Mulberry Market By Product Type (Black, Red, White), By Nature (Organic, Conventional), By Form ( Fruit, Raw/Fresh, Processed, Others), By End-Use (Households, Food Service, Food Industry, Other) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4962

-

Jul 2023

-

183

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

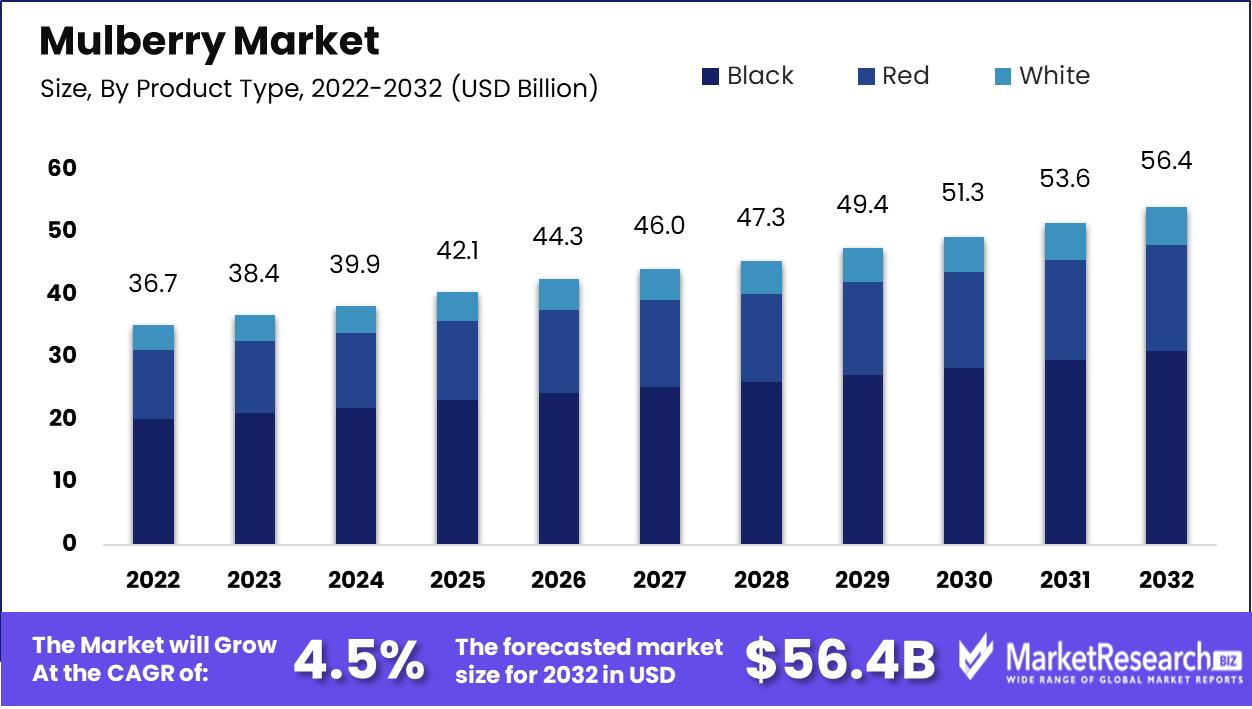

Mulberry Market size is expected to be worth around USD 56.4 Bn by 2032 from USD 36.7 Bn in 2022, growing at a CAGR of 4.5% during the forecast period from 2023 to 2032.

The mulberry market, a fascinating realm revolving around the intricate cultivation, production, and distribution of these delectable berries, has a captivating history of diverse applications. Mulberry has long been revered in traditional medicine for their extraordinary antioxidant and anti-inflammatory properties. In 2022, the food service sector remained a significant contributor to Mulberry's global revenue and continued to serve as the principal market for the company.

The allure of mulberries has extended far beyond the realm of medicine, making a significant impact on the ever-evolving food and beverage industry. Their vibrant essence has been ingeniously captured in various forms, including juices, teas, jams, and more. This dynamic environment anticipates a substantial increase in market size in the coming years, driven by the convergence of rising demand and innovative technological developments.

