Neuromorphic Computing Market By Component (Hardware, Software, and Services), By Deployment Mode (Edge Computing, and Cloud Computing), By End-Use(Consumer Electronics, Automotive and Others), By Application(Signal Processing, Image Processing and Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast Period 2024-2033

-

51219

-

Sept 2024

-

378

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Component Analysis

- By Deployment Analysis

- By End-Use Analysis

- By Application Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- North America Leads the Neuromorphic Computing Market with 40.1% Largest Share

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

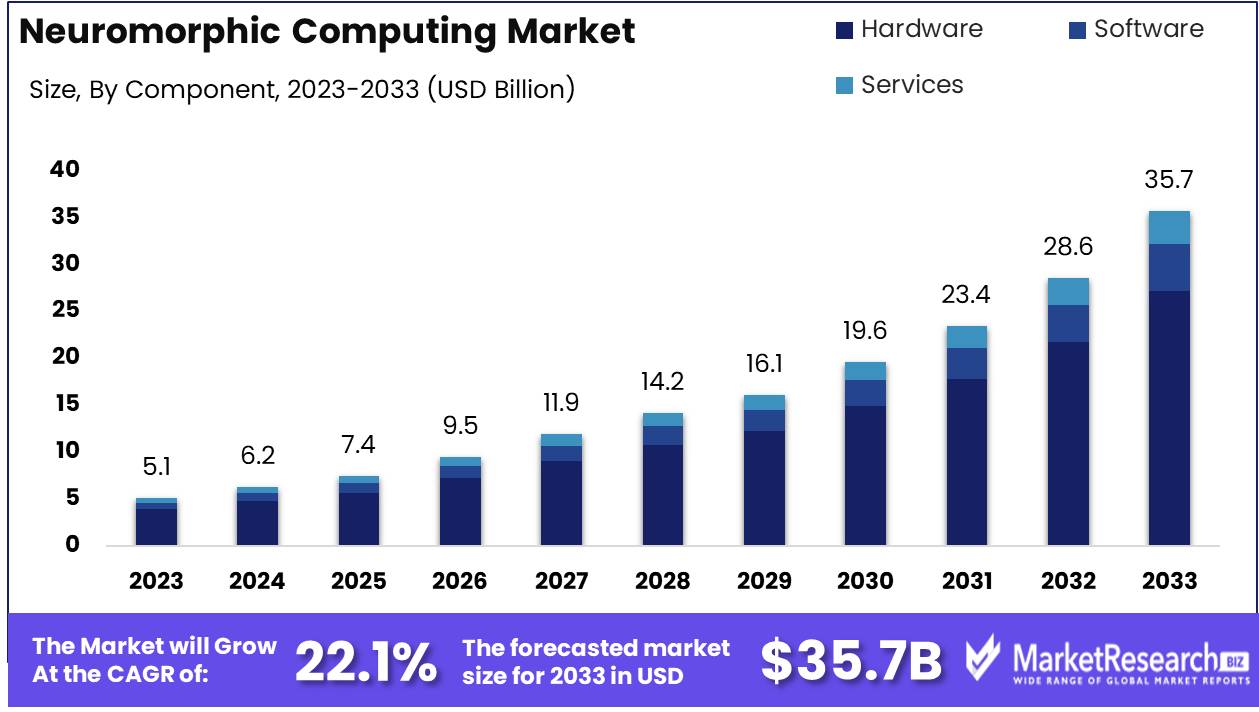

Neuromorphic Computing Market size was valued at USD 5.1 Billion in 2023. It is expected to reach USD 35.7 Billion by 2033, with a Compound annual growth rate (CAGR) of 22.1% during the forecast period from 2024 to 2033.

