NSAIDs Market By Disease Indication (Arthritis, Migraine, Ophthalmic Diseases, Others), By Route of Administration (Oral, Topical, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45946

-

April 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

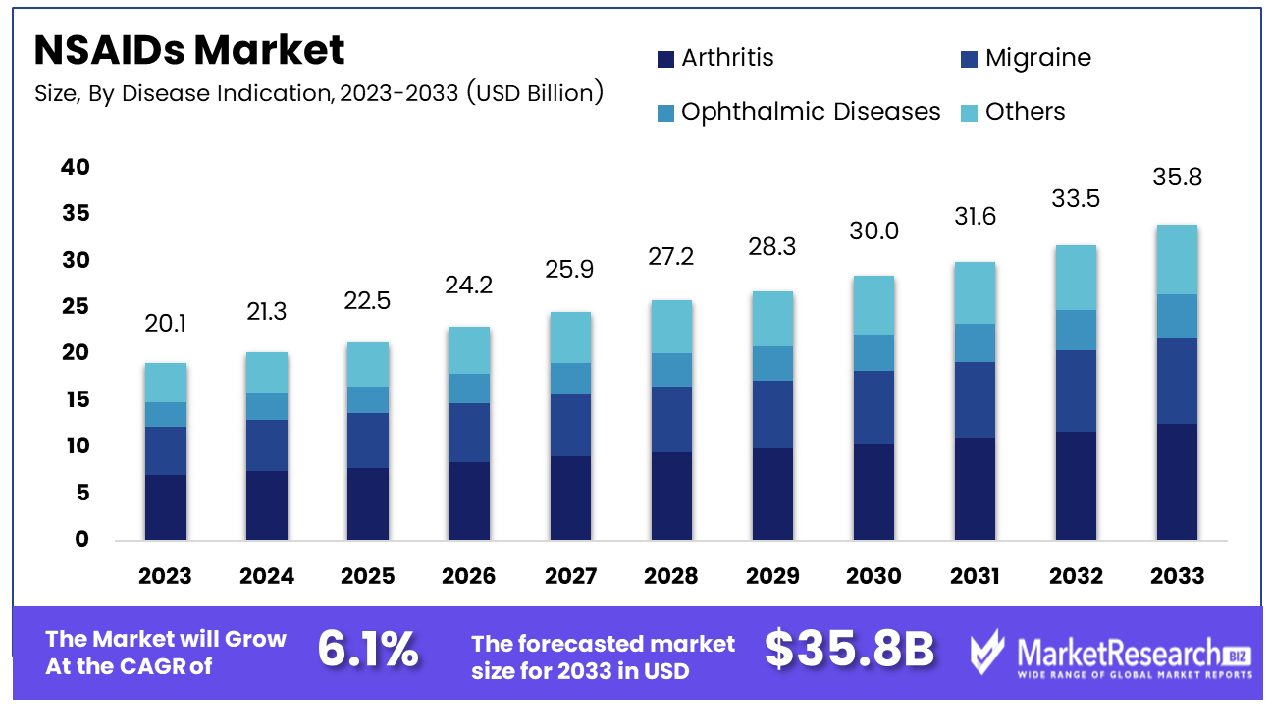

The Global NSAIDs Market was valued at USD 20.1 Bn in 2023. It is expected to reach USD 35.8 Bn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

The NSAIDs Market refers to the pharmaceutical sector encompassing Nonsteroidal Anti-Inflammatory Drugs. These medications are widely utilized for their analgesic, anti-pyretic, and anti-inflammatory properties, catering to a spectrum of ailments such as arthritis, musculoskeletal disorders, and acute pain management. This market is characterized by a diverse range of products, including both prescription and over-the-counter formulations, offering varying degrees of efficacy and safety profiles. Factors driving growth include an aging population, increasing prevalence of chronic diseases, and expanding healthcare infrastructure globally. Market players must navigate regulatory landscapes, innovate in drug delivery mechanisms, and prioritize patient safety to capitalize on emerging opportunities.

As analysts examining the NSAIDs (Non-Steroidal Anti-Inflammatory Drugs) market, our perspective encapsulates a comprehensive understanding of its dynamics and trends. NSAIDs represent a cornerstone of pharmaceutical therapy, globally ubiquitous in their usage, with over 30 billion doses administered annually. However, beneath this staggering consumption lies a landscape shaped by both opportunity and challenge.

