Narrowband-IoT (NB-IoT) Market By Component (Network, Module), By Deployment (In-band, Guard-band, Standalone), By Type (Alarm & Detector, Smart Parking, Smart Meter, Others), By End-User (Automotive, Agriculture, Infrastructure, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51196

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

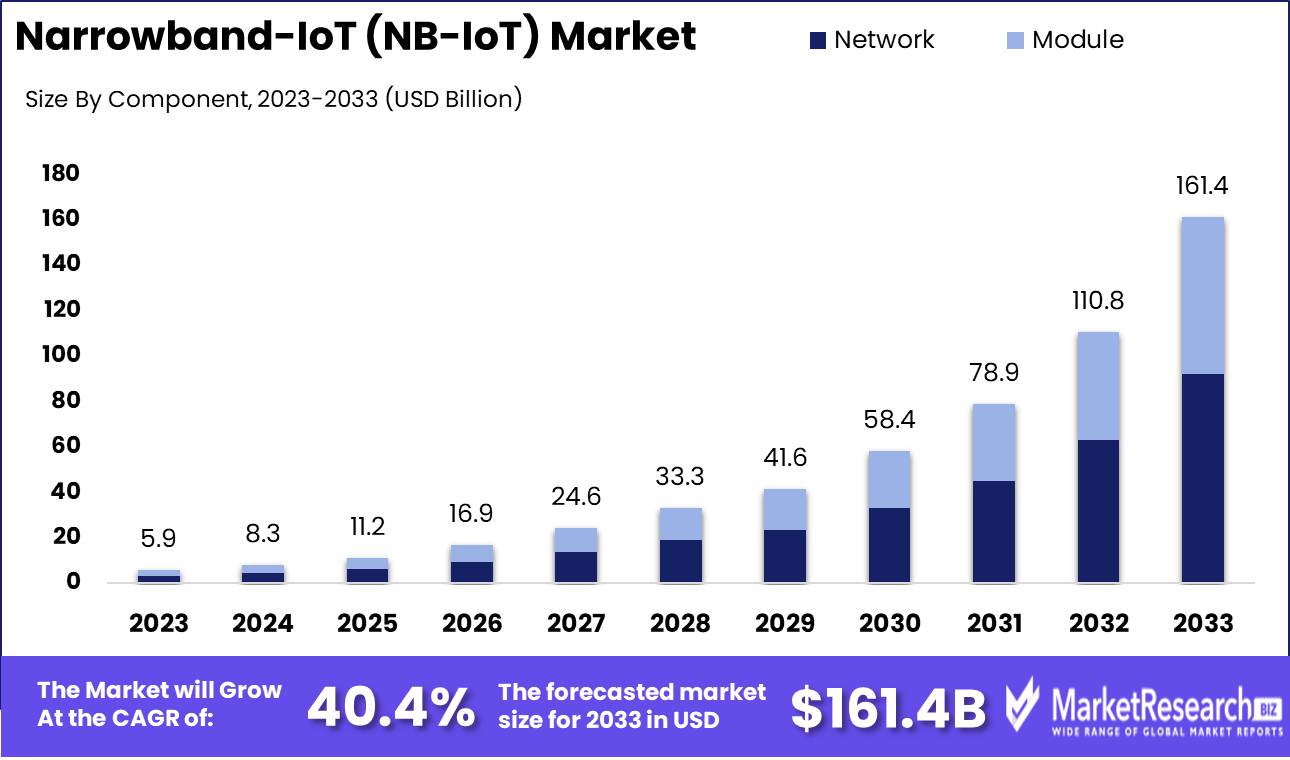

The Narrowband-IoT (NB-IoT) Market was valued at USD 5.9 billion in 2023. It is expected to reach USD 161.4 billion by 2033, with a CAGR of 40.4% during the forecast period from 2024 to 2033.

Narrowband-IoT (NB-IoT) is a low-power, wide-area (LPWA) technology designed to enable efficient communication for devices with minimal data requirements in the Internet of Things (IoT) ecosystem. It operates on existing LTE infrastructure and utilizes narrow frequency bands, ensuring extended coverage and deep penetration in challenging environments such as underground or remote areas. With low power consumption and cost-effective deployment, NB-IoT supports massive IoT applications, including smart cities, utility meters, and industrial automation.

