Mumps Drug Market By Product By Type (RIT 4385, Schwarz, Wistar RA 27/3, Others), By End-User (Hospital, Clinic), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46915

-

May 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

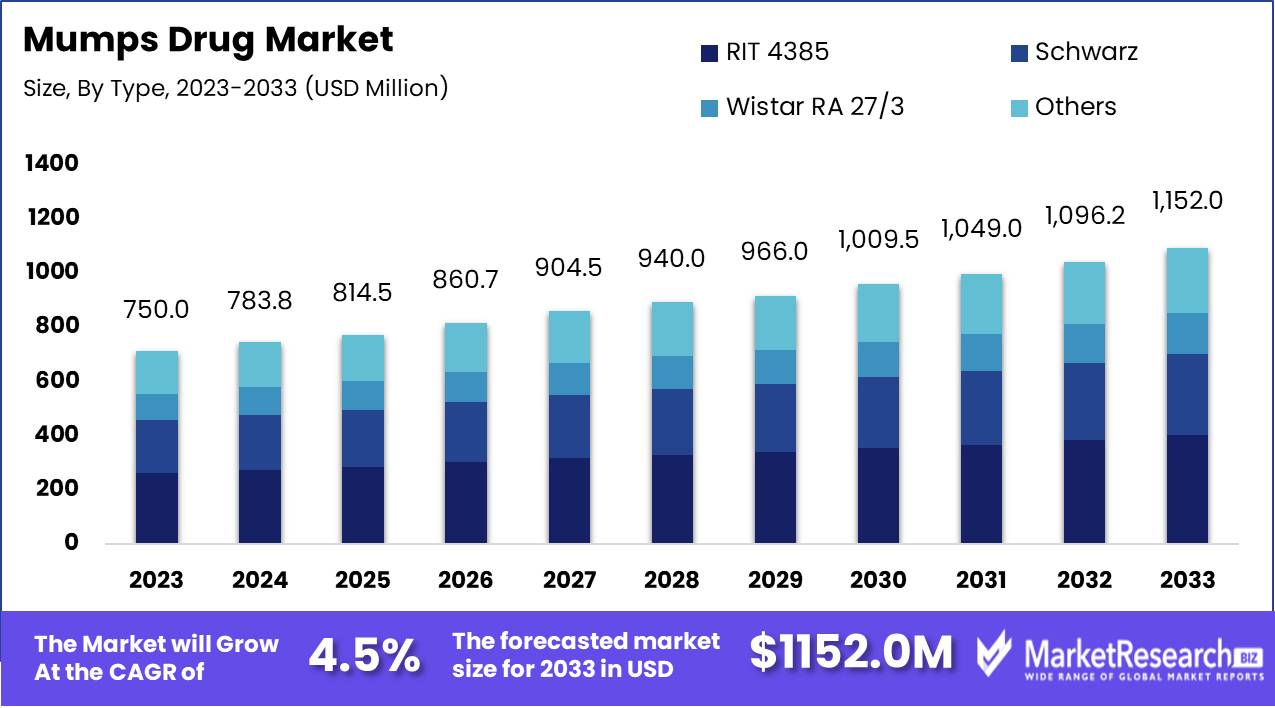

The Mumps Drug Market was valued at USD 750.0 Million in 2023. It is expected to reach USD 1152.0 Million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

The Mumps Drug Market encompasses the development, production, and distribution of pharmaceuticals designed to prevent and treat mumps, an acute viral illness. This market includes vaccines, antiviral medications, and supportive treatments aimed at mitigating the disease's symptoms and complications. Key drivers include increasing vaccination initiatives, growing awareness about mumps prevention, and rising incidences of outbreaks due to vaccine hesitancy. Regulatory approvals, technological advancements in vaccine production, and strategic collaborations among pharmaceutical companies significantly influence market dynamics.

The Mumps Drug Market is poised for significant growth in the coming years, driven by a confluence of technological advancements, evolving regulatory landscapes, and increasing global healthcare awareness. Current market trends suggest a robust pipeline of novel therapeutics, underpinned by extensive R&D investments from leading pharmaceutical companies. The sector is witnessing a paradigm shift towards more efficient and patient-friendly treatments, spurred by innovations in biotechnology and precision medicine.

