Mutual Fund Transfer Agent Market By Service Type (Mutual Fund Accounting, Shareholder Recordkeeping, Dividend Processing, Compliance Reporting, Others), By Fund Type (Equity Funds, Debt Funds, Hybrid Funds, Money Market Funds, Others), By End-User (Mutual Fund Companies, Wealth Management Firms, Banks and Financial Institutions, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

5274

-

July 2024

-

133

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

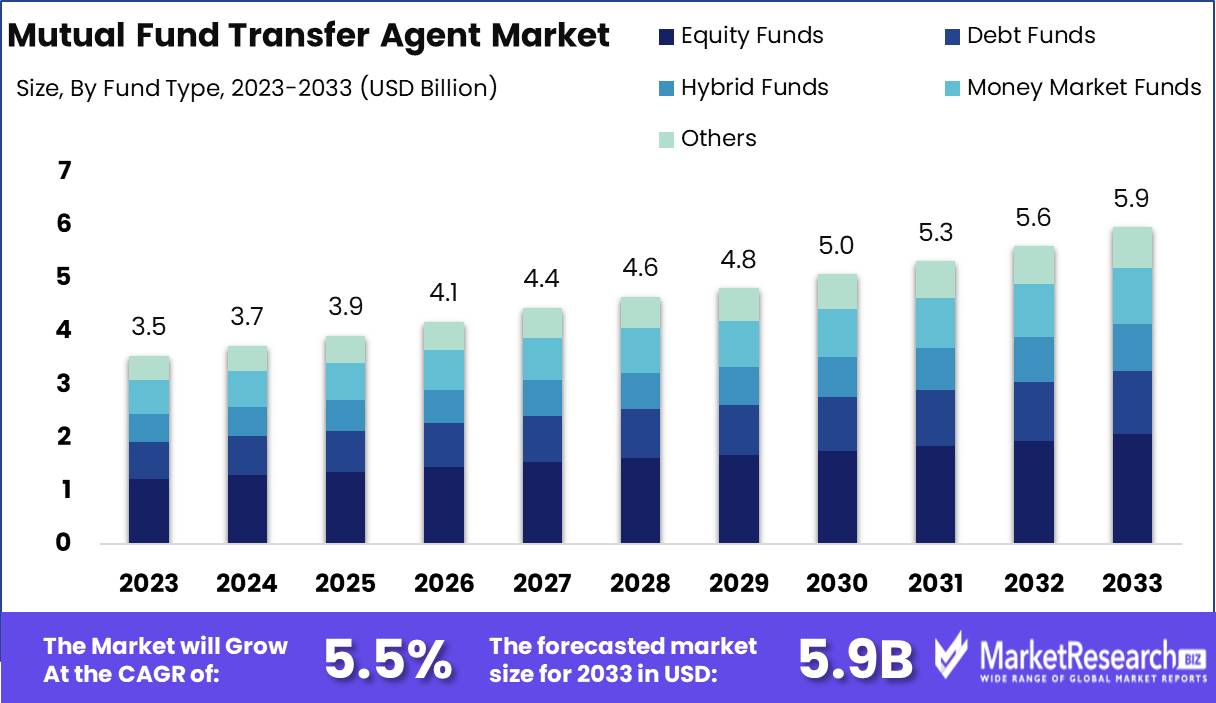

The Global Mutual Fund Transfer Agent Market was valued at USD 3.5 Bn in 2023. It is expected to reach USD 5.9 Bn by 2033, with a CAGR of 5.5% during the forecast period from 2024 to 2033.

The Mutual Fund Transfer Agent Market encompasses services and technologies dedicated to managing investor records, processing transactions, and ensuring regulatory compliance for mutual funds. Transfer agents handle critical tasks such as account maintenance, dividend distribution, and communication with shareholders, facilitating smooth and efficient fund operations. This market is driven by the growing complexity of regulatory requirements, increasing investor participation in mutual funds, and the need for advanced digital solutions to enhance operational efficiency. As mutual funds continue to be a preferred investment vehicle, the demand for reliable and innovative transfer agent services is expected to rise steadily.

