Motorcycles Market By Type (On-Road Motorcycles, Off-Road Motorcycles, Scooters), By Propulsion Type (Electric, ICE), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39849

-

July 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

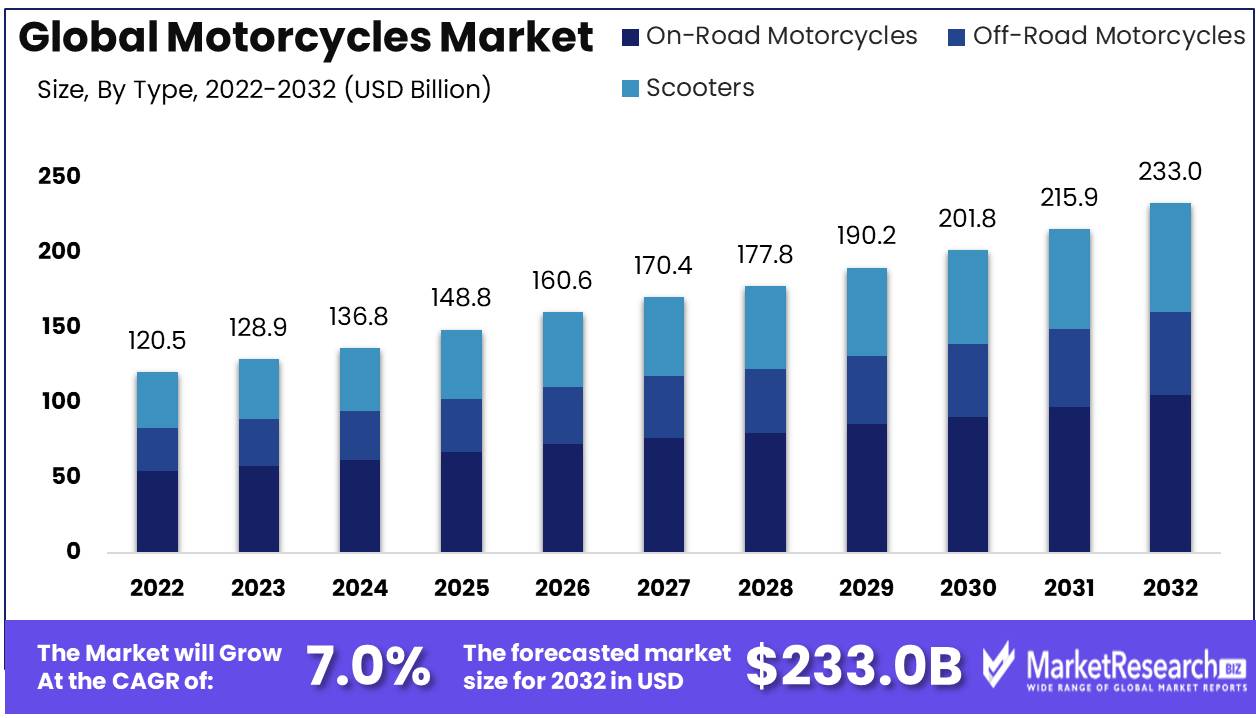

Motorcycles Market size is expected to be worth around USD 233.0 Bn by 2032 from USD 120.5 Bn in 2022, growing at a CAGR of 7.0% during the forecast period from 2023 to 2032

The motorcycles refers to the sector within the transportation industry that deals with manufacturing, distribution, and commercial transactions related to motorcycles. It plays an essential role in providing cost-effective and efficient transportation solutions for both individuals and businesses alike. This report seeks to provide an in-depth examination of this market by outlining its definition, goals, significance, and benefits; in addition to noting innovations made, investments made, integration into various products/services, etc.

The motorcycles market has witnessed significant advances and innovations throughout its history. A key technological advance involves the emergence and progression of electric motorcycles (commonly referred to as e-bikes). Electric motorcycles utilize electric motors instead of traditional internal combustion engines for propulsion, providing multiple benefits like operating without emitting harmful substances, mitigating noise pollution, cost savings on maintenance expenses, and offering practicality and consumer appeal benefits; due to advancements in battery technology, this trend continues to gain ground.

Another noteworthy development involves the incorporation of advanced safety features into motorcycles. Recently, manufacturers have increasingly implemented technological advancements like antilock braking systems (ABS), traction control systems, and electronic stability controls into their products to enhance rider safety and reduce accident rates on demanding roads. Such attributes serve to decrease incidences of accidents as well as enhance riders' abilities to maneuver effectively when confronted by adverse road conditions.

