thailand)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Nutreco (Netherlands)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. ForFarmers. (Netherlands)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. De Heus Animal Nutrition (Netherlands)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Land O'Lakes (U.S.)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Kent Nutrition Group (U.S.)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. J. D. HEISKELL & CO. (U.S.)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Perdue Farms (U.S.)

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. SunOpta (Canada)

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Scratch Peck Feeds (U.S.)

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

- Figure 1: Global Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Type in 2022

- Figure 2: Global Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 3: Global Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 4: Global Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 5: Global Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 6: Global Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 7: Global Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 8: Global Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 9: Global Oilseeds Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Oilseeds Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Oilseeds Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 14: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 15: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 16: Global Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 17: Global Oilseeds Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 19: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 20: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 21: Global Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 22: Global Oilseeds Market Share Comparison by Region (2016-2032)

- Figure 23: Global Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 24: Global Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 25: Global Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 26: Global Oilseeds Market Share Comparison by (2016-2032)

- Figure 27: North America Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 28: North America Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 29: North America Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 30: North America Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 31: North America Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 32: North America Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 33: North America Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 34: North America Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 35: North America Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 40: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 41: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 42: North America Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 43: North America Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 45: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 46: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 47: North America Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 48: North America Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 49: North America Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 50: North America Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 51: North America Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 52: North America Oilseeds Market Share Comparison by (2016-2032)

- Figure 53: Western Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 54: Western Europe Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 55: Western Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 56: Western Europe Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 57: Western Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 58: Western Europe Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 59: Western Europe Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 60: Western Europe Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 61: Western Europe Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 66: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 67: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 68: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 69: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 71: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 72: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 73: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 74: Western Europe Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 76: Western Europe Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 77: Western Europe Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 78: Western Europe Oilseeds Market Share Comparison by (2016-2032)

- Figure 79: Eastern Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 80: Eastern Europe Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 81: Eastern Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 82: Eastern Europe Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 83: Eastern Europe Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 84: Eastern Europe Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 85: Eastern Europe Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 86: Eastern Europe Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 87: Eastern Europe Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 92: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 93: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 94: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 95: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 97: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 98: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 99: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 100: Eastern Europe Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 102: Eastern Europe Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 103: Eastern Europe Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 104: Eastern Europe Oilseeds Market Share Comparison by (2016-2032)

- Figure 105: APAC Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 106: APAC Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 107: APAC Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 108: APAC Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 109: APAC Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 110: APAC Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 111: APAC Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 112: APAC Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 113: APAC Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 118: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 119: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 120: APAC Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 121: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 123: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 124: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 125: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 126: APAC Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 128: APAC Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 129: APAC Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 130: APAC Oilseeds Market Share Comparison by (2016-2032)

- Figure 131: Latin America Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 132: Latin America Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 133: Latin America Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 134: Latin America Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 135: Latin America Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 136: Latin America Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 137: Latin America Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 138: Latin America Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 139: Latin America Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 144: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 145: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 146: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 147: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 149: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 150: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 151: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 152: Latin America Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 154: Latin America Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 155: Latin America Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 156: Latin America Oilseeds Market Share Comparison by (2016-2032)

- Figure 157: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Market Share by By Oilseed Typein 2022

- Figure 158: Middle East & Africa Oilseeds Market Attractiveness Analysis by By Oilseed Type, 2016-2032

- Figure 159: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Market Share by By Productin 2022

- Figure 160: Middle East & Africa Oilseeds Market Attractiveness Analysis by By Product, 2016-2032

- Figure 161: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Market Share by By Breedingin 2022

- Figure 162: Middle East & Africa Oilseeds Market Attractiveness Analysis by By Breeding, 2016-2032

- Figure 163: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Market Share by in 2022

- Figure 164: Middle East & Africa Oilseeds Market Attractiveness Analysis by , 2016-2032

- Figure 165: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Oilseeds Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Figure 170: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Figure 171: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Figure 172: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Figure 173: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Figure 175: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Figure 176: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Figure 177: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Figure 178: Middle East & Africa Oilseeds Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Figure 180: Middle East & Africa Oilseeds Market Share Comparison by By Product (2016-2032)

- Figure 181: Middle East & Africa Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Figure 182: Middle East & Africa Oilseeds Market Share Comparison by (2016-2032)

List of Tables

-

- Table 1: Global Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 2: Global Oilseeds Market Comparison by By Product (2016-2032)

- Table 3: Global Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 4: Global Oilseeds Market Comparison by (2016-2032)

- Table 5: Global Oilseeds Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Oilseeds Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 9: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 10: Global Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 11: Global Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 12: Global Oilseeds Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 14: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 15: Global Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 16: Global Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 17: Global Oilseeds Market Share Comparison by Region (2016-2032)

- Table 18: Global Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 19: Global Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 20: Global Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 21: Global Oilseeds Market Share Comparison by (2016-2032)

- Table 22: North America Oilseeds Market Comparison by By Product (2016-2032)

- Table 23: North America Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 24: North America Oilseeds Market Comparison by (2016-2032)

- Table 25: North America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 29: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 30: North America Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 31: North America Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 32: North America Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 34: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 35: North America Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 36: North America Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 37: North America Oilseeds Market Share Comparison by Country (2016-2032)

