Motor Winding Repair Service Market By Product Types (AC Motors, DC Motors, Servo Motors, Stepper Motors), By End-Use (Oil & Gas, Power Generation, Automotive, Metals & Mining, Pulp & Paper, Cement, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48740

-

July 2024

-

137

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

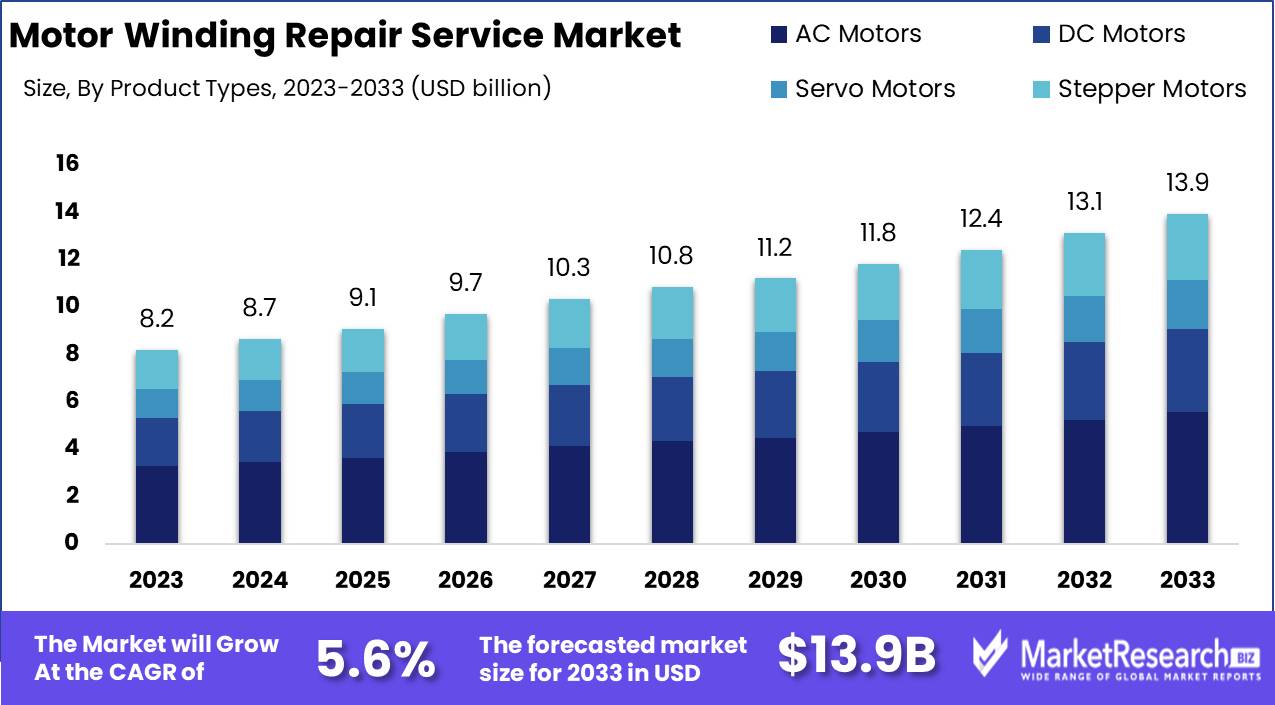

The Global Motor Winding Repair Service Market was valued at USD 8.2 Bn in 2023. It is expected to reach USD 13.9 Bn by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Motor Winding Repair Service Market involves specialized services focused on diagnosing, repairing, and maintaining the windings of electric motors used across various industries. This market is driven by the need to extend the operational life of motors, minimize downtime, and ensure optimal performance. Key services include rewinding, insulation testing, and fault detection. Technological advancements in diagnostic tools and techniques, coupled with the increasing adoption of electric motors in industrial applications, are propelling market growth.

The Motor Winding Repair Service Market is experiencing robust growth, driven by the increasing emphasis on extending the operational life of electric motors and minimizing downtime in industrial applications. The demand for these services is propelled by the need for efficient and reliable motor performance, critical to maintaining industrial productivity. The International Society of Automation (ISA) reported in 2021 that motors maintained using predictive maintenance techniques had an average lifespan extension of 20-30%. This highlights the significant impact of proactive maintenance strategies on motor longevity.

