Nuclear Imaging Devices Market By Technology (Single-Photon Emission Computed Tomography (SPECT), Positron Emission Tomography (PET), Planar Scintigraphy, Other), By Application (Oncology, Cardiology, Neurology, Other), By End-User, By Region And Companie

-

40534

-

Aug 2023

-

137

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

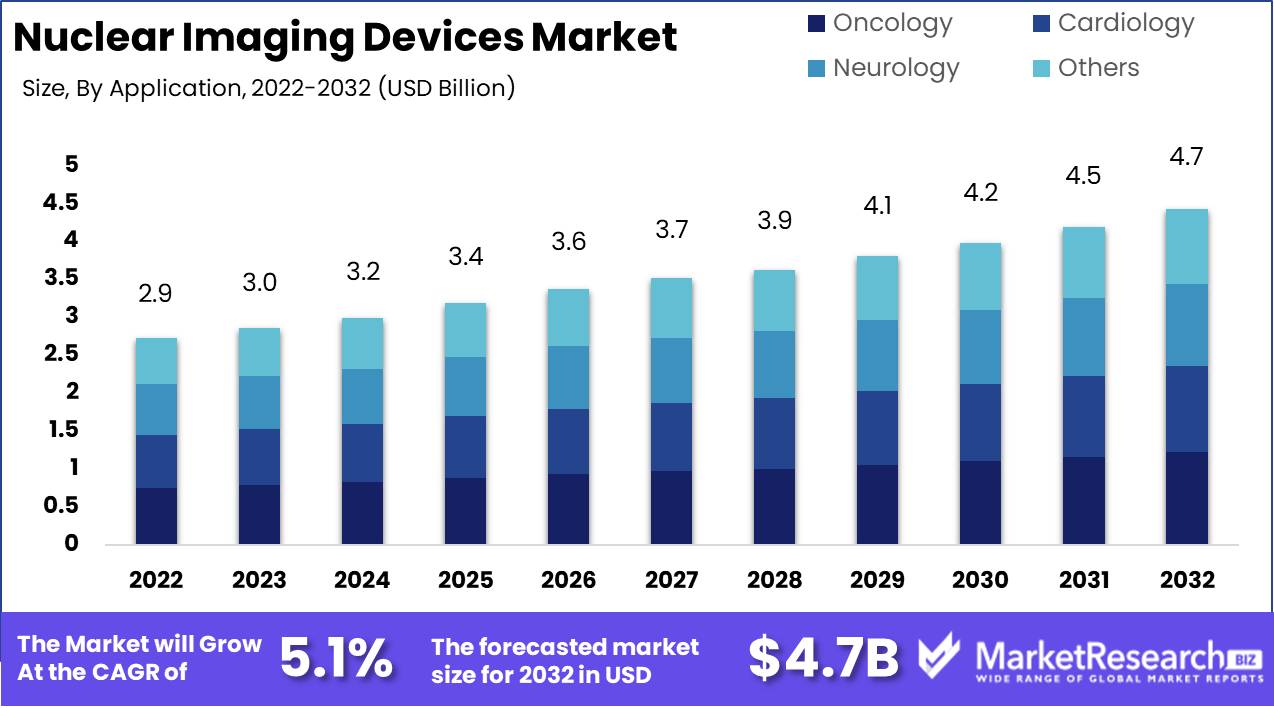

Nuclear Imaging Devices Market size is expected to be worth around USD 4.7 Bn by 2032 from USD 2.9 Bn in 2022, growing at a CAGR of 5.1% during the forecast period from 2023 to 2032.

The nuclear imaging devices market is characterized by its dynamic nature, having witnessed substantial growth and advancements in recent years. Firstly, it is important to note that nuclear imaging devices are a type of medical equipment utilized for the purpose of generating images of the human body through the utilization of radioactive substances. The primary objective of these devices is to assist in the identification and management of diverse medical ailments. The principal aim of nuclear imaging devices is to furnish precise and comprehensive images that assist healthcare professionals in formulating well-informed judgments regarding patient treatment. Medical imaging devices have assumed a pivotal role in the field and have brought about a paradigm shift in the identification and management of diseases and irregularities.

The significance and advantages of nuclear imaging devices cannot be overstated. One of the primary advantages lies in the capability to acquire real-time visual representations of internal anatomical structures, facilitating the timely identification and assessment of pathological conditions. The utilization of this technology has demonstrated significant efficacy in the monitoring of treatment progress and assessment of patient response to therapies. Furthermore, nuclear imaging devices are widely recognized for their non-invasive characteristics, resulting in reduced patient distress and the elimination of invasive procedures.

The nuclear imaging device market has experienced significant advancements that have enhanced their functionalities. The development of devices with improved image quality, increased sensitivity, and reduced radiation exposure has been a focus of researchers and manufacturers. For example, there have been notable advancements in PET-CT (positron emission tomography-computed tomography) devices, which integrate PET and CT technologies to enhance imaging accuracy and anatomical localization.

Significant investments from healthcare providers and technology firms have been drawn towards the advancements in nuclear imaging devices. The integration of nuclear imaging devices into various industries has experienced a notable rise in prevalence. Pharmaceutical companies employ these devices during clinical trials to assess the effectiveness of innovative medications management and observe their impact on the human body.