Mulberries boast a nutritional profile that underscores their popularity. They are rich in essential vitamins such as A, C, and E, and contain an array of vital minerals including iron, potassium, and calcium. Furthermore, the presence of anthocyanins, captivating plant pigments imbued with the tenacity of antioxidants, endows these berries with the inherent capacity to protect our precious cells from harm.

An exciting development emerged in the world of mulberries in 2023. Habitera Farms, located in Brentwood, California, introduced Himalayan purple mulberries to the American public. These unique mulberries are now being cultivated and made available to the public as an attractive alternative to cherries at U-pick farms in the Bay Area.

Moreover, the mulberry industry has witnessed innovation in supply chain management. In Thailand, a new supply chain model for fresh mulberries has been established. This model incorporates active packaging technology, which extends the shelf life of mulberries and preserves their freshness. This breakthrough ensures that consumers can enjoy the goodness of mulberries for longer periods while reducing food waste.

Driving factors

Emphasis on Nutrient-Dense Foods

As nutrition research demonstrates the disease-fighting power of foods dense in vitamins, minerals and antioxidants, mulberries have gained popularity. Overflowing with iron, calcium, vitamin C, fiber and resveratrol, mulberries deliver a mega-dose of nutrients in each serving. Their ability to provide natural nourishment aligns with consumer desires for functional superfoods.

Expansion of Plant-Based Diets

In the quest for wholesome plant-based nourishment, more people are discovering mulberries. With a trove of key nutrients and a sweet, succulent taste, mulberries offer the perfect solution for vegetarians, vegans, and flexitarians seeking to boost nutritional intake from fruit and vegetable sources. Their versatility also allows easy incorporation into plant-forward recipes.

Focus on Gut Health

The growing interest in gut health and microbiome nutrition emphasizes mulberries' potential even more. Their high fiber and antioxidant content promotes good digestion and gut flora. Mulberries also contain anthocyanins, which may help reduce inflammation in the gut lining. Mulberries are an appealing and delicious option for consumers looking for microbiome-nourishing foods.

Restraining Factors

Perishability Hampers Mulberry Distribution

Mulberries are highly perishable fruits and have a short shelf life. They are susceptible to bruising, mold, and spoilage, which makes it challenging to store and transport them over long distances. This limits the distribution and market reach of fresh mulberries.

Limited Geographic Distribution

Mulberry trees flourish in specific geographic regions that offer the ideal climate conditions for their growth. This constrained geographical distribution can lead to disparities in market share and hinder the accessibility of fresh mulberries in regions where the fruit is not cultivated.

Fluctuations in Raw Material prices affecting production costs

The production process entails numerous steps, and cost is a significant constraint that mulberry producers and businesses must overcome. Pruning season is essential for producing high-quality foliage utilized to feed silkworms. The climate throughout the year, especially during the monsoon season, can have a significant impact on the growth cycle of mulberry plants, diminishing it or causing plant diseases, which can increase production costs. In addition, the volatile nature of unprocessed silk and the unpredictability of the foreign exchange rate can make it challenging for mulberry businesses to control production costs.

Product Type Analysis

Black mulberries include mulberries with dark, almost black, coloration. They are known for their intense sweetness and unique flavor profile. Target consumers for black mulberries may include those who appreciate rich, sweet fruits and are looking for antioxidant-rich options.

Red mulberries are characterized by their vibrant red or purple color. They are known for their sweet and slightly tart taste. This segment may attract consumers who prefer a balance between sweetness and tanginess in their fruits.

White mulberries have a pale color and a mild, sweet flavor. They are often used in various culinary applications. This segment may appeal to consumers who seek a subtler taste or use mulberries for cooking and baking.