The Motor Winding Repair Service Market is experiencing robust growth, driven by the increasing emphasis on extending the operational life of electric motors and minimizing downtime in industrial applications. The demand for these services is propelled by the need for efficient and reliable motor performance, critical to maintaining industrial productivity. The International Society of Automation (ISA) reported in 2021 that motors maintained using predictive maintenance techniques had an average lifespan extension of 20-30%. This highlights the significant impact of proactive maintenance strategies on motor longevity.The adoption of advanced technologies, such as IoT sensors and advanced analytics, is revolutionizing the market. Siemens' implementation of a predictive maintenance program for its electric motors, which utilized these technologies, resulted in annual savings of approximately USD 2 million in repair and downtime costs by detecting potential failures up to 3 months in advance. This example underscores the tangible benefits of integrating predictive maintenance solutions in motor management.

The market is further supported by the growing industrial automation trend, increasing the deployment of electric motors across various sectors, including manufacturing, energy, and transportation. As industries continue to prioritize operational efficiency and cost reduction, the demand for specialized motor winding repair services is expected to rise. The focus on sustainability and reducing environmental impact by prolonging motor life aligns with broader corporate responsibility goals.

Key Takeaways

- Market Value: The Global Motor Winding Repair Service Market was valued at USD 8.2 Bn in 2023. It is expected to reach USD 13.9 Bn by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

- By Product Types: By Product Types, AC motors constitute 40% of the Motor Winding Repair Service Market.

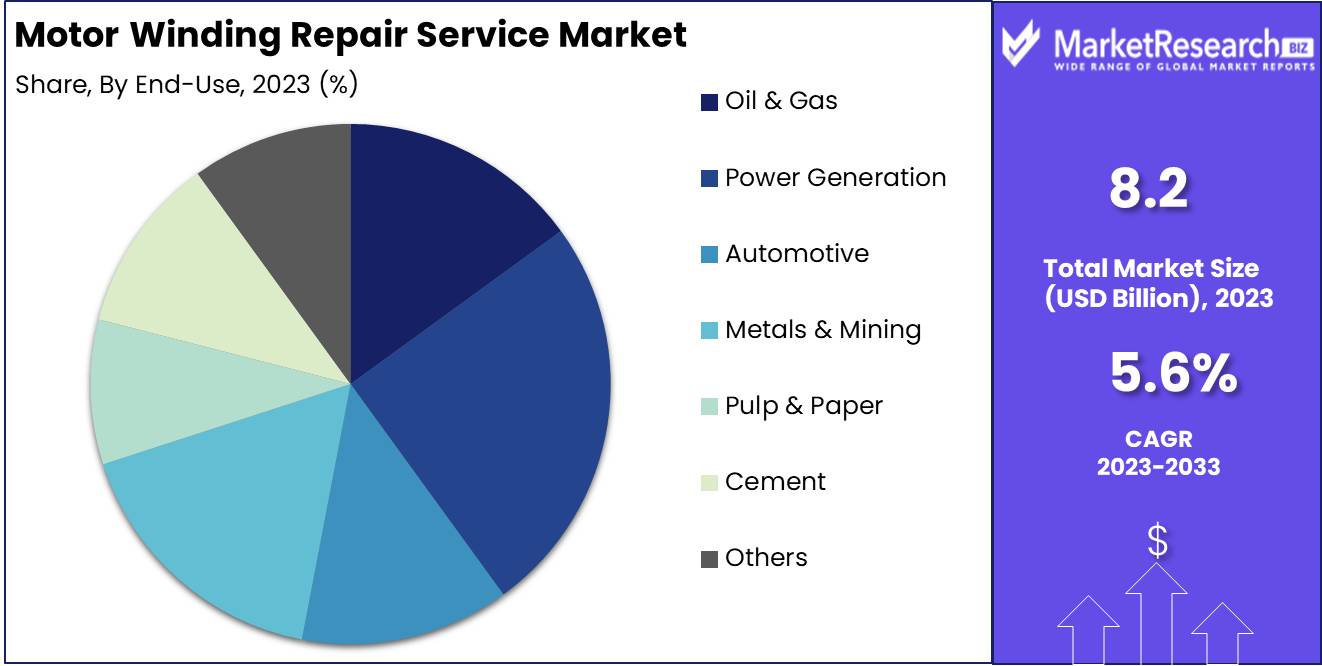

- By End-Use: By End-Use, the power generation sector represents 25% of the Motor Winding Repair Service Market.