The growth of the nuclear imaging devices market can be ascribed to its extensive range of medical applications. These devices are extensively utilized in the fields of cardiology, oncology, neurology, and other specialized areas to facilitate the diagnosis and monitoring of various conditions, including cardiovascular disease, cancer, and neurological disorders. Furthermore, it is noteworthy that the market has experienced a notable expansion beyond the conventional realm of medical applications.

Driving factors

Cancer and CVD Rates Rising

Cancer and cardiovascular disorders are becoming more common, which worries people, doctors, and politicians worldwide. Due to the rise in various health disorders, better diagnostic techniques and technologies are needed for early detection, precise diagnosis, and proper treatment. The nuclear imaging devices market has grown due to this demand. Nuclear imaging helps doctors visualize and evaluate organs, tissues, and physiological processes. Radiopharmaceuticals and gamma cameras are used in this non-invasive imaging method to detect and monitor cancer and cardiovascular disorders.

Nuclear imaging advances

Technological advances have boosted the nuclear imaging devices market and improved diagnostics. PET-CT and SPECT have transformed nuclear imaging. PET-CT imaging provides anatomical and functional data in one scan. This integration helps detect and stage lung, breast, and prostate cancers by pinpointing aberrant metabolic activities. PET-CT also helps identify ischemic heart disease and assess myocardial perfusion.

Non-Invasive Diagnostic Capabilities

Non-invasive nuclear imaging devices have many advantages over invasive diagnostic techniques, which is pushing their adoption. Nuclear imaging is safer and less painful than surgery. Nuclear imaging devices are sensitive and specific, allowing early disease identification. This expedites treatment, improving patient outcomes and survival. Nuclear imaging aids treatment planning by monitoring tumor response and physiological changes.

Restraining Factors

Cost Considerations

Cost is a significant factor to be mindful of within the nuclear imaging devices market. The sophisticated technology and expertise required for manufacturing and maintaining these devices often results in high initial investments. Moreover, the research and development costs associated with improving and upgrading nuclear imaging devices are substantial. These expenses can lead to an increased cost per unit, making it challenging for smaller medical facilities or resource-constrained regions to adopt these innovative technologies.

Despite the relatively high costs involved, it is essential to highlight the long-term benefits that nuclear imaging devices offer. Their ability to aid in the diagnosis and monitoring of various medical conditions provides immense value to patients and healthcare providers alike. By accurately detecting and localizing diseases at an early stage, these devices contribute to more effective treatment plans and improved patient outcomes.

Radiotracer Availability

Another aspect that poses a challenge in the nuclear imaging devices market is the availability of radiotracers. Radiotracers are essential components used in various nuclear imaging techniques, such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT). These tracers, which are strategically designed to emit gamma rays, allow healthcare professionals to visualize and analyze functional processes within the body.

The production and distribution of radiotracers require specialized facilities and expertise, which may not be readily accessible in all regions. Factors like limited production capacity, transportation logistics, and regulations regarding the handling and disposal of radioactive substances can affect the availability of radiotracers. Consequently, this hampers the widespread adoption of nuclear imaging devices and restricts their usage to areas with better infrastructure and resources.

Regulatory and Safety Concerns

The nuclear imaging devices market operates under stringent regulatory frameworks to ensure patient safety and maintain quality standards. These regulations include compliance with guidelines regarding the installation, operation, and disposal of nuclear imaging devices, as well as the handling of radiotracers. While these regulations are critical to ensure patient welfare and prevent potential hazards, they can sometimes create obstacles for market growth.

The stringent nature of regulatory requirements may result in delayed approvals and time-consuming certification processes. This poses challenges for manufacturers, as they must invest additional time and resources to meet the necessary compliance criteria. Additionally, the implementation of safety measures and protocols adds to the operational costs, influencing the overall pricing of nuclear imaging devices.

Covid-19 Impact on Nuclear Imaging Devices Market

Nuclear imaging devices have been at the forefront of medical advancements, revolutionizing the diagnosis and treatment of various diseases. Their ability to provide detailed and precise images of the human body has greatly contributed to the field of medicine. However, with the emergence of the COVID-19 pandemic, the global healthcare industry has undergone significant transformations, impacting various sectors, including the nuclear imaging devices market.

The COVID-19 pandemic has brought about a multitude of challenges in the healthcare industry, forcing healthcare providers to adapt to new protocols and safety measures. As a result, the nuclear imaging devices market has experienced both positive and negative impacts.

One of the major impacts of the pandemic on the nuclear imaging devices market is the increased demand for diagnostic imaging to detect and monitor COVID-19 cases. As the virus primarily affects the respiratory system, nuclear imaging devices have played a crucial role in assessing lung function and evaluating potential complications. The ability of these devices to provide real-time imaging and accurate data has been instrumental in the diagnosis and management of COVID-19 patients.

The pandemic has also posed challenges to the nuclear imaging devices market. The disruptions in the global supply chain and manufacturing processes have resulted in delays and shortages of essential components and equipment. This has impacted the production and distribution of nuclear imaging devices, leading to a temporary slowdown in the market. However, industry experts predict that these challenges will be overcome as the situation stabilizes and manufacturing processes resume at full capacity.