The Mutual Fund Transfer Agent Market is witnessing substantial growth, driven by the increasing complexity of regulatory frameworks and the expanding participation of retail and institutional investors in mutual funds. Transfer agents play a pivotal role in ensuring the smooth operation of mutual funds by managing investor records, processing transactions, and maintaining compliance with regulatory standards. The market is highly consolidated, with Computer Age Management Services (CAMS) and KFin Technologies together accounting for over 95% of the market share. These leading entities have established extensive networks, with over 270 points of service nationwide, underscoring their significant operational scale and reach.

The Mutual Fund Transfer Agent Market is witnessing substantial growth, driven by the increasing complexity of regulatory frameworks and the expanding participation of retail and institutional investors in mutual funds. Transfer agents play a pivotal role in ensuring the smooth operation of mutual funds by managing investor records, processing transactions, and maintaining compliance with regulatory standards. The market is highly consolidated, with Computer Age Management Services (CAMS) and KFin Technologies together accounting for over 95% of the market share. These leading entities have established extensive networks, with over 270 points of service nationwide, underscoring their significant operational scale and reach.The demand for advanced digital solutions is transforming the landscape, as transfer agents seek to enhance operational efficiency and improve investor experiences. The integration of technologies such as blockchain, artificial intelligence, and automation is enabling more secure, transparent, and efficient processing of transactions and maintenance of records. Furthermore, the increasing emphasis on investor education and engagement is driving transfer agents to develop more user-friendly and interactive platforms.

As mutual funds continue to be a favored investment vehicle for wealth management, the role of transfer agents becomes increasingly critical. Firms that invest in technological advancements and robust service networks will be well-positioned to capitalize on the growing market opportunities. The ability to navigate regulatory changes and leverage digital transformation will be key differentiators in this competitive landscape. Overall, the Mutual Fund Transfer Agent Market is set for continued expansion, driven by innovation and the rising demand for efficient and compliant fund administration services.

Key Takeaways

- Market Growth: The Global Mutual Fund Transfer Agent Market was valued at USD 3.5 Bn in 2023. It is expected to reach USD 5.9 Bn by 2033, with a CAGR of 5.5% during the forecast period from 2024 to 2033.

- By Service Type: Shareholder Recordkeeping services constitute 30% of the market, essential for maintaining accurate and up-to-date investor records.

- By Fund Type: Equity Funds are the primary focus, comprising 35% of the market, reflecting their popularity among investors for potential high returns.