Furthermore, the integration of Environmental, Social, and Governance (ESG) criteria is increasingly becoming a critical factor for stakeholders, influencing both corporate strategies and investment decisions. This shift towards sustainability and ethical governance is expected to enhance the market’s credibility and attract more investors who are keen on sustainable health solutions.

The comprehensive report on the Mumps Drug Market includes a PESTEL analysis that underscores the macroeconomic factors shaping the industry. Political stability, economic growth, social trends, technological innovations, environmental regulations, and legal frameworks collectively contribute to the market dynamics. Technological trend analysis within the report highlights significant advancements such as the development of next-generation vaccines, enhanced drug delivery systems, and the adoption of AI and machine learning for drug discovery and development. These technological strides are pivotal in addressing the unmet needs in mumps treatment and prevention, thus expanding market opportunities.

Key Takeaways

- Market Growth: The Mumps Drug Market was valued at USD 750.0 Million in 2023. It is expected to reach USD 1152.0 Million by 2033, with a CAGR of 4.5% during the forecast period from 2024 to 2033.

- By Type: RIT 4385 leads the mumps drug market with strategic advantages.

- By End-User: Hospitals dominate the mumps drug market; clinics ensure early diagnosis access.

- Regional Dominance: North America leads the mumps drug market with a 40% share.

- Growth Opportunity: Advancements in vaccine technology and new therapies are driving substantial growth in the global mumps drug market.

Driving factors

Increasing Prevalence of Mumps: Fueling Demand for Effective Treatments

The escalating incidence of mumps globally is a primary driver for the growth of the mumps drug market. The World Health Organization (WHO) has reported a resurgence in mumps cases, particularly in regions with declining vaccination rates. This resurgence necessitates the development and distribution of effective antiviral treatments and vaccines. As mumps is a highly contagious viral infection, outbreaks can rapidly expand within populations, increasing the urgency and demand for pharmaceutical interventions. Pharmaceutical companies are investing in research and development (R&D) to create more effective treatments and vaccines, anticipating a rise in market demand. The increasing prevalence of mumps directly correlates with the necessity for improved and accessible medical solutions, driving market expansion.

Growing Awareness About Vaccines: Enhancing Prevention and Market Growth

Enhanced awareness and education about the importance of vaccinations have significantly impacted the mumps drug market. Public health campaigns and government initiatives have highlighted vaccines' critical role in preventing mumps outbreaks. For instance, the Centers for Disease Control and Prevention (CDC) has launched several initiatives aimed at increasing vaccination coverage among children and adults. This growing awareness has led to higher vaccination rates, which, while primarily preventive, also encourage the development of booster vaccines and treatments for those who contract the disease.

High Prevalence of Pneumococcal Infections: Indirectly Boosting the Mumps Drug Market

The high prevalence of pneumococcal infections, which often lead to complications in mumps patients, indirectly supports the growth of the mumps drug market. Patients with weakened immune systems or pre-existing conditions, such as pneumococcal infections, are more susceptible to severe mumps complications. This interplay necessitates a comprehensive treatment approach, often involving both antiviral drugs and antibiotics to manage secondary infections. The co-management of these conditions drives the demand for a broader range of pharmaceutical products.

Additionally, the overlap in vaccination strategies for pneumococcal infections and mumps (as part of broader immunization programs) enhances market dynamics. Increased investment in immunization programs for pneumococcal infections often includes components that address mumps, thereby expanding the market scope for mumps drugs and vaccines.

Restraining Factors

Waning Immunity: A Significant Challenge to Sustained Market Growth

Waning immunity among vaccinated individuals is a critical factor restraining the growth of the mumps drug market. Research indicates that the effectiveness of the mumps vaccine diminishes over time, with immunity potentially declining as early as a decade after the initial vaccination. This decrease in vaccine-induced immunity contributes to periodic outbreaks even in highly vaccinated populations, thereby necessitating additional booster doses to maintain community protection.

The need for repeated booster doses underscores a potential increase in market demand for mumps vaccines and related drugs. However, this also points to a persistent challenge: the continuous need to educate the public and healthcare providers about the importance of booster vaccinations.