By Nature Analysis

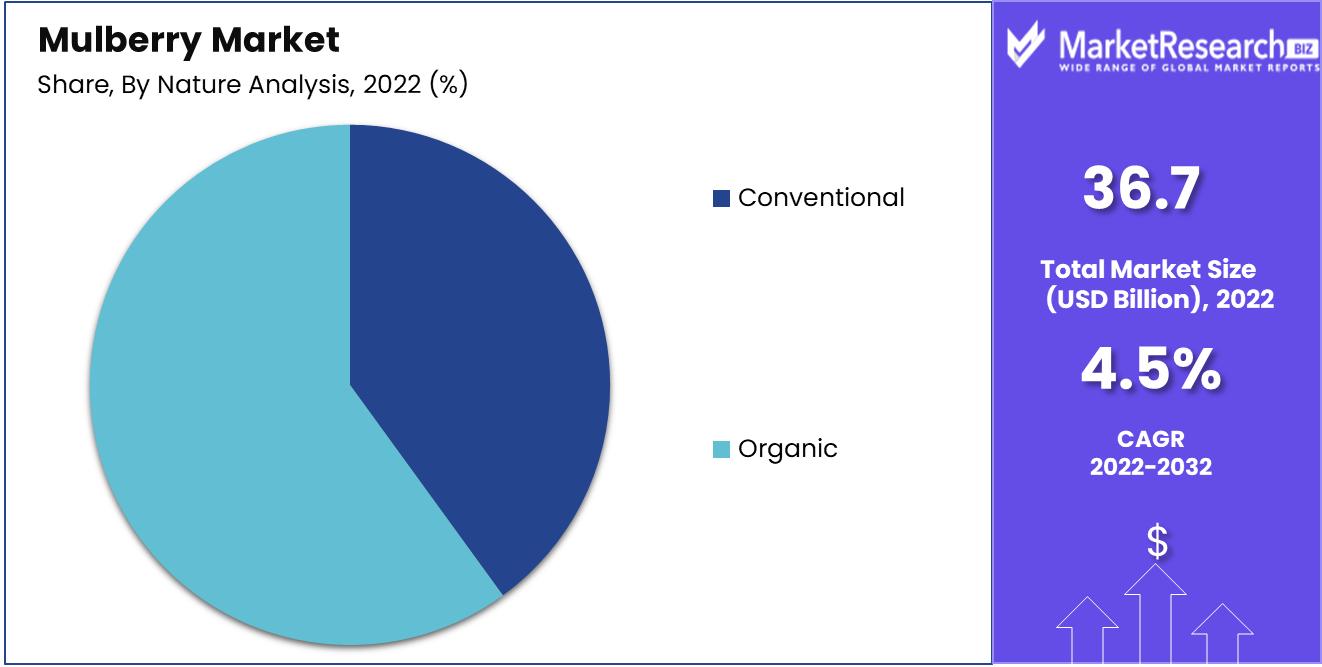

Organic mulberries are grown without synthetic pesticides or fertilizers, making them a choice for consumers who prioritize environmental sustainability and chemical-free food. This segment may appeal to health-conscious individuals and eco-conscious consumers.

Conventional mulberries are grown using traditional farming methods that may involve the use of synthetic chemicals. This segment may cater to a broader consumer base looking for affordability and accessibility.

Key Market Segments

By Product Type

- Black

- Red

- White

By Nature

- Organic

- Conventional

By Form

- Fruit

- Raw/Fresh

- Processed

- Frozen/Chilled

- Canned

- Dehydrated

- Pulp

- Leaves

- Leaf Extract

By End-Use

- Households

- Food Service

- Food Industry

- Bakery & Confectionary

- Convenience food

- Jams, jellies, and pickles

- Dressings, dips, and condiments

- Others (Frozen desserts, Snacks & Cereals)

- Infant formula

- Sports Nutrition

- Beverage Industry

- Dietary supplements

- Animal feed

- Pharmaceutical Industry

- Personal Care & Cosmetics

Growth Opportunity

Growing Interest in Sustainable and Organic Farming

Consumers are becoming increasingly conscious of the environmental impact of their food choices. As a result, there is a rising demand for organic and sustainably grown products. Mulberries are well-suited to organic cultivation methods, and producers who can meet this demand are likely to find significant growth opportunities.

Diversification of Mulberry Product Offerings

Innovation in mulberry-based products is on the rise. Beyond fresh and dried mulberries, there is potential for the development of mulberry jams, juices, teas, and even mulberry-based desserts. Diversifying product offerings can attract new customer segments and boost market growth.

Latest Trends

Expanding Product Range:

Manufacturers are capitalizing on the versatility of mulberries by incorporating them into a wide range of food products. For example, mulberries are used in energy bars and snacks to enhance flavor and nutrition. Additionally, they are blended into smoothies, added to yogurt and cereals, and even used as a base for jams and spreads, contributing to a diverse product landscape.