The pandemic has highlighted the importance of nuclear imaging devices in not only diagnosing and treating COVID-19 but also in managing other chronic conditions. As healthcare systems focus on building resilience and capacity to handle future crises, nuclear imaging devices will play a pivotal role in early detection, precise diagnosis, and monitoring of various diseases. This increased awareness and recognition of the value of nuclear imaging devices will contribute to the long-term growth and expansion of the market.

Technology Analysis

The field of nuclear imaging has seen significant advancements in recent years, with the Single-Photon Emission Computed Tomography (SPECT) Segment dominating the market for nuclear imaging devices. SPECT is a non-invasive imaging technique that uses gamma rays emitted by a radioactive tracer to create detailed images of internal organs and tissues. This segment has gained immense popularity due to its high accuracy and ability to provide valuable diagnostic information.

Consumer trends and behaviors also play a crucial role in the increasing demand for SPECT devices. Patients and healthcare providers are becoming more aware of the benefits of early diagnosis and accurate imaging. SPECT devices offer a non-invasive and precise method of diagnosing various medical conditions, including cardiovascular diseases, neurological disorders, and cancer. This awareness and understanding of the potential of SPECT devices have driven consumer preferences towards this segment.

Application Analysis

Within the nuclear imaging devices market, the Oncology Segment dominates due to its wide range of applications in cancer diagnosis and treatment. Nuclear imaging techniques, such as positron emission tomography (PET) and SPECT, play a crucial role in the detection and monitoring of cancer. These imaging modalities can accurately localize and quantify cancer cells, allowing physicians to make informed treatment decisions.

Consumer trends and behaviors also contribute to the dominance of the Oncology Segment in the nuclear imaging devices market. With the rising incidence of cancer globally, there is a growing need for accurate and early detection. Patients are becoming more proactive in seeking early diagnosis and personalized treatment options. Nuclear imaging devices, particularly PET and SPECT, offer precise imaging capabilities that aid in the early detection and monitoring of cancer. This consumer demand, coupled with advancements in imaging technology, has led to the dominance of the Oncology Segment.

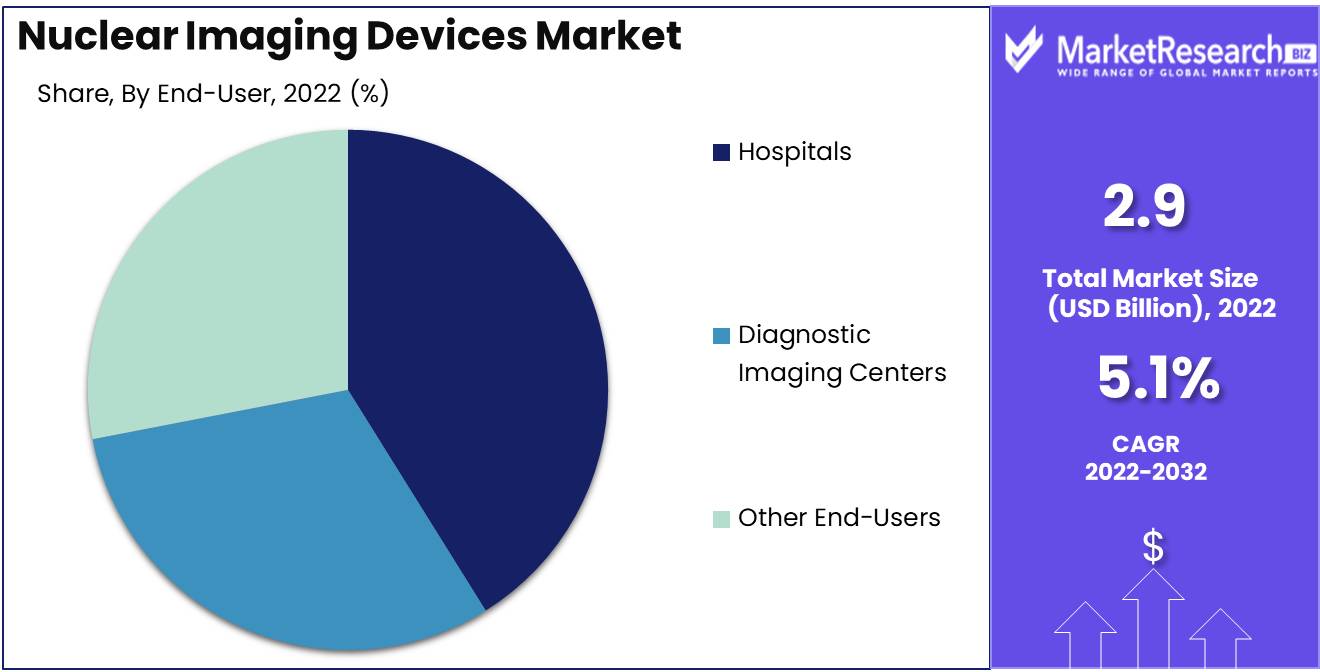

End-User Analysis

Hospitals are the dominant end-users of nuclear imaging devices due to their crucial role in diagnosing and monitoring various medical conditions. The availability of nuclear imaging devices in hospitals allows for prompt and accurate diagnosis, enabling physicians to provide the necessary treatment plans. The convenience and comprehensive services offered by hospitals make them the preferred setting for using nuclear imaging devices.