The Neuromorphic Computing Market focuses on the development and deployment of advanced technologies that mimic the architecture and functioning of the human brain, enhancing computing efficiency. By using artificial neurons and synapses to process information akin to biological neural networks, neuromorphic systems offer substantial improvements in speed, energy efficiency, and cognitive capabilities compared to traditional computing architectures. This technology is poised to revolutionize key sectors such as aerospace & defense and self-driving cars, where real-time data processing and decision-making are critical. Neuromorphic computing also holds transformative potential in fields like artificial intelligence, machine learning, and deep learning, enabling highly efficient, low-power solutions for complex problem-solving and edge computing applications.

The Neuromorphic Computing Market is poised for transformative growth, driven by substantial investments and the expanding integration of artificial intelligence (AI) across diverse industry verticals. Foremost companies including Intel, IBM, and Samsung are channeling substantial resources into neuromorphic technologies, heralding a paradigm shift away from conventional computing architectures towards more advanced AI and robotics applications. This strategic pivot is anticipated to unlock significant advancements and efficiencies, propelling the market forward.

Recent funding activities underscore the market's dynamic nature and its appeal to investors. In 2023, SynSense garnered an additional USD 10 million led by Ausvic Capital, earmarked for ramping up the production of their Speck smart vision sensor. This sensor integrates a neuromorphic AI processor, showcasing the potential of neuromorphic technology in commercial applications. Furthermore, notable developments such as BrainChip Holdings’ collaboration with Lorser Industries to leverage the Akida™ technology in software-defined radio devices exemplify the market’s innovative trajectory. Similarly, Prophesee's release of the GenX320 Event-based Metavision sensor in October 2023, which caters to ultra-low-power Edge AI vision devices, illustrates the expanding applications of neuromorphic computing in cutting-edge markets like AR/VR and security systems.

Intel’s collaborations, notably with the Italian Institute of Technology and the Technical University of Munich, are refining neural network-based learning methods specifically tailored for robotic applications, enhancing the capabilities of neuromorphic computing to process and analyze data more efficiently. This growing trend not only highlights the inherent scalability and efficiency of neuromorphic technologies but also aligns with the rising demand for AI and machine learning solutions across various sectors. Collectively, these developments signify a robust, forward-moving trajectory for the neuromorphic computing market, cementing its critical role in shaping the future landscape of global technology and innovation.

Key Takeaways

- Market Growth: The Neuromorphic Computing market is projected to grow from USD 5.1 billion in 2023 to USD 35.7 billion by 2033, driven by a robust CAGR of 22.1%.

- By Component: Hardware segment dominated the Neuromorphic Computing Market in 2023, capturing over 76% revenue market share.

- By Deployment: Edge Computing dominated the Neuromorphic Computing Market in 2023, capturing over 67.2% of the largest market share due to its real-time, low-latency processing capabilities.