The motorcycles market has seen notable advancements in both design and materials, resulting in motorcycles with reduced weight, enhanced aerodynamics, and superior aesthetics. Manufacturers are using lightweight materials such as carbon fiber or aluminum for greater fuel efficiency while maintaining durability and strength;

The motorcycles market has attracted significant investments from both established companies and emerging ventures looking to capitalize on rising motorcycle demand. Prominent technology conglomerates, like Google, have invested substantially in enterprises focused on self-driving motorcycle technology - tapping into its potential within the motorcycle sector.

Furthermore, ridesharing platforms have identified motorcycles market as an opportunity for expanding their services. Companies such as Uber and Lyft have implemented motorcycle transportation services in certain markets where riding motorcycles is popular as an alternate mode of commuting; providing individuals an additional mode of transport while giving ridesharing companies an avenue to reach more people with their services.

Motorcycles have become an integral component of numerous business sectors over time. Deliveries services have adopted motorcycle use as a strategy to maximize operational efficiency and minimize delivery times; similarly, motorcycles are employed by e-commerce enterprises, food delivery platforms, and logistics providers to meet increasing customer demands for expedited delivery services.

Driving factors

Urbanization is a Catalyst for the Expansion of the Motorcycles Market

Effective transportation is essential as the world's population rapidly urbanizes. Motorcycles are a popular alternative for city inhabitants due to the rise of congested roadways and scarce parking places brought on by urbanization. Urban motorcycles have various advantages over four-wheeled vehicles. They can weave through traffic and improve efficiency due to their size. Motorcycles take up less room in cities.

Traffic Demanding Efficient Transportation

Traffic jams plague cities globally. Gridlocks reduce production, raise pollution, and stress commuters. Motorcycles can alleviate traffic congestion in such situations. Their mobility speeds riders through congested roads, reducing travel times. Motorcycles also use less fuel than cars, making them a cost-effective option for individuals who want to save money while dealing with traffic issues.

Recreational and Adventure Riding Popularity

Motorcycles symbolize freedom and adventure. A surge in motorcycle sales can be attributed to the growing popularity of recreational and adventure riding. Long rides, fresh terrains, and open roads excite many riders. Vacationing, touring, and motorcycle events have grown in popularity, and the motorcycles market has seen demand rise. This tendency has spurred the industry's expansion as manufacturers design adventure motorcycles.

Motorcycle Sharing and Rental Expansion

Motorcycle sharing and rental services have emerged as a practical alternative to car ownership and public transportation in recent years. Individuals can rent motorcycles for short or extended periods, saving money. The rise of ride-sharing platforms and specialized motorcycle rental companies has given people access to motorcycles without ownership. This expansion in shared mobility choices has made motorcycles more accessible, adding to a surge in demand and benefiting the motorcycles market.

Motorbike Technology

Technological improvements have changed the motorcycle industry, improving safety, performance, and comfort. Advanced features include ABS, traction control, riding modes, and electronic suspension. These technologies have increased rider safety and experience. Motorcycles now integrate seamlessly with cellphones, allowing riders to use navigation, music, and communication while on the go. As the world moves toward greener transportation, electric motorcycles offer consumers a sustainable and eco-friendly option.

Restraining Factors

Safety and Accidents

The motorcycles market attracts riders of all ages. However, the market has significant restraining factors that can hinder its growth and performance. One is safety and accident risks with motorcycles. Given the vulnerability of motorcycle riders compared to those in enclosed cars, safety has always been a top priority when it comes to motorcycles. Motorcycles can cause serious injuries or death, which worries potential customers. Concerns over safety may dissuade some individuals from acquiring a motorbike, affecting market growth and safety.

Regulatory Restrictions and Licensing

Another significant restraining factor in the motorcycles market is governmental regulations and licensing requirements. Motorcycle firms typically struggle to expand due to these country-specific requirements. Emission restrictions, noise limits, safety equipment requirements, and rider licensing are examples of regulations. Complying with these regulations can add significant expenses to motorcycle production and limit model sales.

Fuel Prices Are Fluctuating

Another restraining aspect of the motorcycles market is fluctuating fuel prices. Gasoline is the main fuel for motorcycles, therefore a significant price increase can hurt demand. Consumers want fuel-efficient transportation when fuel prices rise. Motorcycles are more fuel-efficient than cars, but demand may drop if individuals move to electric cars or public transportation. This can lead to lower sales and the motorcycles market's profitability.

Limited Storage and Passenger Capacity

A further restraining element in the motorcycles market is limited storage and passenger capacity. Motorcycles have less storage room than vehicles, making it hard for riders to store groceries, personal items, and more. For individuals who rely significantly on their vehicles for everyday chores or commuting, this limitation might be a significant downside. Motorcycles' low passenger capacity may deter individuals who travel with friends. Motorcycles are frequently thought of as a solitary transportation choice, but the lack of passenger space can hinder consumers, especially those who value convenience and versatility.