The narrowband IoT (NB-IoT) market is poised for significant growth, driven by the expansion of smart city initiatives, rising demand for cost-effective, low-power connectivity solutions, and advancements in 5G technology. As cities across the globe prioritize smart infrastructure to enhance urban living, NB-IoT has emerged as a preferred choice for supporting the vast networks of connected devices, sensors, and systems. The technology’s ability to deliver low-cost, energy-efficient connectivity is particularly critical for applications such as environmental monitoring, waste management, and intelligent traffic systems. Furthermore, the ongoing rollouts of 5G networks are expected to strengthen NB-IoT’s role in providing reliable, wide-area coverage for massive machine-type communications (MTC), positioning it as a cornerstone of IoT ecosystems.

However, despite the positive outlook, challenges persist, particularly in emerging markets where network infrastructure limitations may hinder NB-IoT deployment. In regions where legacy infrastructure dominates, significant investments in upgrading networks will be necessary to unlock the full potential of NB-IoT. Nonetheless, sectors such as agriculture and utilities are increasingly adopting NB-IoT for applications like precision farming and smart grid management, further underscoring its versatility. The continued expansion of these industries is expected to drive sustained demand for NB-IoT solutions, reinforcing its position in the broader IoT landscape. Overall, while hurdles remain, the convergence of smart city projects, 5G adoption, and sectoral growth presents a strong foundation for the NB-IoT market’s evolution in the coming years.

Key Takeaways

- Market Growth: The Narrowband-IoT (NB-IoT) Market was valued at USD 5.9 billion in 2023. It is expected to reach USD 161.4 billion by 2033, with a CAGR of 40.4% during the forecast period from 2024 to 2033.

- By Component: The Network component remained dominant in NB-IoT deployment.

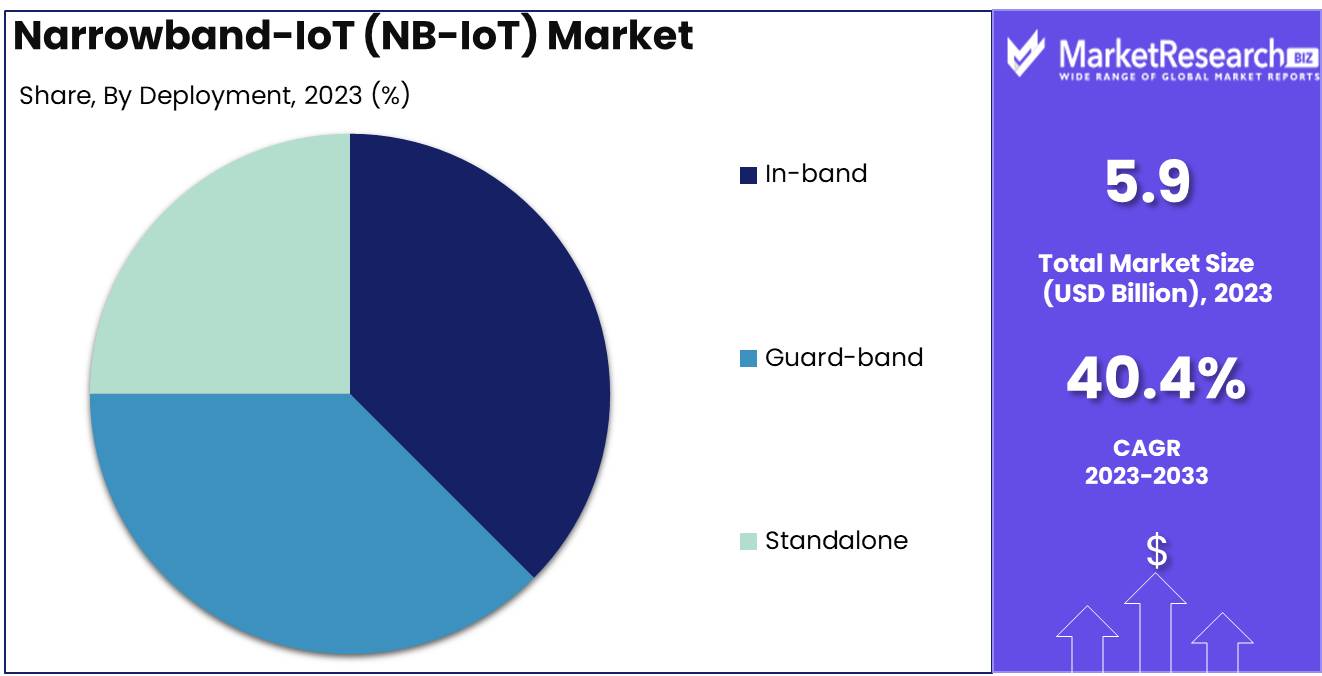

- By Deployment: In-band dominated NB-IoT deployment due to cost-efficiency.