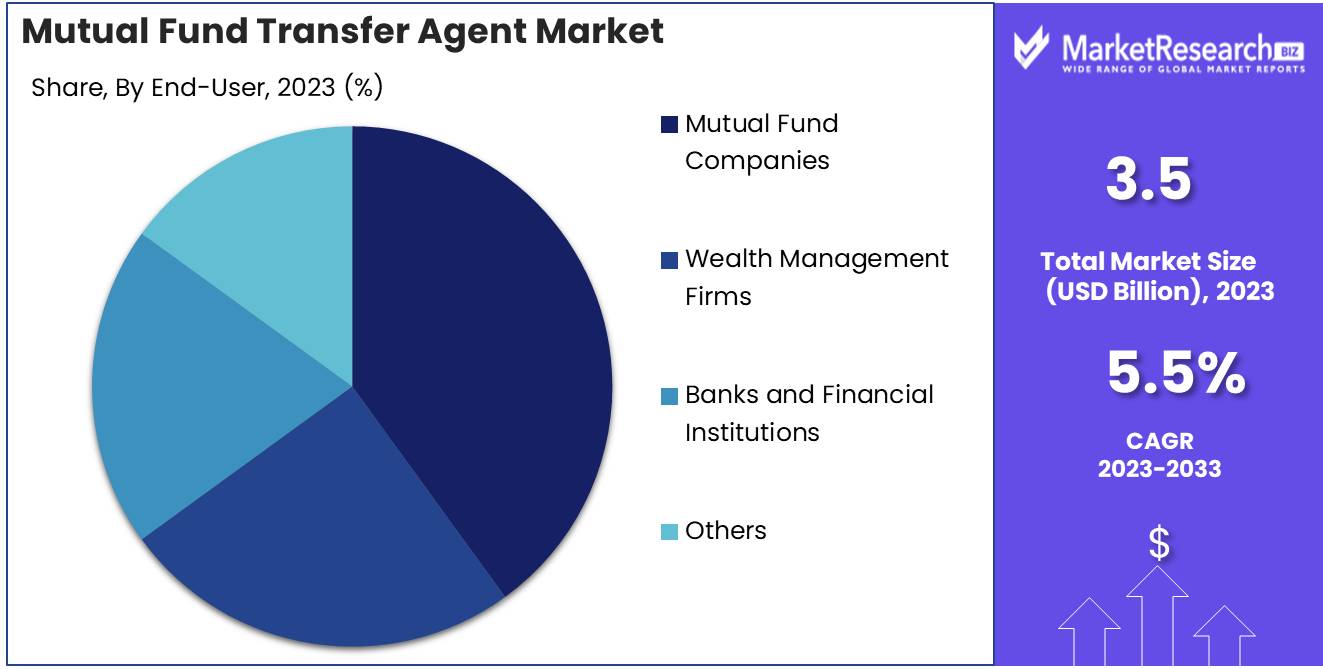

- By End-User: Mutual Fund Companies are the main clients, making up 40% of the market, reliant on transfer agents for efficient fund management.