Adverse Weather

Adverse weather conditions are a restraining issue for the motorcycles market in difficult areas. Rain, snow, strong gusts, and extreme temperatures can make riding motorcycles uncomfortable or dangerous. In bad weather, riders may pick more covered and weather-ready transportation options, reducing motorcycle use. This might lead to reduced demand for motorcycles in some regions or seasons, reducing market growth and profitability.

Type Analysis

The motorcycles market is diverse and dynamic, catering to enthusiasts' demands and preferences. The On Road Motorcycles Segment dominates the overall market. This section contains motorcycles made for public roads, offering riders a thrilling and efficient form of transportation.

Emerging economies' strong economic growth drives On-Road Motorcycle adoption. As China, India, and Brazil continue to grow at a significant rate, purchasing power rises. More people can afford motorcycles, increasing demand for on-road motorcycles.

In recent years, consumer behavior has shifted toward the On-Road Motorcycles Segment. Riders increasingly value ease, cost, and adaptability in transportation. On-road motorcycles allow riders to handle urban traffic while experiencing the excitement of open roads.

The On-Road Motorcycles Segment's technological and design advances have also had a significant impact on consumer preferences. To improve riding, manufacturers have been adding modern safety systems, fuel-efficient engines, and ergonomic designs. These qualities have attracted both seasoned riders and new riders to motorcycles.

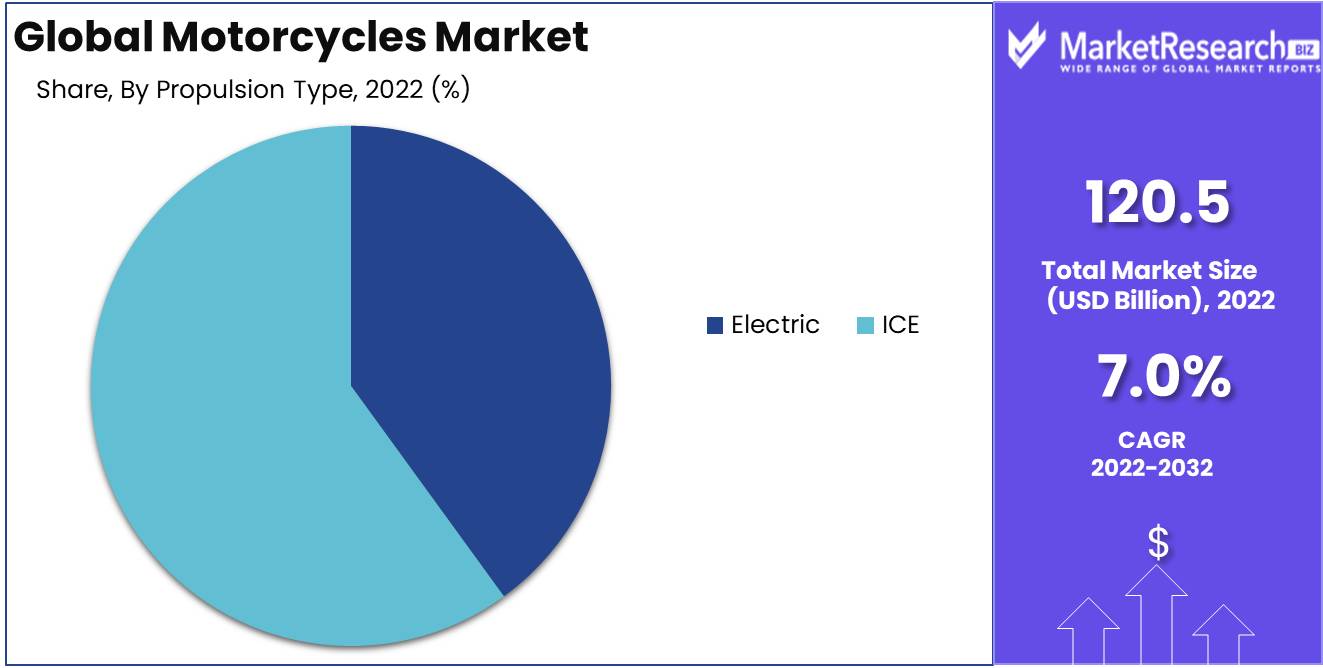

Propulsion Type Analysis

The Internal Combustion Engine (ICE) segment dominates the motorcycles market. For decades, gasoline-powered motorcycles have been the industry standard. Power, reliability, and availability are hallmarks of ICE motorcycles.