Consumer trends and behaviors also contribute to the dominance of the Hospitals Segment. Patients often prefer to seek medical care in hospitals due to the availability of a wide range of services and specialists. The convenience of having diagnostic imaging services, including nuclear imaging, within the same facility, is a significant factor in driving the demand for nuclear imaging devices in hospitals.

Key Market Segments

By Technology

- Single-Photon Emission Computed Tomography (SPECT)

- Positron Emission Tomography (PET)

- Planar Scintigraphy

- Other Technologies

By Application

- Oncology

- Cardiology

- Neurology

- Other Applications

By End-User

- Hospitals

- Diagnostic Imaging Centers

- Other End-Users

Growth Opportunity

Artificial Intelligence (AI) Technology

With the rapid progress in artificial intelligence (AI), the nuclear imaging devices market has entered a new era of more precise and efficient image analysis. AI algorithms can now analyze large volumes of imaging data in real-time, aiding healthcare professionals in detecting subtle abnormalities and providing tailored treatment plans. By harnessing the power of AI, nuclear imaging devices can not only improve diagnostic accuracy but also significantly reduce the time required for interpretation and reporting, thus enhancing overall clinical workflow efficiency. As the demand for automated image analysis solutions continues to soar, nuclear imaging device manufacturers are integrating AI-powered software into their systems, offering seamless integration, increased speed, and improved accuracy.

Rising Focus on Theranostics

Theranostics, the integration of diagnostic and therapeutic purposes, has gained prominence within the nuclear imaging devices market. It involves the use of novel radiopharmaceuticals that not only contribute to accurate diagnoses but also enable the delivery of targeted therapies. The development of theranostic agents has opened up new avenues for the treatment of various cancers, neuroendocrine tumors, and other conditions by combining imaging and therapeutic capabilities into a single modality. Technological advancements in nuclear imaging devices have facilitated the utilization of theranostics by providing a precise imaging platform for therapy planning, patient selection, and treatment response assessment.

Hybrid Imaging Modalities

Hybrid imaging combines the strengths of different imaging modalities, such as nuclear imaging and computed tomography (CT) or magnetic resonance imaging (MRI). By fusing anatomical and functional information, hybrid imaging offers a comprehensive assessment of a patient's condition, enabling precise localization of abnormalities and providing more accurate diagnoses. This approach enhances the sensitivity and specificity of nuclear imaging, resulting in better disease detection and characterization. The nuclear imaging devices market is witnessing an increasing adoption of hybrid imaging modalities, driven by the demand for improved diagnostic accuracy and enhanced patient care outcomes.

Neurology and Cardiology

Nuclear imaging devices are finding increasing applications in neurology and cardiology, facilitating the early detection and accurate assessment of neurological and cardiovascular disorders. The integration of quantitative and molecular imaging techniques has revolutionized the diagnosis and management of conditions such as Alzheimer's disease, Parkinson's disease, and various heart-related ailments. In neurology, nuclear imaging devices, combined with advanced imaging biomarkers and molecular imaging agents, enable the identification of pathological changes at an early stage, leading to timely intervention and improved patient outcomes.

Latest Trends

PET-CT: Redefining Precision Medicine

PET-CT scanners are essential for cancer diagnosis, staging, and monitoring. This cutting-edge technology uses PET's functional imaging and CT's structural data to detect and localize cancerous lesions with exceptional accuracy. PET-CT helps doctors make treatment decisions, adapt therapy strategies, and assess response by pinpointing specific cellular processes. PET-CT scanners are in high demand because they can detect cancer early, improving prognoses and survival rates. PET-CT imaging also distinguishes benign from malignant tumors, allowing doctors to schedule operations and radiation treatments more precisely and spare healthy tissues. This development has shifted oncology care toward individualized and focused treatment regimens, increasing patient outcomes.

SPECT-CT Reveals Secrets

SPECT-CT hybrid imaging devices are another nuclear imaging asset. Physicians can grasp the body's cellular function and anatomical structures by integrating CT's structural features with SPECT's functional information. SPECT-CT imaging helps diagnose cardiac, neurological biomarkers, and musculoskeletal diseases. SPECT-CT helps cardiologists monitor heart blood flow, ischemia, and cardiac tissue viability. This non-invasive method detects coronary artery disease, optimizes treatment options, and guides stent or bypass placement. SPECT-CT imaging can detect bone fractures, infections, and malignancies early.

Radiopharmaceuticals

Hybrid imaging methods depend on radiopharmaceuticals. These radioactive medications emit gamma rays for nuclear imaging. Radiopharmaceuticals are given orally or intravenously to target organs and tissues. As nuclear imaging becomes increasingly common, radiopharmaceuticals demand rises. Technological advances have produced a variety of radiotracers that target body molecular processes. This precision-driven strategy helps clinicians understand illness genesis and make informed patient care decisions.