Globalization of the Market:

The globalization of the mulberry market has expanded its reach and accessibility. Mulberries are now sourced and sold internationally, leading to cross-cultural culinary exchanges and innovations. This globalization is also prompting investments in transportation and logistics to ensure fresh mulberries are available in diverse markets.

Rise in Mulberry-Based Supplements:

Mulberry leaf extracts and supplements are being marketed for their potential health benefits, particularly in managing blood sugar levels. The compounds in mulberry leaves, like DNJ (1-deoxynojirimycin), have been studied for their ability to inhibit carbohydrate absorption and support weight management, attracting consumers looking for natural ways to improve their health.

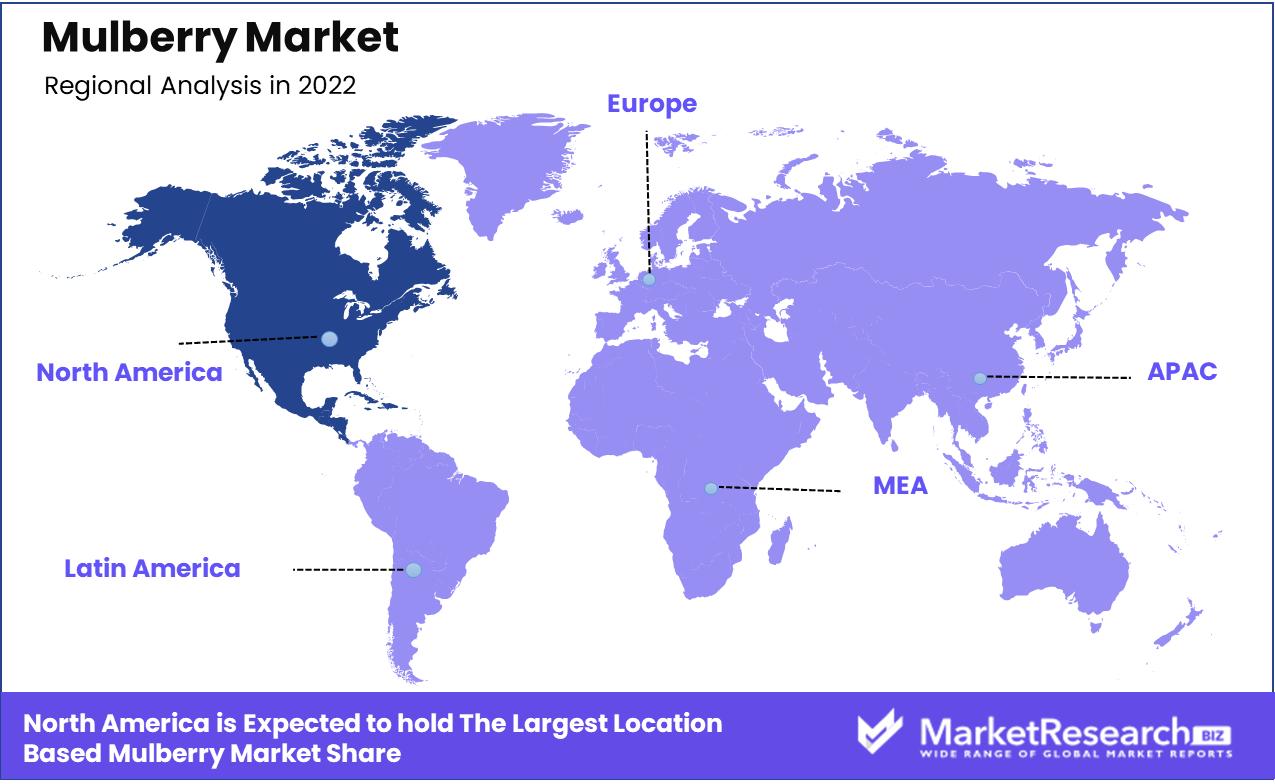

Regional Analysis

North America will represent more than 78% of the global market for mulberries. The United States is the region's primary market driver, followed by Canada. Increasing demand for mulberry leaves as a dietary supplement is a significant factor driving the North American market. Mulberry leaves are an excellent source of antioxidants, vitamins, and minerals, and they have been shown to have a number of health benefits, such as lowering blood sugar levels, improving cholesterol levels, and boosting the immune system.