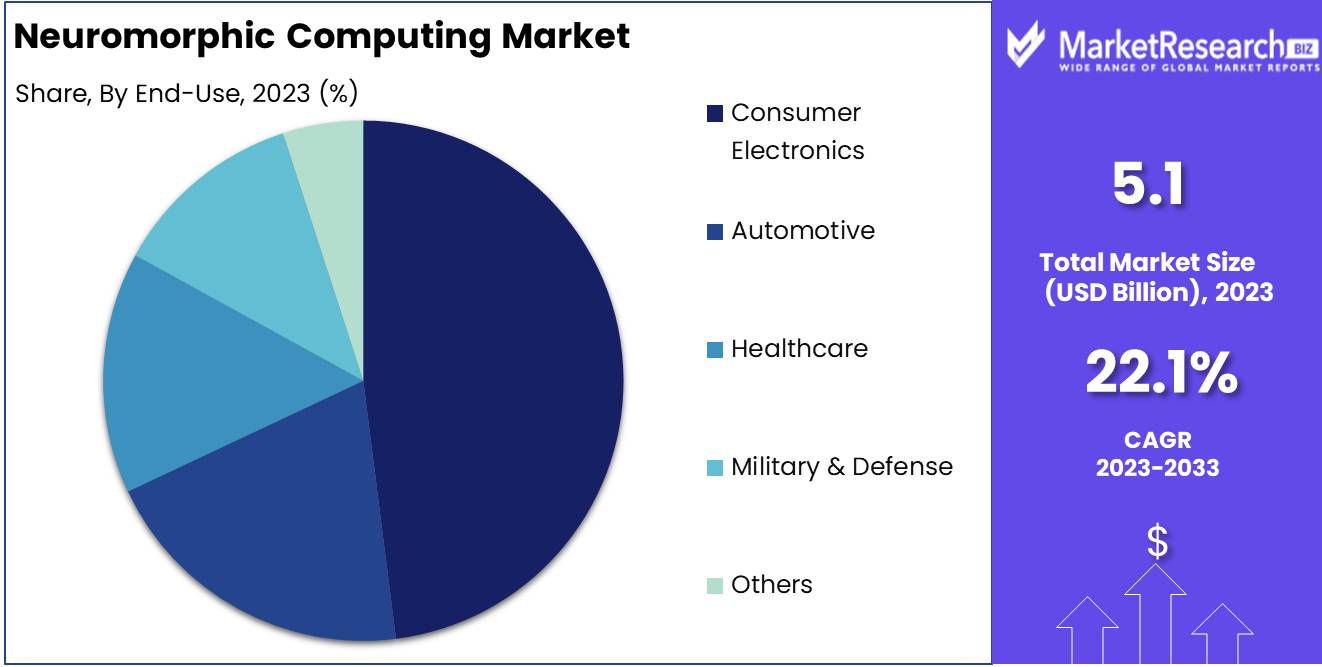

- By End-Use: Consumer Electronics dominated the Neuromorphic Computing Market in 2023, capturing 48.1% of the market share.

- By Application : Image Processing led the Neuromorphic Computing Market in 2023, holding a dominant 48% share due to its widespread adoption in advanced analytics and machine vision technologies.