Oncology and Cardiology Need Nuclear Imaging

For proper diagnosis and therapy planning in oncology and cardiology, nuclear imaging is essential. Healthcare practitioners can detect and localize abnormalities early by using PET-CT and SPECT-CT hybrid imaging technologies to obtain extensive physiological and anatomical information about the target location. Nuclear imaging aids oncologists in cancer staging, therapy selection, and treatment response evaluation. Visualizing tumor metabolic activity or perfusion patterns helps doctors assess malignancies' aggressiveness and create specific treatment approaches. Nuclear imaging helps clinicians assess treatment efficacy and adjust regimens quickly.

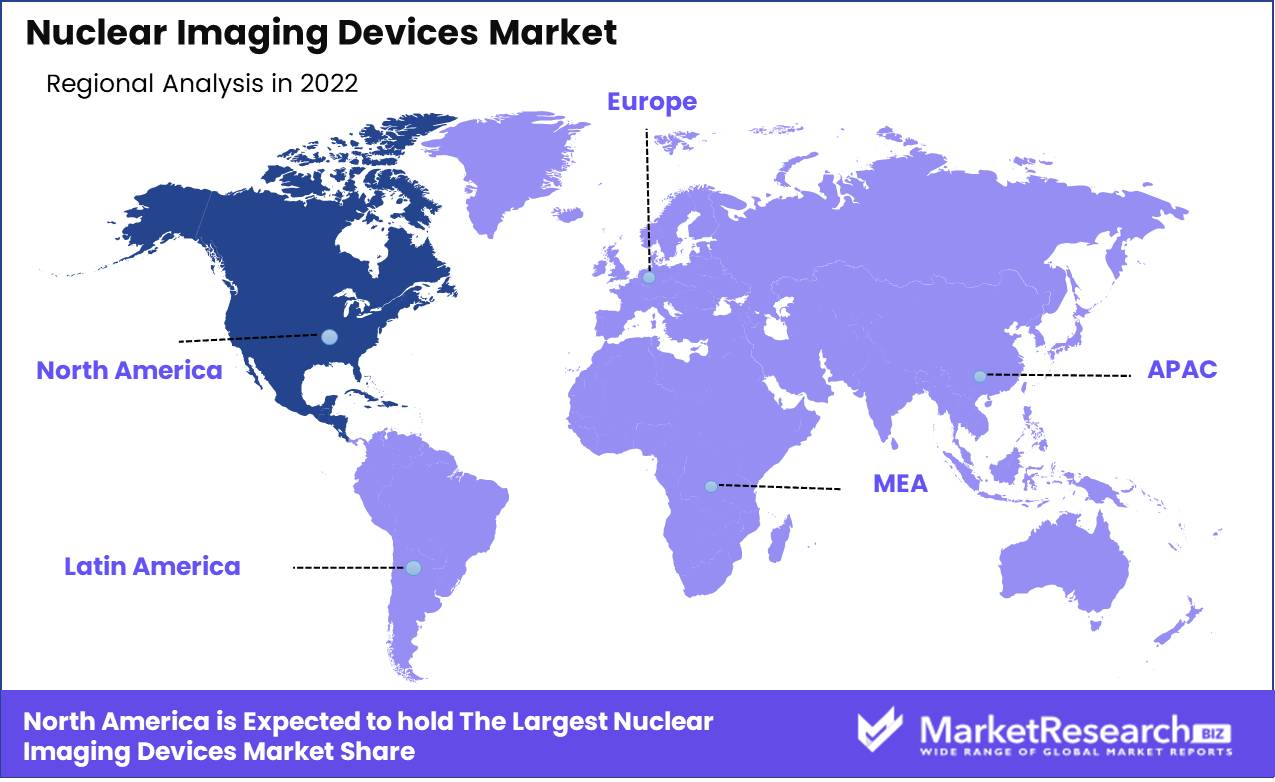

Regional Analysis

North America Region Dominates the Nuclear Imaging Devices Market. In the realm of medical imaging, technology has unquestionably revolutionized the way we diagnose and treat various ailments. Among the cutting-edge diagnostic tools, nuclear imaging devices have emerged as a crucial component for accurate and efficient diagnoses. These devices play a pivotal role in visualizing and mapping the physiological activities of organs, tissues, and cells within the human body. With their immense potential to aid in the early detection and monitoring of diseases, it comes as no surprise that the global market for nuclear imaging devices has been witnessing considerable growth.

One regional player that stands out in dominating the nuclear imaging devices market is none other than North America. Boasting advanced infrastructure, technological prowess, and a robust healthcare system, this region has secured its position at the forefront of medical innovation. Let us delve deeper into the reasons behind North America's market dominance in the field of nuclear imaging devices.

The North American region has a vibrant ecosystem nurturing research and development. It encompasses numerous esteemed academic institutions, private research organizations, and top-notch medical centers working in unison to drive advancements in healthcare technology. This collaborative effort leads to the continuous evolution of nuclear imaging devices, allowing medical professionals to offer superior patient care.