Similar to the On-Road Motorcycle Segment, rising economies drive ICE Segment adoption. Affordable transportation is in demand as these economies flourish. ICE motorcycles are affordable for commuters and other users.

Consumer attitudes toward the ICE Segment have stayed consistent. A significant number of riders enjoy the traditional feel and sound of ICE motorcycles, as well as the ease of recharging at gas stations. In order to meet the diverse demands and preferences of riders, the ICE Segment also offers a wide range of engine displacement, style, and performance levels.

In the motorcycles market, the ICE Segment is expected to expand the fastest in the future years. Several things affect this projection. First, emerging economies will continue to grow, driving demand for affordable and dependable transportation. Due to their affordability and availability, ICE motorcycles can meet this demand.

Key Market Segments

By Type

- On-Road Motorcycles

- Off-Road Motorcycles

- Scooters

By Propulsion Type

- Electric

- ICE

Growth Opportunity

Motorcycles Market Explosion

The motorcycle industry is ripe for growth due to factors like the expansion into emerging markets, the development of electric motorcycles, customization, personalization, collaborations with technology companies for connected motorcycles, and a growing focus on women riders. On the strength of these tendencies, let's examine three more growth opportunities that could help the motorcycles market.

Green Motorcycles Green Shift

Consumers across industries have recently been more concerned about the environment. The motorcycles market has a unique potential to invest in the development and integration of sustainable materials and processes because of this trend. Eco-friendly motorcycle materials lower carbon footprint and appeal to environmentally aware consumers.

Motorcycle-Riding Safety Tech

The car industry's safety features have changed due to technology. Advanced safety technologies can help motorcycle manufacturers capitalize on this growth. Collision warning, blind-spot recognition, adaptive cruise control, and autonomous emergency braking improve rider safety. Collaborations with automobile safety technology businesses can hasten the development of motorcycle safety features. Manufacturers can attract safety-conscious buyers by promoting cutting-edge safety technologies, growing the motorcycle market.

AI Transforming Riding

AI has swiftly spread throughout industries, but its potential in motorcycles is still untapped. Motorcycle manufacturers can offer predictive maintenance, adaptive suspension, and semi-autonomous riding modes by utilizing AI technologies. AI-powered systems can monitor rider behavior, road conditions, and weather to optimize performance and safety. Adding technologies like voice control, natural language processing, and gesture recognition can improve user experience and bring tech-savvy consumers to the motorcycles market.

Rising Emerging Markets

Motorcycle manufacturers have expanded into emerging markets with a burgeoning middle class. Affordable, reliable transportation is needed as discretionary incomes rise and the middle class grows. Our organization targets these markets to reach untapped consumer segments with huge growth potential. The industry has been changed by the development of electric motorcycles, addressing environmental concerns and boosting mobility innovation.

Latest Trends

Electric motorcycles and scooters rise

The rise of electric motorcycles and scooters has been revolutionary. The popularity of electric two-wheelers has skyrocketed as a result of the growing emphasis on sustainability and lowering carbon emissions. Eco-friendly solutions decrease noise, energy use, and operational expenses. Electric motorcycles market and scooters are now high-performance and long-range.

Adventure and Touring Motorcycle Growth

Adventure and touring motorcycles are in high demand as more riders seek thrills and adventure on two wheels. These motorcycles market are built for long-distance travel, off-road excursions, and comfort. Adventure motorcycles combine on-road and off-road capabilities, making them adaptable and popular with adventurers. These motorcycles offer a better riding experience in all situations thanks to features like sturdy suspensions, larger fuel tanks for increased range, and cutting-edge rider aids like traction control and configurable riding modes.

ABS and Traction Control Integration

Riders prioritize safety, therefore motorcycle manufacturers add advanced features. ABS and Traction Control are two safety technologies that are becoming more common on motorcycles of all types.ABS prevents wheel lockup during strong braking, reducing skidding and preserving stability. Traction Control reduces wheel slippage and maintains traction on slippery roads or while accelerating. These safety features boost riders' confidence and prevent accidents, making motorcycles market safer for riders and other road users.

Lightweight, Agile Motorcycle Development

Manufacturers of motorcycles market are working on making lightweight, nimble models in response to changing user preferences. These motorcycles are more maneuverable, efficient, and powerful. Lightweight metals and composites have allowed manufacturers to build lighter motorcycles without compromising safety or structural integrity. Lighter motorcycles are easier to control, especially in heavy traffic, making them appealing to commuters and urban riders.

Motorcycle Technology Adoption

Smart and connected technologies' integration has transformed several industries, including the motorcycles market. Manufacturers are adding Bluetooth, GPS, smartphone integration, and heads-up displays to motorcycles. These technologies allow riders to maintain their hands on the handlebars and eyes on the road while receiving important information like turn-by-turn directions, incoming calls, and music. Connected technologies let riders track rides, check motorcycle health, and receive maintenance reminders.