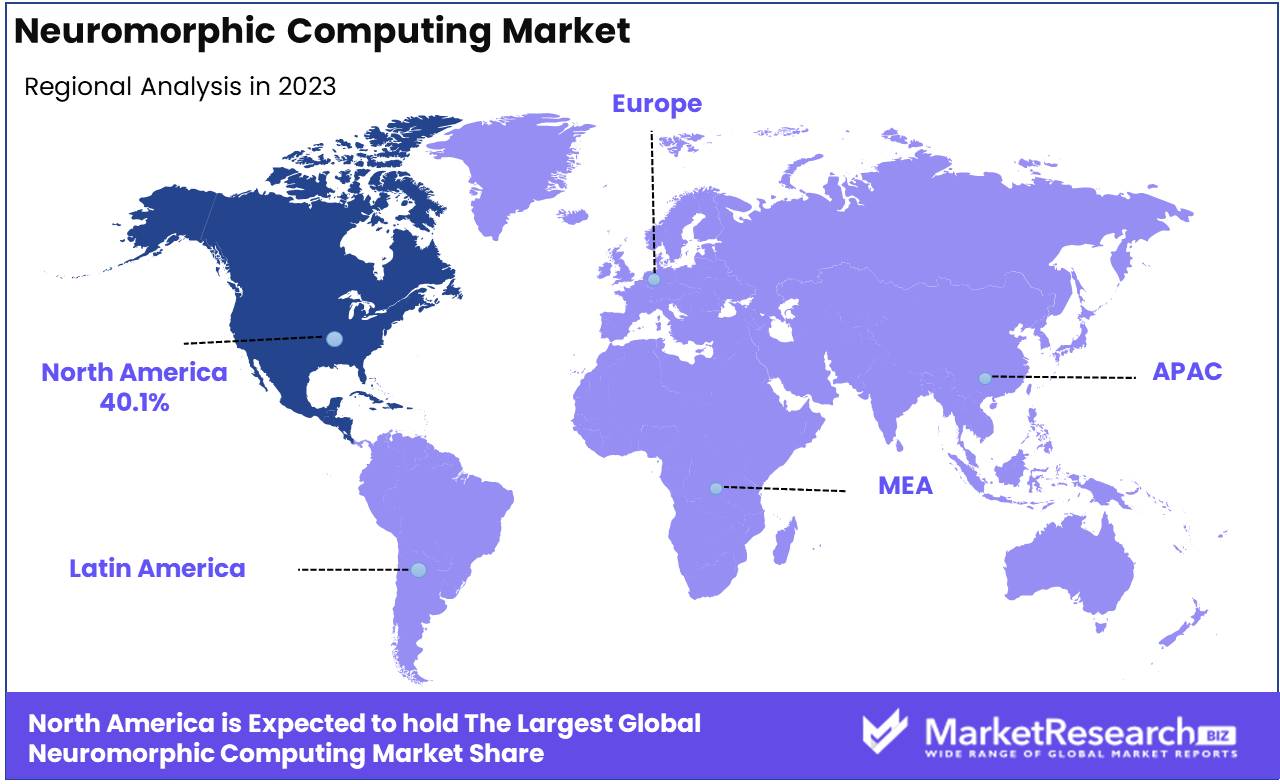

- Regional Growth: North America leads the neuromorphic computing market with a 40.1% share, driven by strong R&D and major AI investments in the U.S.

- Growth Opportunity: Expansion in AI and IoT applications, particularly in real-time data processing and decision-making, presents a substantial growth opportunity for neuromorphic computing.

- Restraining Factor: Limited software compatibility and knowledge gaps hinder the broader adoption of neuromorphic systems, stalling innovation and integration across industries.

Driving factors

The rising demand for Artificial Intelligence (AI) and Machine Learning (ML) is accelerating the growth of the neuromorphic computing market, driven by its application across a wide range of industries. As sectors like healthcare, autonomous vehicles, robotics, and natural language processing increasingly adopt AI, neuromorphic systems designed to mimic the neural networks of the human brain are becoming essential in enhancing the efficiency, speed, and energy consumption of advanced electronic devices.

AI and ML require advanced computing architectures capable of processing vast datasets in real-time, posing limitations for traditional computing systems. Neuromorphic computing’s ability to facilitate parallel processing while minimizing energy usage makes it an attractive solution for supporting AI-driven tasks. According to a recent market research report, with global AI spending projected to reach USD 300 billion by 2026, the synergy between AI advancements and neuromorphic technology is expected to fuel the latter's impressive CAGR of 22.1% over the next decade.

Development of Real-Time Learning Algorithms Drives Innovation and Market Demand

The creation of real-time learning algorithms—central to neuromorphic computing—enhances system adaptability and efficiency, addressing dynamic, real-world problems more effectively than conventional computing architectures. These algorithms enable neuromorphic processors to learn and adapt on-the-fly, mimicking the brain's plasticity and improving performance in AI and ML applications that require continuous learning, such as autonomous systems and IoT devices. This ability to process data instantly and evolve in real-time underpins the rising demand for neuromorphic systems across industries.

Additionally, the development of these algorithms plays a pivotal role in reducing latency and energy consumption in AI applications, further reinforcing neuromorphic computing's competitive edge in emerging markets. Combined with AI and ML’s growing influence, advancements in real-time learning algorithms are key to driving market innovation and expansion.

Restraining Factors

Limited Software Compatibility Awareness and Knowledge Gaps

The neuromorphic computing market faces significant restraint due to limited software compatibility and knowledge gaps within the ecosystem. Neuromorphic systems, inspired by biological neural networks, require specialized software frameworks that are not widely available or fully integrated into mainstream platforms. This lack of compatibility creates challenges for developers and enterprises attempting to implement neuromorphic architectures, often forcing them to invest in proprietary or custom-built software solutions. This drives up costs and elongates the development cycle, stalling broader adoption.

Additionally, knowledge gaps among both technical professionals and potential end users exacerbate the issue. Without a clear understanding of how neuromorphic computing can be effectively utilized in various applications, from AI to edge computing, companies are hesitant to invest. According to industry reports, only a small fraction of AI-related companies have fully grasped neuromorphic computing's potential, slowing the pace of investment and innovation. When key stakeholders lack awareness or expertise, the market misses out on broader integration into industries like healthcare, automotive, and defense, where neuromorphic systems could offer significant benefits.