- By Type: Alarm & Detector dominated the NB-IoT market across applications.

- By End-User: Automotive dominated NB-IoT adoption across multiple applications.

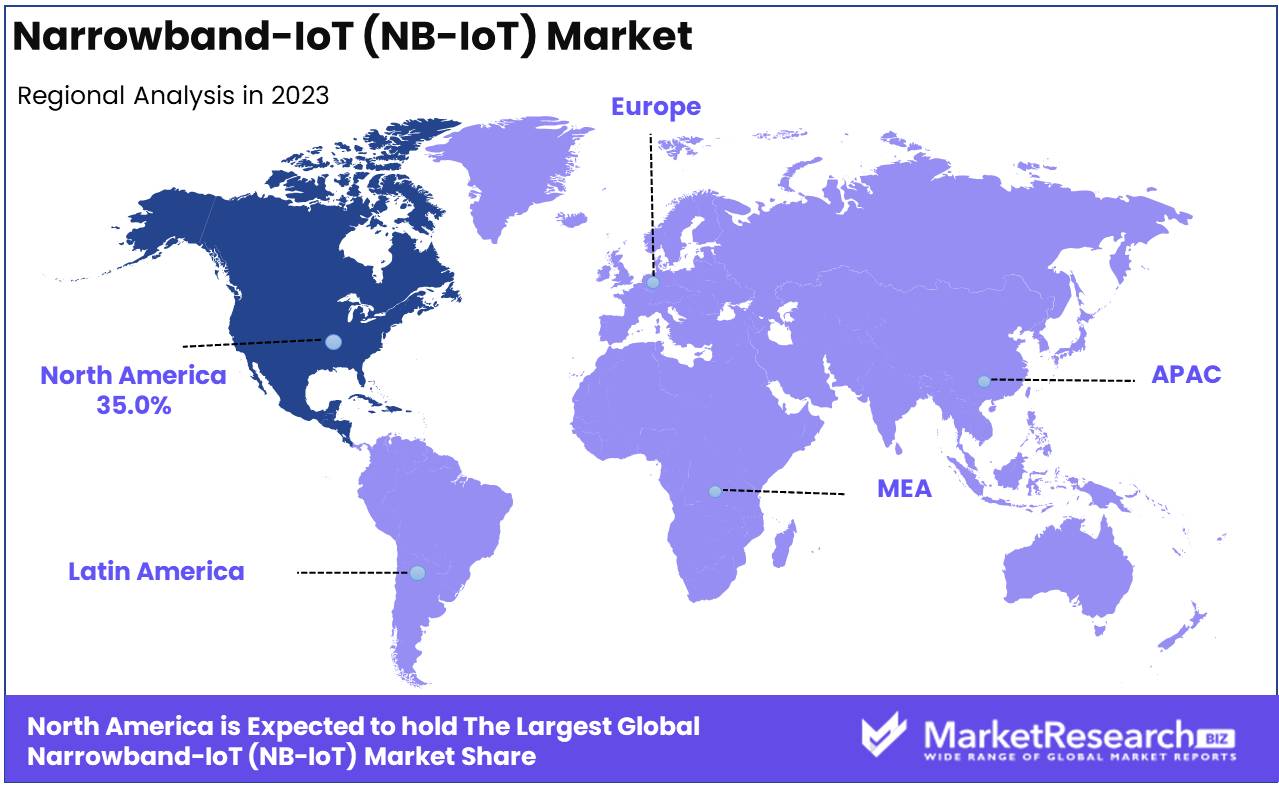

- Regional Dominance: North America dominates the NB-IoT market with a 35% largest market share.

- Growth Opportunity: The combined impact of AI/ML integration and growing operator adoption positions the global NB-IoT market for robust growth. These factors are expected to drive new use cases and expand the market's reach across diverse industries.