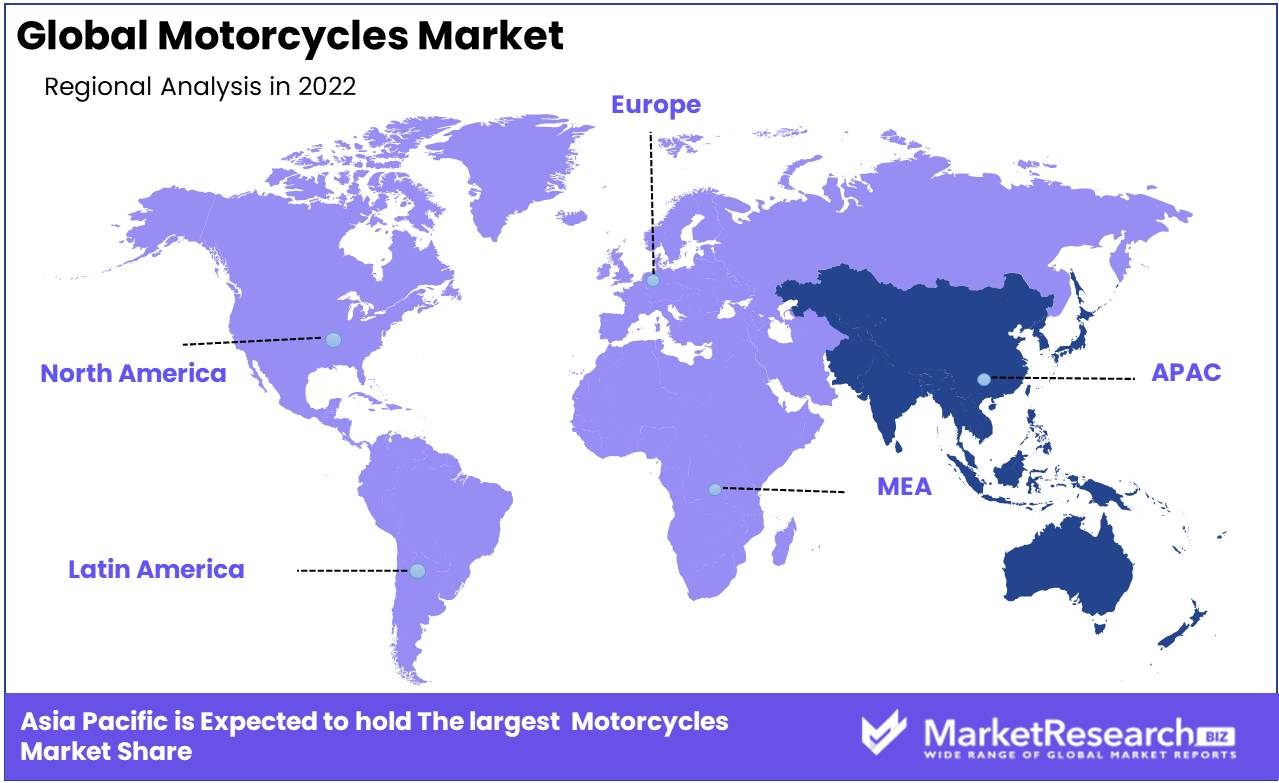

Regional Analysis

Asia-Pacific region has emerged as the dominant force in motorcycles, transforming the industry with its wide production, consumption, and market expansion. Several factors have driven Asia-Pacific motorcycle sales to the top.

First, China and India are two of the world's most populated countries, which favors the Asia-Pacific region. Population development has led to an increase in demand for motorcycles as a means of economical and convenient transportation. Motorcycles are a popular choice for millions of commuters due to congested cities and insufficient public transportation. The region's demand for motorcycles has increased as a result of this production.

The Asia-Pacific region has strong manufacturing and rising demand. International motorcycle manufacturers have realized the potential of the Asia region market and developed production facilities there to fulfill rising demand. Localization of production has produced jobs and led manufacturers to cater to regional tastes. Low labor costs and ideal production conditions have encouraged businesses to locate in the Asia - Pacific region, leading to a significant increase in motorcycles production.

Asia Pacific region has experienced significant technological and innovation developments in motorcycles. This focus on innovation has led to the development of motorcycles that cater to local preferences and requirements, including fuel efficiency, durability, and adaptability to different terrains. These advances have solidified the region's status as a dominant power in the motorcycle market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Bajaj Auto Ltd., an Indian two-wheeler and three-wheeler manufacturer, dominates the motorcycles market. Bajaj Auto, with a rich history dating back to 1945, has established its brand as one that produces high-quality, creative, and economical motorcycles. The company's success is due to its commitment to excellence, ongoing innovation, and customer-centric attitude.