Vaccine Contraindications: Limiting the Reach and Effectiveness of Vaccination Programs

Vaccine contraindications present a substantial barrier to the universal application of mumps vaccination programs, thereby affecting market growth. Contraindications such as severe allergic reactions to vaccine components, compromised immune systems, and certain pre-existing health conditions prevent some individuals from receiving the vaccine. This segment of the population remains vulnerable to mumps infections, potentially facilitating the spread of the virus even in communities with high vaccination coverage.

The presence of contraindications necessitates the development and availability of alternative prophylactic and therapeutic measures, including antiviral drugs and treatments tailored for individuals who cannot be vaccinated. Pharmaceutical companies must invest in R&D to address these gaps, which could lead to innovative solutions and drive market expansion.

By Type Analysis

RIT 4385 leads the mumps drug market with strategic advantages.

In 2023, RIT 4385 held a dominant market position in the "By Type" segment of the Mumps Drug Market. This segment is characterized by several key players, including RIT 4385, Schwarz, Wistar RA 27/3, and others. RIT 4385's leading position can be attributed to its robust clinical efficacy, widespread adoption in immunization programs, and strong safety profile, which have garnered the trust of healthcare providers and patients alike. Additionally, strategic partnerships and collaborations have enhanced its market penetration, contributing to its dominant status.

Schwarz, another significant player, has maintained a solid market presence due to its innovative formulations and targeted marketing strategies, which have effectively addressed specific demographic needs. However, it faces challenges in scaling up production to meet increasing demand.

Wistar RA 27/3, known for its historic contribution to mumps vaccination, continues to be a critical component in the market. Its long-standing reputation and proven track record of effectiveness ensure its steady utilization, especially in regions with established healthcare infrastructure. The "Others" category encompasses a variety of emerging and regional players that are gradually gaining traction through localized strategies and niche market focus. These players often introduce competitive pricing and innovative delivery methods to carve out their market share.

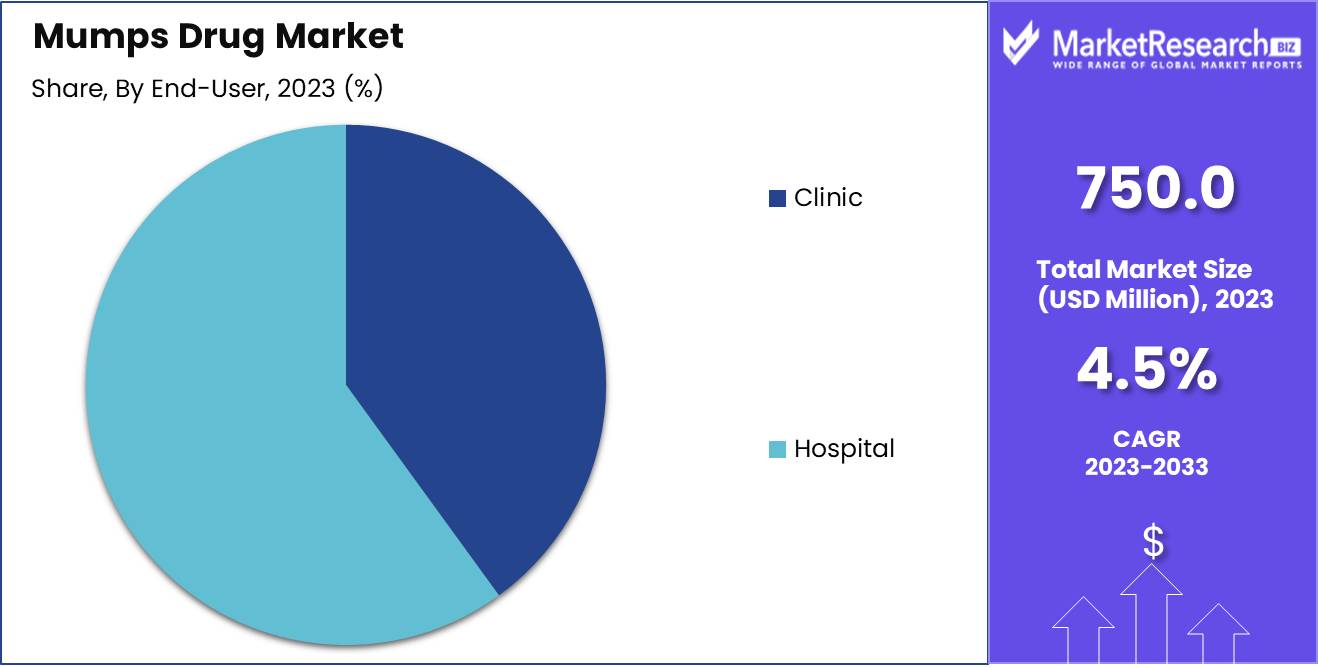

By End-User Analysis

Hospitals dominate the mumps drug market; clinics ensure early diagnosis access.