Driving factors

Increasing Adoption of IoT Devices and Applications: A Key Driver for NB-IoT Market Expansion

The widespread adoption of Internet of Things (IoT) devices across industries is one of the primary forces propelling the growth of the narrowband IoT (NB-IoT) market. IoT technology has gained significant traction in sectors such as healthcare, agriculture, logistics, manufacturing, and utilities due to its ability to improve operational efficiency, reduce costs, and enable remote monitoring. By 2025, it is projected that there will be more than 30 billion connected devices globally, underscoring the need for reliable, efficient communication networks.

NB-IoT, a low-power wide-area (LPWA) network technology, is well-suited to support the massive deployment of IoT devices. This technology operates on licensed spectrum bands, ensuring stable and secure connectivity for a large number of devices over long distances. The cost-effectiveness and simplicity of NB-IoT also make it attractive for IoT applications where large-scale deployments are required, such as smart meters, asset tracking, and environmental monitoring. As more industries leverage IoT to enhance productivity and reduce operational risks, the demand for NB-IoT networks will rise substantially, driving market growth.

Lower Power Consumption and Longer Battery Life: Enhancing the Value Proposition of NB-IoT

NB-IoT’s ability to deliver ultra-low power consumption and extended battery life for connected devices is a significant advantage that supports its widespread adoption. In many IoT use cases such as sensors deployed in remote locations, smart meters, and industrial automation systems devices are required to function for extended periods without frequent battery replacement or maintenance. NB-IoT addresses this challenge by minimizing power consumption while still offering robust connectivity.

This efficiency translates into batteries lasting for up to 10 years in certain IoT applications, reducing the overall maintenance costs for businesses. For instance, in smart metering, NB-IoT allows for consistent and efficient data transmission over long distances, ensuring that devices can remain in the field without regular human intervention. As a result, this lower total cost of ownership has made NB-IoT the preferred connectivity solution for various industries where battery longevity and operational efficiency are critical. As businesses increasingly prioritize energy efficiency and operational reliability, the advantages of NB-IoT will continue to drive its market growth.

Increased Adoption of Smart City Initiatives: Driving NB-IoT Deployment in Urban Infrastructure

The global push toward smart city initiatives represents a significant opportunity for the expansion of the NB-IoT market. Governments and municipalities are increasingly focusing on smart city projects to improve urban management, optimize resource usage, and enhance the quality of life for citizens. It is estimated that global investment in smart city solutions could reach up to $2.57 trillion by 2025, driven by the need for intelligent infrastructure systems in transportation, utilities, security, and public services.

NB-IoT is a critical enabler of smart city infrastructure, as it offers the ability to connect millions of low-power devices across large urban areas. Applications such as smart street lighting, waste management, traffic control, and environmental monitoring rely on NB-IoT to transmit small data packets efficiently and cost-effectively. By supporting these applications with reliable connectivity, NB-IoT helps cities reduce operational costs, improve service delivery, and promote sustainability.

Restraining Factors

Limited Data Transmission Rates: A Bottleneck in NB-IoT Market Growth

The Narrowband-IoT (NB-IoT) market is primarily designed to cater to low-power, low-bandwidth applications such as smart meters, environmental sensors, and asset tracking. While this low bandwidth aligns with NB-IoT's purpose, the limited data transmission rates become a significant restraining factor for broader adoption in applications requiring higher data throughput. NB-IoT typically supports data rates up to 250 kbps, which is sufficient for small-scale IoT applications but inadequate for use cases requiring real-time, high-volume data transmission, such as video surveillance, telemedicine, or advanced industrial automation.

The restricted data rates constrain the versatility of NB-IoT, limiting its appeal to industries that require more robust communication standards. As a result, potential adopters may opt for more flexible or higher-capacity IoT technologies, thereby slowing down the overall growth of the NB-IoT market. In scenarios where low latency or real-time communication is essential, this limitation deters investment, further impacting the market’s growth trajectory. While NB-IoT is still well-suited for long battery life and large-scale deployment, this bottleneck hampers its potential to diversify into more complex applications, which could drive larger revenue streams.

Availability of Alternative Technologies: Intensifying Competitive Pressure on NB-IoT

The availability of alternative IoT technologies such as Long-Term Evolution for Machines (LTE-M), Sigfox, and LoRaWAN, represents another substantial restraining factor for the NB-IoT market. These alternative technologies often provide similar or superior features, depending on the use case. For instance, LTE-M offers higher data transmission rates and mobility support, making it a more attractive option for applications that require mobile connectivity and moderate bandwidth. LoRaWAN, on the other hand, excels in long-range communication with low power consumption, while Sigfox presents a cost-effective solution for ultra-narrowband communication.