North America boasts a robust regulatory framework that encourages innovation while ensuring patient safety. The stringent guidelines set by organizations such as the Food and Drug Administration (FDA) guarantee that nuclear imaging devices meet the highest standards of quality, reliability, and accuracy. Consequently, healthcare providers in this region have unwavering faith in the effectiveness of these devices, leading to their widespread adoption.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

Siemens Healthineers, a healthcare technology giant, dominates the nuclear imaging devices market. Siemens Healthineers has pioneered new technologies since the early 20th century. SPECT and PET systems are among their nuclear imaging devices. Siemens Healthineers is shaping nuclear imaging with precision, reliability, and excellent image quality.

GE Healthcare dominates the nuclear imaging devices market. GE Healthcare offers many nuclear imaging systems to advance medical imaging technologies. Their advanced SPECT and PET devices help professionals diagnose and treat patients. GE Healthcare leads innovation through a global network and research and development.

Philips Healthcare dominates the nuclear imaging devices market. A whole range of nuclear imaging solutions are available from this renowned company, which is renowned for its innovation and dedication to quality. Philips Healthcare's sophisticated SPECT cameras and hybrid PET/CT systems help doctors diagnose and treat numerous medical diseases. Philips Healthcare shapes nuclear imaging's future with customer service and patient care.

Toshiba Medical Systems Corporation, renamed Canon Medical Systems Corporation, leads medical imaging technologies worldwide. Toshiba Medical Systems Corporation has pioneered the market for nuclear imaging devices through research and development. Their high-resolution SPECT and PET technologies help clinicians diagnose and treat many diseases by seeing and quantifying physiological processes. Toshiba Medical Systems Corporation is a major industry participant due to its extensive history and commitment to innovation.

Medtronic, a medical technology giant, dominates the nuclear imaging devices market. Medtronic provides nuclear medicine solutions using their medical imaging and radiation therapy capabilities. SPECT/CT systems integrate anatomical and functional imaging, giving clinicians a complete diagnostic tool. Medtronic improves nuclear imaging by enhancing patient outcomes and workflow efficiency.

Bruker, a major scientific instrument and analytical solution company, offers nuclear imaging devices. Bruker provides cutting-edge preclinical imaging solutions. Their PET and SPECT devices allow non-invasive small animal imaging for medication development and illness research. Bruker's innovation and scientific expertise shape nuclear imaging's future.

Top Key Players in Nuclear Imaging Devices Market

- DIGIRAD CORPORATION (U.S.)

- Neusoft Corporation (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- SurgicEye GmbH (Germany)

- CMR Naviscan. (U.S.)

- Absolute Imaging Inc. (Canada)

Recent Development

- In 2023, GE Healthcare will launch a cutting-edge nuclear imaging equipment to change the industry. This device offers affordable imaging without sacrificing quality. GE Healthcare democratizes nuclear imaging technology and provides medical practitioners with cutting-edge diagnostic tools by using innovative engineering.

- In 2022, Siemens Healthineers, a leading healthcare company, wants to expand its nuclear imaging production capacity in Europe. This massive project intends to address the rising demand for nuclear imaging devices by lowering delivery times and increasing global accessibility. Siemens Healthineers wants to supply medical practitioners with cutting-edge imaging solutions more efficiently by strategically increasing their manufacturing capabilities.

- In 2021, Canon and Fujifilm Medical Systems developed a revolutionary nuclear imaging equipment. These industry giants are uniting their knowledge to produce a next-generation technology that raises precision, performance, and patient care standards. Fujifilm and Canon hope to improve early disease identification and patient outcomes by maximizing nuclear imaging technology.

- In 2020, Philips Healthcare acquired Esaote, a leading manufacturer of nuclear imaging devices, in a drive to strengthen its nuclear imaging portfolio. The purchase shows Philips Healthcare's dedication to innovation and market leadership. This integration allows Philips Healthcare to harness Esaote's expertise and develop its nuclear imaging products, advancing medical imaging technology.

Report Scope:

Report Features Description Market Value (2022) USD 2.9 Bn Forecast Revenue (2032) USD 4.7 Bn CAGR (2023-2032) 5.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Single-Photon Emission Computed Tomography (SPECT), Positron Emission Tomography (PET), Planar Scintigraphy, Other Technologies), By Application (Oncology, Cardiology, Neurology, Other Applications), By End-User (Hospitals, Diagnostic Imaging Centers, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DIGIRAD CORPORATION (U.S.), Neusoft Corporation (China), CANON MEDICAL SYSTEMS CORPORATION (Japan), SurgicEye GmbH (Germany), CMR Naviscan. (U.S.), Absolute Imaging Inc. (Canada) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Nuclear Imaging Devices Market Overview

- 2.1. Nuclear Imaging Devices Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Nuclear Imaging Devices Market Dynamics

- 3. Global Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Nuclear Imaging Devices Market Analysis, 2016-2021

- 3.2. Global Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 3.3. Global Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 3.3.1. Global Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 3.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 3.3.4. Positron Emission Tomography (PET)

- 3.3.5. Planar Scintigraphy

- 3.3.6. Other Technologies

- 3.4. Global Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Oncology

- 3.4.4. Cardiology

- 3.4.5. Neurology

- 3.4.6. Other Applications

- 3.5. Global Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 3.5.1. Global Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 3.5.3. Hospitals