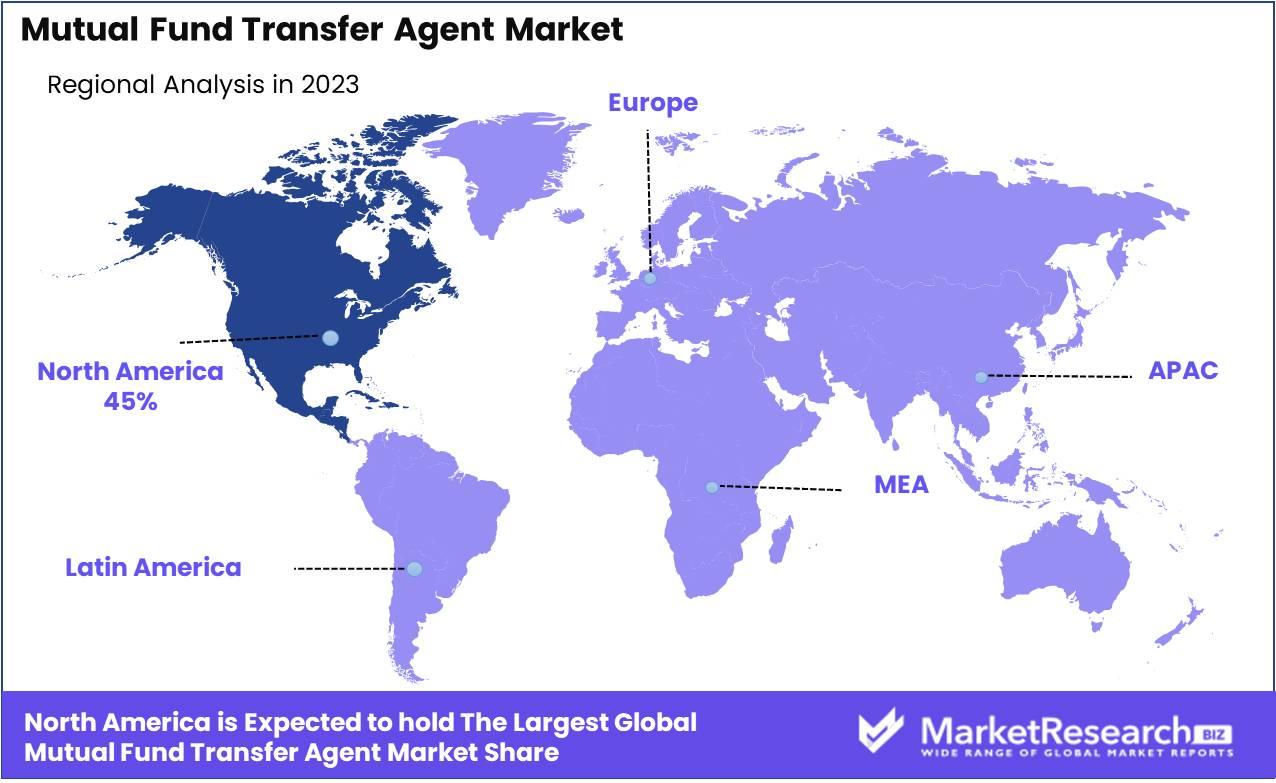

- Regional Dominance: North America leads with a 45% market share, supported by a well-established financial sector and a high volume of equity investments.

- Growth Opportunity: Advancements in minimally invasive surgical technologies present opportunities for increased adoption of anastomosis devices in complex surgeries.

Driving factors

Increasing Demand for Mutual Fund Investments

The escalating demand for mutual fund investments is a primary driver for the growth of the Mutual Fund Transfer Agent Market. With investors seeking diversified and professionally managed portfolios, mutual funds have become an attractive option due to their potential for high returns and risk management capabilities. This surge in mutual fund investments has led to an increased need for efficient transfer agent services to handle the volume of transactions, investor records, and compliance requirements.

As more individuals and institutional investors turn to mutual funds for their investment needs, the demand for robust transfer agent services that ensure accurate transaction processing and record-keeping will continue to grow, thereby driving market expansion.

Regulatory Requirements for Accurate Record-Keeping

Regulatory requirements for accurate record-keeping significantly impact the growth of the Mutual Fund Transfer Agent Market. Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States and similar entities globally mandate stringent compliance and transparency standards for mutual funds. These regulations necessitate meticulous record-keeping, timely reporting, and comprehensive documentation to protect investors and maintain market integrity.

Transfer agents play a crucial role in meeting these regulatory demands by ensuring that all transactions are accurately recorded and reported. The increasing complexity of regulatory requirements further underscores the importance of specialized transfer agent services, thus fueling market growth as mutual fund companies seek to comply with evolving regulations.

Growing Digitalization in Financial Services

The growing digitalization in financial services is a transformative force in the Mutual Fund Transfer Agent Market. Digital technologies, including blockchain, artificial intelligence (AI), and advanced data analytics, are revolutionizing how transfer agents manage and process transactions. Digitalization enhances efficiency, accuracy, and speed in record-keeping and transaction processing, reducing the likelihood of errors and fraud.

Digital platforms provide investors with real-time access to their portfolios, transaction histories, and other essential information, improving transparency and customer satisfaction. As financial services continue to embrace digital transformation, the demand for digitally adept transfer agents who can leverage these technologies to offer enhanced services will significantly drive market growth.

Restraining Factors

High Operational Costs

High operational costs present a significant challenge to the growth of the Mutual Fund Transfer Agent Market. The complex nature of transfer agent services, which includes maintaining accurate investor records, processing transactions, and ensuring compliance with regulatory requirements, demands substantial financial resources. These activities necessitate significant investments in technology, skilled personnel, and infrastructure.

The need for continuous updates to stay compliant with evolving regulations and the adoption of new technologies to enhance service delivery further exacerbates operational costs. Consequently, these high costs can be a barrier to entry for new players and can impact the profitability of existing transfer agents, potentially slowing market growth.

Data Security and Privacy Concerns

Data security and privacy concerns are paramount in the Mutual Fund Transfer Agent Market, given the sensitive nature of financial and personal information handled by transfer agents. The rise of digitalization in financial services, while offering numerous benefits, also exposes the industry to cybersecurity risks such as data breaches, hacking, and fraud. Ensuring the security and privacy of investor data requires robust cybersecurity measures, which involve substantial investments in advanced security technologies, regular audits, and compliance with stringent data protection regulations such as the General Data Protection Regulation (GDPR) and other regional data privacy laws.