Lack of Standardization and Ecosystem Maturity

The absence of standardization in neuromorphic computing is closely related to software compatibility challenges, further hampering market growth. A fragmented ecosystem, where companies develop their own frameworks or use specialized, non-standardized tools, prevents the scaling of neuromorphic solutions across industries. This lack of interoperability between hardware and software platforms creates significant barriers for businesses looking to scale neuromorphic computing solutions globally. It also limits the ability to build a collaborative ecosystem where advancements in one area can easily transfer to another, delaying the maturation of the overall market.

Moreover, without a well-defined ecosystem, the market lacks the necessary resources to train developers and engineers in neuromorphic computing, further deepening the knowledge gap. As a result, research and development cycles are protracted, and the commercialization of new innovations is slowed. Overcoming these barriers requires industry-wide initiatives for standardization, training programs, and partnerships to increase ecosystem maturity and accelerate the integration of neuromorphic systems into more applications. Until these systemic issues are addressed, the neuromorphic computing market will struggle to achieve its full growth potential.

By Component Analysis

Hardware Segment Dominates Neuromorphic Computing Market with Over 76% Market Share in 2023

In 2023, Hardware held a dominant market position in the "By Component" segment of the neuromorphic computing market, capturing more than 76% of the market share, making it the largest contributor to overall market growth. The hardware segment encompasses neuromorphic chips, processors, and other integrated systems designed to emulate the neural architecture of the human brain. This significant share is driven by increasing investments in specialized neuromorphic hardware by industries such as defense, automotive, and healthcare, where real-time processing, energy efficiency, and advanced computational capabilities are critical.

The Software segment, although smaller in comparison, is expected to experience accelerated growth due to the rising demand for algorithms, machine learning frameworks, and neuromorphic simulation tools. These solutions are increasingly being integrated with hardware to optimize applications such as pattern recognition, autonomous systems, and cognitive computing, facilitating more adaptive and efficient data processing.

The Services segment, including consulting, integration, and support services, also plays a critical role in the market. While it currently holds a relatively smaller share, the demand for expert guidance in the implementation of neuromorphic systems is projected to rise as organizations across various sectors adopt this technology. This segment is poised for growth as enterprises seek to navigate the complexities of deploying neuromorphic solutions tailored to their specific use cases.

Each component segment is integral to the overall expansion of the neuromorphic computing market, with hardware leading the way, supported by the increasing synergy between software advancements and service offerings.

By Deployment Analysis

In 2023, Edge Computing held a dominant market position in the "By Deployment" segment of the Neuromorphic Computing Market, capturing more than 67.2% of the total market share. This leadership underscores the growing importance of decentralized data processing solutions, particularly in applications where real-time data analysis and minimal latency are critical. Edge Computing's ability to process data closer to the source significantly enhances operational efficiency across industries such as autonomous vehicles, robotics, and IoT (Internet of Things), where rapid decision-making is imperative.

Moreover, the demand for localized computation has risen sharply as organizations seek to reduce the bandwidth and costs associated with transferring massive datasets to centralized cloud servers. The inherent security advantages of processing data at the edge also play a crucial role in this segment's strong market presence, especially in sectors like healthcare and defense, where data sensitivity and privacy are paramount.

In contrast, Cloud Computing, although highly scalable and cost-efficient for large-scale data processing tasks, accounted for the remaining share of the deployment market. Its centralized model, while ideal for batch processing and storage of extensive datasets, is increasingly viewed as less suitable for latency-sensitive neuromorphic computing applications. However, it continues to serve as a complementary technology, particularly in scenarios where storage capacity and extensive machine learning model training are essential. Despite its lower share in this segment, Cloud Computing remains a key component of the broader neuromorphic computing ecosystem, providing the necessary infrastructure to support the vast amount of data generated at the edge.