The competitive landscape created by these alternatives diverts potential users from NB-IoT, particularly in markets where cost, speed, and flexibility are critical factors. Moreover, the presence of well-established networks such as 4G and the growing 5G infrastructure allows users to explore technologies that provide higher performance, including lower latency and better scalability. In some regions, the slow pace of NB-IoT network rollouts further intensifies this challenge, as businesses opt for already-deployed technologies that meet their immediate needs.

By Component Analysis

In 2023, The Network component remained dominant in NB-IoT deployment.

In 2023, The Network component held a dominant market position in the By Component segment of the Narrowband-IoT (NB-IoT) Market. The Network segment's prominence can be attributed to the increasing deployment of low-power wide-area networks (LPWANs) to support the growing number of IoT devices that require reliable and cost-efficient connectivity. Telecom operators have continued to expand their NB-IoT networks to enhance coverage and performance, particularly in regions with high adoption of smart city initiatives, industrial IoT, and remote monitoring solutions.

Meanwhile, the Module component also demonstrated steady growth, driven by rising demand for NB-IoT-enabled devices across industries such as healthcare, logistics, and utilities. Modules that integrate NB-IoT technology are becoming increasingly essential due to their ability to extend battery life, reduce costs, and improve connectivity in low-power, wide-area applications. The convergence of these factors is expected to fuel ongoing growth in both components, although the network infrastructure is likely to maintain its dominant position due to its foundational role in enabling NB-IoT services across various sectors.

By Deployment Analysis

In 2023, In-band dominated NB-IoT deployment due to cost-efficiency.

In 2023, In-band held a dominant market position in the By Deployment segment of the Narrowband-IoT (NB-IoT) Market. This deployment method leverages the existing LTE spectrum, allowing NB-IoT signals to coexist with LTE communications. The seamless integration into LTE infrastructure provides several advantages, including cost efficiency and broad coverage, making it the preferred choice for telecom operators. Additionally, In-band deployment is ideal for urban environments where maximizing spectrum use is critical, further driving its market share.

Guard-band deployment, while utilizing the unused space between LTE bands, is often considered for applications where interference needs to be minimized. This method provides a balance between efficiency and cost, appealing to regions where spectrum is a premium.

Standalone deployment, which operates independently of LTE, is utilized primarily in rural or remote areas. This approach enables wide coverage in low-density locations, but due to higher infrastructure costs, it occupies a smaller market share.

By Type Analysis

In 2023, Alarm & Detector dominated the NB-IoT market across applications.

In 2023, Alarm & Detector held a dominant market position in the By Type segment of the Narrowband-IoT (NB-IoT) market, driven by the rising adoption of IoT-enabled security solutions. These devices leverage NB-IoT's extended coverage and low power consumption to enhance real-time monitoring, particularly in critical applications such as fire detection and intrusion alarms.

The Smart Parking segment also witnessed significant growth, supported by urbanization trends and increasing demand for efficient parking solutions. Smart Meters, particularly in utilities, capitalized on NB-IoT’s capabilities for seamless data transmission, contributing to enhanced energy management. Smart Lighting, commonly used in smart cities, benefited from cost-efficiency and remote operability enabled by NB-IoT.

Trackers, utilized in logistics and asset tracking, showed a steady uptake, reflecting the market’s growing need for accurate location data over wide areas. The Wearables segment, especially health-related devices, capitalized on the technology’s ability to support extended battery life and reliable connectivity. Finally, the Others category, encompassing diverse applications like agriculture and environmental monitoring, exhibited notable expansion, emphasizing the broad utility of NB-IoT.

By End-User Analysis

In 2023, Automotive dominated NB-IoT adoption across multiple applications.

In 2023, Automotive held a dominant market position in the By End-User segment of the Narrowband-IoT (NB-IoT) market. The automotive sector leveraged NB-IoT for applications such as connected vehicles, fleet management, and predictive maintenance, driving widespread adoption. However, other sectors also witnessed significant adoption of NB-IoT technology.

Agriculture benefitted through smart farming solutions, optimizing crop yield and resource usage. Infrastructure applications, including smart cities and intelligent transportation systems, were integral in enhancing urban efficiency. In Healthcare, NB-IoT was utilized for remote patient monitoring and medical device connectivity, promoting better healthcare outcomes. The Energy & Utilities sector capitalized on smart meters and grid optimization, while Manufacturing applied NB-IoT for factory automation and process monitoring.