- 3.5.4. Diagnostic Imaging Centers

- 3.5.5. Other End-Users

- 4. North America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Nuclear Imaging Devices Market Analysis, 2016-2021

- 4.2. North America Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 4.3. North America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 4.3.1. North America Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 4.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 4.3.4. Positron Emission Tomography (PET)

- 4.3.5. Planar Scintigraphy

- 4.3.6. Other Technologies

- 4.4. North America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Oncology

- 4.4.4. Cardiology

- 4.4.5. Neurology

- 4.4.6. Other Applications

- 4.5. North America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 4.5.1. North America Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 4.5.3. Hospitals

- 4.5.4. Diagnostic Imaging Centers

- 4.5.5. Other End-Users

- 4.6. North America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Nuclear Imaging Devices Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Nuclear Imaging Devices Market Analysis, 2016-2021

- 5.2. Western Europe Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 5.3.1. Western Europe Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 5.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 5.3.4. Positron Emission Tomography (PET)

- 5.3.5. Planar Scintigraphy

- 5.3.6. Other Technologies

- 5.4. Western Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Oncology

- 5.4.4. Cardiology

- 5.4.5. Neurology

- 5.4.6. Other Applications

- 5.5. Western Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 5.5.1. Western Europe Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 5.5.3. Hospitals

- 5.5.4. Diagnostic Imaging Centers

- 5.5.5. Other End-Users

- 5.6. Western Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Nuclear Imaging Devices Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Nuclear Imaging Devices Market Analysis, 2016-2021

- 6.2. Eastern Europe Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 6.3.1. Eastern Europe Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 6.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 6.3.4. Positron Emission Tomography (PET)

- 6.3.5. Planar Scintigraphy

- 6.3.6. Other Technologies

- 6.4. Eastern Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Oncology

- 6.4.4. Cardiology

- 6.4.5. Neurology

- 6.4.6. Other Applications

- 6.5. Eastern Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 6.5.1. Eastern Europe Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 6.5.3. Hospitals

- 6.5.4. Diagnostic Imaging Centers

- 6.5.5. Other End-Users

- 6.6. Eastern Europe Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Nuclear Imaging Devices Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Nuclear Imaging Devices Market Analysis, 2016-2021

- 7.2. APAC Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 7.3.1. APAC Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 7.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 7.3.4. Positron Emission Tomography (PET)

- 7.3.5. Planar Scintigraphy

- 7.3.6. Other Technologies

- 7.4. APAC Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Oncology

- 7.4.4. Cardiology

- 7.4.5. Neurology

- 7.4.6. Other Applications

- 7.5. APAC Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 7.5.1. APAC Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 7.5.3. Hospitals

- 7.5.4. Diagnostic Imaging Centers

- 7.5.5. Other End-Users

- 7.6. APAC Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Nuclear Imaging Devices Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Nuclear Imaging Devices Market Analysis, 2016-2021

- 8.2. Latin America Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 8.3.1. Latin America Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 8.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 8.3.4. Positron Emission Tomography (PET)

- 8.3.5. Planar Scintigraphy

- 8.3.6. Other Technologies

- 8.4. Latin America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Oncology

- 8.4.4. Cardiology

- 8.4.5. Neurology

- 8.4.6. Other Applications

- 8.5. Latin America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 8.5.1. Latin America Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 8.5.3. Hospitals

- 8.5.4. Diagnostic Imaging Centers

- 8.5.5. Other End-Users

- 8.6. Latin America Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Nuclear Imaging Devices Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Nuclear Imaging Devices Market Analysis, 2016-2021

- 9.2. Middle East & Africa Nuclear Imaging Devices Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 9.3.1. Middle East & Africa Nuclear Imaging Devices Market Analysis by By Technology: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 9.3.3. Single-Photon Emission Computed Tomography (SPECT)

- 9.3.4. Positron Emission Tomography (PET)

- 9.3.5. Planar Scintigraphy

- 9.3.6. Other Technologies

- 9.4. Middle East & Africa Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Nuclear Imaging Devices Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Oncology

- 9.4.4. Cardiology

- 9.4.5. Neurology

- 9.4.6. Other Applications

- 9.5. Middle East & Africa Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By By End-User, 2016-2032

- 9.5.1. Middle East & Africa Nuclear Imaging Devices Market Analysis by By End-User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User, 2016-2032

- 9.5.3. Hospitals

- 9.5.4. Diagnostic Imaging Centers

- 9.5.5. Other End-Users

- 9.6. Middle East & Africa Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Nuclear Imaging Devices Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Nuclear Imaging Devices Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Nuclear Imaging Devices Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Nuclear Imaging Devices Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. DIGIRAD CORPORATION (U.S.)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Neusoft Corporation (China)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. CANON MEDICAL SYSTEMS CORPORATION (Japan)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. SurgicEye GmbH (Germany)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. CMR Naviscan. (U.S.)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Absolute Imaging Inc. (Canada)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technology in 2022

- Figure 2: Global Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 3: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 4: Global Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 5: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 6: Global Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 7: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 8: Global Nuclear Imaging Devices Market Attractiveness Analysis by Region, 2016-2032