In 2023, Hospitals held a dominant market position in the end-user segment of the Mumps Drug Market. Hospitals, as critical healthcare infrastructure, have comprehensive facilities and specialist expertise necessary for diagnosing and treating mumps cases, contributing significantly to the high demand for mumps drugs. Their ability to handle severe complications associated with mumps, such as meningitis and encephalitis, underscores their pivotal role in the market. Additionally, hospitals often serve as primary centers for vaccination programs, further driving the uptake of mumps medications and prophylactics.

Conversely, clinics also play a crucial role in the mumps drug market. Clinics, typically more accessible and affordable than hospitals, provide essential services for the early diagnosis and treatment of mumps. They cater to a broad demographic, including those in rural and underserved urban areas, thereby enhancing market penetration. Clinics often act as first contact points for patients with mumps, facilitating early intervention and management. Their contribution to public health through routine immunization and outpatient care makes them indispensable in the overall strategy to control and treat mumps, complementing the more intensive care provided by hospitals.

Key Market Segments

By Type

- RIT 4385

- Schwarz

- Wistar RA 27/3

- Others

By End-User

- Hospital

- Clinic

Growth Opportunity

Advancements in Vaccine Technology

The global mumps drug market is poised for substantial growth in 2024, driven significantly by advancements in vaccine technology. Innovations in vaccine delivery systems and formulations have markedly improved the efficacy and accessibility of mumps vaccines. The development of next-generation vaccines, which offer broader protection and longer-lasting immunity, is particularly noteworthy. Enhanced cold chain logistics and the rise of needle-free delivery methods are also expanding reach, especially in developing regions where mumps outbreaks remain a public health challenge. These technological strides not only bolster vaccination rates but also stimulate demand for related pharmaceutical products, creating a robust growth trajectory for the market.

Development of New Therapies

In parallel with vaccine advancements, the development of new therapies for mumps presents another critical growth opportunity. Recent research has focused on antiviral drugs that can mitigate the severity of mumps symptoms and prevent complications, such as orchitis and meningitis, which can result from the infection. These therapeutic innovations are especially vital given the resurgence of mumps cases in various regions, often linked to vaccine hesitancy and waning immunity among older populations.

The introduction of novel antiviral medications, coupled with comprehensive treatment protocols, is expected to significantly reduce the disease burden and enhance patient outcomes. Consequently, pharmaceutical companies investing in mumps-specific therapies are well-positioned to capture emerging market opportunities.

Latest Trends

Advancements in Technology: Revolutionizing Mumps Treatment and Vaccine Development

Technological advancements will be at the forefront of the mumps drug market in 2024. Innovations in biotechnology and genomics are leading to the development of more effective vaccines and therapeutic solutions. Cutting-edge mRNA technology, which proved successful with COVID-19 vaccines, is being explored for its potential in mumps prevention. This technology offers the possibility of creating vaccines with higher efficacy rates and faster production timelines.

Additionally, advancements in diagnostic tools are improving early detection and management of mumps, which is crucial in controlling outbreaks. Enhanced data analytics and AI-driven research are also accelerating drug discovery and development processes, reducing time-to-market for new treatments.

Collaborations and Partnerships: Strategic Alliances Driving Market Expansion and Innovation

Collaborations and partnerships are increasingly critical in the mumps drug market. Pharmaceutical companies are joining forces with biotechnology firms, research institutions, and governments to leverage complementary strengths and resources. These strategic alliances are essential for advancing research, sharing knowledge, and reducing development costs. For instance, joint ventures and licensing agreements are facilitating the rapid development and distribution of new vaccines.