By End-Use Analysis

Consumer Electronics Dominates the Neuromorphic Computing Market in 2023, Capturing 48.1% Market Share

In 2023, Consumer Electronics held a dominant market position in the By End-Use segment of the Neuromorphic Computing Market, capturing more than 48.1% of the market share. The growing demand for advanced artificial intelligence (AI) applications, edge computing, and energy-efficient processing in devices such as smartphones, wearables, and smart home systems is driving the adoption of neuromorphic computing technologies. As consumer preferences shift towards more intelligent and efficient devices, the integration of neuromorphic processors has become critical to enhancing the performance of real-time applications, boosting this segment's substantial market lead.

Automotive is another rapidly expanding segment, fueled by the increasing focus on autonomous driving systems and advanced driver-assistance systems (ADAS). Neuromorphic computing’s ability to process sensory data in a manner similar to the human brain is highly beneficial for real-time decision-making, a crucial requirement for autonomous vehicles. This segment is poised for robust growth, as the automotive industry increasingly adopts AI-driven technologies to enhance safety, navigation, and operational efficiency.

In the Healthcare sector, neuromorphic computing is gaining traction, particularly in areas such as medical imaging, diagnostic systems, and brain-machine interfaces. The technology's potential to mimic human neural pathways has far-reaching applications in neuroscience, allowing for improved patient outcomes in fields such as prosthetics and rehabilitation. With rising investments in healthcare AI, this segment is projected to witness accelerated growth in the coming years.

The Military & Defense sector is increasingly leveraging neuromorphic computing for applications such as autonomous systems, cybersecurity, and situational awareness. Its ability to process complex data rapidly with low power consumption makes it ideal for high-stakes environments. As global defense budgets prioritize AI-driven technologies, this segment is likely to see sustained growth.

The Others segment, encompassing industries like industrial automation and financial services, is witnessing a gradual adoption of neuromorphic computing technologies. These industries benefit from enhanced decision-making capabilities and improved operational efficiency through real-time processing of large datasets. While currently smaller compared to the aforementioned sectors, this segment is expected to expand as neuromorphic computing becomes more widely understood and applicable across diverse industries.

By Application Analysis

Image Processing Dominates Neuromorphic Computing Market with a 48% Revenue Share in 2023

In 2023, the Image Processing segment secured a dominant position within the Neuromorphic Computing Market, capturing over 48% of the market share. This leading role in the application segment is attributed to the growing demand for image recognition technologies, particularly in industries such as automotive, healthcare, and surveillance. As processing technologies continue to advance, the image processing segment has emerged as a critical area of application, powering market expansion through its use in advanced analytics and machine vision systems.

A detailed analysis of the market reveals that beyond image processing, other application areas also contribute significantly to the industry's growth. Signal Processing, a key enabler of efficient communication and real-time data translation, holds a substantial share of the market, reinforcing its relevance in dynamic data environments. Similarly, Data Processing plays a pivotal role in managing the surge of information generated by IoT devices and sensors, making it indispensable for extracting actionable insights from complex datasets.

Additionally, Object Detection applications are witnessing steady growth, driven by the increasing need for enhanced security and quality control across various sectors. This highlights the broad applicability of neuromorphic computing in modern technology landscapes. The "Others" category, encompassing specialized applications such as robotics and drones, while currently smaller in comparison, shows promising potential for future growth as processing technologies evolve and industries adopt higher levels of automation.

In summary, the market segmentation of neuromorphic computing demonstrates the transformative potential of this technology across various applications, with the image processing segment maintaining its dominant position and paving the way for further market expansion.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- Edge Computing

- Cloud Computing

By End-Use

- Consumer Electronics

- Automotive

- Healthcare

- Military & Defense

- Others

By Application

- Signal Processing

- Image Processing

- Data Processing

- Object Detection

- Others

Growth Opportunity

Expansion in AI and IoT Applications

AI and IoT represent major growth drivers for neuromorphic computing. AI-based systems, particularly in autonomous vehicles, robotics, and smart city infrastructure, rely on real-time data processing and decision-making capabilities. Neuromorphic chips, which simulate the way human brains process information, offer a breakthrough in achieving this.