The need to safeguard against these risks not only increases operational costs but also requires ongoing vigilance and adaptability, which can strain resources and impact market growth.

By Service Type Analysis

Shareholder Recordkeeping dominated the By Service Type segment of the Mutual Fund Transfer Agent Market in 2023, capturing more than a 30% share.

In 2023, Shareholder Recordkeeping held a dominant market position in the By Service Type segment of the Mutual Fund Transfer Agent Market, capturing more than a 30% share. This significant market share is driven by the essential role of shareholder recordkeeping in managing mutual fund investor accounts, tracking ownership, and maintaining accurate and up-to-date records of transactions and holdings. The increasing complexity of regulatory requirements and the need for precise, real-time data management have further propelled the demand for reliable shareholder recordkeeping services.

Mutual Fund Accounting services are also vital, providing comprehensive financial reporting and ensuring the accurate calculation of net asset values (NAVs). These services support fund managers in maintaining financial integrity and meeting regulatory standards.

Dividend Processing is crucial for distributing earnings to shareholders, ensuring timely and accurate payments. This service is particularly important for income-focused funds and investors relying on regular dividend payments

Compliance Reporting services help mutual funds adhere to regulatory requirements and industry standards. These services include preparing and submitting necessary filings, monitoring compliance, and managing regulatory audits.

Others include a variety of additional services such as transaction processing, communication services, and customer support. These services, while important for the overall functioning and efficiency of mutual fund operations, contribute a smaller share to the market compared to the core services of shareholder recordkeeping and accounting.

By Fund Type Analysis

Equity Funds dominated the By Fund Type segment of the Mutual Fund Transfer Agent Market in 2023, capturing more than a 35% share.

In 2023, Equity Funds held a dominant market position in the By Fund Type segment of the Mutual Fund Transfer Agent Market, capturing more than a 35% share. This leadership is driven by the significant investment inflows into equity funds, which are favored for their potential for higher returns and capital appreciation. As global equity markets have performed robustly, investors have increasingly turned to equity funds to leverage market gains, resulting in a higher demand for transfer agent services to manage these investments.

Debt Funds also play a crucial role in the mutual fund landscape, offering investors lower risk and stable returns through investments in bonds and other fixed-income securities. While important, the market share of debt funds is smaller compared to equity funds due to their lower growth potential, which attracts a different investor demographic more focused on income preservation rather than high returns.

Hybrid Funds, which invest in a mix of equities and fixed-income securities, provide a balanced investment option aimed at mitigating risk while still offering growth opportunities. Their appeal lies in their diversified strategy, attracting investors who seek both growth and stability.

Money Market Funds are designed for short-term investments, focusing on liquidity and capital preservation. They are favored by conservative investors and institutions looking for safe investment avenues with minimal risk.

Others encompass a variety of specialized mutual funds, including sector-specific, index, and international funds. These funds cater to niche markets and specific investor interests, offering targeted investment opportunities.

By End-User Analysis

Mutual Fund Companies dominated the By End-User segment of the Mutual Fund Transfer Agent Market in 2023, capturing more than a 40% share.

In 2023, Mutual Fund Companies held a dominant market position in the By End-User segment of the Mutual Fund Transfer Agent Market, capturing more than a 40% share. This leadership is driven by the core need for mutual fund companies to efficiently manage large volumes of investor accounts, transactions, and compliance requirements. As primary issuers of mutual funds, these companies rely heavily on transfer agents to handle critical functions such as shareholder recordkeeping, dividend processing, and regulatory reporting.

Wealth Management Firms also represent a significant segment in the mutual fund transfer agent market. These firms manage substantial investment portfolios on behalf of high-net-worth individuals and institutional clients. They utilize transfer agent services to streamline their operations, maintain accurate records, and provide seamless client services.

Banks and Financial Institutions play a pivotal role in the mutual fund ecosystem by offering mutual funds as part of their investment products. They leverage transfer agent services to manage the administration of these funds, including account maintenance and transaction processing.