The widespread utilization of NSAIDs underscores their significant role in managing pain and inflammation across diverse medical conditions. This expansive reach ensures a consistent demand, providing a stable foundation for market growth. Nevertheless, our analysis unveils nuanced complexities, particularly concerning long-term usage.

While NSAIDs offer notable efficacy, prolonged utilization poses inherent risks, notably an elevated likelihood of gastrointestinal bleeding. This risk, estimated at 1-2% per year, underscores the importance of balanced risk-benefit assessments in clinical decision-making. Such considerations reverberate throughout the healthcare ecosystem, influencing prescribing patterns, patient education initiatives, and regulatory deliberations.

In navigating this landscape, stakeholders must embrace a strategic approach that integrates innovation, regulatory compliance, and patient safety imperatives. Market players poised to thrive will be those adept at leveraging scientific advancements to mitigate risks while enhancing therapeutic outcomes. Furthermore, opportunities abound for novel formulations that offer improved safety profiles without compromising efficacy.

Key Takeaways

- Market Value: The Global NSAIDs Market was valued at USD 20.1 Bn in 2023. It is expected to reach USD 35.8 Bn by 2033, with a CAGR of 6.1% during the forecast period from 2024 to 2033

- By Disease Indication: Arthritis indications take center stage, dominating with a substantial share of 45%, reflecting the prevalent use of NSAIDs in managing arthritis-related pain.

- By Route of Administration: Oral administration routes emerge as the preferred mode, holding a commanding share of 60%, reflecting the convenience and efficacy of oral NSAIDs formulations.

- By Distribution Channel: Retail Pharmacies lead with a significant share of 50%, highlighting their pivotal role in dispensing NSAIDs medications for pain management and relief.

- Regional Dominance: North America capturing a substantial share of 45%, underlining the region's prevalent use of NSAIDs in managing arthritis-related pain and inflammation.

- Growth Opportunity: The market holds promising growth prospects fueled by ongoing innovations in pain management formulations, aiming to address diverse patient needs and preferences effectively

Driving factors

Economic Conditions and Demographics

Economic conditions and demographics play a pivotal role in shaping the dynamics of the NSAIDs (Non-Steroidal Anti-Inflammatory Drugs) market. As economies develop, there's typically an increase in healthcare expenditure, including pharmaceuticals. Moreover, demographic factors such as population size, age distribution, and income levels significantly influence the demand for NSAIDs.

In regions with robust economies and a higher proportion of aging populations, there's often a greater prevalence of chronic pain-related diseases like arthritis and osteoarthritis. These economic and demographic factors create a conducive environment for the growth of the NSAIDs market, as individuals seek relief from pain and inflammation associated with such conditions.

Increasing Prevalence of Pain-Related Diseases

The rising prevalence of pain-related diseases serves as a fundamental driver for the expansion of the NSAIDs market. Conditions like arthritis, rheumatoid arthritis, and musculoskeletal disorders are becoming increasingly common globally, fueled by factors such as sedentary lifestyles, obesity, and aging populations.

According to recent statistics, the prevalence of arthritis alone is expected to rise significantly over the coming years. This surge in chronic pain conditions necessitates effective management strategies, where NSAIDs play a central role. As awareness about these conditions increases and healthcare infrastructure improves, the demand for NSAIDs is expected to escalate correspondingly.

Growing Geriatric Population

The growing geriatric population is a significant contributor to the expansion of the NSAIDs market. Elderly individuals are more prone to chronic pain conditions due to age-related degeneration of joints and tissues. As the global population continues to age, the prevalence of conditions like arthritis and osteoarthritis is expected to soar.

Moreover, older adults often experience multiple comorbidities, necessitating the use of medications like NSAIDs for pain management. With advancements in healthcare extending life expectancy, the sheer number of elderly individuals seeking relief from pain is propelling the demand for NSAIDs.

Restraining Factors

Awareness of NSAID Side Effects

Heightened awareness of NSAID side effects presents a nuanced challenge and opportunity within the NSAIDs market landscape. While NSAIDs are widely utilized for pain relief and inflammation management, there's growing recognition of their potential adverse effects, including gastrointestinal complications, cardiovascular risks, and renal issues.

As awareness of these side effects increases among healthcare professionals and patients alike, there's a shift towards more cautious prescribing practices and a preference for alternative pain management strategies, such as physical therapy or non-pharmacological interventions. This heightened awareness can initially pose a barrier to market growth as concerns about side effects may deter some individuals from using NSAIDs.