BMW AG, a German automaker, has made a name for itself in the motorcycles market. BMW Motorrad's premium motorcycles combine tremendous performance, cutting-edge technology, and unrivaled sophistication. BMW Motorrad's commitment to precision engineering and distinctive design has made the brand.

Ducati Motor Holding S.p.A is synonymous with flair, performance, and riding excitement. Ducati's high-performance motorcycles are known globally from Borgo Panigale, Italy. Ducati's concentration on modern technology, stylish design, and excellent craftsmanship has made it a motorcycle fan favorite. Ducati's wide range of motorcycles meets diverse riding styles and sets performance and innovation standards.

Eicher Motors Limited, an Indian multinational, dominates the motorcycles market with Royal Enfield. Royal Enfield motorcycles are beloved worldwide for their classic design, sturdy structure, and distinctive pounding sound. Its ability to combine classic beauty with modern technology has made the brand a competitive competitor in the motorcycles market. Royal Enfield motorcycles' popularity has grown due to Eicher Motors' commitment to great riding experiences.

American motorcycle maker Harley-Davidson, Inc. is revered globally. Harley-Davidson represents road freedom with its powerful engines, unique design, and long history. The company's motorcycles embody adventure, revolt, and uniqueness. Harley Davidson has maintained its position as a prominent player in the motorcycles market despite setbacks and changing market dynamics thanks to its commitment to its basic beliefs.

Top Key Players in the Motorcycles Market

- Bajaj Auto Ltd. (India)

- BMW AG (Germany)

- Ducati Motor Holding S.p.A (Italy)

- Eicher Motors Limited (India)

- Harley-Davidson, Inc. (U.S.)

- Hero MotoCorp Ltd. (India)

- China Jiailng Industrial Co., Ltd (China)

- Honda Motor Co., Ltd. (Japan)

- KTM Sportmotorcycle GmbH (Austria)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Piaggio and C. SpA (Italy)

- Suzuki Motor Corporation (Japan)

- Triumph Motorcycles (U.K.)

- TVS Motor Company (India)

- Vmoto Limited ABN (Australia)

- Yamaha Motor Co., Ltd. (Japan)

- Zero Motorcycles, Inc (U.S.)

Recent Development

- In 2023, In a revolutionary stride toward sustainable mobility, Harley-Davidson announced the highly anticipated launch of its LiveWire One electric motorcycle, set to hit the roads.

- In 2022, Honda's ADV150 adventure motorcycle, set to debut, is also creating waves.

- In 2021, BMW Motorrad's R 18 Transcontinental is set to revolutionize luxury touring motorcycles.

- In 2020, With the launch of the FTR 1200 S, American motorcycle manufacturer Indian Motorcycles revived flat-track racing.

- In 2019, With the introduction of the game-changing 1290 Super Adventure R Austrian manufacturer KTM established itself in the adventure motorcycle market. Designed for extreme terrain.

Report Scope

Report Features Description Market Value (2022) USD 120.5 Bn Forecast Revenue (2032) USD 233.0 Bn CAGR (2023-2032) 7.0% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(On-Road Motorcycles, Off-Road Motorcycles, Scooters), By Propulsion Type (Electric, ICE) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bajaj Auto Ltd. (India), BMW AG (Germany), Ducati Motor Holding S.p.A (Italy), Eicher Motors Limited (India), Harley-Davidson, Inc.'s (U.S.), Hero MotoCorp Ltd. (India), China Jiailng Industrial Co., Ltd (China), Honda Motor Co., Ltd. (Japan), KTM Sportmotorcycle GmbH (Austria), Kawasaki Heavy Industries, Ltd. (Japan), Piaggio and C. SpA (Italy), Suzuki Motor Corporation (Japan), Triumph Motorcycles (U.K.), TVS Motor Company (India), Vmoto Limited ABN (Australia), Yamaha Motor Co., Ltd. (Japan), Zero Motorcycles, Inc (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Motorcycles Market Overview

- 2.1. Motorcycles Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Motorcycles Market Dynamics

- 3. Global Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Motorcycles Market Analysis, 2016-2021

- 3.2. Global Motorcycles Market Opportunity and Forecast, 2023-2032

- 3.3. Global Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.3.1. Global Motorcycles Market Analysis by By Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.3.3. On-Road Motorcycles

- 3.3.4. Off-Road Motorcycles

- 3.3.5. Scooters

- 3.4. Global Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 3.4.1. Global Motorcycles Market Analysis by By Propulsion Type: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 3.4.3. Electric