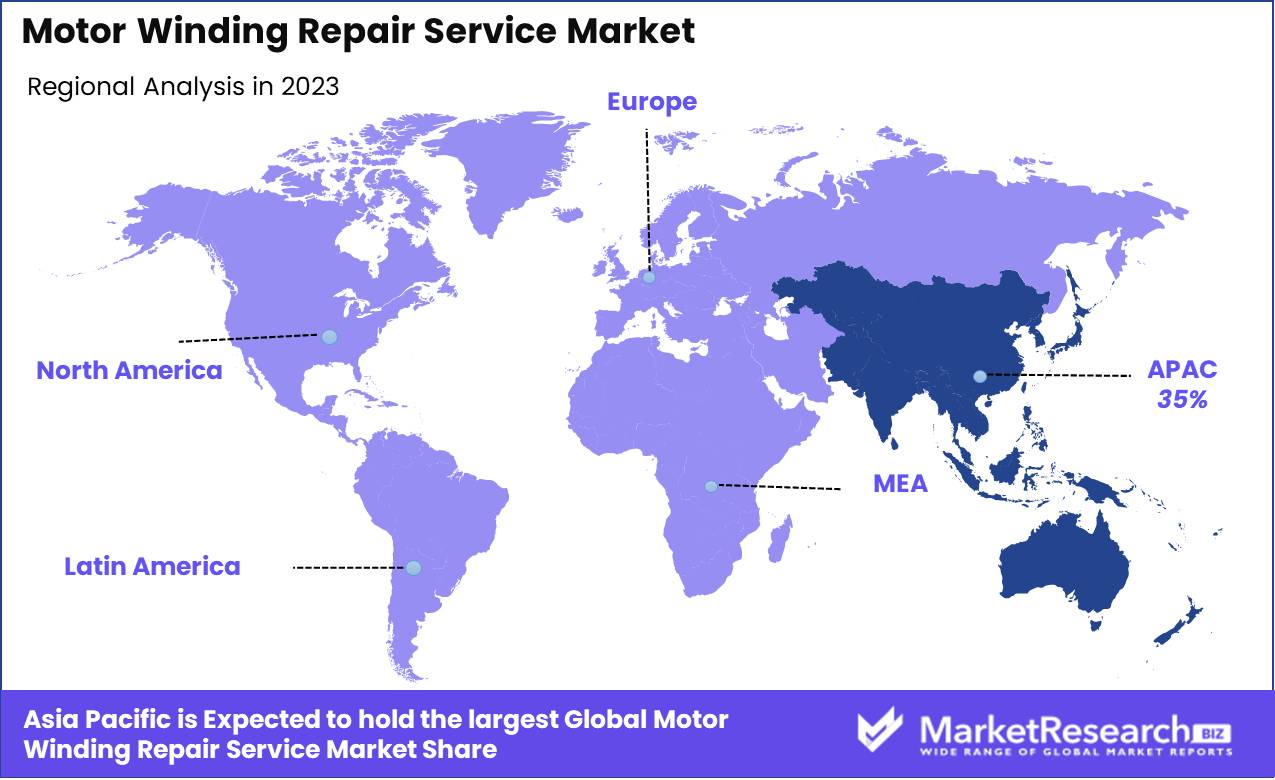

- Regional Dominance: Asia Pacific accounts for around 35% of the global Motor Winding Repair Service Market share.

- Market Value: The growth of renewable energy projects and the need for efficient power generation offer substantial opportunities for the Motor Winding Repair Service Market.

Driving factors

Rising Demand for Electric Motors Spurs Market Growth

The increasing demand for electric motors is a primary driving factor for the growth of the motor winding repair service market. Electric motors are integral components across various industries, including manufacturing, automotive, HVAC, and consumer electronics. As industries expand and the adoption of electric motors rises, the need for maintenance and repair services also escalates.

Regular usage and operational wear and tear necessitate frequent servicing of motor windings to ensure optimal performance and longevity. This demand creates a robust market for motor winding repair services, as businesses seek to minimize downtime and maintain the efficiency of their operations.