In Consumer Electronics, NB-IoT enabled seamless communication between smart devices and home automation systems. Finally, the Others category, including sectors like retail and logistics, increasingly implemented NB-IoT for enhanced tracking and supply chain management. As NB-IoT adoption expands, the Automotive sector remains a leading driver due to its early investments and critical applications.

Key Market Segments

By Component

- Network

- Module

By Deployment

- In-band

- Guard-band

- Standalone

By Type

- Alarm & Detector

- Smart Parking

- Smart Meter

- Smart Lighting

- Tracker

- Wearables

- Others

By End-User

- Automotive

- Agriculture

- Infrastructure

- Healthcare

- Energy & Utilities

- Manufacturing

- Consumer Electronics

- Others

Growth Opportunity

Integration with Artificial Intelligence and Machine Learning

The integration of Artificial Intelligence (AI) and Machine Learning (ML) with NB-IoT is expected to significantly drive market growth. By leveraging AI and ML, NB-IoT devices can improve real-time decision-making, data processing efficiency, and predictive maintenance capabilities. The low-power, wide-area nature of NB-IoT combined with advanced AI-driven algorithms enables more intelligent and adaptive IoT applications. For example, smart cities are expected to benefit from AI-enhanced NB-IoT in areas such as traffic management, environmental monitoring, and public safety. This integration will not only reduce operational costs but also enhance the overall efficiency of IoT systems, creating new growth avenues for operators and solution providers alike.

Increasing Adoption of NB-IoT by Operators

Telecom operators are increasingly adopting NB-IoT technology due to its cost-effectiveness, low power consumption, and broad coverage. This trend is expected to gain momentum, as more operators expand their NB-IoT networks to address the growing demand for connected devices. Major telecom companies are investing in NB-IoT to support applications in agriculture, healthcare, logistics, and smart utilities.

Additionally, NB-IoT’s ability to penetrate hard-to-reach areas, such as rural regions and underground infrastructure, further enhances its appeal to operators, particularly in developing markets. This expanded adoption will likely lead to increased deployments, further solidifying the NB-IoT ecosystem and driving market growth.

Latest Trends

Consumer Electronics Adoption

The adoption of Narrowband-IoT (NB-IoT) in consumer electronics is expected to accelerate significantly. With the increasing demand for connected devices in smart homes, wearable technology, and personal electronics, NB-IoT provides a cost-effective and energy-efficient solution for low-power, wide-area connectivity. The growth of smart home ecosystems, driven by rising consumer interest in smart appliances, security systems, and healthcare devices, will act as a catalyst for NB-IoT penetration. Major electronics manufacturers are likely to incorporate NB-IoT capabilities into their devices, promoting seamless integration and real-time data transmission, which is crucial for monitoring and automation functions. This trend is anticipated to foster a robust growth trajectory for NB-IoT applications in the consumer segment.

Challenges in Standardization

Despite its growing adoption, the NB-IoT market faces challenges in achieving global standardization. Varying regulatory frameworks and spectrum allocation across regions create complexities for manufacturers and service providers looking to deploy NB-IoT solutions at scale. While some regions, such as Europe and China, have embraced unified NB-IoT standards, other markets remain fragmented, leading to interoperability concerns. This lack of standardization poses a significant barrier to global expansion, especially for multinational enterprises. Industry stakeholders are expected to collaborate more intensively to address these regulatory disparities, but a fully harmonized global standard for NB-IoT is unlikely to emerge in the short term, potentially limiting the market’s full potential.

Regional Analysis

North America dominates the NB-IoT market with a 35% largest market share.

The Narrowband-IoT (NB-IoT) market has seen notable growth across various regions, with North America leading the sector. North America, comprising the United States and Canada, accounts for approximately 35% of the global NB-IoT market share, driven by extensive adoption of IoT solutions across industries such as healthcare, manufacturing, and logistics. This region benefits from a well-established IoT ecosystem, supported by major telecommunications companies and significant investments in 5G infrastructure. The region’s advanced technology landscape has accelerated the deployment of smart city projects and IoT applications, further cementing its dominance.

In Europe, the market holds a substantial share of around 25%, with countries such as Germany, the UK, and France leading in NB-IoT deployment. Regulatory support and initiatives promoting smart infrastructure and energy management systems have contributed to the expansion of the NB-IoT market. Asia Pacific, accounting for 30% of the market, is experiencing rapid growth, driven by China’s leadership in NB-IoT deployment, supported by government policies and the presence of major telecom players. Japan and South Korea also play pivotal roles in the region's growth, with increasing smart city and industrial IoT projects.