- 3.4.4. ICE

- 4. North America Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Motorcycles Market Analysis, 2016-2021

- 4.2. North America Motorcycles Market Opportunity and Forecast, 2023-2032

- 4.3. North America Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.3.1. North America Motorcycles Market Analysis by By Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.3.3. On-Road Motorcycles

- 4.3.4. Off-Road Motorcycles

- 4.3.5. Scooters

- 4.4. North America Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 4.4.1. North America Motorcycles Market Analysis by By Propulsion Type: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 4.4.3. Electric

- 4.4.4. ICE

- 4.5. North America Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Motorcycles Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Motorcycles Market Analysis, 2016-2021

- 5.2. Western Europe Motorcycles Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.3.1. Western Europe Motorcycles Market Analysis by By Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.3.3. On-Road Motorcycles

- 5.3.4. Off-Road Motorcycles

- 5.3.5. Scooters

- 5.4. Western Europe Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 5.4.1. Western Europe Motorcycles Market Analysis by By Propulsion Type: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 5.4.3. Electric

- 5.4.4. ICE

- 5.5. Western Europe Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Motorcycles Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Motorcycles Market Analysis, 2016-2021

- 6.2. Eastern Europe Motorcycles Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.3.1. Eastern Europe Motorcycles Market Analysis by By Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.3.3. On-Road Motorcycles

- 6.3.4. Off-Road Motorcycles

- 6.3.5. Scooters

- 6.4. Eastern Europe Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 6.4.1. Eastern Europe Motorcycles Market Analysis by By Propulsion Type: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 6.4.3. Electric

- 6.4.4. ICE

- 6.5. Eastern Europe Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Motorcycles Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Motorcycles Market Analysis, 2016-2021

- 7.2. APAC Motorcycles Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.3.1. APAC Motorcycles Market Analysis by By Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.3.3. On-Road Motorcycles

- 7.3.4. Off-Road Motorcycles

- 7.3.5. Scooters

- 7.4. APAC Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 7.4.1. APAC Motorcycles Market Analysis by By Propulsion Type: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 7.4.3. Electric

- 7.4.4. ICE

- 7.5. APAC Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Motorcycles Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Motorcycles Market Analysis, 2016-2021

- 8.2. Latin America Motorcycles Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.3.1. Latin America Motorcycles Market Analysis by By Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.3.3. On-Road Motorcycles

- 8.3.4. Off-Road Motorcycles

- 8.3.5. Scooters

- 8.4. Latin America Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 8.4.1. Latin America Motorcycles Market Analysis by By Propulsion Type: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 8.4.3. Electric

- 8.4.4. ICE

- 8.5. Latin America Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Motorcycles Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Motorcycles Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Motorcycles Market Analysis, 2016-2021

- 9.2. Middle East & Africa Motorcycles Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Motorcycles Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.3.1. Middle East & Africa Motorcycles Market Analysis by By Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.3.3. On-Road Motorcycles

- 9.3.4. Off-Road Motorcycles

- 9.3.5. Scooters

- 9.4. Middle East & Africa Motorcycles Market Analysis, Opportunity and Forecast, By By Propulsion Type, 2016-2032

- 9.4.1. Middle East & Africa Motorcycles Market Analysis by By Propulsion Type: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Propulsion Type, 2016-2032

- 9.4.3. Electric

- 9.4.4. ICE

- 9.5. Middle East & Africa Motorcycles Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Motorcycles Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Motorcycles Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Motorcycles Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Motorcycles Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Bajaj Auto Ltd. (India)

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. BMW AG (Germany)

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Ducati Motor Holding S.p.A (Italy)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Eicher Motors Limited (India)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Harley-Davidson, Inc. (U.S.)

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Hero MotoCorp Ltd. (India)

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. China Jiailng Industrial Co., Ltd (China)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Honda Motor Co., Ltd. (Japan)

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. KTM Sportmotorcycle GmbH (Austria)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Kawasaki Heavy Industries, Ltd. (Japan)

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Piaggio and C. SpA (Italy)

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Suzuki Motor Corporation (Japan)

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Triumph Motorcycles (U.K.)

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. TVS Motor Company (India)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Vmoto Limited ABN (Australia)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Yamaha Motor Co., Ltd. (Japan)

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Zero Motorcycles, Inc (U.S.)