Others include a variety of financial service providers such as brokerage firms, insurance companies, and independent financial advisors who offer mutual funds as part of their investment portfolios.

Key Market Segments

By Service Type

- Mutual Fund Accounting

- Shareholder Recordkeeping

- Dividend Processing

- Compliance Reporting

- Others

By Fund Type

- Equity Funds

- Debt Funds

- Hybrid Funds

- Money Market Funds

- Others

By End-User

- Mutual Fund Companies

- Wealth Management Firms

- Banks and Financial Institutions

- Others

Growth Opportunity

Adoption of Blockchain for Enhanced Transparency and Security

In 2024, the adoption of blockchain technology represents a significant opportunity for the Mutual Fund Transfer Agent Market. Blockchain's inherent properties of transparency, immutability, and security can address many of the operational challenges faced by transfer agents. By utilizing blockchain, transfer agents can offer enhanced transaction transparency and traceability, ensuring that all changes to investor records are securely documented and verifiable. This technology can significantly reduce the risk of fraud and data tampering, thereby increasing investor confidence.

Blockchain can streamline and automate many back-office processes, potentially lowering operational costs and improving efficiency. As the financial industry continues to explore and integrate blockchain solutions, transfer agents who adopt this technology will be well-positioned to offer superior services, thereby attracting more clients and driving market growth.

Expansion of Services to Emerging Markets

The expansion of transfer agent services to emerging markets presents another lucrative opportunity for 2024. Emerging markets are experiencing rapid economic growth and increasing financial inclusion, leading to a rise in mutual fund investments. These markets, however, often lack the sophisticated infrastructure and regulatory frameworks found in more developed regions. Transfer agents that can navigate these challenges and establish a presence in emerging markets stand to benefit significantly.

By offering tailored solutions that address the unique needs of these regions, such as mobile-based services and simplified compliance processes, transfer agents can tap into a vast and growing investor base. This expansion not only diversifies revenue streams but also spreads operational risk across different geographical areas, contributing to overall market stability and growth.

Latest Trends

Integration of AI and Automation in Transfer Agent Services

The integration of artificial intelligence (AI) and automation into transfer agent services is set to be a transformative trend in 2024. AI technologies, such as machine learning and natural language processing, can significantly enhance the efficiency and accuracy of transfer agent operations. Automated processes can streamline routine tasks like transaction processing, compliance monitoring, and customer service, reducing the potential for human error and lowering operational costs.

AI can also provide advanced analytics capabilities, enabling transfer agents to gain deeper insights into investor behavior and preferences, which can be used to personalize services and improve client satisfaction. As AI and automation technologies continue to advance, their adoption in transfer agent services is expected to drive innovation and operational excellence, positioning firms for competitive advantage in a rapidly evolving market.

Rising Use of Cloud-Based Solutions for Data Management

The rising use of cloud-based solutions for data management is another significant trend shaping the Mutual Fund Transfer Agent Market in 2024. Cloud technology offers scalable, flexible, and cost-effective data storage and processing capabilities, which are crucial for handling the vast amounts of data generated by mutual fund transactions. Cloud-based solutions enable transfer agents to access and manage data in real-time, facilitating more efficient record-keeping and reporting.

Cloud platforms often come with built-in security features and compliance tools that help transfer agents meet regulatory requirements more easily. The adoption of cloud technology not only enhances operational efficiency but also provides a robust foundation for implementing other advanced technologies such as AI and blockchain.

Regional Analysis

Mutual Fund Transfer Agent Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, North America dominated the Mutual Fund Transfer Agent Market, capturing a substantial 45% share. This dominance is driven by the region's highly developed financial sector, extensive mutual fund industry, and stringent regulatory frameworks. The United States, in particular, plays a pivotal role with its large number of mutual funds and extensive investor base. Advanced technological infrastructure and a high degree of automation in transfer agent services further support North America's leading market position.