Patent Expiry Concerns

The looming expiration of patents for key NSAID medications introduces a complex dynamic to the market landscape. Patent expiry typically leads to the entry of generic competitors, resulting in price erosion and market saturation. This phenomenon poses a challenge to innovator companies, as they face increased competition and revenue loss from generic alternatives.

Patent expiry also presents opportunities for market expansion and accessibility. Generic NSAIDs offer cost-effective alternatives, making treatment more affordable and accessible to a broader population. This can stimulate market growth, especially in regions with limited healthcare resources or where NSAIDs were previously cost-prohibitive.

By Disease Indication Analysis

In 2023, Arthritis held a dominant market position in the NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) segment, specifically within the By Disease Indication category. Arthritis accounted for over 45% of the market share, reflecting its significant presence and demand within this therapeutic segment.

Arthritis, a chronic inflammatory condition affecting the joints, has long been a key focus area within the NSAIDs market due to its prevalence and the substantial patient population it serves. The dominance of Arthritis within this segment underscores its status as a primary target for NSAIDs therapy, with a considerable portion of NSAIDs consumption directed towards managing pain and inflammation associated with arthritic conditions.

This substantial market share signifies both the prevalence of Arthritis among the population and the efficacy of NSAIDs in addressing its symptoms. Moreover, it highlights the importance of ongoing research and development efforts aimed at optimizing NSAIDs formulations and delivery mechanisms specifically tailored to meet the needs of arthritis patients.

By Route of Administration Analysis

In 2023, Oral held a dominant market position in the NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) segment, specifically within the By Route of Administration category. Oral formulations accounted for more than 60% of the market share, illustrating their widespread adoption and preference within this therapeutic segment.

Oral administration of NSAIDs has traditionally been favored due to its convenience, ease of use, and systemic delivery of the drug. This dominance of Oral NSAIDs underscores the established trust and reliance on this route of administration among healthcare providers and patients alike.

The significant market share captured by Oral NSAIDs reflects their versatility in treating a wide range of inflammatory conditions, including arthritis, migraines, and other pain-related ailments. Moreover, the availability of various oral formulations, including tablets, capsules, and liquids, provides healthcare practitioners with flexibility in prescribing treatments tailored to individual patient needs.