Their ability to process vast amounts of data with low power consumption is highly advantageous for IoT devices, which require efficient, low-latency computing at the edge. This growing intersection of AI and IoT is anticipated to significantly accelerate the adoption of neuromorphic technologies in 2024.

Real-Time Training Algorithms

The development of real-time training algorithms for neuromorphic computing is another critical opportunity. These algorithms enable systems to adapt in real-time, learning from ongoing inputs, which is essential for applications such as autonomous driving, robotics, and healthcare. For instance, autonomous vehicles must process dynamic environments and make immediate decisions, while healthcare devices can use real-time data to adjust treatment protocols. This capability not only enhances the functionality of intelligent systems but also broadens the market's potential across industries where adaptability is paramount.

In 2024, these advancements are expected to drive widespread adoption, creating new avenues for growth in the global neuromorphic computing market.

Latest Trends

Mimicking Human Brain Architecture

One of the most compelling trends in 2024 is the increasing capability of neuromorphic systems to mimic the human brain's architecture. Leveraging spiking neural networks (SNNs) and brain-inspired algorithms, these systems emulate human cognition, offering enhanced pattern recognition, decision-making, and problem-solving capabilities. The rise of AI-driven industries, from robotics to autonomous systems, is driving demand for Neuromorphic Computing that can replicate brain-like processing in real time.

By reducing the energy and data requirements typical of traditional computing architectures, neuromorphic technology is poised to revolutionize AI applications where efficiency and real-time response are critical, such as medical diagnostics, autonomous driving, and edge computing.

Advancements in Neuromorphic Hardware

2024 will see significant breakthroughs in neuromorphic hardware, with major players like Intel, IBM, and BrainChip accelerating development. These companies are focusing on developing chips that integrate neurons and synapses into their architecture, allowing for more efficient and parallel processing. Advances in memristors, a key component in neuromorphic designs, are enabling systems to store and process data simultaneously, reducing latency and energy consumption.

Additionally, the scaling down of neuromorphic hardware for mobile and wearable devices is becoming increasingly viable, broadening the technology's application in consumer electronics and healthcare. These advancements underscore the potential for neuromorphic hardware to become a cornerstone in next-generation computing platforms, particularly in edge and low-power AI scenarios.

Regional Analysis

North America leads the global neuromorphic computing market, with a commanding 40.1% share, driven primarily by the United States' strong R&D infrastructure and significant investments in AI technologies. The region benefits from a concentration of tech giants and research institutions that are advancing neuromorphic computing applications across sectors such as defense, healthcare, and automotive. The U.S. dominates within North America, while Canada and the rest of the region contribute to growth through innovation hubs and startup ecosystems.

Europe is another key player, with countries like Germany, France, and the UK spearheading neuromorphic computing research and development. Germany, a leader in industrial automation, heavily invests in neuromorphic systems for smart manufacturing. Meanwhile, the UK's strong AI sector and France's advancements in aerospace and defense also support the market's expansion. Other notable contributors include Spain, the Netherlands, and Italy, all working towards integrating neuromorphic technologies in AI-driven industries like transportation and healthcare.

The Asia-Pacific region, with its rapid technological adoption and a growing emphasis on AI, is witnessing significant growth in neuromorphic computing. China and Japan are at the forefront, investing heavily in neuromorphic R&D to support AI applications across automotive, consumer electronics, and healthcare sectors. South Korea and India are emerging as key markets, with South Korea's advancements in semiconductor technologies and India's increasing focus on AI development. Singapore, Thailand, and Vietnam are also contributing to the region's growth, driven by government initiatives supporting digital transformation.

In Latin America, Mexico and Brazil are leading the market for neuromorphic computing, with Brazil focusing on advanced AI research and Mexico enhancing its manufacturing capabilities through smart technologies. While the market here is still emerging compared to North America and Asia, increased investments in AI applications, particularly in automation and healthcare, are expected to drive steady growth across the region.