Essential Need for Machinery Maintenance Drives Service Demand

The essential need for machinery maintenance significantly contributes to the growth of the motor winding repair service market. Industrial machinery and equipment, which rely heavily on electric motors, require regular maintenance to function efficiently and avoid unexpected breakdowns. Preventive maintenance practices, including motor winding repairs, are crucial to extending the lifespan of machinery and ensuring uninterrupted operations.

This necessity for routine maintenance, driven by the high costs associated with machinery downtime and repairs, fosters a steady demand for motor winding repair services. Businesses across sectors are increasingly investing in these services to enhance the reliability and productivity of their machinery.

Focus on Energy Efficiency Promotes Market Expansion

The growing focus on energy efficiency is another critical factor driving the motor winding repair service market. Industries are increasingly prioritizing energy-efficient operations to reduce operational costs and meet regulatory standards. Efficiently functioning electric motors play a vital role in achieving these energy efficiency goals.

Properly maintained and repaired motor windings contribute to the optimal performance of electric motors, ensuring they operate with minimal energy wastage. This emphasis on energy efficiency incentivizes businesses to invest in regular motor winding repairs, thereby boosting the demand for such services. As energy efficiency becomes a paramount concern across industries, the motor winding repair service market is set to experience sustained growth.

Restraining Factors

High Cost of Skilled Labor Challenges Market Growth

The high cost of skilled labor is a significant challenge for the growth of the motor winding repair service market. Skilled technicians are essential for performing precise and effective motor winding repairs, ensuring the longevity and efficiency of electric motors. However, the labor-intensive nature of these services, combined with the specialized expertise required, leads to high labor costs.

This can increase the overall cost of repair services, potentially deterring businesses from opting for professional motor winding repairs. Companies may seek alternative solutions, such as in-house maintenance or less frequent servicing, to mitigate these expenses, thereby impacting the market growth negatively.

Availability of Low-Cost Replacements Hampers Market Expansion

The availability of low-cost motor replacements poses another challenge to the motor winding repair service market. In some cases, businesses may find it more cost-effective to replace a malfunctioning motor rather than repair it, especially if replacement motors are readily available and affordable. This trend is particularly prevalent in industries where minimizing downtime and maintaining continuous operations are critical.

The lower initial cost and convenience of replacing motors can lead to a decline in the demand for repair services, as businesses weigh the cost-benefit analysis of repair versus replacement. This shift towards replacement rather than repair can significantly hamper the growth of the motor winding repair service market.

By Product Types Analysis

By Product Types AC motors held a dominant market position, capturing more than a 40% share.

In 2023, AC motors held a dominant market position in the by product types segment of the motor winding repair service market, capturing more than a 40% share. The significant market share of AC motors can be attributed to their widespread use in various industrial applications, including manufacturing, HVAC systems, and automotive industries. AC motors are preferred for their durability, efficiency, and lower maintenance costs compared to other motor types. The high prevalence of AC motors in heavy-duty applications necessitates frequent repair and maintenance services, driving the demand for motor winding repair services in this segment.DC motors, servo motors, and stepper motors also constitute important segments of the motor winding repair service market. DC motors are commonly used in applications requiring precise speed control and high torque, such as in electric vehicles and industrial machinery. Despite their lower market share compared to AC motors, the need for specialized repair services for DC motors is growing, driven by the increasing adoption of electric vehicles and automation in various industries.

Servo motors and stepper motors, while representing smaller market segments, are crucial in applications that require high precision and control, such as robotics, CNC machinery, and medical devices. The growing trend of automation and the increasing use of robotics in manufacturing and other sectors are expected to drive the demand for winding repair services for these motor types.

By End-Use Analysis

By End-Use Power generation held a dominant market position, capturing more than a 25% share.

In 2023, power generation held a dominant market position in the by end-use segment of the motor winding repair service market, capturing more than a 25% share. The significant market share of the power generation segment can be attributed to the critical role that electric motors play in power plants and related infrastructure. Electric motors are essential components in various power generation processes, including turbines, pumps, and auxiliary systems.The oil & gas, automotive, metals & mining, pulp & paper, and cement industries also represent important end-use segments in the motor winding repair service market. The oil & gas industry relies heavily on electric motors for drilling, pumping, and refining operations. The harsh operational conditions in this industry lead to frequent wear and tear of motor windings, driving the need for repair services.