The Middle East & Africa and Latin America are emerging markets, contributing smaller portions of the global market at 5% and 5% respectively. However, these regions show potential, with increasing investments in IoT solutions and smart infrastructure projects, particularly in urban areas of the Middle East. The global expansion of NB-IoT is fueled by its low power consumption and wide area coverage, making it ideal for diverse IoT applications.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global narrowband IoT (NB-IoT) market is expected to see significant advancements driven by key players such as Huawei Technologies Co. Ltd., Intel Corporation, and Qualcomm Incorporated. These companies have maintained their leadership by offering cutting-edge technologies that enable low-power, wide-area (LPWA) IoT connectivity. Huawei, with its strong R&D investments and a broad portfolio of NB-IoT solutions, remains a dominant force, particularly in the Asian markets. Similarly, Qualcomm's expertise in cellular communication technologies continues to support the evolution of NB-IoT, as its chipsets provide the backbone for connected devices across multiple industries.

The telecommunications giants, including Verizon Communications Inc., Nokia Networks, and Telefonaktiebolaget LM Ericsson, are integral in supporting the global deployment of NB-IoT infrastructure. Their robust network capabilities and partnerships with governments and industries help to expand the technology's reach. Verizon, with its early focus on IoT solutions, is likely to maintain a leading position in the North American market, while Ericsson and Nokia's advanced 5G-NB-IoT integration will be key to growth in Europe and other regions.

Meanwhile, Vodafone Group PLC and Telecom Italia SpA continue to focus on providing end-to-end IoT services, capitalizing on their expansive networks across Europe. China Unicom and Emirates Telecommunications Corporation (Etisalat) also play crucial roles in advancing NB-IoT technologies in Asia and the Middle East, respectively, leveraging their regional influence to drive adoption in these key markets.

Market Key Players

- Huawei Technologies Co. Ltd.

- Emirates Telecommunications Corporation

- Intel Corporation

- Nokia Networks

- Verizon Communications Inc.

- China Unicom

- Telefonaktiebolaget LM Ericsson

- Qualcomm Incorporated

- Telecom Italia SpA

- Vodafone Group PLC.

Recent Development

- In July 2024, Verizon announced the deployment of an NB-IoT network with enhanced 5G integration to serve industries such as healthcare and logistics. The network will support applications like remote patient monitoring and supply chain tracking, leveraging NB-IoT's low power consumption and cost efficiency to scale these solutions across the U.S..

- In February 2024, BT Group, a major UK telecommunications provider, expanded its NB-IoT network across the country to meet the growing demand for IoT-based services. This expansion aims to support smart city initiatives and enhance its service offerings, particularly in smart metering, agriculture, and industrial IoT applications. The company's strategic focus on connectivity and sustainability will help drive the adoption of NB-IoT for real-time monitoring and data collection.

- In January 2024, AT&T continued its roll-out of NB-IoT services in the U.S., focusing on smart lighting solutions for cities as part of a broader push to support smart city infrastructure. AT&T's network covers a wide range of IoT applications, including smart metering, asset tracking, and environmental monitoring, helping municipalities and businesses reduce energy costs and optimize resource use.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Billion Forecast Revenue (2033) USD 161.4 Billion CAGR (2024-2032) 40.0% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Network, Module), By Deployment (In-band, Guard-band, Standalone), By Type (Alarm & Detector, Smart Parking, Smart Meter, Smart Lighting, Tracker, Wearables, Others), By End-User (Automotive, Agriculture, Infrastructure, Healthcare, Energy & Utilities, Manufacturing, Consumer Electronics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Huawei Technologies Co. Ltd., Emirates Telecommunications Corporation, Intel Corporation, Nokia Networks, Verizon Communications Inc., China Unicom, Telefonaktiebolaget LM Ericsson, Qualcomm Incorporated, Telecom Italia SpA, Vodafone Group PLC. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Huawei Technologies Co. Ltd.

- Emirates Telecommunications Corporation

- Intel Corporation

- Nokia Networks

- Verizon Communications Inc.

- China Unicom

- Telefonaktiebolaget LM Ericsson

- Qualcomm Incorporated

- Telecom Italia SpA

- Vodafone Group PLC.