The Middle East & Africa region is gradually adopting neuromorphic computing, with countries like Saudi Arabia, the UAE, and South Africa focusing on AI to drive smart city projects, healthcare advancements, and defense modernization. While the region currently trails others in terms of market size, growing governmental support for AI and digital transformation initiatives is expected to accelerate neuromorphic computing development across the Rest of the Middle East & Africa in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The global neuromorphic computing market is set for significant growth in 2024, driven by rapid advancements in artificial intelligence (AI) and machine learning (ML), alongside increasing demand for brain-inspired computing systems. Key players in this landscape are leveraging their technological expertise to gain competitive advantages and capture market share.

IBM Corporation and Intel Corporation lead the market, both focusing heavily on research and development (R&D) and partnerships to push the boundaries of neuromorphic chip architectures. Their neuromorphic hardware, such as IBM’s TrueNorth and Intel’s Loihi, are pivotal innovations that could dominate enterprise applications, including data centers and AI-driven industries.

Qualcomm Technologies, Inc. and Samsung Electronics Co., Ltd. are also making strides, particularly in integrating neuromorphic systems into mobile and edge computing applications. This positions them well in the growing market for autonomous devices and IoT, where power efficiency and real-time processing are critical.

Niche players such as Brain Corporation and Numenta are focused on advancing neuromorphic software frameworks and algorithms, targeting robotics and cognitive computing, further diversifying the competitive landscape.

In contrast, HRL Laboratories and Knowm Inc. are innovating at the intersection of hardware and software, emphasizing new materials and architectures that mimic biological synapses, which could disrupt the market in terms of performance and scalability.

Market Key Players

- IBM Corporation

- Brain Corporation

- CEA-Leti

- General Vision, inc

- Hewlett Packard Company

- Numenta

- HRL Laboratories

- International Business Machines Corporation

- Intel Corporation

- Knowm Inc

- Qualcomm Technologies, Inc

- Samsung Electronics Co. Ltd

- Vicarious FPC, Inc.

Recent Developments

- In 2023, SynSense: SynSense, a company specializing in neuromorphic computing, secured an additional USD 10 million in funding led by Ausvic Capital. This investment is targeted at accelerating the mass production of their smart vision sensor, Speck, which integrates a neuromorphic AI processor.

- In 2023, BrainChip Holdings Ltd and Lorser Industries Inc.: BrainChip Holdings Ltd, a global leader in neuromorphic artificial intelligence (AI) IP, and Lorser Industries Inc., a leading provider of system-level manufacturing and integration, announced they will use BrainChip’s Akida™ technology to deliver neuromorphic computing solutions for software-defined radio (SDR) devices.

- In 2023, Prophesee: Prophesee unveiled the GenX320 Event-based Metavision sensor, tailored for ultra-low-power Edge AI vision devices. This development expands Prophesee’s technology into Edge markets, such as AR/VR headsets and security systems.

- In 2023, SiLC Technologies introduced the Eyeonic Vision System, an advanced FMCW LiDAR machine vision solution. This technology enhances object detection with high-speed and accuracy, offering capabilities such as polarization intensity and 3D depth sensing with millimeter-level precision over distances exceeding 1,000 meters.

Report Scope

Report Features Description Market Value (2023) USD 5.1 Bn Forecast Revenue (2033) USD 35.7 Bn CAGR (2024-2032) 22.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, and Services), By Deployment Mode (Edge Computing, Cloud Computing), By End-Use(Consumer Electronics, Automotive, Healthcare, Military & Defense, Others), By Application(Signal Processing, Image Processing, Data Processing,Object Detection, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Brain Corporation, CEA-Leti, General Vision, inc, Hewlett Packard Company, Numenta, HRL Laboratories, International Business Machines Corporation, Intel Corporation, Knowm Inc, Qualcomm Technologies, Inc, Samsung Electronics Co., Ltd, Vicarious FPC, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-