Another factor driving the market in North America is the growing popularity of superfruits. Mulberries are considered a superfruit, and their use in a variety of culinary and beverage products is on the rise. A major factor driving the market in the region is the growing awareness of the medicinal properties of mulberries. Mulberries have been shown to have a number of health benefits, such as lowering the risk of cancer, enhancing heart health, and boosting the immune system.

In the coming years, the North American mulberry market is anticipated to expand due to the rising demand for mulberry leaves as a dietary supplement, the rising prevalence of super fruits, and the growing awareness of mulberries' medicinal properties.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Bolt Threads is a biotechnology company that focuses on engineering proteins inspired by nature to create novel materials. They have developed the "Mylo" technology, which generates a sustainable leather substitute from mycelium, the root structure of mushrooms, which can be sourced from mulberry tree waste.

Novartis is a multinational pharmaceutical company that engages in research, development, and manufacturing of a diverse array of healthcare products. They have invested in mulberry-based medications and therapies, particularly in the field of diabetes management, capitalizing on the ability of mulberry leaves to regulate blood sugar.

Silk Road Holdings is an industry leader in the production of silk. They prioritize the cultivation of mulberry trees for sericulture and silk production. By controlling the entire supply chain, from mulberry cultivation to silk manufacturing, they guarantee the quality of silk products for international markets.

The Body Shop is a well-known cosmetics and skincare company that prioritizes ethically sourced, natural ingredients. They incorporate mulberry extracts into their products due to the fruit's high antioxidant content, which nourishes and protects the skin from degeneration.

Top Key Players in Mulberry Market

- Bolt Threads

- Novartis

- Silk Road Holdings

- Body Shop

- Sunrise Agriland Development & Research Pvt. Ltd.

- BATA FOOD

- Top Line Foods

- Peony Food Products

- Yaban Food

- NAVITAS ORGANICS

- Sevenhills Wholefoods

- Xian Yuensun Biological Technology Co. Ltd.

- Dragon Superfoods

- Earth Circle Organics

- Other

Recent Development

- In June 2023, Zimbabwe's horticulture sector, particularly the mulberry market, has seen significant growth and positive developments. Mulberry exports have increased dramatically, according to data from Zimbabwe's National Statistics Agency (ZimStats).

- In 2023, A new supply chain model for fresh mulberries has been developed in Thailand, which uses active packaging technology to extend the shelf life and preserve the freshness of the fruit. This model is expected to enhance new market channels and provide growers with more benefits.

- In 2023, Habitera Farms in Brentwood, California, introduced Himalayan purple mulberries to the American public. These mulberries are being grown and offered to the public as an alternative to cherries at U-pick farms in the Bay Area.

Report Scope

Report Features Description Market Value (2022) USD 36.4 Bn Forecast Revenue (2032) USD 56.4 Bn CAGR (2023-2032) 4.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Black, Red, White), By Nature (Organic, Conventional), By Form ( Fruit, Raw/Fresh, Processed, Frozen/Chilled, Canned, Dehydrated, Pulp, Leaves, Leaf Extract), By End-Use (Households, Food Service, Food Industry, Infant formula, Sports Nutrition, Beverage Industry, Dietary supplements, Animal feed, Pharmaceutical Industry, Personal Care & Cosmetics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bolt Threads, Novartis, Silk Road Holdings, Body Shop, Sunrise Agriland Development & Research Pvt. Ltd., BATA FOOD, Top Line Foods, Peony Food Products, Yaban Food, NAVITAS ORGANICS, Sevenhills Wholefoods, Xian Yuensun Biological Technology Co. Ltd., Dragon Superfoods, Earth Circle Organics, Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bolt Threads

- Novartis

- Silk Road Holdings

- Body Shop

- Sunrise Agriland Development & Research Pvt. Ltd.

- BATA FOOD

- Top Line Foods

- Peony Food Products

- Yaban Food

- NAVITAS ORGANICS

- Sevenhills Wholefoods

- Xian Yuensun Biological Technology Co. Ltd.

- Dragon Superfoods

- Earth Circle Organics

- Other