- Figure 9: Global Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 10: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 11: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 12: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 13: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 14: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 15: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 16: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 17: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 18: Global Nuclear Imaging Devices Market Share Comparison by Region (2016-2032)

- Figure 19: Global Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 20: Global Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 21: Global Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 22: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 23: North America Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 24: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 25: North America Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 26: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 27: North America Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 28: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 29: North America Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 30: North America Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 31: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 32: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 33: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 34: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 35: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 36: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 37: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 38: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 39: North America Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 40: North America Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 41: North America Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 42: North America Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 43: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 44: Western Europe Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 45: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 46: Western Europe Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 47: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 48: Western Europe Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 49: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 50: Western Europe Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 51: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 52: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 53: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 54: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 55: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 56: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 57: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 58: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 59: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 60: Western Europe Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 61: Western Europe Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 62: Western Europe Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 63: Western Europe Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 64: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 65: Eastern Europe Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 66: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 67: Eastern Europe Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 68: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 69: Eastern Europe Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 70: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 71: Eastern Europe Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 72: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 73: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 74: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 75: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 76: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 77: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 78: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 79: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 80: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 81: Eastern Europe Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 82: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 83: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 84: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 85: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 86: APAC Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 87: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 88: APAC Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 89: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 90: APAC Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 91: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 92: APAC Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 93: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 94: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 95: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 96: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 97: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 98: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 99: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 100: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 101: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 102: APAC Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 103: APAC Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 104: APAC Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 105: APAC Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 106: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 107: Latin America Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 108: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 109: Latin America Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 110: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 111: Latin America Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 112: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 113: Latin America Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 114: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 115: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 116: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 117: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 118: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 119: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 120: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 121: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 122: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 123: Latin America Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 124: Latin America Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 125: Latin America Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 126: Latin America Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Figure 127: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Technologyin 2022

- Figure 128: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis by By Technology, 2016-2032

- Figure 129: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By Applicationin 2022

- Figure 130: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis by By Application, 2016-2032

- Figure 131: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by By End-Userin 2022

- Figure 132: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis by By End-User, 2016-2032

- Figure 133: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 134: Middle East & Africa Nuclear Imaging Devices Market Attractiveness Analysis by Country, 2016-2032

- Figure 135: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Figure 136: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 137: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Figure 138: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Figure 139: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Figure 140: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 141: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Figure 142: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Figure 143: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Figure 144: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Figure 145: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Figure 146: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Figure 147: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- List of Tables

- Table 1: Global Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 2: Global Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 3: Global Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 4: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 6: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 7: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 8: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 9: Global Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 10: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 11: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 12: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 13: Global Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 14: Global Nuclear Imaging Devices Market Share Comparison by Region (2016-2032)

- Table 15: Global Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 16: Global Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 17: Global Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 18: North America Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 19: North America Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 20: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 21: North America Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 22: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 23: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 24: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 25: North America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 26: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 27: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 28: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 29: North America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 30: North America Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 31: North America Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 32: North America Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 33: North America Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 34: Western Europe Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 35: Western Europe Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 36: Western Europe Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 37: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 39: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 41: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 42: Western Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 43: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 44: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 45: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 46: Western Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 47: Western Europe Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 48: Western Europe Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 49: Western Europe Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 50: Western Europe Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 51: Eastern Europe Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 52: Eastern Europe Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 53: Eastern Europe Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 54: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 56: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 58: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 59: Eastern Europe Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 60: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 61: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 62: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 63: Eastern Europe Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 64: Eastern Europe Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 65: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 66: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 67: Eastern Europe Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 68: APAC Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 69: APAC Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 70: APAC Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 71: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 72: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 73: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 74: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 75: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 76: APAC Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 77: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 78: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 79: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 80: APAC Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 81: APAC Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 82: APAC Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 83: APAC Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 84: APAC Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 85: Latin America Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 86: Latin America Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 87: Latin America Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 88: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 90: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 92: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 93: Latin America Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 94: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 95: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 96: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 97: Latin America Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 98: Latin America Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 99: Latin America Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 100: Latin America Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 101: Latin America Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- Table 102: Middle East & Africa Nuclear Imaging Devices Market Comparison by By Technology (2016-2032)

- Table 103: Middle East & Africa Nuclear Imaging Devices Market Comparison by By Application (2016-2032)

- Table 104: Middle East & Africa Nuclear Imaging Devices Market Comparison by By End-User (2016-2032)

- Table 105: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 106: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) (2016-2032)

- Table 107: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 108: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Technology (2016-2032)

- Table 109: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By Application (2016-2032)

- Table 110: Middle East & Africa Nuclear Imaging Devices Market Revenue (US$ Mn) Comparison by By End-User (2016-2032)

- Table 111: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 112: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Technology (2016-2032)

- Table 113: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By Application (2016-2032)

- Table 114: Middle East & Africa Nuclear Imaging Devices Market Y-o-Y Growth Rate Comparison by By End-User (2016-2032)

- Table 115: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by Country (2016-2032)

- Table 116: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By Technology (2016-2032)

- Table 117: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By Application (2016-2032)

- Table 118: Middle East & Africa Nuclear Imaging Devices Market Share Comparison by By End-User (2016-2032)

- 1. Executive Summary

-

- DIGIRAD CORPORATION (U.S.)

- Neusoft Corporation (China)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- SurgicEye GmbH (Germany)

- CMR Naviscan. (U.S.)

- Absolute Imaging Inc. (Canada)