In the automotive industry, electric motors are used in various applications, including manufacturing processes and electric vehicles. The increasing adoption of electric vehicles and automation in automotive manufacturing is expected to boost the demand for motor winding repair services.

The metals & mining sector utilizes electric motors for extraction, processing, and transportation of minerals. The heavy-duty nature of these operations requires robust maintenance and repair services to ensure the longevity and efficiency of the motors.

The pulp & paper and cement industries also rely on electric motors for various stages of their production processes. The continuous operation in these sectors necessitates regular maintenance and repair services to maintain productivity and operational efficiency.

Key Market Segments

By Product Types

- AC Motors

- DC Motors

- Servo Motors

- Stepper Motors

By End-Use

- Oil & Gas

- Power Generation

- Automotive

- Metals & Mining

- Pulp & Paper

- Cement

- Others

Growth Opportunity

Expansion into Emerging Markets

Emerging markets present a substantial growth opportunity for the global motor winding repair service market in 2024. Countries in Asia, Africa, and Latin America are experiencing rapid industrialization and infrastructural development, leading to increased adoption of electric motors across various sectors. These regions often face challenges such as limited access to high-quality maintenance services and skilled labor, creating a significant demand for professional motor winding repair services.

By expanding into these markets, service providers can tap into a burgeoning customer base that requires reliable maintenance solutions to support their growing industrial activities. The expansion into these markets not only drives growth but also helps establish a presence in regions with high potential for future demand.

Utilization of Advanced Diagnostic Tools

The adoption of advanced diagnostic tools represents another key opportunity for the motor winding repair service market in 2024. Innovations in diagnostic technology, such as predictive maintenance software and sophisticated testing equipment, enable more accurate and efficient identification of motor winding issues. These tools can significantly reduce the time and cost associated with repairs, improving service delivery and customer satisfaction.

By investing in advanced diagnostics, repair service providers can offer more proactive maintenance solutions, reducing the likelihood of motor failures and extending the operational life of electric motors. This technological advancement can position service providers as leaders in the market, attracting clients who prioritize reliability and efficiency in their maintenance practices.

Latest Trends

Predictive Maintenance Technologies

One of the most significant trends in the motor winding repair service market for 2024 is the adoption of predictive maintenance technologies. These technologies utilize data analytics, machine learning, and IoT sensors to monitor the condition of electric motors in real-time. By analyzing operational data, predictive maintenance can forecast potential failures and identify issues before they result in costly breakdowns.

This proactive approach allows businesses to schedule maintenance activities more efficiently, reducing unplanned downtime and extending the lifespan of their equipment. The increasing reliance on predictive maintenance is driven by its ability to enhance operational efficiency and reduce maintenance costs, making it an essential trend for the motor winding repair service market.

Use of Automation and Robotics

The use of automation and robotics is another key trend shaping the motor winding repair service market in 2024. Automation technologies streamline the repair process, improving precision and reducing the time required for complex tasks. Robotics can assist in disassembling and reassembling motor components, performing intricate winding repairs, and conducting thorough inspections.

These advancements not only enhance the quality of repairs but also address the challenge of skilled labor shortages by reducing dependency on manual labor. The integration of automation and robotics in repair services ensures consistent performance, minimizes human error, and increases overall productivity.

Regional Analysis

The Asia Pacific region dominates the Motor Winding Repair Service Market, accounting for 35% of the global market share. This dominance is attributed to the region's extensive industrial base, particularly in countries like China, India, and Japan, which have a high demand for motor winding repair services. The rapid industrialization and urbanization in these countries are driving the need for efficient and reliable motor repair services to ensure minimal downtime and operational efficiency. The presence of a large number of manufacturing plants and industrial facilities further fuels the demand for motor winding repairs.

North America holds a significant share in the Motor Winding Repair Service Market, driven by the high adoption of advanced technologies and the presence of a well-established industrial sector. The United States and Canada are key contributors to the market, with a strong emphasis on maintaining industrial machinery and equipment.

Europe represents a substantial portion of the Motor Winding Repair Service Market, supported by the presence of numerous manufacturing industries and a focus on sustainability and energy efficiency. The increasing adoption of automation and advanced machinery in industries is creating a continuous demand for motor winding repair services.