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Motorcycles Market Revenue (US$ Mn) Market Share by By Type in 2022

- Figure 2: Global Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 3: Global Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 4: Global Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 5: Global Motorcycles Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Motorcycles Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Motorcycles Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 10: Global Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 11: Global Motorcycles Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 13: Global Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 14: Global Motorcycles Market Share Comparison by Region (2016-2032)

- Figure 15: Global Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 16: Global Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 17: North America Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 18: North America Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 19: North America Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 20: North America Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 21: North America Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 26: North America Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 27: North America Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 29: North America Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 30: North America Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 31: North America Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 32: North America Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 33: Western Europe Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 34: Western Europe Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 35: Western Europe Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 36: Western Europe Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 37: Western Europe Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 42: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 43: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 45: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 46: Western Europe Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 48: Western Europe Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 49: Eastern Europe Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 50: Eastern Europe Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 51: Eastern Europe Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 52: Eastern Europe Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 53: Eastern Europe Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 58: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 59: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 61: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 62: Eastern Europe Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 64: Eastern Europe Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 65: APAC Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 66: APAC Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 67: APAC Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 68: APAC Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 69: APAC Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 74: APAC Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 75: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 77: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 78: APAC Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 80: APAC Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 81: Latin America Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 82: Latin America Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 83: Latin America Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 84: Latin America Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 85: Latin America Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 90: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 91: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 93: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 94: Latin America Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 96: Latin America Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Figure 97: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Market Share by By Typein 2022

- Figure 98: Middle East & Africa Motorcycles Market Attractiveness Analysis by By Type, 2016-2032

- Figure 99: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Market Share by By Propulsion Typein 2022

- Figure 100: Middle East & Africa Motorcycles Market Attractiveness Analysis by By Propulsion Type, 2016-2032

- Figure 101: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Motorcycles Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Figure 106: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Figure 107: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Figure 109: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Figure 110: Middle East & Africa Motorcycles Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Motorcycles Market Share Comparison by By Type (2016-2032)

- Figure 112: Middle East & Africa Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

"

- List of Tables

- "

- Table 1: Global Motorcycles Market Comparison by By Type (2016-2032)

- Table 2: Global Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 3: Global Motorcycles Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Motorcycles Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 7: Global Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 8: Global Motorcycles Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 10: Global Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 11: Global Motorcycles Market Share Comparison by Region (2016-2032)

- Table 12: Global Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 13: Global Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 14: North America Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 15: North America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 19: North America Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 20: North America Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 22: North America Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 23: North America Motorcycles Market Share Comparison by Country (2016-2032)

- Table 24: North America Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 25: North America Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 26: Western Europe Motorcycles Market Comparison by By Type (2016-2032)

- Table 27: Western Europe Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 28: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 32: Western Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 33: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 35: Western Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 36: Western Europe Motorcycles Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 38: Western Europe Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 39: Eastern Europe Motorcycles Market Comparison by By Type (2016-2032)

- Table 40: Eastern Europe Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 41: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 45: Eastern Europe Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 46: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 48: Eastern Europe Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 49: Eastern Europe Motorcycles Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 51: Eastern Europe Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 52: APAC Motorcycles Market Comparison by By Type (2016-2032)

- Table 53: APAC Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 54: APAC Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 58: APAC Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 59: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 61: APAC Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 62: APAC Motorcycles Market Share Comparison by Country (2016-2032)

- Table 63: APAC Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 64: APAC Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 65: Latin America Motorcycles Market Comparison by By Type (2016-2032)

- Table 66: Latin America Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 67: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 71: Latin America Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 72: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 74: Latin America Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 75: Latin America Motorcycles Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 77: Latin America Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- Table 78: Middle East & Africa Motorcycles Market Comparison by By Type (2016-2032)

- Table 79: Middle East & Africa Motorcycles Market Comparison by By Propulsion Type (2016-2032)

- Table 80: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Motorcycles Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by By Type (2016-2032)

- Table 84: Middle East & Africa Motorcycles Market Revenue (US$ Mn) Comparison by By Propulsion Type (2016-2032)

- Table 85: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by By Type (2016-2032)

- Table 87: Middle East & Africa Motorcycles Market Y-o-Y Growth Rate Comparison by By Propulsion Type (2016-2032)

- Table 88: Middle East & Africa Motorcycles Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Motorcycles Market Share Comparison by By Type (2016-2032)

- Table 90: Middle East & Africa Motorcycles Market Share Comparison by By Propulsion Type (2016-2032)

- 1. Executive Summary

-

- Bajaj Auto Ltd. (India)

- BMW AG (Germany)

- Ducati Motor Holding S.p.A (Italy)

- Eicher Motors Limited (India)

- Harley-Davidson, Inc. (U.S.)

- Hero MotoCorp Ltd. (India)

- China Jiailng Industrial Co., Ltd (China)

- Honda Motor Co., Ltd. (Japan)

- KTM Sportmotorcycle GmbH (Austria)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Piaggio and C. SpA (Italy)

- Suzuki Motor Corporation (Japan)

- Triumph Motorcycles (U.K.)

- TVS Motor Company (India)

- Vmoto Limited ABN (Australia)

- Yamaha Motor Co., Ltd. (Japan)

- Zero Motorcycles, Inc (U.S.)