Moreover, public-private partnerships are playing a pivotal role in funding large-scale clinical trials and ensuring equitable access to treatments, particularly in low- and middle-income countries. These collaborations are not only fostering innovation but also enhancing the global capacity to respond to mumps outbreaks efficiently.

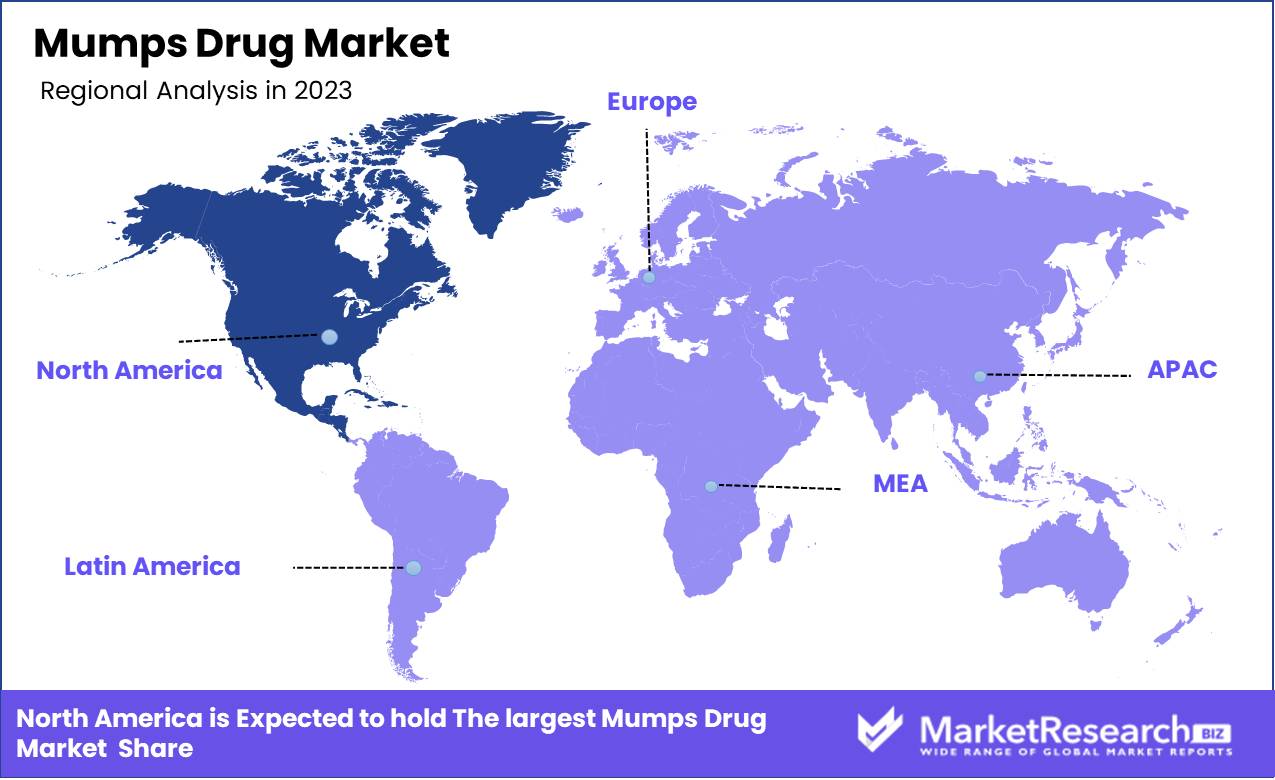

Regional Analysis

North America leads the mumps drug market with a 40% share.

The global mumps drug market exhibits distinct regional trends and dynamics, with significant variations in market size, growth potential, and healthcare infrastructure. North America stands out as the dominant region, commanding approximately 40% of the global market share. This dominance is attributable to advanced healthcare facilities, high vaccination coverage, and substantial investment in healthcare research and development. The U.S. and Canada are key contributors, driven by strong governmental support and high awareness about mumps prevention and treatment.

In Europe, the mumps drug market is bolstered by well-established healthcare systems and comprehensive immunization programs. Countries such as the UK, Germany, and France lead the market, with increasing emphasis on immunization and public health initiatives.

The Asia Pacific region is poised for significant growth, fueled by rising healthcare expenditure, expanding population, and increasing awareness about infectious diseases. Countries like China, India, and Japan are key players, with substantial investments in healthcare infrastructure and vaccination programs.