Europe holds a significant market share, propelled by a mature financial market and well-established mutual fund industry in countries such as the United Kingdom, Germany, and France. The region's stringent regulatory requirements and emphasis on transparency and investor protection drive the demand for reliable transfer agent services.

Asia Pacific is experiencing rapid growth in the mutual fund transfer agent market, fueled by increasing financial literacy, rising disposable incomes. The growing adoption of mutual funds as investment vehicles and the development of financial markets are driving the demand for transfer agent services. Despite its fast-paced growth, Asia Pacific's market share is still developing compared to the established markets of North America and Europe.

Middle East & Africa show promising potential for growth in the mutual fund transfer agent market, supported by increasing investments in financial infrastructure and a growing focus on diversifying economies. The adoption of mutual funds is gradually increasing, driven by efforts to improve financial inclusion and investment opportunities.

Latin America is emerging as a growing market for mutual fund transfer agent services. The region benefits from improvements in financial infrastructure and a growing awareness of mutual fund investments. While the market share is expanding, it is still smaller compared to dominant regions due to economic variability and slower adoption of advanced financial technologies.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Mutual Fund Transfer Agent Market is experiencing transformative shifts, driven by digitalization and regulatory changes. Leading companies such as Computershare Limited, The Bank of New York Mellon Corporation, and Wells Fargo Bank are instrumental in shaping these trends.

Computershare Limited stands out for its robust technological integration and global footprint. The company has continuously enhanced its digital offerings, focusing on security and efficiency, which are paramount in handling sensitive financial transactions and client data. Their innovative approach in automating mutual fund transfers has significantly reduced errors and improved processing times, which is critical for client satisfaction.

The Bank of New York Mellon Corporation, with its extensive experience and strong regulatory compliance framework, continues to provide exceptional service in asset servicing and mutual fund transfers. Their global strategy involves leveraging advanced analytics and artificial intelligence to improve operational efficiency and to offer bespoke solutions to mutual fund managers.

Wells Fargo Bank has expanded its role beyond traditional banking to become a key player in the mutual fund transfer market. Their commitment to enhancing user experience through mobile and online platforms has seen a positive reception from younger demographics who prefer digital-first financial solutions.

Companies like HSBC Holdings plc and American Stock Transfer & Trust Company, LLC are also significant contributors, focusing on expanding their services to emerging markets and integrating sustainable practices into their operations.

Market Key Players

- Computershare Limited

- The Bank of New York Mellon Corporation

- Wells Fargo Bank

- National Association

- American Stock Transfer & Trust Company, LLC

- Continental Stock Transfer & Trust Company, Inc.

- Broadridge Corporate Issuer Solutions, Inc.

- Karvy Computershare Private Limited

- Franklin Templeton International Services (India) Pvt. Ltd.

- HSBC Holdings plc.

Recent Development

Report Scope

Report Features Description Market Value (2023) USD 3.5 Bn Forecast Revenue (2033) USD 5.9 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Mutual Fund Accounting, Shareholder Recordkeeping, Dividend Processing, Compliance Reporting, Others), By Fund Type (Equity Funds, Debt Funds, Hybrid Funds, Money Market Funds, Others), By End-User (Mutual Fund Companies, Wealth Management Firms, Banks and Financial Institutions, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Computershare Limited, The Bank of New York Mellon Corporation, Wells Fargo Bank, National Association, American Stock Transfer & Trust Company, LLC, Continental Stock Transfer & Trust Company, Inc., Broadridge Corporate Issuer Solutions, Inc., Karvy Computershare Private Limited, Franklin Templeton International Services (India) Pvt. Ltd., HSBC Holdings plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Computershare Limited

- The Bank of New York Mellon Corporation

- Wells Fargo Bank

- National Association

- American Stock Transfer & Trust Company, LLC

- Continental Stock Transfer & Trust Company, Inc.

- Broadridge Corporate Issuer Solutions, Inc.

- Karvy Computershare Private Limited

- Franklin Templeton International Services (India) Pvt. Ltd.

- HSBC Holdings plc.