The Middle East & Africa region is gradually expanding its presence in the Motor Winding Repair Service Market, primarily driven by the growth of the oil and gas, mining, and construction industries.

Latin America is experiencing steady growth in the Motor Winding Repair Service Market, fueled by the expansion of the industrial sector and increasing awareness about the benefits of regular motor maintenance. The demand for motor winding repair services is particularly high in the mining and oil and gas industries, where equipment reliability is critical.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Motor Winding Repair Service Market in 2024 is expected to experience robust growth due to the increasing need for maintenance and efficiency in industrial motors. Key players in this market are poised to leverage their expertise, advanced technologies, and expansive service portfolios to capture significant market shares.

Integrated Power Services (IPS) is expected to lead the market with its comprehensive range of motor repair and maintenance services. IPS’s strategic acquisitions and focus on expanding its service capabilities will likely enhance its market presence and drive growth.

Delba Electrical is positioned to capitalize on its strong reputation for high-quality repair services and its ability to handle complex motor repairs. Delba’s emphasis on customer satisfaction and technical excellence will continue to attract a loyal customer base.

Continental Group is anticipated to expand its market share by leveraging its extensive industry experience and advanced repair technologies. The company’s focus on innovation and efficiency in repair processes will be key to its success.

Whelco Industrial and Renown Electric Motors & Repair Inc. are expected to benefit from their strong regional presence and specialized repair services. Their expertise in servicing a wide range of motors, coupled with competitive pricing, will drive demand.

Timken Power Systems (Smith Services) and Lloyd Electric will continue to be significant players due to their broad service offerings and commitment to quality. Their ability to provide comprehensive solutions for motor repair and maintenance will be a crucial growth driver.

EMW Productions LLC and Rogers Electric Motor Services will likely enhance their market positions by focusing on niche segments and offering tailored repair solutions. Their emphasis on customer-centric services and quick turnaround times will be beneficial.

A Plus Winding Services and Smith Services will continue to grow by leveraging their expertise in motor winding repairs and maintaining strong customer relationships. Their focus on efficiency and reliability will attract more clients.

Siemens, Regal Beloit Corporation, and TECO E&M/TECO-Westinghouse are expected to leverage their global presence and advanced technological capabilities to dominate the market. These companies’ ability to offer integrated solutions and state-of-the-art repair services will be pivotal in capturing market share.

Market Key Players

- Integrated Power Services

- Delba Electrical

- Continental Group

- Whelco Industrial

- Renown Electric Motors & Repair Inc.

- Timken Power Systems (Smith Services)

- Lloyd Electric

- EMW PRODUCTIONS LLC

- Rogers Electric Motor Services

- A Plus Winding Services

- Smith Services

- Siemens

- Regal Beloit Corporation

- TECO E&M/TECO-Westinghouse

Recent Development

- May 2024: ElectroMechanical Services, Inc. launched a new diagnostic technology for motor winding analysis, aiming to reduce downtime and improve maintenance efficiency.

- June 2024: Winding Services Solutions expanded its operations into Europe, offering specialized repair services for industrial and commercial electric motor systems.

Report Scope

Report Features Description Market Value (2023) USD 8.2 Bn Forecast Revenue (2033) USD 13.9 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Types (AC Motors, DC Motors, Servo Motors, Stepper Motors), By End-Use (Oil & Gas, Power Generation, Automotive, Metals & Mining, Pulp & Paper, Cement, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Integrated Power Services, Delba Electrical, Continental Group, Whelco Industrial, Renown Electric Motors & Repair Inc., Timken Power Systems (Smith Services), Lloyd Electric, EMW PRODUCTIONS LLC, Rogers Electric Motor Services, A Plus Winding Services, Smith Services, Siemens, Regal Beloit Corporation, TECO E&M/TECO-Westinghouse Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Integrated Power Services

- Delba Electrical

- Continental Group

- Whelco Industrial

- Renown Electric Motors & Repair Inc.

- Timken Power Systems (Smith Services)

- Lloyd Electric

- EMW PRODUCTIONS LLC

- Rogers Electric Motor Services

- A Plus Winding Services

- Smith Services

- Siemens

- Regal Beloit Corporation

- TECO E&M/TECO-Westinghouse