The Middle East & Africa region presents a mixed scenario, with variable healthcare standards and access to medical facilities. However, increasing government initiatives to improve healthcare access and vaccination coverage are expected to drive market growth. Latin America exhibits moderate growth potential, with countries like Brazil and Mexico at the forefront. These nations are focusing on enhancing healthcare infrastructure and immunization efforts to combat mumps outbreaks effectively.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- The rest of the Middle East & Africa

Key Players Analysis

The global Mumps Drug Market in 2024 is characterized by significant contributions from several key players, each leveraging unique strengths to drive growth and innovation.

Beijing Minhai Biotechnology Co. Ltd and Beijing Tiantan Biological Products Co. Ltd. stand out in the Chinese market due to their extensive R&D capabilities and strong government support. Their focus on developing cost-effective mumps vaccines positions them as crucial players in addressing public health needs within and beyond China. China National Pharmaceutical Group Corporation, another Chinese giant, leverages its vast distribution network and robust financial resources to enhance vaccine accessibility. Its strategic partnerships and investments in biotech innovations underscore its pivotal role in the market.

GlaxoSmithKline Plc (GSK), a global leader in pharmaceuticals, brings unparalleled expertise in vaccine development. GSK's established global presence and commitment to advanced research ensure its continued influence and capability to set industry standards in mumps vaccine efficacy and safety. Organic Vaccines and Prometheon Pharma represent the innovative edge of the market, focusing on novel delivery mechanisms and vaccine formulations. Their advancements in organic and needle-free vaccines could revolutionize the market by improving compliance and expanding reach.

Sinovac Biotech Ltd., with its proven track record in vaccine production and rapid response to epidemics, remains a critical player. Sinovac's agile manufacturing processes and strong regulatory compliance enhance its competitive advantage. Zydus Cadila Healthcare Limited, an Indian pharmaceutical leader, combines affordable healthcare solutions with robust research initiatives. Its focus on expanding vaccine accessibility in developing regions aligns with global public health goals.

Market Key Players

- Beijing Minhai Biotechnology Co. Ltd

- Beijing Tiantan Biological Products Co. Ltd.

- China National Pharmaceutical Group Corporation

- GlaxoSmithKline Plc

- Organic Vaccines

- Prometheon Pharma

- Sinovac Biotech Ltd.

- Zydus Cadila Healthcare Limited

Recent Development

- In May 2024, According to Market Research Reports, the mumps drug market is projected to grow significantly, driven by increasing vaccination initiatives and rising awareness about mumps prevention. Key players such as GlaxoSmithKline and Beijing Tiantan Biological Products Co., Ltd. are expanding their production capabilities to meet this growing demand.

- In April 2024, Fierce Pharma listed a new mumps vaccine among the top 10 most anticipated drug launches of the year. This launch by Sinovac Biotech Ltd. aims to address the rising demand for effective mumps immunization, particularly in regions with lower vaccination rates.

- In March 2024, the World Health Organization (WHO) published an updated position paper on mumps vaccines, emphasizing the importance of the Measles, Mumps, and Rubella (MMR) vaccine in controlling outbreaks globally. The report highlighted changes in the epidemiological features of mumps and underscored the need for increased vaccination coverage to prevent the spread of the virus.

Report Scope

Report Features Description Market Value (2023) USD 750.0 Million Forecast Revenue (2033) USD 1152.0 Million CAGR (2024-2032) 4.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (RIT 4385, Schwarz, Wistar RA 27/3, Others), By End-User (Hospital, Clinic) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Beijing Minhai Biotechnology Co. Ltd, Beijing Tiantan Biological Products Co. Ltd., China National Pharmaceutical Group Corporation, GlaxoSmithKline Plc, Organic Vaccines, Prometheon Pharma, Sinovac Biotech Ltd., Zydus Cadila Healthcare Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Beijing Minhai Biotechnology Co. Ltd

- Beijing Tiantan Biological Products Co. Ltd.

- China National Pharmaceutical Group Corporation

- GlaxoSmithKline Plc

- Organic Vaccines

- Prometheon Pharma

- Sinovac Biotech Ltd.

- Zydus Cadila Healthcare Limited