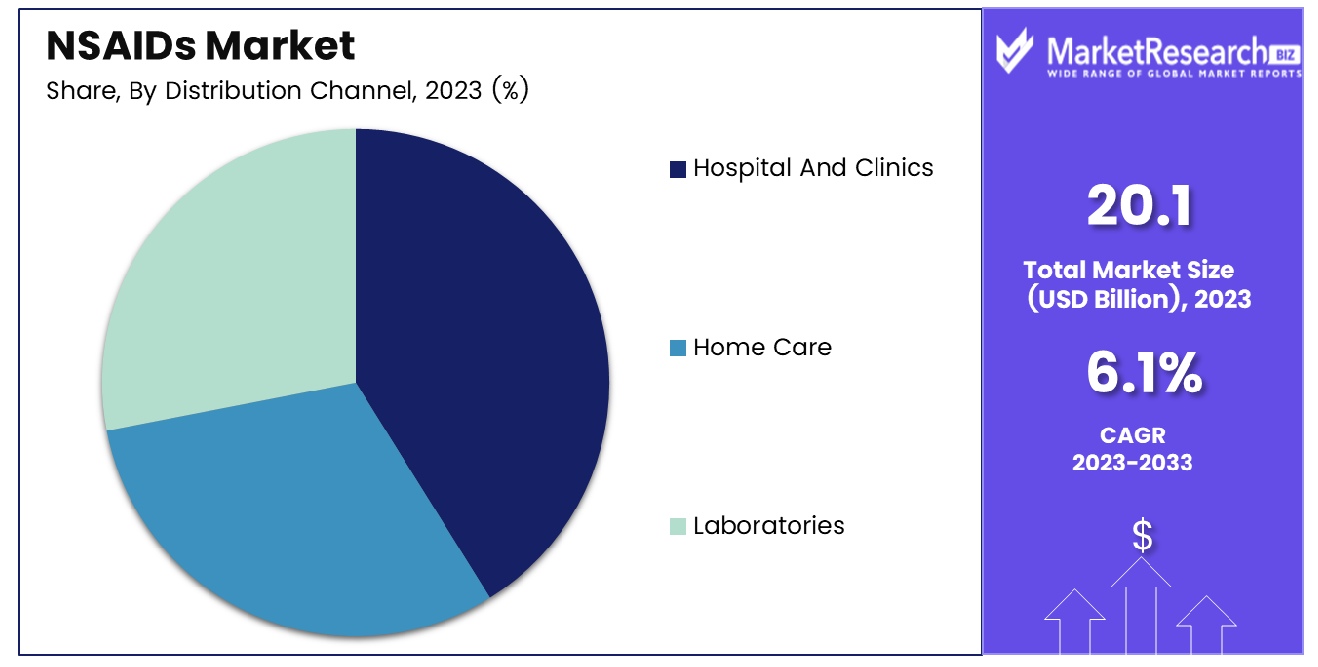

By Distribution Channel Analysis

In 2023, Retail Pharmacy held a dominant market position in the NSAIDs (Nonsteroidal Anti-Inflammatory Drugs) segment, specifically within the By Distribution Channel category. Retail Pharmacy outlets accounted for more than 50% of the market share, signifying their prominent role in the distribution and accessibility of NSAIDs to consumers.

Retail Pharmacies, including chain pharmacies, independent pharmacies, and drugstores, serve as crucial intermediaries between pharmaceutical manufacturers and end-users. Their widespread presence in local communities, coupled with the convenience they offer, positions them as preferred destinations for consumers seeking over-the-counter (OTC) and prescription NSAIDs alike.

The dominance of Retail Pharmacy in the NSAIDs market reflects the trust and confidence placed in these establishments by both healthcare providers and patients. Retail Pharmacies provide personalized guidance, patient education, and medication counseling, enhancing the overall patient experience and ensuring safe and effective use of NSAIDs.

The availability of a diverse range of NSAIDs formulations and brands in Retail Pharmacies caters to the varying needs and preferences of consumers. Whether it's oral tablets, topical creams, or specialized formulations, Retail Pharmacies offer a comprehensive selection of NSAIDs products to address different types of pain and inflammation.

Key Market Segments

By Disease Indication

- Arthritis

- Migraine

- Ophthalmic Diseases

- Others

By Route of Administration

- Oral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Growth Opportunity

Meeting the Demands of an Aging Population

As the global population continues to age, the demand for Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) is poised to witness substantial growth. With aging comes an increase in chronic conditions such as arthritis and osteoarthritis, which often necessitate long-term pain management.

NSAIDs, renowned for their efficacy in alleviating pain and inflammation, are expected to be in high demand among the elderly population seeking relief from these conditions. This demographic shift presents a significant opportunity for pharmaceutical companies operating in the NSAIDs market to capitalize on the burgeoning demand.

Expanding OTC Availability

The over-the-counter (OTC) availability of NSAIDs has been a game-changer in the pharmaceutical industry, providing consumers with convenient access to pain relief medications without the need for a prescription. This accessibility has not only empowered consumers to manage minor aches and pains independently but has also contributed to the expansion of the NSAIDs market.

With more consumers opting for self-medication, pharmaceutical companies are presented with an opportunity to introduce innovative OTC NSAID products to cater to this growing segment of the market.

Latest Trends

Shift to Topical NSAID Preparations

One of the prominent trends shaping the landscape of the global NSAIDs market in 2024 is the notable shift towards topical NSAID preparations. Traditionally, NSAIDs were predominantly administered orally in the form of tablets or capsules. However, with advancements in pharmaceutical technology and growing consumer preference for localized pain relief, topical NSAID formulations have gained significant traction. These topical preparations offer several advantages over oral NSAIDs, including targeted delivery to the site of pain, reduced systemic side effects, and enhanced patient compliance.

NSAIDs are favored by healthcare providers for their potential to minimize gastrointestinal complications commonly associated with oral NSAIDs. This trend underscores the evolving treatment paradigms in pain management and presents lucrative opportunities for pharmaceutical companies to innovate and diversify their product portfolios to cater to the growing demand for topical NSAID solutions.

Retail Pharmacies Dominance

Another noteworthy trend in the global NSAIDs market is the increasing dominance of retail pharmacies in the distribution and dispensing of NSAID products. Retail pharmacies serve as crucial touchpoints for consumers seeking over-the-counter (OTC) NSAID medications to manage various pain-related conditions. Their widespread presence, coupled with convenient access and professional guidance from pharmacists, makes retail pharmacies the preferred destination for purchasing NSAID products.