- Table 38: North America Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 39: North America Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 40: North America Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 41: North America Oilseeds Market Share Comparison by (2016-2032)

- Table 42: Western Europe Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 43: Western Europe Oilseeds Market Comparison by By Product (2016-2032)

- Table 44: Western Europe Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 45: Western Europe Oilseeds Market Comparison by (2016-2032)

- Table 46: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 50: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 51: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 52: Western Europe Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 53: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 55: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 56: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 57: Western Europe Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 58: Western Europe Oilseeds Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 60: Western Europe Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 61: Western Europe Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 62: Western Europe Oilseeds Market Share Comparison by (2016-2032)

- Table 63: Eastern Europe Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 64: Eastern Europe Oilseeds Market Comparison by By Product (2016-2032)

- Table 65: Eastern Europe Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 66: Eastern Europe Oilseeds Market Comparison by (2016-2032)

- Table 67: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Eastern Europe Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 69: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 71: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 72: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 73: Eastern Europe Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 74: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 75: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 76: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 77: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 78: Eastern Europe Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 79: Eastern Europe Oilseeds Market Share Comparison by Country (2016-2032)

- Table 80: Eastern Europe Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 81: Eastern Europe Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 82: Eastern Europe Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 83: Eastern Europe Oilseeds Market Share Comparison by (2016-2032)

- Table 84: APAC Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 85: APAC Oilseeds Market Comparison by By Product (2016-2032)

- Table 86: APAC Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 87: APAC Oilseeds Market Comparison by (2016-2032)

- Table 88: APAC Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: APAC Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 90: APAC Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 92: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 93: APAC Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 94: APAC Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 95: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 96: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 97: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 98: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 99: APAC Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 100: APAC Oilseeds Market Share Comparison by Country (2016-2032)

- Table 101: APAC Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 102: APAC Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 103: APAC Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 104: APAC Oilseeds Market Share Comparison by (2016-2032)

- Table 105: Latin America Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 106: Latin America Oilseeds Market Comparison by By Product (2016-2032)

- Table 107: Latin America Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 108: Latin America Oilseeds Market Comparison by (2016-2032)

- Table 109: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 110: Latin America Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 111: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 112: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 113: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 114: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 115: Latin America Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 116: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 117: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 118: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 119: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 120: Latin America Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 121: Latin America Oilseeds Market Share Comparison by Country (2016-2032)

- Table 122: Latin America Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 123: Latin America Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 124: Latin America Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 125: Latin America Oilseeds Market Share Comparison by (2016-2032)

- Table 126: Middle East & Africa Oilseeds Market Comparison by By Oilseed Type (2016-2032)

- Table 127: Middle East & Africa Oilseeds Market Comparison by By Product (2016-2032)

- Table 128: Middle East & Africa Oilseeds Market Comparison by By Breeding (2016-2032)

- Table 129: Middle East & Africa Oilseeds Market Comparison by (2016-2032)

- Table 130: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 131: Middle East & Africa Oilseeds Market Revenue (US$ Mn) (2016-2032)

- Table 132: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 133: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Oilseed Type (2016-2032)

- Table 134: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Product (2016-2032)

- Table 135: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by By Breeding (2016-2032)

- Table 136: Middle East & Africa Oilseeds Market Revenue (US$ Mn) Comparison by (2016-2032)

- Table 137: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 138: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Oilseed Type (2016-2032)

- Table 139: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Product (2016-2032)

- Table 140: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by By Breeding (2016-2032)

- Table 141: Middle East & Africa Oilseeds Market Y-o-Y Growth Rate Comparison by (2016-2032)

- Table 142: Middle East & Africa Oilseeds Market Share Comparison by Country (2016-2032)

- Table 143: Middle East & Africa Oilseeds Market Share Comparison by By Oilseed Type (2016-2032)

- Table 144: Middle East & Africa Oilseeds Market Share Comparison by By Product (2016-2032)

- Table 145: Middle East & Africa Oilseeds Market Share Comparison by By Breeding (2016-2032)

- Table 146: Middle East & Africa Oilseeds Market Share Comparison by (2016-2032)

- 1. Executive Summary

-

- Cargill Incorporated (U.S.)

- Dow (U.S.)

- BASF SE (Germany)

- Chr. Hansen Holding A/S (Denmark)

- DSM (Netherlands)

- DuPont (U.S.)

- Evonik Industries AG (Germany)

- NOVUS INTERNATIONAL (U.S.)

- Alltech (Nicholasville)

- Associated British Foods plc (U.K.)

- Charoen Pokphand Foods PCL (Thailand)

- Nutreco (Netherlands)

- ForFarmers. (Netherlands)

- De Heus Animal Nutrition (Netherlands)

- Land O'Lakes (U.S.)

- Kent Nutrition Group (U.S.)

- J. D. HEISKELL & CO. (U.S.)

- Perdue Farms (U.S.)

- SunOpta (Canada)

- Scratch Peck Feeds (U.S.)

- De Heus Animal Nutrition (Netherlands)

- MEGAMIX (Russia)

- Agrofeed (Hungary)