The growing trend of self-medication and consumer empowerment further reinforces the significance of retail pharmacies in driving NSAID sales. Pharmaceutical companies are thus compelled to strengthen their partnerships with retail pharmacy chains and optimize their distribution networks to effectively reach end consumers. By aligning with this trend and enhancing their retail pharmacy collaborations, companies can capitalize on the evolving dynamics of the global NSAIDs market and sustain growth in the competitive landscape.

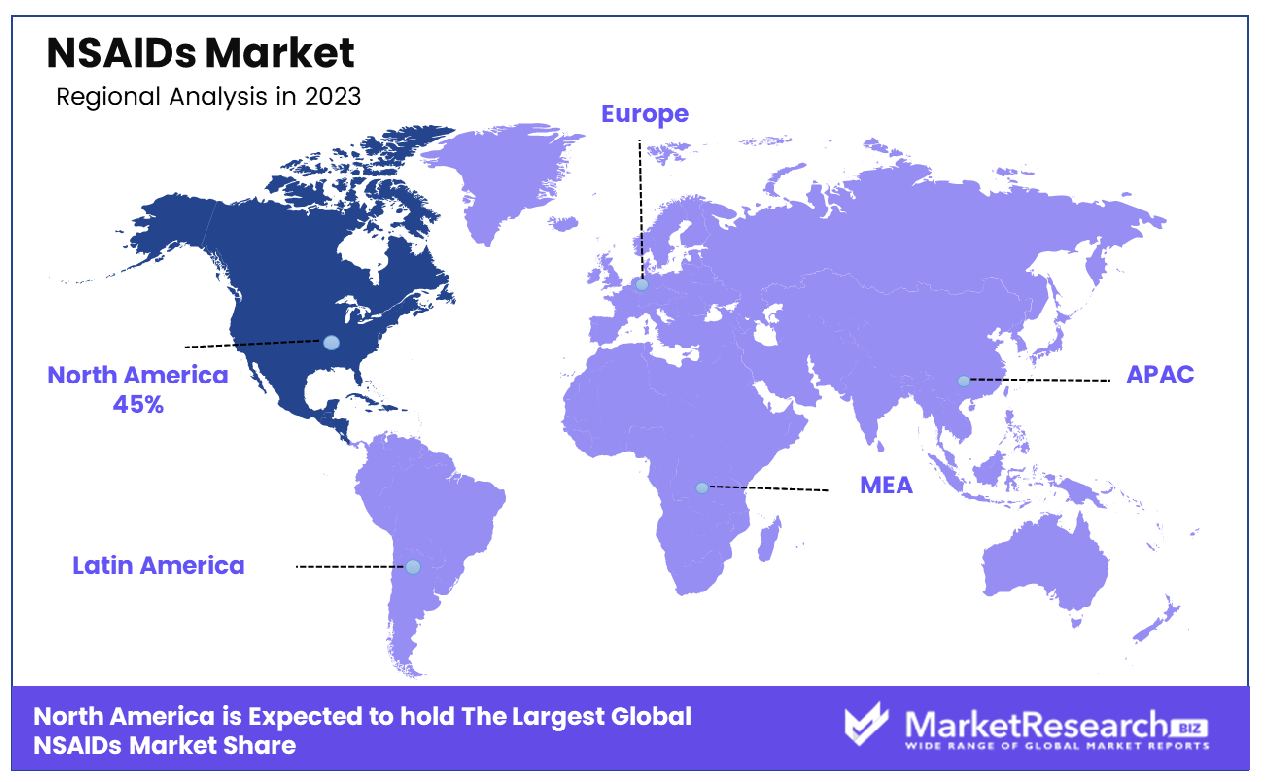

Regional Analysis

North America dominates the NSAIDs market with a significant share of approximately 45%.

North America dominates the NSAIDs market with a significant share of approximately 45%. This dominance is attributed to the high prevalence of chronic diseases such as arthritis and the growing geriatric population in the region. Additionally, favorable reimbursement policies and the presence of established pharmaceutical companies further fuel market growth. According to the Arthritis Foundation, arthritis affects over 54 million adults in the United States alone, thereby driving the demand for NSAIDs. Furthermore, technological advancements in drug delivery systems and increasing healthcare expenditure contribute to the expansion of the NSAIDs market in North America.

Europe holds a substantial share in the NSAIDs market owing to the rising incidence of musculoskeletal disorders and inflammatory diseases across the region. According to the European Network for the Assessment of Health Technology, over 100 million people in Europe suffer from chronic pain, stimulating the demand for NSAIDs.

The Asia Pacific region is witnessing rapid growth in the NSAIDs market due to factors such as increasing healthcare expenditure, rising awareness about pain management, and the growing geriatric population. Countries like China and India are major contributors to market growth, driven by the high prevalence of chronic diseases and improving access to healthcare services.

The NSAIDs market in the Middle East & Africa is witnessing steady growth, supported by factors such as the increasing prevalence of chronic diseases, improving healthcare infrastructure, and rising healthcare expenditure. The region's growing elderly population, coupled with lifestyle changes leading to a higher incidence of musculoskeletal disorders, contributes to market expansion.

Latin America presents lucrative opportunities for the NSAIDs market, driven by factors such as the rising prevalence of chronic diseases, improving healthcare infrastructure, and increasing healthcare expenditure. Countries like Brazil and Mexico are key contributors to market growth in the region, owing to their large population bases and expanding pharmaceutical sectors.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the global NSAIDs market of 2024, several key players are shaping the industry landscape with their innovative products, strategic initiatives, and market expansion endeavors. Among these prominent companies, Pfizer Inc., Dr. Reddy’s Laboratories Ltd, GSK plc, Teva Pharmaceutical Industries Ltd., Viatris Inc, Johnson And Johnson Services Inc., Merck & Co., Inc., and Bayer AG stand out as major influencers.

Pfizer Inc., a pharmaceutical giant renowned for its extensive portfolio, continues to assert its dominance in the NSAIDs market through research and development efforts aimed at addressing unmet medical needs. The company's focus on developing novel formulations and expanding its market presence reinforces its position as a key player in the industry.

Dr. Reddy’s Laboratories Ltd, known for its commitment to delivering high-quality generic medications, plays a crucial role in the NSAIDs market by offering cost-effective alternatives to branded products. Its emphasis on product innovation and strategic partnerships contributes to its sustained growth and competitive edge in the market.

GSK plc, with its strong research capabilities and diversified product portfolio, remains a significant player in the NSAIDs market. The company's focus on addressing therapeutic gaps and leveraging advanced technologies underscores its commitment to improving patient outcomes and driving market growth.

Teva Pharmaceutical Industries Ltd., Viatris Inc, Johnson And Johnson Services Inc., Merck & Co., Inc., and Bayer AG also play pivotal roles in the global NSAIDs market, each contributing unique strengths and perspectives to meet the evolving needs of patients and healthcare providers worldwide. As competition intensifies and market dynamics evolve, these key players are expected to continue shaping the trajectory of the NSAIDs market through innovation, strategic collaborations, and patient-centric approaches.

Market Key Players

- Pfizer Inc.

- Dr. Reddy’s Laboratories Ltd

- GSK plc

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc

- Johnson And Johnson Services Inc.

- Merck & Co., Inc.

- Bayer AG

Recent Development

In February 2024, Recent developments in non-opioid pain medication include Vertex Pharmaceuticals' VX-548, a NaV1.8 inhibitor, showing efficacy in phase 3 trials, and Antibe Therapeutics' otenaproxesul, a safer NSAID, entering phase 2 trials.

In August 2023, ITV's Media for Equity program invests £5 million in advertising inventory in Flarin®, a lipid-formulated ibuprofen brand, aiming to boost brand awareness and growth in joint pain relief.

In August 2023, Chinese chemical giants like Hengli, Wanhua, and Sinopec are expanding into innovative segments like battery materials and solar panel production, backed by government support, posing challenges for Western counterparts.

Report Scope

Report Features Description Market Value (2023) USD 20.1 Bn Forecast Revenue (2033) USD 35.8 Bn CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Disease Indication (Arthritis, Migraine, Ophthalmic Diseases, Others), By Route of Administration (Oral, Topical, Others), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Dr. Reddy’s Laboratories Ltd, GSK plc, Teva Pharmaceutical Industries Ltd., Viatris Inc, Johnson And Johnson Services Inc., Merck & Co., Inc., Bayer AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pfizer Inc.

- Dr. Reddy’s Laboratories Ltd

- GSK plc

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc

- Johnson And Johnson Services Inc.

- Merck & Co., Inc.

- Bayer AG